Folic Acid Market Size, Share, Trends, and Forecast by Application, Distribution Channel, and Region, 2025-2033

Folic Acid Market Size and Share:

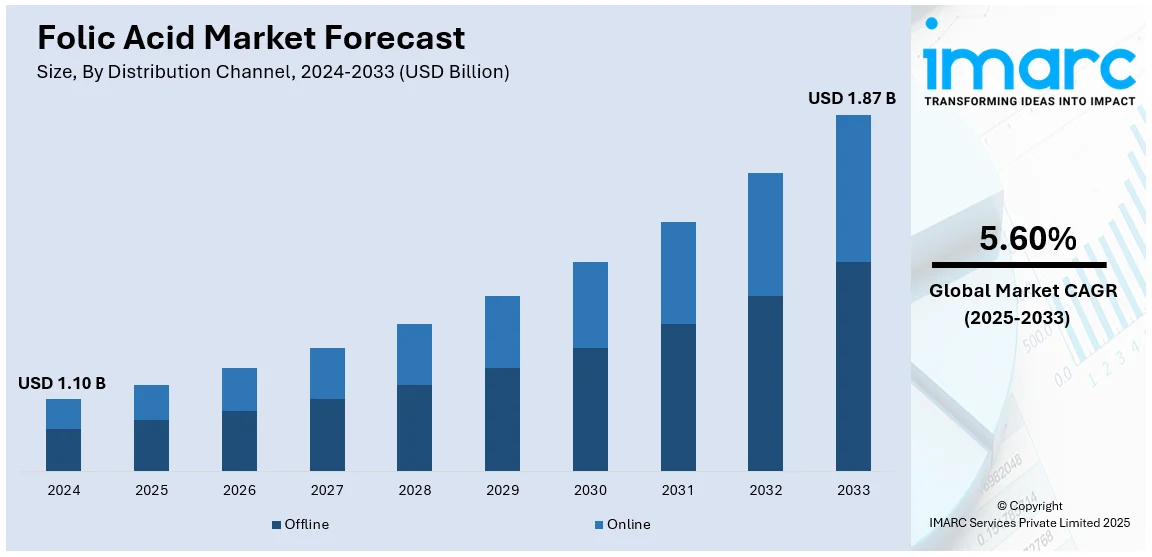

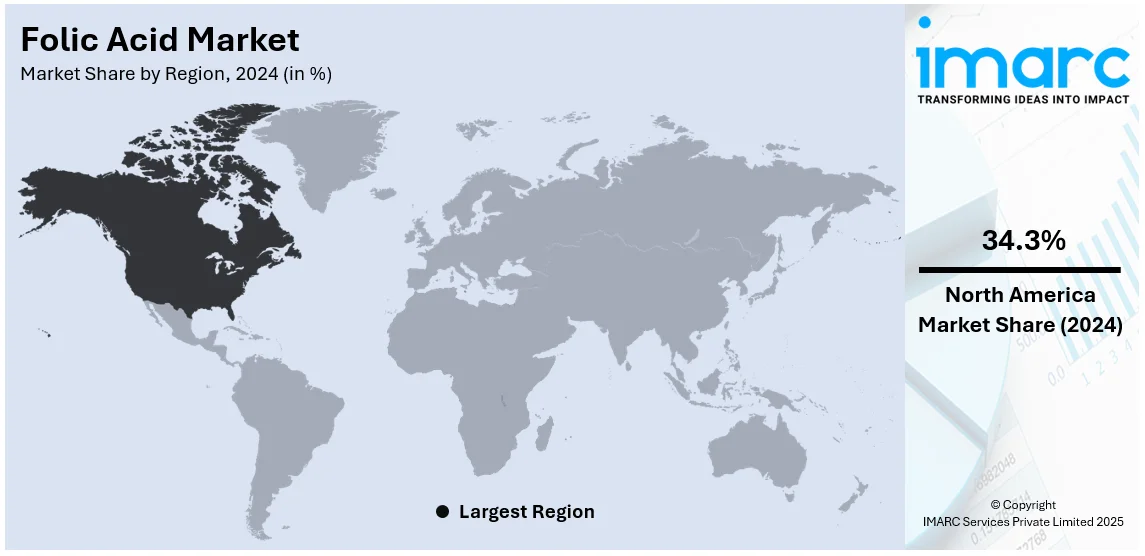

The global folic acid market size was valued at USD 1.10 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.87 Billion by 2033, exhibiting a CAGR of 5.60% from 2025-2033. North America currently dominates the market, holding a market share of over 34.3% in 2024. The growth of the North American region is driven by stringent health regulations, rising health awareness, and robust dietary supplement consumption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.10 Billion |

| Market Forecast in 2033 | USD 1.87 Billion |

| Market Growth Rate (2025-2033) | 5.60% |

The high level of public awareness about the importance of folic acid in preventing birth defects, particularly in early pregnancy, is leading to widespread usage, especially among women planning pregnancy or who are already pregnant. Moreover, the growing awareness about the crucial role of folic acid in preventing cardiovascular diseases, supporting brain health, and boosting overall well-being is encouraging its consumption among a broader demographic, including individuals outside of pregnancy. Besides this, the rising popularity of online shopping, and the growing availability of folic acid supplements through e-commerce platforms is making it more accessible to consumers. The convenience of purchasing supplements online, along with the ability to compare prices and read reviews, is contributed to the market growth.

The United States plays a crucial role in the market, driven by laws requiring the enrichment of food items with folic acid. These regulations focus on tackling public health issues, like avoiding neural tube defects, by making sure that vital nutrients are included in frequently eaten foods. These policies aid in the extensive access to and usage of folic acid. In 2024, the California legislature passed AB 1830, requiring that corn masa products be fortified with folic acid to aid in decreasing neural tube defects in pregnant women. The law mandates 0.7 mg of folic acid for every pound of corn masa flour and 0.4 mg for wet masa, with enforcement starting in January 2026.

Folic Acid Market Trends:

Enhanced Focus on Infant Nutrition

The rising emphasis on infant nutrition is a crucial factor bolstering the market growth. Folic acid plays a crucial role in healthy brain development and reducing the risk of birth defects in babies, resulting in its greater presence in prenatal vitamins and baby formulas. As recognition increases regarding the vital importance of adequate nutrition during the early phases of life, parents and healthcare practitioners are becoming more careful about adding crucial nutrients like folic acid into babies' diets. This trend is additionally backed by nutritional guidelines and recommendations from pediatric associations globally, increasing the market demand for folic acid in products aimed at infants and young children. In 2024, Danone India introduced AptaGrow, a nutrition product for toddlers aged 3-6, containing 37 nutrients such as folic acid, DHA, and prebiotics to promote growth, brain development, and immune support. The launch features the AptaGrow Growth Chakra, a resource designed for mothers to monitor their child's progress and obtain customized meal plans.

Innovation in Supplement Formulation and Delivery

The continuous advancements in supplement formulation and delivery by the pharmaceutical industry are enhancing market expansion. Businesses are creating sophisticated supplements that not only feature folic acid but also incorporate it with other vital nutrients to improve overall health advantages. These advancements seek to enhance nutrient bioavailability, promoting better absorption and reducing possible side effects. By concentrating on all-encompassing solutions that enhance different health aspects like red blood cell formation, immune function, and bone durability, producers can satisfy the increasing consumer need for more effective and multifunctional dietary supplements. This method aids in tackling particular health issues with customized nutrient blends, thus broadening the market potential of folic acid-containing products. In 2024, Cadila Pharmaceuticals introduced Militol, an iron supplement featuring ferric maltol, folic acid, along with vitamins B12, C, and D. Tailored to improve absorption and reduce side effects, it aids in the production of red blood cells, promotes immune health, and strengthens bones.

Government Programs and Health Awareness Campaigns

Public health campaigns and government programs focused on nutritional education are having a beneficial impact on the market. Numerous governing authorities globally are launching initiatives and regulations that advocate for the health advantages of folic acid, especially in the prevention of birth defects and enhancement of overall well-being. These efforts frequently encompass financial aid for folic acid supplements, integration of folic acid into health guidelines, and assistance for research regarding the advantages of folic acid. These policies not only boost the intake of folic acid via supplements but also through enriched foods. In 2024, the Food Corporation of India (FCI) initiated a campaign in Kakinada to inform the public about fortified rice, debunking misconceptions and highlighting its health advantages. Fortified rice, enhanced with nutrients such as iron, folic acid, and vitamin B12, is distributed through the Public Distribution System to address malnutrition.

Folic Acid Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global folic acid market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on application and distribution channel.

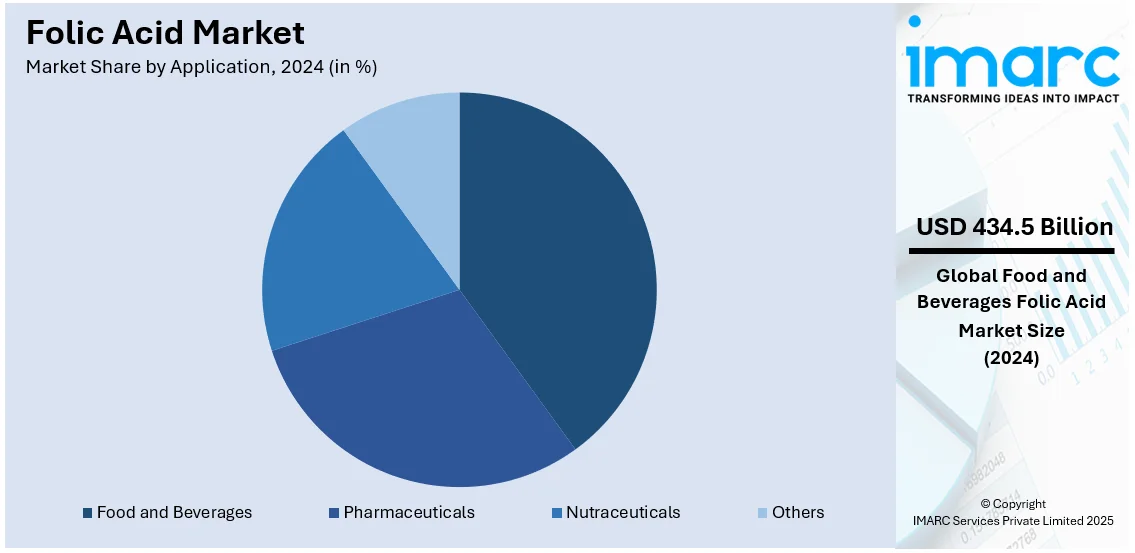

Analysis by Application:

- Food and Beverages

- Pharmaceuticals

- Nutraceuticals

- Others

Food and beverages stand as the largest component in 2024, holding 39.5% of the market. The food and beverages sector leads the market mainly due to the extensive adoption of government regulations that mandate the fortification of essential foods to address micronutrient deficiencies, especially neural tube defects in infants. This regulatory structure is crucial for integrating folic acid into widely consumed food items like cereals, bread, pasta, and flour, making it a standard additive in both advanced and emerging regions. Additionally, the growing consumer consciousness about health and wellness is driving the demand for fortified foods. People are becoming increasingly aware of how nutrients affect overall health and are choosing products enhanced with essential vitamins like folic acid. This trend is further supported by the growing clean label movement, where consumers seek products that provide health advantages and transparent ingredient lists.

Analysis by Distribution Channel:

- Offline

- Online

In 2024, offline represented the largest segment, accounting 78.5% of the market share. Offline holds the biggest market share due to preference for personalized shopping experiences and immediate product access in stores like pharmacies and health food outlets. User trust and the ability to receive immediate, personalized advice drive many to purchase from brick-and-mortar stores such as pharmacies, health food shops, and supermarkets. These venues offer the advantage of direct client service where shoppers can ask questions and get recommendations on folic acid supplements and fortified foods from knowledgeable staff. Additionally, the physical presence of products allows people to verify packaging and expiration dates, ensuring product quality and safety, which is particularly crucial for dietary supplements. Furthermore, in many regions, especially where internet access and e-commerce penetration are limited, offline stores remain the primary source of health-related products. These stores are often strategically located to be easily accessible to a wide range of users, ensuring that products like folic acid supplements are readily available to those who may not shop online.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for the largest market share at 34.3%. North America dominates the market, primarily because of extensive regulatory requirements mandating the enrichment of staple foods with folic acid, with the goal of diminishing health problems linked to folate deficiency, including major birth defects. This regulatory framework guarantees a consistent addition of folic acid into the daily diet of the population via widely eaten foods such as bread, pasta, and cereals. Additionally, the existence of top pharmaceutical and nutraceutical firms in the area, consistently innovating and broadening their product ranges, is enhancing the demand and accessibility of folic acid-enriched products. Furthermore, the increasing elderly demographic, which needs supplements to address age-related health issues such as cognitive deterioration and heart diseases, is driving the higher use of folic acid. An article published in 2024 by the Population Reference Bureau (PRB) projected that the population of Americans aged 65 and older, which stood at 58 million in 2022, is expected to reach 82 million by 2050—a significant growth of 47%. This demographic's share of the total population is also forecasted to increase from 17% in 2022 to 23% by mid-century.

Key Regional Takeaways:

United States Folic Acid Market Analysis

In North America, the United States represented 86.70% of the overall market share. The United States holds a considerable portion of the market, fueled by heightened individual awareness regarding health and nutrition. Public health programs, such as the compulsory enrichment of products like flour with folic acid, are crucial in fostering market expansion. The nation’s strong healthcare system, combined with the broad availability of dietary supplements, additionally improves consumers’ access to folic acid. Moreover, the emphasis on preventive health and the growing involvement in wellness trends persist in boosting the demand for folic acid supplements, especially among expectant mothers and the elderly. The rising number of health-aware consumers and the increasing amount of people aiming to sustain overall wellness further drives the need for folic acid. Moreover, the growth of e-commerce platforms is increasing the availability of folic acid supplements, as online sellers provide a range of products, making it easier for consumers to find personalized nutrition options. The IMARC Group forecasts that the e-commerce market in the United States will reach US$ 2,083.97 Billion by 2032, reflecting a compound annual growth rate (CAGR) of 6.80% between 2024 and 2032.

Europe Folic Acid Market Analysis

Europe plays an essential role in the market, propelled by regulatory backing and a significant emphasis on public health efforts. The increasing interest in functional foods in the region, like fortified cereals and drinks, is boosting the need for folic acid. The increasing recognition of the extensive health advantages of folate, including its possible impact on cardiovascular and cognitive well-being, is resulting in greater intake of folic acid supplements in the area. In addition to this, numerous countries in the area are enforcing compulsory folic acid fortification in main food items, greatly lowering the chances of birth defects and enhancing maternal health. In 2024, the UK government announced intentions for a law requiring that non-wholemeal wheat flour be fortified with folic acid by the end of 2026. The aim is to reduce neural tube defects in newborns by 20%, improve maternal health, and save the NHS £20 million in ten years.

Asia Pacific Folic Acid Market Analysis

The Asia Pacific area is experiencing swift expansion as a result of heightened health consciousness and enhanced healthcare accessibility in nations such as China and India. The growing fortified food industry in the area, encompassing cereals and baked goods, is strengthening the market expansion. The increasing recognition of maternal health and the escalating prevalence of nutritional deficiencies are prompting governments to adopt policies that advocate for folic acid supplementation, particularly for expectant mothers. The National Birth Defects Awareness Month in 2024 kicked off with the theme "Breaking Barriers: Inclusive Support for Children with Birth Defects." This initiative emphasizes the significance of folic acid intake, maintaining good health before pregnancy, and the early detection of birth defects to improve child health outcomes.

Latin America Folic Acid Market Analysis

In Latin America, the market is expanding as people become more aware about the significance of folate for maternal and general health. Nations like Brazil and Mexico have experienced an increase in fortified food items, such as cereals and grains, which enhance the overall accessibility of folic acid. Moreover, regulatory agencies and health organizations are proactively advocating for the advantages of folic acid supplementation, especially for expectant mothers, to help decrease birth defects. In 2024, UNICEF launched the "Maternal Nutrition Improvement Acceleration Plan" to tackle maternal malnutrition and anemia in 16 at-risk countries, including Venezuela. The program includes essential nutrition services such as education, micronutrient supplementation, and screenings. The approach aims to improve maternal health to reduce infant mortality, stunting, and poverty, offering women and children better chances for healthy development.

Middle East and Africa Folic Acid Market Analysis

The Middle East and Africa signify developing markets for folic acid, with considerable growth potential fueled by rising awareness regarding maternal health and the significance of nutrition. Numerous nations in the area are prioritizing enhancements to prenatal care, thereby increasing the demand for folic acid supplements. Public health initiatives aimed at decreasing birth defects and folate deficiencies are supporting market expansion. Furthermore, government efforts to enhance staple foods with vital nutrients such as folic acid to tackle common micronutrient deficiencies are driving market expansion. In 2024, Nigeria announced plans to establish guidelines for fortifying bouillon cubes with iron, zinc, folic acid, and vitamin B12 to combat malnutrition. This initiative aims to address widespread micronutrient deficiencies, referred to as "hidden hunger," through the adoption of cost-effective food fortification techniques.

Competitive Landscape:

Major participants in the market are ramping up their initiatives to grow and create new solutions within the industry. These firms are allocating funds towards research activities to boost the effectiveness and usage scope of folic acid, concentrating on increasing its bioavailability within the human body. They are also concentrating on securing dependable supply chains and improving production capabilities to meet the rising demand. Strategic partnerships and collaborations with food and pharmaceutical companies are common as they aim to integrate folic acid into a broader array of products. Additionally, industry leaders are running awareness initiatives and educational programs to inform the public about the health benefits of folic acid, which is increasing its consumption. For example, in 2024, Sri Lanka declared its ability to manufacture fortified rice kernels enhanced with folic acid and iron via extrusion technology. The fortified rice will fight malnutrition and be provided through the National Free School Meal Programme, with the backing of the WFP, PATH, and additional partners.

The report provides a comprehensive analysis of the competitive landscape in the folic acid market with detailed profiles of all major companies, including:

- dsm-firmenich

- Jiangxi Tianxin Pharmaceutical Co., Ltd.

- Nantong changhai food additive Co., ltd

- Parchem

- Xinfa Pharmaceutical Co., Ltd

Latest News and Developments:

- December 2024: Nutrizoe introduced SnackEasy, a line of healthy snacks for pregnant women, meeting their demand for protein-packed, nausea-friendly, and sugar-free choices. Crafted from natural components and enriched with DHA, calcium, and folic acid, SnackEasy promotes the health of both mothers and their unborn children.

- December 2024: Ifad Multi Products Limited and the Global Alliance for Improved Nutrition (GAIN) introduced Fortified Wheat Flour (Atta) in Bangladesh. Fortified with folic acid, vitamin B12, iron, and zinc, it seeks to enhance immunity, avert anemia and birth defects, and promote general well-being.

- August 2024: Centrum introduced its line of maternal vitamins, featuring Centrum Conception for those attempting to conceive and Centrum Pregnancy + DHA Omega-3 for expectant mothers. These products supply essential nutrients such as folic acid, DHA, and vitamins C, D, and E to promote fertility, a healthy pregnancy, and metabolism.

Folic Acid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Offline, Online |

| Distribution Channels Covered | Food and Beverages, Pharmaceuticals, Nutraceuticals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | dsm-firmenich, Jiangxi Tianxin Pharmaceutical Co., Ltd., Nantong changhai food additive Co., ltd, Parchem, Xinfa Pharmaceutical Co., Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the folic acid market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global folic acid market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the folic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Folic acid is a synthetic form of folate, a type of B vitamin (B9) that is crucial for the production and repair of DNA and other genetic material. It is particularly important in aiding rapid cell division and growth, such as during infancy and pregnancy. It is used in dietary supplements and fortified foods.

The global folic acid market was valued at USD 1.10 Billion in 2024.

IMARC estimates the global folic acid market to exhibit a CAGR of 5.60% during 2025-2033.

The global folic acid market is primarily driven by the growing awareness about its health benefits, particularly in preventing birth defects, which is leading to increased use in supplements and fortified foods. Additionally, rising healthcare expenditure and the growing dietary supplements market is driving its demand. Governmental mandates on folic acid fortification also significantly contribute to the market growth.

In 2024, food and beverages represented the largest segment by application, driven by stringent governmental regulations mandating folic acid fortification in breads, cereals, and flour to combat nutritional deficiencies.

Offline leads the market by distribution channel owing to individual preference for personalized shopping experiences and immediate product access in stores like pharmacies and health food outlets.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global folic acid market include dsm-firmenich, Jiangxi Tianxin Pharmaceutical Co., Ltd., Nantong changhai food additive Co., ltd, Parchem, Xinfa Pharmaceutical Co., Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)