Firefighting Foam Market Size, Share, Trends and Forecast by Type, End Use Industry and Region, 2025-2033

Firefighting Foam Market Size and Share:

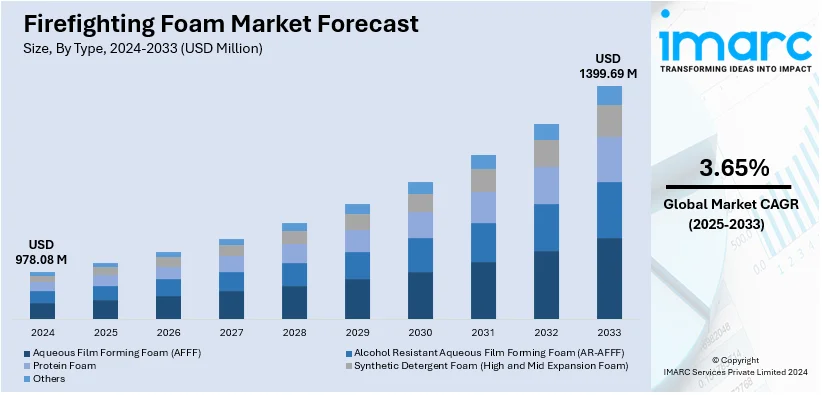

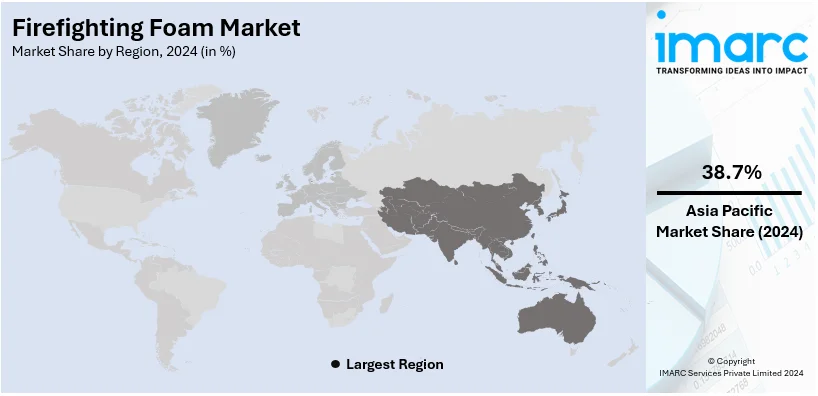

The global firefighting foam market size was valued at USD 978.08 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,399.69 Million by 2033, exhibiting a CAGR of 3.65% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 38.7% in 2024. The market is growing owing to the rising awareness among individuals about fire safety and stringent safety regulations and the increasing development of innovative foam technologies to improve fire suppression capabilities, reduce environmental impact, and enhance overall effectiveness in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 978.08 Million |

|

Market Forecast in 2033

|

USD 1,399.69 Million |

| Market Growth Rate 2025-2033 | 3.65% |

One key driver in the firefighting foam market is the increasing demand for advanced firefighting solutions due to rising fire safety concerns in industrial and commercial sectors. As industries such as oil and gas, aviation, and chemicals continue to expand, the risk of large-scale fires escalates, leading to a higher demand for effective firefighting systems. This has prompted the adoption of specialized foam products that provide faster suppression and greater efficiency. Furthermore, stricter regulations and safety standards globally are pushing organizations to invest in high-quality firefighting foams, fueling market growth.

The United States plays a dominant role in the firefighting foam market with an 85.80% market share due to its large-scale industrial, military, and aviation sectors that require significant firefighting capabilities. For instance, the U.S. military, which has been a primary consumer of firefighting foams containing per- and polyfluoroalkyl substances (PFAS), has started transitioning to PFAS-free alternatives due to environmental concerns and stringent regulatory requirements, such as the National Defense Authorization Act (2020) that mandates PFAS-free foams by 2023. The challenges include no effective drop-in replacement and over $2.1 billion in estimated transition costs. Moreover, U.S. regulatory bodies like the Environmental Protection Agency (EPA) have been pivotal in setting standards that shape the firefighting foam market, particularly with the push to eliminate harmful substances, which is impelling the market growth.

Firefighting Foam Market Trends:

Stringent Safety Regulations

Governing agencies of various countries are encouraging the adoption of firefighting foams by implementing stringent safety regulations, which is bolstering the growth of the market. In line with this, various sectors, such as petrochemicals, manufacturing, and aviation, are adhering to strict fire safety standards and guidelines. These regulations mandate the use of advanced firefighting foam systems to enhance fire suppression capabilities and protect lives and assets. Moreover, the rising installation of firefighting foam solutions in the oil and gas industry due to the high risk of flammable liquid fires is propelling the market growth. For instance, according to the National Fire Protection Association (NFPA), there were over 5,000 installations of firefighting foam systems in the U.S. in 2022, particularly within the oil and gas sector, where fire suppression requirements are critical. Apart from this, oil and gas companies are employing fixed foam systems in storage tanks and foam fire suppression equipment in processing facilities. Furthermore, non-compliance can result in severe penalties and increased vulnerability to catastrophic fires. Additionally, these safety regulations often evolve to address emerging risks. According to the firefighting foam market forecast, the growing demand for advanced firefighting foam technologies offering enhanced effectiveness across multiple industries is expected to significantly contribute to market expansion in the coming years.

Technological Advancements

Technological advancement in foam firefighting formulations and system pushes the market growth forward. In this regard, key players are developing new foam technologies aimed to enhance fire suppression capabilities along with reducing environmental impact with all-around effectiveness. More of this, traditional foams contained Per- and polyfluoroalkyl substances PFAS that cause huge harm towards the environment. Additionally, traditional foams contain per- and polyfluoroalkyl substances (PFAS) that have huge environmental harm. An industrial report states that the global area affected by forest fires grew approximately 5.4% annually between 2001 and 2023. Almost 6 million additional hectares (15 million acres) of tree cover are now incinerated annually, which is comparable to the size of Croatia. Manufacturers are introducing biodegradable and less harmful foam solutions that meet stringent environmental regulations. These eco-friendly foams are gaining traction as organizations are increasingly seeking sustainable fire suppression options. Besides this, advancements in foam expansion ratios and stability are making firefighting foam more efficient at extinguishing various fire types, including flammable liquid fires. In addition, foam discharge systems are becoming more precise, ensuring optimal coverage and fire control. Apart from this, the integration of digital technology, such as remote monitoring and automated foam delivery systems, further enhances the usability and effectiveness of firefighting foam.

Rising Fire Risks in the Oil and Gas Sector

In 2024, a fire broke out at Indian Oil Corporation's Mathura refinery, injuring eight personnel. The increasing incidents of fire-related accidents in the oil and gas sector are a significant factor driving the firefighting foam market demand. Operations in this sector involve flammable materials, including crude oil, natural gas, and petrochemicals, which present a high risk of fires and explosions. Firefighting foam plays a critical role in controlling and extinguishing such fires by forming a barrier that suppresses oxygen supply and cools the fire. With stringent safety regulations and the rising focus on minimizing operational hazards, companies in the oil and gas industry are increasingly adopting advanced firefighting solutions. Additionally, the expansion of oil exploration and production activities worldwide further amplifies the demand for firefighting foam. The development of specialized foam types, such as fluorine-free and alcohol-resistant foams, caters to industry-specific requirements, supporting safety measures and contributing to the market growth.

Firefighting Foam Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global firefighting foam market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and end use industry.

Analysis by Type:

- Aqueous Film Forming Foam (AFFF)

- Alcohol Resistant Aqueous Film Forming Foam (AR-AFFF)

- Protein Foam

- Synthetic Detergent Foam (High and Mid Expansion Foam)

- Others

Aqueous film forming foam (AFFF) stands as the largest component in 2024, holding around 41.6% of the market. It is used throughout industry, but most importantly in aviation, military, and petrochemicals, because it is very effective at extinguishing flammable liquid fires. Rapid formation of a protective film on burning surfaces enables efficient extinguishing and vapor suppression for high-risk fire scenarios. Despite growing concerns about the environmental impact of AFFF's use of per- and polyfluoroalkyl substances (PFAS), its dominance persists due to its proven performance and the lack of immediate, equally effective alternatives in many critical applications.

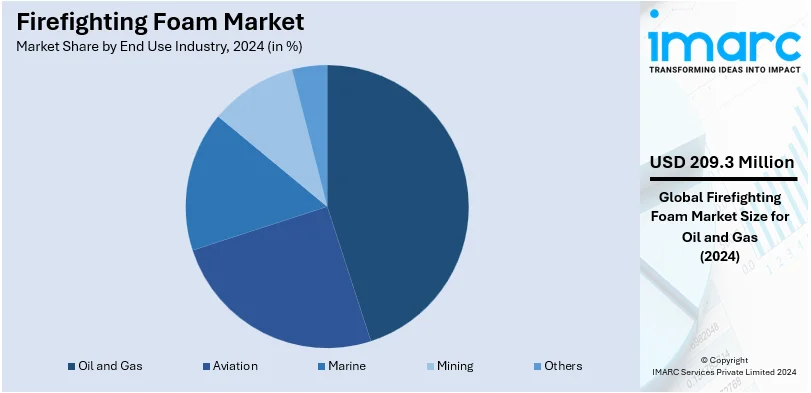

Analysis by End Use Industry:

- Oil and Gas

- Aviation

- Marine

- Mining

- Others

Oil and Gas leads the market with around 21.4% of market share in 2024. This dominance is driven by the high risk of fire hazards in oil and gas facilities, such as refineries, offshore platforms, and storage tanks. The presence of flammable liquids, including crude oil and natural gas, increases the potential for catastrophic fires, necessitating the use of advanced firefighting systems. Aqueous Film Forming Foam (AFFF) is particularly popular in these environments due to its effectiveness in suppressing flammable liquid fires and forming a protective barrier on surfaces. As a result, the oil and gas industry's stringent safety regulations and risk management strategies continue to bolster its significant share of the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest firefighting foam market share of over 38.7% driven by rapid industrialization, urbanization, and stringent fire safety regulations. Countries such as China, India, and Japan have significant demand due to their expanding petrochemical, aviation, and manufacturing sectors, which require robust fire suppression systems. Additionally, increasing investments in infrastructure development and oil and gas projects contribute to market growth. Regulatory measures aimed at enhancing fire safety standards further boost demand for advanced firefighting solutions. The growing awareness of environmental concerns has also prompted a shift towards eco-friendly alternatives, strengthening the region’s role as a dominant player in the global firefighting foam market.

Key Regional Takeaways:

North America Firefighting Foam Market Analysis

The North American firefighting foam market is driven by stringent fire safety regulations, extensive industrial operations, and strong military demand. The United States, holding a significant share, leads due to its large-scale aviation, petrochemical, and defense industries, where firefighting foam is vital for flammable liquid fire suppression. Regulatory efforts by agencies such as the EPA are fostering a transition to eco-friendly, PFAS-free alternatives, reflecting growing environmental concerns. Canada also contributes significantly, focusing on industrial safety standards and fire risk management. Additionally, ongoing research into safer, effective firefighting agents bolsters the market. With advanced infrastructure and increasing investments, North America remains a pivotal region in the global firefighting foam market.

United States Firefighting Foam Market Analysis

The U.S. firefighting foam market is bolstered by strict fire-safety regulations and growing incidences of industrial fires, along with an 85.80% market share. The National Fire Protection Association also reported more than 1.3 million fires in the United States in 2022, which requires developments in fire suppression technologies. The Department of Defense further provided substantial funding in 2023 for the production of PFAS-free firefighting foams, just as environmental mandates require. The market is dominated by leading key players such as 3M and Chemours, which focus on sustainable alternatives. The domestic production push under federal policies ensures a steady supply and minimizes imports. Increased awareness of environmental impacts and corporate sustainability initiatives propel the adoption of fluorine-free foams. U.S.-based companies are actively exporting to emerging markets, leveraging advanced R&D to strengthen their global foothold.

Europe Firefighting Foam Market Analysis

Strict safety standards and an increasing penchant for environmentally friendly products work towards the benefit of the European Firefighting Foam market. As reported by the European Chemicals Agency, in 2023, the European Union completely banned PFAS-based foams. Following this move, the demand is growing for eco-friendly counterparts. The markets for heavy investments in industrial fire safety are Germany, the UK, and France due to growing fire hazards in both manufacturing and oil & gas sectors. According to a fire safety report, Germany spent around USD 500 Million in 2022 in upgrading fire suppression systems, as per a fire safety report. Angus Fire and Dr. Sthamer are two companies that are at the forefront of innovation, producing fluorine-free foam solutions. R&D initiatives by governments and stringent environmental norms are pushing for the development of firefighting technologies. Increasing awareness and industrial collaborations are setting Europe as a leader in sustainable fire safety solutions.

Asia Pacific Firefighting Foam Market Analysis

Asia Pacific's firefighting foam market is growing rapidly with industrial growth and increasing awareness of safety. The Oil Industry Safety Directorate (OISD), in a statement, said that incidents such as a refinery fire in June 2022 and a furnace explosion in January 2022 highlight the urgent need for more sophisticated fire suppression systems. India and China are the largest consumers of PFAS-free firefighting foams in the region, which is in line with global environmental standards. Under the "Make in India" initiative, fire safety products are now being locally manufactured, thereby reducing the country's dependence on imports. Tyco and SFFeco are collaborating with regional players to innovate customized solutions for high-risk industries, including oil & gas and petrochemicals. Urbanization and industrial safety regulatory mandates, along with investment in eco-friendly technologies, will provide a significant growth platform in the Asia Pacific region of the global firefighting foam market.

Latin America Firefighting Foam Market Analysis

The Latin American market for firefighting foam is expanding steadily due to industrial expansion and environmental regulations. According to Brazil's National Industrial Confederation, the region invested USD 1.2 Billion in 2023 in fire safety infrastructure, with a focus on fluorine-free foams. Advanced fire suppression solutions are in huge demand from the oil & gas industry in Mexico and Brazil. Countries such as Colombia are adopting environment-friendly solutions to meet global norms. Top companies like Ansul and Kidde are entering the market and are using tie-ups to improve their distribution network. Urbanization and safety initiatives undertaken by the government create new avenues for innovative foam technology. Export-oriented growth and investment in R&D strengthen Latin America's market prospects.

Middle East and Africa Firefighting Foam Market Analysis

The Middle East and Africa firefighting foam market is driven by growing defense spending and industrial safety efforts. According to the International Trade Government, Saudi Arabia, for instance, allocated USD 69 Billion for defense in its 2023 budget, increasing 50% from the previous year and accounting for 23% of its total budget. This high amount encompasses allocations to safety and modernization programs, which most probably involve sophisticated firefighting systems. Region-specific drivers include the oil & gas sectors, with the likes of SABIC, which seeks to introduce non-fluorinated firefighting foams, adhering to global environmental standards. South Africa tops the list for fire safety innovations in Africa, owing to local companies like Firex Manufacturing. Urbanization, infrastructure growth, and strict compliance mandates from government agencies have forced industrial establishments to adopt environmental fire extinguishing agents. These factors, therefore, place the region as one of the emerging forces in the global firefighting foam market.

Competitive Landscape:

Key players in the market are investing in research and development (R&D) activities to introduce advanced firefighting foam formulations that are more effective, eco-friendly, and compliant with evolving safety regulations. They are creating foam solutions tailored to specific fire hazards. In line with this, companies are focusing on developing eco-friendly firefighting foam alternatives that do not contain per- and polyfluoroalkyl substances (PFAS) and are biodegradable. Additionally, manufacturers are incorporating digital technology into foam delivery systems, such as remote monitoring, automated foam proportioning, and data-driven solutions, to enhance foam system performance. Moreover, companies are ensuring that their firefighting foam products meet the latest regulatory requirements to maintain market credibility.

The report provides a comprehensive analysis of the competitive landscape in the firefighting foam market with detailed profiles of all major companies, including:

- Angus Fire Limited

- Dafo Fomtec Ab

- DIC Corporation

- Eau&Feu

- Fabrik chemischer Präparate von Dr. Richard Sthamer GmbH & Co. KG

- Johnson Controls International Plc

- Kerr Fire (Kidde plc)

- KV Fire Chemicals Pvt. Ltd.

- National Foam Inc.

- Perimeter Solutions

- SFFECO Global

Latest News and Developments:

- October 2024: Halt! Fire Fighting Foam Spray launched a handheld, plant-based fire suppression solution for home and outdoor use. Its triple-action formula effectively handles multiple fire types, including grease, electrical, and lithium-ion battery fires. Compact, easy-to-use, and environmentally friendly, it is designed to be stored near high-risk areas like kitchens and grills.

- October 2024: National Foam launched UniversalF3 Green 1%-3% AR-SFFF, a fluorine-free firefighting foam concentrate. It is the first of its kind to receive UL and ULC 162 listings for both Type II and Type III applications. This innovation is designed for tackling fuel-in-depth fires at oil, gas, and chemical facilities while offering a logistical advantage in emergency response.

- October 2024: Firefly Fire Pumps launched India’s first indigenous Compressed Air Foam System (CAFS) at the Fire India 2024 expo in Delhi. This advanced firefighting technology creates a lighter, adherent foam that reduces water usage and improves fire suppression, particularly in high-rise and industrial fire scenarios. The system was demonstrated in Mumbai, effectively tackling fires up to 150 meters.

- In November 2024, Perimeter Solutions, a supplier of firefighting products, finalized its redomiciliation from Luxembourg to the U.S. on November 20, 2024. The company, now based in Delaware, continues to operate from its Missouri headquarters. This move is intended to simplify regulatory compliance, optimize tax strategies, and lower operating costs.

- In October 2023, Fomtec announced that they are exploring the shift towards synthetic fluorine-free foam (SFFF). John Olav-Ottesen, managing director, reflects on the intricacies of change from PFAS foams to emphasize research, testing, and data-driven decisions to make environmental and performance outcomes better.

- In June 2022, Perimeter Solutions, a leading global manufacturer of high-quality firefighting products and lubricant additives, launched SOLBERG® VERSAGARD™ 1×3 multipurpose fluorine-free foam concentrate. It is an alcohol resistant, fluorine-free pseudoplastic foam technology. Moreover, it is the newest addition to the SOLBERG VERSAGARD line of fluorine-free firefighting foam concentrates.

- In January 2021, National Foam Inc. announced the completion of its fluorine free foam manufacturing line expansion in Angier, North Carolina. This expansion, along with ongoing product initiatives, is designed to support the growing shift to synthetic fluorine free foam concentrates.

- In March 2020, Johnson Controls International Plc, the global leader for smart, healthy, and sustainable buildings and architect of OpenBlue connected solutions, launched ANSUL NFF 3x3 UL201 Foam Concentrate. This new, patent-pending, and non-fluorinated foam (NFF) technology provides fast, effective fire suppression on most Class B hydrocarbon and polar solvent fuel fires.

Firefighting Foam Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Aqueous Film Forming Foam (AFFF), Alcohol Resistant Aqueous Film Forming Foam (AR-AFFF), Protein Foam, Synthetic Detergent Foam (High and Mid Expansion Foam), Others |

| End Use Industries Covered | Oil and Gas, Aviation, Marine, Mining, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Angus Fire Limited, Dafo Fomtec Ab, DIC Corporation, Eau&Feu, Fabrik chemischer Präparate von Dr.Richard Sthamer GmbH & Co. KG, Johnson Controls International Plc, Kerr Fire (Kidde plc), KV Fire Chemicals Pvt. Ltd., National Foam Inc., Perimeter Solutions, SFFECO Global, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the firefighting foam market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global firefighting foam market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the firefighting foam industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Firefighting foam is a specialized foam used to suppress fires, especially in flammable liquid fires. It forms a blanket over the fire, cutting off oxygen and cooling the surface. Common types include Aqueous Film Forming Foam (AFFF), used in industries like oil and gas, aviation, and military sectors.

The firefighting foam market was valued at USD 978.08 Million in 2024.

IMARC estimates the global firefighting foam market to exhibit a CAGR of 3.65% during 2025-2033.

Key factors driving the global firefighting foam market include increasing industrialization, stringent fire safety regulations, and growing demand in high-risk sectors such as oil and gas, aviation, and chemicals. Rising awareness of advanced fire suppression technologies and investments in safer, environmentally friendly foam alternatives also contribute significantly to market growth.

In 2024, aqueous film forming foam (AFFF) represented the largest segment by type, driven by its effectiveness in fire suppression and widespread use in industries like aviation and military.

Oil and gas lead the market by end use industry owing to its high demand for fire suppression solutions in drilling, refining, and offshore operations.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global firefighting foam market include Angus Fire Limited, Dafo Fomtec Ab, DIC Corporation, Eau&Feu, Fabrik chemischer Präparate von Dr. Richard Sthamer GmbH & Co. KG, Johnson Controls International Plc, Kerr Fire (Kidde plc), KV Fire Chemicals Pvt. Ltd., National Foam Inc., Perimeter Solutions, SFFECO Global, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)