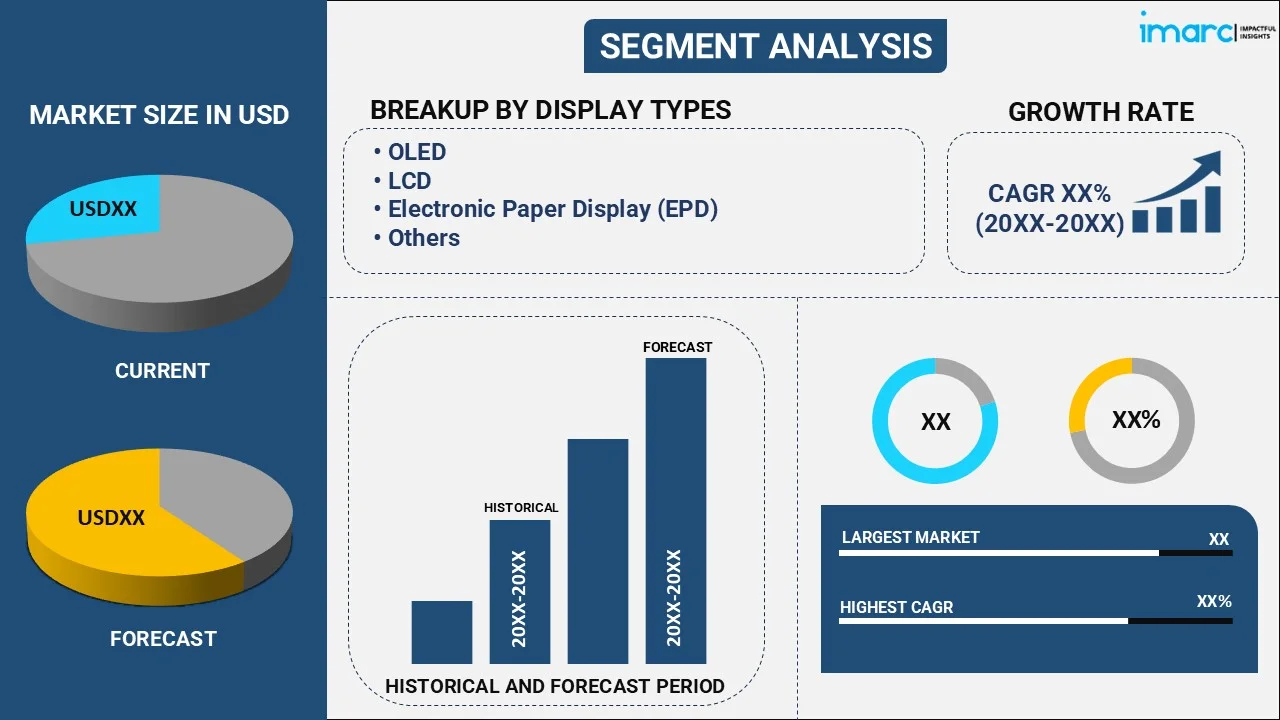

Flexible Display Market Report by Display Type (OLED, LCD, Electronic Paper Display (EPD), and Others), Substrate Material (Glass, Plastic, and Others), Application (Smartphones and Tablets, Smart Wearables, Televisions and Digital Signage Systems, Personal Computers and Laptops, and Others), and Region 2025-2033

Flexible Display Market Size:

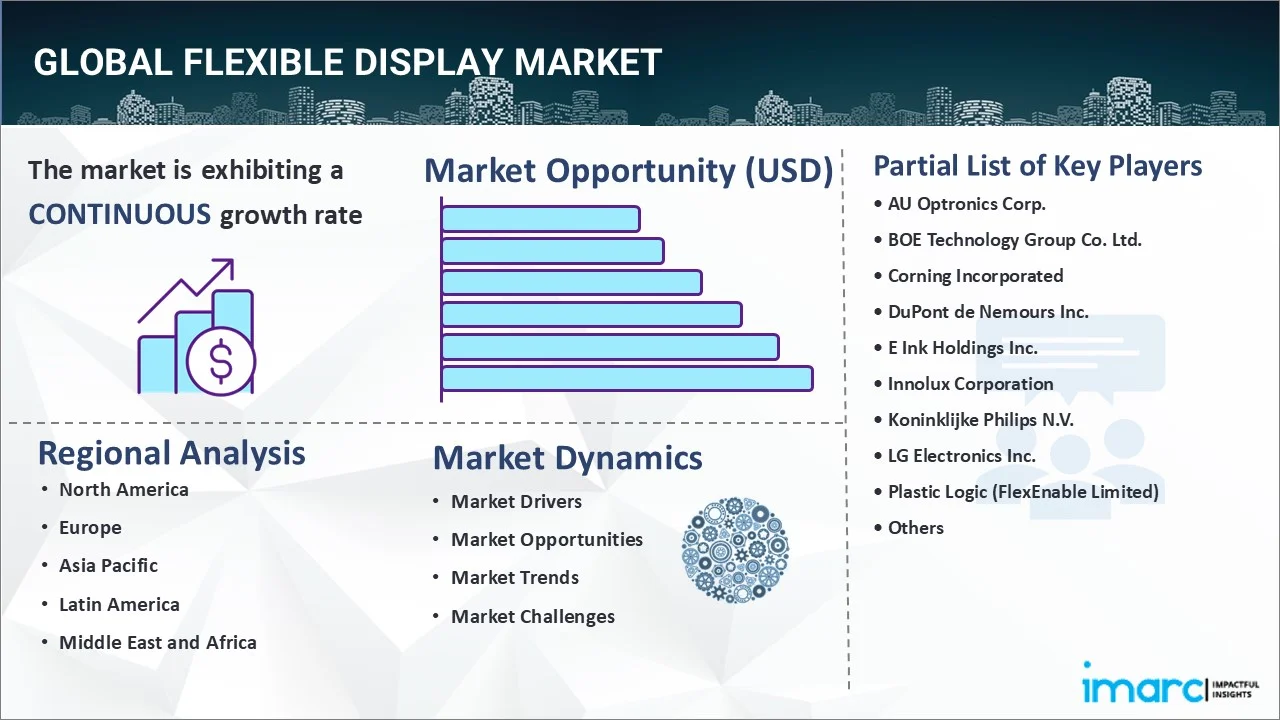

The global flexible display market size reached USD 27.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 170.3 Billion by 2033, exhibiting a growth rate (CAGR) of 21.19% during 2025-2033. The market is propelled by the rapidly increasing sales of smartphones, exponentially expanding product application in wearable devices, significant technological advancements in display technology, and constantly increasing demand for automotive displays.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 27.8 Billion |

| Market Forecast in 2033 | USD 170.3 Billion |

| Market Growth Rate 2025-2033 | 21.19% |

Flexible Display Market Analysis:

- Major Market Drivers: The rising number of individuals using smartphones with bendable screens, wide adoption of flexible screens across wearable devices, and the increasing product demand from the automotive displays industry are some of the major market drivers positively influencing the flexible display market growth.

- Key Market Trends: Some of the major key market trends include significant technological advancements in OLED technology for better flexibility and durability in confluence with the introduction of rollable displays for a wide variety of applications, including signage and TVs. These trends create a positive flexible display market outlook.

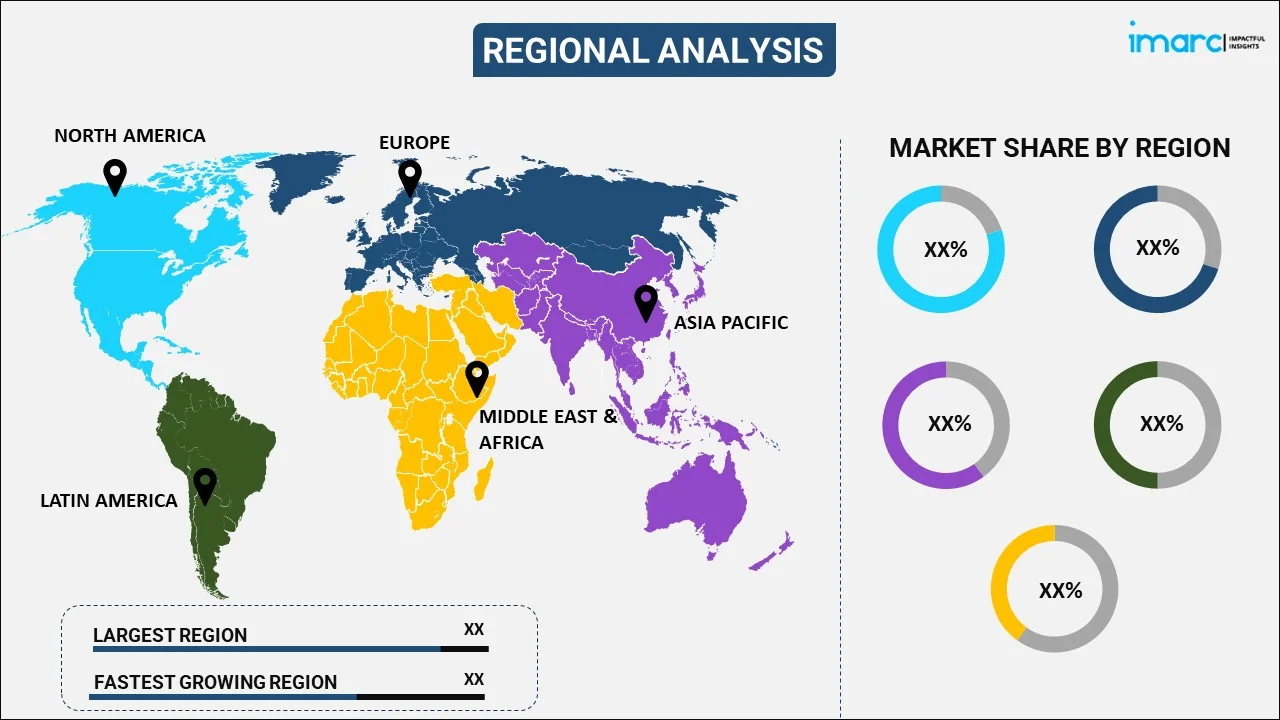

- Geographical Trends: Asia Pacific accounted for the largest region for the flexible display market, on account of the strong manufacturing infrastructure of the region. Additionally, nations such as China, South Korea, and Japan harbor some of the major flexible display companies, such as Samsung Display, LG Display, and BOE Technology Group. Another factor contributing toward APAC region being the largest shareholder is the increasing demands for tablets, smartphones, and other electronic devices, which is further leading to a rise in the flexible display demand.

- Competitive Landscape: Some of the major market players in the global flexible display industry include AU Optronics Corp., BOE Technology Group Co. Ltd., Corning Incorporated, DuPont de Nemours Inc., E Ink Holdings Inc., Innolux Corporation, Koninklijke Philips N.V., LG Electronics Inc., Plastic Logic (FlexEnable Limited), Royole Corporation, Samsung Electronics Co. Ltd., Sharp Corporation, Toshiba Corporation, among many others.

- Challenges and Opportunities: The challenges of this market include the limitations in manufacturing completely foldable and durable displays. Additionally, the rising demand for innovative form factors such as wearables, smartphones, and automotive displays and major innovations in material science and manufacturing procedures, serve as some of the flexible display market recent opportunities.

Flexible Display Market Trends:

Increasing Demand for Smartphones

One of the major factors driving the market is the increasing demand for smartphones globally. According to a report published by the IMARC GROUP, the global smartphone market has already reached 1,468.4 Million Units in 2023, and is projected to reach 1,968.7 Million Units by 2032, growing at a CAGR of 3.2% during 2024-2032. The rising proliferation of smartphones as an essential in the daily life of humans has led to extensive investments by key players in order to launch better flexible displays with the intent of catering to the changing demands of consumers. Additionally, numerous benefits offered by flexible display such as bigger screen sizes, improved durability, and innovative form factors, are generating flexible display market revenue.

The Rising Product Adoption in Wearable Devices

The rapidly expanding wearable devices is propelling the market growth, according to a report by the IMARC GROUP, the global wearable technology has reached US$ 64.2 Billion in 2023 and is expected to reach US$ 192.2 Billion by 2032. The report also states that the market is exhibiting a CAGR of 12.6% during 2024-2032. These devices including augmented reality (AR), fitness trackers, and smartwatches are widely integrated with display technology so as to offer consumers more appealing and comfortable experiences. Other than this, flexible displays enhance ergonomics, complies with the human body, and upholds innovative designs, this factor is further resulting to improved flexible display market statistics. Moreover, constant technological advancements within the wearable devices along with the increasing awareness about health and fitness monitoring, are other factor creating a positive flexible display market overview.

Flexible Display Market Recent Development

Apart from the aforementioned factors, another major factor driving this market is the significant product developments. Key players are particularly introducing these developments in the organic light-emitting diode (OLED) displays as this technology provides a wide array of advantages, such as quicker response time, high contrast rations, and better viewing angles, thus making them a preferred choice for flexible display applications. A report by the IMARC GROUP suggests that the global OLED market size is projected to reach US$ 257.8 Billion by 2032, at a growth rate of 18.19% during 2024-2032. With this exponentially growing market, key players are focusing on launching new products and improving the manufacturing procedures of OLED. For instance, plastic substrates and thin-film encapsulation improve the flexibility and durability of displays thus enhancing their applicability across numerous devices.

Flexible Display Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional and country levels for 2025-2033. Our report has categorized the market based on display type, substrate material and application.

Breakup by Display Type:

- OLED

- LCD

- Electronic Paper Display (EPD)

- Others

OLED accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the display type. This includes OLED, LCD, electronic paper display (EPD), and others. According to the report, OLED represented the largest segment.

The flexible display market share is dominated by OLED due to the various advantages offered by it as compared to traditional display technologies. One of the major advantages is that it offers superior image quality with darker blacks, wider viewing angles, and higher contrast rations. The contrast ratio offered by OLEDs is 1,000,000:1 which is considerably higher than LCDs, thus resulting in more lifelike and vibrant images. Moreover, the increasing demand for premium displays in a wide array of industries such as consumer electronics, automotive, and others is driving the market for OLEDs.

Breakup by Substrate Material:

- Glass

- Plastic

- Others

Plastic holds the largest share in the industry

The flexible display market report has provided a detailed breakup and analysis of the market based on the substrate material. This includes glass, plastic, and others. According to the report, plastic accounted for the largest market share.

Plastic holds the maximum number of shares in the market on account if its inherent qualities including economical, lightweight, and flexile nature, when compared to glass substrates. Other than this, the exponential rise in the demand for foldable smartphones is leading to the increased adoption of plastic substrates. As per a report by the ECONOMIC TIMES, in India the foldable smartphones contributed 13% of the ultra-premium android shipments. It also suggested that this percentage is expected to grow by 35% by the end of 2025. Moreover, plastic substrates allow key players to produce foldable displays that sustain continuous bending without negotiating with the durability of the device.

Breakup by Application:

- Smartphones and Tablets

- Smart Wearables

- Televisions and Digital Signage Systems

- Personal Computers and Laptops

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes smartphones and tablets, smart wearables, television and digital signage systems, personal computers and laptops, and others.

The rising adoption of tablets and smartphones on a daily basis is contributing to a positive flexible display market forecast. The growing number of individuals seeking new innovations in their devices is influencing key players to experiment with a variety of these displays in order to cater to the changing demands of the consumers. Flexible displays offer bigger screen sizes, sleeker designs, and better durability due to which they are highly adopted in the smartphones and tablets industry.

The significant developments in health monitoring, fitness tracking, and connectivity features are leading to an exponential rise in the smart wearables market. Flexible displays offer lightweight, comfortable, and visually appealing forms to fitness bans, smartwatches, and augmented reality (AR) glasses. The expansion of the smart wearables market is directly proportional to the flexible display market demand.

These displays play a crucial role in the television and digital signage systems, by providing enhanced viewing experiences, space-saving designs, and versatile installation options for commercial and residential applications. In line with this, the increasing adoption of smart TVs is also contributing to the growth of this market. A report by the IMARC GROUP states that the global smart TV market size is expected to reach US$ 464.3 Billion by 2032, expanding at a CAGR of 5.8% during 2024-2032.

The product adoption rate is rising in the personal computers and laptops industry as they offer lighter, sleek, and more compact devices. They also allow innovative forms including dual-screen devices, foldable laptops, fulfilling demands of both consumers and professionals.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest flexible display market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific holds the maximum number of shares due to the expanding income level of individuals. The increasing spending capacity of individuals across the region is leading to a high demand for electronic devices. According to the INTERNATIONAL MONETARY FUND (IMF), the growth rate of the region is projected to be 4.6% in 2023 as compared to 3.9% in 2022. This, in confluence with the robust manufacturing ecosystem possessed by the region specifically in nations such as Japan, South Korea, and China is creating a positive impact on the market.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the flexible display industry include AU Optronics Corp., BOE Technology Group Co. Ltd., Corning Incorporated, DuPont de Nemours Inc., E Ink Holdings Inc., Innolux Corporation, Koninklijke Philips N.V., LG Electronics Inc., Plastic Logic (FlexEnable Limited), Royole Corporation, Samsung Electronics Co. Ltd., Sharp Corporation and Toshiba Corporation.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players are constantly innovating and creating strategies in order to maintain a competitive edge and expand their portfolio. Additionally, they are extensively investing in research and development (R&D) activities in order to improve their product portfolio, so as to cater to the changing consumer demands. Other than this, key players in this industry are also taking strategic steps such as entering into partnerships and participating in mergers and acquisitions. For instance, in 2022 BOE introduced OLED flexible “N” shaped foldable display technology support screen which can perform internal as well as external folding. (Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- May 2021: Huawei Technologies Co. Ltd. innovated and patented a new flexible screen, which will enhance gaming performance.

- April 2022: Samsung Electronics announced the launch of Neo QLED 8K and Neo QLED TVs. These televisions provide better picture quality and sounds which transform living spaces.

Flexible Display Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Display Types Covered | OLED, LCD, Electronic Paper Display (EPD), Others |

| Substrate Materials Covered | Glass, Plastic, Others |

| Applications Covered | Smartphones and Tablets, Smart Wearables, Televisions and Digital Signage Systems |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AU Optronics Corp., BOE Technology Group Co. Ltd., Corning Incorporated, DuPont de Nemours Inc., E Ink Holdings Inc., Innolux Corporation, Koninklijke Philips N.V., LG Electronics Inc., Plastic Logic (FlexEnable Limited), Royole Corporation, Samsung Electronics Co. Ltd., Sharp Corporation, Toshiba Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the flexible display market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global flexible display market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the flexible display industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global flexible display market was valued at USD 27.8 Billion in 2024.

We expect the global flexible display market to exhibit a CAGR of 21.19% during 2025-2033.

The growing popularity of digital signage systems in the media and entertainment sector, along with the emergence of compact and energy-efficient product variants, is primarily driving the global flexible display market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for flexible displays.

Based on the display type, the global flexible display market has been segmented into OLED, LCD, Electronic Paper Display (EPD), and others. Currently, OLED holds the majority of the total market share.

Based on the substrate material, the global flexible display market can be divided into glass, plastic, and others. Among these, plastic currently exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global flexible display market include AU Optronics Corp., BOE Technology Group Co. Ltd., Corning Incorporated, DuPont de Nemours Inc., E Ink Holdings Inc., Innolux Corporation, Koninklijke Philips N.V., LG Electronics Inc., Plastic Logic (FlexEnable Limited), Royole Corporation, Samsung Electronics Co. Ltd., Sharp Corporation, and Toshiba Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)