Fingerprint Sensor Market Size, Share, Trends and Forecast by Type, Technology, Application, and Region, 2025-2033

Fingerprint Sensor Market Size and Share:

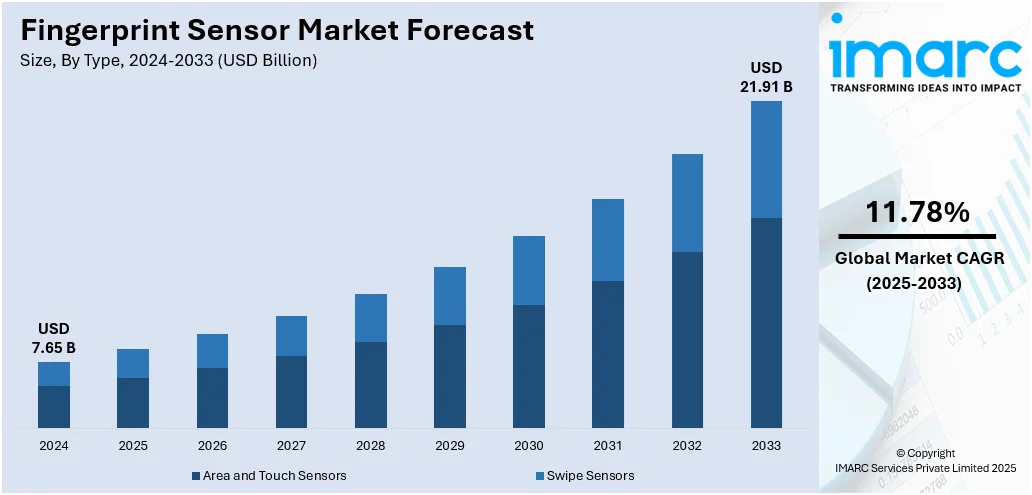

The global fingerprint sensor market size was valued at USD 7.65 Billion in 2024. The market is expected to reach USD 21.91 Billion by 2033, exhibiting a CAGR of 11.78% from 2025-2033. APAC currently dominates the market, holding a market share of 44.0% in 2024. The market is experiencing rapid growth, driven by the increasing focus on security and identity verification, rapid technological advancements, the proliferation of smart devices and the Internet of Things (IoT) applications, imposition of stringent government regulations, and the rising consumer preference for convenience thus aiding the fingerprint sensor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.65 Billion |

| Market Forecast in 2033 | USD 21.91 Billion |

| Market Growth Rate (2025-2033) | 11.78% |

One major driver in the fingerprint sensor market is the growing demand for biometric authentication in smartphones and consumer electronics. As users prioritize security and ease of access, fingerprint sensors provide a fast, accurate, and user-friendly solution for unlocking devices and authorizing transactions. This trend aligns with large-scale government use, such as the U.S. Department of Homeland Security’s IDENT system, which holds more than 320 million unique identities and processes more than 400,000 biometric transactions on regular basis. Such institutional reliance on fingerprint technology reinforces public trust and accelerates adoption in consumer markets. Additionally, advancements in under-display and ultrasonic sensors enable seamless integration into sleek device designs, fueling widespread usage across mobile devices, wearables, and digital payment platforms, ultimately driving fingerprint sensor market growth.

To get more information on this market, Request Sample

The U.S. is the most critical country in the fingerprint sensor market due to its technology-forward ecosystem and deep emphasis on security with 88.70% market share. Strong usage on smartphones, laptops, and wearables drives market demand, backed by user demand for secure and easy authentication. Government agencies and law enforcement similarly depend significantly on fingerprint biometrics for identification and border control. In addition, the U.S. encourages innovation with leading players creating advanced capacitive, optical, and ultrasonic sensors. With digital transformation picking up speed in multiple industries such as finance, healthcare, and automotive, the demand for robust biometric solutions keeps rising, solidifying the leadership in United States fingerprint sensor market outlook.

Fingerprint Sensor Market Trends:

Increasing focus on security and identity verification

One of the key elements supporting the market expansion is the growing emphasis on security and identity verification brought about by the exponential growth in digital transactions, online services, and smart gadgets. An industry analysis estimates that global non-cash transactions reached 1.3 trillion in 2023 and are expected to reach 2.3 trillion by 2027. It is anticipated that by that time, 30% of all transactions will be made using contemporary payment methods like digital wallets and QR-code payments. Furthermore, the market is expanding due to the extensive use of fingerprint sensors, which provide a very dependable and effective method of biometric authentication. Besides this, the growing vulnerability of traditional security measures, such as passwords and PINs, to breaches and hacking attempts, leading to a shift towards biometrics for a more secure authentication process, is bolstering the fingerprint sensor market growth. Along with this, the increasing demand for sensors in various sectors, including banking and finance, government, healthcare, and consumer electronics, is anticipated to drive the fingerprint sensor market demand.

Rapid Advancements in Sensor Technology

The industry is expanding as a result of the quick advancements in sensor materials, design, and functionality that have produced more precise, dependable, and affordable sensors. Accordingly, the development of optical and ultrasonic sensors that enhance identification speed and accuracy in difficult situations—like wet or dirty fingers—is stimulating growth. Additionally, they are more efficient than conventional capacitive sensors because they use light or high-frequency sound waves to record detailed fingerprint images. The fingerprint sensor market is also growing as a result of increased attention being paid to the shrinking of sensor components so that they may be included into a greater variety of goods, like door locks and smartphones.

Growing adoption of smart devices and the Internet of Things (IoT) applications

One of the main factors driving the growth of the fingerprint sensor market is the expansion of smart devices and the Internet of Things, which increases the need for safe and practical user identification methods. 16.6 billion IoT devices were connected by the end of 2023, up 15% from 2022, according to IoT Analytics' 2024 report. By the end of 2024, it was predicted that the number would have increased by 13% to 18.8 billion. Accordingly, the market is expanding as a result of the growing use of sensors in smart devices, including smartphones, tablets, door locks, alarm systems, and smart appliances, because of their capacity to offer safe and rapid access. Moreover, the growing interconnectedness of numerous devices in the IoT ecosystem, propelling the adoption of sensors to ensure secure access and prevent unauthorized use, is contributing to the market growth. Besides this, the widespread integration of fingerprint sensors into smart devices to add a layer of convenience, as users can easily authenticate themselves without the need to remember complex passwords or carry additional tokens, is catalyzing the market growth.

Implementation of government regulations and compliance requirements

The imposition of various government regulations and compliance requirements regarding data security and privacy is strengthening the fingerprint sensor market growth. According to reports, 144 countries have implemented national data privacy laws, covering 6.64 billion people, or 82% of the global population, up from 79% previously. Concurrently, the implementation of stringent government policies to protect consumer data and ensure the privacy of personal information, encouraging businesses and organizations to adopt advanced security measures for identity verification and access control, is favoring the market demand. Moreover, the burgeoning adoption of fingerprint sensors in industries, such as finance, healthcare, and telecommunications as a compliant and secure authentication solution is creating a positive outlook for the market growth. Besides this, the rising investment in fingerprint sensor technology owing to the legal mandate to enhance security measures is driving the fingerprint sensor market demand.

Rising consumer preference for convenience and user experience

The ongoing shift in consumer preference toward more convenient and seamless user experiences is providing a thrust to the fingerprint sensor market size. Additionally, the rising adoption of sensors that allows instant authentication with a single touch eliminating the need for typing passwords or carrying additional security tokens, is bolstering the market growth. Along with this, the increasing need for convenience in unlocking smartphones, authorizing payments, and accessing secure locations is acting as a growth-inducing factor. Besides this, the rising demand for a frictionless user experience, leading to the incorporation of fingerprint sensors in consumer electronics, automotive, banking, and public services, is offering remunerative growth opportunities for the market.

Fingerprint Sensor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fingerprint sensor market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, and application.

Analysis by Type:

- Area and Touch Sensors

- Swipe Sensors

Area and touch sensors represent the majority of shares in the fingerprint sensor market, driven by their superior accuracy, speed, and user-friendly interface. These sensors capture a larger surface area of the fingerprint in a single touch, allowing for faster and more reliable recognition. Their widespread adoption in smartphones, laptops, and tablets is fueled by consumer demand for seamless and secure biometric authentication. Area and touch sensors are also easier to integrate into various device designs, including under-display and side-mounted placements, enhancing design flexibility. As manufacturers seek to improve user experience and reduce authentication time, these sensors remain the top choice, especially in high-volume consumer electronics. Their balance of performance, cost, and integration ease drives continued market dominance.

Analysis by Technology:

- Capacitive

- Optical

- Thermal

- Others

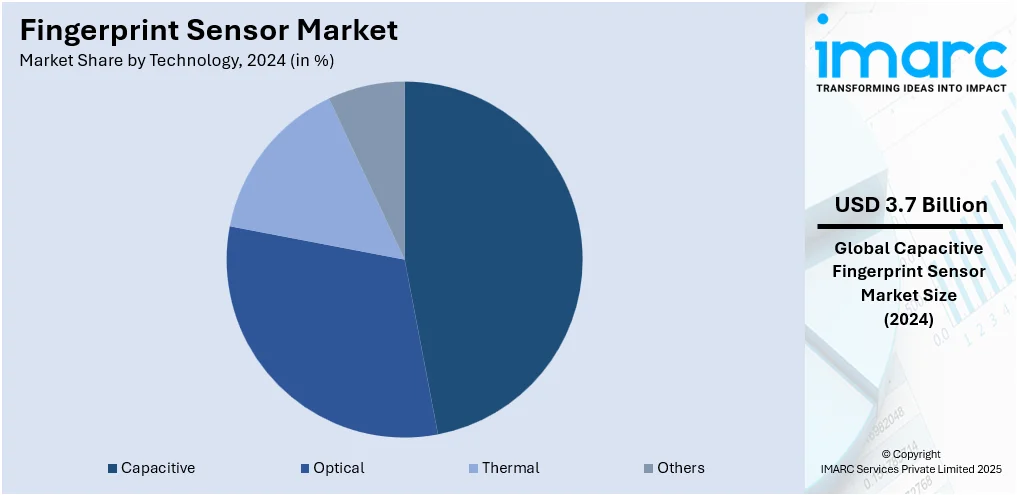

Based on the fingerprint sensor market forecast, the capacitive fingerprint sensors dominate the market with a 47.8% share owing to their high accuracy, reliability, and cost-effectiveness. These sensors detect fingerprints by measuring electrical signals generated by the ridges and valleys of a finger, offering better security and fewer false readings compared to optical sensors. Their mature technology and compact size make them ideal for widespread use in smartphones, laptops, and other portable electronics. Capacitive sensors are also energy-efficient and easy to integrate into thin devices, supporting sleek and modern designs. Due to their proven performance, affordable production, and wide adoption in mid-range and premium devices, capacitive sensors continue to be the preferred choice for manufacturers, ensuring their dominance in the fingerprint sensor market.

Analysis by Application:

- Consumer Electronics

- Government and Law Enforcement

- Military, Defense and Aerospace

- Travel and Immigration

- Banking and Finance

- Healthcare

- Smart Homes

- Others

Consumer electronics account for the majority of shares in the fingerprint sensor market due to the widespread integration of biometric authentication in smartphones, tablets, laptops, and wearables. Users demand secure yet convenient access to their devices, making fingerprint sensors a preferred solution for unlocking screens, authorizing mobile payments, and protecting personal data. As mobile commerce and digital banking grow, device manufacturers prioritize fingerprint technology to enhance user experience and security. Continuous innovation in sensor design—such as in-display, side-mounted, and rear-mounted options—enables seamless integration without compromising aesthetics. Additionally, the fast replacement cycle of consumer electronics ensures sustained demand. These factors collectively make the consumer electronics segment the dominant force in fingerprint sensor market analysis.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

APAC leads the fingerprint sensor market with a 44.0% share due to its large population base, rapid urbanization, and high adoption of smartphones and consumer electronics. Countries like China, India, South Korea, and Japan drive demand through massive production and consumption of mobile devices, which increasingly integrate fingerprint sensors for security and convenience. Additionally, strong manufacturing capabilities and the presence of major OEMs and sensor producers in the region contribute to cost-effective and large-scale production. Government initiatives promoting digital identity, such as India’s Aadhaar program, also accelerate biometric adoption. The region’s expanding fintech, automotive, and smart device sectors further boost sensor integration, solidifying APAC’s dominance in this fast-growing market.

Key Regional Takeaways:

North America Fingerprint Sensor Market Analysis

The North America fingerprint sensor market is primarily driven by the rising demand for secure biometric authentication across various industries, particularly in smartphones and mobile banking. The surge in digital payments, which necessitates stronger identity verification, is contributing to the market's growth. According to the USA Payment Methods & Digital Payments Report 2025, digital and mobile payments are experiencing rapid growth, with nearly 70% of online adults in the U.S. utilizing these payment methods within the last three months. In addition, the growing emphasis on national security and government initiatives is further driving the market as fingerprint sensors are increasingly incorporated into identity management systems. The expansion of IoT-connected devices requiring enhanced security measures is also accelerating the adoption of fingerprint sensors. The healthcare sector is contributing to market demand through the use of fingerprint sensors for patient authentication and access control. Furthermore, ongoing advancements in sensor technology, including improvements in accuracy and speed, are broadening their application scope. Additionally, the automotive industry's adoption of fingerprint sensors for vehicle access and ignition is creating significant growth opportunities in the market.

Europe Fingerprint Sensor Market Analysis

The European fingerprint sensor market is experiencing growth due to the rising demand for secure biometric authentication in financial services, particularly for online banking and digital payments. In accordance with this, the increasing adoption of fingerprint sensors in government ID programs is driving market expansion. Similarly, the growing e-commerce sector, where secure payment methods are vital, is contributing to the market appeal. According to the International Trade Administration, Europe ranks as the third-largest retail e-commerce market globally, generating USD 631.9 Billion in revenue. With an annual growth rate of 9.31%, European retail e-commerce sales are expected to reach USD 902.3 Billion by 2027. The automotive industry’s rapid integration of fingerprint technology for vehicle access and personalization is also enhancing market demand. Additionally, the rising emphasis on privacy protection and data security across industries is further fueling market growth. The healthcare industry’s heightened focus on patient authentication and secure access control in medical environments is also a key market driver. Besides this, stringent regulatory requirements for stronger security measures are accelerating the adoption of biometric solutions across Europe, providing an impetus to the market.

Asia Pacific Fingerprint Sensor Market Analysis

The market in the Asia Pacific is largely driven by the growing adoption of biometric technologies in national ID programs, particularly in countries like India and China. In addition to this, the rise of mobile payments and e-commerce is significantly fueling the need for secure authentication solutions. In 2024, UPI set a new record with 172 billion transactions, a 46% increase from 117.64 billion in 2023. The total transaction value reached INR 23.25 Lakh Crore, emphasizing a significant role in advancing financial inclusivity in India, according to the National Payments Corporation of India (NPCI). Similarly, the rapid urbanization and smart city initiatives across the region are promoting the integration of fingerprint sensors for access control and public security. Moreover, the increasing growth of financial technologies and digital banking in the region is further expanding the market scope. Additionally, the healthcare industry is contributing to market growth through secure patient identification and access control. Furthermore, stringent government regulations requiring stronger security measures are creating a lucrative market outlook.

Latin America Fingerprint Sensor Market Analysis

In Latin America, the market is growing due to the increasing demand for secure authentication in government-issued IDs and national security systems. Similarly, the rising adoption of biometric access control in commercial and residential sectors is driving market expansion. Additionally, the growing focus on patient identification and access control in the healthcare sector, fueling the adoption of biometric solutions, is impelling the market. Furthermore, increasing investments in smart city initiatives across the region are fostering the integration of fingerprint sensors for enhanced security and access management. Accordingly, in June 2024, Mompox, Colombia's first smart city, launched with a 45 billion COP investment, featuring 4,500 fiber optic points, smart roads, drones, environmental sensors, and enhanced security measures. The project aims to expand connectivity, tourism, agriculture, and public safety.

Middle East and Africa Fingerprint Sensor Market Analysis

The market in the Middle East and Africa is significantly influenced by the growing demand for secure financial transactions, particularly in the banking and mobile payments sectors. Furthermore, the region's increasing reliance on biometric authentication for border control and immigration security is driving market expansion. Additionally, the rise of smart home devices and personal gadgets, including wearable devices, is driving market demand. According to the latest data, the adoption of smart home devices in the UAE is growing rapidly, with over 2.85 million registered users on the SmartThings application in the region. Apart from this, the region's commitment to digital identity programs is also contributing to market accessibility, with governments integrating biometric solutions for national IDs and secure online services.

Competitive Landscape:

The market for fingerprint sensors is extremely competitive with many global and regional players competing on technology leadership and market share. It is dominated by notable companies like Apple, Synaptics, Qualcomm, Fingerprint Cards AB, and Goodix that compete on innovation in sensor categories, such as capacitive, optical, and ultrasonic technologies. They spend significantly on R&D to improve performance, minimize power consumption, and facilitate integration into thinner and flexible devices. The competition is further heightened by growing collaborations between sensor makers and OEMs in smartphones, automotive systems, and IoT products. Mergers and acquisitions are also defining the landscape, as OEMs try to enhance capabilities and global coverage. Price competition continues to dominate, particularly in consumer electronics, compelling companies to weigh cost effectiveness against high-quality performance. Moreover, changing security and regulatory demands compel organizations to invest in compliance and enhanced encryption in biometric technology.

The report provides a comprehensive analysis of the competitive landscape in the fingerprint sensor market with detailed profiles of all major companies, including:

- BIO-Key International

- Egis Technology Inc.

- Fingerprint Cards AB (Fingerprints)

- HID Global Corporation

- Idemia

- Idex Biometrics ASA

- NEC Corporation

- NEXT Biometrics

- Qualcomm Technologies Inc.

- Shenzhen Goodix Technology Co., Ltd.

- Synaptics Incorporated

Latest News and Developments:

- June 2025: NEXT Biometrics launched the L1 Slim fingerprint sensor, the thinnest of its kind, designed for seamless integration in ID and financial service devices. Certified for India's Aadhaar and MOSIP frameworks, the sensor offers superior security, performance, and integration efficiency, reducing time-to-market by up to 12 months.

- February 2025: CardLab launched the "Access" biometric smart card, featuring Fingerprint Cards' T-Shape sensor for fast, secure authentication. It combines physical and logical access with NFC, BLE, and energy harvesting, enhancing security while improving user experience, and is prepared for FIDO 1+ certification.

- January 2025: Invixium launched its cost-effective Enterprise Series biometric products: IXM ROSTO (face + card) and IXM TOUCH 3 (finger + card). Designed for SMBs, these devices feature advanced authentication options, including facial recognition, fingerprint scanning, and support for multiple credentials, offering enhanced security and ease of use.

- January 2025: Redwire announced its acquisition of Edge Autonomy for USD 925 Million, expanding its capabilities in autonomous technology. This deal enhances Redwire's space and defense tech portfolio, adding combat-proven UAS platforms. The merger also strengthens its offering of biometric solutions, including fingerprint sensors for enhanced security.

- October 2024: Infineon introduced two automotive-qualified fingerprint sensor ICs, CYFP10020A00 and CYFP10020S00, designed for vehicle personalization and payment authentication. The sensors offer precise identification with flexible customization, support an operating temperature range of -40 to +105°C, and feature AES encryption for secure data transmission.

Fingerprint Sensor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Area and Touch Sensors, Swipe Sensors |

| Technologies Covered | Capacitive, Optical, Thermal, Others |

| Applications Covered | Consumer Electronics, Government and Law Enforcement, Military, Defense and Aerospace, Travel and Immigration, Banking and Finance, Healthcare, Smart Homes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BIO-Key International, Egis Technology Inc., Fingerprint Cards AB (Fingerprints), HID Global Corporation, Idemia, Idex Biometrics ASA, NEC Corporation, NEXT Biometrics, Qualcomm Technologies Inc., Shenzhen Goodix Technology Co., Ltd., Synaptics Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fingerprint sensor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global fingerprint sensor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fingerprint sensor industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fingerprint sensor market was valued at USD 7.65 Billion in 2024.

The fingerprint sensor market is projected to exhibit a CAGR of 11.78% during 2025-2033, reaching a value of USD 21.91 Billion by 2033.

Key factors driving the fingerprint sensor market include rising demand for secure authentication in smartphones and electronics, growing mobile payment adoption, government biometric programs, and technological advancements like under-display and ultrasonic sensors. These trends enhance user convenience, security, and device integration, fueling widespread global adoption across industries.

Asia Pacific currently dominates the fingerprint sensor market, accounting for a share of 44.0% due to high smartphone production, rapid digitalization, and strong consumer demand for secure devices. Major manufacturing hubs like China, South Korea, and India drive adoption, supported by government biometric initiatives and growing fintech and electronics industries.

Some of the major players in the fingerprint sensor market include BIO-Key International, Egis Technology Inc., Fingerprint Cards AB (Fingerprints), HID Global Corporation, Idemia, Idex Biometrics ASA, NEC Corporation, NEXT Biometrics, Qualcomm Technologies Inc., Shenzhen Goodix Technology Co., Ltd., Synaptics Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)