Foam Blowing Agents Market Size, Share, Trends and Forecast by Product Type, Foam Type, Application, and Region, 2025-2033

Foam Blowing Agents Market Size and Share:

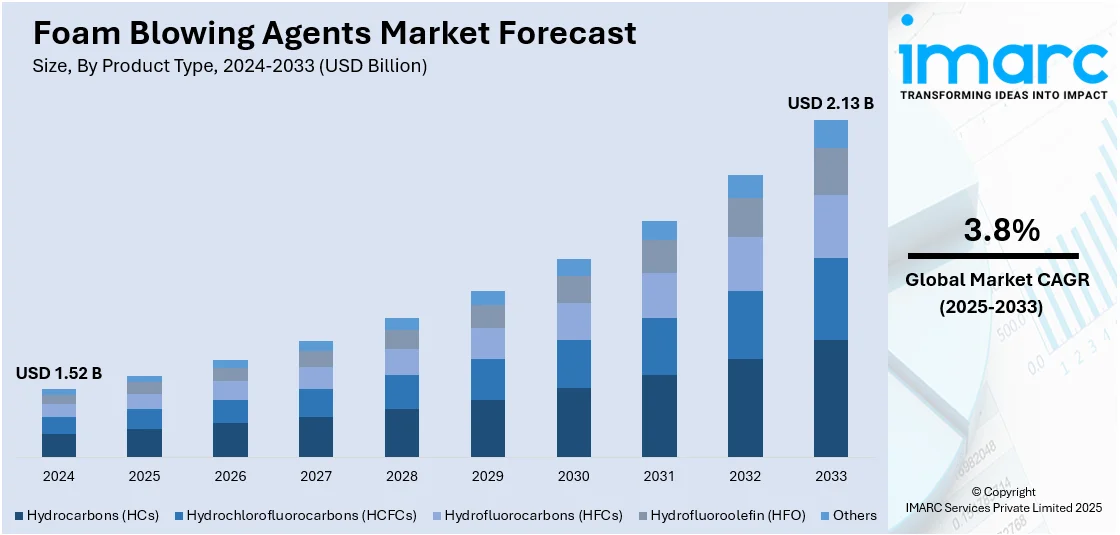

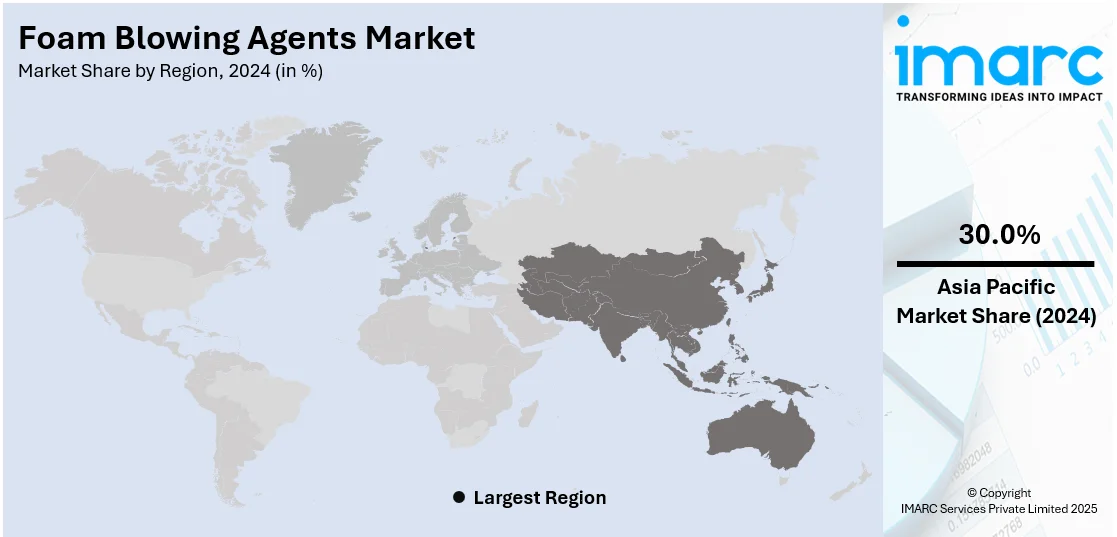

The global foam blowing agents market size was valued at USD 1.52 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.13 Billion by 2033, exhibiting a CAGR of 3.8% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 30.0% in 2024. The market is primarily driven by rising construction and automotive industry demand, increasing focus on sustainability, adoption of energy-efficient materials, stricter environmental regulations are driving the foam blowing agent market, growing demand for insulation materials and accelerating awareness regarding eco-friendly alternatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024 |

| Market Size in 2024 | USD 1.52 Billion |

| Market Forecast in 2033 | USD 2.13 Billion |

| Market Growth Rate 2025-2033 | 3.8% |

The global market is experiencing robust growth due to the rising demand for sustainable and lightweight materials in construction and automotive industries. For instance, on September 10, 2024, Infra.Market announced its position as India's largest manufacturer of Autoclaved Aerated Concrete (AAC) blocks, achieving an annual production capacity of 3 million cubic meters across nine plants nationwide. This expansion highlights the company's commitment to sustainable construction, as AAC blocks currently constitute 7-8% of the conventional brick market, reflecting a shift towards environmentally friendly building materials. Additionally, the increasing adoption of polyurethane and polystyrene foams in insulation, packaging, and refrigeration applications is acting as a key growth-inducing factor for the market. Moreover, continual technological advancements in eco-friendly and low-global-warming-potential (GWP) blowing agents, driven by stringent environmental regulations, are creating a positive market outlook.

The United States stands out as a key regional market, driven by the rising demand for energy-efficient insulation materials in the construction sector. For instance, on March 14, 2024, the U.S. Environmental Protection Agency (EPA) recognized 103 U.S. manufacturing plants for achieving ENERGY STAR certification in 2023. These plants collectively prevented over 8 million metric tons of carbon dioxide emissions, which is equivalent to the annual electricity use of 1.5 million American homes. The industrial sector accounts for 30% of U.S. greenhouse emissions, and certified plants have implemented various energy-saving initiatives to enhance their sustainability efforts. Moreover, the rapid expansion of the automotive industry is further providing a boost to the adoption of foam blowing agents for lightweight and fuel-efficient vehicle production. Additionally, the increasing utilization of eco-friendly and low-global-warming-potential agents, aligning with stringent environmental regulations, is providing an impetus to the market. Furthermore, numerous innovations in foam technologies and growing applications in packaging and appliances are broadening the market scope, ensuring sustained demand across industries.

Foam Blowing Agents Market Trends

Increasing awareness of environmental sustainability

The market is being driven by rising environmental sustainability awareness. As the worldwide focus on environmental protection continues to grow, more and more industries seek sustainable means through which they can reduce their carbon footprint. Notably, the total CO2 emissions are expected to stand at 41.6 Billion Tons in 2024, compared to 40.6 Billion Tons from last year. Blowing agents in foams play an important role in this regard. Low GWP and ODP agents are rising in trends because they offer less impact in climate change as well as ozone depletion. Manufacturers and consumers are becoming more conscious of the environmental consequences of their choices, thereby catalyzing the demand for eco-friendly alternatives. On the regulatory side, authoritative bodies and the government are implementing new environmental regulations and rules that bring heavy pressures on the industries to go green. This in turn encourages the product uptake as it aligns with sustainability objectives. Moreover, increasing awareness of environmental sustainability extends to end-users also. Consumers are becoming increasingly conscious of products that are environmentally friendly, energy conserving, and having lower ecological impact.

Growing demand for polyurethane foam

The increasing demand for polyurethane foam, a versatile material with a wide range of applications in various industries, including construction, automotive, furniture, and packaging, is driving the market. For instance, as per a report published by McKinsey, an estimated USD 50 Billion was invested in architecture, engineering, and construction (AEC) tech during 2020-2022, marking 85% increase than the last 3 years. In the construction sector, polyurethane foam is applied for insulation with excellent thermal resistance and energy efficiency. Increased interest in conserving energy and building regulations enforcing energy-efficient construction practices is fostering the demand for polyurethane foam, thereby propelling the market. Additionally, the automotive sector is a large user of polyurethane foam for use in car seats, interior components, and sound-absorbing materials. The growing automotive sector, along with the increasing demand for lightweight materials and improved vehicle comfort, fuels the demand for polyurethane foam. The furniture industry also relies on polyurethane foam for cushioning and comfort in mattresses, sofas, and upholstery, thus creating a positive outlook for the market.

Expansion of cold chain infrastructure

The expansion of cold chain infrastructure is creating a positive outlook for the market. The cold chain industry encompasses the transportation, storage, and distribution of temperature-sensitive products, such as food, pharmaceuticals, and chemicals, while maintaining specific temperature ranges. For instance, an estimated USD 198 Billion for biopharmaceutical R&D has been spent worldwide by the research-based biopharmaceutical industry in 2020. Foam blowing agents play a vital role in insulating cold chain infrastructure, including refrigerated trucks, warehouses, and refrigeration units. These agents produce insulating foams that help maintain stable and controlled temperatures, protecting perishable goods from temperature fluctuations and ensuring product integrity. As the demand for temperature-controlled logistics increases due to the growth of the food and pharmaceutical industries, there is a corresponding need for efficient insulation materials. These agents produce high-performance insulation foams with excellent thermal properties, contributing to energy efficiency and reducing temperature-related product losses. Moreover, the expansion of cold chain infrastructure is driven by changing consumer preferences for fresh and frozen food products, the globalization of food supply chains, and the increasing need for temperature-sensitive medical products.

Foam Blowing Agents Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global foam blowing agents market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, foam type, and application.

Analysis by Product Type:

- Hydrocarbons (HCs)

- Hydrochlorofluorocarbons (HCFCs)

- Hydrofluorocarbons (HFCs)

- Hydrofluoroolefin (HFO)

- Others

Hydrocarbons stand as the largest component in 2024. This dominance is due to their cost-effectiveness, availability, and high compatibility with various foam manufacturing processes. Their superior thermal insulation properties make them a preferred choice in industries such as construction, automotive, and packaging. Additionally, hydrocarbons exhibit low toxicity and are easier to handle compared to alternatives, ensuring widespread adoption. Furthermore, advancements in technology are enabling the development of hydrocarbon-based agents with lower environmental impact, aligning with global regulatory standards. This balance of performance and sustainability reinforces hydrocarbons' leadership in the market.

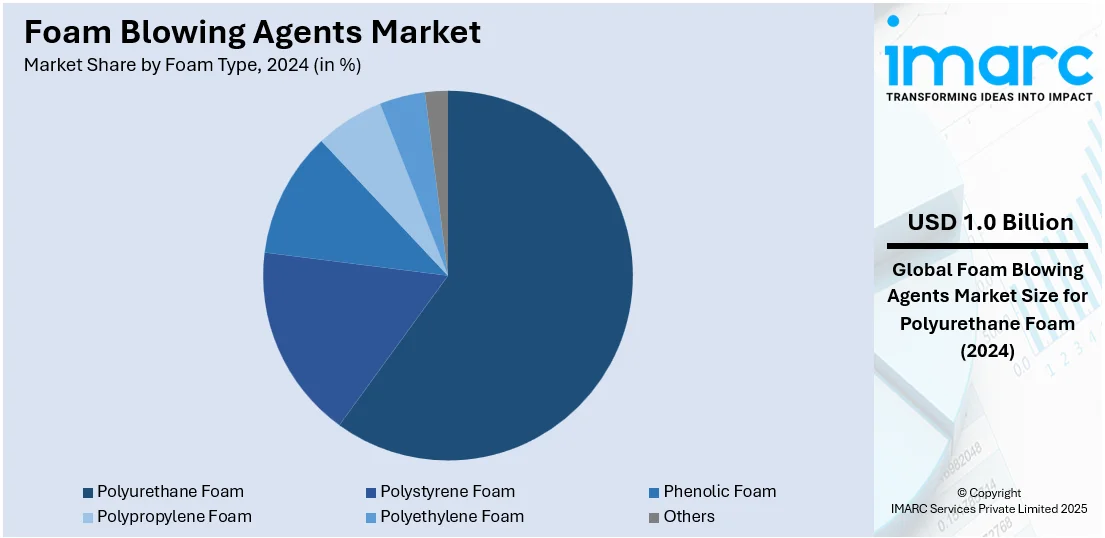

Analysis by Foam Type:

- Polyurethane Foam

- Polystyrene Foam

- Phenolic Foam

- Polypropylene Foam

- Polyethylene Foam

- Others

Polyurethane foam leads the market with around 60.0% of market share in 2024, due to its exceptional versatility and widespread applications across industries. Its superior insulation properties make it a preferred choice in the construction and refrigeration sectors, addressing energy efficiency demands. Additionally, its lightweight nature and structural strength are driving its adoption in automotive manufacturing for enhancing vehicle performance and fuel efficiency. The growing emphasis on sustainability has further propelled demand for eco-friendly polyurethane foam variants. Moreover, ongoing advancements in production technologies are reinforcing its dominance by expanding its applicability in emerging end-use industries.

Analysis by Application:

- Building and Construction

- Automotive

- Bedding and Furniture

- Appliances

- Packaging

- Others

Building and construction leads the market in 2024, which can be attributed to the rising demand for insulation materials that are energy-efficient across commercial, residential, and industrial projects. The growing focus on sustainable construction practices is augmenting the adoption of eco-friendly foam blowing agents. Additionally, the increasing need for durable, lightweight, and cost-effective materials in modern construction is facilitating the market's expansion. Furthermore, stringent regulations on energy efficiency and thermal insulation in buildings are driving the demand for advanced foam products, solidifying the segment’s leading position in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 30.0%. Rapid urbanization, infrastructure development, and the construction sector's expansion across Asia Pacific are contributing to the market in the region. As countries in Asia Pacific experience economic growth, there is a rising demand for energy-efficient buildings and insulation materials, leading to increased consumption of foam blowing agents. Additionally, the automotive industry in the region is flourishing, with growing vehicle production and consumer demand for comfortable interiors, which further catalyzes the market. The packaging industry in the Asia Pacific is also expanding due to e-commerce growth, thus propelling the product demand for protective packaging applications.

Key Regional Takeaways:

United States Foam Blowing Agents Market Analysis

Foam blowing agents are experiencing increased adoption driven by advancements in the chemicals sector. According to International Trade Administration, the total FDI in the U.S. chemical manufacturing industry was USD 766.7 Billion in 2023. The production of polyurethane foams, widely utilized in furniture, insulation, and other applications, has surged in response to the growing need for innovative chemical products. The focus on energy-efficient materials in manufacturing has further boosted demand for foam blowing agents, as they enhance thermal insulation properties. Their usage in lightweight and durable materials aligns with the rising preference for sustainability within industrial applications. New formulations of foam blowing agents have also been tailored to meet evolving regulatory standards, which prioritize reduced environmental impact and improved performance. The growing integration of advanced production techniques within the sector has facilitated a seamless incorporation of foam blowing agents into various chemical products. With the industry’s trajectory towards innovation, the future of foam blowing agents in this space remains highly optimistic.

Asia Pacific Foam Blowing Agents Market Analysis

The product adoption in the automotive industry is gaining traction as a result of the rising focus on fuel efficiency as well as lightweight materials. For instance, as per a report published by India Brand Equity Foundation in December 2023, the automobile sector received a cumulative equity FDI inflow of about USD 35.65 Billion between April 2000. Their role in manufacturing flexible and rigid polyurethane foams for vehicle interiors, soundproofing, and thermal insulation has become indispensable. Automotive manufacturers are leveraging these agents to meet stringent weight-reduction targets, as lighter vehicles contribute to improved fuel economy. The growth in automotive production and increasing demand for electric vehicles have amplified the use of foam blowing agents for noise reduction and thermal management. Innovations in foam technology, coupled with enhanced durability, have made these materials critical for modern vehicle designs. Additionally, advancements in supply chains and collaborations between manufacturers and suppliers are ensuring the availability of high-quality foam blowing agents, enabling seamless adoption within the sector. The automotive industry's evolution toward efficiency and innovation continues to fuel their increasing application.

Europe Foam Blowing Agents Market Analysis

The rising awareness of environmental sustainability and the need for carbon emission reductions have driven the adoption of foam blowing agents in various industries. For instance, according to the European Environment Agency, net greenhouse gas (GHG) emissions dropped by 31% in the EU-27 during the period 1990 and 2022. New eco-friendly formulations, designed to comply with stringent environmental regulations, are replacing traditional agents with high global warming potential. Their use in creating low-emission insulation materials has become pivotal in energy-efficient building projects. Industries are increasingly focusing on reducing their carbon footprints, and foam blowing agents have emerged as a key component in achieving this objective. The development of advanced technologies ensures these agents maintain high performance while minimizing environmental impact. Industries, including refrigeration and packaging, are utilizing these agents to meet sustainability goals, further boosting demand. The push toward greener solutions and the integration of sustainable practices across multiple sectors continue to elevate the role of foam blowing agents in fostering a cleaner and more eco-conscious future.

Latin America Foam Blowing Agents Market Analysis

Foam blowing agents are witnessing rising adoption within the packaging sector, fuelled by the expansion of online distribution platforms. For instance, as per the reports, the Latin America market has more than 300 Million digital buyers. As demand for lightweight, durable, and protective packaging materials grows, foam blowing agents have become essential in creating cost-effective solutions. Their role in producing impact-resistant packaging materials ensures safe product delivery, a critical requirement for e-commerce businesses. Technological advancements in foam production are enabling better design flexibility, aligning with the needs of various packaging formats. The availability of innovative materials in the packaging industry is further driving the adoption of these agents. As online platforms continue to expand, the requirement for high-performance packaging materials is projected to surge, securing foam blowing agents’ relevance in this evolving sector.

Middle East and Africa Foam Blowing Agents Market Analysis

Foam blowing agents are gaining prominence due to the increasing demand for polyurethane foam in construction projects. Notably, according to reports, Saudi Arabia’s construction sector is witnessing significant growth, with over 5,200 projects underway, valued at USD 819 Billion. Their utility in producing thermal and acoustic insulation materials aligns with the growing focus on energy-efficient buildings. The surge in large-scale construction activities, particularly in real estate development, has driven demand for high-performance insulation products. Foam blowing agents contribute to the production of durable and lightweight materials, ensuring long-lasting and cost-effective solutions for builders. Additionally, advancements in foam formulations are enabling better adherence to diverse structural requirements, enhancing their adoption in complex construction designs. With the continued rise in construction initiatives, foam blowing agents are poised to remain an integral component of modern building materials.

Competitive Landscape:

The competitive landscape of the market is characterized by the augmenting demand for energy-efficient as well as eco friendly solutions across industries. Market participants are focusing on innovation, developing advanced formulations to comply with stringent environmental regulations while enhancing product performance. Additionally, companies are investing in research and development to introduce low-global-warming-potential (GWP) and ozone-safe blowing agents. Additionally, strategic collaborations, capacity expansions, and diversification of product portfolios are key trends shaping the competitive landscape. Moreover, regional players are leveraging local supply chains and tailored solutions to strengthen their market presence and address specific customer needs. For instance, on September 26, 2024, Evonik announced the transition of its ROHACELL foams at its Darmstadt site to 100% renewable energy, reducing annual CO₂ emissions by 3,400 tons. This shift will enable a significant reduction in carbon emissions, aligning with the company’s sustainability goals. The transition is expected to cut the plant’s annual CO2 emissions by over 1,000 metric tons.

The report provides a comprehensive analysis of the competitive landscape in the foam blowing agent market with detailed profiles of all major companies, including:

- Arkema S.A.

- DuPont de Nemours Inc.

- Exxon Mobil Corporation

- Foam Supplies Inc.

- Harp International Ltd.

- HCS Group GmbH

- Honeywell International Inc.

- Linde plc

- Marubeni Corporation

- Solvay S.A.

- The Chemours Company

- Zeon Corporation

Latest News and Developments:

- December 2024: Nouryon intoduced Expancel® BIO microspheres a lightweight filler and foam blowing agent which is largely biobased, at Foam Expo Europe 2024 in Stuttgart. In response to consumer demand for sustainable solutions, this innovation promotes environment friendly procedures and improves applications such as coatings, adhesives, and automotive components.

- July 2024: BASF and Dow Chemical announced their collaboration to develop next-generation blowing agents with significantly lower global warming potential. The goal of this partnership is to accelerate the production of foam using sustainable ingredients. This project addresses environmental issues in insulation and packaging and helps the industry's transition to greener practices.

- March 2024: Solvay and Arkema formed a joint venture to manufacture low-GWP blowing agents, expanding the number of environmentally acceptable foam production alternatives. The growing need for sustainable materials in a variety of applications is being addressed by this partnership. The project demonstrates the industry's drive for more creative and environmentally friendly solutions.

- February 2024: MasterFoam, an innovative endothermic blowing agent, was introduced by Broadway. This product helps with molding processes to produce a foaming effect during material liquefaction.

Foam Blowing Agents Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hydrocarbons (HCs), Hydrochlorofluorocarbons (HCFCs), Hydrofluorocarbons (HFCs), Hydrofluoroolefin (HFO), Others |

| Foam Types Covered | Polyurethane Foam, Polystyrene Foam, Phenolic Foam, Polypropylene Foam, Polyethylene Foam, Others |

| Applications Covered | Building and Construction, Automotive, Bedding and Furniture, Appliances, Packaging, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arkema S.A., DuPont de Nemours Inc., Exxon Mobil Corporation, Foam Supplies Inc., Harp International Ltd., HCS Group GmbH, Honeywell International Inc., Linde plc, Marubeni Corporation, Solvay S.A., The Chemours Company, Zeon Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the foam blowing agents market from 2019-2033.

- The foam blowing agents market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the foam blowing agents industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The foam blowing agents market was valued at USD 1.52 Billion in 2024.

The foam blowing agents market is projected to exhibit a CAGR of 3.8% during 2025-2033, reaching a value of USD 2.13 Billion by 2033

Rising demand for energy-efficient products, increasing construction activities, growing environmental concerns, advancements in foam blowing agents technology, stringent regulations on greenhouse gas emissions, enhanced demand from the automotive industry, eco-friendly alternatives, and expanding applications in packaging are key drivers for the foam blowing agent market.

Asia Pacific currently dominates the market, accounting for a share of around 30.0%. The dominance is driven by the rising demand for eco-friendly products, rapid construction sector growth, adoption of energy-efficient insulation materials, urbanization, and government regulations.

Some of the major players in the foam blowing agents market include Arkema S.A., DuPont de Nemours Inc., Exxon Mobil Corporation, Foam Supplies Inc., Harp International Ltd., HCS Group GmbH, Honeywell International Inc., Linde plc, Marubeni Corporation, Solvay S.A., The Chemours Company, and Zeon Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)