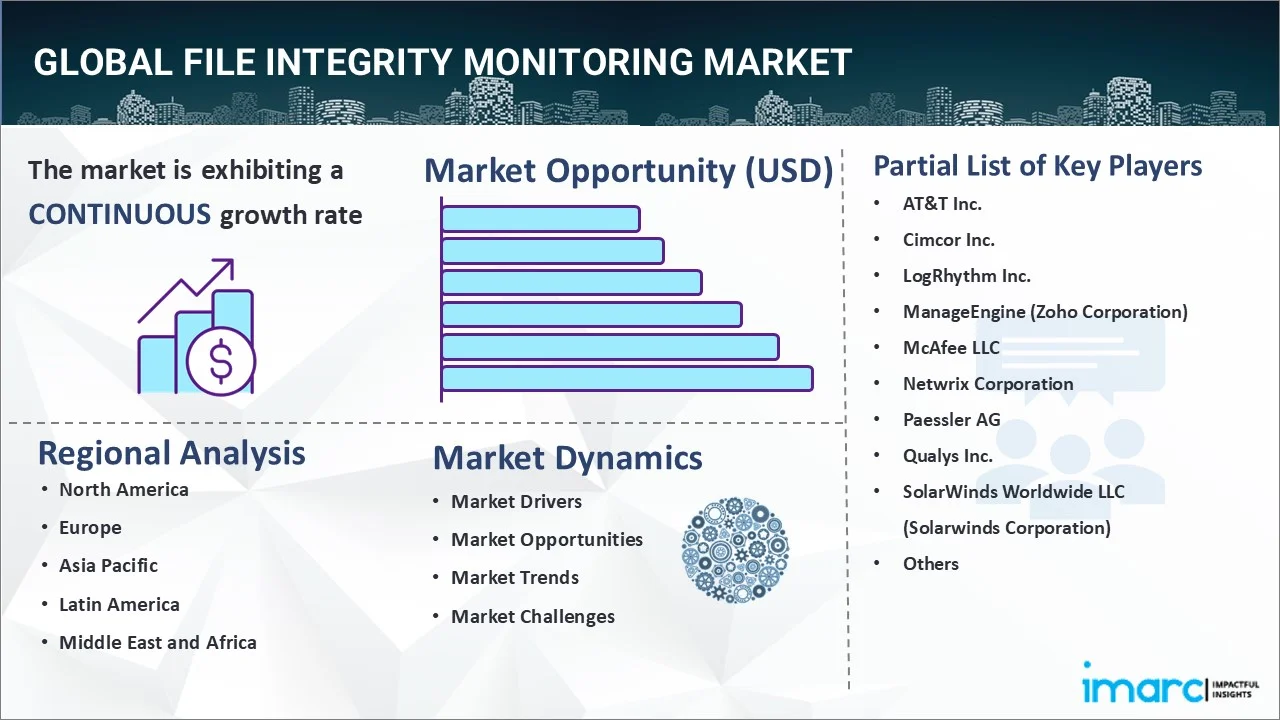

File Integrity Monitoring Market Report by Installation (Agent-based, Agent-less), Deployment Mode (Cloud-based, On-premises), Organization (Small and Medium Enterprises, Large Enterprises), End Use Industry (BFSI, Government, Healthcare, Education, IT and Telecom, and Others), and Region 2025-2033

File Integrity Monitoring Market Size:

The global file integrity monitoring market size reached USD 1,034.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,375.8 Million by 2033, exhibiting a growth rate (CAGR) of 13.35% during 2025-2033. The market is experiencing steady growth driven by increasing cyber threats and regulatory compliance requirements in various industries, the growing adoption of digital transformation strategies enhancing solutions across the globe, and continual technological advancements in cloud computing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,034.0 Million |

| Market Forecast in 2033 | USD 3,375.8 Million |

| Market Growth Rate 2025-2033 | 13.35% |

File Integrity Monitoring Market Analysis:

- Major Market Drivers: The escalating demand for FIM solutions due to the increasing cases of cyber threats and stringent regulatory requirements is fueling the market. Besides, technological advancements in terms of AI and ML integration with FIM tools support the development by raising the detection rate and efficiency, hence providing an impetus to the market demand.

- Key Market Trends: One major file integrity monitoring market trends is that of incorporating state-of-the-art technologies such as artificial intelligence and machine learning to leverage FIM solution functionality related to real-time monitoring and predictive analytics. Another important trend is the increasing integration of file integrity monitoring with other broader security frameworks including SIEM systems, reflecting a rapidly growing trend for comprehensive cybersecurity strategies.

- Geographical Trends: North America dominates the market supported by stringent regulatory requirements and a high incidence of cybersecurity threats. However, rapid growth in the future is being witnessed in the Asia-Pacific region with digitalization and awareness related to cybersecurity.

- Competitive Landscape: According to the file integrity monitoring market research report, the FIM market is quite competitive, and key market players are involved in technological innovation and strategic partnerships to further their product lines. Additionally, numerous firms are also investing in R&D for developing advanced FIM solutions. Some of the key players include AT&T Inc., Cimcor Inc., LogRhythm Inc., ManageEngine (Zoho Corporation), McAfee LLC, Netwrix Corporation, Paessler AG, Qualys Inc., SolarWinds Worldwide LLC (Solarwinds Corporation), Trend Micro Incorporated, Tripwire Inc. (Belden Inc.) and Trustwave Holdings Inc. (Singapore Telecommunications Limited).

- Challenges and Opportunities: One of the major challenges is the complexity and associated cost of implementing and maintaining FIM solutions that become a deterrent to small and medium-scale enterprises. On the contrary, the rapid proliferation of cloud computing, together with dispersion, offers opportunities as these trends further drive the need for full-featured, scalable FIM solutions.

File Integrity Monitoring Market Trends:

Increasing cybersecurity threats and regulatory compliance requirements

Growing occurrences of cyber-attacks and data breaches across industry verticals are driving file integrity monitoring market growth. In data integrity and security, it becomes critical to identify any unauthorized changes on files and systems with the help of FIM solutions. Furthermore, enhanced compliance requirements across the globe, such as the GDPR (General Data Protection Regulation) for Europe and the HIPAA (Health Insurance Portability and Accountability Act), require organizations to implement FIM tools to meet compliance policies defined by these regulations. Along with this, regulations related to specific industries such as finance and healthcare or government also require FIM to protect confidential data against high fines that may be incurred. This growing realization of acute cybersecurity threats and stern compliance protocols converge to a creamy demand for FIM solutions which is creating a positive file integrity monitoring market outlook.

Technological advancements and integration with advanced security solutions

Technological advancements, especially with the incorporation of AI and machine learning (ML), are transforming file integrity monitoring solutions. These include both real-time monitoring and management functionality via higher-order capabilities such as machine learning (ML) algorithms, the use of predictive analytics, and more automated incident response. Along with this, the incorporation of AI and ML enables FIM tools to accurately identify anomalies, false positives, or potential security threats making them more efficient. According to the file integrity monitoring market analysis, the integration of FIM with broader security information and event management (SIEM) systems and other cybersecurity frameworks provides a comprehensive follow-up measure to protect against potential threats. With these technological advancements, FIM technologies are gaining more traction in different sub-industries and other industries as well which helps increase the overall market growth.

The proliferation of cloud computing and remote work environments

The accelerating popularity of cloud computing and the adoption of remote workspaces are increasing the file integrity monitoring market revenue. Coupled with this, the rising need for clear security measures due to escalating operations and data on cloud services is further propelling the market. With the rise of compliant messaging systems, using FIM solutions becomes vital to specially monitor enterprise cloud environments. Further, the increase in remote work is creating a larger attack surface for potential security threats and thus demands that new cybersecurity measures are put to protect distributed networks as well as endpoints. Apart from this, the diverse and dynamic IT environments of organizations require solution providers such as FIM solutions which can deliver continuous monitoring around the hour real-time alerts. Hence increasing dependence on cloud services and remote work models also acts as a key factor in supporting the requirement of continuous FIM solutions expanse, propelling file integrity monitoring market size.

File Integrity Monitoring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global file integrity monitoring market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on installation, deployment mode, organization, and end use industry.

Breakup by Installation:

- Agent-based

- Agent-less

Agent-less accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the installation. This includes agent-based and agent-less. According to the report, agent-less represented the largest segment.

Agent-less holds the largest file integrity monitoring market share driven by its flexibility and less resource consumption. It requires less software deployed on the monitored systems, which reduces the complexity of management and overhead. It relies on ubiquitous network protocols and tools to monitor file integrity, this approach is much more scalable and flexible for organizations of any size. Along with this, the agent customization-free and lightweight approach of FIM is especially attractive for large organizations that have complex, widespread IT landscapes composed of cloud infrastructure instances as well as those with capped remote work implementation. Moreover, the cost-effectiveness of agent-less solutions that effortlessly integrate with existing security frameworks is further fueling their adoption in the market. The file integrity monitoring market forecast states that the agent-less FIM is seamlessly ahead on installation, a testament to its place in current cybersecurity patterns.

Breakup by Deployment Mode:

- Cloud-based

- On-premise

Cloud-based holds the largest share of the industry

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premise. According to the report, cloud-based accounted for the largest market share.

The largest segment is cloud-based deployment due to the increased risk associated with the adoption of cloud computing and the considerable extension need for scalable and flexible security solutions. According to the file integrity monitoring market overview, cloud-based FIM has important benefits such as lower upfront costs, reduced updates, and maintenance to scalability based on exact requirements. These solutions aid organizations in monitoring the health of their files and systems on a real-time basis. These qualities make cloud-based deployment more attractive due to the inherent benefits that come with it (better access and collaboration, just to name a few). Moreover, the increasing dependence on cloud services for essential business functions has heightened the need for strong security protocols to shield confidential information and adhere to data protection laws. Therefore, the cloud mode of deployment is dominating the market and playing a key role in dealing with present-day cybersecurity issues, bringing scalable solutions to meet the current enterprise environment.

Breakup by Organization:

- Small and Medium Enterprises

- Large Enterprises

Large enterprises represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the organization. This includes small and medium enterprises and large enterprises. According to the report, large enterprises represented the largest segment.

This file integrity monitoring market report states that large enterprises as the largest organization segment in the File Integrity Monitoring (FIM) market due to their wide and complex IT infrastructure that requires secure and operational security solutions. This data often includes a litany of sensitive information, and these organizations handle multiple locations, highlighting the need for thorough FIM to protect against breaches as well as adhere to stringent regulatory protocols. Due to the serious financial and reputational risks cybersecurity incidents pose on large enterprises, they are turning to well-developed FIM tools. In addition, large organizations tend to integrate FIM with larger security frameworks, which contributes to the overall maturity of their defense capability. Furthermore, FIM tools in large enterprises have capabilities such as artificial intelligence and machine learning to use the latest technologies so they can increment detection techniques and response, which is also an advantage. Therefore, the file integrity monitoring demand in this segment is high, due to which it dominates in that market.

Breakup by End Use Industry:

- BFSI

- Government

- Healthcare

- Education

- IT and Telecom

- Others

BFSI exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, government, healthcare, education, IT and telecom, and others. According to the report, BFSI accounted for the largest market share.

The Banking, Financial Services, and Insurance (BFSI) sector leads the file integrity monitoring industry by end-use industry segment on account of an extraordinary need to protect sensitive financial data as well as secure regulatory compliance. It involves developing effective security lines that protect from both theft and unauthorized access for the protection of valuable customer information and trust. On the regulatory front, regulations such as GDPR, SOX, and PCI DSS are implementing stringent norms on financial institutions for data protection, and as a result of this, organizations are rapidly turning to FIM solutions. Real-time monitoring and alerting on unauthorized changes help in compliance by ensuring data integrity against financial frauds to avoid data breaches. According to the file integrity monitoring market segmentation, the BFSI industry is the major end-use segment in this market due to the high stakes involved with cybersecurity, coupled with complex compliance requirements that warrant substantial investment in advanced FIM tools.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest file integrity monitoring market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for file integrity monitoring.

The file integrity monitoring market in North America is the largest attributed to the increasing number of cyber-attacks and data breaches occurring in the region. This is compelling enterprises to deploy stronger security measures, driving the adoption of FIM solutions across verticals. Mandates and regulatory requirements, and compliance for multinational companies, are additional drivers that underscore file integrity monitoring needs. Furthermore, the high number of top FIM vendors in North America allows for innovation and rapid adoption of advanced security technologies. In addition to this, the adoption of cloud computing and remote working is accelerating file integrity monitoring market value further in this region. As a result, North America's focus on cybersecurity and compliance is enabling it to become the largest market for FIM worldwide.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the file integrity monitoring industry include

- AT&T Inc.

- Cimcor Inc.

- LogRhythm Inc.

- ManageEngine (Zoho Corporation)

- McAfee LLC

- Netwrix Corporation

- Paessler AG

- Qualys Inc.

- SolarWinds Worldwide LLC (Solarwinds Corporation)

- Trend Micro Incorporated

- Tripwire Inc. (Belden Inc.)

- Trustwave Holdings Inc. (Singapore Telecommunications Limited)

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

The leading players in the market are concentrating on entering new markets and/or expanding their regional presence to realize efficiency cost savings from optimal product development and improve effectiveness through continuous design improvements. Numerous file integrity monitoring companies are increasingly investing in R&D to effectively integrate advanced technologies such as AI/ML into their FIM solutions to enhance real-time detection while also drastically decreasing the number of false positives. In addition, strategic alliances and acquisitions remain a mainstay to aid firms in diversifying their product offerings around the world. Apart from this, companies are working to deliver ease-of-use and integration themes with their more comprehensive security frameworks which often involve things including Security Information and Event Management (SIEM) systems. Cloud deployments are one example of scalable and flexible deployment options that the companies developing CDPs are building to meet rising demand from an increasing number of industries. These initiatives enable market leaders to adapt to the changing cybersecurity requirements of organizations and help them maintain their prominent position in the competitive cybersecurity market.

File Integrity Monitoring Market News:

- April 22, 2024: CyberKnight announced its attendance as one of the largest exhibitors at the Gulf Information Security Expo & Conference. The event highlights "Elevating Cyber Resilience with Zero Trust Security" and introduces regional IT Security leaders to the broad spectrum of technologies that comprise its cybersecurity portfolio aligned to protect hybrid enterprises against rising cyber threats while enhancing compliance standards, both regionally and internationally.

- August 29, 2023: LogRhythm enabled its security information and event management (SIEM) platform to be integrated with the Cimcor CimTrak File Integrity Monitoring solution. LogRhythm's SIEM platform enables customers to monitor the state of their physical, virtual, hybrid (both multi-cloud and on-premises) air-gapped as well as Log R Depth assets.

File Integrity Monitoring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Installations Covered | Agent-based, Agent-less |

| Deployment Modes Covered | Cloud-based, On-premise |

| Organizations Covered | Small and Medium Enterprises, Large Enterprises |

| End Use Industries Covered | BFSI, Government, Healthcare, Education, IT and Telecom, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | AT&T Inc., Cimcor Inc., LogRhythm Inc., ManageEngine (Zoho Corporation), McAfee LLC, Netwrix Corporation, Paessler AG, Qualys Inc., SolarWinds Worldwide LLC (Solarwinds Corporation), Trend Micro Incorporated, Tripwire Inc. (Belden Inc.) and Trustwave Holdings Inc. (Singapore Telecommunications Limited), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the file integrity monitoring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global file integrity monitoring market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the file integrity monitoring industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global file integrity monitoring market was valued at USD 1,034.0 Million in 2024.

We expect the global file integrity monitoring market to exhibit a CAGR of 13.35% during 2025-2033.

The rising number of cross-border terrorist activities, drug trafficking, cybercrime, etc., along with the increasing integration of Artificial Intelligence (AI), Machine Learning (ML), and multi-factor authentication with file integrity monitoring technology to reduce the impact of breaches, is primarily driving the global file integrity monitoring market.

The sudden outbreak of the COVID-19 pandemic has led to the growing adoption of file integrity monitoring technology to protect critical organization information, during the remote working scenario.

Based on the installation, the global file integrity monitoring market has been segmented into agent-based and agent-less. Currently, agent-less holds the majority of the total market share.

Based on the deployment mode, the global file integrity monitoring market can be divided into cloud-based and on-premise, where cloud-based currently exhibits a clear dominance in the market.

Based on the organization, the global file integrity monitoring market has been segregated into small and medium enterprises and large enterprises. Currently, large enterprises account for the largest market share.

Based on the end use industry, the global file integrity monitoring market can be bifurcated into BFSI, government, healthcare, education, IT and telecom, and others. Among these, BFSI exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global file integrity monitoring market include AT&T Inc., Cimcor Inc., LogRhythm Inc., ManageEngine (Zoho Corporation), McAfee LLC, Netwrix Corporation, Paessler AG, Qualys Inc., SolarWinds Worldwide LLC (Solarwinds Corporation), Trend Micro Incorporated, Tripwire Inc. (Belden Inc.), and Trustwave Holdings Inc. (Singapore Telecommunications Limited).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)