Faucet Market Size, Share, Trends and Forecast by Type, Application, Technology, Distribution Channel, End User, and Region 2025-2033

Faucet Market Size and Share:

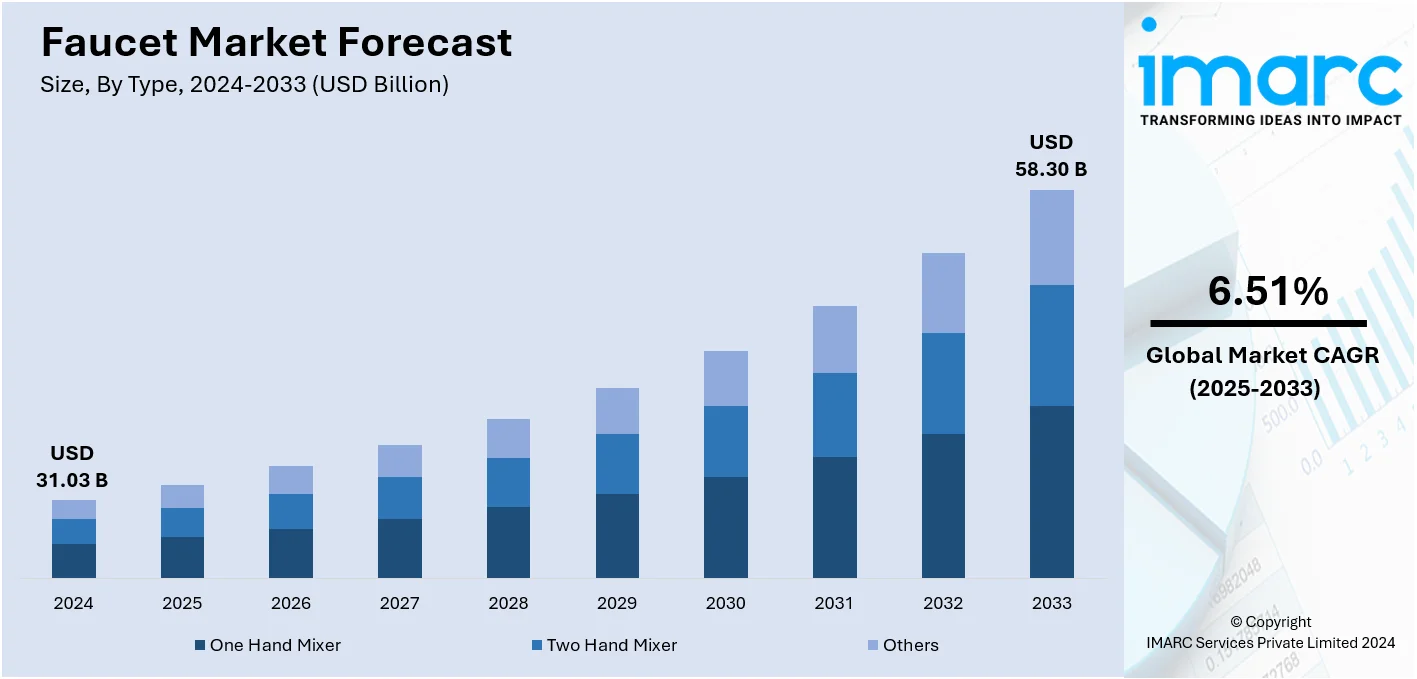

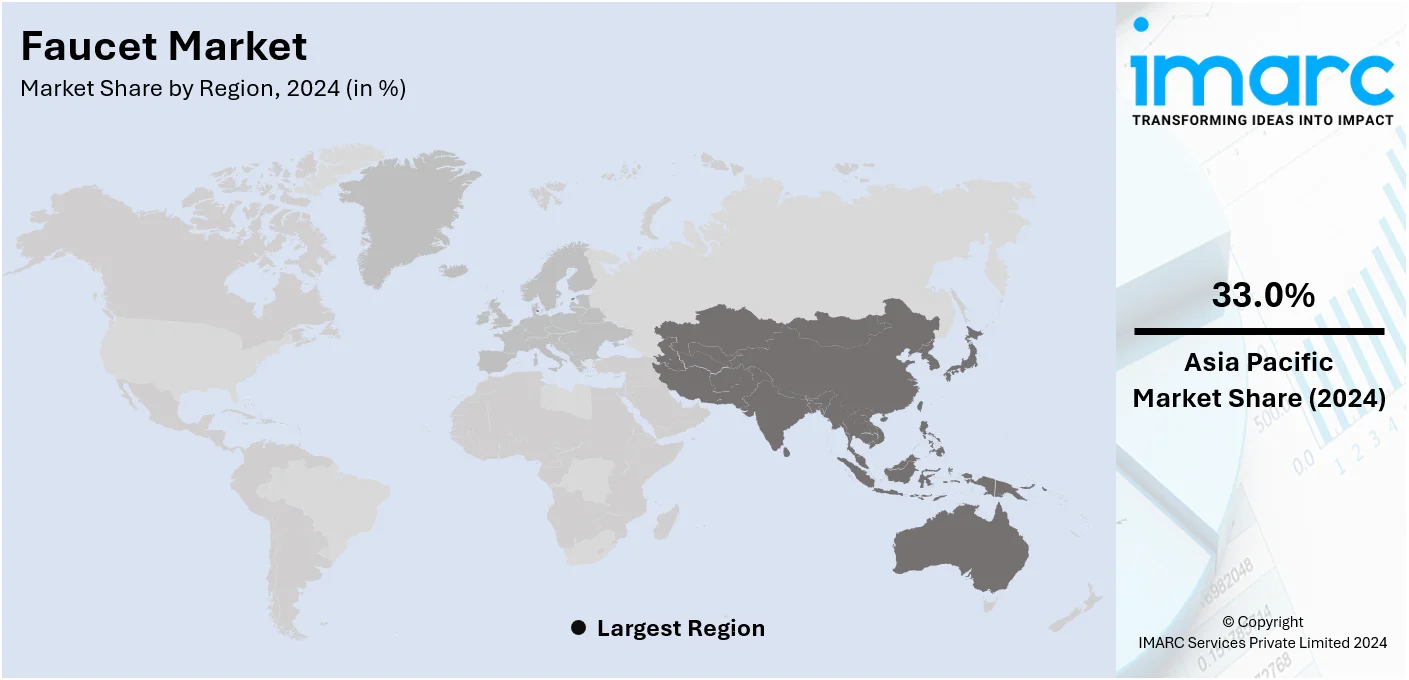

The global faucet market size was valued at USD 31.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 58.30 Billion by 2033, exhibiting a CAGR of 6.51% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 33.0% in 2024. The increasing urbanization across the globe, rising health consciousness among the masses, and significant technological advancements. Additionally, the imposition of strict regulations by governments and organizations, rising expenditure capacities, and the shifting trend towards home improvement and renovations are some of the major factors propelling the faucet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 31.03 Billion |

| Market Forecast in 2033 | USD 58.30 Billion |

| Market Growth Rate 2025-2033 | 6.51% |

The global faucet market is primarily driven by rapid urbanization, a considerable rise residential and commercial construction activities, and increasing consumer awareness of sustainable water usage. Advancements in technology, such as smart faucets with touchless and temperature control features, are enhancing demand in both developed and developing regions. On 20th May 2024, Delta Faucet Company unveiled its Touch2O with Touchless Technology which can be activated in three ways: by motion, touch, or use. This innovative faucet was developed to ensure users have access to clean and easy-to-use controls, featuring a capacitive sensor for detecting human presence and an optional TempSense LED light that turns from blue to red to alert users to changes in water temperature. Additionally, government regulations promoting water-efficient systems and eco-friendly practices are further propelling market growth. Besides this, increasing disposable incomes and a preference for premium, aesthetically designed fixtures are also contributing factors. Moreover, the shift towards home renovation projects and modern kitchen and bathroom designs is playing a key role in expanding the faucet market outlook.

To get more information on this market, Request Sample

The United States stands out as a key regional market, primarily driven by the growing trend of smart homes, with consumers increasingly adopting innovative fixtures that integrate smart technologies. According to a recent study, 32% of U.S. households had smart home technology by 2020, with market adoption expected to reach 57% by the mid-2020s. Smart TVs, plug-ins, and speakers are the most popular devices, and 64% of respondents said they will purchase new smart tech within a year, exceeding industry forecasts. Along with this, rising awareness about water conservation has led to a rise in demand for faucets with flow control and water-saving features. Concurrently, the aging housing infrastructure in the United States is fueling home remodeling and renovation activities, further driving the faucet market demand. Apart from this, shifts in lifestyle preferences, including a focus on minimalistic and modern interiors, have spurred demand for sleek, designer faucets. Furthermore, the increasing influence of e-commerce is also expanding access to a diverse range of faucet products across the country.

Faucet Market Trends:

The Increasing Urbanization Across the Globe

Urbanization is one of the most prominent factors driving the growth of the faucet market. The rapid migration of individuals from rural to urban areas is leading to a rise in construction activities, including new residential developments, commercial buildings, and public infrastructure. This increased construction requires a wide array of plumbing fixtures, including faucets for bathrooms and kitchens. Furthermore, the urban lifestyle demands amenities and conveniences that often necessitate the renovation of older buildings, which further bolsters the faucet market growth. Additionally, urban areas have better water supply systems and sewage facilities, making the installation of advanced faucets more feasible. Moreover, urban areas also attract businesses and commercial setups, such as hotels, restaurants, and offices, which require different types of faucets, thus diversifying the market. For example, according to industry reports, in Q4 2022, there were 14,267 projects in the pipeline worldwide, with a total of 2,298,846 rooms, an increase of 4% YOY. Such trends are expected to augment the demand for different faucets during the forecast period.

The Rising Health Consciousness Among the Masses

Consumers are increasingly becoming aware of the significance of hand hygiene in preventing the spread of viruses and bacteria. This growing health consciousness is driving demand for faucets that offer hygienic features, such as touchless or sensor-based operation, which minimizes physical contact with the fixture and reduces the risk of cross-contamination. According to industry reports, a recent study showed that touchless faucets reduce the spread of germs by up to 80%, which makes them the preferred choice for facilities. Moreover, the widespread utilization of sensor-based faucets in healthcare facilities, where stringent hygiene standards are required, is one of the significant faucet market trends. Additionally, the growing demand for easy-to-clean faucet designs which feature fewer crevices and grooves where bacteria can reside, is supporting the market growth. Moreover, the introduction of faucets with antimicrobial coatings that provide additional protection against bacterial growth is favoring the market growth.

The Significant Technological Advancements

Rapid technological advancements, such as the introduction of sensor-based faucets, which allow touchless operation to improve hygiene and enhance water conservation, is propelling the market growth. Furthermore, the launch of smart faucets, equipped with features such as temperature control settings, water usage data, and compatibility with home automation systems, are contributing to the market growth. In January 2022, Moen introduced its smart faucet, which allows for completely hands-free operation through gestures to control both temperature and flow, highlighting innovation in the industry. Additionally, some advanced faucet models also offer filtration systems that purify water before dispensing, thereby adding an additional layer of safety. Moreover, consumers are showing a keen interest in smart faucets that can be controlled via smartphones, thus aligning with the broader trend of smart home adoption. Besides this, the willingness to pay a premium for these advanced features indicates a robust market potential for technologically enhanced faucets.

Faucet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global faucet market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, technology, materials, distribution channel, and end user.

Analysis by Type:

- One Hand Mixer

- Two Hand Mixer

- Others

One hand mixer leads the market in 2024. One-hand mixers are user-friendly and easy to operate with one hand, making them more convenient than their two-hand counterparts. Furthermore, they have a smaller footprint, making them ideal for compact kitchens and bathrooms where space is at a premium. Additionally, modern one-hand mixers come in a range of stylish designs, which can add a contemporary look to a kitchen or bathroom. Besides this, they are more budget-friendly than other types of faucets, making them attractive to a wide range of consumers. Moreover, one-hand mixers are designed to conserve water, thereby saving on water bills and contributing to environmental sustainability.

Analysis by Application:

- Bathroom

- Kitchen

- Others

Bathroom leads the market with around 42.2% of market share in 2024. Bathrooms are frequently used spaces in both residential and commercial settings, which drives the faucet market demand. Furthermore, they require various types of faucets, such as sink faucets, shower faucets, and bathtub faucets, thus increasing the overall product demand. Additionally, the increasing number of home renovation and improvement projects, which often prioritize bathroom upgrades, including the installation of modern faucets, is supporting the market growth. Besides this, the growing consumer awareness about the importance of water conservation, leading to the adoption of water-efficient bathroom faucets, is favoring the market growth.

Analysis by Technology:

- Cartridge

- Compression

- Ceramic Disc

- Ball

Cartridge leads the market in 2024. Cartridge technology is known for its longevity and resilience, reducing the need for frequent replacements or repairs. Furthermore, faucets with cartridge technology are easy to operate, often requiring just a single handle for both temperature and flow control. Additionally, cartridge faucets can be used in various settings, such as kitchens, bathrooms, and commercial spaces, thereby expanding their market reach. Moreover, they require less maintenance compared to other types, making them a more cost-effective choice in the long run. Apart from this, cartridge faucets are designed to be water-efficient, aligning with environmental sustainability goals and reducing water bills for consumers.

Analysis by Materials:

- Metal

- Plastics

Metal leads the market in 2024. Metals are known for their long-lasting properties, which aid in improving faucet’s service life and reducing maintenance costs. Additionally, metals used in faucets are naturally corrosion-resistant, which makes them ideal for long-term use in wet conditions. Besides this, metal faucets offer high tensile strength, making them resistant to wear and tear, thereby ensuring product longevity. Furthermore, they have a timeless and refined appearance that adds a sense of elegance to both kitchens and bathrooms. Moreover, metals are highly resistant to temperature changes, making metal faucets more suitable for both hot and cold water applications.

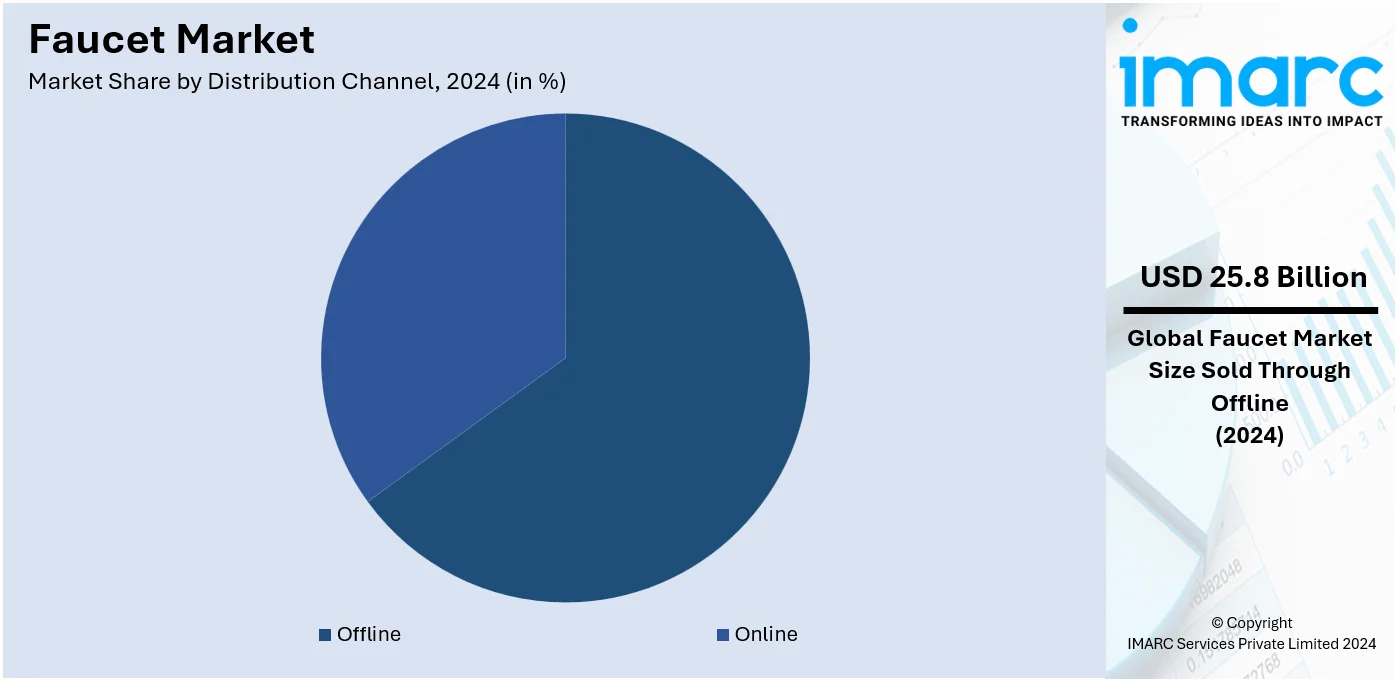

Analysis by Distribution Channel:

- Online

- Offline

Offline leads the market with around 83.3% of the market share in 2024. Offline is dominating the market as consumers prefer to physically inspect faucets before making a purchase to assess the quality, finish, and design. Additionally, offline store staff can offer real-time advice, demonstrations, and customization options, which can significantly influence a customer's purchasing decision. Besides this, they have display units and live demonstrations that allow customers to try the product before committing to a purchase. Moreover, products can be returned or exchanged more easily at offline stores, thus enhancing consumer confidence. Along with this, offline stores provide instant availability of faucets for those in immediate need of a replacement.

Analysis by End User:

- Residential

- Commercial

- Industrial

Residential leads the market with around 53.3% of the market share in 2024. Residential is dominating the market as they have multiple faucet requirements, including kitchens, bathrooms, and outdoor areas. Furthermore, homeowners often replace or upgrade faucets as part of home renovation projects, leading to a consistent demand in the residential sector. Besides this, the availability of a diverse range of design options, finishes, and features, which allows consumers to personalize their living spaces, is contributing to the market growth. Additionally, faucets designed for residential use have a broad range of price points, making them accessible to a wider audience compared to specialized commercial-grade faucets.

Regional Analysis

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 33.0%. Asia Pacific has some of the most populous countries in the world, which naturally translates to higher demand for residential and commercial buildings, and consequently, faucets. Furthermore, the increasing disposable income of the regional population, which allows more spending on home improvement and infrastructure projects, is enhancing the faucet market. Additionally, the high rates of urbanization in many Asia Pacific countries contribute to increased construction activities, which require both residential and commercial plumbing solutions, including faucets. Other than this, rapid growth of hospitality, healthcare, and educational institutions in the region is further contributing to the rising demand for commercial faucets. In addition to this, policies implemented by the regional governments are improving sanitation levels and access to clean water across the region and are also promoting growth.

Key Regional Takeaways:

United States Faucet Market Analysis

In 2024, the US accounted for around 83.30% of the total North America faucet market. As reported by the U.S. Census Bureau, investment in residential construction grew 59% between May 2020 and May 2022, which signifies healthy growth in the housing industry. Construction activity has been on a roll in the United States, and a good portion of that is a major growth driver for the U.S. faucet market because new residential projects need many types of plumbing fixtures, such as faucets in kitchens and bathrooms. Additionally, changed aesthetic preferences along with interior decoration trends significantly contribute to consumer decision-making on materials and finishes. Consumers are always looking for sophisticated, contemporary-looking faucets matching the interior ambiance of their contemporary homes, driving demand for contemporary designs, advanced materials, and finishes for faucets. Furthermore, home remodeling, including renovation and new home construction, are also gaining acceptance, thereby sustaining the faucet market. These trends are likely to continue and thereby sustain U.S. faucet market growth in the coming years, especially for sophisticated and aesthetically appealing products.

Europe Faucet Market Analysis

With this adoption of modern technology and uprising demands for luxury home improvements, the European faucet market is witnessing extreme growth. Since contemporary technology advancements are allowing, manufacturers are progressively offering a wider range of digital and electronic faucets for the residential and commercial purposes. For instance, in January 2022, Daniel Rubinetterie, an innovative manufacturer in Europe, launched 'Reflex,' a new line of faucets designed for kitchen and bathroom applications, catering to the growing demand for smart, stylish fixtures. The increasing desire for modern, opulent homes has also spurred the renovation of kitchen and bathroom settings, further fueling the demand for high-quality faucets and related products. According to industry reports, as consumers in Europe continue their focus on enhancing the aesthetics and functionality of homes, especially their kitchens, a growing market will be witnessed, with digital and touchless faucets leading this demand in terms of future luxury faucet solutions in the market. Furthermore, a rise in investment in the industrial sector and urbanization is expected to contribute to the market growth. As per macro trends, the urban population of the European Union in 2023 stood at 340,311,203, reflecting a 0.8% rise compared to 2022.

Asia Pacific Faucet Market Analysis

The market for Asia Pacific faucets is growing rapidly, driven by rapid urbanization, where the demand for innovative plumbing solutions is increasing. The United Nations Environment Programme (UNEP) reckons that Asia will account for almost half of all new constructions in the world by 2040, thus creating substantial demand for faucets as well as related products for residential and commercial sectors. Based on this growth, producers are launching advanced, fashionable, and functional faucet designs to cater to shifting consumer preferences. For instance, in August 2023, Hindware Limited unveiled two state-of-the-art faucet ranges, namely "Fabio" and "Agnese," with modern technology, creativity, and contemporary design. These expansions are directed at providing comprehensive solutions that increase customers' convenience, targeting a diversified customer base comprising architects, dealers, and builders. These trends are to enhance the growth of the Asia Pacific faucet market due to an uprise in demand for superior, technologically advanced faucets in the region.

Latin America Faucet Market Analysis

Latin American faucet market is growing with great strength due to the increasing demand for houses and changes in the household dynamics. Industry reports say that there is an increase in demand for homes in Mexico, however, the average number of residents per house is declining. In 1990, Mexico had five people per home, however, by 2020, it has declined to 3.6 per home, as per industry reports. This is brought about by urbanization, small family sizes, and increased development of housing. All these aspects contribute to the growing need for modern plumbing fixtures, including faucets. The more homes are built or renovated, the more consumers are turning to high-quality, stylish, and technologically advanced faucets. A third driver is consumer preference for modern, well-designed kitchens and bathrooms. This drives the demand for innovative faucet solutions in Latin America, and trends are expected to continue, creating steady growth for the faucet market in the region.

Middle East and Africa Faucet Market Analysis

Large-scale infrastructure development, and growing demand for modern high-quality plumbing solutions in the Middle East and Africa are creating massive growth for faucets in this region. For example, Saudi Arabia launched its Rua Al Madinah project in August 2022 with the objective of enhancing tourism and pilgrimage industries within the Kingdom. The rising demand for advanced and long-lasting faucets will open an opportunity for expansion in the segments of residential and commercial. In transport and road infrastructure investments by the United Arab Emirates, an equal feature stands out in that country's double-decked Sheikh Zayed road project totalling USD 2.7 Billion, according to industry reports. Hence, such tremendous development, added to other new constructions, makes a growing requirement for faucets and plumbing fixtures in new construction, as well as renovated buildings. The accelerated process of urbanization and modernization in the region has increased faucet demand due to the preference for technologically advanced and water-efficient aesthetically appealing faucets. These factors, along with rising hospitality and commercial sector standards in the Middle East and Africa, will also continue to contribute to faucet growth.

Competitive Landscape:

Leading faucet manufacturers are innovating products with newer features such as touchless technology, voice-activated controls, and water-saving mechanisms, which contribute to the increment of faucet market revenue. Besides, they also manufacture eco-friendly and water-saving faucets to meet the demands of environment-conscious buyers. Moreover, several top market players are developing smart faucets that can be accessed through mobile or connected to a home automation system to improve consumer experience. Apart from this, the leading brands are expanding their product portfolio by adding multiple designs, finishes, and functionalities to establish their strong presence in the market. They are also targeting emerging markets where disposable income is increasing, and construction activities are growing. Besides this, companies are teaming up with designers, architects, and other industry players to produce products that are visually appealing and functionally superior, thus enhancing the value of faucets.

The report provides a comprehensive analysis of the competitive landscape in the faucet market with detailed profiles of all major companies, including:

- Danze Faucets

- Delta Faucet Company

- House of Rohl

- Jaquar India

- Kohler Co.

- LIXIL Corporation

- Moen Incorporated

- Roca Sanitario S.A.U.

- Signature Hardware

- Toto Ltd.

Latest News and Developments:

- October 2025: TOTO has launched its new G Shower and L Shower collections, along with an extended selection of GT, LH, and Pull-Out bathroom faucets for the Indian market. Remaining loyal to TOTO’s philosophy of merging beautiful and cozy spaces with enjoyable experiences, the new collection integrates cutting-edge technology, elegant design, and daily comfort.

- July 2025: PRAYAG INDIA, a prominent producer of high-end bathroom and kitchen fixtures as well as plumbing products, has launched its newest offering, the CP Faucet Colour Range. This fresh collection brings a contemporary touch to standard chrome-plated styles, offering clients an appealing selection of color choices that are practical and aesthetically pleasing.

- February 2025: Delta Faucet, a prominent designer of kitchen and bath products, is unveiling its latest range of product innovations and expansions at the 2025 Kitchen and Bath Industry Show (KBIS) from February 25 to 27 in Las Vegas, Nevada. (Booth # 1139). New Delta® products and innovations debuting at KBIS 2025 feature Delta® Clarifi™ Filtration Systems: Clarifi™ High Flow High Capacity Under Sink Water Filtration System and Clarifi™ 2-Stage Under Sink Advanced Water Filtration System, among other offerings.

- February 2025: Brondell, an innovator of kitchen and bathroom products based in San Francisco, is launching its brand-new Jema Kitchen Faucet Collection at the Kitchen and Bath Industry Show (KBIS) in Las Vegas from February 25 to 27, 2025. Jema serves as the flagship item in Brondell's new faucet line, broadening their market presence while delivering performance, efficiency, and practicality to kitchens across North America.

- May 2024: Delta Faucet Company is introducing Touch2O® featuring Touchless™ Technology. Initially revealed at the 2024 Kitchen & Bath Industry Show, this efficient innovation reduces cleaning time by maintaining kitchen faucets without mess. Touchless Technology simplifies multi-tasking by offering three convenient methods to manage water flow by placing a hand close to the faucet to trigger the motion sensor, tapping any part of the faucet surface, or using the traditional handle for manual operation.

Faucet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | One Hand Mixer, Two Hand Mixer, Others |

| Applications Covered | Bathroom, Kitchen, Others |

| Technologies Covered | Cartridge, Compression, Ceramic Disc, Ball |

| Materials Covered | Metal, Plastics |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Danze Faucets, Delta Faucet Company, House of Rohl, Jaquar India, Kohler Co., LIXIL Corporation, Moen Incorporated, Roca Sanitario S.A.U., Signature Hardware, Toto Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the faucet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global faucet market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the faucet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The faucet market was valued at USD 31.03 Billion in 2024.

IMARC estimates the global faucet market to exhibit a CAGR of 6.51% during 2025-2033.

The market is driven by factors such as rapid urbanization, increasing construction activities, technological advancements in smart faucets, rising health consciousness promoting touchless designs, and government regulations encouraging water-efficient systems.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the faucet market include Danze Faucets, Delta Faucet Company, House of Rohl, Jaquar India, Kohler Co., LIXIL Corporation, Moen Incorporated, Roca Sanitario S.A.U., Signature Hardware, and Toto Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)