Fertilizer Market Size, Share, Trends and Forecast by Product Type, Product, Product Form, Crop Type, and Region, 2026-2034

Fertilizer Market Size and Share:

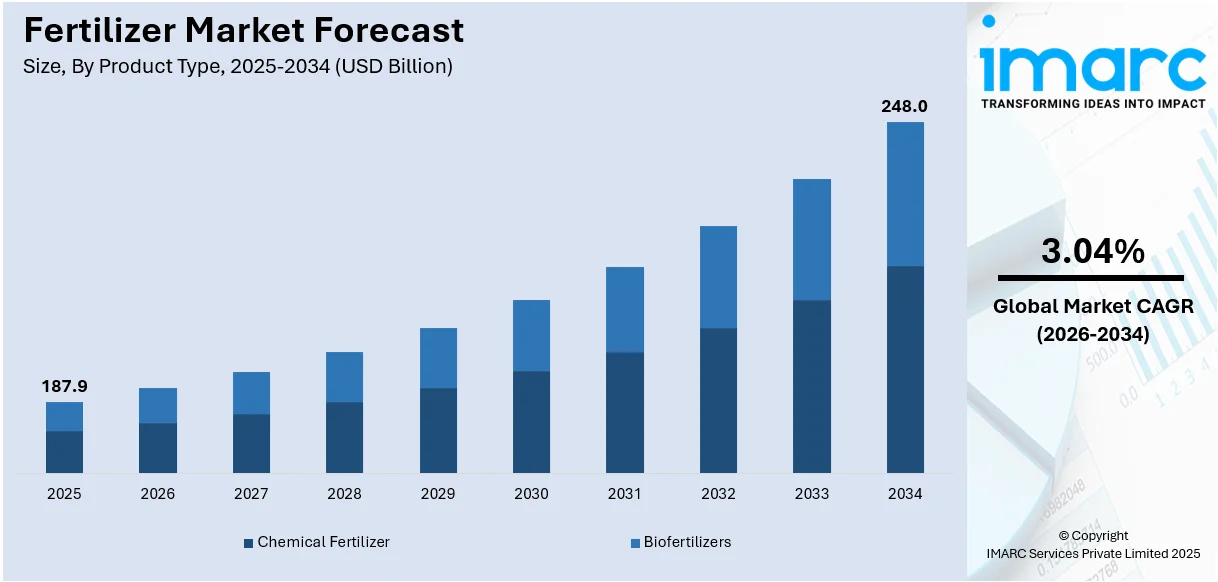

The global fertilizer market size was valued at USD 187.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 248.0 Billion by 2034, exhibiting a CAGR of 3.04% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 52.5% in 2025. The rapid population expansion, high demand for food, increased income levels, government policies and subsidies, increased activities in research and development (R&D), and rapid increases in agricultural technology are some of the factors driving the market growth across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 187.9 Billion |

| Market Forecast in 2034 | USD 248.0 Billion |

| Market Growth Rate (2026-2034) | 3.04% |

The global fertilizer market is experiencing steady growth, driven by the increasing demand for food production and the need to improve agricultural output. The growing populations worldwide are putting pressure on farmers to produce more from fewer resources. Fertilizers, especially nitrogen phosphorous and potassium-based products, will be in high demand if soil fertility is to increase and crop productivity is also to be improved. Population growth, among other factors, is trending the market upwards. Adoption of organic fertilizers, as well as eco-friendly production methods, is increasingly becoming the norm. The government also plays a part in the market through the adoption of subsidies and regulations on food security and sustainable agriculture. The market, however, remains threatened by fluctuating raw materials and environmental concerns over using chemical fertilizers, though with these challenges, coming years are expected to bear new growth through innovations for slow-release and bio-based fertilizers.

To get more information on this market Request Sample

The United States emerged as a key regional market for fertilizers. The need to cater to the growing demand for agricultural products due to a rising population and changed dietary habits drives the fertilizer market in the U.S. Increasingly, precision farming techniques that optimize fertilizer usage are also fueling growth. Government initiatives, coupled with subsidies, have been encouraging farmers to pursue food security more sustainably while increasing fertilizer demand. Organic farming is on the rise and there will be higher demand for bio-based and organic fertilizers. Other developments in fertilizer formulation are slow-release and nutrient-efficient products, which bring high crop productivity while leaving low residues that harm the environment. Some of the challenges are fluctuating raw material costs and pressure from regulation, however the response to this is through creative innovations.

Fertilizer Market Trends:

Population growth and increased food demand

One of the major fertilizer market trends include the fast growth of the world population rising the need for food. According to the United Nations, the world population had hit 8 billion in 2022, and it is expected to reach 9.7 Billion by 2050. Such a population explosion increases food demand by 60% by mid-century. The more people on the planet, the more food they will require. As demand continues to rise over the coming generations, farmers keep searching to increase agricultural output and higher crop yields for production. Fertilizers contribute by providing nutrients back into the soil, which assists healthy growth among plants and pushes out yields from more harvests on each site. With the expanding world's population, growing pressure occurs on the farmlands to produce all food grown on less ground space than ever before. This has led to a continued increase in the demand for fertilizers to enhance crop yields and ensure food security.

Economic Development and Increasing Incomes

Economic development and growing incomes in developing economies directly relate to fertilizer consumption. According to the International Monetary Fund, world GDP expanded by around 3.5 percent in 2022. Emerging markets and developing economies contributed the most to this growth, with an average growth of 4.2 percent in GDP, compared to 1.8 percent in advanced economies. Growth in economies increases living standards and changes eating habits toward greater consumption of diversified food products. This change in food consumption, like increased meat intake, requires more animal feed, and the latter would require fertilizers for cultivating feedstock. In addition, an increase in income allows farmers to invest in improved agricultural techniques, including fertilizers, to boost crop yields and improve their quality. Such an economic transition in emerging markets stimulates the fertilizer market.

Government Policies and Subsidies

Government policies and subsidies greatly expand the global fertilizer market size 2024. Many countries follow agricultural policies to encourage farmers and make them more productive in agriculture. As per the International Fertilizer Association, fertilizer subsidy worldwide exceeded USD 50 Billion every year, and India spent around USD 13 Billion on its farmer support schemes in 2023-24. Such policies include fertilizers, which are made to be cheap and within reach of farmers. Moreover, governments encourage the use of certain fertilizers in certain agricultural situations or for particular environmental reasons. These subsidies play a critical role in stabilizing the fertilizer market price, ensuring affordability for farmers while supporting agricultural productivity and sustainable practices.

Fertilizer Market Growth Drivers:

Greater Emphasis on Sustainable Agriculture

Increased concerns about sustainable and eco-friendly farming practices are offering a favorable fertilizer industry outlook. As worries about conventional farming practices and the environment grow, there is a detectable movement towards green options. Organic fertilizers, which are derived from nature in the form of plant and animal waste, are increasingly being embraced because of their lesser environmental footprint compared to chemical fertilizers. This trend is also complemented by government programs promoting green agriculture practices through incentives and subsidies. As farmers and other stakeholders in the agriculture sector embrace the long-term gains of using green technologies, such as enhanced soil quality and lowered environmental degradation, the need for sustainable fertilizers is likely to grow at an upward pace.

Technological Progress

Rapid technological advancements are taking a central position in the development and renewal of the fertilizer industry. Technology advances in fertilizer manufacturing, for instance, the creation of slow-release fertilizers and controlled-release systems, promote more effective nutrient delivery with less frequent application and less environmental stress. Furthermore, improvements in precision agriculture tools, including nutrient management software and soil sensors, help farmers maximize fertilizer use, enhancing crop yield while reducing waste. These technologies not only increase efficiency but also are cost-saving for farmers, continuing to drive market adoption further. The use of data-driven solutions for fertilizer application is expected to spur demand for fertilizers specifically targeted to the needs of individual crops, opening the door to more sustainable and productive farming practices worldwide, thereby presenting a positive fertilizer market outlook 2025. In 2024, ICL Group begun dispatching products featuring eqo.x, its biodegradable coating technology for controlled release fertilizers (CRF). In September 2022, the brand unveiled the new technology tailored for open-field agriculture, stating it "is the initial product in the market that offers a controlled release fertilizer coating for urea, which decomposes faster and was specifically created to comply with upcoming European fertilizer regulations set to take effect in 2026."

Fertilizer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fertilizer market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, product, product form and crop type.

Analysis by Product Type:

- Chemical Fertilizer

- Biofertilizers

In 2025, the chemical fertilizer segment leads the global fertilizer market, holding a significant 66.6% of the market share. The growth of this segment is mainly due to the increasing demand for food production, especially in regions that have large-scale agricultural operations. Chemical fertilizers, including nitrogenous, phosphatic, and potash-based fertilizers, are essential for replenishing vital nutrients in the soil and ensuring optimal crop growth. Chemical fertilizers, however, play a critical role in meeting the food security challenges in the face of a rising population worldwide by increasing the productivity of existing arable land. Chemical fertilizers are also relatively inexpensive and yield benefits immediately, thus remaining a favorite among farmers globally. Innovation in this segment is also happening with new formulations like slow and controlled-release fertilizers to promote nutrient uptake, decrease the harmful effects on the environment, and reduce the application, which all contribute to continued dominance in the market.

Analysis by Product:

Access the comprehensive market breakdown Request Sample

- Straight Fertilizers

- Nitrogenous Fertilizers

- Urea

- Calcium Ammonium Nitrate

- Ammonium Nitrate

- Ammonium Sulfate

- Anhydrous Ammonia

- Others

- Phosphatic Fertilizers

- Mono-Ammonium Phosphate (MAP)

- Di-Ammonium Phosphate (DAP)

- Single Super Phosphate (SSP)

- Triple Super Phosphate (TSP)

- Others

- Potash Fertilizers

- Muriate of Potash (MoP)

- Sulfate of Potash (SoP)

- Secondary Macronutrient Fertilizers

- Calcium Fertilizers

- Magnesium Fertilizers

- Sulfur Fertilizers

- Micronutrient Fertilizers

- Zinc

- Manganese

- Copper

- Iron

- Boron

- Molybdenum

- Others

- Nitrogenous Fertilizers

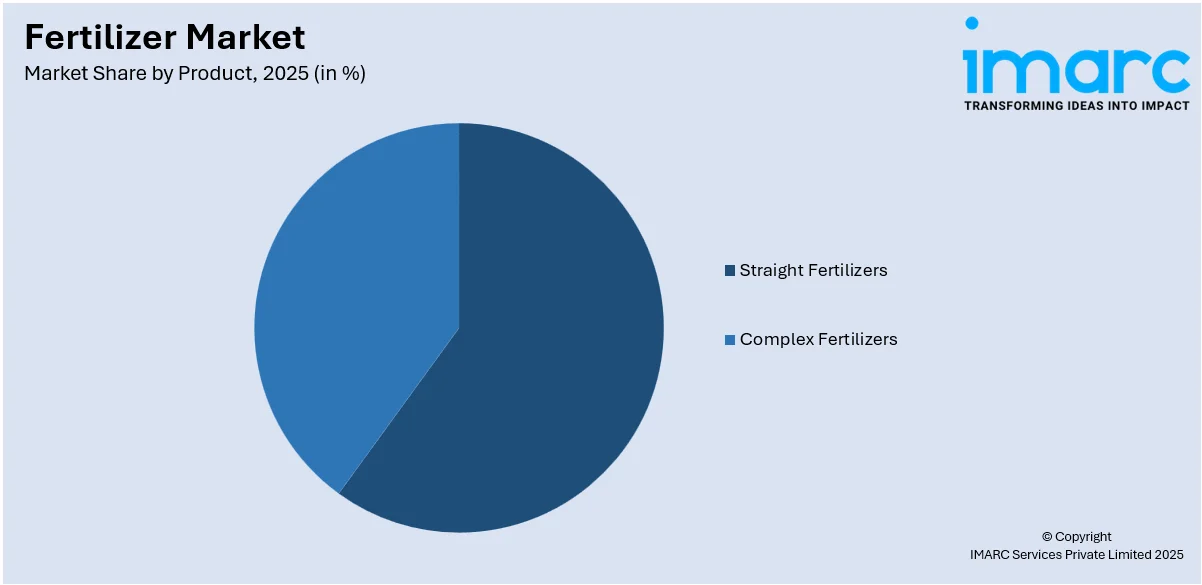

- Complex Fertilizers

Straight fertilizers, which include single-nutrient products like nitrogen, phosphorus, or potassium fertilizers lead the global fertilizer market. These fertilizers find significant use only when one identifies a certain nutrient deficiency in soil and, therefore, make targeted supplementation in the crop possible. The growth in precision agriculture practices has created momentum for the growth of direct application fertilizers, wherein fertilizers make focused input applications efficient at the micro-plot, soil condition, and crop requirement basis. With the rise in demand for food production and the need to optimize crop yields, straight fertilizers are becoming indispensable for farmers aiming to achieve higher productivity while maintaining soil health. As these products are designed to address specific nutrient needs, their use is expanding in regions where soil fertility is low or where nutrients are required for optimal crop growth. Such easy-to-use formulations, having direct implications on crop performance, render these popular among farmers in general.

Analysis by Product Form:

- Dry

- Liquid

Dry fertilizers dominate the market, holding 81.8% share in 2025. The general acceptance of dry fertilizers lies in the fact that they are easy to handle and can be applied in considerable amounts. Dry fertilizers are usually broadcast or directly incorporated into the soil. Dry fertilizers have a long shelf life and do not easily decompose under different environmental conditions, making them more reliable for the farmer. The dry fertilizer is also applicable in places where transportation and distribution logistics require bulk delivery as it can be delivered and stored in large quantities. The market for dry fertilizers remains on the rise with more and more global agricultural sectors utilizing high-efficiency farming practices, such as precision agriculture that requires timely and effective application of nutrients. Dry fertilizers' cost-effectiveness, coupled with their availability, ensures continuous dominance in the fertilizer sector.

Analysis by Crop Type:

- Grains and Cereals

- Pulses and Oilseeds

- Fruits and Vegetables

- Flowers and Ornamentals

- Others

Grains and cereals are one of the largest crop types, which amounts to 45.8% of the global fertilizer market in 2025. These crops are staple food items for most of the population around the world. Wheat, rice, and maize are essential sources of food for billions of people worldwide. The demand for fertilizers in the grains and cereals segment is driven by the need to increase yield productivity to meet the growing food requirements. Fertilizer application is essential in enriching soil fertility, ensuring these crops get the nutrients they require for proper growth and good yields. With land per capita continuing to decline, it becomes important to maximize the use of arable land in place. Fertilizers, especially nitrogen, phosphorus, and potassium-based products, are essential to improve crop performance, reduce yield gaps, and increase general food production. The increasing acceptance of sustainable and efficient farming practices, such as precision farming technologies, accelerates fertilizer demand in this segment to meet global food security goals.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share of over 52.5%. As per the fertilizer market report, Asia Pacific dominates the market since the region is characterized by a vast and diverse agricultural landscape, coupled with its large population. Moreover, the presence of major agricultural economies, such as China and India, plays a pivotal role in fueling fertilizer consumption. Thereby, favorable government policies and initiatives, along with the embracing of highly technical farming techniques and methods, including precision farming and innovative fertilizers in practice, enhance productivity across this region. Furthermore, being a major fertilizer-producing country and exporter also maintains its position in the fertilizer market across the globe in this continent called Asia Pacific. It will also be able to take both domestic and international demand since it is highly competitive in terms of production capability and cost efficiency. This gives the region a high market share. In line with this, the region's increased awareness about sustainable agriculture and environmental concerns has led to the development and adoption of eco-friendly fertilizers, further propelling its leadership in the global fertilizer market.

The North American fertilizer market is growing steadily, with more people adopting precision farming. This practice has been gathering increased attention, and the demand for high-yielding crops is growing at a fast pace. Modern technologies such as GPS-guided application systems and drones ensure fertilizer efficiency. The increasing focus on sustainable agriculture also encourages the demand for organic and bio-based fertilizers. he regulatory support and subsidies toward fertilizer usage is also offering a favorable fertilizer market outlook. The more recently developed popularity of controlled-release fertilizers and eco-friendly formulations further complies with regional demand for the more sustainable, efficient practice of farming.

The fertilizer market in Europe is focused on sustainability and reduction of environmental impact. There is strong support for organic and bio-based fertilizers within the EU's Green Deal and Farm to Fork Strategy. Governments are nudging the adoption of friendly environmental practices, which has heightened demand for products that decrease the runoff of nitrogen and help improve soil health. Precision agriculture, which is increasingly using smart farming practices, is also on the rise. In addition, strict regulations on chemical fertilizers for environmental reasons are making this continent shift to more environmentally and resource-friendly fertilizer solutions.

Latin America fertilizer market is growing, mainly due to the increasing demand for agricultural productivity, especially in Brazil, Argentina, and Mexico. Large-scale farming of crops such as soybeans, corn, and coffee, which are common in the region, consumes a lot of fertilizers. The adoption of precision agriculture and other advanced farming technologies is also increasing the demand for fertilizers. The use of fertilizers helps to improve soil fertility and yields while maximizing yields, which is being addressed by Latin American countries amidst this growth in food demand at a global level. Additionally, policies that support agriculture, as well as agreements with respect to international trade, stimulate market dynamics in the region.

Middle East and Africa fertilizers have high growth, with huge agriculture-based production in Egypt and South Africa. The increasing demand for food in these regions has resulted in increased use of fertilizers. Increased adoption of modern agricultural techniques like drip irrigation and controlled-release fertilizers is further boosting the market expansion. The pressure to become self-sufficient in food production also fuels investment in fertilizers. It emphasizes increasing the crop yield and improving the soil's fertility, with government programs and increased awareness about sustainability practices acting as a trendsetter for this market.

Key Regional Takeaways:

United States Fertilizer Market Analysis

In 2025, the United States accounts for over 77.80% of the fertilizer market in North America. The healthy agricultural sector in the U.S. is highly supported by its fertilizer market. In fiscal year 2024, the USDA said that about USD 437.2 Billion is committed to agriculture, of which fertilizers account for the cost. Nitrogen-based fertilizers dominate the market, with one of the significant cost drivers being natural gas, which comprises about 90% of the costs for ammonia production at USD 7 per MMBtu. Huge quantities of imported ammonia drive U.S. production of critical DAP and MAP fertilizers that feed directly into yield enhancements in crops. The top export product has been urea, taking advantage of the competitiveness of natural gas pricing in the United States. Technological capability and sustainability features give CF Industries and Nutrient a leg up in the market. The fertilizer market is also facing challenges from the increase in energy prices, however this is offset by eco-friendly fertilizer innovation and government-backed R&D programs. Strategic collaborations with and investments in domestic production further strengthen the global position of the U.S. fertilizer market.

Europe Fertilizer Market Analysis

Sustainability and technological innovation characterize the fertilizer market in Europe, which is a result of strict government policies. According to Eurostat, the region had approximately 8.9 million metric tons of nitrogen-based fertilizers consumed in 2022. The production of ammonia became costly due to the shortages that occurred due to the Russia-Ukraine conflict, so the manufacturers sought greener alternatives. As ammonia was Europe's largest source from Russia, trade disruptions occurred by the Black Sea that halted its supply chain. European companies such as Yara are leaders in nitrates and technical ammonium nitrate production, catering to both agricultural and industrial needs. Industrial applications, such as diesel exhaust fluids, are growing due to regulatory pressures to reduce emissions. Europe also invests heavily in R&D to develop innovative fertilizers that meet sustainability goals. Mature markets like Germany and France emphasize precision farming and nutrient efficiency, ensuring stable fertilizer demand. These factors are increasing the demand for fertilizers and offering a favorable fertilizer market outlook.

Asia Pacific Fertilizer Market Analysis

Asia is the largest shareholding region in the fertilizer market, accounting for 57% of global consumption of nitrogen in 2020, with China alone taking 23.7 Mt and India 20.4 Mt, as per an industry report. New plant constructions in Saudi Arabia and Oman will help to address regional deficits with a balanced supply for Asia. Global supply constraints and affordability are two challenges that are likely to lead to moderate growth over the next years, as estimated by the IFA. Asia is a very crucial region in the trade of urea as being one of the most essential fertilizers. Chinese exports have been limited since late 2021, when the country prohibited exports from controlling its fertilizer prices. The consumption of nitrogen fertilizers in the industrial sector is rising rapidly, especially in urea-formaldehyde resins used in many industries. Investment in the production of nitrogen fertilizers is growing due to the agricultural requirements of Asia. Regional initiatives focus on self-sufficiency and sustainability, ensuring that Asia is a vital player in the fertilizer industry, regardless of the changes seen in the market.

Latin America Fertilizer Market Analysis

Latin America fertilizer market is in fast growth due to the agricultural potential and the increasing food demand at the global level. The largest consumer in the region is Brazil, with a usage of 41.1 million metric tons in 2022, according to the National Association for Fertilizer Promotion. The nitrogen-based product usage has been relatively strong in Brazil. Reportedly, the import of urea from the Arab Gulf supports agricultural activities in the region. Production is increasing with investment in the field that tries to reduce dependence on imports. The fertilizer trade of Venezuela impacts North America's supply chains, thereby connecting the region. Mosaic and Yara are expanding their footprint in Latin America as the region enter an agricultural boom. Brazil has adequate natural gas, which it uses to manufacture ammonia for use in the production of urea and DAP fertilizers. The market has some disadvantages, including volatile energy prices and supply chain issues, but it has the advantages of technology and government support. Latin America is strategically located and has the potential to export. Hence, it is one of the important players in the global fertilizer market.

Middle East and Africa Fertilizer Market Analysis

The Middle East and Africa have become significant geographical locations in the global fertilizer market. This is due to the region's gigantic natural gas supplies. They can be applied cheaply for ammonia and urea, which are mostly used to manufacture nitrogen fertilizers. Nitrogen application in Africa stands at less than 4% of global intake according to IFA, considering supply and availability factors in 2020. The Middle East, led by Qatar’s Qafco, is a major urea exporter, with most ammonia surpluses converted into fertilizers for global trade. The Russia-Ukraine conflict disrupted traditional Black Sea trade flows, increasing demand for Middle Eastern exports. Africa faces challenges in scaling production, but investments in fertilizer plants are underway, supported by international collaborations. Rising global prices have prompted African governments to prioritize fertilizer accessibility. Meanwhile, the Middle East has been the leader in export markets due to its strategic location and competitive production costs, so it is a prominent player in the fertilizer supply chain.

Competitive Landscape:

The competition in the global fertilizer market is highly intense, and the players are diversely spread. Being one of the most important industries in agriculture, numerous companies, both large conglomerates and specialized firms, participate in this highly dynamic sector. Here again, the competition is intense due to factors such as the range of products, quality, fertilizer market price strategies, distribution networks, and innovative solutions. Market leaders look to position themselves as leaders in thought and subject matter experts in fertilizer market research and consulting services to make themselves different from their competition. Also, companies are constantly innovating and developing their products to be more aligned with the changing requirements of farmers and other agricultural stakeholders. They also invest significantly in R&D to create environment-friendly and sustainable fertilizers in line with increasing environmental issues. This would mean, according to fertilizer market forecast, a world where a growing global population makes food security a great challenge, hence, an increasingly fierce competition that will require companies to innovate, cooperate, and adapt to ever-swiftly changing natures.

The report provides a comprehensive analysis of the competitive landscape in the fertilizer market with detailed profiles of all major companies, including:

- CF Industries

- Haifa Group

- Indian Farmers Fertiliser Co-operative Limited (IFFCO)

- Israel Chemicals Ltd. (ICL)

- Nutrien Limited

- Sociedad Química y Minera (SQM)

- The Mosaic Company

- Uralkali

- Yara International

Latest News and Developments:

- October 2025: Prime Minister Narendra Modi will unveil two significant initiatives for agriculture, the PM Dhan-Dhaanya Krishi Yojana and the Self-Reliance in Pulses Mission at the National Agricultural Science Complex, Pusa, New Delhi, on October 11, 2025. The programs focus on improving agricultural output, securing food availability, and boosting the income of India’s farming sector. Over 1 lakh farmers have received certification for organic farming through the National Mission on Natural Farming, and 10,000 Primary Agricultural Credit Societies have been digitized and transformed into e-PACS operating as Common Service Centres, fertilizer shops, and Pradhan Mantri Kisan Samriddhi Kendras.

- October 2025: The Nigerian company Dangote has initiated the construction of a $2.5 billion fertilizer facility in southeastern Ethiopia, collaborating with Ethiopian Investment Holdings (EIH). Fueled by regional natural gas reserves (Hilala and Calub), the facility is set to generate 3 million tons of urea annually, positioning it among the largest globally.

- September 2025: Zimbabwe’s Mutapa Investment Fund (MIF), the national sovereign wealth fund, has obtained a $125 million facility from the African Export-Import Bank (Afreximbank) to aid fertilizer production and distribution for the 2025/2026 agricultural season. The primary crops needing chemical fertilizers in the nation are maize, tobacco, and cotton. For the 2025/2026 season, the government targets increasing national maize production to 2.52 million tons, rising from 1.3 million tons collected in the prior season.

- September 2025: Rashtriya Chemicals & Fertilizers Limited (RCF) initiated commercial functions of a new Liquid Carbon Dioxide Plant at its Trombay Unit on September 12, 2025. The facility has a daily production capacity of 100 metric tons. This growth aligns with RCF's plan to broaden its product offerings and possibly create new revenue opportunities in several sectors such as food and beverage, agriculture, and manufacturing.

- August 2025: The Sustain Sudan initiative has begun with solid commitments from partners. The Sustain Sudan initiative unites international collaborators to restore agriculture, assist smallholder farmers, and create robust agri-food systems to guarantee enduring food security. The project starts with fertilizers and subsequently shifts to crop protection products.

- May 2025: The Ministry of Agriculture and Rural Development (SADER) started providing free fertilizer on May 9 in the State of Mexico as a component of the Fertilizers for Well-Being 2025 initiative. The program will provide almost 70,000 tons of fertilizer to over 157,000 staple crop growers. The initiative focuses on growers of corn, beans, rice, sugarcane, and various other vital crops for the regional economy. Over 56,000 women are among the beneficiaries, and their leadership in agriculture supports food sovereignty and the maintenance of traditional farming methods.

Fertilizer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Chemical Fertilizer, Biofertilizers |

| Products Covered |

|

| Product Forms Covered | Dry, Liquid |

| Crop Types Covered | Grains And Cereals, Pulses And Oilseeds, Fruits And Vegetables, Flowers And Ornamentals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | CF Industries, Haifa Group, Indian Farmers Fertiliser Co-operative Limited (IFFCO), Israel Chemicals Ltd. (ICL), Nutrien Limited, Sociedad Química y Minera (SQM), The Mosaic Company, Uralkali, Yara International etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fertilizer market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global fertilizer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fertilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Fertilizer refers to a substance that can be added to soil or plants, providing essential nutrients that support their healthy growth. These mainly include primary nutrients like nitrogen, phosphorus, and potassium, as well as secondary nutrients and micronutrients. Fertilizers are important for enriching soil fertility and crop production in agriculture.

The fertilizer market was valued at USD 187.9 Billion in 2025.

IMARC estimates the global fertilizer market to exhibit a CAGR of 3.04% during 2026-2034.

The rapid population expansion, high demand for food, economic growth in emerging markets, increased income levels, government policies and subsidies, increased activities in research and development (R&D), and rapid increases in agricultural technology are some of the factors driving the market growth.

In 2025, chemical fertilizers represented the largest segment due to the increasing demand for food production, especially in regions that have large-scale agricultural operations.

Straight fertilizers lead the market due to the increasing demand for food production, especially in regions that have large-scale agricultural operations.

The dry fertilizer is the leading segment as they are easy to handle and can be applied in considerable amounts.

Grains and cereals represented the largest segment as they are the staple food items for most of the population around the world.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global fertilizer market include CF Industries, Haifa Group, Indian Farmers Fertiliser Co-operative Limited (IFFCO), Israel Chemicals Ltd. (ICL), Nutrien Limited, Sociedad Química y Minera (SQM), The Mosaic Company, Uralkali, Yara International etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)