Firefighting Drone Market Size, Share, Trends and Forecast by Type, Size, Propulsion, Application, and Region, 2025-2033

Firefighting Drone Market Size and Share:

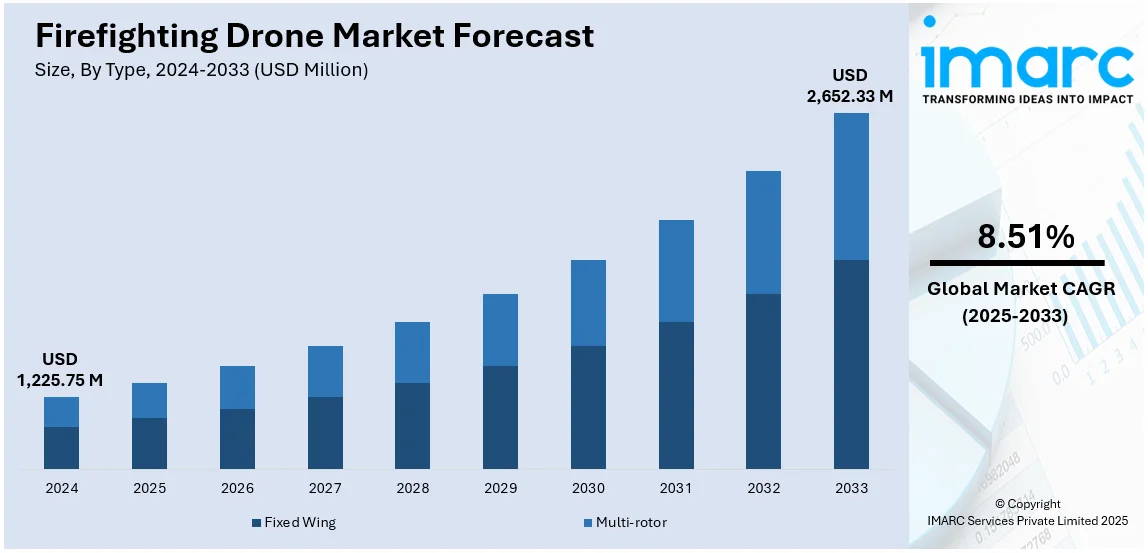

The global firefighting drone market size was valued at USD 1,225.75 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,652.33 Million by 2033, exhibiting a CAGR of 8.51% from 2025-2033. North America currently dominates the market, holding a market share of over 34.0% in 2024. The market is expanding due to rising wildfire incidents, advancements in AI-powered surveillance, and increasing adoption by emergency response agencies. Drones equipped with thermal imaging, autonomous navigation, and fire-retardant payloads enhance firefighting efficiency and safety. Growing investments in drone technology and regulatory support further drive market growth, strengthening firefighting drone market share globally.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,225.75 Million |

| Market Forecast in 2033 | USD 2,652.33 Million |

| Market Growth Rate (2025-2033) | 8.51% |

The firefighting drone market is driven by increasing wildfire incidents growing demand for advanced aerial surveillance and rising investments in autonomous firefighting solutions. According to the data published by National Interagency Coordination Center, in 2024, the U.S. reported 64,897 wildfires a 14.4% increase from 56,580 in 2023 consuming 8,924,884 acres compared to 2,693,910 acres the previous year. A total of 4,552 structures were destroyed, including 2,406 residences, 2,066 minor structures and 80 commercial/mixed-use buildings. The Southwest Area accounted for the most destruction, with 1,455 structures lost. Drones equipped with thermal imaging, AI-driven navigation and real-time data transmission enhance situational awareness and operational efficiency. Governments and fire departments are adopting drones for rapid response, reducing firefighter risks and improving rescue missions. The integration of AI, IoT and cloud computing further strengthens drone capabilities supporting autonomous firefighting operations and boosting firefighting drone market demand. Expanding regulatory approvals and advancements in battery technology also drive adoption.

The United States firefighting drone market is driven by increasing wildfire frequency, rising government investments in emergency response technology and advancements in AI-powered aerial surveillance. For instance, in January 2025, ZenaTech's subsidiary ZenaDrone applied for FAA Part 137 certification for the ZenaDrone 1000. This initiative aims to improve efficiency and sustainability in agricultural spraying and wildfire management using AI technology benefiting US farmers. Fire departments and disaster management agencies are adopting drones for real-time thermal imaging, situational awareness and autonomous firefighting. Integration with IoT and cloud-based analytics enhances operational efficiency improving rapid response and firefighter safety. Regulatory support for unmanned aerial systems (UAS) in emergency services along with advancements in battery life and payload capacity, further accelerates market growth.

Firefighting Drone Market Trends:

Increased Adoption of AI and IoT

AI-powered drones equipped with real-time data processing and IoT connectivity are transforming firefighting operations by enhancing fire detection, monitoring, and response efficiency. AI-driven image recognition enables drones to identify fire spread patterns, detect hotspots, and assess structural damage with high accuracy. For instance, in May 2024, ideaForge announced its partnership with Skylark Labs to integrate self-evolving AI into drones for enhanced public safety. This collaboration enables real-time detection of weapons, suspicious individuals, vehicles, fires and smoke empowering first responders with advanced monitoring capabilities to efficiently identify threats in urban and rural environments. IoT integration allows seamless data transmission to command centers, ensuring real-time coordination among emergency teams. These technologies improve predictive analytics, enabling proactive fire management, optimizing resource allocation and minimizing risks to firefighters and civilians during operations.

Advancements in Thermal Imaging Technology

Drones equipped with infrared and thermal cameras significantly enhance firefighting efforts by improving visibility in smoke-filled environments and detecting hidden hotspots. These advanced imaging systems allow firefighters to assess fire intensity, locate trapped individuals, and identify structural weaknesses in real time. Thermal imaging enables early fire detection, even in low-visibility conditions, reducing response times and improving situational awareness. The integration of AI-driven analysis further enhances accuracy, making thermal-equipped drones essential tools for both wildfire suppression and urban firefighting operations. These technological advancements and increasing adoption are creating a positive firefighting drone market outlook, driving demand for more efficient and intelligent aerial firefighting solutions.

Longer Flight Duration and Battery Innovations

Advancements in battery technology and hybrid power sources are extending the flight duration of firefighting drones, allowing for prolonged aerial monitoring and enhanced operational coverage. High-capacity lithium-ion batteries, fuel cell technology, and solar-assisted charging improve endurance, enabling drones to operate in large-scale fire incidents. Longer flight times enhance real-time surveillance, support continuous data transmission, and improve efficiency in remote or hazardous areas. Growing investments in advanced drone power systems are driving innovation in battery technology, enabling longer flight durations and improved safety in firefighting operations. For instance, in February 2025, Dreamfly Innovations, a leader in drone battery technology, secured $1.4 million in seed funding led by Avaana Capital. Focused on high-performance, fire-resistant batteries, the company aims to support India's drone ecosystem, enhance production, and innovate solutions. These advancements contribute to extended aerial surveillance, reduced downtime, and increased efficiency in large-scale fire incidents and emergency response missions.

Firefighting Drone Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global firefighting drone market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, size, propulsion, and application.

Analysis by Type:

- Fixed Wing

- Multi-rotor

Multi-rotor stands as the largest type in 2024, holding around 64.3% of the market. Multi-rotor drones dominate the firefighting drone market due to their superior maneuverability, stability, and ease of deployment in complex fire scenarios. These drones can hover in place, navigate confined spaces, and provide real-time aerial surveillance with thermal imaging and AI-driven analytics. Their versatility makes them ideal for urban firefighting, search-and-rescue operations, and hazardous area monitoring. Increasing advancements in payload capacity, battery efficiency, and autonomous navigation further enhance their effectiveness, solidifying their position as the leading type in the market.

Analysis by Size:

- Micro Drones

- Macro Drones

Micro drones lead the market with around 75.8% of market share in 2024. Micro drones are leading the firefighting drone market due to their compact size, agility, and ability to navigate tight spaces in hazardous environments. These drones provide real-time thermal imaging and situational awareness in confined areas such as burning buildings, tunnels, and collapsed structures. Their lightweight design allows for rapid deployment, supporting search-and-rescue operations and firefighter safety. Advancements in AI, battery efficiency, and autonomous navigation further enhance their capabilities, making micro drones a crucial tool for modern firefighting and emergency response efforts.

Analysis by Propulsion:

- Electric Motor

- Solar Powered

- Piston Engine

Electric motor leads the market with around 64.1% of market share in 2024. Electric motor-powered drones lead the firefighting drone market due to their efficiency, lower maintenance, and eco-friendly operation. These drones offer quieter performance, longer endurance with advanced battery technologies, and improved maneuverability in emergency situations. Electric motors enable precise control, making them ideal for urban and indoor firefighting applications. Advancements in battery capacity, lightweight materials, and AI-driven flight optimization further enhance their operational effectiveness. Growing investments in sustainable drone technology continue to drive the adoption of electric motor-powered firefighting drones worldwide.

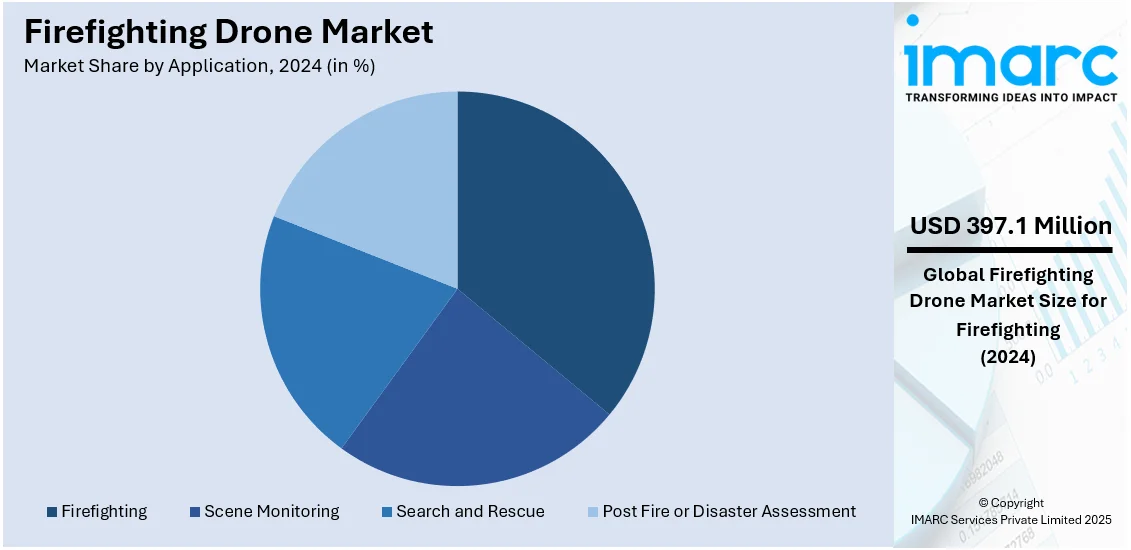

Analysis by Application:

- Scene Monitoring

- Search and Rescue

- Post Fire or Disaster Assessment

- Firefighting

Firefighting leads the market with around 32.4% of market share in 2024. Firefighting remains the leading application in the firefighting drone market due to increasing wildfire incidents, urban fire risks, and the need for advanced aerial surveillance. Drones equipped with thermal imaging, AI-driven analytics, and autonomous navigation enhance situational awareness, enabling faster response times and improved firefighter safety. Their ability to carry fire-retardant payloads and assist in search-and-rescue operations further strengthens their adoption. Technological advancements in battery life, real-time data transmission, and swarm drone technology continue to drive demand for firefighting drones globally.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 34.0%. North America holds the largest share in the firefighting drone market due to increasing wildfire occurrences, strong government funding, and advancements in drone technology. Fire departments and emergency response agencies are rapidly adopting drones for aerial surveillance, thermal imaging, and autonomous firefighting operations. Regulatory support for unmanned aerial systems (UAS) in firefighting, along with investments in AI-powered drones and long-endurance battery solutions, is driving market growth. The presence of leading drone manufacturers and technology innovators further strengthens North America's dominance in this sector.

Key Regional Takeaways:

United States Firefighting Drone Market Analysis

In 2024, the United States accounted for over 88.20% of the firefighting drone market in North America. The United States firefighting drone market is propelled by several key factors. Advancements in drone technology, such as enhanced battery life, improved thermal imaging, and sophisticated navigation systems, have significantly increased the efficiency and effectiveness of drones in emergency situations. The escalating frequency and severity of wildfires, exacerbated by climate change, have further underscored the need for advanced tools such as drones to monitor and combat fires effectively. Also, about 85% of wildfires in the U.S. are caused by people every year, according to the National Park Service. Government initiatives and favorable policies have further heightened the adoption of drones in firefighting operations. In addition to this, the rising demand for cost-effective firefighting solutions has driven the integration of drones, offering a more affordable alternative to traditional methods. The ability of drones to collect real-time data and integrate with existing emergency response systems has enhanced situational awareness and decision-making during firefighting efforts. Furthermore, the increasing investment in disaster management and the growing demand for aerial surveillance in public safety operations have contributed substantially to industry expansion. Collectively, these factors have fostered a robust environment for the growth of the firefighting drone market in the United States.

Asia Pacific Firefighting Drone Market Analysis

The Asia Pacific firefighting drone market is expanding due to the region’s rapid urbanization and industrialization, which increase the risk of fires in both rural and urban areas. As per recent industry reports, in 2024, 52.9% of the total population in Asia lived in urban areas, equating to about 2,545,230,547 individuals. With densely populated cities and large industrial zones, there is a growing need for efficient firefighting technologies to mitigate potential hazards. Drones provide a unique advantage in these scenarios, offering quick deployment and the ability to access hard-to-reach areas, such as tall buildings or remote locations. Additionally, the increasing investment in smart city initiatives across Asia Pacific has fueled the integration of drone technology for public safety applications, including firefighting. The region’s adoption of drones is also facilitated by improving regulatory frameworks that encourage the use of unmanned aerial vehicles (UAVs) for firefighting purposes.

Europe Firefighting Drone Market Analysis

The Europe firefighting drone market is driven by several factors that highlight the increasing need for advanced firefighting solutions. One of the most significant drivers is the growing frequency and intensity of wildfires across the region, fueled by climate change. According to the European Commission, in 2023, approximately 500,000 hectares of land was burnt due to wildfires in Europe, making it the fourth-largest scorched area in EU history. However, compared to 1,200,000 hectares in 2017, the burned area in 2023 was 58% less. This is propelling governments and firefighting agencies to seek innovative technologies to enhance emergency response capabilities. Drones, with their ability to conduct aerial surveillance and provide real-time data, are increasingly being used to support firefighting efforts by monitoring fire spread, assessing damage, and guiding ground forces. Technological advancements in drones, such as longer flight times, improved thermal imaging, and enhanced autonomous navigation systems, have further boosted their effectiveness in challenging conditions. Additionally, the cost-effectiveness of drones, especially compared to traditional methods such as helicopters and ground vehicles, makes them an attractive solution for firefighting agencies operating under budget constraints. The European Union has also been instrumental in promoting the use of drones, providing support through regulations and funding programs aimed at improving disaster response.

Latin America Firefighting Drone Market Analysis

The Latin America firefighting drone market is growing, primarily driven by an increase in the frequency of wildfires, particularly in countries such as Brazil, where vast forests are at risk. As per the Rainforest Foundation, in 2024, a total of 140,346 fire outbreaks occurred in the Amazon rainforest in Brazil, recording a 42.3% increase in comparison to 2023. Moreover, 44.2 Million acres were burned in 2024, an increase of approximately 66% in comparison to the previous year. Drones offer an effective solution for monitoring and managing fires in remote areas, providing real-time data and aerial surveillance, thereby propelling their widespread adoption. Additionally, the rising demand for environmentally sustainable firefighting methods, given concerns over climate change and deforestation, is encouraging the usage of drones, as they minimize the environmental impact compared to traditional methods.

Middle East and Africa Firefighting Drone Market Analysis

The Middle East and Africa firefighting drone market is expanding steadily due to the rising need for innovative solutions to combat fires in arid and high-temperature environments. Numerous countries in the region face challenges in managing large-scale fires due to limited resources and difficult terrain. Drones offer a versatile solution by enabling aerial surveillance, rapid deployment, and the ability to navigate through harsh conditions. Additionally, the region’s growing investment in advanced technologies and smart city initiatives is fostering the adoption of drones in firefighting operations. According to the IMARC Group, the Middle East smart cities market size is expected to grow at a CAGR of 22.82% during 2025-2033. As concerns over safety and environmental impacts grow, drones provide a safer, more eco-friendly alternative to traditional firefighting methods.

Competitive Landscape:

The firefighting drone market is highly competitive, with companies focusing on innovation, advanced payload systems, and AI-driven automation. Manufacturers are integrating thermal imaging, real-time data analytics, and autonomous navigation to enhance firefighting efficiency. Partnerships between drone developers, emergency response agencies, and technology firms are driving product advancements. The market is witnessing increasing investments in long-endurance battery solutions, AI-powered flight control, and swarm drone technology. Regulatory approvals and government funding further intensify competition. Companies are differentiating through improved payload capacity, enhanced situational awareness, and customized drone solutions tailored for urban and wildfire firefighting applications, strengthening their market presence.

The report provides a comprehensive analysis of the competitive landscape in the firefighting drone market with detailed profiles of all major companies, including:

- Aerialtronics DV B.V.

- AeroVironment Inc.

- BSS Holland B.V.

- Draganfly Inc.

- Drone Amplified

- DSLRPros

- Flyability SA

- MMC-UAV

- Skydio Inc.

- SZ DJI Technology Co. Ltd.

Latest News and Developments:

- January 2025: Data Blanket, a prominent manufacturer of AI-driven drones, has made a significant procurement request to SES AI Corporation, a leader in the development and production of advanced Li-Metal and Li-ion batteries known for their superior performance. These batteries are intended to enhance the functionality of AI-powered drones used for border control and forest fire management.

- September 2024: Teledyne FLIR has announced a limited-time promotion for SIRAS drones, which feature a variety of innovative attributes, including a quick-connect double radiometric thermal sensor. Until the end of 2024, emergency service agencies, such as fire departments and police, can purchase one unit at a significantly reduced price of USD 6,995, reflecting a discount exceeding 28%.

- September 2024: The El Dorado County Fire Protection District has launched a new Unmanned Aircraft Systems (UAS) Program designed to incorporate drones in their firefighting efforts. These drones will aid in locating individuals in remote areas needing rescue and can also be deployed to fight wildland fires when identifying the exact location of the blaze poses a challenge. The firefighting drones are currently operational in the region.

- August 2024: Windracers, a UK-based manufacturer of autonomous freight drones, recently reported that the Lancashire Fire and Rescue Service has tested their latest Ultra UAV drones as a preventive measure against wildfires. Equipped with AI technologies developed by the University of Sheffield, these drones utilize thermal and visual data to detect and assess fires, supplying crucial information to firefighters on the ground. This field study aims to explore innovative and cost-effective early intervention strategies.

- April 2024: Drone Amplified, a key player in firefighting drone technology, has formed a partnership with Inspired Flight Technologies (IFT), a well-respected producer of advanced unmanned aircraft systems (UAS). This collaboration allows the Inspired Flight drone system to integrate Drone Amplified's cutting-edge IGNIS 2 aerial ignition technology, enhancing operational efficiency and reducing costs.

Firefighting Drone Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Multi-rotor |

| Sizes Covered | Micro Drones, Macro Drones |

| Propulsions Covered | Electric Motor, Solar Powered, Piston Engine |

| Applications Covered | Scene Monitoring, Search and Rescue, Post Fire or Disaster Assessment, Firefighting |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aerialtronics DV B.V., AeroVironment Inc., BSS Holland B.V., Draganfly Inc., Drone Amplified, DSLRPros, Flyability SA, MMC-UAV, Skydio Inc., SZ DJI Technology Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the firefighting drone market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global firefighting drone market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the firefighting drone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The firefighting drone market was valued at USD 1,225.75 Million in 2024.

IMARC estimates the firefighting drone market to reach USD 2,652.33 Million by 2033, exhibiting a CAGR of 8.51% during 2025-2033.

The firefighting drone market is driven by increasing wildfire incidents, rising adoption of AI-powered thermal imaging, and advancements in autonomous navigation. Government funding, regulatory approvals, and demand for safer, more efficient firefighting solutions boost adoption. Enhanced battery technology, real-time data analytics, and swarm drone deployment further accelerate market growth.

North America currently dominates the market due to increasing wildfire occurrences, strong government investments in drone technology, and widespread adoption by fire departments. Advanced AI-driven surveillance, regulatory support for unmanned aerial systems, and innovations in battery efficiency further drive market growth.

Some of the major players in the firefighting drone market include Aerialtronics DV B.V., AeroVironment Inc., BSS Holland B.V., Draganfly Inc., Drone Amplified, DSLRPros, Flyability SA, MMC-UAV, Skydio Inc., SZ DJI Technology Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)