Feminine Hygiene Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Feminine Hygiene Products Market Size and Share:

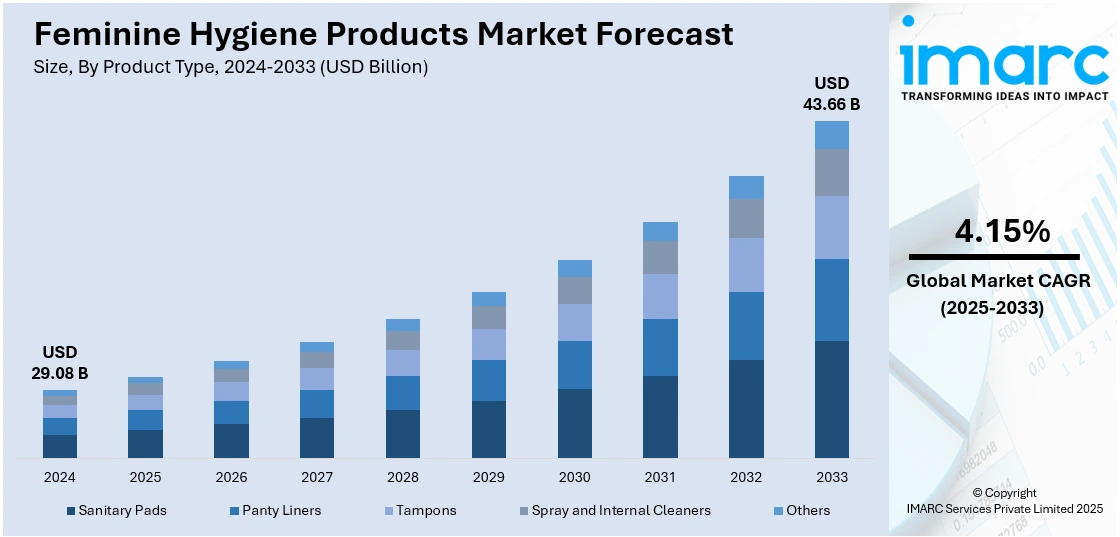

The global feminine hygiene products market size was valued at USD 29.08 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 43.66 Billion by 2033, exhibiting a CAGR of 4.15% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 34.7% in 2024. The increasing concerns about genital health, heightening menstrual awareness among women, and the easy availability of products through online and offline retail channels represent some of the key factors driving the market in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 29.08 Billion |

|

Market Forecast in 2033

|

USD 43.66 Billion |

| Market Growth Rate 2025-2033 | 4.15% |

The global feminine hygiene products market is growing due to increasing awareness about menstrual health, improved accessibility, and the availability of diverse product options. Rising incomes, particularly in developing regions, are enabling more women to afford high-quality hygiene products. Efforts by governments and non-government organizations (NGOs) to promote menstrual hygiene and reduce stigma are also contributing significantly. Innovative and eco-friendly products, such as biodegradable sanitary pads and reusable menstrual cups, are attracting environmentally conscious consumers. In addition to this, e-commerce platforms are making it easier for women to access these products discreetly, thus creating a positive outlook for market expansion.

The USA is emerging as a key market, holding 88.00% of the total share. This is due to heightened awareness of menstrual health, increased accessibility, and a growing variety of products. Each year, Americans spend over $2 billion on menstrual products, with an average individual using nearly 17,000 tampons or pads in their lifetime. Thus, the rising disposable incomes, enabling more women to purchase quality hygiene products are contributing to the market growth. Government initiatives and NGO efforts to promote menstrual hygiene and reduce associated stigmas further aid in market expansion. The introduction of innovative, eco-friendly products, such as biodegradable sanitary pads and reusable menstrual cups, appeals to environmentally conscious consumers. Additionally, the convenience of e-commerce platforms allows for discreet access to these products, broadening their reach. The increasing demand for premium and organic options reflects a prioritization of safety and comfort, driving continuous advancements in product quality and impelling the market growth.

Feminine Hygiene Products Market Trends:

Rise in Awareness and Education Among the Masses

A substantial increase in awareness and education of menstrual health and hygiene is also pushing demand for feminine hygiene products. As estimated by the World Health Organization, over 60% of women in developing countries still are without even basic education on menstrual hygiene. However, things are changing with global efforts on the part of governments, NGOs, and educational institutions. The United Nations reported in 2023 that over 150 million people across 20 countries took part in campaigns to raise awareness of menstrual health. Such programs included educational programs, workshops, and media campaigns meant to remove the stigma around menstruation and to give people correct health information. For example, in India, the "Menstrual Hygiene Scheme" that was initiated by the government has covered over 40 million women since it was introduced. Thus, the purchase of sanitary products has increased by 30% year over year across those regions, and in order to keep pace, a rise in prioritizing menstrual health. Hence, women have increased efforts to find the appropriate, efficient sanitary products.

Surge in Focus on Women Empowerment and Gender Equality

The surge in the focus on women's empowerment and gender equality has been a significant driving force behind the growth of the feminine hygiene products market. According to a 2023 report by the UN Women, over 1.5 billion women globally still lack access to affordable and reliable menstrual hygiene products. This has spurred initiatives by governments and NGOs to address the gender inequality associated with menstrual health. Companies have responded by expanding their product offerings, with a reported 25% increase in demand for menstrual cups and organic cotton products in 2023, as women seek products that align with their health and environmental values. In countries like India, over 85% of urban women now have access to sanitary products, a substantial increase from 60% in 2015, according to the World Bank. This access is essential for enabling women to participate in education, career opportunities, and social activities confidently, thereby empowering them to achieve greater equality in society.

Ongoing Technological Advancements and Product Innovations

Technological developments and innovations in products have shaped the market and fulfilled the changeable demands and needs of women. Manufacturing companies continuously focus on research and development of new products and enhanced or better-quality products to bring more comfort, absorbent properties, and convenience. Another great product that is picking up today is the menstrual cup. Menstrual cups offer greater comfort, longer wear time and lower environmental impact. Thus, they are popular among women who are opting for more eco-friendly alternatives. Eco-friendly materials have also gained popularity in the feminine hygiene products market. For example, Procter & Gamble's organic cotton line grew 14% year over year in 2023, showing increased demand for sustainable products. In addition, advanced designs for leak-proof extended wearing time, and improved absorbency continue to sell well. Super premium feminine hygiene products, in all advanced designs, increased their global sales by 10% in 2023, which further supports this upward trend toward product innovation and inclusion of technology. Many major manufacturers are now using biodegradable and organic materials within these products, which would diminish the environmental impact and increase options for consumers who are focusing more on sustainability. Technological advancements have also led to the development of innovative features and designs, thereby propelling feminine hygiene product market growth.

Feminine Hygiene Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global feminine hygiene products market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Sanitary Pads

- Panty Liners

- Tampons

- Spray and Internal Cleaners

- Others

Sanitary pads are the leading products in the market with an approximate market share of around 45.1% in the year 2024. The high absorbency levels and reliable protection against the menstrual flow from the sanitary pads ensure the comfort and confidence of women in their menstrual cycle. Moreover, with sanitary pads being easily found at various retail outlets, and due to their easy availability, their accessibility is boosting the market's growth, as they are handy for women in different areas.

Sanitary pads also have a long history and familiarity within the market. They have been in use for generations. Generations of women who use them have established confidence in them and trust that is associated with them. The increased popularity of sanitary pads due to their comfort and convenience in the form of soft materials and contoured designs that ensure a comfortable fit and easy use, thus accelerating the product adoption rate. In all, the three aspects of absorbency, accessibility, familiarity, and comfort have ensured sanitary pads as the best option for women looking for menstrual hygiene products.

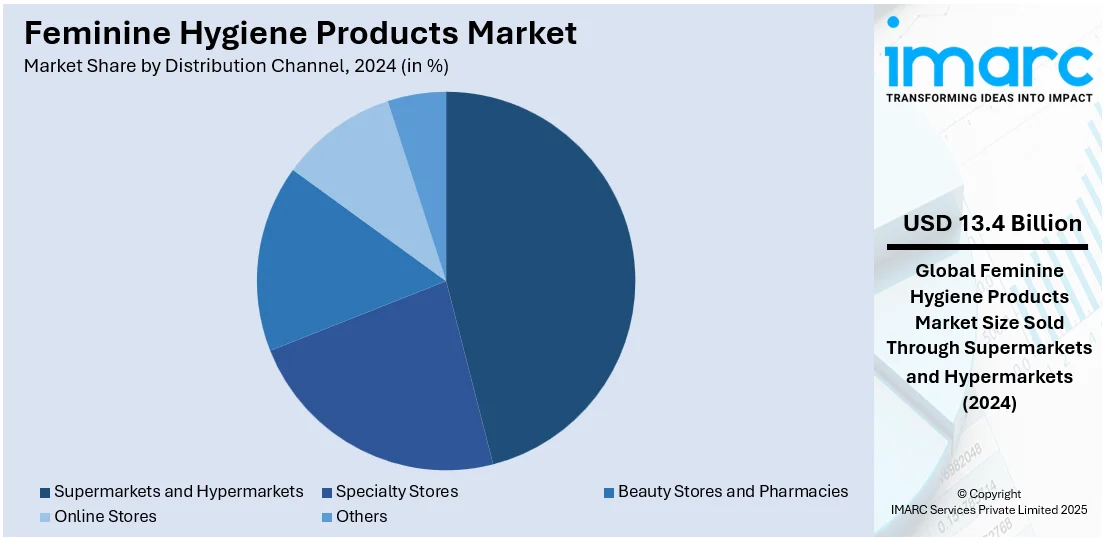

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Beauty Stores and Pharmacies

- Online Stores

- Others

Supermarkets and hypermarkets lead the market with approximately 45.9% market share in 2024. Supermarkets and hypermarkets offer products from various brands, allowing customers to obtain a wide range of selections. This broad assortment guarantees that consumers will be able to locate certain products that cater to their preferences and needs. Furthermore, supermarkets and hypermarkets provide convenience in a one-stop shopping experience, and this fact alone drives market growth.

Additionally, due to their negotiating power and economies of scales, supermarkets and hypermarkets allow price competition. Similarly, as more and more consumers prefer markets where they can bargain more and gain lower prices with manufacturing companies and suppliers are promoting the development of this market. Supermarkets and hypermarkets are investing in strategic marketing and promotion activities, such as point-of-sale displays and other advertisement campaigns, which augment visibility and awareness. All this marketing support and brand presence builds consumer confidence in buying these products from supermarkets and hypermarkets, which in turn provides a positive feminine hygiene products market outlook.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Asia Pacific was the leading market share of over 34.7% in the year 2024. The major growth drivers of the market in Asia Pacific include the increasing awareness of genital health, easy access to the products, and rising affordability. Large populations in the Asia Pacific, especially in developing nations such as China and India present a large consumer base. Moreover, increasing urbanization within the Asia Pacific also contributes. With more people going to urban areas, a large population with a higher income level tends to be a by-product. This growth in income levels allows many individuals to consider personal care items, which include feminine hygiene products. Apart from this, rising awareness in the Asia Pacific region regarding the significance of menstrual health and hygiene and its decreasing stigma and taboo regarding menstruation has further boosted its acceptance and demand. Beyond this, the governments of many nations in the Asia Pacific region have also launched initiatives and campaigns for educating and making women empowered regarding menstrual health, thereby offering a very positive outlook in the market.

Key Regional Takeaways:

North America Feminine Hygiene Products Market Analysis

The feminine hygiene products market in North America is experiencing growth due to increased awareness of menstrual health, higher disposable incomes, and the availability of diverse products. Government initiatives and NGO efforts to promote menstrual hygiene and reduce stigma are also contributing significantly. For instance, federally regulated workplaces in Canada are mandated to provide free menstrual products to employees starting December 15, 2023, ensuring equitable access in the workplace. Besides this, innovative and eco-friendly products, such as biodegradable sanitary pads and reusable menstrual cups, are attracting environmentally conscious consumers. Additionally, e-commerce platforms are making it easier for women to access these products discreetly. The demand for premium and organic options is further expanding as women prioritize safety and comfort, fueling continuous advancements in product quality and variety across the market.

Europe Feminine Hygiene Products Market Analysis

The feminine hygiene market in Europe has grown due to the awareness of menstrual health and sustainability. Organic and eco-friendly products boosted the growth of the market. The European Menstrual Health Survey found that as much as 45 percent of women want their options to be eco-friendly, giving a huge demand for biodegradable pads, organic cotton tampons, and menstrual cups. Even more, majors like Unilever and Johnson & Johnson are taking advantage of this trend by creating new product lines that can satisfy environmental concerns. In 2023, Unilever's "Sustainability Line" of feminine hygiene products had so far generated a 15 percent year-over-year sales increase in the eco-conscious segment. Further, the increasing concern for menstrual education in regions like the UK and France, with governmental support for menstrual hygiene, would further fuel market growth in the next few years.

Asia Pacific Feminine Hygiene Products Market Analysis

The feminine hygiene products market is gaining pace in the Asia Pacific region, with increasing awareness regarding menstrual health and the evolving cultural norms. Significant growth contributors were China, India, and Japan. According to a World Health Organization report, about 85% of women use sanitary products in urban regions in India, which is increasingly different from the traditional methods of usage by cloths or ashes. There is also an uptrend due to the disposable income level and awareness about menstruation hygiene. The demand for organic and eco-friendly products is growing, and local brands such as Sirona and Kaisi are gaining momentum by introducing sanitary products with eco-friendly features. Companies like Procter & Gamble and Kimberly-Clark are expanding their reach through strategic partnerships and acquisitions, with the sanitary product market in India expected to grow by 12% annually through 2025.

Latin America Feminine Hygiene Products Market Analysis

Latin America's feminine hygiene products market is growing steadily, with the improving access to menstrual health education and rising awareness. According to a report by the Latin American Menstrual Health Coalition, more than 80% of women in Brazil now use sanitary products, a significant increase from previous decades. The shift towards social changes such as an increased percentage of women entering the labor market leads to an increase in the demand for convenience products such as tampons and menstrual cups. Another reason is that more consumers prefer organic and environment-friendly products; eco-friendly product sales increased 18% year over year. Local brands, like Cottonelle and Naturalis, are benefiting from these trends. Regional partnerships and improvements in the distribution network also provide a further support to the market by helping products reach underserved areas.

Middle East and Africa Feminine Hygiene Products Market Analysis

The feminine hygiene products market is growing in the Middle East and Africa, as awareness on menstrual hygiene increases with increased emphasis on health education. A 2022 study by the African Menstrual Health Network reports that more than 60% of women in South Africa use sanitary products, and the figure is expected to increase with further access to education and healthcare services. The disposable income is also increasing, particularly in the GCC countries, which contributes to the increased adoption of branded sanitary products. For instance, the UAE market recorded a 14% growth in premium product sales in 2023, a news report stated. Companies like Procter & Gamble are expanding their presence in the region by focusing on both product innovation and the expansion of distribution channels. Increasing support from governments and NGOs is further facilitating market expansion in Africa.

Competitive Landscape:

The global feminine hygiene products market is highly competitive, driven by established brands and emerging players introducing innovative products. Key companies dominate the market with strong distribution networks and diverse product portfolios. These players compete through product innovation, marketing campaigns, and a focus on sustainability, offering eco-friendly options such as biodegradable pads and reusable menstrual cups. Regional brands are gaining traction by catering to localized preferences and affordability, particularly in emerging markets. Private-label products are also expanding, appealing to price-conscious consumers. The rise of e-commerce has further intensified competition, allowing smaller brands to reach broader audiences. Strategic partnerships, acquisitions, and product diversification are common strategies to maintain market share in this rapidly evolving industry, where consumer preferences for quality, comfort, and environmental responsibility are reshaping competitive dynamics.

The report provides a comprehensive analysis of the competitive landscape in the feminine hygiene products market with detailed profiles of all major companies, including:

- Procter & Gamble

- Edgewell Personal Care

- Unicharm

- Kimberly-Clark Corporation

- Kao Corporation

Latest News and Developments:

- October 2024: SOFY, a leading feminine hygiene products brand by Unicharm, unveiled its upgraded SOFY Anti-Bacteria range and introduced the SOFY CLUB APP, marking a significant step in the brand's 'SOFYverse'.

- October 2024: Procter & Gamble Hygiene and Health Care Ltd. reported a marginal 0.57% increase in profit, the quarter ended September 2024.

- August 2024: Laurier, a top brand in sanitary protection in Singapore, has launched its new Feminine Foaming Wash. The product gives women a fresh and hygienic solution for intimate care. It comes with rich, dense foam that cleans without causing irritation to the skin. It also has a convenient pressing pump head for hygiene and easy use. It is formulated to prevent odor and stuffiness, so it is safe for daily use.

- October 2023: Suzano, world's largest producer of market pulp, announced that they will invest USD100 million in a new fluff pulp line to meet the rise in global demand for absorbent personal hygiene products including feminine hygiene products. This investment will take Suzano's annual fluff pulp production capacity from 100,000 to 440,000 tons by Q4 2025. Suzano's Eucafluff, a bleached kraft fluff pulp made from 100% planted eucalyptus, is designed to enhance liquid retention, comfort, and discretion in hygiene products.

- August 2023: The company Sequel, a health and wellness firm for women, has announced that its spiral tampon received approval from the U.S. Food and Drug Administration for marketing. Sequel will sell a product that it believes will restore some life to a commodity category in which it is extremely difficult to innovate.

Feminine Hygiene Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Sanitary Pads, Panty Liners, Tampons, Spray and Internal Cleaners, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Beauty Stores and Pharmacies, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Procter & Gamble, Edgewell Personal Care, Unicharm, Kimberly-Clark Corporation, Kao Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the feminine hygiene products market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global feminine hygiene products market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the feminine hygiene products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Feminine hygiene products include sanitary pads, tampons, panty liners, menstrual cups, and related items designed to maintain personal hygiene during menstruation or other feminine health needs. These products aim to provide comfort, protection, and convenience for women during their menstrual cycles.

The global feminine hygiene products market was valued at USD 29.08 Billion in 2024.

IMARC estimates the global feminine hygiene products market to exhibit a CAGR of 4.15% during 2025-2033.

The market is driven by increasing menstrual health awareness, rising disposable incomes, government and NGO initiatives, and demand for innovative, eco-friendly, and organic products.

In 2024, sanitary pads represented the largest segment by product type, driven by their high absorbency and easy availability.

Supermarkets and hypermarkets lead the market by distribution channel owing to their wide variety of products and competitive pricing.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global feminine hygiene products market include Procter & Gamble, Edgewell Personal Care, Unicharm, Kimberly-Clark Corporation, Kao Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)