Fog Computing Market Size, Share, Trends and Forecast by Component, Deployment Models, Application, and Region, 2025-2033

Fog Computing Market Size, Share, and Growth Insights:

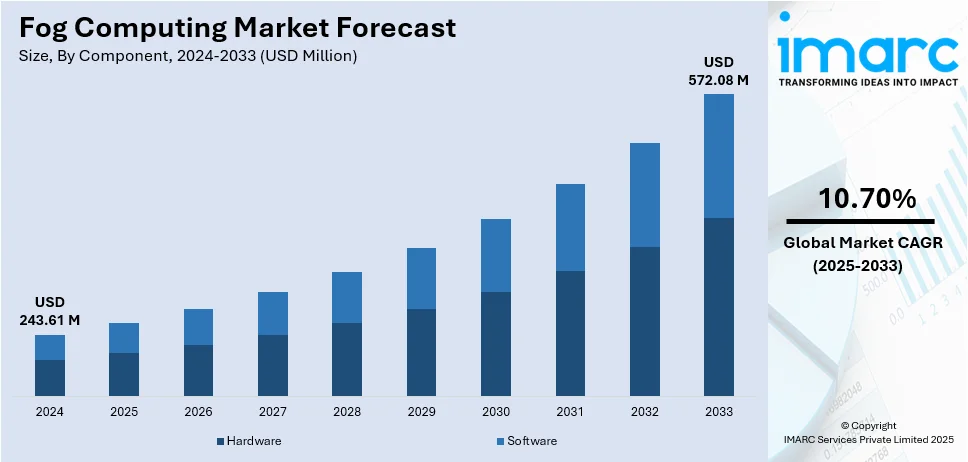

The global fog computing market size is anticipated to reach USD 243.61 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 572.08 Million by 2033, exhibiting a CAGR of 10.70% during 2025-2033. North America currently dominates the market, holding a significant market share of over 44.6% in 2024. The fog computing market share is primarily driven by the widespread adoption of the Internet of Things (IoT) technology, the rising demand for low latency and real-time processing, more efficient data security, scalability, improved bandwidth management, the rise of fifth generation (5G), and the increasing requirement for decentralized computing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2025

|

USD 243.61 Million |

|

Market Forecast in 2033

|

USD 572.08 Million |

| Market Growth Rate (2025-2033) | 10.70% |

The fog computing market is expanding due to the increasing demand for real-time processing and low latency solutions in industries such as IoT, smart cities, and autonomous vehicles. This approach enhances data processing by decentralizing computation addressing the limitations of cloud computing. The rise in connected devices and edge computing adoption further fuels the fog computing market growth on a global scale. For instance, in July 2024, VIA Technologies announced its partnership with Rutronik to enhance IoT and edge AI solutions for the industrial and commercial sectors. This partnership aims to leverage high performance Mediatek Genio processors streamlining product development and supporting extensive lifecycles thus advancing digital transformation and enhancing operational efficiency. Industries leveraging artificial intelligence (AI) and machine learning (ML) are integrating fog computing to improve operational efficiency. Its ability to enable rapid decision making while reducing network congestion is acting as a key driver.

The United States fog computing market is driven by the widespread adoption of IoT devices across sectors like healthcare, manufacturing, and transportation. The need for low-latency data processing to support applications such as autonomous vehicles, smart grids and industrial automation is boosting the demand. Increasing reliance on edge computing to overcome cloud computing limitations such as bandwidth constraints and latency issues is a significant factor. The rise in 5G deployment enhances fog computing capabilities fostering market growth. For instance, in April 2024, Openvia Mobility and NTT DATA announced their plans to launch a Private 5G network for road infrastructure in the United States starting with Richmond, Virginia's Pocahontas Parkway. This initiative aims to enhance connectivity for smart mobility services utilizing Cloud and Edge Computing to improve real time traffic monitoring and user experience on highways. Additionally, the emphasis on data security coupled with regulatory compliance requirements is encouraging businesses to adopt fog computing solutions for real time and decentralized data processing

Global Fog Computing Market Scope and Dynamics

The scope of the market is significantly expanding due to the inclusion of secure data processing features and compliance with stringent regulatory requirements, which is enriching the value proposition of fog computing solutions. Moreover, the proliferation of connected healthcare devices, such as wearable sensors and remote patient monitoring systems, is raising the need for secure, real-time data processing, further enhancing the market's potential in the healthcare sector. As per the market analysis, the integration of blockchain technology into fog computing frameworks is ensuring secure and immutable data transactions, particularly in critical applications like financial services and supply chain management, which is also enhancing the market scope. The market dynamics are also influenced by the strategic collaboration between cloud service providers and fog computing developers, which is enabling the creation of hybrid solutions that bridge the gap between cloud and edge computing. In line with this, the development of industry-specific fog computing applications is diversifying the market, thereby positioning it for sustained growth in the coming years.

Fog Computing Market Trends:

Proliferation of IoT Devices

One of the primary factors increasing the fog computing market share is the rising prevalence of internet of things (IoT) devices. As reported in IoT Analytics’ 171-page State of IoT Summer 2024 document there were 16.6 billion connected IoT devices by the conclusion of 2023 representing a 15% increase compared to 2022. These devices produce vast amounts of data that require real-time processing and analysis to provide timely insights and responses. Conventional cloud computing models frequently encounter difficulties in managing this significant data volume, resulting in latency challenges and bandwidth constraints. Furthermore, fog computing tackles these challenges by making cloud capabilities accessible at the edge of the network, nearer to where data is generated, thereby settling these trials. This resets latency, decreases data that needs to be dispatched to the cloud, and provides IoT applications a performance raise. Consequently, fog computing solutions are increasingly being adopted by industries that make intensive utilization of IoT devices.

Growth of 5G Networks

The increasing deployment of 5G networks is another key factor contributing to the market growth. As per CTIA, following the launch of 5G in 2018 three nationwide networks along with regional provider networks throughout the U.S. now reached 330 million Americans. According to the GSMA, 5G is the quickest mobile generation to be rolled out exceeding one billion connections by the close of 2022 and reaching 1.6 billion connections by the end of 2023 with an expected 5.5 billion by 2030. The 5G technology is set to offer ultra-low latency, high bandwidth, and improved connectivity all of which are essential for the success of fog computing. Its essential characteristics, like high speed and lower latency, further ease the processing and analysis of data on fog nodes, thus enabling faster and more reliable services. This is markedly applicable to applications that need real-time responses, such as autonomous vehicles, augmented reality (AR), virtual reality (VR), and industrial automation. The conjunction between 5G and fog computing is projected to create lucrative opportunities for the market growth.

Growing Demand for Real-Time Data Processing and Analytics

The need for processing and analyzing data in real time is boosting the demand for fog computing in different industries. The contemporary world is paced fast, and businesses and organizations are in dire need of instant insights and actions from the data produced through operations. Fog computing assists real-time processing via the provision of computation and storage resources closer to the source of data. This is particularly useful for time-critical applications in smart grids, healthcare monitoring, video surveillance, and financial services. Moreover, it increases the responsiveness and efficiency of applications, improves data security, and increases privacy by exposing less sensitive information to the broad internet, thereby creating a positive fog computing market outlook.

Fog Computing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fog computing market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment models, and application.

Analysis by Component:

- Hardware

- Gateways

- Routers and Switches

- IP Video Cameras

- Sensors

- Micro Data Center

- Software

- Fog Computing Platform

- Customized Application Software

Software stands as the largest component in 2024, holding around 65.2% of the market. The demand for software components like fog computing platforms and customized application software is driven by an increasing need for more flexible and scalable solutions that could address the multiple needs of various industries. Fog computing platforms bring along a comprehensive framework that owns the management of distributed computing resources and data across several edge devices, improving the overall flexibility and effectiveness of the system. Whereas in custom-made application software solutions, businesses are able to tailor fog computing to meet their operational requirements in terms of extracting the best performance and integration with the existing infrastructures. These software solutions also come along with significant tools for monitoring, administration, and organization of edge devices to ensure smooth and efficient operations, which increases the fog computing market revenue.

Analysis by Deployment Models:

- Private Fog Node

- Community Fog Node

- Public Fog Node

- Hybrid Fog Node

The demand for private fog nodes is facilitated by organizations looking for enhanced data security and control, particularly in industries like finance and healthcare, where sensitive data processing and compliance are crucial.

Community fog nodes accommodate particular groups with common interests, such as research institutions or smart cities, boosting shared resources and collective data processing, thereby improving efficiency, and lowering costs.

Public fog nodes are proposed for wide and relatively insensitive applications to achieve economies of scale. They can be more cost-effective for sectors like retail or entertainment to deal with varied data loads.

As a combination of private and public components, the hybrid fog node provides flexibility and optimized resource utilization to enable objectives with respect to security, cost, and performance by a balance based on individual needs and the sensitivity of data for a given business.

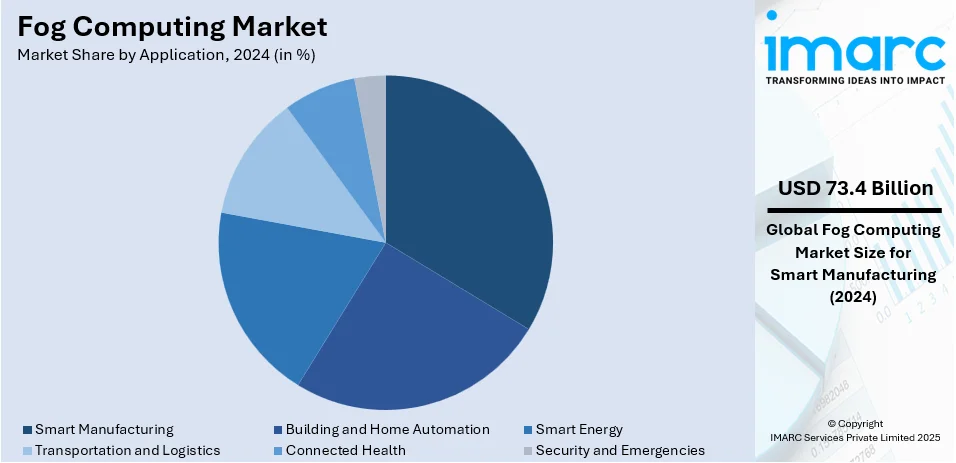

Analysis by Application:

- Building and Home Automation

- Smart Energy

- Smart Manufacturing

- Transportation and Logistics

- Connected Health

- Security and Emergencies

Smart manufacturing leads the market with around 33.5% of market share in 2024. The rising demand for fog computing in smart manufacturing due to the requirement for real-time monitoring, predictive maintenance, and better automation is contributing to the market growth. Fog computing strengthens local data processing, which deters latency to a lowest and time-to-decision efficiently. This is pivotal to predictive maintenance, as it offers real-time recognition of imminent equipment failures and prevents expensive downtime through the extension of the life of a given machine. Besides, fog computing confirms advanced automation systems by providing the computational power needed for real-time data analysis and fast response, thereby offering production lines and overall efficiency optimization. In addition to this, with the processing of sensitive data locally, fog computing provides enhanced data security and privacy, thus impacting the fog computing industry outlook positively.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 44.6%. The fog computing industry report shows that the market demand in North America is driven by the region's advanced technological infrastructure, significant investments in IoT and smart city projects, and the presence of key industry players. North America, particularly the United States, is at the forefront of adopting cutting-edge technologies, with extensive R&D efforts and a robust ecosystem supporting innovation. The region's substantial investment in IoT applications across various sectors, including healthcare, automotive, and industrial automation, establishes a rising need for enhanced data processing solutions like fog computing. Additionally, the existence of key tech brands and startups in North America fosters the expansion and deployment of fog computing technologies, thus facilitating widespread adoption across the region.

Key Regional Takeaways:

United States Fog Computing Market Analysis

In 2024, United States accounted for a share of 87.10% of the North America market. The market for fog computing in the US is growing quickly as more companies use decentralized computing models to improve real-time decision-making and lower latency. Instead of depending entirely on centralized cloud servers, industries like manufacturing, healthcare, and transportation are utilizing fog computing solutions to maximize operational efficiency. This allows for faster data processing at the network's edge. This change is being driven by the increasing use of IoT devices, as more businesses seek to locally process and analyse vast amounts of data produced by connected devices in order to ensure faster answers and lower bandwidth expenses. Additionally, the rise of AI-powered edge analytics is playing a pivotal role in fuelling market growth by enabling intelligent decision-making at the edge without the need for constant cloud interaction. Some new generative AI systems had over 100 million users as of early 2023, according to the GAO. Companies in the U.S. are also prioritizing enhanced data security and privacy by keeping sensitive information closer to the source, mitigating risks associated with cloud-based data storage. Furthermore, the U.S. government’s increasing focus on smart city initiatives and autonomous vehicle technologies is further propelling the demand for fog computing solutions, as they provide the low-latency connectivity required for these applications to function efficiently and reliably. For instance, in 2022, Honeywell and Accelerator for America announced the launch of the Honeywell Smart City Accelerator Program to aid cities strategically project their futures and establish capacity to fund transformational initiatives.

Asia Pacific Fog Computing Market Analysis

The market for fog computing in Asia Pacific is expanding significantly at the moment as companies use edge computing solutions more frequently to manage the increasing amounts of data generated by IoT devices. Fog computing solutions are in higher demand as businesses in industries including manufacturing, healthcare, and logistics concentrate on reducing latency by processing data closer to the source. The implementation of distributed computing systems that provide real-time analytics and quicker decision-making at the edge is made possible by telecom operators' expansion of their 5G networks. The Ministry of Industry and Information Technology claims that over 90% of China's villages and all of the nation's cities and towns are covered by the country's 5G network. In addition, industries are embracing smart city initiatives, where smart traffic systems, surveillance, and environmental monitoring require immediate data processing to enhance urban living. Over 90% of the USD 562.65 million that the Central Government has already made available to 100 Smart Cities under the SCM has been used, according to the Press Information Bureau. Organizations are also leveraging fog computing for predictive maintenance in industries like manufacturing and automotive, where real-time data analytics from connected devices are crucial for reducing downtime. The rising adoption of connected devices and the growing emphasis on network security are propelling the market forward, as fog computing facilitates more secure and localized data management. The increasing focus on enhancing operational efficiency while reducing bandwidth costs and latency is driving businesses across Asia Pacific to explore and implement fog computing solutions.

Europe Fog Computing Market Analysis

Europe's fog computing market is growing significantly as more and more sectors use edge computing solutions to improve real-time decision-making and lower latency. In industries like manufacturing, healthcare, and transportation, fog computing is being used by organizations to solve issues arising from the increasing amount of data produced by IoT devices. Fog computing is being used by companies to enable quicker data processing and analysis at the network edge, boosting efficiency and reducing dependency on centralized cloud data centers. Businesses are implementing fog computing to improve the smooth functioning of smart cities and autonomous vehicles by processing essential information locally, as demand for these technologies grows. The EU's Mission on Climate-Neutral and Smart Cities is one example. Its dual goals are to: (1) establish 100 climate-neutral and smart cities by 2030; and (2) guarantee these cities function as centers for innovation and experimentation so that all towns in Europe can follow suit by 2050. Also, the demand for localized data processing is being driven by European rules centered on data security and privacy, which is further encouraging the use of fog computing. Fog computing is also being used by industries to enhance real-time monitoring and management of complex systems, which reduces operating costs and downtime. Fog computing is increasingly essential for handling the massive, low latency needs connected to high-speed mobile connections as more companies invest in 5G networks. According to the International Telecommunication Union (ITU), Europe has the most extensive 5G coverage, with 68 percent of the population covered. As organizations continue embracing digital transformation, fog computing is emerging as a key enabler in achieving faster, more efficient operations across multiple industries.

Latin America Fog Computing Market Analysis

Due to a number of factors unique to the region, the fog computing market in Latin America is expanding significantly. In order to solve the latency problems brought on by the increasing need for real-time data processing, companies are quickly incorporating edge computing technologies. Industries including manufacturing, healthcare, and smart cities are using fog computing more and more to process data closer to the source, reducing latency and bandwidth consumption, as they accelerate their adoption of IoT solutions. 5G network deployment is being prioritized by governments and businesses, which is fostering a favorable climate for fog computing adoption and allowing low-latency applications in vital industries like industrial automation and driverless cars. Businesses are also concentrating on increasing operational efficiency by utilizing fog computing's capacity to manage enormous amounts of data in decentralized networks, which provides improved security, scalability, and dependability. The need for fog computing solutions is also being driven by the growth of smart city efforts in Latin America, such as transportation and smart grids. To reduce the dangers of data breaches and cloud dependence, companies are also moving sensitive data processing closer to the source as a result of growing cybersecurity worries. For example, Brazil suffered economic damages of almost USD 20 billion in 2018 as a result of malevolent cyberattacks. These persistent patterns are establishing fog computing as an essential technology for the digital transformation of the area.

Middle East and Africa Fog Computing Market Analysis

The fog computing market in the Middle East and Africa is being driven by the region's growing focus on enabling low-latency processing for critical applications such as smart cities, oil and gas operations, and industrial automation. Governments and private organizations are actively implementing advanced IoT ecosystems and edge technologies to overcome challenges in network reliability and bandwidth constraints, especially in remote or underdeveloped areas. The market is witnessing increasing investments in hybrid cloud architectures that integrate fog computing to support real-time data analysis and decision-making across sectors like healthcare, transportation, and energy management. The adoption of 5G networks across the region is accelerating, further propelling the demand for fog computing solutions to manage the massive influx of data generated by connected devices. According to the International Telecommunication Union (ITU), 5G coverage reaches 12 percent of the population in the Arab States region. Companies are continually forming partnerships with global technology providers to deploy scalable fog platforms that align with local infrastructure requirements and regulatory standards. At the same time, industries are focusing on improving cybersecurity measures in fog deployments to address rising concerns about data privacy and system vulnerabilities. These trends are collectively enhancing the operational efficiency, agility, and sustainability of businesses in the Middle East and Africa, driving the adoption of fog computing across diverse applications.

Top Leading Fog Computing Companies:

The fog computing market is highly competitive with major players focusing on innovation, partnerships and strategic acquisitions to gain an edge. Key companies such as Cisco Systems, IBM and Dell Technologies are investing in advanced fog solutions to address the growing demand for low latency and real time processing. Emerging firms are leveraging niche applications in IoT, smart cities and industrial automation to carve out market segments. The competitive landscape is further influenced by increasing collaboration between technology providers and industry verticals enhancing customized offerings. Open-source frameworks and interoperability initiatives are driving differentiation among vendors. Additionally, advancements in 5G and edge computing technologies are intensifying competition as players strive to deliver seamless, secure, and efficient fog computing solutions. For instance, in November 2024, Fujitsu and AMD announced a strategic partnership by signing a MoU to produce computing platforms for AI and high-performance computing (HPC). The partnership intends to facilitate the creation of open source and energy efficient platforms with advanced processors and superior power performance and highly flexible AI/HPC software.

The fog computing market forecast report provides a comprehensive analysis of the competitive landscape in the market with detailed profiles of all major companies, including:

- ADLINK Technology Inc.

- Cisco Systems Inc.

- Cradlepoint Inc. (Telefonaktiebolaget LM Ericsson)

- Dell Technologies Inc.

- FogHorn Systems

- Fujitsu Limited

- General Electric

- Hitachi Vantara Corporation (Hitachi Ltd.)

- Huawei Technologies Co. Limited

- International Business Machines Corporation

- Oracle Corporation

- Toshiba Corporation

Latest News and Developments:

- January 2023: AWS IoT Greengrass 3.0, an update to their edge computing platform for Internet of Things devices, was unveiled by Amazon Web Services (AWS). The current release makes it easier for developers to create and implement fog computing applications by supporting more programming languages and offering enhanced security features.

- April 2018: A strategic cooperation agreement was inked by Toshiba Digital Solutions Corporation (Toshiba) and Nebbiolo Technologies Inc. (Nebbiolo) to use cutting-edge fog computing technology to implement industrial IoT solutions. Furthermore, the partnership created a comprehensive factory IoT project to upgrade the outdated hardware and software fleet that is presently installed on industrial automation floors through the use of a virtualized fog platform. This will allow for consolidation, central management, enhanced security, and high availability, all of which will increase overall operational efficiency.

- August 2018: A fog computing platform has been released by SONM, an open-source decentralized system and blockchain-based marketplace. In order to create a decentralized marketplace where suppliers and customers can rent and buy computing power from one another to be used for particular computing tasks, SONM is developed to enable users to connect personal devices to a single platform.

Fog Computing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Models Covered | Private Fog Node, Community Fog Node, Public Fog Node, Hybrid Fog Node |

| Applications Covered | Building and Home Automation, Smart Energy, Smart Manufacturing, Transportation and Logistics, Connected Health, Security and Emergencies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ADLINK Technology Inc., Cisco Systems Inc., Cradlepoint Inc. (Telefonaktiebolaget LM Ericsson), Dell Technologies Inc., FogHorn Systems, Fujitsu Limited, General Electric, Hitachi Vantara Corporation (Hitachi Ltd.), Huawei Technologies Co. Limited, International Business Machines Corporation, Oracle Corporation, Toshiba Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fog computing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global fog computing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fog computing industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fog computing market size is anticipated to reach USD 243.61 Million in 2025.

The fog computing market is projected to exhibit a CAGR of 10.70% during 2025-2033, reaching a value of USD 572.08 Million by 2033

The market is primarily driven by the increasing IoT adoption, demand for low-latency real-time processing, the rise of 5G networks, improved data security, the need for decentralized computing, the growing focus on edge computing for efficient data handling and the expansion of smart city initiatives

North America currently dominates the fog computing market, accounting for a share of over 44.6%, driven by its advanced technological infrastructure, early adoption of IoT devices, high demand for low-latency processing, and strong presence of leading market players.

Some of the major players in the fog computing market include DLINK Technology Inc., Cisco Systems Inc., Cradlepoint Inc. (Telefonaktiebolaget LM Ericsson), Dell Technologies Inc., FogHorn Systems, Fujitsu Limited, General Electric, Hitachi Vantara Corporation (Hitachi Ltd.), Huawei Technologies Co. Limited, International Business Machines Corporation, Oracle Corporation, and Toshiba Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)