Fixed Satellite Services (FSS) Market Report by Service (TV Channel Broadcast, Telecom Backhaul, Broadband Services, Content and Video Distribution, Military Satellite Communication), Organization Size (Small Offices and Home Offices (SOHO), Small and Medium Businesses (SMB), Large Enterprises), End-User (Media and Entertainment, Education, Government, IT and Communications, Retail, Oil and Gas, Aerospace and Defense, and Others), and Region 2025-2033

Fixed Satellite Services Market Size & Share:

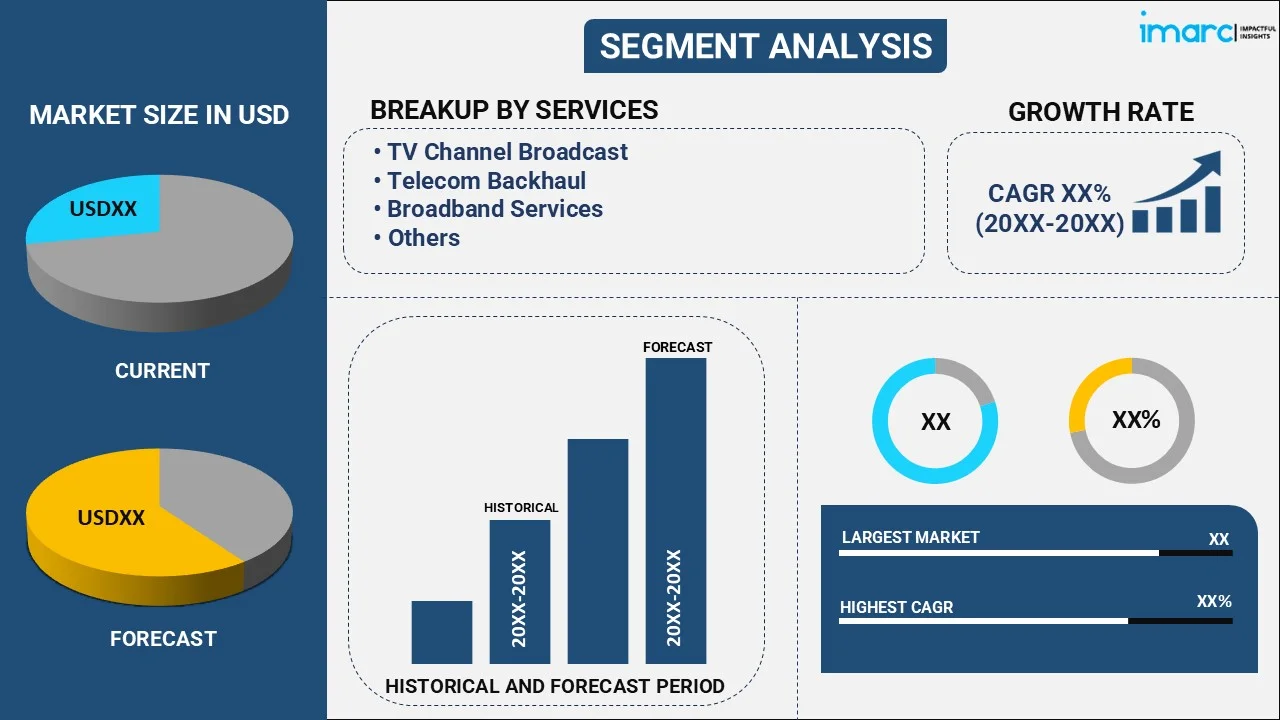

The global fixed satellite services market size reached USD 26.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 37.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.98% during 2025-2033. The increasing income levels and rising sales of smartphones have fueled the demand for high-speed internet as one of the essential aspects of communication. As a result, the demand for broadband has increased significantly in recent years, which is driving the growth of the global market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 26.1 Billion |

|

Market Forecast in 2033

|

USD 37.7 Billion |

| Market Growth Rate 2025-2033 | 3.98% |

Fixed satellite services, also known as FSS, are radiocommunication services used between different earth stations. These satellite services use the VSAT technology for sending and receiving telephone calls and television signals for broadcasting. They offer low power output and have large dish-style antennas for better service reception. As FSS systems provide services to numerous users simultaneously, they are placed strategically for covering a vast area to allow users to communicate while traveling, without losing signals. As a result, governments, military organizations, as well as small and large business firms across the globe, use these systems.

Owing to a rise in the adoption of HDTV channels and emerging DTH TV platforms, there has been an escalation in the demand for fixed satellite services across the globe. Furthermore, increasing expenditure on military satellite communication; telecom backhaul, content and broadcast delivery; and enterprise and broadband connectivity is anticipated to drive the demand for fixed satellite services during the forecast period.

Fixed Satellite Services Market Trends:

Increasing Proliferation of 5G Solutions

With the increasing penetration of 5G services, the market demand is projected to witness an uptrend as 5G technology requires fixed satellites to build robust connectivity. Fixed satellites help provide the essential infrastructure to meet the demands of high-bandwidth connectivity and low-latency for facilitating various 5G applications including augmented reality, remote healthcare, and autonomous vehicles. The ability of fixed satellites to deliver stable coverage across different geographical areas, including remote areas, is crucial for the effective operations of 5G networks.

Growing Adoption of FSS in the Oil & Gas Industry

There has been a rise in the demand for high-throughput connectivity and corporate enterprise networks in the oil and gas industry. This has provided several growth opportunities to the major players operating in the global market. Advancements in technologies including automation and analytics have led to a remarkable boost in data generation within the oil and gas industry. This trend is significantly driven by the growing dependability of the industry on data-intensive applications, remote operations, and the need for consistent connectivity in challenging environments. As the adoption of FSS is witnessing a rapid upsurge, the manufacturers in the market are expanding their product offerings to cater to the specific requirements of the oil and gas industry, including data management, industry-specific solutions for remote operations, and critical communications.

Emergence of Hybrid Satellite Network

A hybrid satellite network integrates several satellite arrangements or a sequence of terrestrial and satellite infrastructure for providing optimized capacity, coverage, and resilience. Hybrid satellite networks can reach areas that may not have adequate access by a single satellite system. With the growing demand for robust connectivity and high-performance, hybrid satellite network is rapidly emerging as a favorable solution to address these requirements. By conjoining the strengths of various technologies, operators can offer more scalable, flexible, and dependable communication services to a broader range of users.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global fixed satellite services market report, along with forecasts at the global and regional level from 2025-2033. Our report has categorized the market based on service, organization size and end-user.

Breakup by Service:

- TV Channel Broadcast

- Telecom Backhaul

- Broadband Services

- Content and Video Distribution

- Military Satellite Communication

Breakup by Organization Size:

- Small Offices and Home Offices (SOHO)

- Small and Medium Businesses (SMB)

- Large Enterprises

Breakup by End-User:

- Media and Entertainment

- Education

- Government

- IT and Communications

- Retail

- Oil and Gas

- Aerospace and Defense

- Others

Breakup by Region:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

Competitive Landscape:

The report has also analysed the competitive landscape of the market with some of the key players being Embratel Star One, Eutelsat Communications, Telesat Holdings, SKY Perfect JSAT Corporation, Thaicom Public Company Ltd, Nigerian Communications Satellites Ltd, Telenor Satellite AS, Singapore Telecommunications Ltd (Singtel), SES S.A, Arabsat, Hispasat, Intelsat Corporation. The key manufacturers are entering into strategic partnerships and launching novel solutions for attaining a substantial fixed satellite services market share.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Service, Organization Size, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Embratel Star One, Eutelsat Communications, Telesat Holdings, SKY Perfect JSAT Corporation, Thaicom Public Company Ltd, Nigerian Communications Satellites Ltd, Telenor Satellite AS, Singapore Telecommunications Ltd (Singtel), SES S.A, Arabsat, Hispasat, Intelsat Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The global fixed satellite services market was valued at USD 26.1 Billion in 2024.

We expect the global fixed satellite services market to exhibit a CAGR of 3.98% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic has led to the rising deployment for fixed satellite services to provide high-speed internet services and offer reliable as well as affordable connectivity to meet the requirements of the users, during remote working scenario.

The increasing adoption of fixed satellite services for establishing a 5G connection, along with the growing demand for HDTV channels and emerging DTH TV platforms, is primarily driving the global fixed satellite services market.

Based on the service, the global fixed satellite services market can be segmented into TV channel broadcast, telecom backhaul, broadband services, content and video distribution, and military satellite communication. Currently, TV channel broadcast holds the majority of the total market share.

On a regional level, the market has been classified into Asia Pacific, Europe, North America, Middle East and Africa, and Latin America, where Europe currently dominates the global market.

Some of the major players in the global fixed satellite services market include Embratel Star One, Eutelsat Communications, Telesat Holdings, SKY Perfect JSAT Corporation, Thaicom Public Company Ltd, Nigerian Communications Satellites Ltd, Telenor Satellite AS, Singapore Telecommunications Ltd (Singtel), SES S.A, Arabsat, Hispasat, Intelsat Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)