Feed Additives Market Size, Share, Trends, and Forecast by Source, Product Type, Livestock, Form, and Region, 2025-2033

Feed Additives Market Size and Share:

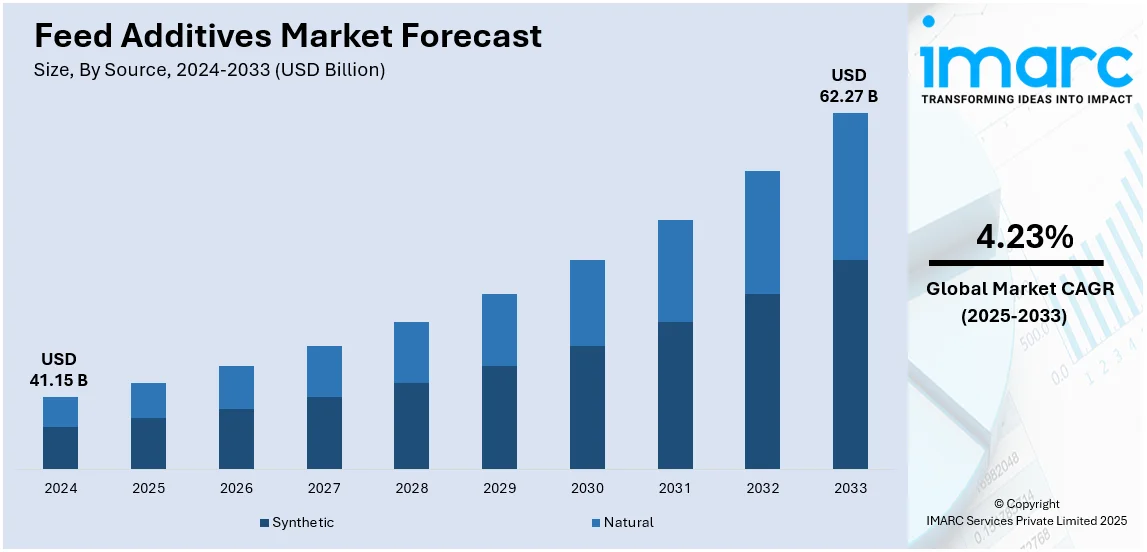

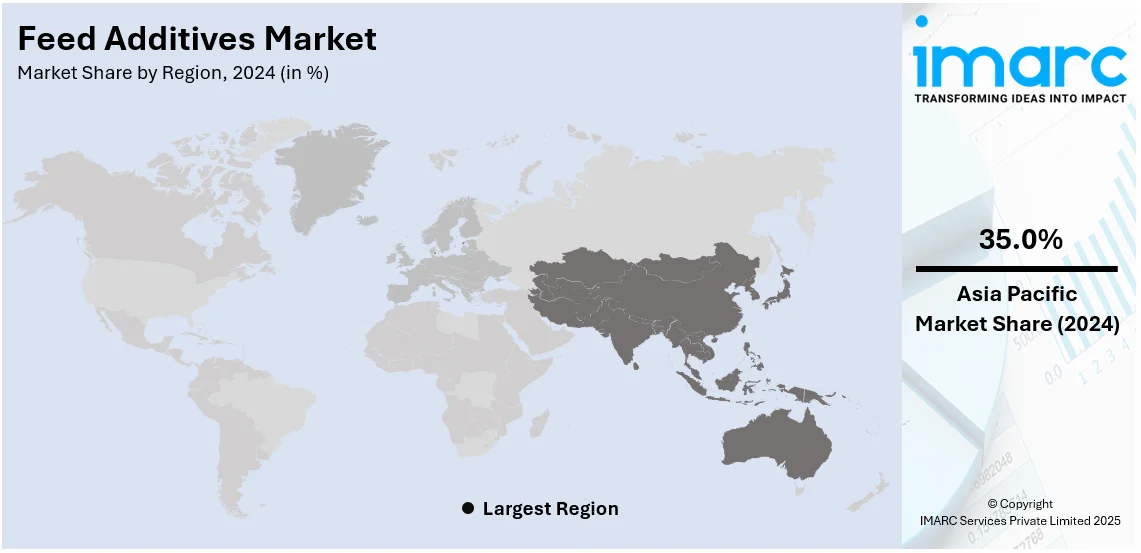

The global feed additives market size was valued at USD 41.15 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 62.27 Billion by 2033, exhibiting a CAGR of 4.23% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 35.0% in 2024. The market is fueled by increasing global demand for high-quality, safe animal protein, compelling the livestock industry to be more efficient and sustainable in terms of production systems. With producers aiming to enhance animal health, feed conversion, and product quality, application of vitamins, enzymes, probiotics, and other additives is still gaining momentum. Some of the major players and factors driving this include increased interest in animal nutrition, increased demand for protein diets, and fast growth of livestock operations across the globe, which are further increasing the feed additives market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 41.15 Billion |

|

Market Forecast in 2033

|

USD 62.27 Billion |

| Market Growth Rate 2025-2033 | 4.23% |

The market for feed additives is spurred by a growing need for quality animal protein and livestock productivity. As the global population continues to grow, the livestock sector finds itself under more pressure to satisfy the demand for meat, milk, and eggs. Feed additives like vitamins, minerals, amino acids, and enzymes enhance animal health, digestion, and feed efficiency. Some of the most important feed additives market trends are the growing awareness of animal nutrition and health management is a very important factor, in addition to minimizing disease breakouts in animals. According to the feed additives market analysis, the trend towards sustainable agricultural practices and the ban on using antibiotics in animal feed is driving the use of natural additives such as phytogenics and probiotics. Technological innovation in feed formulation also stimulates market expansion by making possible tailored, nutrient-enriched feed offerings.

The US market is led by the increasing demand for premium animal protein, such as meat, milk, and eggs, driven by rising consumer preferences for nutrition and sustainably produced foods. Improved livestock production and increased concerns of animal health and nutrition are key drivers. Because of regulatory controls and customers' calls for antibiotic-free products, the transition away from antibiotics in animal feed has contributed to the increase in the usage of natural additives such as probiotics, prebiotics, and enzymes, which is among the key feed additives market growth factors. The livestock industry of the U.S. also gains from advancements in technologies of feed formulation and precision agriculture that enhance feed efficiency and productivity. Government incentives for sustainable farming and the increased emphasis on minimizing greenhouse gas emissions further increase the use of feed additives. For instance, in May 2024, the FDA announced the multi-year review of Bovaer® (3-NOP), a first-in-class methane-reducing feed ingredient and concluded that it satisfies safety and efficacy standards for use in lactating dairy cattle, according to a statement released by Elanco Animal Health Incorporated.

Feed Additives Market Trends:

Increasing number of health concerns

Consumer demand is shifting toward cleaner, antibiotic-free animal products. This is quite pertinent in view of the increasing recognition of the possible health risks associated with antibiotic residues in meat. In this sense, antibiotic-free meat serves consumers' health as well as responds to more general fears over antibiotic resistance - a hot issue in world health. For instance, cow mortality has been rising globally, exceeding 5% annually in many countries, with Denmark's mortality rate reaching 5.4% in 2020 and 5.6% in 2021, highlighting a growing health issue. The livestock industry is looking for alternatives antibiotics to preserve animal health, and probiotics and prebiotics are important feed additions in this regard. These additives help maintain a balanced gut flora, enhance immunity, and reduce disease incidence among livestock. As per feed additives market research report, the product is integral to a new paradigm of animal farming that places consumer health at its core. In addition, the marketing advantage conferred by antibiotic-free labeling creates further incentives for the industry to adopt feed additives. In response to this tendency, producers are also spending money on research to develop natural feed additives that work, so enhancing their significance in the contemporary livestock sector. This trend aligns with the global movement toward clean-label animal products, further boosting the growth potential of natural and functional additives.

Enhanced focus on climate change and resource efficiency

Traditional livestock farming is resource-intensive and contributes significantly to greenhouse gas emissions, including methane, a potent climate-affecting gas. For instance, during 1990- 2023, radiative forcing, which is the warming effect on the climate, primarily due to greenhouse gases emissions, increased by 51.5%. Some feed additives are designed to mitigate this by reducing methane emissions from ruminants like cows and sheep. These additives work by altering the fermentation process in the stomach of the animal, resulting in lower methane production. In addition to reducing the environmental impact of the cattle sector, this also supports international efforts to slow down climate change. As countries strive to meet their carbon reduction targets under agreements like the Paris Accord, the role of feed additives in sustainable animal farming becomes more critical. Livestock farmers, too, are increasingly motivated to adopt environmentally friendly practices due to both regulatory pressures and consumer demand for sustainable products, thus enhancing the market for such specialized feed additives and intensifying the feed additives market dynamics. Growing interest in carbon-neutral farming methods is also opening doors for additives that support emissions tracking and sustainability metrics.

Augmenting demand for humane methods of animal rearing

Animal welfare movements are pressuring the livestock industry to abandon cruel practices and adopt humane methods of animal rearing. For instance, in 2023 the total meat production in India increased by 5.62% as compared to the previous year. An animal in good health is less likely to need emergency care, which is consistent with ethical agricultural practices and compassionate treatment. This not only helps farmers comply with increasingly stringent animal welfare laws but also appeals to a growing segment of consumers who make purchasing decisions based on ethical considerations. As a result, there is an increased emphasis on certifications and labels specifying ethical farming practices, which often include the use of specialized feed additives. The feed additives market worth is determined by the contribution to this ethical shift by enhancing the overall health and well-being of animals, thus reducing the need for invasive treatments or the use of antibiotics that often come under ethical scrutiny. Thus, feed additives play a function that is both nutritional and morally growing, providing livestock farmers with a practical path to ethical, contemporary animal husbandry. This shift is also influencing product development, with manufacturers creating additives tailored for animal welfare-compliant operations.

Feed Additives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global feed additives market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on source, product type, livestock, and form.

Analysis by Source:

- Synthetic

- Natural

Synthetic stand as the largest component in 2024, holding around 73.9% of the market. The synthetic source segment of the market is influenced by several factors. Synthetic feed additives are often more concentrated, leading to lower inclusion rates in animal feeds. They are easier and cheaper to produce as compared to natural sources. Furthermore, synthetic additives come with the advantage of consistency in quality and composition. Regulatory approval processes for synthetic feed additives are well-established, expediting market entry. The ease of customization in synthetic sources to meet specific animal nutritional requirements also adds to its market demand. As per the feed additives market outlook, innovations in synthetic chemistry are leading to more effective and safer feed additives, thus boosting this segment.

Analysis by Product Type:

- Amino Acids

- Lysine

- Methionine

- Threonine

- Tryptophan

- Phosphates

- Monocalcium Phosphate

- Dicalcium Phosphate

- Mono-Dicalcium Phosphate

- Defulorinated Phosphate

- Tricalcium Phosphate

- Others

- Vitamins

- Fat-Soluble

- Water-Soluble

- Acidifiers

- Propionic Acid

- Formic Acid

- Citric Acid

- Lactic Acid

- Sorbic Acid

- Malic Acid

- Acetic Acid

- Others

- Carotenoids

- Astaxanthin

- Canthaxanthin

- Lutein

- Beta-Carotene

- Enzymes

- Phytase

- Protease

- Others

- Mycotoxin Detoxifiers

- Binders

- Modifiers

- Flavors and Sweeteners

- Flavors

- Sweeteners

- Antibiotics

- Tetracycline

- Penicillin

- Others

- Minerals

- Potassium

- Calcium

- Phosphorus

- Magnesium

- Sodium

- Iron

- Zinc

- Copper

- Manganese

- Others

- Antioxidants

- Bha

- Bht

- Ethoxyquin

- Others

- Non-Protein Nitrogen

- Urea

- Ammonia

- Others

- Preservatives

- Mold Inhibitors

- Anticaking Agents

- Phytogenics

- Essential Oils

- Herbs and Spices

- Oleoresin

- Others

- Probiotics

- Lactobacilli

- Stretococcus Thermophilus

- Bifidobacteria

- Yeast

Amino acids leads the market with around 16.8% of market share in 2024. Amino acids as a segment is propelled by several variables. There is a constant demand for protein-rich diets for livestock, which comprises adding essential amino acids to animal feeds. Moreover, a lack of amino acids may cause growth inhibition and health problems in animals, and hence their addition to feed becomes vital. Customized feed formulations also depend much on amino acids to fulfill the specific nutritional requirements. Scientific studies that prove the effectiveness of amino acids in enhancing animal health are also responsible for this factor. The regulatory bodies now realize the importance of amino acids and are thus standardizing their use in animal feeds. Amino acids are versatile and can be added to feeds for different animals, which increases their market appeal.

Analysis by Livestock:

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Breeders

- Swine

- Starters

- Growers

- Sows

- Aquatic Animal

- Others

Poultry leads the market with around 36.9% of market share in 2024. Poultry holds the largest share in the feed additives market due to its high global demand and rapid production growth. As the most consumed meat worldwide, poultry requires efficient feed to ensure optimal health, growth, and productivity. Feed additives play a crucial role in enhancing poultry nutrition by improving feed efficiency, promoting better digestion, and preventing diseases. Additionally, increasing consumer demand for healthier, antibiotic-free meat has driven the need for alternative feed solutions. The growing focus on improving poultry farming practices, coupled with technological advancements in feed additives, has contributed to poultry's dominant position in the market.

Analysis by Form:

- Dry

- Liquid

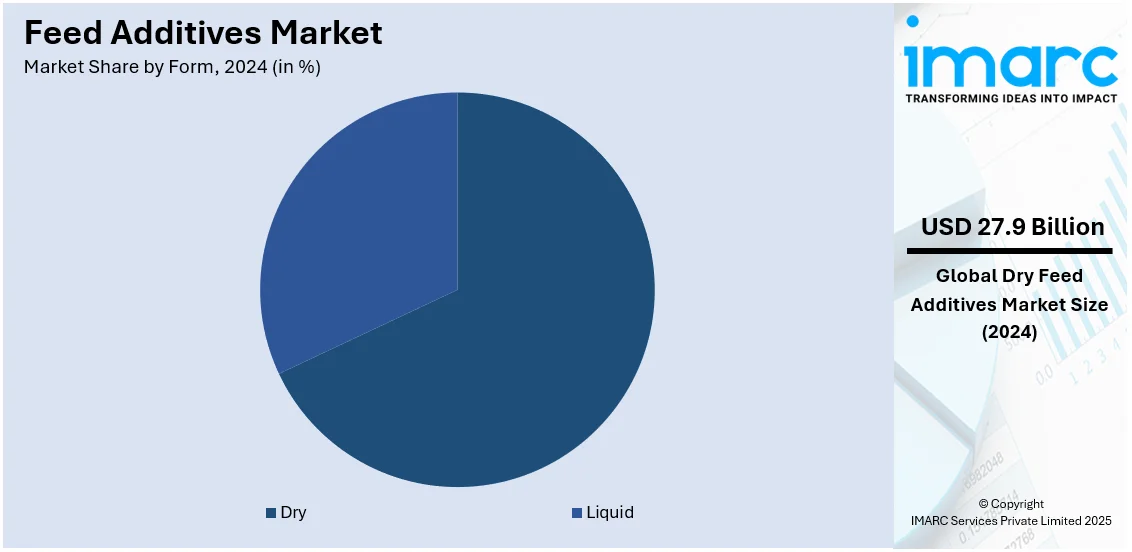

Dry leads the market with around 67.9% of market share in 2024. The dry form is gaining traction due to several reasons, such as, they are easier to store, handle, and mix with feed compared to their liquid counterparts. The dry form is more stable, and therefore shelf life is assured for longer periods, which is preferable for bulk purchases. Manufacturers and end-users prefer this form as the risk of contamination and spoilage is relatively low. These dry forms of the additives are more frequently available in micro-encapsulated form, which would be easier to digest for the animals. Additionally, they cost less in storage and transportation. In general, all these aspects combined drive preference towards the dry segment.

Analysis by Region:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 35.0%. The Asia-Pacific region has seen significant growth in the adoption of feed additives, driven by the increasing livestock population. For instance, the total livestock population in the country has reached 535.78 Million, marking a 4.6% increase over the 2012 Livestock Census. Due to urbanization, as well as changing eating preferences, efficiency of livestock production takes more focus within the region. Increased demand in the consumption of meat and animal products encourages farmers who deal in livestock production to employ feed additives for improvement of their animal's health, rate of growth, as well as efficient feeding. Moreover, they serve to handle an outbreak of any disease affecting these animals while producing in that line. Demand for quality protein sources, mainly driven by the rapidly growing middle class, has added to the call for high-quality animal products. Thus, feeding additives have emerged as a very important part of ensuring the sustainable growth of the livestock sector in Asia-Pacific.

Key Regional Takeaways:

North America Feed Additives Market Analysis

Increased demand in North America to produce quality animal protein is being driven by more efficient livestock production. This growth in demand for sustainable farm-practice-related changes has picked pace for incorporating natural products such as probiotics, prebiotics, and enzymes to be adopted across various regions within this continent as even the regulation authorities are looking tight on antibiotic residue in animal food production. In addition, growing awareness among consumers of the welfare of animals and environmental impacts of livestock farming has spurred the demand for feed additives that help improve feed efficiency and decrease emissions, like products that reduce methane. Other improvements in precision nutrition and feed formulation technologies help develop customized solutions for maximizing animal health and productivity. Government support for sustainable agriculture and innovations boosts market growth in North America.

United States Feed Additives Market Analysis

In 2024, the United States accounted for the largest market share of over 35.0% in North America. The adoption of feed additives is increasing rapidly due to the growing demand for protein-rich diets, particularly in the United States. As consumers shift toward higher protein intake, particularly in meat and dairy products, the demand for efficient livestock production has escalated. This has led to an increase in the need for quality feed additives that enhance the nutritional value and growth performance of animals. Additionally, the expansion of animal feed manufacturing facilities across the region has further driven the demand for these additives. According to reports, the US animal food manufacturing industry, with 5,650 facilities producing over 284 Million Tons of feed annually, benefits animal feeding by improving efficiency and nutrition, driven by advanced, automated mills producing up to 1 Million Tons yearly, supporting growing swine and poultry operations worth approximately USD 52 Billion. The need for improved feed efficiency, disease prevention, and overall animal health is prompting manufacturers to incorporate feed additives into their formulations. This shift is aimed at optimizing production yields, ensuring sustainable agricultural practices, and meeting the dietary requirements of the growing population. With rising awareness about the health benefits of protein-rich diets, the market for feed additives in the region is set to expand.

Europe Feed Additives Market Analysis

The rising production of dairy products and increasing demand for dairy items have driven the adoption of feed additives in Europe. For instance, the EU, producing around 150 Million Tons of milk annually, ranks as the second-largest global producer after India, with rising demand for dairy products driving growth in high-value exports like cheese and supporting animal feed benefits, as production yields per cow can reach 10,000 kg annually. As the dairy industry expands to meet the growing consumer appetite for milk, cheese, yogurt, and other dairy products, there is a pressing need to enhance the quality of feed provided to livestock. Feed additives are becoming indispensable for improving dairy cow productivity, milk quality, and overall health. These additives also help in optimizing nutrient absorption, promoting digestion, and controlling diseases within livestock populations. The need for efficient feeding practices is heightened as dairy producers aim to reduce costs while maintaining high production standards. Additionally, with rising consumer awareness about sustainable and healthy food options, feed additives that improve animal welfare and product quality are gaining traction in the European market, further fueling their widespread use.

Latin America Feed Additives Market Analysis

The growth of e-commerce platforms in Latin America has significantly influenced the adoption of feed additives. For instance, Latin America's e-commerce market has grown 2.8 times in sales value and 3.1 times in transactions, reaching approximately USD 364 Million between 2019-2023, with over 300 Million digital buyers benefiting sectors like animal feed additives through improved accessibility and distribution, poised for 20% growth by 2027. With the increasing accessibility of online retail platforms, the accessibility of feed additives has expanded. Consumers and businesses are now more easily able to purchase animal feed and related products, including additives, through online marketplaces. This shift toward e-commerce has enabled livestock producers, particularly those in remote or rural areas, to access high-quality feed solutions and improve their livestock production systems. The convenience and cost-effectiveness of online shopping are making feed additives more available to a wider audience. This trend is helping smaller businesses and farmers in Latin America implement better feeding practices and optimize their livestock production without having to rely on traditional distribution channels. The rapid growth of digital infrastructure is playing a pivotal role in the increasing adoption of these additives across the region.

Middle East and Africa Feed Additives Market Analysis

The Middle East and Africa are experiencing growing adoption of feed additives due to increasing investments in modern agricultural practices. For instance, Saudi Arabia's FDI inflow in agriculture, forestry, and fishing reached approximately USD 41 Million in 2023, supporting growing agricultural investments that enhance animal feed additives production. These regions focus on improving food security and agricultural and livestock production efficiency. As nations within these regions look to modernize their agricultural systems, there is an emphasis on introducing innovative solutions, including feed additives, to boost the productivity of livestock. These additives help in improving feed conversion ratios, enhancing animal growth rates, and preventing diseases, which is vital as demand for meat and dairy products increases. Furthermore, governments and private sectors are providing financial support for the modernization of farming practices, including the incorporation of feed additives to improve livestock productivity. This trend is crucial for ensuring sustainable agricultural growth and meeting the nutritional needs of rapidly expanding populations in the Middle East and Africa.

Competitive Landscape:

The leading companies in the market prioritize sustainability, innovation, and legal compliance. Product development has been accelerated by the growing demand for natural and antibiotic-free additives, especially in the areas of probiotics, prebiotics, enzymes, and amino acids. By providing customized solutions for regional agricultural needs, regional players also contribute. To increase product portfolios and satisfy the rising demand for high-quality, sustainable animal nutrition in international markets, strategic alliances, acquisitions, and R&D expenditures are typical strategies. For instance, in November 2024, Bovaer®, dsm-firmenich's novel methane-reducing feed additive, was approved for use with dairy and beef cattle in Japan. A big step toward more sustainable agriculture in Japan has been taken with this permission.

The report has also analyzed the competitive landscape of the market with some of the key players being:

- Adisseo

- ADM

- Ajinomoto Co., Inc

- Alltech

- BASF SE

- Bentoli

- Cargill, Incorporated

- Evonik Industries AG

- Kemin Industries, Inc.

- Lallemand Inc.

- Novonesis Group

- Novus International, Inc.

- Solvay S.A.

Latest News and Developments:

- May 2025: ABB announced it will supply automation and electrical systems for a new cattle feed additive facility in Dalry, Scotland, developed by dsm-firmenich to support global methane reduction goals. The site will scale production of Bovaer®, an additive that reduces methane emissions by up to 30% in dairy cows and 45% in feedlot cattle, and is already licensed in over 65 countries.

- February 2025: ITOCHU Corporation announced a comprehensive partnership with Sumitomo Chemical to exclusively handle the global sales of all methionine produced at Sumitomo’s Ehime Works, beginning April 2025. Methionine, an essential amino acid widely used as a feed additive for livestock growth, is part of a market expanding at an annual rate of 4%, driven by the need to supplement corn- and soybean-based feed. This agreement strengthens ITOCHU’s role in the global feed additives market, expanding its reach to over 70 countries and reinforcing its animal nutrition portfolio.

- January 2025: Axitan Limited and QualiTech announced a strategic partnership to develop and distribute endolysin-based feed additives for the poultry, swine, and ruminant industries in North America. The agreement includes exclusive distribution rights for QualiTech on Axitan’s FORC3®, a product shown to reduce Clostridium perfringens infections in poultry, with future expansion into pathogen-specific solutions for other livestock segments.

- November 2024: Layn Natural Ingredients unveiled its new feed ingredient, TruGro® CGA, at EuroTier 2024, aimed at optimizing piglet health and growth during the post-weaning period. Derived from stevia leaf, this innovative product addresses challenges faced by swine producers in supporting piglet development. The company is showcasing TruGro® CGA at Hall 21, Stand #G18 during the tradeshow in Hanover, Germany, from November 12 to 15, 2024. Layn Natural Ingredients, a leader in botanical extracts, serves various industries including food, nutraceuticals, and animal health.

- September 2024: Volac Wilmar Feed Ingredients, a joint venture between Volac and Wilmar International, has launched Mega-Fat 70, a new rumen-protected fat formulation for dairy cows. This product, designed for use throughout lactation, contains 70% palmitic and 20% oleic fatty acids, offering balanced benefits for both farmers and feed mills. Dr. Richard Kirkland, Global Technical Manager at Volac Wilmar, highlights that Mega-Fat 70 combines key advantages from the Megalac range into one formulation.

- September 2024: Novus International and Ginkgo Bioworks have formed a partnership to develop innovative feed additives aimed at enhancing animal agriculture. By leveraging Ginkgo's enzyme services, the collaboration will focus on creating more efficient, cost-effective enzymes for livestock health. This initiative responds to challenges in the agricultural sector, aiming to improve sustainability, efficiency, and the overall well-being of animals like chickens, pigs, and cows.

- August 2024: Volac, a UK-based animal nutrition company, has launched a new website for its feed additives division. The site showcases the company’s range of evidence-based products aimed at enhancing livestock production efficiency and sustainability. It also emphasizes Volac’s expert technical support services for global livestock production systems.

- July 2024: French feed additive company Nuqo continues its global expansion with new affiliates in regions such as Thailand, Mexico, and India, positioning these hubs as key drivers of growth. Despite its wide reach, the company acknowledges its potential for further growth in key markets, signaling room for improvement. Nuqo's flexible strategy paves the way for future developments, with exciting opportunities for new partnerships on the horizon.

Feed Additives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sources Covered | Synthetic, Natural |

| Product Types Covered |

|

| Livestocks Covered |

|

| Forms Covered | Dry, Liquid |

| Regions Covered | Asia Pacific, North America, Europe, Middle East and Africa, Latin America |

| Companies Covered | Adisseo, ADM, Ajinomoto Co., Inc, Alltech, BASF SE, Bentoli, Cargill, Incorporated, Evonik Industries AG, Kemin Industries, Inc., Lallemand Inc., Novonesis Group, Novus International, Inc., Solvay S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the feed additives market from 2019-2033.

- The feed additives market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the feed additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The feed additives market was valued at USD 41.15 Billion in 2024.

IMARC estimates the feed additives market to reach USD 62.27 Billion by 2033 exhibiting a CAGR of 4.23% during 2025-2033.

The global feed additives market is driven by rising demand for high-quality animal protein, increasing livestock productivity, and growing awareness of animal health. Factors like restrictions on antibiotic use, sustainability concerns, and advancements in precision nutrition also contribute, alongside expanding livestock farming in emerging economies and technological innovations in feed formulations.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the global feed additives market include Adisseo, ADM, Ajinomoto Co., Inc, Alltech, BASF SE, Bentoli, Cargill, Incorporated, Evonik Industries AG, Kemin Industries, Inc., Lallemand Inc., Novonesis Group, Novus International, Inc., Solvay S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)