Food Intolerance Products Market Report by Type (Bakery Products, Confectionery Products, Dairy and Dairy Alternatives, Meat and Seafood Products, and Others), Product Type (Diabetes-Free Food, Gluten-Free Food, Lactose-Free Food, and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Stores, and Others), and Region 2025-2033

Food Intolerance Products Market Overview:

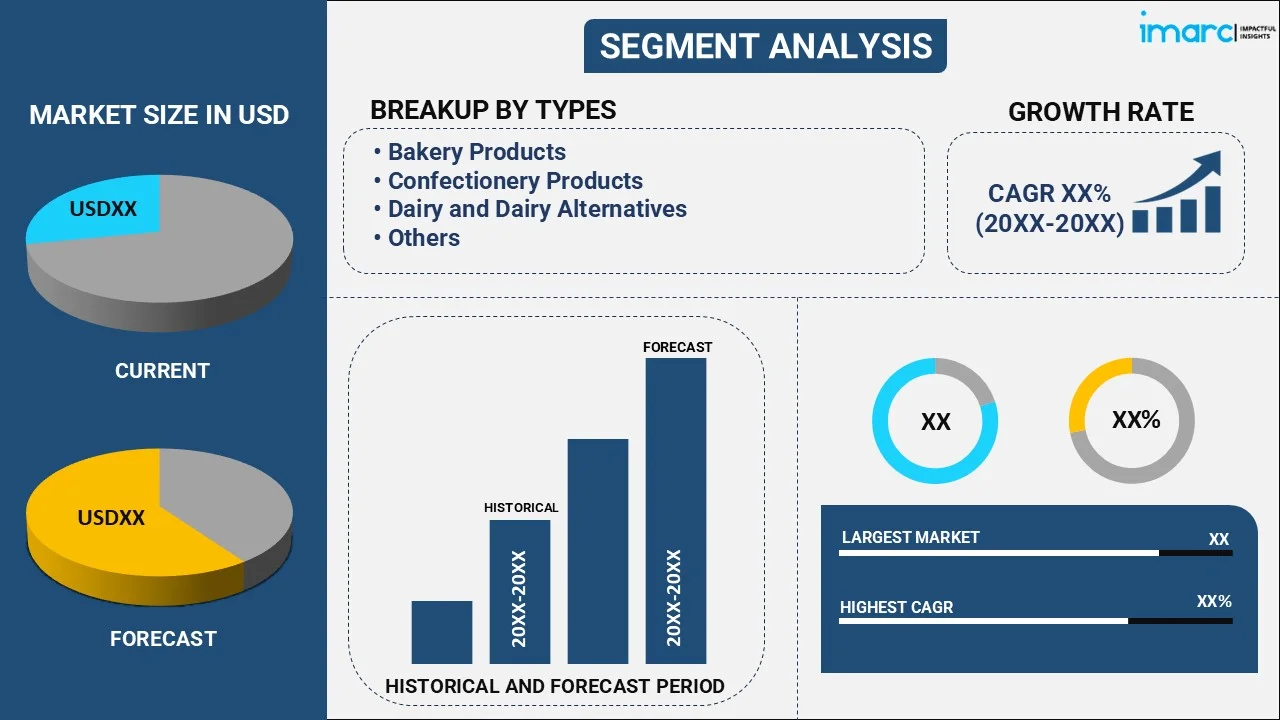

The global food intolerance products market size reached USD 12.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 16.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.46% during 2025-2033. The growing prevalence of food intolerances, increasing health consciousness among consumers, and key players are innovating and broadening their offerings to meet the demand for gluten-free, lactose-free, and allergy-friendly products are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.0 Billion |

|

Market Forecast in 2033

|

USD 16.6 Billion |

| Market Growth Rate 2025-2033 | 3.46% |

Food Intolerance Products Market Analysis:

- Major Market Drivers: The market is experiencing steady growth because of the rising number of individuals with food intolerances and allergies. Furthermore, progress in food technology and the increased presence of intolerance-friendly products in regular retail outlets are bolstering the growth of the market.

- Key Market Trends: The escalating demand for gluten-free and lactose-free items, influenced by lifestyle preferences and health requirements, is offering a favorable market outlook. Besides this, the adoption of new ideas in product formulations, such as incorporating natural ingredients and adding extra nutrients, is gaining traction.

- Geographical Trends: North America leads the market because of higher awareness levels and better diagnostic facilities for food intolerances.

- Competitive Landscape: Some of the major market players in the industry include Abbott Nutrition, Amy’s Kitchen Inc., Boulder Brands Inc. (Pinnacle Foods Inc.), Conagra Brands Inc., Danone S.A., Dr. Schar AG/SPA, Fifty-50 Foods Inc., General Mills Inc., Kellogg Company, Nestle S.A., The Hain Celestial Group Inc., and The Kraft Heinz Company.

- Challenges and Opportunities: Challenges, like expensive production costs and strict regulations, which may restrict smaller companies from entering the market, are influencing the food intolerance products market revenue. However, opportunities in broadening product varieties to serve a wider variety of allergies, improving distribution channels, and utilizing online marketing to reach more diverse audiences are supporting the market growth.

Food Intolerance Products Market Trends:

Rising Prevalence of Food Intolerances and Allergies

Health issues like lactose intolerance, gluten sensitivity, and celiac disease are being diagnosed more frequently, encouraging those affected to look for specialized food items. Improvements in medical testing and increased knowledge about these diseases are encouraging more people to recognize their unique nutritional requirements. This knowledge is influenced not just by healthcare professionals but also by abundant digital resources, empowering individuals to take charge of their health by making proactive choices in their diet. As a result, there is a rise in the need for food items that accommodate these special diets, encouraging companies to create new products and extend their offerings. In June 2024, Rudi's Rocky Mountain Bakery introduced Sandos, their portable PB&J sandwiches, at Whole Foods Market. Available in both peanut butter and nut-free options with grape or strawberry spreads, these sandwiches catered to consumers seeking allergy-friendly and nutritious snack options.

Growing Health Consciousness Among Consumers

Consumers are becoming more aware about how their diet affects their health and well-being, leading to a preference for healthier eating habits. There is an increase in demand for food intolerance products because of this concern, even among people who do not have any diagnosed intolerances. Consumers are choosing gluten-free, lactose-free, and sugar-free products as part of a lifestyle decision to improve health, control weight, and avoid possible health problems. The movement is supported by extensive data from health professionals, influencers, and media promoting the benefits of lowering the consumption of specific allergens and irritants. In addition, food companies are capitalizing on this movement by developing products that cater to those with specific sensitivities while also appealing to health-conscious consumers in general. In February 2023, Nestlé presented more than 35 new items at Natural Products Expo West 2023 in Anaheim, California. Key food products included first-ever plant-based natural bliss oat milk and California Pizza Kitchen's BBQ chicken frozen pizza with gluten-free cauliflower crust, appealing to a variety of dietary needs and health-conscious individuals.

Technological Advancements and Product Innovation

Food manufacturers are putting money into research operations to produce top-notch products that cater to intolerances without sacrificing taste, texture, or nutritional content. Advancements in food processing and sourcing ingredients are enabling the creation of products that closely resemble their traditional versions, increasing their appeal to a broader range of consumers. Furthermore, progress in plant-based ingredients and alternative sweeteners is leading to the development of dairy-free, gluten-free, and sugar-free items that cater to both dietary restrictions and consumer tastes. These advances in technology are aiding in lowering expenses and enhancing the ability to create allergy-friendly food in larger quantities, making it more convenient and cost-effective for consumers. In 2023, the Central Food Technological Research Institute (CFTRI) introduced three novel healthy food technologies within the framework of the 'One Week One Lab' initiative. This consisted of a gluten-free cake mix made from buckwheat for those with celiac disease, a spice bread containing anti-inflammatory properties, and a fiber-enriched rusk designed to boost nutrition. Prominent guests and CFTRI leaders presented these technologies, showcasing creativity in meeting nutritional requirements and supporting well-being through functional food items.

Food Intolerance Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, product type, and distribution channel.

Breakup by Type:

- Bakery Products

- Confectionery Products

- Dairy and Dairy Alternatives

- Meat and Seafood Products

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bakery products, confectionery products, dairy and dairy alternatives, meat and seafood products, and others.

Bakery products include gluten-free breads, cakes, cookies, and pastries for consumers with gluten intolerance or celiac disease. This segment is expanding quickly because of the rising need for gluten-free choices that maintain both flavor and consistency. Progress in baking technology and replacing ingredients, like almond flour and coconut flour are leading to advancements in the gluten-free bakery sector, increasing the attractiveness and availability of these products. As a result, the rise of the gluten-free bakery segment is bolstering the food intolerance products market value.

Confectionery products, such as chocolates, candies, and gums made without popular allergens like gluten, dairy, and nuts appeal to a wide range of people looking for delicious treats without adverse health issues. The segment is supported by the addition of healthier, low-sugar options and the incorporation of natural sweeteners. Companies are prioritizing transparent labeling to appeal to health-conscious individuals.

Dairy and dairy alternatives consist of lactose-free dairy products like milk, cheese, yogurt, and non-dairy alternatives, including almond milk, soy milk, and oat milk. The shift towards eating more plant-based foods and the increasing number of people with lactose intolerance are important factors influencing this category. Advancements in taste and consistency are enhancing the popularity of non-dairy options. Furthermore, the segment is advantageously positioned due to increasing consumer demand for sustainable and ethically sourced food items. The food intolerance products market forecast indicates a steady growth for this segment, driven by these evolving consumer preferences.

Breakup by Product Type:

- Diabetes-Free Food

- Gluten-Free Food

- Lactose-Free Food

- Others

Diabetes-free food holds the largest share of the industry

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes diabetes-free food, gluten-free food, lactose-free food, and others. According to the report, diabetes-free food accounted for the largest market share.

Diabetes-free food holds the biggest market share according to the food intolerance products market overview, catering to individuals managing diabetes by providing low-sugar and low-glycemic index options. The rise of this segment is driven by the rising occurrence of diabetes on a global scale and the growing awareness about the benefits of controlling blood sugar levels. Apart from this, advancements in sugar substitutes like stevia and monk fruit, combined with a focus on fiber-rich and nutrient-packed recipes, are broadening the range and accessibility of diabetic-friendly food choices. Moreover, the increasing popularity of health-conscious eating habits among non-diabetic individuals that looking to decrease sugar consumption is supporting the food intolerance products market growth. During Diabetes Awareness Month in January 2024, Rebar collaborated with DMC Medical Center to introduce a new line of beverages for individuals with diabetes. These drinks contain 25% less carbohydrates than regular ones, specifically designed for diabetics with different options depending on the fruit sugar content and a sugar-free yogurt base.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, online stores, others. According to the report, supermarkets and hypermarkets represented the largest segment.

Supermarkets and hypermarkets represent the largest segment as per the food intolerance products market outlook, offering wide reach and easy access for consumers. These retailers provide a diverse range of products, including gluten-free and lactose-free foods as well as diabetes-friendly choices, all available in one place. Their broad network and spacious store layout enable thorough product showcases and frequent promotions, improving user awareness and convenience. The dominance of the segment is also driven by partnerships with manufacturers and the addition of private-label products tailored to specific dietary needs. Additionally, supermarkets and hypermarkets frequently have specialized areas for health foods, simplifying the search and purchase of products suitable for intolerance.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest food intolerance products market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for food intolerance products.

North America represents the largest segment, driven by high consumer awareness and advanced diagnostic capabilities. The region is advantaged by a robust retail system featuring supermarkets, hypermarkets, and online platforms that provide a variety of products suitable for people with different dietary needs. The high occurrence of food intolerances and allergies and the growing focus on health and well-being are driving the food intolerance products demand in the region. Moreover, stringent regulations in North America guarantee top-notch food safety and labeling standards, enhancing consumer trust in the products. The market dominance is also supported by the presence of key industry leaders and continuous advancements in food technology. In November 2023, Daring Foods introduced five new plant-based and gluten-free frozen meals in the US, expanding its product offerings. The newly introduced dishes, such as Spicy Fajita and Teriyaki Plant Chicken Bowls, were created to appeal to health-conscious users by offering more than 16 grams of protein in each serving.

Competitive Landscape:

- The food intolerance products market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the industry include Abbott Nutrition, Amy’s Kitchen Inc., Boulder Brands Inc. (Pinnacle Foods Inc.), Conagra Brands Inc., Danone S.A., Dr. Schar AG/SPA, Fifty-50 Foods Inc., General Mills Inc., Kellogg Company, Nestle S.A., The Hain Celestial Group Inc., The Kraft Heinz Company, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Important individuals in the industry are prioritizing creativity, broadening product ranges, and improving distribution channels to satisfy increasing consumer requests. They dedicate their resources for research and development (R&D) in order to develop new formulas that cater to different food intolerances, making sure that their products are both efficient and attractive. Furthermore, leading food intolerance products companies are utilizing strategic alliances and purchases to enhance their market position and extend their user base. Marketing strategies are becoming more focused on digital channels, specifically aiming at health-conscious customers on online platforms and social media. Besides this, consumers are prioritizing sustainability and clean label initiatives more, as they are seeking transparency and environment-friendly options in their food selections. In March 2023, Dr. Schär revealed a €6.8 million initiative to install a new gluten-free manufacturing unit at its plant in Alagón, Spain. This move generated 22 new positions and broadened its ability to supply gluten and lactose-free items to European markets.

Food Intolerance Products Market News:

- February 2024: Nestlé introduced its initial animal-free and lactose-free whey protein powder, Better Whey, marking a notable step into the precision fermentation dairy protein market. This product targeted people who are lactose intolerant and focused on sustainability by minimizing environmental impact compared to regular dairy products.

- October 2023: Amy's Kitchen introduced a line of family size entrées with six new options designed for serving three to four people, accommodating different dietary requirements, such as gluten-free choices like cheese enchiladas and broccoli & cheddar bake.

- July 2023: Dr Schär revealed a €12m investment in its biscuit production facility in Dreihausen, Germany, with the goal of enhancing efficiency and maximizing production time through the implementation of new equipment and robotics. This growth helped Dr Schär increase their gluten-free product output, in line with their dedication to food intolerances.

Food Intolerance Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bakery Products, Confectionery Products, Dairy and Dairy Alternatives, Meat and Seafood Products, Others |

| Product Types Covered | Diabetes-Free Food, Gluten-Free Food, Lactose-Free Food, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Nutrition, Amy’s Kitchen Inc., Boulder Brands Inc. (Pinnacle Foods Inc.), Conagra Brands Inc., Danone S.A., Dr. Schar AG/SPA, Fifty-50 Foods Inc., General Mills Inc., Kellogg Company, Nestle S.A., The Hain Celestial Group Inc., The Kraft Heinz Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current food intolerance products market trends, market forecasts, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the market and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the food intolerance products industry.

Key Questions Answered in This Report

The global food intolerance products market was valued at USD 12.0 Billion in 2024.

We expect the global food intolerance products market to exhibit a CAGR of 3.46% during 2025-2033.

The rising prevalence of coeliac disease and lactose intolerance, along with the introduction of nutrient-rich and flavorful vegan, gluten, and lactose-free food products that do not trigger food intolerance, is primarily driving the global food intolerance products market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of food intolerance-based products.

Based on the product type, the global food intolerance products market has been bifurcated into diabetes-free food, gluten-free food, lactose-free food, and others. Among these, diabetes-free food currently holds the majority of the total market share.

Based on the distribution channel, the global food intolerance products market can be segmented into supermarkets and hypermarkets, convenience stores, online stores, and others. Currently, supermarkets and hypermarkets exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global food intolerance products market include Abbott Nutrition, Amy’s Kitchen Inc., Boulder Brands Inc. (Pinnacle Foods Inc.), Conagra Brands Inc., Danone S.A., Dr. Schar AG/SPA, Fifty-50 Foods Inc., General Mills Inc., Kellogg Company, Nestle S.A., The Hain Celestial Group Inc., and The Kraft Heinz Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)