Financial Analytics Market Size, Share, Trends and Forecast by Type, Component, Application, Organization Size, Vertical, and Region, 2025-2033

Financial Analytics Market Size and Share:

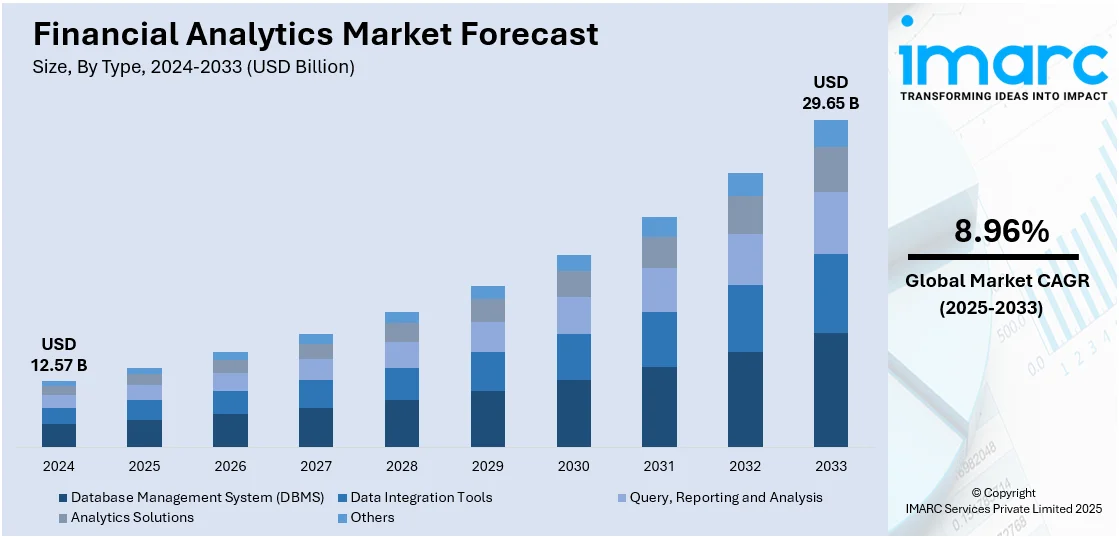

The global financial analytics market size was valued at USD 12.57 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 29.65 Billion by 2033, exhibiting a CAGR of 8.96% during 2025-2033. North America currently dominates the market, holding a significant market share of over 34.0% in 2024. The rapid digitalization within public and private organizations, the integration of artificial intelligence (AI), machine learning (ML), and cloud computing, and the creation of sophisticated financial analytics solutions are some of the key drivers driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.57 Billion |

| Market Forecast in 2033 | USD 29.65 Billion |

| Market Growth Rate 2025-2033 | 8.96% |

The market for global financial analytics is mainly spurred by the expanding usage of sophisticated data analytics software, rising need for real-time tracking of financial activity, and growing focus on regulatory compliance. Analytics is being utilized by organizations to drive better decision-making, streamline operations, and contain risks. The spread of big data and improvement in artificial intelligence further accelerate the market growth by supporting predictive and prescriptive analytics. Additionally, the move towards cloud-based services and the necessity of improved financial forecasting capabilities in fast-changing market conditions are major drivers of the growth of the financial analytics market.

The United States is a leading country in the financial analytics market due to its developed economy, strong capital markets, and leading financial technology industry. As the home to the world's biggest stock exchanges, the U.S. is the capital allocation and financial decision-making hub of the world. For instance, as per industry reports, the New York Stock Exchange (NYSE), the world's largest securities marketplace, facilitates the trading of over nine million corporate stocks and securities daily. Hosting 82% of the S&P 500 and 70 of the globe's leading corporations, it serves as a premier platform for buying and selling equities. Further, the highly regulated but vibrant financial ecosystem of the country stimulates growth and innovation in analytics solutions. In addition to this, the country’s diverse industries, ranging from technology to healthcare, demand sophisticated analytics tools to optimize performance, manage risks, and enhance decision-making. This strategic positioning cements the U.S. as a key player in global financial analytics.

Financial Analytics Market Trends:

Personalized Financial Services and Customer Insights

The shift towards personalized financial services and customer-centric approaches represents one of the key factors positively influencing the market. Additionally, with the availability of vast amounts of customer data, financial institutions are leveraging analytics to gain deeper insights into individual customer behaviors, preferences, and needs. For instance, in June 2023, Salesforce launched Personalized Financial Engagement, a new solution to help financial institutions use AI, real-time data, and CRM to manage customers’ financial plans and deliver intelligent, personalized financial insights at scale. Marketing professionals in financial institutions can now leverage Data Cloud, Financial Services Cloud, and Marketing GPT to provide automated, tailored customer experiences driven by generative AI and reliable first-party data.

Advancements in Technology and Analytics Capabilities

Rapid technological advancements and the integration of artificial intelligence (AI), machine learning (ML), and cloud computing are enhancing the capabilities of financial analytics solutions. AI-powered algorithms analyze complex financial data with unprecedented speed and accuracy and enable real-time insights and predictive modeling. For instance, in September 2024, IntellectAI introduced its innovative wealth platform, WealthForce.AI, for the Middle Eastern market. As per the IBS Intelligence, WealthForce.AI’s introduction seeks to transform wealth management in the region by equipping Relationship Managers (RMs) with state-of-the-art artificial intelligence and sophisticated data analytics solutions. This platform is part of the eMACH.ai suite, which integrates various AI technologies to enhance operational capabilities in financial services. These platforms offer scalability, accessibility, and previously unattainable collaboration capabilities, thus creating a positive financial analytics market outlook.

Rising Focus on Risk Management and Compliance

The growing emphasis on risk management and compliance within the business landscape is another major factor propelling the market growth. Additionally, increasing cases of volatility, credit defaults, cybersecurity threats, and operational disruptions are catalyzing the demand for robust financial analytics solutions to assess, quantify, and manage potential risks comprehensively. According to data obtained from the Reserve Bank of India (RBI) under the Right to Information (RTI) Act, credit card defaults have risen by INR 951 Cr, to INR 4,073 Cr in FY23 from INR 3,122 Cr in FY22. According to industry reports, Internet users in India continued to fall victim to cyberattacks with nearly a quarter of users, 20%, falling victim to cyber threats in the first quarter of 2024. While nearly 22.9% of users were attacked by web-borne threats, 20.1% of users were found to be vulnerable to local threats during the same period.

Financial Analytics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global financial analytics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, component, application, organization size, and vertical.

Analysis by Type:

- Database Management System (DBMS)

- Data Integration Tools

- Query, Reporting and Analysis

- Analytics Solutions

- Others

Database management system (DBMS) leads the market with around 22.4% of market share in 2024. This system efficiently helps in efficiently storing, organizing, and retrieving vast amounts of financial data. In addition, a DBMS facilitates data integration by providing tools to aggregate and join data from disparate systems and helps in generating accurate and holistic analyses, such as performance reports, risk assessments, and trend predictions. Apart from this, DBMS technologies offer scalability options that allow organizations to accommodate increasing data loads without sacrificing performance. Furthermore, DBMS can accommodate various data types, allowing financial analysts to integrate and analyze a wide range of data sources for more comprehensive insights. Moreover, it provides robust security mechanisms to protect financial information from unauthorized access, ensuring compliance with data protection regulations.

Analysis by Component:

- Solutions

- Financial Function Analytics

- Financial Market Analytics

- Services

- Managed Services

- Professional Services

Services lead the market by component and provide access to expert financial analysts who possess a deep understanding of economic trends, market dynamics, and regulatory changes. Apart from this, financial markets are highly dynamic, and services can offer real-time analysis and updates. This agility allows clients to make timely decisions, respond to market shifts, and grab opportunities quickly. Furthermore, services offer tailored solutions to meet the unique needs of clients and provide customized reports, analyses, and recommendations based on specific investment goals, asset classes, or industries. Moreover, services excel in navigating the complex regulatory landscape, which ensures that clients adhere to legal requirements while optimizing their financial operations.

Analysis by Application:

- Wealth Management

- Governance, Risk and Compliance Management

- Financial Forecasting and Budgeting

- Customer Management

- Transaction Monitoring

- Stock Management

- Others

The market research report indicates that wealth management leads the market as application. This segment focuses on building strong client relationships based on trust and performance. Financial analytics allows wealth managers to demonstrate their expertise by showcasing data-driven investment strategies that align with clients' financial goals. This contributes to client satisfaction and long-term retention. Apart from this, wealth management clients demand real-time updates on their portfolio performance. Financial analytics solutions facilitate the monitoring of portfolio performance in real time, allowing wealth managers to make prompt adjustments based on market developments and client objectives. Furthermore, it emphasizes tailoring investment strategies to the individual needs and preferences of clients which is further driving the financial analytics demand. Financial analytics provides the tools to analyze client profiles, financial objectives, and market trends, enabling wealth managers to create customized investment plans that deliver optimal outcomes for each client.

Analysis by Organization Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises lead the market with around 65% of market share in 2024. Such enterprises are highly prone to risk exposure due to their extensive operations and market influence. Financial analytics aids in assessing, mitigating, and managing these risks effectively. In addition, compliance with regulatory standards and reporting requirements is a crucial aspect for large enterprises, and financial analytics provides the necessary tools to meet these obligations. Apart from this, the scale and complexity of financial operations in large enterprises drive the demand for robust analytics. Furthermore, these organizations manage intricate financial transactions, investment portfolios, risk exposure, and diverse revenue streams, which promotes the use of advanced analytical tools to analyze, interpret, and derive insights from this complex web of financial data.

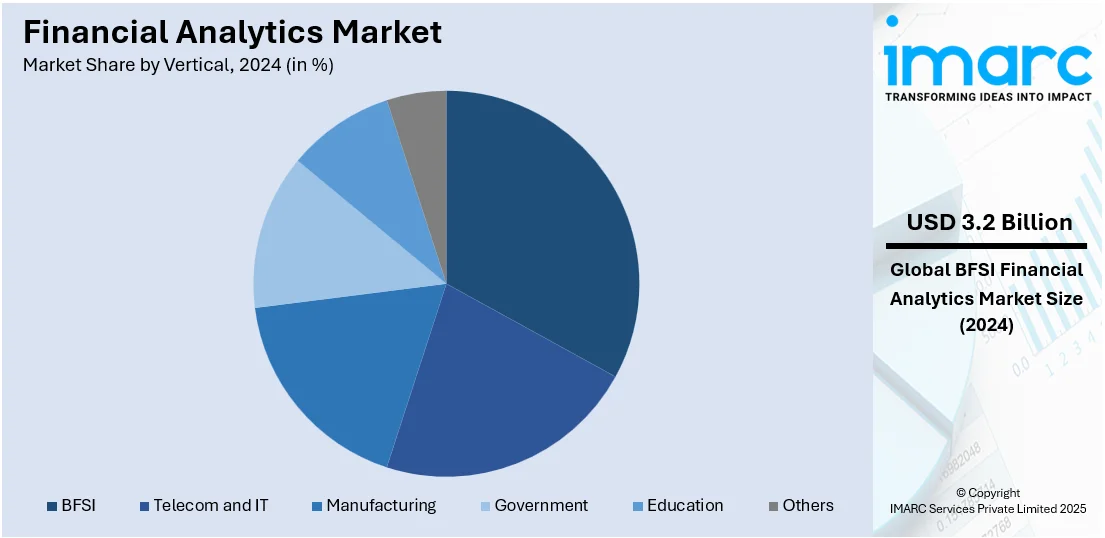

Analysis by Vertical:

- BFSI

- Telecom and IT

- Manufacturing

- Government

- Education

- Others

BFSI leads the market with around 25.8% of market share in 2024. This sector encompasses a wide range of financial activities, from lending and investment to insurance and risk management. The complexity of these operations necessitates sophisticated analytics to analyze vast amounts of data, assess risks, optimize investments, and ensure compliance with regulatory standards. Apart from this, BFSI institutions require real-time insights to make informed decisions in response to market fluctuations. Financial analytics provides the tools to monitor market trends, assess portfolio performance, and make instantaneous adjustments to investment strategies. Furthermore, the BFSI sector focuses on delivering personalized and customer-centric services, which promotes the adoption of financial analytics solutions to enable institutions to analyze customer behavior, preferences, and needs.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 34.0%. Businesses in North America prioritize data-driven decision-making to remain competitive. Financial analytics provides the tools to analyze market trends, customer behaviors, and performance metrics, enabling organizations to make informed strategic choices. The North American region boasts a skilled workforce comprising data scientists, financial analysts, and technology professionals which are driving the financial analytics market growth across the region. This expertise accelerates the adoption and implementation of complex financial analytics solutions. For instance, in September 2024, BlackRock, Microsoft, Global Infrastructure Partners (GIP), and MGX announced the Global AI Infrastructure Investment Partnership (GAIIP) to invest in advanced data centers to address the increasing need for enhanced power, as well as energy infrastructure to develop new power sources for these facilities. These infrastructure investments will be chiefly in the United States fueling AI innovation and economic growth, and the remainder will be invested in U.S. partner countries.

Key Regional Takeaways:

United States Financial Analytics Market Analysis

In 2024, United States accounted for the 73.20% of the market share in North America. The US manufacturing sector's growth has emerged as one of the strong motivators for financial analytics market. According to an industrial report, the manufacturing sector added USD 2.3 Trillion to the U.S. GDP in 2023, representing 10.2% of the overall GDP. Thus, it suggests that there would be more demand for the financial solution that will have the efficiency of operations, the cost control, and thereby profitability in the industry. Additionally, the Current Population Survey reports that 15.6 million people were employed in U.S. manufacturing in 2023, which represents 9.7% of total U.S. employment. The large workforce within this sector further emphasizes the need for advanced financial tools that can handle complex data analytics, provide insights into labor costs, and optimize budgeting and forecasting processes. As the manufacturing industry continues to evolve, especially through the increasing adoption of digital technologies and automation, financial analytics becomes critical in supporting strategic decision-making, risk management, and cost reduction. It is for this reason that the continued growth of the manufacturing industry is an important factor driving the demand for financial analytics solutions in the United States.

Europe Financial Analytics Market Analysis

The rapid roll-out of 5G and fiber broadband networks across Europe drives the growth in the region's financial analytics market. In 2023, one in five mobile connections across Europe was a 5G connection, while this will rise to more than 80% by 2030, as per an industry report. It will offer faster and more reliable data transmission that would allow faster and more real-time analytics for financial services institutions. Also, FTTP is on the rise in fixed broadband services. This would provide better connectivity and support for high-speed, stable internet access to large volumes of data that financial analytics platforms process. Therefore, the continuous improvement of the telecommunication infrastructure will give way to better data processing speeds and access to cloud-based financial tools for financial institutions. The potential and actual developments make the area quite fertile for the growth of financial analytics solutions that can really enhance decision-making, risk management, and overall performance.

Asia Pacific Financial Analytics Market Analysis

The Asia Pacific region is the growth driver for the financial analytics market, given the continued development of Industry 4.0. As Southeast Asian countries face increased pressure due to the Made in China 2025 initiative, which encourages the relocation of manufacturing back to China, there is a heightened need to manage labor issues and optimize operational efficiencies. Industry 4.0, combining smart manufacturing technologies like IoT, automation, and AI, plays an important role in shaping the region's manufacturing industry. Proper adaptation of Industry 4.0 is believed to increase productivity by up to 30-40%. This calls for state-of-the-art financial analytics to keep track and analyze the metrics of performance, to reduce costs and enhance the quality of decision-making in real time. With businesses in the region more sensitized to the benefits associated with Industry 4.0 on productivity and growth, demand for financial analytics tools that help in streamlining resource allocation, financial forecasting, and risk management shall continue to grow.

Latin America Financial Analytics Market Analysis

The rapid demographic changes in Brazil are a significant growth driver for the Latin American financial analytics market, particularly within the pharmaceutical and healthcare sectors. According to an industrial report, the proportion of the population aged 50 and over in Brazil is projected to rise to 24% by 2030, leading to an increased demand for healthcare services and pharmaceuticals. As the largest healthcare market in Latin America, Brazil's pharmaceutical sector is poised for strong growth, driven by an aging population and the adoption of new technologies. According to the International Trade Association, the healthcare industry in Brazil is price-sensitive, with companies looking to improve efficiency and optimize costs. In this context, financial analytics tools are becoming essential for healthcare providers and pharmaceutical companies to manage costs, forecast trends, and enhance decision-making. The increasing reliance on advanced technologies in Brazil’s healthcare sector necessitates robust financial analytics solutions to ensure profitability, compliance, and resource allocation. This growing demand for financial insights in healthcare presents a significant opportunity for financial analytics solutions across Latin America.

Middle East and Africa Financial Analytics Market Analysis

The rapidly growing population, with approximately half its population of 460 million years under the age of 26, in the Middle East and Africa is poised to become a driving source for growth in this space. The youth-dominated region is increasingly embracing technological development, such as BaaS, that is leading towards a change in financial service delivery. Being one of the earlier adopters of technologies, this young population increasingly explores digital financial solutions that drive demand for advanced analytics solutions in financials that could support data-driven decisions to optimize service delivery and experience. This growing use of digital financial platforms throughout the region further necessitates a robust analytics solution in dealing with enormous financial data for trend identification and predictive capabilities of market behavior. The region is expected to continue the high-speed digital transformation in MEA, and therefore financial analytics solutions will become pivotal in helping financial institutions and businesses navigate the emerging new landscape, drive efficiency, and ensure competitiveness in the market.

Competitive Landscape:

The market is highly competitive, with key players like IBM, Oracle, SAP, and SAS Institute leading the industry. These companies focus on offering AI-driven and cloud-based analytics solutions, catering to the increasing demand for real-time insights. In addition, smaller firms are gaining ground through specialized tools and niche offerings. Furthermore, mergers, acquisitions, and strategic partnerships are common and aimed at expanding market reach and enhancing technological capabilities. Moreover, the growing emphasis on predictive and prescriptive analytics intensifies competition across the sector. For instance, in September 2024, Oracle launched a new service Financial Crime and Compliance Management (FCCM) Monitor Cloud Service, designed to help banks, FinTechs, and other financial services companies pinpoint potential adherence and financial crime issues and lower adherence costs.

The report provides a comprehensive analysis of the competitive landscape in the financial analytics market with detailed profiles of all major companies, including:

- Alteryx

- Birst

- Domo

- Fair Isaac Corporation (FICO)

- Hitachi Vantara

- IBM

- Information Builders

- Microsoft Corporation

- Oracle Corporation

- QlikTech International A.B

- Rosslyn Data Technologies

- SAP SE

- SAS Institute

- Teradata Corporation

- Tibco Software

- Zoho Corporation

Latest News and Developments:

- September 2024: Clearwater Analytics, a global frontrunner in SaaS-based solutions for investment management, accounting, reporting, and analytics, has introduced Clearwater Insights — a robust peer benchmarking tool. The new offering empowers Chief Financial Officers (CFOs) and treasury teams with robust tools to perform benchmarking analyses using Clearwater's daily investment data portfolio, enhancing decision-making and optimizing returns.

- May 2024: Wipro revealed its collaboration with Microsoft to roll out a collection of cognitive assistants for the financial services sector, driven by generative artificial intelligence (GenAI). The IT services firm emphasized that these AI-powered tools will deliver comprehensive market insights to financial professionals.

- December 2023: FICO launches sophisticated cloud-based analytics software for the Indian banking sector. Leading Indian banks, like AU Small Finance Bank, HDFC Bank, and Axis Bank, form the early adopters of this technological advancement.

Financial Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Database Management System (DBMS), Data Integration Tools, Query, Reporting and Analysis, Analytics Solutions, Others |

| Components Covered |

|

| Applications Covered | Wealth Management, Governance, Risk and Compliance Management, Financial Forecasting and Budgeting, Customer Management, Transaction Monitoring, Stock Management, Others |

| Organization Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Verticals Covered | BFSI, Telecom and IT, Manufacturing, Government, Education, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Alteryx, Birst, Domo, Fair Isaac Corporation (FICO), Hitachi Vantara, IBM, Information Builders, Microsoft Corporation, Oracle Corporation, QlikTech International A.B, Rosslyn Data Technologies, SAP SE, SAS Institute, Teradata Corporation, Tibco Software, Zoho Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the financial analytics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global financial analytics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the financial analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global financial analytics market was valued at USD 12.57 Billion in 2024.

IMARC estimates the global financial analytics market to exhibit a CAGR of 8.96% during 2025-2033.

Key drivers include rising demand for data-driven decision-making, increasing adoption of AI and advanced analytics tools, growing emphasis on regulatory compliance, expanding digital transformation initiatives, and the need for real-time financial insights to enhance operational efficiency and competitive advantage.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global financial analytics market include Alteryx, Birst, Domo, Fair Isaac Corporation (FICO), Hitachi Vantara, IBM, Information Builders, Microsoft Corporation, Oracle Corporation, QlikTech International A.B, Rosslyn Data Technologies, SAP SE, SAS Institute, Teradata Corporation, Tibco Software, Zoho Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)