Flash LED Market Size, Share, Trends and Forecast by Power Consumption, Types of Devices, and Region, 2025-2033

Flash LED Market Size and Share:

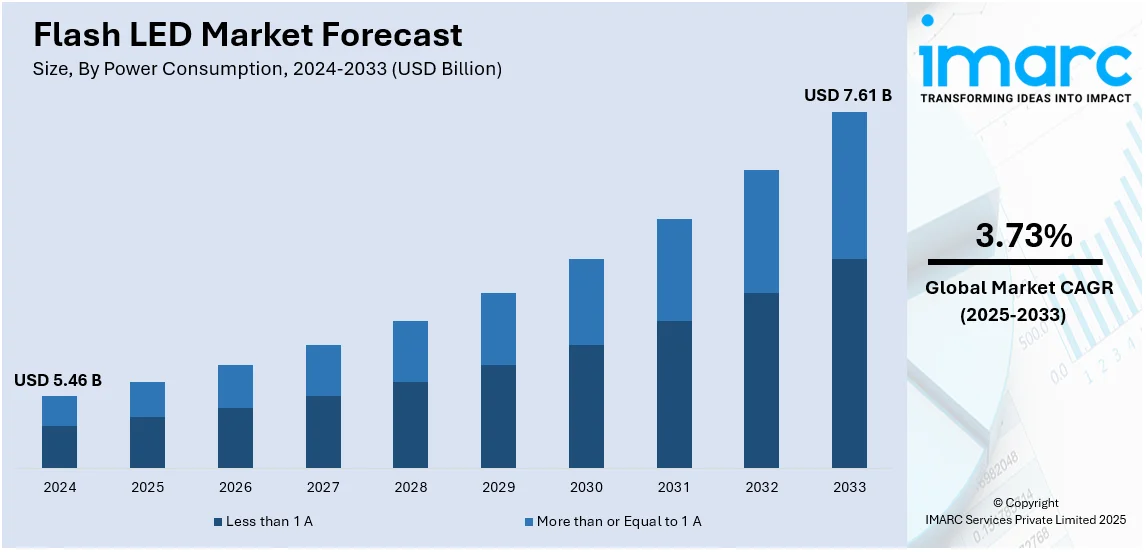

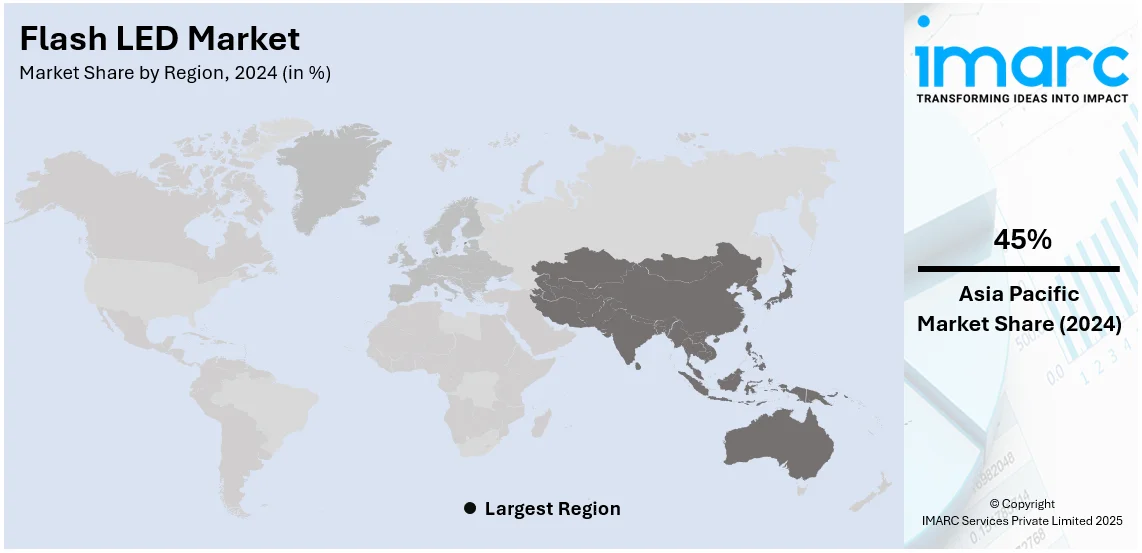

The global flash LED market size was valued at USD 5.46 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.61 Billion by 2033, exhibiting a CAGR of 3.73% from 2025-2033. Asia Pacific currently dominates the market, holding a flash LED market share of over 45% in 2024. The flash LED market is driven by rising smartphone adoption, enhanced camera technologies, and increasing demand for low-light photography. Expanding automotive applications in ADAS and smart lighting boost growth. Additionally, advancements in LED efficiency, miniaturization, and growing usage in industrial and medical imaging further propel market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.46 Billion |

|

Market Forecast in 2033

|

USD 7.61 Billion |

| Market Growth Rate (2025-2033) | 3.73% |

The flash LED market is driven by increasing smartphone penetration, as advanced camera features necessitate high-intensity LED flashes for better low-light photography. Growing adoption of automotive advanced driver-assistance systems (ADAS) and smart lighting solutions further accelerates demand. Expanding applications in industrial and medical imaging enhance market growth. Rising consumer preference for high-resolution imaging in consumer electronics fosters innovation in high-luminance, energy-efficient LEDs. The proliferation of IoT and connected devices fuels demand for compact, high-performance LED solutions. Additionally, advancements in LED technology, such as miniaturization and improved energy efficiency, contribute to expanding adoption across various end-use sectors.

The U.S. Flash LED market is driven by strong demand for high-end smartphones featuring advanced camera capabilities, enhancing low-light photography. Expanding applications in automotive lighting, particularly in ADAS and smart headlamps, further boost market growth. The rising adoption of industrial and medical imaging solutions fuels demand for high-intensity LEDs. Increasing consumer preference for high-resolution imaging in wearables and smart devices accelerates innovation. Presence of key market players and ongoing advancements in LED efficiency and miniaturization supporting the flash LED market growth. Additionally, growing investments in IoT and connected devices contribute to the rising need for compact, energy-efficient Flash LED solutions.

Flash LED Market Trends:

Rising Adoption of Smartphones with Advanced Camera Capabilities

A leading reason for this market is the adoption of flash LEDs in mobiles to enhance photo-taking capability. According to reports, over 1.2 billion mobile phones were shipped around the globe in 2023, and the majority had two or three cameras. With the demand for higher-resolution sensors like 48MP, 64MP, and 108MP cameras, advanced illumination solutions, including multi-tone LED flashes, are called for to provide better image quality in low-light conditions. Companies like Apple, Samsung, and Xiaomi have incorporated high-performance flash LEDs into their flagship smartphones, but in-house development is called for because "research on this domain is rather critical". In addition, the increasing demand for photography and videography on the part of consumers—more than 60% of mobile phone users upload photos on social media—reflects how vital flash LEDs are to uniform illumination.

Growing Adoption of Automotive LED Lighting

Another key driver is the automotive industry's shift to LED lighting technologies, including flash LEDs for advanced driver-assistance systems (ADAS). According to reports, in 2023, about 90 million vehicles were produced worldwide, and the share of LED-based headlights, taillights, and interior lighting systems is growing. Flash LEDs are increasingly integrated into ADAS components, such as cameras used in lane departure warnings and parking assist systems, which require reliable illumination. Also, electric vehicles (EVs), of which 14 million sales are recorded for the year 2023 by International Energy Agency, have contributed to an increased demand for energy-efficient lighting solutions, including flash LEDs. Since regulatory standards aim at increasing the visibility and safety of automotive lighting, advanced LED technologies offering higher brightness, longevity, and less power consumption have been increasingly used by the manufacturers.

Rising Demand for Professional Photography Equipment

The growing interest in professional photography and content creation is strongly fueling the adoption of flash LEDs in standalone cameras and lighting equipment. According to reports, in 2023, the shipment of digital cameras exceeded 7 million units, with a large share targeting professional users. High-end DSLRs and mirrorless cameras from Canon, Nikon, and Sony increasingly feature advanced flash LED systems to support dynamic lighting requirements. Additionally, the rise of content platforms like YouTube and Instagram has increased demand for ring lights and external flash systems that use LED technology. Flash LEDs are versatile because they can offer adjustable brightness, color temperatures, and improved durability, making them a preferred choice for amateur and professional photographers alike.

Flash LED Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global flash LED market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on power consumption, and types of devices.

Analysis by Power Consumption:

- Less than 1 A

- More than or Equal to 1 A

Based on the flash LED market forecast, Flash LEDs consuming Less than 1 A are widely used in budget and mid-range smartphones, offering energy-efficient illumination for photography. These LEDs prioritize low power consumption to enhance battery life while maintaining adequate brightness. They are also utilized in compact electronic devices where thermal management is a concern.

Besides this, the flash LEDs consuming More than or Equal to 1 A are preferred in high-end smartphones and professional imaging devices requiring intense illumination for low-light conditions. These LEDs deliver higher brightness and better color accuracy, supporting advanced photography features. They are also integrated into automotive and industrial applications demanding powerful and reliable lighting solutions.

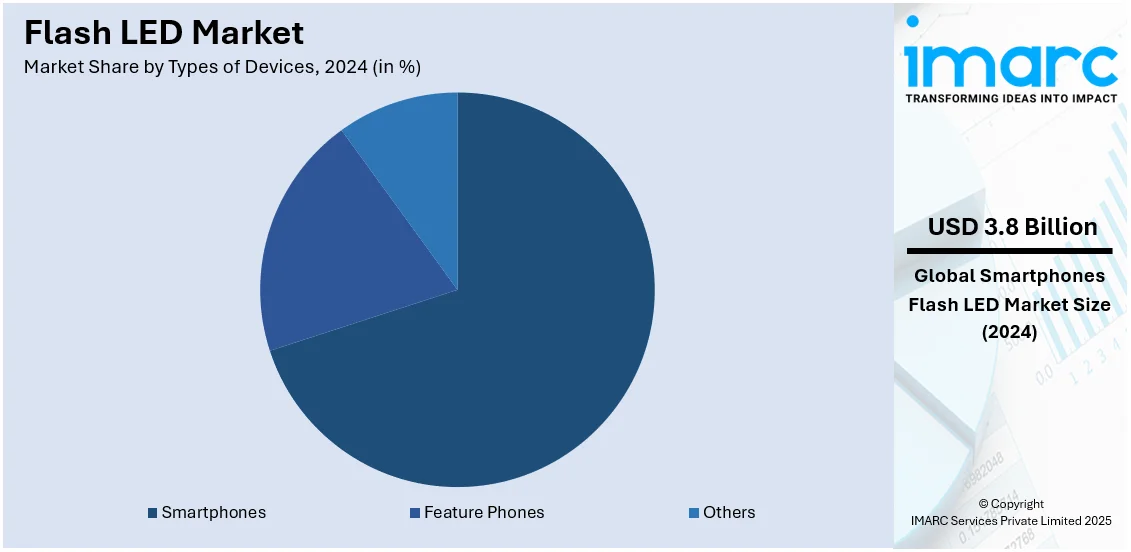

Analysis by Types of Devices:

- Smartphones

- Feature Phones

- Others

Smartphones account for 70% of the Flash LED market share, driven by increasing consumer demand for high-quality camera performance, particularly in low-light photography. Advanced imaging technologies, including multi-camera setups and AI-enhanced photography, require high-intensity, energy-efficient LED flashes. The rising popularity of social media, video content creation, and mobile photography further accelerates demand. Continuous innovation in smartphone design, such as thinner bezels and compact components, pushes manufacturers to develop miniaturized yet powerful Flash LED solutions. Additionally, growing smartphone penetration in emerging markets, coupled with frequent model upgrades, sustains high production volumes. The integration of LED flash technology in premium and mid-range smartphones strengthens the flash LED market demand.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

APAC dominates the Flash LED market with a 45% share due to the region’s strong consumer electronics industry, particularly in smartphone manufacturing. High production volumes from major economies drive demand for advanced LED solutions, catering to evolving camera technologies. The growing adoption of automotive lighting, including ADAS and smart headlamps, further positively impacting the flash LED market outlook. Rising industrialization and increasing investments in smart infrastructure contribute to higher LED integration in diverse applications. Additionally, the presence of a robust semiconductor ecosystem supports innovation in miniaturization and energy efficiency. Favorable government policies, cost-effective manufacturing, and a well-established supply chain strengthen APAC’s leadership, while increasing consumer preference for high-quality imaging solutions accelerates demand for high-performance Flash LEDs across the region.

Key Regional Takeaways:

United States Flash LED Market Analysis

The largest contributor to the growth of flash LED is consumer electronics like wearables and smartphones in the United States. According to an industry report, more than 90% of people use a smartphone, which has increased the demand for high-performance flash LEDs in camera modules. Devices that come with dual or triple cameras have created the demand for advanced LED flashes that enhance low-light shooting. The other important aspect is the increasing application of flash LEDs in interior ambient lighting and advanced driver-assistance systems (ADAS) in the car industry. The U.S. electric vehicle (EV) market, which sold over 1.2 million units in 2023, according to reports, is supporting the demand for state-of-the-art LED solutions. Flash LEDs are also used in digital signage, augmented reality, and high-resolution displays in the advertising and entertainment sectors. The federal government's energy efficiency programs and strict power consumption regulations have further supported the expansion of the market through the adoption of energy-saving LED technology.

Europe Flash LED Market Analysis

The European market for flash LEDs is supported by the region's emphasis on energy-efficient and sustainable technology. With over 900 million active mobile connections in Europe, countries such as Germany, France, and the UK are leading the way in smartphone usage, as per reports. High-end smartphones are increasingly using flash LEDs to satisfy consumer demand for better photography performance. In 2023, about 10.6 million new cars were registered in the 27 Member States of Europe, a 14% increase over 2022, according to data from the International Council on Clean Transportation. Flash LEDs are used in safety systems, interior lighting, and adaptive lighting systems. The European Union's strict energy efficiency laws and environmental objectives support the adoption of LED solutions in the industry. Other driving forces in the demand for flash LEDs are advancements in diagnostic and imaging technologies in healthcare applications. A growing number of smart cities in Europe is another driver of market growth, with the emphasis being placed on energy-efficient lighting solutions.

Asia Pacific Flash LED Market Analysis

The Asia-Pacific region leads the global market for flash LEDs because of its increasing automotive and consumer electronics industries. The largest markets for flash LEDs in smartphones and tablets are China and India, where more than 2 billion smartphone users are located, as per reports. Energy-efficient LED lighting is steadily gaining popularity in the region, considering that China alone, accounting for over 60% of the globe's EV sales, according to reports, has rapidly emerging EV markets. Japan and South Korea are also the leaders in display technologies, where flash LEDs are used highly in advanced display systems and digital signage. The market is growing due to the increased acceptance of LED-based solutions in the healthcare and industrial sectors of the region, which are further boosted by government incentives. Demand is also being created by smart city programs in China, India, and Singapore, that focus on energy-efficient infrastructure.

Latin America Flash LED Market Analysis

There is growing smartphone use and car lightening up across Latin America that is boosting demand in the region's flash LED market. According to reports, with penetration rates of more than 80% in Brazil and Mexico, where demand for premium camera modules with flash LEDs is increasing, it is leading the region. In the automobile sector, LED technologies are being used increasingly, particularly in Mexico, which produces over 4 million cars per year, for safety and lighting applications, as per reports. Further boosting the expansion of markets, advertising and retail segments in the region are also utilizing LED displays for digital signage and promotion. Increased adoption of smart city initiatives by countries such as Chile and Colombia and government initiatives supporting energy-efficient technologies are further supporting the flash LED market share.

Middle East and Africa Flash LED Market Analysis

Currently, the flash LEDs market is experiencing tremendous growth due to growing digitalisation and increasing requirements of energy-efficient technologies in the Middle East and Africa. The increasing use of flash LEDs in consumer electronics is primarily due to the high increase in the cellphones used nowadays. According to reports, there are already over 500 million mobile connections in Africa. Advanced LED lighting solutions for automobiles are gaining acceptance quickly within the Middle East automobile industry, mainly in Saudi Arabia and the United Arab Emirates. Increased smart city initiatives, including the Saudi Arabian NEOM project, also are spurring on energy-efficient use of LED-based lighting systems. Another driver of demand in the region's retail and leisure industries is digital signage and display applications for flash LEDs.

Competitive Landscape:

The Flash LED market is characterized by intense competition, with multiple players focusing on technological advancements and product differentiation. Companies compete on factors such as energy efficiency, luminance, miniaturization, and cost-effectiveness to meet evolving consumer demands. Continuous innovation in high-intensity, low-power LEDs is crucial for maintaining a competitive edge. The market sees strong participation from semiconductor manufacturers, leveraging advancements in chip design and integration. Strategic partnerships with smartphone makers, automotive firms, and industrial equipment providers drive growth. Research and development investments focus on enhancing optical performance and thermal management. Additionally, regional expansion and supply chain optimization play key roles in sustaining market presence amid fluctuating raw material costs and evolving regulatory standards.

The report provides a comprehensive analysis of the competitive landscape in the flash LED market with detailed profiles of all major companies, including:

- Cree Inc.

- Epistar Corporation

- Everlight Electronics Co. Ltd.

- Shenzhen Jufei Optoelectronics Co. Ltd.

- Lumileds Holding B.V.

- LG Innotek

- Osram Gmbh.

- Samsung

- Semileds Corporation

- Seoul Semiconductors Co. Ltd.

Latest News and Developments:

- In August 2024: Lumileds announced the sale of its Lamps and Accessories division to First Brands Group. This strategic move allows Lumileds to concentrate on its core expertise in LED and MicroLED technologies, which serve diverse applications across automotive, general illumination, display, and flash sectors.

- July 2024: Modern innovations in photographic lighting are introduced with the AriesX Studio Flash introduction, with a focus on power efficiency and versatility. With its sophisticated settings, portability, and enhanced battery management, the product is designed with professional photographers in mind.

Flash LED Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Power Consumption Covered | Less than 1 A, More than or Equal to 1 A |

| Type of Devices Covered | Smartphones, Feature Phones, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cree Inc., Epistar Corporation, Everlight Electronics Co. Ltd., Shenzhen Jufei Optoelectronics Co. Ltd., Lumileds Holding B.V., LG Innotek, Osram Gmbh., Samsung, Semileds Corporation, Seoul Semiconductors Co. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the flash LED market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global flash LED market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the flash LED industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flash LED market was valued at USD 5.46 Billion in 2024.

The flash LED market was valued at USD 7.61 Billion in 2033 exhibiting a CAGR of 3.73% during 2025-2033.

Key factors driving the Flash LED market include increasing smartphone adoption with advanced camera features, growing demand for automotive lighting in ADAS and smart headlamps, expanding use in industrial and medical imaging, rising consumer preference for high-resolution imaging in wearables, and innovations in LED miniaturization and energy efficiency.

Asia Pacific leads the flash LED market holding 45% market share due to its dominance in smartphone manufacturing, particularly in countries like China and South Korea. The region also benefits from rapid automotive sector growth, expanding industrial applications, and significant investments in smart infrastructure, driving high demand for energy-efficient and high-performance Flash LED solutions.

Some of the major players in the flash LED market include Cree Inc., Epistar Corporation, Everlight Electronics Co. Ltd., Shenzhen Jufei Optoelectronics Co. Ltd., Lumileds Holding B.V., LG Innotek, Osram Gmbh., Samsung, Semileds Corporation and Seoul Semiconductors Co. Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)