Fiberglass Pipes Market Size, Share, Trends and Forecast by Product Type, Fiber Type, Production Process, Material, End User, and Region, 2025-2033

Fiberglass Pipes Market Size and Share:

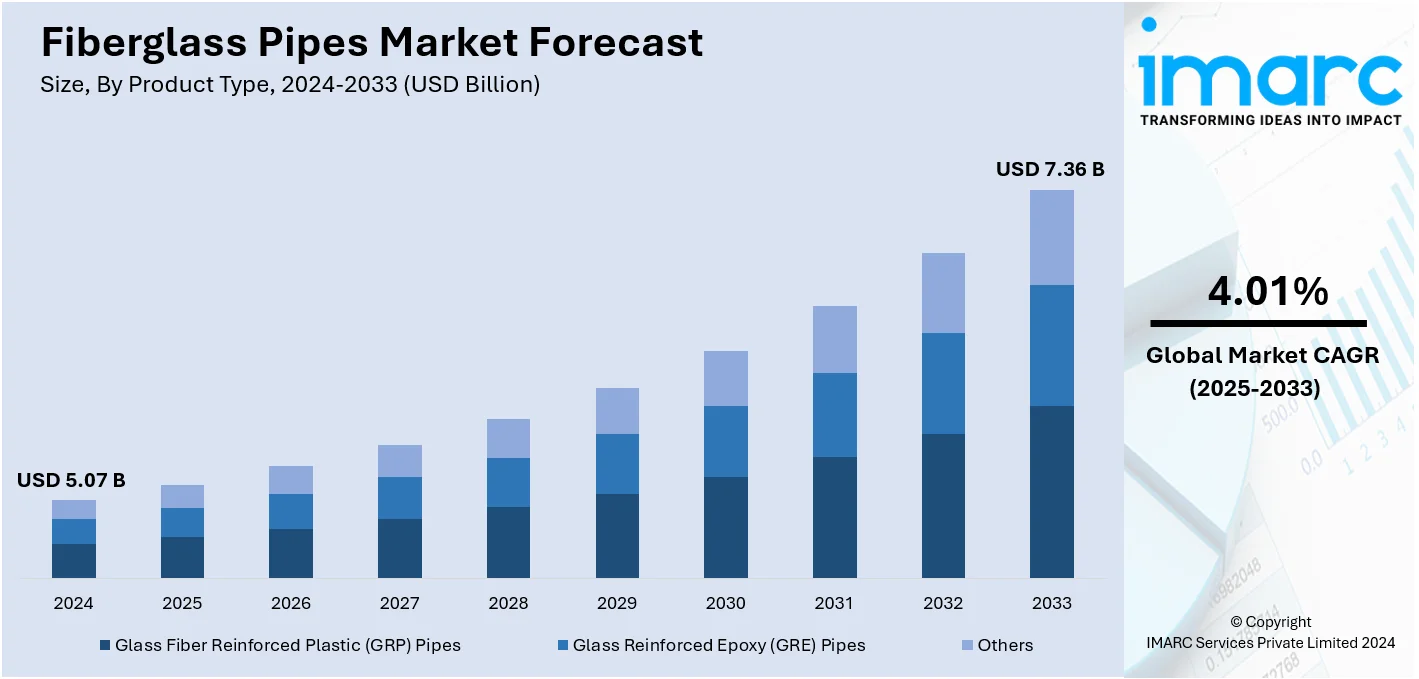

The global fiberglass pipes market size was valued at USD 5.07 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.36 Billion by 2033 exhibiting a CAGR of 4.01% during 2025-2033. Asia Pacific currently dominates the market holding a significant market share of over 43.8% in 2024. The market is experiencing robust growth mainly driven by increasing demand in industries like oil and gas, chemicals and water treatment.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.07 Billion |

|

Market Forecast in 2033

|

USD 7.36 Billion |

| Market Growth Rate 2025-2033 | 4.01% |

The fiberglass pipes market is driven by the product’s superior properties such as corrosion resistance, lightweight nature, and high durability making them ideal for various industrial applications. Growing demand from industries like oil and gas, chemicals and wastewater management is a key driver as fiberglass pipes offer cost effective solutions with low maintenance requirements. For instance, in August 2024, Inpipe Sweden AB launched advanced UV-cured GRP liners in India aiming to transform infrastructure with cost effective and no-dig solutions. The partnership promises 80% savings compared to traditional methods and a lifespan of up to 100 years emphasizing sustainability and minimal environmental impact in pipeline rehabilitation efforts. Increasing infrastructure development particularly in emerging economies and the shift towards environmentally friendly materials are further fueling market growth. Technological advancements in pipe manufacturing also enhance product efficiency boosting adoption globally.

To get more information on this market, Request Sample

The United States fiberglass pipes market is primarily driven by the growing demand from industries such as oil and gas, chemical processing, and water treatment where these pipes are valued for their corrosion resistance and durability. The push for infrastructure modernization including pipeline upgrades and wastewater management systems is further accelerating adoption. Lightweight and easy to install fiberglass pipes reduce transportation and installation costs making them a preferred choice in construction and industrial projects. In line with this, companies are actively pursuing strategic acquisitions and partnerships to expand their product offerings and strengthen their market presence. For instance, in August 2024, Harrington Process Solutions acquired Cortrol Process Systems enhancing its flow control offerings. Cortrol specializes in non-metallic corrosion resistant products including fiber-reinforced plastic systems for various industries. Increased environmental regulations are encouraging the use of non-corrosive and long-lasting materials like fiberglass. Technological advancements in manufacturing and customization are also contributing to the market's steady growth.

Fiberglass Pipes Market Trends:

Rising Demand in Corrosion Prone Industries

Fiberglass pipes are increasingly adopted in corrosion-prone industries like oil and gas, chemicals, and wastewater treatment due to their exceptional resistance to corrosion which extends the lifespan of pipelines in harsh environments. According to industry reports, India's oil and gas sector remains the third largest global oil consumer as of 2023. With 100% FDI allowed in many segments, the industry is set to attract $25 billion in exploration and production. Crude oil production reached 4.89 MMT during April-May 2024. With the growing demand for efficient and durable infrastructure, the oil and gas sector is increasingly turning to advanced materials such as fiberglass pipes. Unlike metal pipes, fiberglass does not corrode or degrade from exposure to chemicals, salts or extreme weather conditions reducing maintenance costs and downtime. This makes them a preferred choice for handling aggressive fluids and gases where durability and reliability are critical. Additionally, their lightweight nature aids in easier installation and transportation further boosting demand in these sectors.

Rising Focus on Sustainability

The shift towards sustainable materials is gaining momentum across industries as environmental concerns and regulations push for greener solutions. This trend is particularly evident in the adoption of ecofriendly and recyclable materials such as biodegradable packaging and sustainable piping systems. In the context of fiberglass pipes manufacturers are increasingly focusing on using recyclable and low impact resins reducing the environmental footprint. These sustainable materials not only meet regulatory standards but also resonate with environmentally conscious consumers and businesses aligning with global sustainability goals and enhancing brand reputation in the market. In line with this, in February 2024, Rice University researchers developed an energy efficient method to upcycle glass fiber reinforced plastic (GFRP) into silicon carbide, a valuable material used in various industries.

Expansion in Emerging Markets

Infrastructure development in emerging markets such as Asia-Pacific, the Middle East and Latin America is significantly driving the demand for fiberglass pipes. For instance, in February 2024, KKR successfully raised $6.4 billion for its Asia Pacific Infrastructure Investors II fund marking it as the largest pan-regional infrastructure fund for the region. Rapid urbanization, industrialization, and the expansion of water, wastewater, and oil and gas infrastructure in these regions create a need for durable and corrosion-resistant piping solutions. Fiberglass pipes with their lightweight, cost-effective and long-lasting properties are well suited to meet these demands. The growing focus on sustainable and ecofriendly materials in infrastructure projects further accelerates the adoption of fiberglass pipes in these developing markets.

Fiberglass Pipes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fiberglass pipes market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, fiber type, production process, material, and end user.

Analysis by Product Type:

- Glass Fiber Reinforced Plastic (GRP) Pipes

- Glass Reinforced Epoxy (GRE) Pipes

- Others

Glass reinforced epoxy (GRE) pipes stand as the largest product type in 2024 holding around 51.9% of the market. Glass Reinforced Epoxy (GRE) pipes are the largest product type in the fiberglass pipes market because of their exceptional strength, high resistance to corrosion, and durability. The GRE pipes are widely used for industries that involve oil and gas, chemical processing, and water treatment in the handling of tough chemicals and extreme environmental conditions. GRE pipes offer a reliable solution for transporting fluids in corrosive environments making them essential in critical infrastructure. Their increasing use in infrastructure projects and the demand for sustainable and low-maintenance piping systems are factors that keep them dominant in the market.

Analysis by Fiber Type:

- E-Glass

- T-Glass/S-Glass/R-Glass

- Others

E-glass leads the market with around 55.8% market share in 2024. E-glass holds the largest share of the fiberglass pipes market by fiber type due to the high strength and durability along with cost effectiveness, this fiber type has been widely used in applications especially in oil and gas, chemical and water treatment industries where reliability forms a critical parameter. Its lightweight nature also cuts down transportation and installation costs making further drive for demand. The use of e-glass fibers offers enhanced performance in harsh environments and is the material of choice for manufacturing long-lasting durable fiberglass pipes requiring minimal maintenance.

Analysis by Production Process:

- Centrifugal Casting

- Filament Winding

- Pultrusion

- Others

Filament winding leads the market holding around 71.8% of the market share in 2024. Filament winding leads the market by production process because it has the ability to produce highly strong and lightweight pipes that have applications in demanding industries such as oil and gas, chemical processing, and water treatment. This production process involves winding continuous filaments of fiberglass around a mandrel in a controlled pattern to ensure uniform thickness and superior strength. Filament winding has become a preferred method in manufacturing pipes mainly because of its cost-effectiveness and high performance in producing durable and corrosion-resistant fiberglass pipes.

Analysis by Material:

- Polyester

- Polyurethane

- Epoxy

- Others

Polyurethane leads the fiberglass pipes market based on material because of its excellent durability, flexibility, and resistance to corrosion. Combining it with fiberglass further enhances the mechanical properties of pipes which are made suitable for industrial applications that include water treatment, oil and gas, and chemical processing. Polyurethane-based fiberglass pipes are ideal in harsh environments due to their resistance to weathering, chemicals, and abrasion thus ensuring longevity with low maintenance costs.

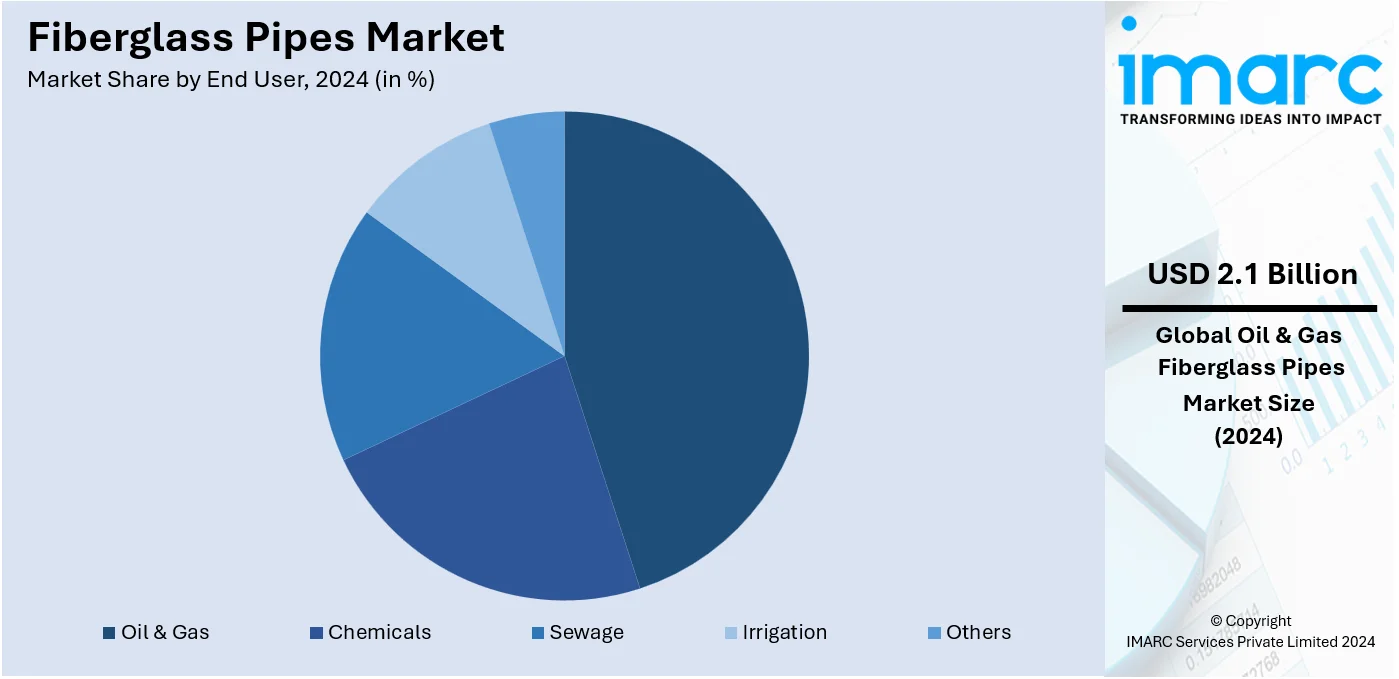

Analysis by End User:

- Oil & Gas

- Chemicals

- Sewage

- Irrigation

- Others

Oil & gas leads the market with around 40.8% market share in 2024. The oil and gas industry dominates the fiberglass pipe market by end user as this sector requires highly durable and corrosion-resistant materials. Fiberglass pipes provide a wide range of benefits in the transportation of oil, gas, and other fluids in demanding environments such as deep-sea operations or severe climates. The resistance to corrosion, high strength-to-weight ratio, and capability to handle high-pressure conditions make fiberglass pipes the most preferred choice in this industry. The reduced maintenance costs and extended service life of fiberglass pipes further enhance their appeal. As exploration and production for oil and gas continue to grow the demand for fiberglass pipes in these applications will remain robust driving innovation and market expansion.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 43.8%. Asia-Pacific holds the largest share of the fiberglass pipe market due to rapid industrialization, infrastructure development, and growing demand in sectors like oil and gas, water treatment, and chemical processing. Countries such as China and India are investing heavily in infrastructure driving the adoption of fiberglass pipes for their corrosion resistance, durability, and cost-effectiveness.

Key Regional Takeaways:

North America Fiberglass Pipes Market Analysis

The North America fiberglass pipes market is driven by robust infrastructure projects, particularly in water treatment, construction, and oil and gas industries. As demand for corrosion-resistant and durable piping systems grows, fiberglass pipes are increasingly favored for their cost-effectiveness and extended service life compared to traditional materials. The U.S. construction market with significant investments in modernization fuels demand for these pipes in utilities and water distribution systems. The oil and gas sector especially with the expansion of shale gas exploration benefits from fiberglass pipes' lightweight and non-corrosive properties. Environmental concerns and advancements in manufacturing technologies further support their growing adoption in the region.

United States Fiberglass Pipes Market Analysis

In 2024, the United States captured 84.80% of the North American market. The U.S. fiberglass pipes market is primarily driven by the growing demand for durable and corrosion-resistant materials in the construction, oil and gas, and water treatment industries. As infrastructure renewal becomes a priority, industries are increasingly turning to fiberglass pipes for their superior resistance to corrosion, low maintenance, and longer service life compared to traditional materials like steel and concrete. The U.S. construction equipment market which reached a size of USD 43.53 Billion in 2023 highlights the ongoing expansion and investment in infrastructure projects driving demand for fiberglass pipes in construction and utilities. The government's infrastructure investment programs including water pipeline replacement initiatives are further boosting market demand as fiberglass pipes are ideal for both potable and wastewater systems. The oil and gas industry which is expanding with the growth of shale gas exploration also contributes to the increased adoption of fiberglass pipes for transporting natural gas due to their lightweight and non-corrosive properties. Furthermore, advancements in manufacturing technologies have made fiberglass pipes more cost-effective allowing them to compete with traditional materials. The rising emphasis on sustainability and the environmental advantages of fiberglass further support its increasing use across industries ensuring continued market growth in the U.S.

Europe Fiberglass Pipes Market Analysis

The fiberglass pipes market in Europe is expanding led by demand for efficient, sustainable, and cost-effective piping solutions across various industries such as construction, oil and gas, and utilities. The European construction market size reached USD 3.38 Billion by 2023 indicating vast investments in infrastructure renewal and modernization. With the region's shift towards eco-friendly construction fiberglass pipes are being increasingly utilized due to their corrosion resistance, low maintenance requirements, and long service life. These pipes are particularly significant in water treatment and distribution where they can withstand the high pressure and chemical environment making them ideal for modern water systems. The growing regulatory push for sustainability and lower environmental footprints is another key driver of demand for fiberglass pipes. In addition to construction, the oil and gas sector remains a major driver as fiberglass pipes are used to transport hydrocarbons offering advantages like lightweight construction and corrosion resistance. Due to the advancement of technology in manufacturing making fiberglass pipes cheaper, their usage is expected to rise in European infrastructure projects especially water and sewage systems in the coming years.

Latin America Fiberglass Pipes Market Analysis

The fiberglass pipes market in Latin America is driven by rapid urbanization and infrastructure development. According to industrial reports, urbanization in Latin American countries has reached around 80%, a rate higher than most other regions. This urban growth creates a substantial demand for durable, corrosion-resistant, and cost-effective piping solutions particularly in water supply and sewage systems. The oil and gas sector is expanding where fiberglass pipes are increasingly used for transporting oil, gas, and chemicals due to their lightweight and corrosion-resistant properties.

Middle East and Africa Fiberglass Pipes Market Analysis

The fiberglass pipes market in the Middle East and Africa is driven by the need for durable and corrosion resistant materials in the oil, gas, and water treatment sectors. The region’s extreme environmental conditions such as high temperatures and saline water make fiberglass pipes an ideal solution due to their resistance to corrosion and long service life. The UAE oil and gas market is projected to grow at a compound annual growth rate (CAGR) of 6.30% from 2025 to 2033 further boosting demand for fiberglass pipes in this sector.

Competitive Landscape:

The fiberglass pipes market is highly competitive with numerous global and regional players focusing on product innovation and technological advancements. Key strategies include expanding manufacturing capabilities enhancing the durability and corrosion resistance of pipes and leveraging advanced production techniques like filament winding. Collaborations and partnerships are common, as businesses aim to strengthen their market position and capture emerging opportunities in rapidly developing regions. For instance, in August 2024, RPC Pipe Systems was acquired by Amiblu a global leader in glass-fiber reinforced plastic pipe systems. This acquisition aims to strengthen Amiblu's presence in Australia and New Zealand.

The report provides a comprehensive analysis of the competitive landscape in the fiberglass pipes market with detailed profiles of all major companies, including:

- Abu Dhabi Pipe Factory LLC

- Amiantit Company

- Amiblu Holding GmbH

- Andronaco Industries

- Chemical Process Piping Pvt. Ltd.

- FIBREX

- Future Pipe Industries

- Graphite India Limited

- Gruppo Sarplast

- Hubei Apex Technology Co., Ltd.

Latest News and Developments:

- November 2024: Bessac Andina installed GRP pipes under Bogotá’s North Highway using the trenchless pipe jacking method. This remote-controlled technique avoided excavation, reduced environmental impact, and maintained normal traffic flow. The project reflects a sustainable approach to urban infrastructure.

- October 2024: TOPFIBRA announced the successful production of its first GRP pipe with the help of the E-CFW main winder, marking the second product line installed for Al Nargis Group. This achievement underscores the company’s commitment to innovation in Effective Filament Winding (EFW) technology and strengthens its ongoing technology partnership with Al Nargis Group.

- September 2024: Amiblu acquired RPC Pipe Systems its long-time partner for Flowtite pipe technology expanding its presence in Australia and New Zealand. This move aligns with Amiblu’s mission to address water scarcity and infrastructure challenges with sustainable and durable GRP pipes.

- April 2024: Hobas Pipe USA expanded its production capacity by 50% with a new manufacturing line operational by October 1, 2024. The upgrade supports growing demand for large-diameter, corrosion-resistant fiberglass pipes in water and wastewater infrastructure.

Fiberglass Pipes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Glass Fiber Reinforced Plastic (GRP) Pipes, Glass Reinforced Epoxy (GRE) Pipes, Others |

| Fiber Types Covered | E-Glass, T-Glass/S-Glass/R-Glass, Others |

| Production Processes Covered | Centrifugal Casting, Filament Winding, Pultrusion, Others |

| Materials Covered | Polyester, Polyurethane, Epoxy, Others |

| End Users Covered | Oil & Gas, Chemicals, Sewage, Irrigation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abu Dhabi Pipe Factory LLC, Amiantit Company, Amiblu Holding GmbH, Andronaco Industries, Chemical Process Piping Pvt. Ltd., FIBREX, Future Pipe Industries, Graphite India Limited, Gruppo Sarplast, Hubei Apex Technology Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fiberglass pipes market from 2019-2033.

- The fiberglass pipes market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fiberglass pipes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global fiberglass pipes market was valued at USD 5.07 Billion in 2024.

IMARC Group estimates the market to reach USD 7.36 Billion by 2033 exhibiting a CAGR of 4.01% during 2025-2033.

Key drivers include rising demand for corrosion-resistant materials in industries, growing adoption in sustainable infrastructure projects, advancements in composite technologies, and cost-effective maintenance compared to traditional materials.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global fiberglass pipes market include Abu Dhabi Pipe Factory LLC, Amiantit Company, Amiblu Holding GmbH, Andronaco Industries, Chemical Process Piping Pvt. Ltd., FIBREX, Future Pipe Industries, Graphite India Limited, Gruppo Sarplast, Hubei Apex Technology Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)