Federated Learning Market Size, Share, Trends and Forecast by Application, Organization Size, Industry Vertical, and Region, 2025-2033

Federated Learning Market Size and Trends:

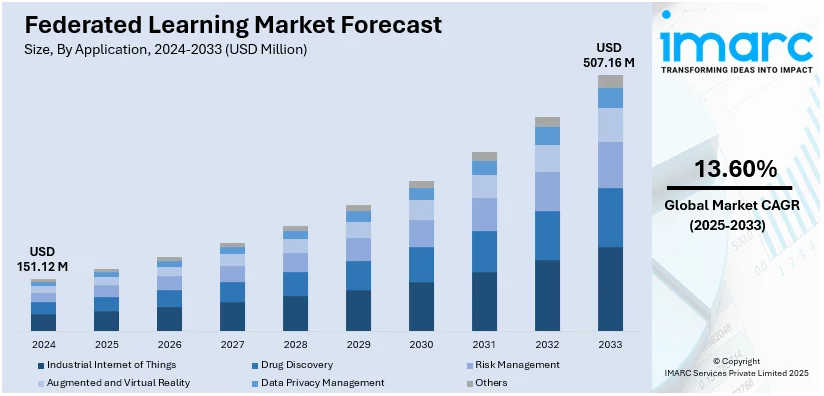

The global federated learning (FL) market size was valued at USD 151.12 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 507.16 Million by 2033, exhibiting a CAGR of 13.60% from 2025-2033. North America currently dominates the market, holding a market share of over 32.7% in 2024. The market is rapidly growing, driven by increasing concerns over data privacy, the rise of connected devices, advancements in edge computing, demand for energy-efficient artificial intelligence (AI) solutions, a focus on personalized applications, and regulatory pressures for data localization.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 151.12 Billion |

| Market Forecast in 2033 | USD 507.16 Billion |

| Market Growth Rate (2025-2033) | 13.60% |

Data privacy has become a major concern in recent years, with organizations, individuals, and governments paying more attention to the handling of sensitive information. The increasing number of high-profile data breaches and scandals has amplified the call for stricter regulations around data use. There was a total of 6,845,908,997 known data breaches in United States during the year 2023. Out of these 2,741 were publicly disclosed incidents. Federated learning addresses these concerns by enabling machine learning (ML) models to train on decentralized data, ensuring that raw data never leaves the device or its source location. This approach aligns with privacy regulations like GDPR in Europe and CCPA in the United States, as it minimizes risks of data exposure and reduces compliance headaches for companies. Additionally, people are becoming more aware of their rights to data ownership. Federated learning empowers users to contribute to AI models without giving away their personal information, making it a user-friendly and privacy-respecting solution.

The United States is a major market disruptor with 87.10% share in North America. This leadership is because of rapid expansion of the Internet of Things (IoT) devices that has created a unique challenge and opportunity for machine learning. Smartphones, wearables, smart home devices, and other connected gadgets generate vast amounts of data daily. It has been found that American adults are projected to spend over 3 hours and 45 minutes per day on smartphone-based internet activities in 2024. This leads to increased data generation and traditional centralized models face limitations in processing this data due to bandwidth constraints, latency issues, and high costs. Federated learning solves these problems by processing data locally on devices, only sharing updates to improve the global model. This approach not only reduces the burden on central servers but also allows devices to learn from each other without exchanging raw data. For example, a group of smart thermostats in different homes can collaboratively learn user preferences while keeping personal data secure. This ability to optimize device performance locally while maintaining connectivity makes federated learning a cornerstone for IoT advancements.

Federated Learning Market Trends:

Increasing Demand for Edge Computing

As the need for faster data processing grows, businesses are turning to edge computing to minimize latency and enhance real-time decision-making. As per the International Data Corporation’s (IDC) Worldwide Edge Spending Guide, spending on edge computing is expected to reach $228 billion by the end of 2024, marking a 14% increase from the year 2023. The report also predicts sustained strong growth through the year 2028, with spending estimated to reach nearly $378 billion. Federated learning complements edge computing perfectly because it processes data at the edge on devices like smartphones, sensors, or edge servers. This reduces the need to send raw data to central servers, cutting down on transmission costs and improving response times.

Rapid Advancements in Artificial Intelligence (AI)

AI has become an integral part of industries like finance, healthcare, entertainment, and retail. According to a survey, 87 percent of organizations worldwide believe that AI technologies will give them a competitive edge. However, training AI models typically requires massive amounts of data, which is often difficult to access due to privacy or logistical concerns. Federated learning offers a way to overcome these barriers by allowing AI models to learn from decentralized data sources without aggregating raw data. This innovation accelerates the development of AI applications while making them more inclusive. Organizations that previously could not participate in AI training due to data sensitivity can now contribute, enriching the diversity of data used in model development. As a result, federated learning is paving the way for more robust and accurate AI systems that are representative of global datasets.

Growing Focus on Energy Efficiency

Energy efficiency is increasingly becoming a crucial factor as organizations strive to lower their carbon footprints. Traditional centralized AI training consumes significant computational resources, resulting in high energy costs. Federated learning (FL) mitigates this issue by performing computations locally on devices, reducing the need for energy-intensive data transfers and centralized processing. This approach is particularly beneficial for industries like agriculture, where energy constraints can be a limiting factor. By adopting federated learning, organizations can train AI models in an environmentally friendly way, making technology more accessible to regions with limited power infrastructure. This energy-saving aspect is not only cost-effective but also aligns with the global push for sustainable practices.

Federated Learning Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global federated learning market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on application, organization size, and industry vertical.

Analysis by Application:

- Industrial Internet of Things

- Drug Discovery

- Risk Management

- Augmented and Virtual Reality

- Data Privacy Management

- Others

Industrial internet of things (IIoT) held the largest market share in 2024, accounting for 26.2%. This dominance stems from the demand for safe, decentralized data processing in manufacturing, energy, logistics, and other industrial sectors. IIoT ecosystems create massive volumes of sensitive operational data via linked sensors and devices. Federated learning provides real-time analytics and predictive maintenance while adhering to strict data privacy requirements and reducing latency difficulties. It improves equipment performance, lowers downtime, and stimulates creativity in smart factories and supply chains, making it an important tool for the changing industrial landscape.

Analysis by Organization Size:

- Large Enterprises

- SMEs

In 2024, large enterprises accounted for the largest market share with 62.5%. This is due to their substantial data volumes, diverse operational needs, and focus on compliance with global data privacy regulations. These organizations often operate across multiple regions and industries, making federated learning an ideal solution for managing decentralized data securely. Large enterprises leverage this technology to enhance customer experiences through personalized services, optimize operations with predictive analytics, and drive innovation while protecting sensitive information. By adopting federated learning, they reduce the risks and costs associated with centralized data storage and processing, ensuring scalability and adaptability in an increasingly data-driven world.

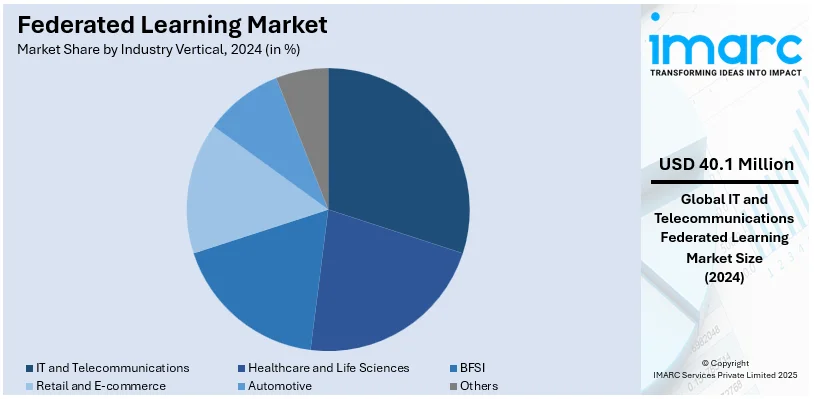

Analysis by Industry Vertical:

- IT and Telecommunications

- Healthcare and Life Sciences

- BFSI

- Retail and E-commerce

- Automotive

- Others

IT and telecommunications lead the market share in 2024 with 26.5%. This dominance is driven by its need to handle vast amounts of user data securely and efficiently. With increasing demand for personalized services, robust network optimization, and advanced fraud detection, federated learning enables telecom companies and IT firms to train AI models on decentralized data without compromising user privacy. It supports real-time analytics for predictive maintenance of network infrastructure and enhances customer experiences by tailoring offerings based on localized insights. This approach aligns with stringent data privacy regulations and facilitates seamless scalability, making federated learning a cornerstone for innovation in the IT and telecom industries.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America held the largest market share with 32.7%. This growth is fueled by the region's advanced technological infrastructure, strong presence of key industry players, and stringent data privacy regulations like CCPA in the U.S. and PIPEDA in Canada. The adoption is driven by industries such as healthcare, finance, and IT, where data security and regulatory compliance are critical. Organizations in the region are leveraging federated learning to enhance AI capabilities while safeguarding sensitive information, particularly in applications like personalized healthcare, fraud detection, and smart city solutions. This growth is further supported by substantial investments in AI research and innovation by both private enterprises and government bodies.

Key Regional Takeaways:

United States Federated Learning Market Analysis

In 2024, the United States held the largest market share in North America with 87.10%. This growth was a result of its leadership in AI innovation, robust ecosystem of tech companies, and a strong regulatory framework for data privacy, such as the CCPA. The country’s large-scale adoption spans industries like healthcare, where federated learning enables personalized treatments while protecting sensitive health data, and finance, where it bolsters fraud detection and compliance with stringent regulations. Additionally, the USA’s significant investment in edge computing and IoT technologies accelerates the implementation of federated learning in smart cities and autonomous vehicles. For instance, in August and September, the government announced $25 million investment in four projects related to edge computing. Also, companies are making efforts to innovate new edge computing solutions. One Stop Systems, in collaboration with U.S. Special Operations Command, is creating advanced edge computing solutions that are suited for military ML and AI applications. These developments are increasing the need for federated learning solution in the country.

Europe Federated Learning Market Analysis

Europe’s federated learning market is propelled by its stringent data protection regulations, particularly the GDPR, which emphasizes user privacy and data security. The technology is gaining traction in healthcare, where federated learning supports cross-border research collaborations without compromising patient confidentiality, and in finance, where it enhances fraud prevention systems. For instance, DRAGON and HealthChain projects aim to employ FL solutions across multiple hospitals in the region, facilitating the prediction of treatment responses for cancer. By assisting clinicians in making treatment decisions based on CT images and histology slides, FL showcased a direct clinical impact. Countries like Germany, the UK, and France are leading adopters, with strong government and private sector investments driving innovation.

Asia Pacific Federated Learning Market Analysis

The Asia Pacific region is experiencing rapid growth in the federated learning market, driven by its expanding technology infrastructure and rising adoption of IoT devices. China’s market for IoT grew from $39 billion in 2022 to $48 billion in 2023 at a growth rate of 22 percent. Countries like China, Japan, India and South Korea are at the forefront, leveraging federated learning for smart city initiatives, e-commerce personalization, and advanced manufacturing. The region’s diverse data privacy regulations, such as China’s Cybersecurity Law, make federated learning an attractive solution for managing data securely across borders. Increased investment in AI research and innovation is further boosting adoption across industries in the region.

Latin America Federated Learning Market Analysis

The Latin American federated learning industry is still in its early phases, but it has considerable potential due to increased digitization across industries and the growing demand for privacy-preserving technology. Countries such as Brazil and Mexico are implementing federated learning in banking for fraud detection and agriculture for predictive analytics to increase yields. Challenges like insufficient technical infrastructure and legislative uncertainty are also being addressed through government initiatives and alliances with global technology firms.

Middle East and Africa Federated Learning Market Analysis

The Middle East and Africa are developing markets for federated learning, owing to investments in smart city projects and digital healthcare programs. Countries such as the UAE and South Africa are exploring the application of federated learning in industries like energy and transportation, where decentralized data processing might increase operational efficiency. Although adoption is slower than in other countries due to infrastructure problems, increased interest in AI and IoT technologies is building the framework for future growth.

Competitive Landscape:

Key market players are working on improving their technologies through strategic partnerships, research developments, and the invention of cutting-edge solutions. They are focusing on the creation of privacy-preserving AI technologies to meet the rising demand for safe and decentralized data processing. In order to maximize performance in a variety of industries, such as healthcare, banking, and the Internet of Things (IoT), these players are also incorporating federated learning into platforms that enable edge computing and machine learning (ML). Significant efforts are being made to enable smooth deployment of real-time applications such as predictive maintenance, tailored services, and collaborative research. Furthermore, collaborations with academic institutions and business leaders are speeding innovation in federated learning, encouraging solutions that meet tight data protection standards while enhancing scalability. Investments in AI technologies and continuous refinement of federated learning frameworks are helping market leaders meet the rising demand for efficient, privacy-focused AI systems across global markets.

The report provides a comprehensive analysis of the competitive landscape in the federated learning market with detailed profiles of all major companies, including:

- Acuratio Inc

- apheris AI GmbH

- Consilient Inc.

- Enveil

- FedML

- Intellegens Limited

- Lifebit Biotech Ltd

- Owkin, Inc

- Sherpa.ai

Latest News and Developments:

- In August 2024, Consilient Inc. and Secura/Isaac Group announced a strategic partnership to enhance financial crime detection using federated learning technology. Through the use of AI, this partnership enables payment platforms, regulators, FIUs, and financial institutions to spot suspicious activity while protecting user privacy.

- In May 2024, apheris AI GmbH announced the general availability of Apheris Compute Gateway 3.0. It is a comprehensive federated analytics and machine learning solution that enables organizations to collaborate securely on highly sensitive data.

Federated Learning Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Industrial Internet of Things, Drug Discovery, Risk Management, Augmented and Virtual Reality, Data Privacy Management, Others |

| Organization Sizes Covered | Large Enterprises, SMEs |

| Industry Verticals Covered | IT and Telecommunications, Healthcare and Life Sciences, BFSI, Retail and E-commerce, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acuratio Inc, apheris AI GmbH, Consilient Inc., Enveil, FedML, Intellegens Limited, Lifebit Biotech Ltd, Owkin, Inc, Sherpa.ai, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the federated learning market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global federated learning market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the federated learning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global federated learning market was valued at USD 151.12 Million in 2024.

The global federated learning market is estimated to reach USD 507.16 Million by 2033, exhibiting a CAGR of 13.60% from 2025-2033.

The key drivers of the global federated learning market include rising concerns over data privacy, increasing adoption of IoT and edge computing, demand for energy-efficient AI solutions, regulatory compliance with data localization laws, and growing investments in personalized applications across healthcare, finance, and smart city technologies.

North America currently dominates the market, holding a market share of over 32.7% in 2024. The market is rapidly growing, driven by increasing concerns over data privacy, advancements in edge computing, demand for energy-efficient artificial intelligence (AI) solutions, and regulatory pressures for data localization.

Some of the major players in the global federated learning market include Acuratio Inc, apheris AI GmbH, Consilient Inc., Enveil, FedML, Intellegens Limited, Lifebit Biotech Ltd, Owkin, Inc, Sherpa.ai, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)