Flare Monitoring Market Size, Share, Trends and Forecast by Mounting Method, End User, and Region, 2025-2033

Flare Monitoring Market 2024, Size and Trends:

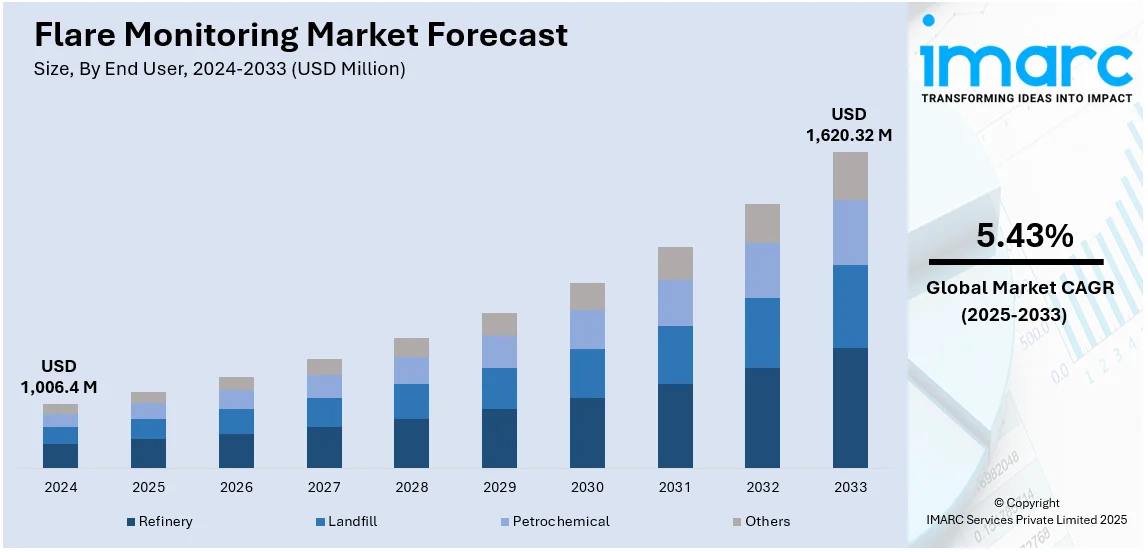

The global flare monitoring market size was valued at USD 1,006.4 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,620.32 Million by 2033, exhibiting a CAGR of 5.43% during 2025-2033. North America currently dominates the market, holding a market share of over 34.3% in 2024. The significant growth in the oil and gas industry, the widespread adoption of flare monitoring in the chemical and petrochemical industries, and the recent development of wireless flare monitoring systems represent some of the key factors driving the flare monitoring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,006.4 Million |

|

Market Forecast in 2033

|

USD 1,620.32 Million |

| Market Growth Rate (2025-2033) | 5.43% |

The significant growth in the oil and gas industry across the globe is one of the primary factors creating a positive outlook for the market. Flare monitoring is widely used in offshore drilling rigs, pipeline transportation, and refineries to lower harmful gas emissions, minimize the risk of oil spills, detect leakages, optimize extraction processes, maximize efficiency, and reduce equipment downtime. Additionally, the recent development of wireless flare monitoring systems, which utilize Wi-Fi, Bluetooth, and the Internet of Things (IoT) technology to provide real-time data, enable remote access, and allow operators to identify potential issues quickly, is positively influencing the flare monitoring market growth. Besides this, the integration of artificial intelligence (AI) and machine learning (ML) to improve detection accuracy, reduce false alarms, and predict flare behavior is proving a thrust to the market growth. According to reports, AI solutions support manufacturers’ core production processes, with 24% applied to assembly and quality testing and 23% dedicated to product development and engineering. Moreover, the implementation of various government initiatives to minimize industrial emission levels and ensure compliance with environmental regulations is propelling the market growth.

The United States is a key disruptor, with its government urging industries to reduce air pollution. In 2023, approximately 66 million tons of pollution were released into the atmosphere in the country. One major reason for the cause of this pollution is flaring: burning off excess gases in refineries, petrochemical plants, and oil & gas facilities. It emits harmful pollutants such as carbon dioxide (CO₂), methane (CH₄), sulfur oxides (SOx), and volatile organic compounds (VOCs). These emissions contribute to global warming, acid rain, and respiratory diseases, which is why authorities are enforcing stricter monitoring and reporting rules. As a result, the EPA’s Refinery Sector Rule demands continuous monitoring of flares to ensure they operate within prescribed limits, pushing companies to invest in advanced flare monitoring systems.

Flare Monitoring Market Trends:

Rising Focus on Sustainability and Carbon Footprint Reduction

With global discussions around climate change intensifying, industries are under growing pressure to reduce their carbon footprint. The oil & gas sector, in particular, is one of the biggest emitters of greenhouse gases (GHGs), and flaring contributes significantly to this problem. According to a report by the International Energy Agency (IEA), oil and gas operations were responsible for approximately 15 percent of global energy-related emissions in 2023, equating to 5.1 billion tonnes of greenhouse gas (GHG) emissions. Stakeholders ranging from investors and environmental groups to governments and consumers are demanding more responsible operations. This is forcing companies to adopt technologies that help them track, report, and minimize flaring. As a result, technologies like remote sensing, gas analyzers, and AI-driven monitoring systems are playing a critical role in this transition. By continuously measuring flare efficiency and emissions, companies can optimize combustion processes, recover waste gases, and lower their environmental impact.

Expansion of Oil & Gas Exploration and Production Activities

Despite the global shift toward renewable energy, oil and gas continue to be crucial energy sources, particularly in developing economies. Nations like the U.S., China, India, Saudi Arabia, and Brazil are expanding their oil and gas exploration and production (E&P) efforts to meet rising energy demands. In India, refiners are projected to add 56 million tonnes of oil per annum (MTPA) by 2028, increasing domestic capacity to 310 MTPA. Over the past decade, the country has also boosted its refining capacity from 215.1 million metric tonnes per annum (MMTPA) to 256.8 MMTPA. However, with increased extraction and refining comes higher gas flaring, which needs to be controlled to comply with regulations and environmental commitments, thus boosting the flare monitoring market demand.

Growing Adoption of Automation and Digital Technologies in Industry

Industries are rapidly adopting automation, artificial intelligence (AI), and digital technologies to enhance efficiency, reduce human errors, and improve compliance. Flare monitoring is no exception. Traditional manual monitoring methods are being replaced by advanced digital systems that provide real-time data, predictive insights, and automated alerts. AI-powered flare monitoring systems can analyze historical data, predict flare performance, and optimize combustion efficiency. Machine learning (ML) algorithms can detect anomalies, such as incomplete combustion or excess emissions, and trigger corrective actions before they lead to regulatory violations. These technologies also help companies optimize their operational strategies, leading to cost savings and reduced environmental impact. Moreover, cloud-based platforms are enabling remote monitoring that allow industries to track flare performance across multiple sites from a central control room. This is particularly beneficial for offshore rigs and remote oil fields where on-site monitoring is challenging. As digitalization continues transforming industrial operations, smart flare monitoring solutions are becoming a necessity rather than an option.

Flare Monitoring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global flare monitoring market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on mounting method and end user.

Analysis by Mounting Method:

- In-process Mounting

- Gas Analyzer

- Calorimeter

- Mass Spectrometer

- Gas Chromatograph

- Remote Mounting

- Multi Spectrum Infrared (MSIR)

- Thermal Imager

- Others

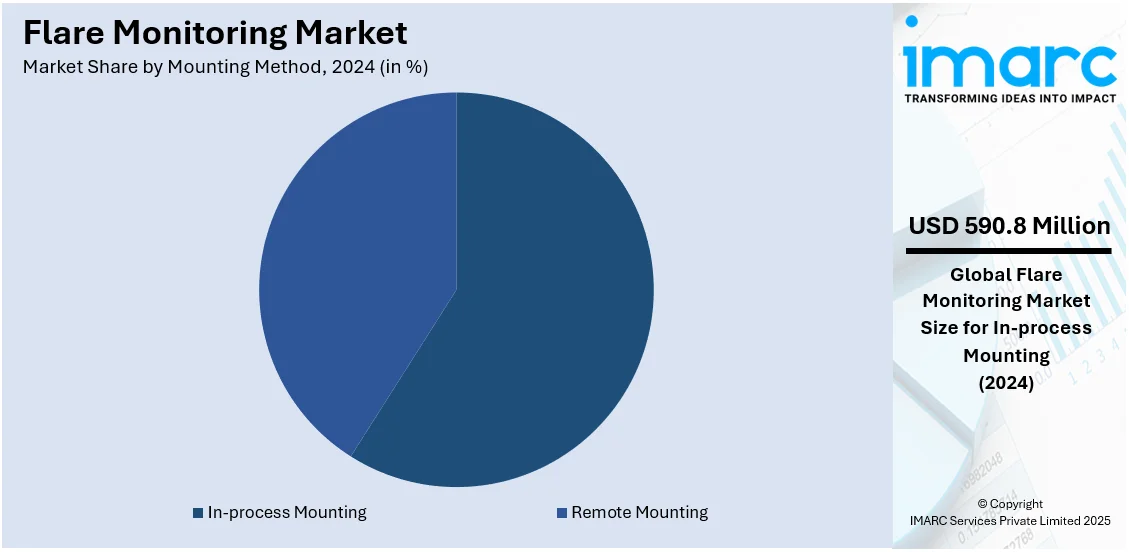

As per the flare monitoring market forecast, in-process mounting stands as the largest mounting method in 2024, holding 58.7% of the market. It dominates the flare monitoring market due to its ability to provide continuous, real-time monitoring of flare combustion efficiency and emissions. This method involves installing sensors directly within the flare stack or combustion chamber, ensuring precise measurements of parameters like temperature, gas composition, and flare intensity. Industries such as oil and gas, petrochemicals, and refineries prefer in-process mounting because it enables proactive compliance with stringent environmental regulations, reduces gas wastage, and enhances operational efficiency. The increasing adoption of automation and advanced sensor technologies, including infrared and ultraviolet (UV) spectrometers, further strengthens demand for in-process mounting solutions.

Analysis by End User:

- Refinery

- Landfill

- Petrochemical

- Others

Refineries represented the largest end-user segment in the flare monitoring market share during 2024, due to their high volume of hydrocarbon processing and significant flaring activities. Strict environmental regulations, such as those imposed by the U.S. EPA and the European Environment Agency, require refineries to monitor and control flare emissions to minimize air pollution and greenhouse gas output. Continuous monitoring solutions, including infrared (IR) cameras, mass spectrometers, and gas analyzers, are widely deployed to ensure compliance, optimize combustion efficiency, and reduce operational losses. As global refining capacity expands, particularly in regions like the Middle East, Asia-Pacific, and North America, the demand for advanced flare monitoring systems continues to rise, reinforcing this segment’s dominance in the market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Based on the flare monitoring market outlook, in 2024, North America held the largest market share of 34.3%. The region's dominance in the flare monitoring market is driven by strict environmental regulations, technological advancements, and substantial oil and gas production activities. The U.S. Environmental Protection Agency (EPA) enforces strict emission monitoring standards, compelling refineries, petrochemical plants, and shale gas operations to adopt advanced flare monitoring systems. The region’s strong presence of key industry players, such as Thermo Fisher Scientific and Honeywell, further accelerates technological innovation and adoption. The ongoing expansion of shale gas exploration, particularly in the Permian Basin, alongside increasing investments in automation and digital flare monitoring solutions, reinforces North America's dominance. Additionally, Canada’s stringent carbon emission policies and focus on sustainability further contribute to the growing demand for flare monitoring systems in the region.

Key Regional Takeaways:

United States Flare Monitoring Market Analysis

Flare monitoring adoption is expanding across various sectors, particularly within the petrochemical and chemical industries in North America. According to International Trade Administration, the U.S. chemical manufacturing industry total FDI in the industry was USD 766.7 Billion in 2023. The growth of these sectors has led to an increased need for safety and environmental monitoring, particularly in managing emissions and ensuring compliance with regulations. As industries focus on reducing their carbon footprint and improving operational efficiency, advanced flare monitoring systems are becoming a key component in achieving these goals. The high volume of hazardous materials processed in these facilities makes it imperative to adopt technologies that can accurately measure and detect flare activity, enabling immediate intervention if necessary. The demand for efficient monitoring systems has surged as regulatory pressure increases and environmental concerns continue to rise, leading companies to invest in the latest flare monitoring technologies. This trend is expected to continue as more companies within these industries embrace sustainable practices and seek solutions that ensure both safety and environmental protection.

Asia Pacific Flare Monitoring Market Analysis

Flare monitoring in the Asia-Pacific region is slowly becoming more widespread, as the operative influence of increasing landfills spreads across the region. Reports show that Indian cities are among the largest waste generators globally, producing approximately 62 million tons of waste annually. Of this, 43 million tons (70%) are collected, 12 million tons are treated, while the remaining 31 million tons are sent to landfill sites. As issues of waste management are becoming major concerns, the need to monitor flare emissions from landfill sites has been on the rise. Continued urbanization and the increase in population contributes to a hike in waste generated within the area, placing more pressure on waste management systems. Considering the fact that these landfill sites are likely to give out harmful gases, such as methane, monitoring and control becomes very crucial to protect the environment. Flare monitoring technology can mitigate risks related to landfill gas flaring. Therefore, to ensure safety and ecological cleanliness, dangerous gases are discharged in an environmentally compliant manner. As a result, industries have embraced the idea of advanced flare monitoring systems as a means of securing their operations in a safely and environmentally friendly manner.

Europe Flare Monitoring Market Analysis

As per the flare monitoring market trends, in Europe, the adoption of flare monitoring technologies is being driven by the growth in industrial production. Reports indicate that the EU's industrial production rose by 8.5% in 2021 compared to 2020. This growth continued in 2022, with a further increase of 0.4% compared to 2021. With a broad industrial base encompassing manufacturing, energy, and chemical production, the need for effective flare monitoring systems has intensified to meet safety standards and environmental regulations. As industrial activities increase, the volume of flare gas generated also rises, making the role of flare monitoring in detecting and managing these emissions more critical. Industries such as steel production and chemicals require constant monitoring of their flare systems to prevent the release of dangerous substances into the atmosphere. As stricter environmental regulations are implemented across the region, industries are turning to more advanced and efficient monitoring systems to comply with emission reduction goals. Additionally, as the global push for sustainability grows, companies are investing in technologies that improve both the efficiency and safety of their flare systems, reinforcing the role of flare monitoring in maintaining environmental integrity.

Latin America Flare Monitoring Market Analysis

Flare monitoring technology has become more popular, especially in refinery operations, due to increasing business and mining activities across South America. International Energy Association states that Latin America is accountable for 40% of the world's copper production as Chile captures 27%, Peru 10% while Mexico manages 3%. Mining is thus rendered to boost refinery operations most as extraction and processing methods advance. Refineries process large quantities of materials, and the flare system needs to be controlled with great accuracy to handle and contain gases that are released during the refining process. The flare monitoring technologies are now critical in ensuring safe disposal of these gases, which are hazardous. Mining activities have become one of the contributing factors in the growing demand for refining capacities. Flare monitoring systems are now being increasingly adopted as a preventive measure against the environmental implications and strict safety standards. Real-time data acquisition helps in taking decisions and averting potential hazards in safety measures.

Middle East and Africa Flare Monitoring Market Analysis

There has been a growth in the market for flare monitoring systems in the Middle East and Africa as the exploration and production activities expand. For example, in the period 2024-2028, 668 oil and gas projects are forecasted to be launched in the Middle East. Growing energy demands in the region require developing additional oil fields and gas plants, increasing the amount of flaring, which requires better flare monitoring technologies for timely management of emissions. As oil and gas production processes cause degradation to the environment, flare monitoring technologies are effective tools for measurement and regulation of flare release. Monitoring flares at extraction sites and processing plants ensures regulatory compliance and minimizes the environmental footprint of oil and gas operations. This drives increased investment in flare monitoring technologies throughout the region. This trend is expected to continue in direct proportion to growing environmental awareness and a focus on sustainability within the energy sector.

Competitive Landscape:

Key players in the market are focusing on developing advanced monitoring technologies that provide real-time data, enhance combustion efficiency, and ensure regulatory compliance. Companies are investing in optical gas imaging, infrared and ultraviolet sensing, and AI-driven analytics to improve detection accuracy and minimize emissions. Integrated monitoring systems that combine hardware and software are being widely adopted, enabling continuous remote monitoring and predictive maintenance. There is also a strong emphasis on automation, with industrial flare monitoring solutions increasingly leveraging cloud-based platforms for data analysis and reporting. Research and development efforts are directed toward improving sensor accuracy, expanding detection capabilities in extreme conditions, and reducing operational costs. Moreover, strategic partnerships and collaborations with regional distributors are helping expand market reach, while regulatory compliance remains a key driver for innovation. Additionally, sustainability initiatives are pushing industry players to develop eco-friendly monitoring solutions that align with carbon reduction goals. These efforts collectively contribute to improved industrial efficiency, lower environmental impact, and enhanced regulatory adherence across various sectors.

The report provides a comprehensive analysis of the competitive landscape in the flare monitoring market with detailed profiles of all major companies, including:

- Ametek Inc.

- Emerson Electric Co.

- Fluenta AS (Vista Holding Group)

- Hernis Scan Systems AS (Eaton Corporation)

- Honeywell International Inc.

- John Zink Company, LLC (Koch Industries, Inc.)

- MKS Instruments Inc.

- Providence Photonics, LLC

- Teledyne FLIR LLC (Teledyne Technologies Inc)

- Thermo Fisher Scientific Inc.

- Williamson Corporation

- Zeeco Inc.

Latest News and Developments:

- In October 2024, AMETEK enriched its portfolio with the strategic acquisition of Virtek Vision in Q3 2024, strengthening and expanding its portfolio capabilities in advanced metrology instrumentation, thus investing in the growth of the precision technology market. Further innovation and growth within the Company's instrumentation division is fueled by this acquisition.

- In September 2024, LightPath Technologies launched its new Mantis camera worldwide to monitor high-temperature processes in boilers and furnaces of power plants. The advanced camera supports applications like flare monitoring for industrial efficiency and safety. The first commercial order was for furnace inspection by a customer in the Southeastern US. It marked the company's shift from making components to providing optical technology solutions.

- In July 2024, Flotek Industries' JP3 Analyzer was approved by EPA for oil and gas flare monitoring, meeting the new NSPS OOOOb regulations. This optical analyzer assesses and measures the net heating values in flare gases with a high degree of accuracy, ensuring cleaner and more efficient operations. The approval marks a significant advance in flare regulation compliance within the oil and gas sector.

- In March 2024, Panametrics, a Baker Hughes business, expands flare.IQ emissions monitoring technology to upstream operators. This new technology improves transparency and reduces flare emissions, saving more than 80 Million Tons of CO2 globally. Flare monitoring has now taken a giant leap toward sustainability in oil and gas operations.

- In March 2024, Baker Hughes and bp partnered to improve flare emissions monitoring with flare.IQ technology. The partnership allows bp to measure the methane emissions of its flares, a step forward in flare combustion research and precision in emission measurement for the upstream oil and gas industry.

Flare Monitoring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mounting Methods Covered |

|

| End Users Covered | Refinery, Landfill, Petrochemical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ametek Inc., Emerson Electric Co., Fluenta AS (Vista Holding Group), Hernis Scan Systems AS (Eaton Corporation), Honeywell International Inc., John Zink Company, LLC (Koch Industries, Inc.), MKS Instruments Inc., Providence Photonics, LLC, Teledyne FLIR LLC (Teledyne Technologies Inc), Thermo Fisher Scientific Inc., Williamson Corporation, Zeeco Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the flare monitoring market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global flare monitoring market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the flare monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flare monitoring market was valued at USD 1,006.4 Million in 2024.

IMARC Group estimates the market to reach USD 1,620.32 Million by 2033, exhibiting a CAGR of 5.43% during 2025-2033.

Stringent environmental regulations, rising sustainability efforts, expanding oil and gas exploration, increasing adoption of automation, growing investments in refinery infrastructure, and advancements in flare monitoring technologies are driving market growth.

North America currently dominates the market, driven by the rising environmental concerns, increasing government initiatives, and significant technological advancements.

Some of the major players in the flare monitoring market include Ametek Inc., Emerson Electric Co., Fluenta AS (Vista Holding Group), Hernis Scan Systems AS (Eaton Corporation), Honeywell International Inc., John Zink Company, LLC (Koch Industries, Inc.), MKS Instruments Inc., Providence Photonics, LLC, Teledyne FLIR LLC (Teledyne Technologies Inc), Thermo Fisher Scientific Inc., Williamson Corporation, Zeeco Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)