FMCG Logistics Market Size, Share, Trends and Forecast by Product Type, Service Type, Mode of Transportation, and Region, 2025-2033

FMCG Logistics Market Size & Share:

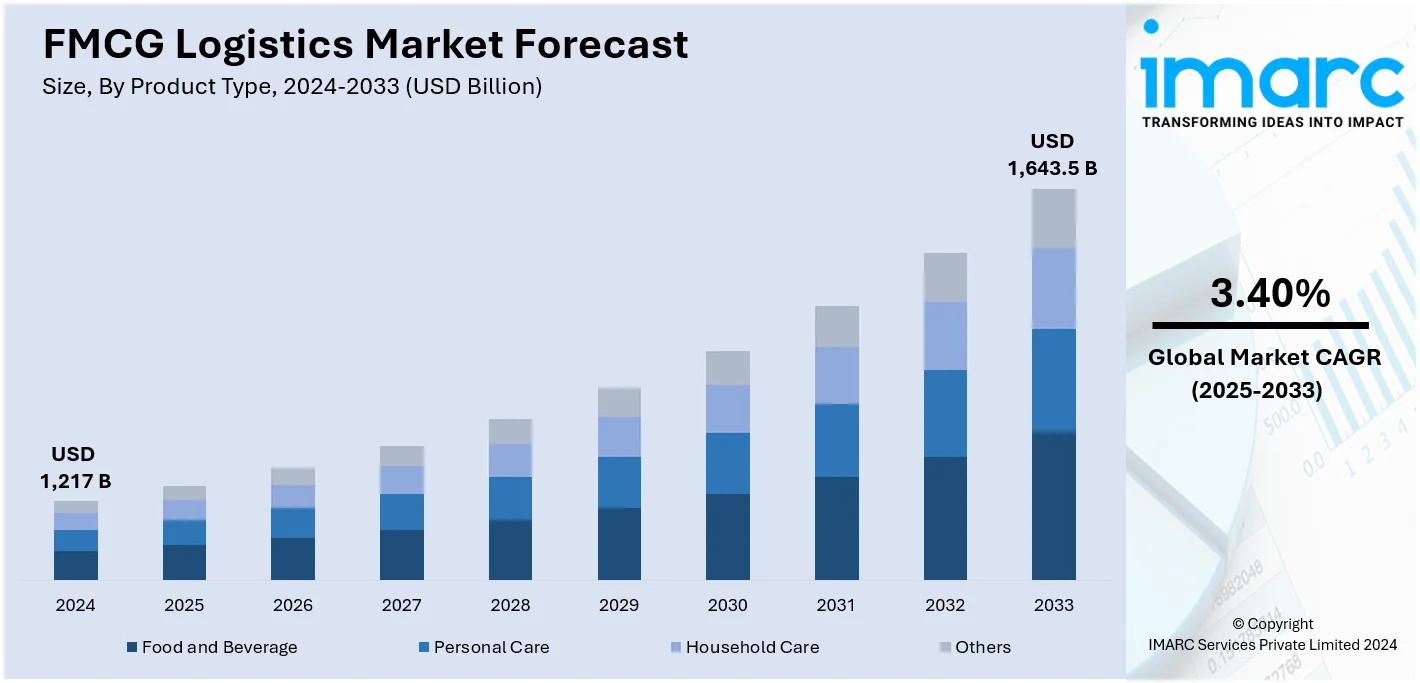

The global FMCG logistics market size was valued at USD 1,217 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,643.5 Billion by 2033, exhibiting a CAGR of 3.40% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 48.9% in 2024. This domination primarily results from augmenting e-commerce infrastructure, escalating urbanization, and increasing disposable incomes across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,217 Billion |

|

Market Forecast in 2033

|

USD 1,643.5 Billion |

| Market Growth Rate (2025-2033) | 3.40% |

The global FMCG logistics market is rapidly growing, primarily because of the amplifying e-commerce sector, which requires more effective and quicker delivery solutions. Escalating urbanization and evolving customer preferences for convenience have magnified the requirement for optimized supply chain operations. Moreover, innovations in logistics technologies, encompassing warehouse management systems, automation, or IoT-powered tracking, are significantly improving both transparency and efficacy. In addition, the expansion of cold chain logistics is critical to cater to the need for perishable goods, especially in food and beverage sectors. Heavy investments in infrastructure advancement and the globalization of FMCG trade further aid the market's sustained expansion.

The United States plays a critical role in the global FMCG logistics market, majorly impacted by elevated customer need for fast-moving goods, robust infrastructure, and comprehensive e-commerce adoption. For instance, as per industry reports, in 2024, the United States is home to 270.11 million digital shoppers. Moreover, the country’s well-developed supply chain framework, encompassing last-mile delivery services, superior warehousing, and transportation, facilitate seamless operations. Furthermore, technological advancements, like AI-powered logistics solutions, automation, and IoT-based tracking, notably minimize delivery timelines and improve efficacy. In addition, the amplifying need for packaged and perishable goods, combined with the emergence of sustainable logistics methods, further solidifies the market. As a result, the U.S. remains a prime hub for innovation and expansion in FMCG logistics.

FMCG Logistics Market Trends:

E-commerce Expansion and Direct-to-Consumer (D2C) Strategies

The considerable expansion in the e-commerce sector, owing to the increasing product purchase from various online distribution channels, is primarily driving the global market growth. A PwC report shows that nearly 75% of customers have purchased FMCG products online, with millennials and Gen Z driving this trend. In addition, millennials and Gen Z are the key demographic fueling this trend. To meet the demands of fast-moving supply chains and manage seasonal fluctuations in warehouse requirements, companies are leveraging innovative solutions, including tight price monitoring technologies. Besides this, FMCG companies are increasingly adopting direct-to-consumer (D2C) models to reduce dependency on intermediaries, further boosting product demand and streamlining logistics operations.

Increase in Technological Advancements and Automation in Logistics

The adoption of advanced technologies like IoT, machine learning (ML), and big data analytics is transforming the FMCG logistics landscape significantly by minimizing lead times and optimizing supply chains. According to IoT Analytics, automotive manufacturers are expected to increase their enterprise IoT spending by 18% in 2025, underscoring the technology’s growing impact. In addition, key players are actively developing logistics automation solutions with last-mile delivery capabilities to efficiently handle perishables. Incorporating autonomous delivery vehicles and drones further enhances the efficiency and reliability of these last-mile logistics solutions. Furthermore, combined with the rising proliferation of smartphones, internet access, urbanization, and shifting consumer preferences, these innovations are driving substantial growth in the FMCG logistics market.

Adoption of Sustainable Logistics Practices

Sustainability is becoming a key focus in the global FMCG logistics market, driven by regulatory pressures and consumer demand for eco-friendly practices. Companies are increasingly adopting green logistics solutions, including electric vehicles, optimized packaging, and energy-efficient warehousing, to reduce carbon emissions. Innovations like blockchain for supply chain transparency and AI for reducing operational waste further support these initiatives. In addition, these sustainable practices not only enhance brand reputation but also improve cost efficiency, positioning sustainability as a vital trend in the evolving FMCG logistics landscape. For instance, in December 2024, GreenLine Mobility Solutions entered a strategic partnership with Exide Industries to incorporate GreenLine's LNG-powered environment friendly trucks into Exide's logistics business, aiding the company to align its supply chain operations with rising sustainability trends.

FMCG Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global FMCG logistics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, service type, and mode of transportation.

Analysis by Product Type:

- Food and Beverage

- Personal Care

- Household Care

- Others

Food and beverage stand as the largest product type in 2024, holding around 40.5% of the market. This is due to the steady need for both non-perishable and perishable goods. Expansion is principally aided by increasing customer preferences for beverages, ready-to-eat meals, and packaged foods, especially in urban regions. Furthermore, fast delivery solutions, cutting-edge cold chain logistics, and temperature-maintained storage, are crucial in guaranteeing product safety as well as quality. Magnifying e-commerce activity and well-structured retail distribution networks have further fortified this segment. In addition, the utilization of IoT and automation technologies in both transportation and warehousing facilitates timely deliveries and effective inventory management, catering to the escalating requirement across numerous regions.

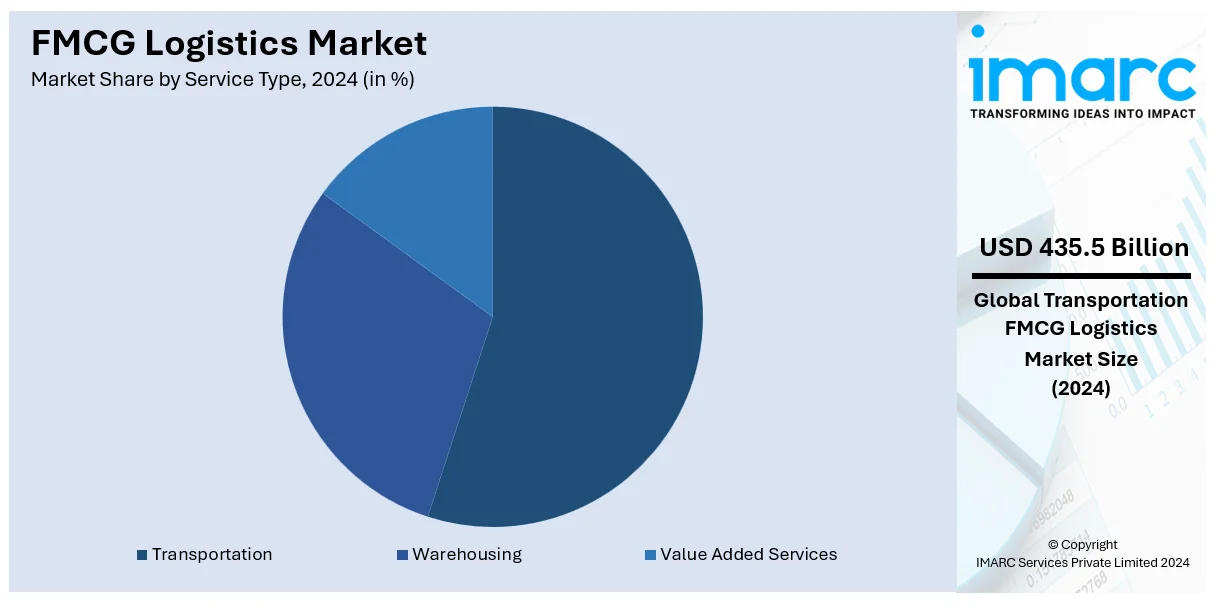

Analysis by Service Type:

- Transportation

- Warehousing

- Value Added Services

Transportation leads the market with around 35.8% of market share in 2024. This segment is chiefly influenced by the robust demand for effective and fast movement of goods. Fast-moving consumer goods, especially in personal care, food, and beverages, require upgraded transportation networks to reduce product loss and facilitate timely deliveries. Beside this, the notable expansion of cross-border and regional trade has elevated dependability on multimodal transport systems, incorporating sea, road, rail, and air logistics. Additionally, technological innovations, like real-time fleet management and GPS-based tracking, are improving operational transparency as well as efficacy. Moreover, with the emerging utilization of sustainable and electric transportation options, various firms are enhancing cost-efficiency while mitigating environmental concerns, further bolstering the segment’s expansion.

Analysis by Mode of Transportation:

- Railways

- Airways

- Roadways

- Waterways

Roadways lead the market with around 40.2% of market share in 2024. This dominance is owned to their comprehensive coverage, versatility, and cost effectiveness. Vans and trucks are extensively deployed for short-to-medium shipment transport and last-mile deliveries, guaranteeing goods reach end users and retail outlets swiftly. Moreover, the accelerating urban population and intensifying e-commerce requirement have magnified road transportation demands, specifically household, beverages, and food products. Enhancements in infrastructure, enveloping freight corridors and road networks, further aid market growth. Additionally, the utilization of telematics solutions and electric vehicles (EVs) is improving delivery accuracy as well as fuel efficiency, strengthening roadways as an ideal mode of FMCG logistics globally.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 48.9%. The FMCG logistics market in the Asia-Pacific (APAC) region is fueled by rapid urbanization, rising disposable incomes, and an expanding middle class in countries like China, India, and Southeast Asia. According to the World Bank, East Asia and the Pacific is the world’s fastest urbanizing region, with an average annual urbanization rate of 3%. This urban growth has significantly increased consumer demand for fast-moving consumer goods and efficient logistics solutions to support their distribution. E-commerce growth remains a key driver, as online retail sales continue to expand, prompting businesses to streamline logistics operations to cater to rising consumer expectations for quick deliveries. The shift to omnichannel retailing has further accelerated the need for flexible and integrated supply chain strategies. Technological advancements, such as automation and IoT, enhance operational efficiency, while the increasing focus on sustainability encourages companies to adopt greener logistics practices. These factors are reshaping the FMCG logistics landscape in APAC.

Key Regional Takeaways:

United States FMCG Logistics Market Analysis

In 2024, United States accounted for the 77.40% of the market share in North America. The FMCG logistics market in the United States is experiencing significant growth, driven by the increasing demand for fast and efficient delivery of consumer goods. A major factor behind this growth is the dramatic rise in e-commerce, with the number of online retail sites worldwide nearly tripling from 2019 to 2023, reaching over 26.5 Million, according to a report from Markinblog.com. The U.S. is home to more than half of these sites, highlighting the country’s dominant position in the global e-commerce landscape. This surge in e-commerce has led to a growing demand for faster and more reliable delivery services, prompting businesses to invest in advanced logistics solutions and expand their last-mile delivery networks. Furthermore, advancements in technology, including automation and artificial intelligence (AI), are reshaping the logistics industry. These technologies help optimize routes, improve inventory management, and enhance demand forecasting, making logistics operations more efficient. Sustainability is also becoming a priority, with companies adopting eco-friendly practices like electric vehicles and energy-efficient warehouses to meet environmental goals and regulatory requirements. Consumer preferences for personalized, on-demand deliveries are further driving changes in logistics operations, with businesses increasingly focusing on supply chain transparency and speed. These factors are key drivers of the growth and transformation of the U.S. FMCG logistics market.

North America FMCG Logistics Market Analysis

The North America FMCG logistics market is witnessing stable expansion, majorly influenced by the rapid proliferation of e-commerce industry and magnifying need for fast-moving consumer goods. FMCG logistics generally includes the effective distribution, transportation, and warehousing of both non-perishable and perishable goods across numerous kinds of channels. Furthermore, the sector heavily profits from automation, cutting-edge supply chain technologies, and resilient transportation networks, which significantly improve both delivery time and operational efficacy.

The notable emergence in online shopping and customer shift towards quicker delivery options is actively bolstering enhancements in last-mile delivery services. For instance, as per industry reports, e-commerce adoption in Canada is projected to reach 77.6% by 2025. Notably, approximately 85% of Canadians engage with Amazon, a leading e-commerce platform, each month, resulting in an impressive 161 million visits to its website. Moreover, leading industry players are increasingly opting for sustainable methodologies sustainable methodologies and upgraded tracking solutions to address the transforming customer expectations. Additionally, the incorporation IoT or data analytics in supply chain management facilitates predictive logistics and real-time assessment. With technological innovations and its highly advanced infrastructure, North America remains a crucial region for growth in FMCG logistics.

Europe FMCG Logistics Market Analysis

The FMCG logistics market in Europe is experiencing robust growth, driven by the increasing demand for faster and more flexible delivery options due to the rise of e-commerce. The shift towards online shopping has led FMCG companies to invest heavily in last-mile delivery networks and regional warehouses to meet consumer expectations for quick and efficient service. Technological progress, especially in artificial intelligence (AI), is significantly influencing the transformation of logistics operations. According to reports, 8% of EU enterprises with 10 or more employees adopted AI technologies to improve their business operations in 2023. In logistics, AI is being used for route optimization, inventory management, and demand forecasting, improving efficiency and reducing costs. The adoption of IoT and RFID technologies further enhances supply chain visibility and accuracy, streamlining operations across the region.

Sustainability is also a key focus, with stringent regulations and evolving consumer preferences pushing companies to adopt greener logistics practices. The integration of electric vehicles, renewable energy solutions, and eco-friendly packaging is helping reduce carbon footprints. As businesses emphasize transparency and operational efficiency, these factors collectively drive the evolution of the FMCG logistics market in Europe.

Latin America FMCG Logistics Market Analysis

The FMCG logistics market in Latin America is driven by high urbanization levels and the growing digitalization of retail. According to research, urbanization in Latin American countries has reached approximately 80%, surpassing most other regions. This extensive urban concentration fuels demand for efficient logistics networks to cater to densely populated areas. The rapid expansion of e-commerce, particularly in key markets like Brazil and Mexico, has further accelerated the need for modernized supply chains, including last-mile delivery solutions. Additionally, advancements in automation and data analytics are improving operational efficiency, while sustainability initiatives drive the adoption of greener logistics practices across the region.

Middle East and Africa FMCG Logistics Market Analysis

The FMCG logistics market in the Middle East and Africa is driven by rising urbanization, increasing consumer demand, and the growth of e-commerce in key markets such as the UAE and Saudi Arabia. According to the World Bank, the Middle East and North Africa (MENA) region is already 64% urbanized, creating significant demand for efficient supply chains to serve densely populated urban areas. The push for faster and more reliable delivery services has led to investments in advanced logistics infrastructure and last-mile delivery networks. Additionally, sustainability initiatives are gaining traction, with companies adopting eco-friendly practices and energy-efficient logistics solutions.

Competitive Landscape:

The competitive landscape of this market is highlighted by the robust expansion of established logistics providers and specialized supply chain firms. Major players are currently focusing on improving their operational efficacy through leading-edge technologies, such as data-based analytics, automation, and IoT-driven tracking. Furthermore, tactical mergers, partnerships, and acquisitions are extensively prevalent to solidify service abilities and geographical foothold. For instance, in September 2024, Nulogy and Kinaxis, two of the leading supply chain firms, strategically partnered to create innovative solutions aimed at enhancing supply chain networks for brand manufacturing globally. This collaboration seeks to enable FMCG brand, along with its supplier network, to collaborate more efficiently through digital transformation, improving costs, service quality, and revenue outcomes. Moreover, several companies are also actively investing in sustainable methods, like green logistics solutions, to adhere to the corporate responsibility objectives as well as environmental policies. The escalating need for cost-efficient and quick delivery services further magnifies competition, encouraging providers to optimize and innovate their offerings. This dynamic environment facilitates constant improvement, strategically placing key players to attain a significant market share.

The report provides a comprehensive analysis of the competitive landscape in the FMCG logistics market with detailed profiles of all major companies, including:

- C.H. Robinson Worldwide Inc.

- CCI Logistics Ltd.

- CEVA Logistics (CMA CGM S.A.)

- DB Schenker (Deutsche Bahn AG)

- Fedex Corporation

- Hellmann Worldwide Logistics SE & Co. KG

- Kenco Group

- Kuehne + Nagel International AG

- Penske Logistics Inc. (Penske Truck Leasing Co. L.P.)

- Rhenus Group

- Simarco Worldwide Logistics Ltd

- XPO Logistics Inc

Latest News and Developments:

- November 2024: Welspun One has invested USD 325 Million in a 4.45 Million sq. ft. logistics park at JNPA SEZ, Navi Mumbai, to meet FMCG sector demands. The facility, located near key transport networks, includes 3.95 Million sq. ft. of warehousing, 0.25 Million sq. ft. of office space, and 0.25 Million sq. ft. of industrial space, offering efficient logistics solutions for FMCG companies.

- June 2024: Reliance Retail initiated a pilot program offering instant delivery of FMCG products and groceries in specific regions of Navi Mumbai and Mumbai, aiming to fulfill orders within an hour. The service, available through the ‘hyperlocal delivery’ feature on the JioMart app, aims to cut delivery times to **30-45 minutes** as additional stores come on board.

- July 2023: Swiggy acquired LYNK Logistics Limited, marking its entry into India's retail market. LYNK continued operating independently, helping FMCG brands expand through its network of 100,000+ stores across eight cities.

- May 2023: Bikaji Foods partnered with Ripplr to optimize its supply chain and enhance distribution across India. Ripplr's use of AI and machine learning provides end-to-end supply chain services for FMCG firms. This collaboration allowed Bikaji Foods to leverage Ripplr's technology, while Ripplr gained from Bikaji’s FMCG industry expertise.

FMCG Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Food and Beverage, Personal Care, Household Care, Others |

| Service Types Covered | Transportation, Warehousing, Value Added Services |

| Modes of Transportation Covered | Railways, Airways, Roadways, Waterways |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | C.H. Robinson Worldwide Inc., CCI Logistics Ltd., CEVA Logistics (CMA CGM S.A.), DB Schenker (Deutsche Bahn AG), Fedex Corporation, Hellmann Worldwide Logistics SE & Co. KG, Kenco Group, Kuehne + Nagel International AG, Penske Logistics Inc. (Penske Truck Leasing Co. L.P.), Rhenus Group, Simarco Worldwide Logistics Ltd, XPO Logistics Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the FMCG logistics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global FMCG logistics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the FMCG logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

FMCG logistics refers to the management of supply chain operations for fast-moving consumer goods, including storage, transportation, and distribution. It ensures timely delivery of perishable and high-demand products like food, beverages, and personal care items, optimizing efficiency to meet consumer needs and minimize delays.

The FMCG Logistics market was valued at USD 1,217 Billion in 2024.

IMARC estimates the global FMCG Logistics market to exhibit a CAGR of 3.40% during 2025-2033.

The global FMCG logistics market is driven by rising e-commerce penetration, increasing demand for efficient supply chain solutions, rapid urbanization, and advancements in cold chain logistics. Additionally, technological integration, such as automation and real-time tracking, enhances operational efficiency, supporting market growth.

According to the report, food and beverage represented the largest segment by product type, driven by high consumer demand and perishability.

Transportation leads the market by service type, mainly driven by the need for efficient delivery and growing distribution networks.

According to the report, roadways represented the largest segment by mode of transportation, driven by cost-effectiveness and flexibility.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global FMCG Logistics market include C.H. Robinson Worldwide Inc., CCI Logistics Ltd., CEVA Logistics (CMA CGM S.A.), DB Schenker (Deutsche Bahn AG), Fedex Corporation, Hellmann Worldwide Logistics SE & Co. KG, Kenco Group, Kuehne + Nagel International AG, Penske Logistics Inc. (Penske Truck Leasing Co. L.P.), Rhenus Group, Simarco Worldwide Logistics Ltd, XPO Logistics Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)