Floating Offshore Wind Energy Market Size, Share, Trends and Forecast by Turbine Capacity, Water Depth, Technology, and Region, 2025-2033

Floating Offshore Wind Energy Market Size and Share:

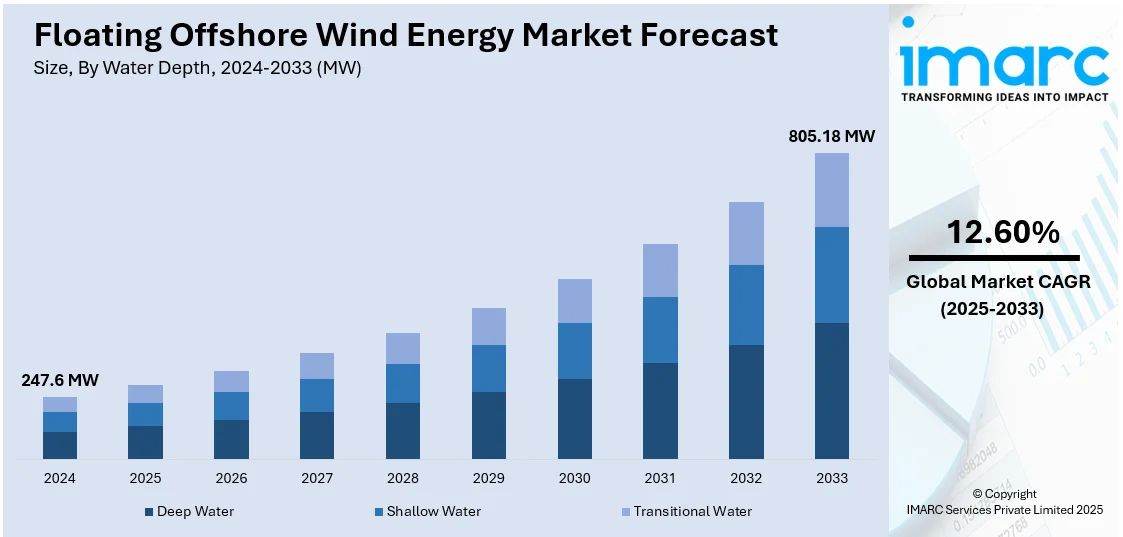

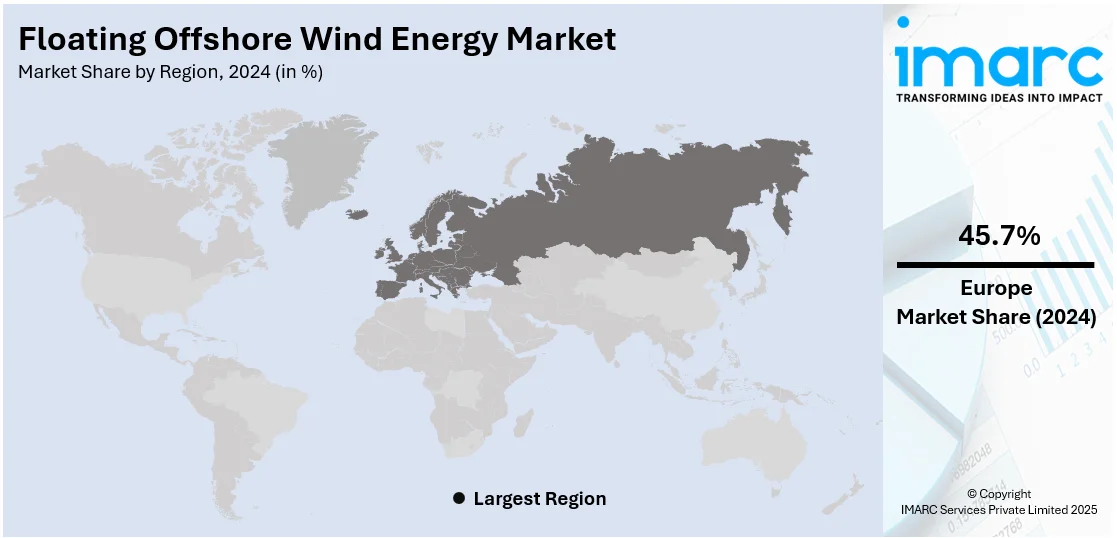

The global floating offshore wind energy market size was valued at 247.6 MW in 2024. Looking forward, IMARC Group estimates the market to reach 805.18 MW by 2033, exhibiting a CAGR of 12.60% from 2025-2033. Europe currently dominates the market, holding a market share of over 45.7% in 2024. The growth of the European region is because of its favorable policies, established offshore infrastructure, strong environmental commitments, and technological leadership. The investment in renewable energy, along with favorable wind conditions, further strengthens its market position.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 247.6 MW |

| Market Forecast in 2033 | 805.18 MW |

| Market Growth Rate 2025-2033 | 12.60% |

As worldwide energy demands increase and worries about climate change grow, there is a notable shift toward clean, renewable energy alternatives. Floating offshore wind provides a high-capacity, eco-friendly option, assisting nations in achieving their energy targets and decreasing dependence on fossil fuels. Moreover, governing authorities worldwide are imposing policies, providing subsidies, and offering incentives to promote the development of renewable energy. These consist of tax credits, grants, and advantageous regulations that alleviate the substantial upfront expenses of floating offshore wind farms, enhancing their appeal to developers and investors. Apart from this, advancements in floating wind platforms, turbines, and power transmission systems are boosting the performance and efficiency of offshore floating wind farms. These advancements allow turbines to function more efficiently in deeper, more challenging waters, thereby increasing the possibilities for offshore wind energy production.

The United States plays a vital role in the market, fueled by government funding and strategic efforts, which are essential for advancing the floating offshore wind sector. These initiatives offer financial support, establish defined goals, emphasize technological progress, and aim at lowering expenses, enhancing supply chains, and creating essential infrastructure for extensive implementation. In 2024, the U.S. Department of Energy published the Floating Offshore Wind Shot Progress and Priorities report, which underscored over 50 milestones and $950 million in funding allocated from 2022 to 2024. Significant accomplishments featured progress in technology R&D, enhancements to port facilities, and analyses of co-generation capabilities. The report additionally specified immediate priorities, concentrating on cutting expenses, enhancing supply chains, broadening transmission capacities, and guaranteeing the fair implementation of floating offshore wind technologies.

Floating Offshore Wind Energy Market Trends:

Supportive Regulatory Framework and Policy Initiatives

Numerous nations are implementing favorable regulatory structures that promote investment in renewable energy technologies, such as floating wind initiatives. These policies encompass subsidies, tax incentives, and green energy requirements that enhance the financial appeal of floating offshore wind initiatives. Additionally, governing authorities are establishing ambitious renewable energy goals that require the implementation of offshore wind energy as a key provider of clean electricity. Efficient and simplified permitting procedures are also shortening project timelines and expenses, fostering a better atmosphere for developers and investors. These advantageous regulations, along with global accords on climate change, are boosting investments in the industry. In 2024, South Korea’s Ministry of Environment and Ministry of Trade, Industry, and Energy approved the Environmental Impact Assessments (EIAs) for two floating offshore wind projects, including Hexicon’s MunmuBaram and Korea Floating Wind’s projects off the coast of Ulsan. Both projects, each with a capacity of 1,125 MW, were designed to support South Korea’s renewable energy targets and provide clean power to hundreds of thousands of households. The projects were set to play a key role in the nation’s offshore wind industry expansion.

Technological Advancements in Floating Platforms

Ongoing innovations in floating platform designs are enhancing the stability, efficiency, and cost-efficiency of offshore wind turbines. Progress in materials science and engineering are resulting in the creation of lighter, more resilient floating structures capable of enduring tough marine conditions. Moreover, the incorporation of sophisticated monitoring and control systems is enhancing performance, lowering maintenance expenses, and boosting energy production. Floating platforms, unlike fixed-bottom turbines, provide increased flexibility in installation, allowing wind farms to be established in deeper waters where conventional offshore wind turbines would not be practical. This transition to deeper waters is vital, as it creates extensive new zones for wind energy advancement, utilizing wind resources that were previously unreachable. In 2024, Aker Solutions signed a Front End Engineering Design (FEED) contract with METCentre in Norway to pilot the world’s first subsea power distribution system for floating offshore wind. The Subsea Collector technology aimed to reduce costs and complexity in offshore wind farms by providing a more flexible connection between turbines. The pilot was set to support the expansion of METCentre's floating wind test area, with plans to grow to seven turbines by 2026.

International Collaboration and Knowledge Sharing

As floating wind technology continues to develop, nations and organizations are collaborating to exchange research, development methods, and operational insights. Collaborative research initiatives, partnerships, and consortiums are aiding in decreasing the learning curve and speeding up innovation. The sharing of information among countries with different expertise levels is aiding in the standardization of technologies and regulatory structures, simplifying the process for developers to initiate projects across various regions. For instance, in 2025, ORE Catapult and Japan’s FLOWRA signed a Memorandum of Understanding (MoU) in Tokyo to collaborate on reducing costs and risks in floating offshore wind through technology standardization, joint testing, and personnel exchange. The agreement aligns with a broader UK-Japan partnership to boost offshore wind development. It aims to drive innovation, energy security, and emissions reduction in both countries. Such worldwide collaborative strategy is not only advancing the technological development of floating wind energy, but also speeding up the scalability of these initiatives on a global scale.

Floating Offshore Wind Energy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global floating offshore wind energy market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on turbine capacity, water depth, and technology.

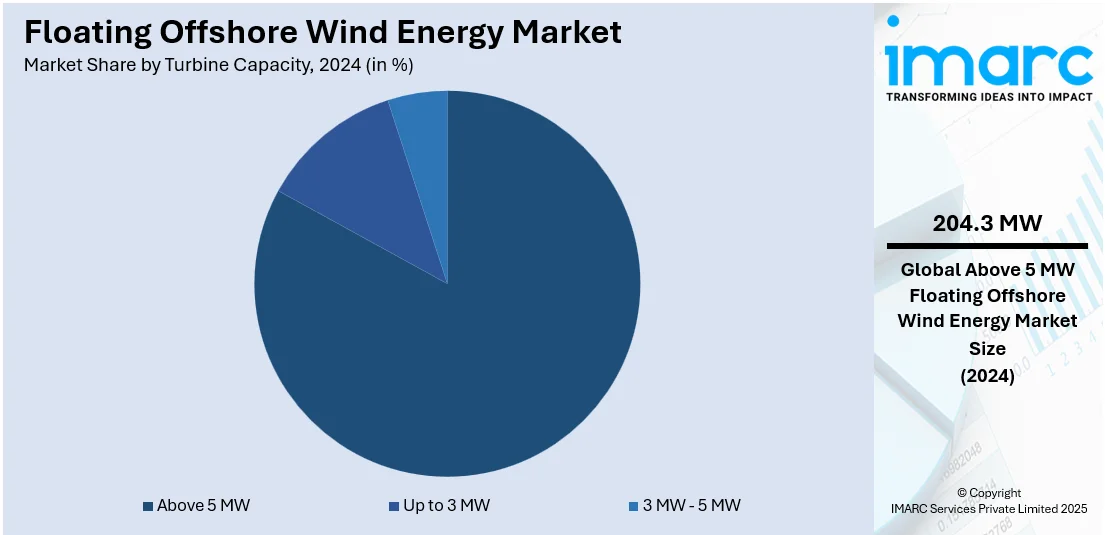

Analysis by Turbine Capacity:

- Up to 3 MW

- 3 MW - 5 MW

- Above 5 MW

Above 5 MW stands as the largest component, holding 82.5% of market in 2024. It holds the biggest market share owing to the increasing demand for larger-capacity turbines capable of producing more energy. These turbines are developed to capture greater wind energy, particularly in regions wherein wind patterns are more unpredictable or in deeper offshore locations. Innovations in turbine design and floating platform technology are making these larger turbines more practical and economically viable, even in difficult offshore environments. These high-capacity turbines facilitate larger projects with better economies of scale, lowering the cost per megawatt of produced electricity. Moreover, they are progressively recognized as crucial for fulfilling the rising energy needs and renewable energy goals established by numerous nations. As offshore wind farms transition to deeper waters, above 5 MW segment remains prevalent, presenting substantial opportunities for extensive, sustainable energy production over the long term.

Analysis by Water Depth:

- Deep Water

- Shallow Water

- Transitional Water

Shallow water represents the largest segment, accounting 46.5% of the market share. It dominates the market because of its advantageous conditions for turbine setup and functioning. It, generally between 30 meters and 60 meters deep, enables the installation of floating wind turbines at comparatively lower costs than in deeper waters. This area is especially appealing as turbines can be more easily secured to the seabed, decreasing the complexity and costs linked to floating platforms in deeper offshore settings. Moreover, shallow waters tend to be nearer to current port facilities, which lowers logistical difficulties and expenses. The wind resources in these regions are generally robust and steady, making shallow water sites perfect for effective energy production. This mix of economic feasibility, technical practicality, and abundant wind resources guarantees that the shallow water continues to be a significant segment in the market.

Analysis by Technology:

- Horizontal Axis Wind Turbines

- Vertical Axis Wind Turbines

Horizontal axis wind turbines lead the market with 86.2% of market share, primarily because of their established efficiency and effectiveness in capturing wind energy. They are the most commonly utilized type of wind turbine, recognized for their significant energy production and dependability. These turbines have blades that spin around a horizontal axis, making them perfect for offshore settings where wind speeds are more steady and powerful. Their design accommodates larger rotor diameters, resulting in increased energy capture, particularly in regions with advantageous wind conditions. Technological progress is boosting the efficiency of horizontal axis wind turbines, as advancements in materials, aerodynamics, and turbine control systems contribute to enhanced performance. Additionally, the scalability of horizontal axis wind turbines enables them to be ideal for large offshore wind farms, delivering affordable, high-capacity energy production.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, Europe accounted for the largest market share of over 45.7%, propelled by its robust dedication to renewable energy and sustainable growth. The area has historically been a leader of offshore wind energy, with multiple countries making significant investments in offshore wind farms. Europe's robust regulatory structures, governmental incentives, and bold renewable energy goals are creating a strong base for the expansion of the floating offshore wind industry. As capacity installations grow and a definitive plan for future development emerges, Europe continues to lead the floating offshore wind energy market, establishing the benchmark for other areas. In 2024, TotalEnergies launched a pilot project for a 3 MW floating wind turbine to supply renewable power to the Culzean offshore platform in the UK North Sea. The turbine, located 2 km west of the platform, reduced GHG emissions by providing 20% of its power requirements. The project aimed to test the integration of floating wind with existing gas turbine power generation and optimize future floating wind technology.

Key Regional Takeaways:

United States Floating Offshore Wind Energy Market Analysis

In North America, the market portion held by the United States was 82.50%. The US is an expanding sector in the floating offshore wind energy market, fueled by advantageous wind conditions, especially on the East Coast and Pacific Coast. The nation is concentrating on increasing its offshore wind power capacity, with government programs having a crucial impact. Offshore leasing initiatives and renewable energy regulations are offering robust backing for the advancement of floating wind power. The US is making significant investments in research and development (R&D) to enhance turbine technology, boost efficiency, and lower costs, making the nation an appealing market for floating wind initiatives. In 2024, the Biden-Harris administration made a notable advancement by conducting the inaugural offshore wind lease auction in the Gulf of Maine. The auction granted four zones for floating wind projects, producing more than $21.9 million in income. These leased regions can supply energy to 2.3 million households, aiding the US aim of reaching 15 GW of floating wind capacity by 2035. This initiative highlights the nation's dedication to increasing renewable energy capacity, lowering carbon emissions, and building a sustainable energy future via offshore wind projects

Europe Floating Offshore Wind Energy Market Analysis

Europe is a crucial segment in the market, boasting a rich history of offshore wind advancement. Countries such as the UK, Denmark, and Germany are emerging as frontrunners in the field, consistently investing in floating wind technology. Europe enjoys advantageous wind conditions and proximity to deep waters, rendering it an ideal site for floating wind farms. Governing authorities in the region are establishing ambitious renewable energy goals and providing the required regulatory framework and financial incentives to promote floating offshore wind initiatives. In 2025, the Crown Estate progressed its floating offshore wind initiatives in the UK by narrowing down bidders for Offshore Wind Leasing Round 5, aiming for 4.5 GW in the Celtic Sea. The leases might supply energy to over 4 million residences and generate over 5,000 employment opportunities. Long-term objectives consist of achieving 20–30 GW of floating wind energy capacity by 2030, emphasizing Europe's ongoing leadership and dedication to sustainability in this field.

Asia Pacific Floating Offshore Wind Energy Market Analysis

The Asia Pacific region is crucial for the floating offshore wind energy market, as nations like Japan, South Korea, and China are making substantial investments in renewable energy. The region possesses significant offshore wind capacity, particularly in deeper waters where floating turbines are necessary. Nations are establishing offshore wind farms to achieve their energy and sustainability objectives, with technological innovations and strategic alliances propelling further development. In 2024, BlueFloat Energy announced the location of its Winds of September Phase 1 floating wind project off the coast of Hsinchu City, Taiwan. The project targeted a capacity of 180 MW, utilizing 12 floating platforms. In partnership with the Metal Industries Research & Development Centre (MIRDC), BlueFloat supported a local supply chain analysis focused on mooring and anchoring systems. The project aimed to begin commercial operations by 2030.

Latin America Floating Offshore Wind Energy Market Analysis

Latin America is emerging as a vital segment in the market, as nations such as Brazil and Chile investigate the opportunities of offshore wind. The extensive coastlines and favorable wind patterns in the region create an appealing setting for floating wind farms. Governments are progressively acknowledging the chance to vary their energy sources and lessen dependence on fossil fuels. For instance, in 2024, Deep Wind Offshore announced its entry into the Chilean offshore wind market, applying for leases for both floating and bottom-fixed wind projects. These measures aimed to assist Chile in achieving its goal of producing 60% of its electricity from renewable sources by 2030, enhancing the region's capacity in floating offshore wind energy.

Middle East and Africa Floating Offshore Wind Energy Market Analysis

The Middle East and Africa represent an emerging segment in the floating offshore wind energy market. Traditionally reliant on oil and gas, the region is increasingly exploring renewable energy sources like floating offshore wind. Government initiatives aimed at boosting renewable energy generation, along with international investments, are helping to shape the future of the floating offshore wind industry in this region. Additionally, favorable coastlines and wind conditions make it an attractive area for offshore wind projects. In 2024, Egypt signed agreements with the UAE's AMEA Power to develop a 500 MW wind farm in the Gulf of Suez, as part of a $600 million investment. The partnership aligned with Egypt’s goal to generate 42% of its electricity from renewable sources by 2030. The project aimed to reduce carbon emissions, create jobs, and enhance Egypt's energy security.

Competitive Landscape:

Major market participants are concentrating on enhancing turbine technology, boosting the efficiency and affordability of floating platforms, and broadening their international reach. They are allocating resources to R&D for improving the efficiency of floating wind turbines, focusing on longevity, scalability, and simplicity of installation. For example, in 2024, DNV initiated Phase 2 of its Floating Substation Joint Industry Project (JIP) to promote floating wind technology. The initiative aimed at enhancing standards for essential elements, such as high-voltage apparatus and dynamic cables, involving 19 significant industry participants. The project intended to revise the DNV-ST-0145 standard and facilitate the expansion of offshore floating wind energy installations. Besides this, leading companies are establishing strategic alliances and partnerships to enhance supply chains and lower expenses. Furthermore, numerous entities are collaborating with governments to obtain offshore leasing arrangements and access beneficial regulatory conditions. The ongoing development of supporting infrastructure, such as ports and transmission networks, is also a critical focus for key players.

The report provides a comprehensive analysis of the competitive landscape in the floating offshore wind energy market with detailed profiles of all major companies, including:

- ABB Ltd.

- Alstom SA

- BlueFloat Energy International, S.L.U

- Blue Gem Wind Ltd.

- BW Ideol

- DNV AS

- Engie SA

- Envision Energy

- General Electric Company

- Hitachi Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Rockwell Automation, Inc.

- RWE AG

- Siemens Gamesa Renewable Energy S.A.

Latest News and Developments:

- March 2025: ECO TLP, a California startup, achieved a key milestone for its floating offshore wind turbine platform, receiving Approval in Principle from the American Bureau of Shipping. The innovative design, featuring cylindrical concrete hulls and a tension-leg mooring system, promises to reduce costs and simplify installation for floating wind farms. The project is now progressing to FEED approval, advancing towards commercialization for global markets.

- January 2025: Sarens PSG, in partnership with BlueFloat Energy and Nadara, launched a study from Aberdeen’s ETZ to streamline industrial-scale deployment of floating offshore wind turbines in the North Sea. The research focuses on transport, port infrastructure, and integration of next-gen WTGs. It aims to reduce costs, risks, and timelines for floating wind projects.

- December 2024: ABB was awarded a FEED contract by Aker Solutions for the 560 MW Green Volt floating offshore wind project in the UK, aiming to become Europe's first commercial-scale floating wind farm. Located off Scotland’s coast, it was set to power 555,000 homes annually by 2029. ABB provided electrical and automation systems to support grid integration and efficiency.

- September 2024: Renexia selected Aker Solutions to design subsea substations for Med Wind, the largest floating offshore wind farm in the Mediterranean, located near Sicily. The project included eight low-maintenance modules, developed in collaboration with ABB, specifically designed to minimize environmental impact. Once completed, Med Wind was expected to supply 9 terawatt-hours of clean energy annually, enough to power approximately 3.4 million homes.

Floating Offshore Wind Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | MW |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Turbine Capacities Covered | Up to 3 MW, 3 MW - 5 MW, Above 5 MW |

| Water Depths Covered | Deep Water, Shallow Water, Transitional Water |

| Technologies Covered | Horizontal Axis Wind Turbines, Vertical Axis Wind Turbines |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Alstom SA, BlueFloat Energy International, S.L.U, Blue Gem Wind Ltd., BW Ideol, DNV AS, Engie SA, Envision Energy, General Electric Company, Hitachi Ltd., Mitsubishi Heavy Industries, Ltd., Rockwell Automation, Inc., RWE AG, Siemens Gamesa Renewable Energy S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the floating offshore wind energy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global floating offshore wind energy market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the floating offshore wind energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The floating offshore wind energy market was valued at 247.6 MW in 2024.

The floating offshore wind energy market is projected to exhibit a CAGR of 12.60% during 2025-2033, reaching a value of 805.18 MW by 2033.

The floating offshore wind energy market is driven by the growing demand for renewable energy, technological advancements in floating platform designs, favorable government policies, and the need to reduce carbon emissions. Additionally, advancements in turbine efficiency, declining costs, and growing investments in offshore infrastructure are positively influencing the market.

Europe currently dominates the floating offshore wind energy market, accounting for a share of 45.7%. The dominance of the region is because of its favorable policies, established offshore infrastructure, strong environmental commitments, and technological leadership. The region's investment in renewable energy, along with favorable wind conditions, further strengthens its market position.

Some of the major players in the floating offshore wind energy market include ABB Ltd., Alstom SA, BlueFloat Energy International, S.L.U, Blue Gem Wind Ltd., BW Ideol, DNV AS, Engie SA, Envision Energy, General Electric Company, Hitachi Ltd., Mitsubishi Heavy Industries, Ltd., Rockwell Automation, Inc., RWE AG, Siemens Gamesa Renewable Energy S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)