Femtocell Market Size, Share, Trends and Forecast by Form Factor, Technology, Type, Application, and Region, 2025-2033

Femtocell Market Size and Share:

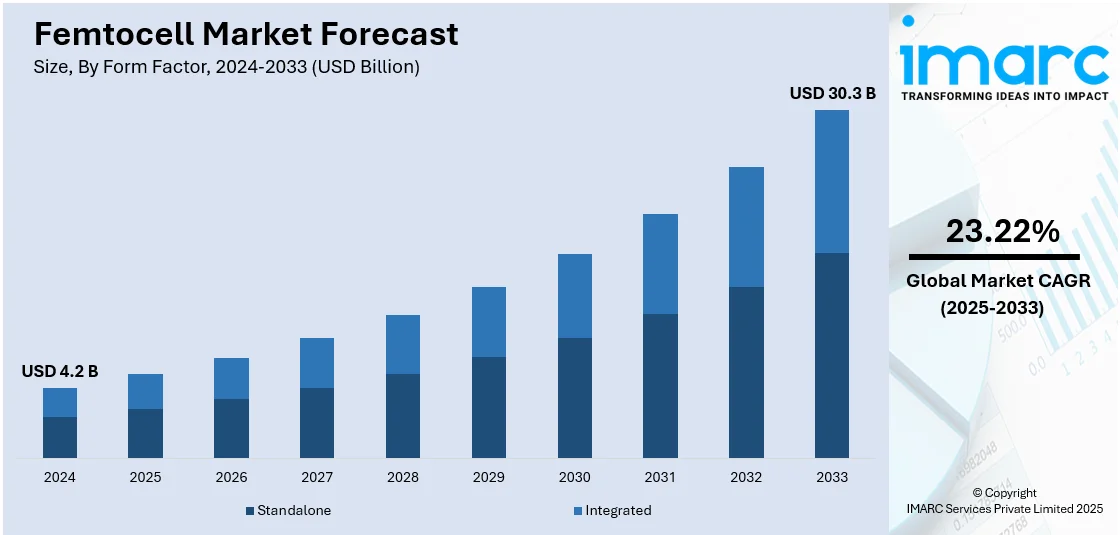

The global femtocell market size was valued at USD 4.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 30.3 Billion by 2033, exhibiting a CAGR of 23.22% from 2025-2033. North America currently dominates the market, holding a market share of 38.6% in 2024. The femtocell market share in the North America region is growing because of high mobile data usage, widespread 4G/5G adoption, and strong demand for enhanced network coverage. Additionally, technological advancements, substantial investments in smart cities, and the presence of key industry players are supporting the market growth in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.2 Billion |

|

Market Forecast in 2033

|

USD 30.3 Billion |

| Market Growth Rate 2025-2033 | 23.22% |

With the surge in mobile device usage and high-bandwidth applications like video streaming and online gaming, cellular networks often face congestion, particularly in urban areas. Femtocells assist in managing this traffic by providing localized cellular service and directing calls and data via broadband connections. Moreover, the introduction of LTE and the shift to 5G networks necessitate extensive small cell installations to guarantee coverage and capacity. Femtocells, being low-power base stations, are ideal for enhancing network density alongside macro cell towers, particularly in home and business settings. In addition to this, Internet of Things (IoT) devices frequently need smooth connectivity in areas with restricted macro network coverage. Femtocells provide localized assistance for these devices, especially in smart homes, factories, and healthcare settings, by lowering latency and enhancing reliability.

The United States represents an essential part of the market, propelled by a growing number of smartphones and connected devices usage for various tasks such as calls, video conferencing, social media, streaming, and navigation. Cellular networks frequently encounter congestion, which is driving the demand for femtocells to provide an immediate solution by delivering localized, dedicated coverage through the broadband link of the users. Furthermore, the increasing dependence on remote healthcare services is elevating the need for dependable indoor mobile connectivity, leading to a rise in femtocell usage to facilitate telemedicine solutions with consistent voice and high-speed data access. In 2024, the US telemedicine market hit USD 26.6 billion and is estimated by the IMARC Group to expand at a CAGR of 17.8%, reaching USD 128.4 billion by 2033.

Femtocell Market Trends:

Expansion of 4G and 5G Infrastructure

The rapid expansion and enhancement of 4G and 5G infrastructure worldwide is a vital factor impelling the market growth. With mobile data usage increasing exponentially, operators are under constant pressure to provide uninterrupted and high-speed connectivity, especially indoors where signals tend to weaken. Femtocells, being compact and low-power cellular base stations, offer a practical solution by extending coverage within homes, offices, and commercial buildings. The ongoing rollout of 5G is catalyzing the demand for such localized coverage boosters. As networks shift toward ultra-low latency and high-speed services, femtocells play a critical role in bridging coverage gaps and reducing strain on macro networks. According to GSMA, by 2025, 5G networks are projected to cover one-third of the global population, highlighting the urgent need for robust last-mile connectivity solutions. This growing footprint of next-generation networks underscores the relevance of femtocells as complementary tools that enhance quality of service without heavy infrastructure investments. Their ability to support dense network demands in urban areas while maintaining cost-efficiency makes them an essential component in modern telecom strategies. As 4G continues to expand in developing regions and 5G sees rapid uptake in developed markets, the demand for femtocells is rising further.

Rising Number of Connected IoT Devices

The rapid proliferation of connected IoT devices is a major factor driving the femtocell market. As homes, businesses, and industries increasingly adopt IoT technologies for automation, monitoring, and data-driven operations, the demand for consistent, high-speed, and low-latency connectivity continues to rise. According to recent data, the number of connected IoT devices is growing by 13%, reaching 18.8 billion globally. This surge in device connectivity is placing additional pressure on existing network infrastructure, particularly in indoor environments where macro network signals often struggle to penetrate. Femtocells offer a practical and scalable solution to ensure that IoT devices remain reliably connected, especially in dense urban environments, smart homes, and enterprise settings. Their ability to provide localized, high-quality coverage makes them critical in supporting IoT expansion. By efficiently managing network traffic and reducing latency, femtocells enhance the performance of interconnected devices. This need for dependable indoor connectivity is further intensified by the rise of smart buildings and industrial IoT applications. As a result, the growing IoT ecosystem is accelerating the adoption of femtocell solutions across various sectors, highlighting the technology’s crucial role in supporting the next wave of digital transformation.

Femtocell Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global femtocell market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on form factor, technology, type, and application.

Analysis by Form Factor:

- Standalone

- Integrated

Standalone, holding a share of 80.1%, dominates the market owing to its ease of use, affordability, and capability to deliver focused, localized coverage. Such device functions autonomously, providing users with an effective means to broaden network coverage in targeted locations such as residences, workplaces, or small enterprises. The independent design allows for simpler installation without requiring a link to an external gateway or controller, making it a practical option for both users and operators. Moreover, standalone facilitates the smooth transfer of data traffic from the macro network, enhancing overall network efficiency. Its small size and self-sufficient design also make it ideal, perfect for spaces with limitations, improving flexibility and scalability. As wireless technology progresses, standalone femtocell is being recognized as a dependable option for enhancing mobile connectivity and providing steady service in difficult settings.

Analysis by Technology:

- IMS/SIP Femtocell Technology

- IU-H Femtocell Technology

IU-H femtocell technology, with a market share of 68.1%, represents the largest segment attributed to its superior ability to provide both indoor and outdoor wireless coverage. The IU-H architecture allows for smooth integration with essential network components, offering operators enhanced flexibility and scalability in managing the network. This technology facilitates efficient traffic diversion from macro networks, alleviating congestion and enhancing overall network efficiency. IU-H femtocell is very efficient in providing excellent voice and data services in regions with poor signals, thus crucial for improving user experience. Additionally, the technology accommodates various frequency bands, guaranteeing compatibility with a wide range of mobile devices and network setups. By providing low latency and high data rates, IU-H femtocell is essential for enhancing 5G networks, thereby maintaining its significance as the demand for quicker, more dependable mobile connectivity keeps increasing.

Analysis by Type:

- 2G Femtocell

- CDMA

- GSM/GPRS

- 3G Femtocell

- W-CDMA/HSPA

- CDMA2000-EVDO

- TD-CDMA

- 4G Femtocell

- WiMAX

- LTE

4G femtocell (WiMAX and LTE), accounting for a share of 69.3%, leads the market because of its excellent data transfer speeds and improved network efficiency. This femtocell aims to deliver high-quality voice, data, and video services, making it perfect for enhancing mobile coverage in regions with weak signal reception. WiMAX and LTE femtocells provide quicker internet speeds and more dependable connections, meeting the growing need for high-bandwidth applications such as video streaming and online gaming. Their capability to transfer data traffic from the macro network to nearby small cells assist in alleviating network congestion, guaranteeing an improved user experience. Moreover, 4G femtocell works with a variety of devices and offers greater capacity than previous technologies, making it very appealing to mobile operators aiming to satisfy the increasing need for data. Its capacity to seamlessly blend with current network infrastructure also enhances its market leadership.

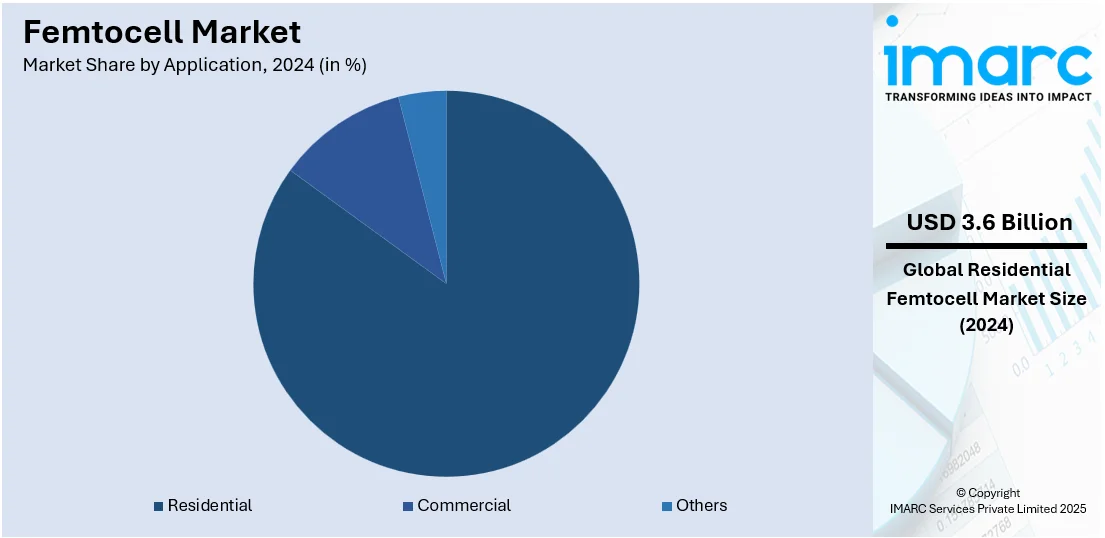

Analysis by Application:

- Residential

- Commercial

- Others

Residential holds a share of 85.4% on account of the increasing need for improved indoor mobile connectivity. As dependence on smartphones and mobile devices for personal and work tasks grows, having a strong and dependable signal at home is becoming crucial. Femtocell offers an affordable way to enhance voice and data coverage in locations lacking strong signals from macro networks, such as basements or isolated parts of buildings. Residential femtocell alleviates congestion and improves the overall network experience by diverting traffic from the macro network. In addition, as users seek increased high-speed internet and uninterrupted connectivity for activities such as video streaming, gaming, and smart home gadgets, the necessity for dependable indoor coverage keeps growing. These elements establish residential femtocell as the favored option for enhancing mobile network efficiency in households.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America with a share of 38.6% leads the market because of its sophisticated telecommunications infrastructure, strong need for uninterrupted mobile connectivity, and early embrace of new technologies. The area boasts a significant population of tech-oriented users who demand steady, high-speed internet and dependable mobile services, fueling the increasing demand for femtocells. Telecom providers in North America are at the forefront of rolling out 5G networks, which is boosting the need for femtocells to improve coverage and relieve traffic from macro networks. Government programs and regulatory backing for innovation in telecommunications are facilitating the swift adoption of femtocells. For example, in 2024, SaskTel broadened its 5G service to more than 50 cell sites throughout rural and Indigenous areas in Saskatchewan, Canada. This implementation enhanced mobile connectivity and also benefited sectors like healthcare, education, and agriculture. Such advancements underscore North America's role in utilizing femtocell technology to enhance coverage and improve network performance.

Key Regional Takeaways:

United States Femtocell Market Analysis

United States, holding a market share of 87.40%, is witnessing a rising femtocell adoption driven by the expanding Internet of Things (IoT) ecosystem. For instance, by the end of 2024, the number of IoT devices across the globe is expected to exceed 17 Billion, with 5.4 Billion in North America alone. As IoT devices continue to proliferate across residential and commercial spaces, maintaining strong indoor coverage has become critical to support seamless connectivity. This increasing reliance on connected environments is prompting users and service providers to deploy femtocells to enhance indoor network performance. Moreover, the constant need for smart devices in households and businesses is amplifying the demand for reliable indoor mobile coverage, positioning femtocells as essential infrastructure. With more IoT-enabled systems being introduced for automation, healthcare, and security, the need to support low-latency, high-speed connections indoors is intensifying. Consequently, femtocells are emerging as a strategic solution to bridge indoor coverage gaps in this technologically advanced market.

Europe Femtocell Market Analysis

Europe is seeing a rise in femtocell installations propelled by the widespread availability and penetration of broadband connections. According to reports, in 2023, the overwhelming majority (93.9%) of EU businesses utilized a fixed broadband connection for internet access. With a mature internet infrastructure in place, femtocells can be easily integrated into home and business networks, offering improved indoor coverage and better service quality. As users demand higher data speeds and uninterrupted mobile experiences, broadband connections provide the necessary backhaul support for femtocell functionality. This compatibility between femtocells and fixed broadband networks is encouraging both consumers and telecom operators to deploy the technology in challenging indoor environments. In regions where thick building materials disrupt signal penetration, femtocells offer an effective indoor solution. The continued expansion of high-speed broadband connectivity across urban and rural areas is thus a key enabler of femtocell adoption throughout the European market.

Asia Pacific Femtocell Market Analysis

Asia-Pacific is experiencing notable femtocell deployment because of the expanding 5G infrastructure across urban and suburban regions. For instance, Indian 5G users are expected to grow to 770 Million by 2028. With operators actively rolling out 5G networks, femtocells are being utilized to support enhanced data throughput and stable indoor connectivity, especially in high-density environments. The need to deliver low-latency and high-capacity services indoors is pushing network providers to invest in femtocell solutions. As 5G coverage expands, the importance of indoor signal optimization grows, making femtocells a practical choice for network densification. In this context, the synergy between femtocell technology and the development of 5G infrastructure is playing a pivotal role in boosting adoption. Increasing mobile broadband usage and growing consumer expectations for uninterrupted service are further accelerating femtocell deployment across this high-growth region.

Latin America Femtocell Market Analysis

Latin America is witnessing increased femtocell uptake as smartphone users continue to grow across the region. According to GSMA, the end of 2021, smartphone connections in Latin America are expected to reach 500 million, resulting in a 74% adoption rate. With more individuals relying on smartphones for communication, entertainment, and business, the demand for strong indoor connectivity has become more pressing. Femtocells are offering a cost-effective solution to address signal gaps within homes and offices. The rising number of smartphone users is placing pressure on existing mobile networks, encouraging telecom providers to enhance indoor service quality through femtocell deployment. This growing user base is a key driver for market growth.

Middle East and Africa Femtocell Market Analysis

Middle East and Africa are observing greater femtocell deployment due to rising investment in ICT infrastructure. For instance, total expenditure on information and communications technology (ICT) in the Middle East, Türkiye, and Africa (META) will exceed USD 238 Billion this year, marking a rise of 4.5% compared to 2023. As governments and enterprises increase funding toward digital connectivity, femtocells are being integrated to strengthen indoor mobile coverage. The expansion of ICT frameworks is creating an environment conducive to advanced network solutions. Growing ICT investment is helping bridge connectivity gaps, positioning femtocells as an essential tool for indoor signal enhancement across both residential and commercial spaces in the region.

Competitive Landscape:

Major participants in the industry are concentrating on creating inventive solutions to meet the increasing demand for enhanced mobile network coverage and fast data transfer. These companies are heavily investing in research and development (R&D) to integrate femtocell technology with emerging 5G networks, aiming to improve network efficiency and alleviate congestion in high-density areas. They are also working on improving the interoperability of femtocells with existing infrastructure and exploring software-defined networking (SDN) to provide more adaptable and scalable solutions. Furthermore, these players are forming strategic partnerships with telecom providers to expand their market reach and reduce costs while enhancing the user experience. For example, in 2025, Nokia and Zain KSA launched the first 4G/5G femtocell solution in the MEA region. This solution, featuring Nokia's Smart Nodes, aims to optimize indoor connectivity and improve the network coverage and customer experience for enterprise customers.

The report provides a comprehensive analysis of the competitive landscape in the femtocell market with detailed profiles of all major companies, including:

- BTI Wireless

- Nokia Corporation

- Nybsys Inc

- PT Telekomunikasi Selular

- Sunwave Communications Co., Ltd

Latest News and Developments:

- January 2025: Nokia and Zain KSA partnered to launch the first 4G/5G Femtocell solution in the MEA region, enhancing indoor enterprise connectivity. The deployment featured Nokia’s Smart Nodes and supporting technologies like IP Security Gateway and Femto Manager. This solution addressed mobile coverage gaps with a plug-and-play setup that reduced infrastructure dependency.

- October 2024: Axyom.Core announced the commercial launch of the industry's first 4G/5G dual-mode enterprise femtocell product, marking a milestone in indoor wireless connectivity. The femtocell extended service coverage to areas with limited or no access, targeting offices, hospitals, schools, and retail environments. Service providers had the opportunity to deploy or resell these femtocells amid rising demand driven by 5G adoption.

- June 2024: the Telecommunications and Multimedia Applications Institute (iTEAM) at UPV University in Valencia and Vodafone Spain formed a partnership focused on advancing 5G SA networks. The collaboration emphasized research and development using Open RAN (O-RAN) hardware. Both entities aimed to foster innovation in next-generation mobile infrastructure. The initiative marked a significant step in Spain’s 5G technological evolution.

Femtocell Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Form Factors Covered | Standalone, Integrated |

| Technologies Covered | IMS/SIP Femtocell Technology, IU-H Femtocell Technology |

| Types Covered |

|

| Applications Covered | Residential, Commercial, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BTI Wireless, Nokia Corporation, Nybsys Inc, PT Telekomunikasi Selular, Sunwave Communications Co., Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the femtocell market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global femtocell market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the femtocell industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The femtocell market was valued at USD 4.2 Billion in 2024.

The femtocell market is projected to exhibit a CAGR of 23.22% during 2025-2033, reaching a value of USD 30.3 Billion by 2033.

The femtocell market is driven by rising mobile data traffic, demand for improved indoor network coverage, increasing adoption of 5G networks, and cost-effective solutions for network congestion. Telecom operators also support femtocell deployment to enhance service quality and retain clients in high-density urban environments.

North America currently dominates the femtocell market, accounting for a share of 38.6%. The dominance of the region is because of the high mobile data usage, widespread 4G/5G adoption, and strong demand for enhanced network coverage. Additionally, technological advancements, substantial investments in smart cities, and the presence of key industry players support the market growth in the region.

Some of the major players in the femtocell market include BTI Wireless, Nokia Corporation, Nybsys Inc, PT Telekomunikasi Selular, Sunwave Communications Co., Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)