Food Logistics Market Size, Share, Trends and Forecast by Transportation Mode, Product Type, Service Type, Segment, and Region, 2026-2034

Food Logistics Market Size and Share:

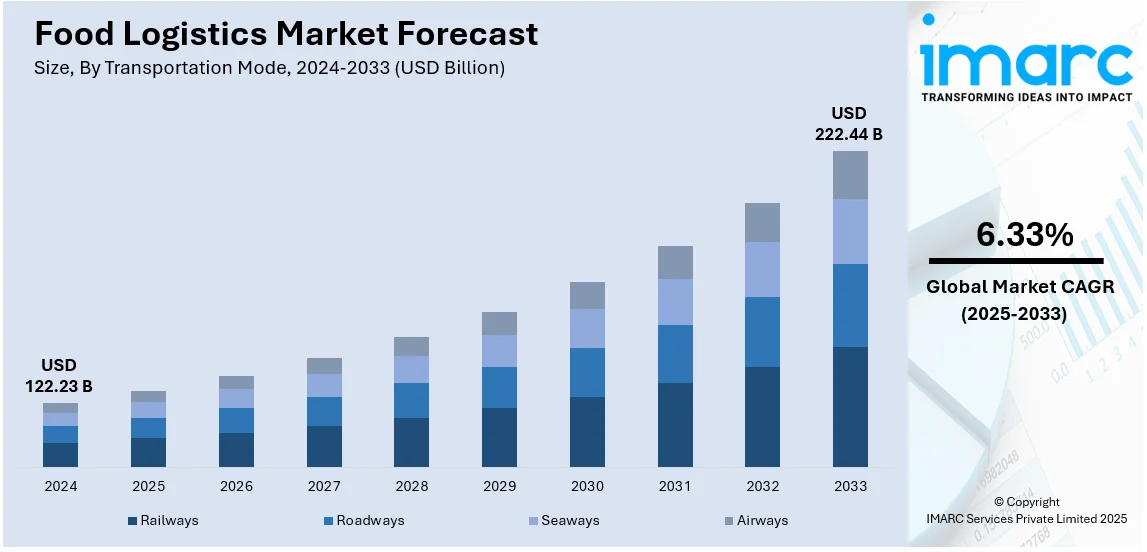

The global food logistics market size was valued at USD 122.23 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 222.44 Billion by 2034, exhibiting a CAGR of 6.33% from 2026-2034. North America currently dominates the market holding a significant food logistics market share of 43.2% driven by growing rapidly driven by increasing demand for fresh and perishable foods, rapid globalization of food trade, significant technological advancements, including temperature-controlled logistics, surge in e-commerce platforms, and imposition of safety regulations, ensuring quality of food products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 122.23 Billion |

|

Market Forecast in 2034

|

USD 222.44 Billion |

| Market Growth Rate 2026-2034 | 6.33% |

The increasing demand for perishable food products is a key driver in the food logistics market outlook. Consumers prefer fresh, frozen, and processed foods, necessitating efficient cold chain solutions to maintain quality and safety. Advanced temperature-controlled storage and transportation support the preservation of dairy, meat, seafood, and fresh produce. Globalization has expanded international food trade, requiring robust logistics networks to meet stringent food safety regulations. A report from the Australian Food and Agriculture Industry Taskforce highlights the need for a bipartisan strategy to address climate change, trade tensions, and market shifts. With the sector contributing $187 billion to the economy and supporting 1.4 million jobs, technological advancements like IoT-enabled tracking further optimize food logistics.

The U.S. food logistics market is driven by rising demand for fresh and processed food, increasing e-commerce grocery sales, and advanced cold chain infrastructure with a share of 89.20%. With a well-developed transportation network and strict food safety regulations, logistics providers focus on efficiency and compliance to maintain product quality. The growing preference for online food delivery services has intensified the need for reliable supply chains, leading to investments in temperature-controlled warehouses and real-time tracking technologies. Additionally, international trade of perishable goods, including dairy, seafood, and meat, requires sophisticated logistics solutions. Government regulations, such as the Food Safety Modernization Act (FSMA), further emphasize the importance of high-quality food transportation and storage, fostering continuous innovation in the sector.

Food Logistics Market Trends:

Increasing demand for perishable foods

The rising consumer preference for fresh and perishable foods is significantly driving the market growth. In line with this, the growing awareness of health and nutrition, leading to an increased demand for fruits, vegetables, dairy products, and meats, is bolstering the market growth. According to the World Bank, investing USD 13 Billion annually (2025-2034) in high-impact nutrition programs could prevent 6.2 million child deaths, 980,000 stillbirths, 27 million stunting cases, and 144 million maternal anemia cases. Also, the consumer demand for fresh food is rising with two out of three consumers in the United States. The logistics of transporting these perishable items are complex, as they require a controlled environment to maintain quality and freshness. It involves temperature-controlled warehousing and transportation, which is crucial for extending the shelf life of perishable goods. Furthermore, the ongoing advancements in refrigerated transport technologies, innovative packaging solutions, and improved inventory management techniques, are positively impacting the market growth. Besides this, the changing dietary preferences and the popularity of global cuisines, which further complicate the logistics requirements due to the varied nature of these food products, are supporting the food logistics market growth.

Rapid globalization of food trade

The movement of food products across international borders has intensified due to factors, such as trade liberalization, economic growth in emerging markets, and diversification of food sources. As per FAO, in 2022, food trade made up around 85 percent of all trade in food and agriculture. This globalization of food trade involves complex logistics and supply chain management to handle the transportation, storage, and distribution of diverse food items. It requires dealing with different regulatory environments, transportation modes, and logistics infrastructures. This has led to the development of specialized logistics services, such as multi-modal transportation solutions and integrated supply chain management systems. Additionally, globalization has necessitated the adoption of international standards and best practices in food logistics, including traceability and compliance with various health and safety regulations.

Significant technological advancements

The advancement of technology has revolutionized how food products are transported, stored, and tracked throughout the supply chain. Key technological advancements include temperature-controlled logistics (TCL), which is vital for maintaining the quality of perishable goods. TCL involves sophisticated refrigeration and climate-control systems in warehouses and transportation vehicles. For instance, on July 24, 2024, Raben Group announced a EUR 10 Million investment in a zero-emission logistics center in Thessaloniki. Built on 50 acres, phase one (4,000m² warehouse, 40 ramps, TCL cooling chamber for food, 700m² offices) completes in 2025. Furthermore, the integration of global positioning system (GPS) tracking and radio frequency identification (RFID) technology, which have improved the visibility and traceability of food products during transit, allowing for real-time monitoring and management, is positively influencing the market growth. Besides this, the development of transportation management systems (TMS) and warehouse management systems (WMS), which have become more sophisticated, integrating various aspects of logistics operations for better efficiency and cost-effectiveness, is driving the food logistics market demand.

Food Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global food logistics market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on transportation mode, product type, service type, and segment.

Analysis by Transportation Mode:

- Railways

- Roadways

- Seaways

- Airways

Roadways dominate the food logistics market growth with 52.8% due to their flexibility, cost-effectiveness, and extensive reach in transporting perishable goods. The widespread road network enables efficient last-mile delivery, ensuring fresh and frozen food products reach supermarkets, restaurants, and households on time. The rise in e-commerce and online grocery shopping has increased demand for refrigerated trucks and temperature-controlled transport solutions. Road transportation also offers better accessibility to remote and rural areas, where other modes like rail or air are less viable. Additionally, technological advancements such as GPS tracking, route optimization, and IoT-enabled temperature monitoring enhance operational efficiency, reducing spoilage risks. Government investments in infrastructure further strengthen road transport’s dominance in food logistics.

Analysis by Product Type:

- Fish, Shellfish, and Meat

- Vegetables, Fruits, and Nuts

- Cereals, Bakery and Dairy Products

- Coffee, Tea, and Vegetable Oil

- Others

Fish, shellfish, and meat account for a significant share of market demand due to rising global consumption and the need for efficient cold chain logistics. Increasing health consciousness and dietary preferences have fueled demand for protein-rich foods, driving the trade of fresh, frozen, and processed meat and seafood products. Strict food safety regulations require temperature-controlled storage and transportation to maintain product quality and prevent spoilage. The expansion of e-commerce and online grocery platforms has further boosted demand for reliable cold chain solutions to ensure timely and fresh deliveries. Additionally, globalization has increased cross-border trade of seafood and meat, necessitating advanced logistics networks to meet consumer demand while complying with stringent import-export regulations.

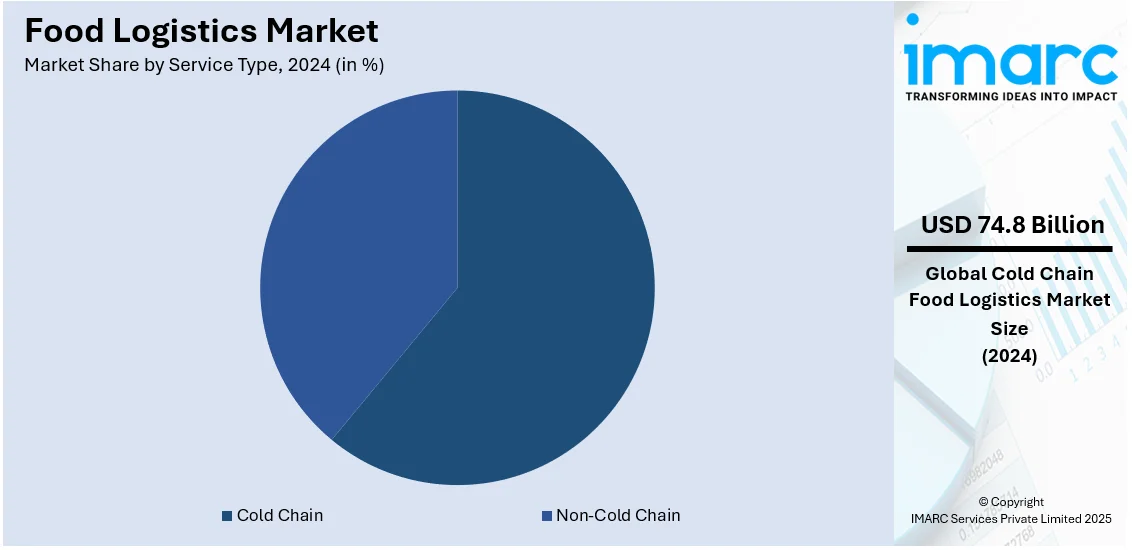

Analysis by Service Type:

- Cold Chain

- Non-Cold Chain

Cold chain logistics represents the majority of food logistics market share of 61.2% due to the rising demand for temperature-sensitive food products, including dairy, seafood, frozen foods, and fresh produce. Maintaining product quality and safety throughout the supply chain requires advanced temperature-controlled storage and transportation solutions. The increasing consumer preference for fresh and organic food has further driven investments in refrigeration technologies and insulated transport systems. Stringent food safety regulations mandate strict temperature monitoring, enhancing the need for IoT-enabled tracking and automated cooling solutions. Additionally, the expansion of e-commerce and online grocery services has increased the demand for efficient cold chain networks, ensuring timely and fresh deliveries. These factors collectively contribute to the segment’s dominance.

Analysis by Segment:

- Transportation

- Packaging

- Instrumentation

Based on the food logistics market forecast, the transportation is the leading segment in the food logistics market due to its critical role in ensuring timely and efficient food distribution. The increasing demand for perishable food products, including fresh produce, dairy, meat, and seafood, necessitates reliable transportation solutions to maintain quality and safety. Advanced cold chain logistics, including refrigerated trucks and temperature-controlled containers, support the seamless movement of goods across regions. The rise of e-commerce and online grocery shopping has further driven the need for efficient last-mile delivery services. Additionally, globalization has expanded cross-border food trade, increasing reliance on multimodal transportation networks, including road, rail, air, and sea freight. Technological advancements, such as real-time tracking and route optimization, further enhance transportation efficiency.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

North America leads the food logistics market with 43.2% market share due to its advanced infrastructure, strong cold chain networks, and high demand for perishable food products. The region's well-developed transportation system, including extensive road, rail, and air networks, ensures efficient food distribution. Rising consumer preference for fresh and frozen foods has driven investments in temperature-controlled storage and transportation solutions. Additionally, the growing e-commerce sector and online grocery shopping have increased demand for efficient last-mile delivery services. Government regulations and food safety standards further support market growth by ensuring compliance with stringent quality requirements. Technological advancements, including IoT-enabled tracking and automation, enhance operational efficiency. The presence of key logistics providers and distribution hubs further strengthens North America's dominance.

Key Regional Takeaways:

United States Food Logistics Market Analysis

The food logistics market in the United States is significantly driven by the growing demand for fresh, frozen, and processed food products, fueled by increasing e-commerce penetration and shifting consumer preferences. The U.S. Census Bureau reported that fourth-quarter 2024 retail e-commerce sales reached USD 308.9 Billion, up 2.7% from Q3, with total retail sales at USD 1,883.3 Billion, reflecting a 1.8% rise. Year-over-year, e-commerce sales increased by 9.4%, while total retail sales grew 3.8%, with e-commerce accounting for 16.4% of total sales. This rise is influencing food logistics, prompting companies to enhance supply chain efficiency through investments in temperature-controlled storage, automation, and last-mile delivery solutions. Cold chain infrastructure is expanding, with advancements in tracking technology ensuring food safety and regulatory compliance. Sustainability is becoming a major focus, with logistics providers adopting electric refrigerated trucks, eco-friendly packaging, and energy-efficient warehouses. The rise of meal kits and online grocery shopping is pushing logistics firms to develop adaptable distribution networks. Despite high operational costs, labor shortages, and strict regulations, technological integration is optimizing food transportation, ensuring reliability and efficiency in meeting growing consumer demand across the country.

Europe Food Logistics Market Analysis

The European market for food logistics is expanding due to strict food safety regulations, rising demand for perishable food, and the growth of cross-border trade. According to the European Commission, EU agri-food exports reached a record EUR 21.7 Billion in October 2024, reflecting a 10% monthly increase and an 8% rise year-over-year. Cumulative exports from January to October totaled EUR 197.3 Billion, 3% higher than the same period in 2023, with the U.S. and UK as the largest growth markets. The region benefits from a well-established cold chain network, supported by advanced refrigeration technology and real-time tracking systems. Increasing e-commerce adoption and direct-to-consumer food delivery services are driving investments in automated warehousing and AI-driven supply chain management. Sustainability remains a priority, with companies investing in energy-efficient cold storage and low-emission transport. Expanding regional and international trade agreements are fostering growth in the market, but Brexit-related trade disruptions and varying regulatory standards present challenges. The rise of plant-based and organic foods is reshaping logistics dynamics, requiring specialized storage and handling solutions to maintain product integrity throughout the supply chain.

Asia Pacific Food Logistics Market Analysis

The Asia Pacific market is growing rapidly, propelled by urbanization, rising disposable income, and an expanding middle class. According to an industry report, the middle-class population in emerging markets is expected to double from 354 million households in 2024 to 687 million by 2034, with China accounting for nearly half. India’s middle class will more than double within five years, further fueling demand for efficient food logistics. The expansion of organized retail and online food delivery services is increasing the need for advanced cold chain solutions. Infrastructure improvements in China, India, and Southeast Asia are enhancing temperature-controlled logistics, though maintaining integrity over long distances remains a challenge. Investments in automation, blockchain for food traceability, and AI-powered demand forecasting are optimizing supply chains. Government efforts to augment food security and minimize post-harvest losses are also shaping market growth. Multinational logistics providers are expanding last-mile connectivity and multi-temperature storage to support the region’s shifting food supply needs.

Latin America Food Logistics Market Analysis

The Latin American food logistics market is expanding due to strong agricultural production and rising demand for processed and perishable food. Cold chain development is vital for exports, particularly in meat, seafood, and tropical fruits, though infrastructure gaps, high costs, and regulatory barriers challenge efficiency. Digital logistics platforms are improving visibility, while e-commerce growth in Brazil and Mexico is driving last-mile delivery solutions. Investment in automation is rising, exemplified by Walmart’s USD 500 Million robotic distribution center in Silao, Guanajuato, announced on October 11, 2024. Serving 600+ stores across eight states, it will be among Latin America’s most advanced, incorporating AI-powered automation from Symbotic. Sustainability is gaining importance, with companies adopting solar-powered cold storage to enhance efficiency and reduce environmental impact.

Middle East and Africa Food Logistics Market Analysis

The Middle East and Africa market is witnessing steady growth attributed to rising food imports, urbanization, and growing demand for packaged and frozen food. According to the World Economic Forum, GCC countries, despite ranking among the top 50 for food security, import up to 85% of their food. To reduce dependency, they are investing USD 30.5 Billion in agriculture and fisheries, USD 3.8 Billion in food technology, and major projects like Saudi Arabia’s food clusters and Oman’s USD 4.2 Billion Saham Agricultural City. This reliance on imports is fueling investments in cold chain logistics and temperature-controlled warehousing. Governments are enhancing food security, but challenges like weak transport networks, high energy costs, and regulatory issues persist. E-commerce growth is driving AI-based tracking and forecasting to improve efficiency and reduce food waste.

Competitive Landscape:

The food logistics market is highly competitive, driven by the need for efficiency, reliability, and compliance with strict food safety regulations. Industry players focus on expanding their cold chain infrastructure, enhancing transportation networks, and adopting advanced tracking technologies to maintain product quality. Technological innovations, such as IoT-enabled monitoring and AI-driven route optimization, play a crucial role in improving supply chain efficiency. Partnerships with food manufacturers, retailers, and e-commerce platforms further strengthen market presence. Additionally, the growing demand for sustainable logistics solutions, including electric and refrigerated transport, influences competition. Companies differentiate themselves through service quality, scalability, and compliance with evolving regulations, making the market dynamic and innovation-driven.

The report provides a comprehensive analysis of the competitive landscape in the food logistics market with detailed profiles of all major companies, including:

- AmeriCold Logistics LLC

- DSV

- C.H. Robinson Worldwide, Inc.

- Schneider National

- CaseStack

- A.N. Deringer, Inc.

- Echo Global Logistics, Inc.

- Evans Distribution Systems, Inc.

- Hellmann Worldwide Logistics SE & Co. KG

- Matson Logistics

- Odyssey Logistics & Technology Corporation

Latest News and Developments:

- May 2025: C.H. Robinson joined the pioneering I-10 coalition, led by Smart Freight Centre, to test long-haul heavy-duty battery-electric trucks along the US I-10 corridor from Los Angeles to El Paso. Partnering with Terawatt Infrastructure, the coalition will utilize six advanced charging hubs featuring Megawatt Charging System (MCS) technology, supporting Class 8 electric and autonomous vehicles with secure, smart charging solutions. This initiative aims to enhance supply chain sustainability and resiliency, benefiting C.H. Robinson’s extensive network of carriers and customers across diverse industries while advancing climate-smart freight innovations.

- April 2025: DSV completed its acquisition of Schenker from Deutsche Bahn for approximately DKK 106.7 billion (EUR 14.3 billion), doubling DSV’s size and creating a global transport and logistics leader. The combined company will generate around DKK 310 billion (EUR 41.6 billion) in revenue with nearly 160,000 employees across 90+ countries. The acquisition enhances DSV’s global network, market reach, and service offerings, supporting sustainable growth and digitalization. Integration begins May 2025, targeting DKK 9 billion annual synergies by 2028 and improved operating margins.

- April 2025: Lineage, one of the leading temperature-controlled warehouse REIT, announced plans to expand its US cold-storage network by acquiring four existing warehouses from Tyson Foods for $247 million, totaling 49 million cubic feet and 160,000 pallet positions. Additionally, Lineage will invest over $740 million to build two fully automated greenfield warehouses, adding 80 million cubic feet and 260,000 pallet positions. Tyson Foods will be an anchor customer in these new facilities. The expansion leverages Lineage’s automation technology and data science to create smarter, more agile supply chains, with over USD 1 billion capital deployment expected by 2025.

- March 2025: Echo Global Logistics, a leading technology-enabled transportation and supply chain provider, opened a new office in Mexico City to enhance its cross-border logistics services. Building on nearly a decade of cross-border operations and existing facilities in Monterrey, Guadalajara, and Laredo, Texas, the Mexico City office will serve as the division headquarters. The new location strengthens Echo’s commitment to clients and carriers operating in the Mexican market.

- March 2025: Porter Logistics, a leading Atlanta-based 3PL warehousing company, expanded into cold chain logistics, adding 145,000 square feet of advanced cold storage to its existing 270,000 square feet facility, totaling 750,000 square feet on Selig Drive. This expansion supports food, pharmaceutical, and chemical industries with temperature-controlled storage ranging from ambient to -20°F freezer conditions. Porter offers comprehensive 3PL services including order fulfillment, bulk distribution, inventory management, and cross-docking.

- February 2025: Batory Foods, a US-based distributor of premium food ingredients, enhanced its logistics by deploying e2open’s real-time transportation visibility (RTTV) solution integrated with its long-used Transportation Management System (TMS). This upgrade enables continuous, precise shipment tracking across all modes and regions, improving operational efficiency, transparency, and customer service. With predictive arrival data and proactive communication, Batory optimizes workforce management and carrier collaboration. Powered by e2open’s multi-enterprise network and Shippeo’s data analytics, the solution minimizes disruptions, enhances decision-making, and boosts on-time deliveries throughout Batory’s extensive supply chain.

- January 2025: Americold Realty Trust plans to invest USD 75–80 million to build its first Import-Export cold storage hub in Port Saint John, New Brunswick. This modern facility, featuring 22,000 pallet positions, will integrate Americold’s storage solutions with DP World’s shipping logistics and CPKC’s rail network. Aimed at strengthening food supply links between Central/Eastern Canada and global markets in Europe, South America, and APAC, the project is supported by Opportunities NB. It is expected to create up to 100 jobs by 2029 and add USD 37 million to the provincial GDP, reinforcing Port Saint John’s role as a major Atlantic port.

- January 2025: Logwin Group acquired Hanse Service Internationale Fachspedition GmbH and Pharmalogisticspartner in Hamburg, strengthening its pharmaceutical and food logistics expertise. Hanse Service offers certified temperature-controlled logistics, including air/sea freight, warehousing, and specialized packaging with 7,600 m² of storage. The acquisition enhances Logwin’s national and international temperature-controlled logistics capabilities. This strategic move signals Logwin’s commitment to growth and innovation in the pharmaceutical and food logistics sectors.

Food Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transportation Modes Covered | Railways, Roadways, Seaways, Airways |

| Product Types Covered | Fish, Shellfish, and Meat, Vegetables, Fruits, and Nuts, Cereals, Bakery and Dairy Products, Coffee, Tea, and Vegetable Oil, Others |

| Service Types Covered | Cold Chain, Non-Cold Chain |

| Segments Covered | Transportation, Packaging, Instrumentation |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | AmeriCold Logistics LLC, DSV, C.H. Robinson Worldwide, Inc., Schneider National, CaseStack, A.N. Deringer, Inc., Echo Global Logistics, Inc., Evans Distribution Systems, Inc., Hellmann Worldwide Logistics SE & Co. KG, Matson Logistics, Odyssey Logistics & Technology Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the food logistics market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global food logistics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the food logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The food logistics market was valued at USD 122.23 Billion in 2024.

The food logistics market was valued at USD 222.44 Billion in 2033, exhibiting a CAGR of 6.33% during 2025-2033.

The food logistics market is driven by rising demand for perishable goods, expansion of e-commerce grocery sales, advancements in cold chain technology, and stringent food safety regulations. Increasing global food trade, real-time tracking innovations, and the need for efficient supply chains to reduce food wastage further propel market growth.

North America leads the food logistics market due to its advanced cold chain infrastructure, strong transportation networks, and stringent food safety regulations. The rise in e-commerce grocery sales, increasing demand for fresh and frozen food, and technological advancements in real-time tracking further strengthen the region’s dominance in the market.

Some of the major players in the food logistics market include AmeriCold Logistics LLC, DSV, C.H. Robinson Worldwide, Inc., Schneider National, CaseStack, A.N. Deringer, Inc., Echo Global Logistics, Inc., Evans Distribution Systems, Inc., Hellmann Worldwide Logistics SE & Co. KG, Matson Logistics, Odyssey Logistics & Technology Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)