Food and Beverages Processing Equipment Market Report by Type, End Product Form, Mode of Operation, Application, and Region, 2025-2033

Food and Beverages Processing Equipment Market Size and Share:

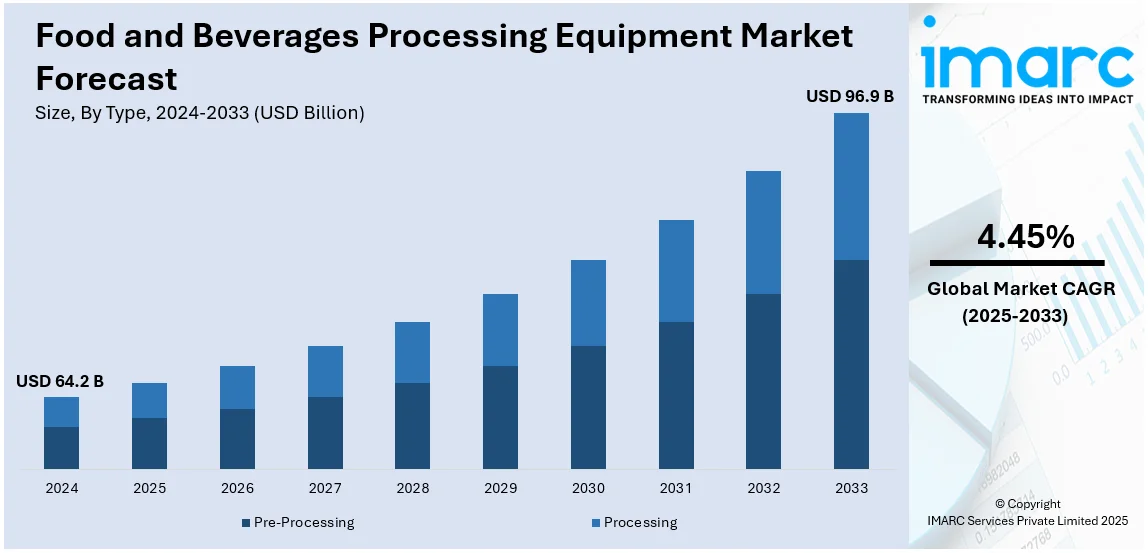

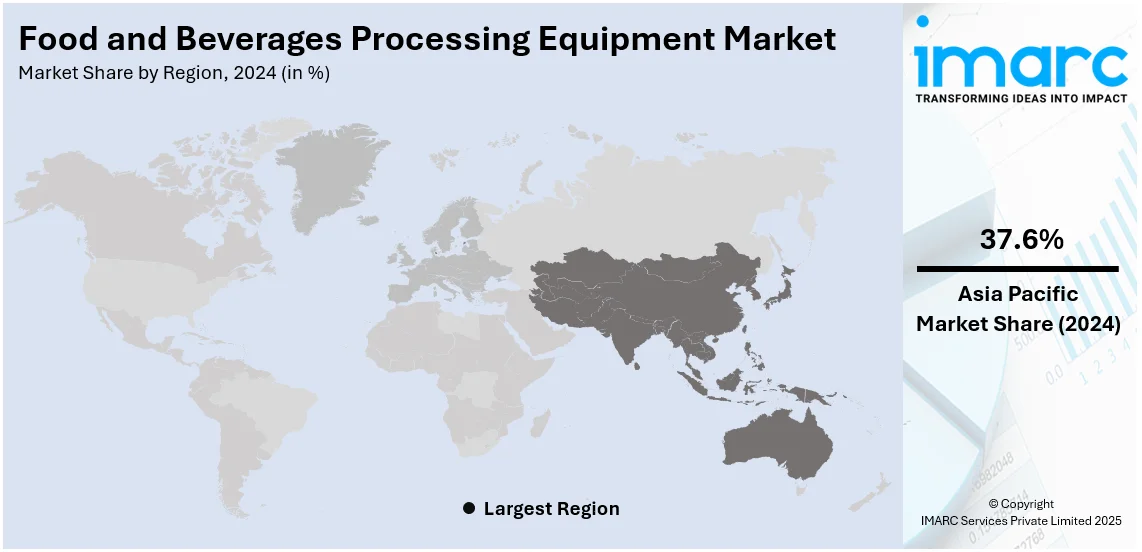

The global food and beverages processing equipment market size was valued at USD 64.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 96.9 Billion by 2033, exhibiting a CAGR of 4.45% during 2025-2033. Asia Pacific currently dominates the market, holding 37.6% of the market share in 2024. The Asia Pacific food and beverages processing equipment market share is driven by rising consumer demand for processed food, technological advancements in automation, increased food safety regulations, expanding food industries, and growing urbanization.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 64.2 Billion |

|

Market Forecast in 2033

|

USD 96.9 Billion |

| Market Growth Rate (2025-2033) |

4.45%

|

With the increase in demand for processed food and beverages globally, the food and beverage processing equipment market is showing improvement. The demand for products such as ready-to-eat foods and packaged items is created by urbanization and increasingly busy lifestyles. Also, changing consumer preferences for convenience and time-saving consumption modes have been increasingly fueling the demand for processed food and beverages all around the world. Technological advances such as automation and digitalization have improved production efficiency and labor cost reductions and have assured quality consistency in products. The segment also includes consumers who are becoming more health conscious and more inclined toward organically and preservative-free processed food and beverages on account of the innovative processing technologies available. More people are now concerned about food safety regulations, which encourage further growth in the market through investment made by manufacturers in highly developed equipment to fulfill their quality and compliance standards.

The United States stands out as a key market disruptor, driven by the country's focus on automation and digitization drives the demand for efficient, high-performance equipment that enhances productivity and ensures consistent product quality. Manufacturers have, therefore, moved toward advanced processing technologies in order to satisfy these varied consumer needs. The stringent food safety regulations and quality standards also make US firms invest in high-tech processing machinery that enables them to comply with such demands. Besides e-commerce that is growing, there is much demand for easy-to-cook products that only make it more urgent for customers to meet processing needs with efficiency. Substantial R&D investment enables the US to continue taking the lead in new technology and calls itself a major disruptor in the international marketplace.

Food and Beverages Processing Equipment Market Trends

Increasing Awareness about Sustainability

The need for energy-efficient and environmentally friendly processing equipment is increasing due to sustainability concerns. Manufacturers are investing in technologies that reduce waste, water consumption, and carbon footprints. In May 2024, Diageo announced its investment plan to decarbonize its historic Guinness brewery in Dublin. This initiative aims to reduce carbon emissions related to premium spirits packaging and distribution by 88% and decrease glass waste by 99%.

Focus on Expansion of Packaging Automation

Packaging automation is gaining traction as manufacturers seek more efficient and cost-effective ways to package food and beverages. Automated packaging solutions eliminate waste and increase packing speed, especially in high-volume manufacturing conditions. In May 2024, Pernod Ricard and ecoSPIRITS revealed a five-year worldwide licensing deal where Pernod Ricard would supply its leading spirits brands in large, reusable containers to hospitality establishments.

Growing Use of Smart Technologies

The food and beverages processing equipment market overview is exploring automation and smart processing technologies, such as IoT-enabled equipment and artificial intelligence, which are transforming the food and beverage processing equipment industry. These improvements boost production efficiency and offer greater quality control. In March 2024, Sojo Industries, a leading automation and robotics mobile manufacturer of multi-pack assembly for food and beverage brands and retailers, launched Sojo Shield, a unique dock-to-dock software platform offering real-time, accurate reporting on key tracking events such as shipping, receiving, and transport.

Food and Beverages Processing Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the food and beverages processing equipment market forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on type, end product form, mode of operation, and application.

Analysis by Type:

- Pre-Processing

- Processing

Processing leads the market with around 53.7% of market share in 2024. Processing equipment is used for tasks, such as mixing, grinding, pasteurization, and packing. These machines use innovative automation technology to provide consistent quality, safety, and efficiency in manufacturing, benefiting industries such as dairy, baking, meat, and drinks.

Analysis by End Product Form:

- Solid

- Liquid

- Semi-Solid

Solid leads the market share in 2024. The primary functions of solid food processing equipment are cutting, grinding, and packaging. It is critical for handling baked goods, snacks, and meat products, assuring uniformity, precision, and quality control throughout the manufacturing process.

Analysis by Mode of Operation:

- Semi-Automatic

- Automatic

Semi-automatic leads the market with around 54.0% of market share in 2024. Semi-automatic food and beverage processing equipment combines manual and automated activities, providing greater flexibility and control in tasks such as packing, mixing, and filling. It improves production efficiency while allowing operators to oversee individual operations, making it appropriate for midsize manufacturing companies. This segment is shaping the food and beverages processing equipment market outlook.

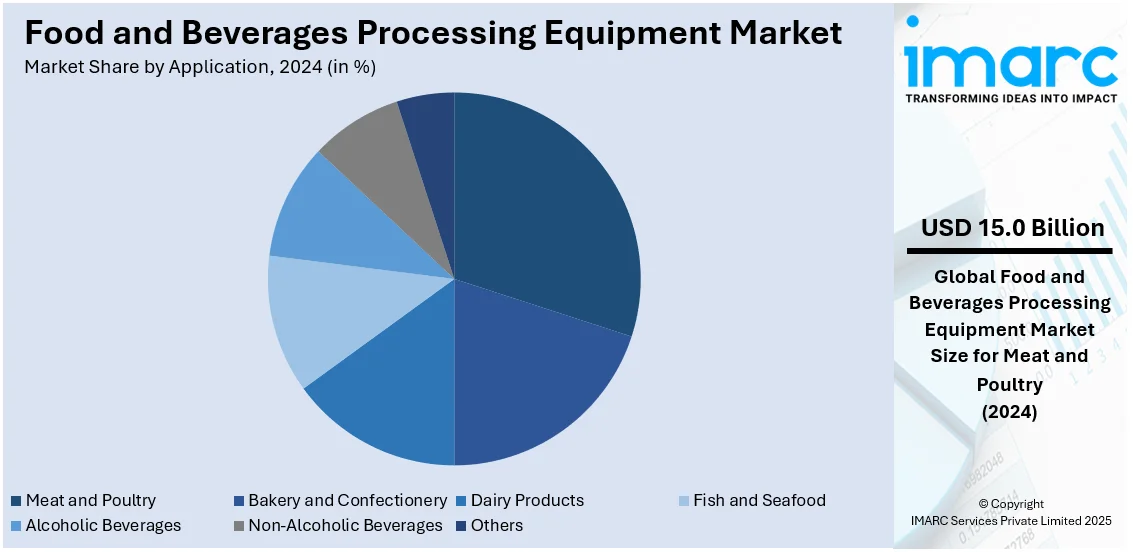

Analysis by Application:

- Bakery and Confectionery

- Meat and Poultry

- Dairy Products

- Fish and Seafood

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Others

Bakery and confectionery leads the market with around 20.0% of market share in 2024. Meat and poultry processing equipment is designed to handle duties such as cutting, grinding, deboning, and packaging. These technologies ensure sanitation, safety, and efficiency when handling huge volumes, thereby addressing the global market need for high-quality and processed meat.

Regional Analysis

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, Asia Pacific accounted for the largest market share of over 37.6%. As per the food and beverages processing equipment market analysis, Asia Pacific leads the market as a result of increased demand for processed foods, urbanization, and technological developments. The region is a significant contributor, owing to the rising consumption of packaged and convenient meals.

Key Regional Takeaways:

United States Food and Beverages Processing Equipment Market Analysis:

In 2024, the United States accounted for over 88.50% of the food and beverages processing equipment market in North America. Technological advancements and growing processed food demand propel the U.S. food and beverages processing equipment market. According to the U.S. Department of Agriculture's Economic Research Service (USDA ERS), one of the largest manufacturing sectors, food processing provides jobs for around 1.7 million and consists of over 42,700 establishments. Food-processing industries comprise the sub-segments of meat, dairy, bakery, and beverage processing, where advanced mechanisms are needed according to efficiency standards, safety protocols, and sustainability considerations. The FDA and other regulatory mechanisms enforce stricter codes to ensure higher food safety through automated or hygienically processed food materials. Robotics, AI, and sustainable energy-efficient products have led to investments in other avenues to revolutionize market progression. This rise in plant-based and organic food products fuels innovative equipment used in food processing. Governmentally supported initiatives for local food production and exports of such products create a stable expansion within the U.S. food and beverage processing equipment market.

Europe Food and Beverages Processing Equipment Market Analysis:

This growth in the market for food and beverage processing equipment in Europe can be attributed to technological advancements, as well as the growing concerns over food safety and efficiency. FoodDrinkEurope's Data & Trends of the European Food and Drink Industry 2024 stated that the industry employs around 4.7 million people with a turnover of €1.2 trillion (USD 1.23 trillion) for the EU food and drink sector, which stands as the biggest manufacturing industry for the EU. Half of the EU's 27 Member States are big manufacturers employing food and drinks, a sector driven mainly by increased demand for automation and smart processing technologies in pursuit of improved productivity while maintaining rigidly stringent food safety standards at play in the EU. Growing also is the investment in sustainable processing equipment on the back of sustainability targets pursued under the banner of the EU. The rising consumer demand for organic, plant-based, and functional foods further fuels innovation in processing technologies, ensuring to provide a positive European food and beverage processing equipment market outlook.

Asia Pacific Food and Beverages Processing Equipment Market Analysis:

Asia Pacific food and beverage processing equipment market is growing as more people become urbanized, the disposable incomes rise, and there is an increasing demand for processed foods. In 2023, the USDA reported that China's F&B industry increased by 3.75% to USD 1.67 trillion, with robust consumer demand and industrial growth. Rapid adoption of automation and smart processing technologies is creating efficiency and higher product quality throughout the region. Countries such as India and Japan are investing in high-end food processing infrastructure. This is possible because of governments promoting local manufacturing and food exports. The need for plant-based, functional, and convenience foods is also fostering innovation in the development of new processing equipment. Stringent food safety regulations in key markets, such as China and Australia, are encouraging the adoption of hygienic and energy-efficient machinery. With continued investments in automation and sustainability, Asia Pacific is poised to remain a key hub for food and beverage processing equipment.

Latin America Food and Beverages Processing Equipment Market Analysis:

The Latin American food and beverage processing equipment market growth is driven by increasing industrialization and demand for processed foods. According to an industrial report, the food and beverage processing sector in Brazil earned a revenue of USD 231 billion in 2023, thus growing by 7.2% from the previous year with a share of 10.8% in Brazil's GDP. This growth of the food industry shows that it is also expanding in the region through an increase in consumer demands and exports. Mexico and Argentina are investing in the latest food processing technologies to ensure efficiency and quality that matches international standards. Governments are encouraging the production of food locally and exporting it, thus increasing demand for modern processing equipment. There is also a rising demand for packaged, frozen, and convenience foods, which accelerates the demand for automated machinery. Sustainability is also a key driver for manufacturers to use energy-efficient and environmentally friendly processing solutions. With a strong industrial base and continuous investment in modernization, Latin America is positioned for steady growth in food processing equipment.

Middle East and Africa Food and Beverages Processing Equipment Market Analysis:

The Middle East and Africa food and beverage processing equipment market is witnessing growth due to rapid urbanization, rising disposable incomes, and increasing demand for processed foods. According to the U.S. Department of Agriculture, USDA, states that in 2023 Saudi Arabia's food retail market stands at more than USD 51 billion and would grow by more than 5% annually from urbanization to population growth. The changing purchasing habits, shop expansions, physical stores, along with the popularization of platforms, are what drive investment for advanced food processing technologies to catch up with modern consumer preferences. Governments across the region are implementing policies to boost local food production and enhance food security, increasing demand for automated and energy-efficient processing equipment. Additionally, the rise of quick-service restaurants and packaged food consumption is fueling market expansion. With ongoing infrastructure development and technological advancements, the Middle East and Africa remain key regions for food and beverage processing equipment growth.

Competitive Landscape:

Key players in the food and beverages processing equipment market are making significant efforts to drive growth and innovation by focusing on technological advancements, sustainability, and meeting evolving consumer demands. Companies are increasingly investing in automation, robotics, and AI-powered solutions to improve operational efficiency, reduce labor costs, and ensure consistent quality in production. By incorporating smart technologies like IoT and data analytics, manufacturers can optimize production processes and achieve real-time monitoring for better decision-making. Furthermore, there is a strong focus on sustainability, with players adopting energy-efficient equipment and minimizing waste through recycling and reusing materials during production. In response to the growing demand for healthier, organic, and plant-based products, key players are developing specialized equipment to handle new ingredients and production methods while maintaining high standards of food safety and quality. Additionally, collaboration with research institutions and innovation hubs allows for the development of cutting-edge solutions that meet market needs. To cater to diverse consumer preferences, manufacturers are expanding their product portfolios to include equipment designed for various food types, from dairy to snacks and beverages. These efforts collectively position the key players to not only stay competitive in a rapidly evolving market but also contribute to shaping the future of food processing technology.

The report provides a comprehensive analysis of the competitive landscape in the food and beverages processing equipment market with detailed profiles of all major companies, including:

- Marel

- GEA Group

- Bühler

- JBT Corporation

- Alfa Laval

- TNA Australia Solutions

- Bucher Industries

- Equipamientos Cárnicos

- S.L. (Mainca)

- Clextral

- SPX Flow

- Bigtem Makine

- Fenco Food Machinery

- Krones Group

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- January 2025: JBT Corporation completed its voluntary takeover of Marel hf., forming JBT Marel Corporation. The combined company aims to transform the future of food with diverse solutions and enhanced operational scale.

- May 2024: Diageo announced its investment plan to decarbonize its historic Guinness brewery in Dublin.

- May 2024: Pernod Ricard and ecoSPIRITS revealed a five-year worldwide licensing deal where Pernod Ricard will supply its leading spirit brands in large, reusable containers to hospitality establishments.

- March 2024: Sojo Industries, a leading automation and robotics mobile manufacturer of multi-pack assembly for food and beverage brands and retailers, launched Sojo Shield, a unique dock-to-dock software platform offering real-time, accurate reporting on key tracking events such as shipping, receiving, and transport.

- January 2024: GEA introduced its new continuous bacon processing line at IPPE 2024 in Atlanta. The system enhances slicing, packaging, cooking, and freezing efficiency. CEO Azam Owaisi emphasized the company's commitment to innovation and customer-centric solutions in the food industry.

Food and Beverages Processing Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Pre-Processing, Processing |

| End Product Forms Covered | Solid, Liquid, Semi-Solid |

| Mode of Operations Covered | Semi-Automatic, Automatic |

| Applications Covered | Bakery and Confectionery, Meat and Poultry, Dairy Products, Fish and Seafood, Alcoholic Beverages, Non-Alcoholic Beverages, Others |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

| Companies Covered | Marel, GEA Group, Bühler, JBT Corporation, Alfa Laval, TNA Australia Solutions, Bucher Industries, Equipamientos Cárnicos, S.L. (Mainca), Clextral, SPX Flow, Bigtem Makine, Fenco Food Machinery, Krones Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the food and beverages processing equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global food and beverages processing equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the food and beverages processing equipment industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The food and beverages processing equipment market was valued at USD 64.2 Billion in 2024.

The food and beverages processing equipment market is projected to exhibit a CAGR of 4.45% during 2025-2033.

The food and beverages processing equipment market is impelled by increasing demand by consumers for processed and convenient foods, technological advancements in automation, and the need for efficient production. Additionally, rising health consciousness, stringent food safety regulations, and urbanization contribute to the demand for advanced, high-performance processing equipment.

Asia Pacific currently dominates the market driven by increased demand for processed foods, urbanization, and technological developments.

Some of the major players in the food and beverages processing equipment market include Marel, GEA Group, Bühler, JBT Corporation, Alfa Laval, TNA Australia Solutions, Bucher Industries, Equipamientos Cárnicos, S.L. (Mainca), Clextral, SPX Flow, Bigtem Makine, Fenco Food Machinery, Krones Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)