Flame Retardants Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033

Flame Retardants Market Size & Share:

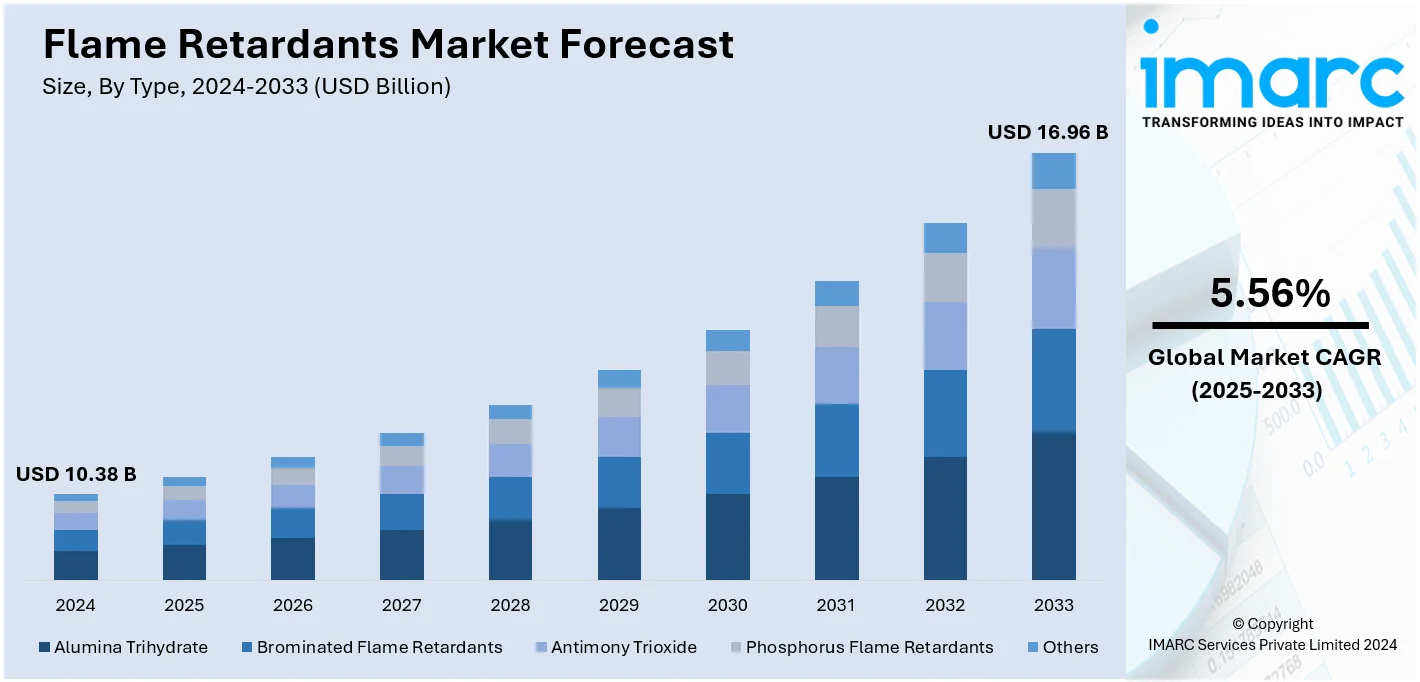

The global flame retardants market size was valued at USD 10.38 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.96 Billion by 2033, exhibiting a CAGR of 5.56% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 57.6% in 2024. The increasing use of flame retardants in the aerospace industry, rising emphasis on fire safety regulations and standards across various industries, and the introduction of bio-based flame retardants derived from renewable sources are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.38 Billion |

| Market Forecast in 2033 | USD 16.96 Billion |

| Market Growth Rate (2025-2033) | 5.56% |

The market is experiencing gradual growth mainly driven by rising safety regulations across various industries, mainly in the construction, electronics and automotive sectors. For instance, in June 2024, Evonik introduced its TEGO Therm product range to improve the safety of electric vehicle battery enclosures. These heat-resistant and fire-resistant coatings help prevent thermal run away complying with UL 94 V-0 standards. The rising demand for fire-resistant materials in residential and commercial buildings along with the strict fire safety norms is also creating a positive outlook for the market growth. The growing use of electronic vehicles and electronic devices that require flame-retardant components further fuels the market demand. Expanding infrastructure projects in emerging economies are further boosting the market opportunities.

The United States flame retardants market is driven by stringent fire safety regulations and standards across industries including construction, automotive, and electronics. For instance, in July 2024, Cambium and Checkerspot announced their partnership to create PFAS-free foam products resistant to high temperatures and fire targeting defense and commercial sectors. This collaboration harnesses advanced biomaterials to improve performance across industries such as aerospace and automotive while maintaining a sustainable domestic supply chain. An increasing demand for fire-resistant materials in residential and commercial buildings fueled by urbanization and infrastructure development supports market growth. Innovation in non-halogenated, eco-friendly flame retardants aligns with sustainability goals and regulatory compliance, thereby contributing to the market growth.

Flame Retardants Market Trends:

Growing emphasis on fire safety regulations

One of the major factors favorably impacting the market is the growing focus on fire safety standards and regulations across several industries. Furthermore, the automobile industry's growing usage of flame retardants to make interior parts like dashboards, seats, and wiring harnesses that stop flames in an accident provides a positive outlook for the market. Between 2018 and 2022, an annual average of 119,681 vehicle fires involving automobiles or passenger vehicles were reported according to the NFPA. These incidents made up 56% of all vehicle fires and 61% of highway vehicle fires. Typically, they led to 380 civilian fatalities (65%), 783 civilian injuries (59%) and USD 765 million in damages to property (35%). Moreover, the rising dependence of the electronics sector on flame retardants to protect devices and prevent electrical fires is driving the growth of the market. To lower the risk of fires and safeguard people and property, regulatory agencies and governing bodies around the world are also enforcing strict safety regulations.

Rising demand from several industries

The increasing demand for fire retardants across several industry verticals, including electronics, automotive, and construction, to improve safety and satisfy legal requirements is significantly impacting the market. Additionally, the need for flame retardants in roofing, cladding, and insulation to reduce the danger of fires in residential, commercial, and industrial buildings is driven by the world's growing urbanization and infrastructure development. According to the World Bank, 56% of the global population or 4.4 Billion people currently live in cities. By 2050, this figure is expected to double with nearly 70% of people living in urban areas. Apart from this, the leading automakers are increasingly incorporating flame-retardant materials into vehicle interiors and electrical systems to improve driver and passenger safety. Moreover, the increasing adoption of fire retardants in consumer electronics such as smartphones, laptops and other mobile devices is propelling the market growth.

Technological advancements

Continuous advancement in flame retardant technologies is the other major factor contributing to the market growth. Additionally, the rising focus on developing flame retardants that are environmentally friendly and less toxic is offering a favorable market outlook. Apart from this, the introduction of bio-based flame retardants derived from renewable sources is attracting a wider consumer base. According to the IEA, around 40% of renewable energy supply comes from electricity generation. Additionally, several manufacturers and researchers are creating cutting-edge flame retardant solutions that are more adaptable, efficient, and eco-friendly. Additionally, the market is expanding due to the growing use of nanoscale flame retardant compounds to reduce chemical use and improve environmental health.

Flame Retardants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global flame retardants market report, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end use industry.

Analysis by Type:

- Alumina Trihydrate

- Brominated Flame Retardants

- Antimony Trioxide

- Phosphorus Flame Retardants

- Others

According to report brominated flame retardants holds the largest segment because they are highly effective in fire prevention and delay of its spread. They are also highly efficient in extinguishing flames and preventing ignition which ensure the safety of individuals and businesses. Other than this they can be integrated into plastics, foams, textiles and coatings which makes them suitable for various industrial applications. They also offer long-term flame retardancy so that during the entire life cycle of the product flame retardancy is maintained. Additionally, they perform at lower concentrations than competing flame retardants enabling manufacturers to achieve the desired level of flame safety without substantially increasing the price of production.

Analysis by Application:

- Unsaturated Polyester Resins

- Epoxy Resins

- PVC

- Rubber

- Polyolefins

- Others

Epoxy Resins leads the market with around 26.8% of flame retardants market share in 2024. According to the report, epoxy resins account for the largest market share as they possess exceptional flame retardant properties. Additionally, they undergo a chemical transformation that promotes the formation of a char layer when exposed to fire and high temperatures. Apart from this their intrinsic ability to resist flames and slow down the spread of fire makes epoxy resins highly effective in enhancing fire safety. Furthermore, epoxy resins can be formulated to suit various materials making them adaptable for different industries and products. Moreover, they remain effective for extended periods ensuring that the fire protection they provide lasts throughout the lifespan of the product. Besides this, they have a relatively low environmental impact compared to certain alternatives.

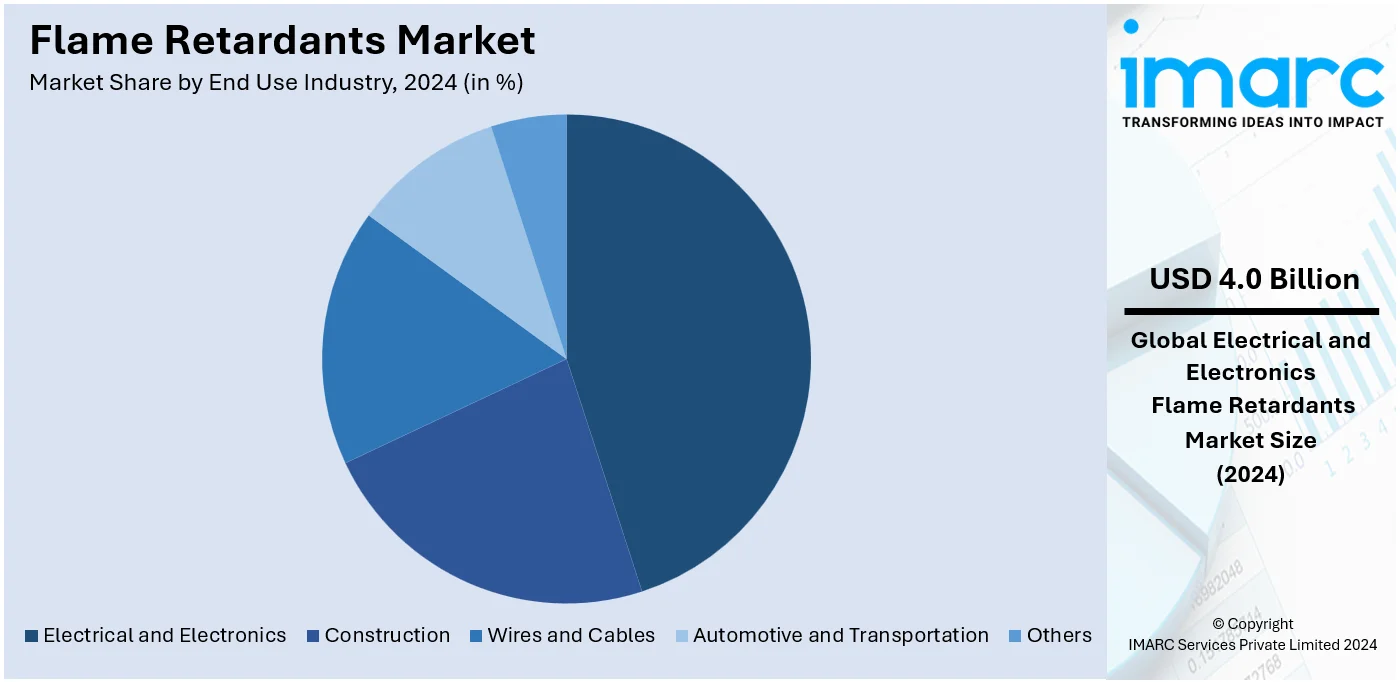

Analysis by End Use Industry:

- Construction

- Wires and Cables

- Automotive and Transportation

- Electrical and Electronics

- Others

Electrical and electronics leads the market with around 38.1% of market share in 2024. According to the report electrical and electronics accounted for the largest market share as they are constructed from a wide range of materials including plastics, printed circuit boards (PCBs) and insulation materials. Flame retardants are employed to enhance the fire resistance of these materials, protecting the electronic components and preventing fires from spreading within the device. Apart from this, they are prone to high fire risks due to the presence of electrical currents and potential overheating. Flame retardants are engineered to suppress fires quickly preventing damage to the device itself and potential fire hazards in the surrounding environment. Moreover, they help prevent short circuits from escalating into full-blown fires by interrupting the ignition process and reducing the combustion rate.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 57.6%. According to the report Asia Pacific accounted for the largest market share due to rapid urbanization and infrastructure development. The construction of residential and commercial buildings, transportation networks and industrial complexes requires the incorporation of fire-resistant materials. Flame retardants are essential in meeting the stringent safety standards in these projects thus driving their widespread use. Additionally, the high concentration of electronic manufacturing in the region drives the demand for flame retardants. Apart from this, the easy availability of key raw material sources including chemicals required for flame retardant production supports the flame retardant market growth. Moreover, the expansion of various industries and increasing cases of fire accidents in the Asia Pacific is catalyzing the demand for flame retardants.

Key Regional Takeaways:

North America Flame Retardants Market Analysis

The flame retardants market in North America is propelled by strict fire safety standards and a growing demand from the construction, automotive, and electronics sectors. The United States leads the market supported by strong infrastructure development and a growing focus on electric vehicles which require flame-retardant materials to ensure battery safety. In construction the retrofitting of older buildings and the use of fire-resistant solutions in new projects are key contributors. Canada’s expanding residential and commercial construction sector further supports growth. The electronics industry driven by advanced consumer devices increasingly relies on flame retardants to meet safety standards. Additionally, rising awareness of environmental concerns is encouraging the adoption of sustainable and non-toxic flame retardants across the region.

United States Flame Retardants Market Analysis

United States held 76.8% of the market share in North America in the year 2024. The flame retardants market in the United States is driven by stringent fire safety regulations and increasing demand in various sectors such as automobile, construction, and electronics. The growing emphasis on fire safety, particularly in residential and commercial buildings, leads to higher adoption of flame-retardant materials. A notable example of this demand is seen in the electric vehicle (EV) industry. According to the International Energy Agency, new electric car registrations in the U.S. stood at 1.4 Million in 2023. This represents a 40% increase from 2022. The growth of EVs is creating a significant demand for flame-retardant materials, especially in high-energy batteries, to prevent burning when accidents or overheating occurs. In line with this, the construction sector's growth and the retrofitting of old buildings for fire resistance is another factor propelling the market demand. Increasing environmental awareness creates further demand for non-toxic, environment-friendly flame retardants. These factors coupled with government support for research and development are fostering steady growth in the U.S. flame retardants market.

Europe Flame Retardants Market Analysis

In Europe, the flame retardants market is driven by stringent safety regulations and growing concerns over fire hazards particularly in the automotive, construction and electronics sectors. The European Union has implemented strict fire safety requirements that have significantly led to the use of flame-resistant materials in general industries like building materials, electrical wires, and even car parts. With the growing adoption of electric vehicles the demand for flame retardants is on the rise to avoid any accidents or mis happenings. According to the International Energy Agency, while global electric car sales are increasing, they remain highly concentrated in a few major markets with Europe accounting for 25% of global EV sales in 2023. This growth is driving the need for flame-retardant solutions particularly in high-energy batteries to ensure vehicle safety. The construction sector, bolstered by infrastructure development and building retrofits, also significantly contributes to market growth. In addition, the growing use of flame retardants in consumer electronic products like smartphones and laptop is driving demand. Shifting environmental regulations towards cleaner and greener alternatives promote the market to shift from non-toxic and ecofriendly flame retardants. Each of these factors supports this growth in Europe's flame retardants market.

Latin America Flame Retardants Market Analysis

Latin America Flame Retardants Market drivers mainly include increasing fire safety regulations, especially in the construction and automotive sectors. A key driver is rapid urbanization in the region; as per BBVA Research, Latin American countries have achieved 80% urbanization, which is higher than other regions. This rapid urbanization, especially in cities like São Paulo and Mexico City, is fueling the need for fire-resistant materials for residential and commercial buildings for safety codes. Moreover, the growth of the automotive and electronics industries further fuels demand for flame-retardant solutions to ensure market expansion.

Middle East and Africa Flame Retardants Market Analysis

In the Middle East and Africa, the flame retardants market is driven by rapid infrastructure development and the growing construction sector particularly in countries like the UAE, Saudi Arabia and South Africa. According to an article published by Business Standard a majority of the population in the Gulf Cooperation Council (GCC) countries nearly 50 Million people are employed in sectors such as construction, oil, transport and services. This concentration in high-risk industries increases the demand for fire-resistant materials. Furthermore, the automotive and electronics sectors also contribute to the growth of the market alongside a rising focus on environmentally sustainable flame retardants.

Competitive Landscape:

The flame retardants market is highly competitive with established players focusing on innovation, sustainability and regulatory compliance. Companies are investing in ecofriendly and non-halogenated solutions to meet rising environmental standards and consumer demand for safer alternatives. Strategic partnerships, mergers and acquisitions are key approaches to expanding market reach and enhancing product portfolios. For instance, in March 2024, a leading worldwide innovation service provider Azelis, which works in the specialty chemicals and food ingredients sector, announced that it had been named the official distributor of LANXESS polymer additives phosphorous flame retardants in the United States. This includes the Levagard and Disflamoll product lines. The Americas application labs and CASE technological know-how of Azelis will be used to expand the market and meet client demands. Leading players are strengthening their presence across key industries like construction, automotive and electronics by offering specialized formulations tailored to specific applications. Regional players compete by providing cost-effective solutions while global companies emphasize research and development to improve performance and reduce toxicity. Continuous advancements in material technologies and increased focus on sustainability are driving the competitive landscape fostering growth opportunities for companies across the value chain.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Almatis GmbH

- BASF SE

- Borealis GmbH (OMV Aktiengesellschaft)

- Budenheim Iberica S.L.U

- Campine NV

- Clariant AG

- Dover Chemical Corporation (ICC Industries Inc.)

- Dow Inc.

- ICL Group Ltd

- Lanxess AG

- Otsuka Chemical Co. Ltd.

- RTP Company (Miller Waste Mills Inc.)

Latest News and Developments:

- December 2024: ICL introduced VeriQuel R100, a reactive phosphorus-based flame retardant designed for rigid polyurethane insulation. The patented product ensures stability, compliance with environmental regulations and seamless integration into manufacturing. Four U.S. roofing companies have adopted it with more developments ongoing in the U.S. and Europe.

- November 2024: Clariant has launched Exolit AP 422 A, a melamine-free flame retardant ensuring high fire resistance and regulatory compliance. It offers a reliable alternative for firestop coatings and sealants addressing evolving industry standards.

- September 2024: Asahi Kasei has introduced LASTAN™ a flexible, flame-retardant nonwoven fabric designed to enhance EV battery safety. It is suitable for applications like top covers and busbar protection and offers a lightweight and adaptable alternative to traditional mineral-based materials addressing thermal runaway protection challenges.

- April 2024: Finolex Cables has launched FinoGreen an eco-safe range of halogen-free flame-retardant industrial cables which will contribute around 5% to the company’s wires business. Designed for voltages up to 1100 V FinoGreen cables reduce smoke emissions and limit hydrochloric acid gas release in case of fire enhancing safety in electrical installations.

- June 2023: Birla Cellulose part of Grasim Industries introduced Birla SaFR a flame-retardant sustainable fibre at ITMA 2023 in Milan. Launched by India's Minister of State for Textiles the fibre is designed for technical textiles, offering fire resistance, sustainability and compatibility with high-performance fibres for protective clothing.

Flame Retardants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Alumina Trihydrate, Brominated Flame Retardants, Antimony Trioxide, Phosphorus Flame Retardants, Others |

| Applications Covered | Unsaturated Polyester Resins, Epoxy Resins, PVC, Rubber, Polyolefins, Others |

| End Use Industries Covered | Construction, Wires and Cables, Automotive and Transportation, Electrical and Electronics, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Almatis GmbH, BASF SE, Borealis GmbH (OMV Aktiengesellschaft), Budenheim Iberica S.L.U, Campine NV, Clariant AG, Dover Chemical Corporation (ICC Industries Inc.), Dow Inc., ICL Group Ltd, Lanxess AG, Otsuka Chemical Co. Ltd., RTP Company (Miller Waste Mills Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the flame retardants market from 2019-2033.

- The flame retardants market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the flame retardants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Flame retardants are chemical substances designed to inhibit or slow the spread of fire. They are used in various materials such as plastics, textiles, and coatings to enhance fire resistance and ensure safety in industries like construction, automotive, and electronics.

The flame retardants market was valued at USD 10.38 Billion in 2024.

IMARC estimates the flame retardants market to exhibit a CAGR of 5.56% during 2025-2033.

Increasing fire safety regulations, the growing demand for fire-resistant materials in construction, automotive, and electronics, and innovations in eco-friendly and bio-based flame retardants are key drivers of the market.

In 2024, brominated flame retardants represented the largest segment by type, driven by their high efficiency in fire prevention.

Epoxy resins lead the market by application owing to their exceptional flame-retardant properties and adaptability across industries.

The electrical and electronics sector is the leading segment by end-use industry, driven by the need to prevent electrical fires and ensure component safety.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global flame retardants market include Almatis GmbH, BASF SE, Borealis GmbH (OMV Aktiengesellschaft), Budenheim Iberica S.L.U, Campine NV, Clariant AG, Dover Chemical Corporation (ICC Industries Inc.), Dow Inc., ICL Group Ltd, Lanxess AG, Otsuka Chemical Co. Ltd., RTP Company (Miller Waste Mills Inc.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)