Farm Management Software Market Report by Agriculture Type (Precision Farming, Livestock Monitoring, Smart Greenhouse, Fish Farming, and Others), Deployment Mode (On-premises, Cloud-based), Service (System Integration and Consulting, Maintenance and Support, Managed Services, Assisted Professional Services), and Region 2025-2033

Farm Management Software Market Size:

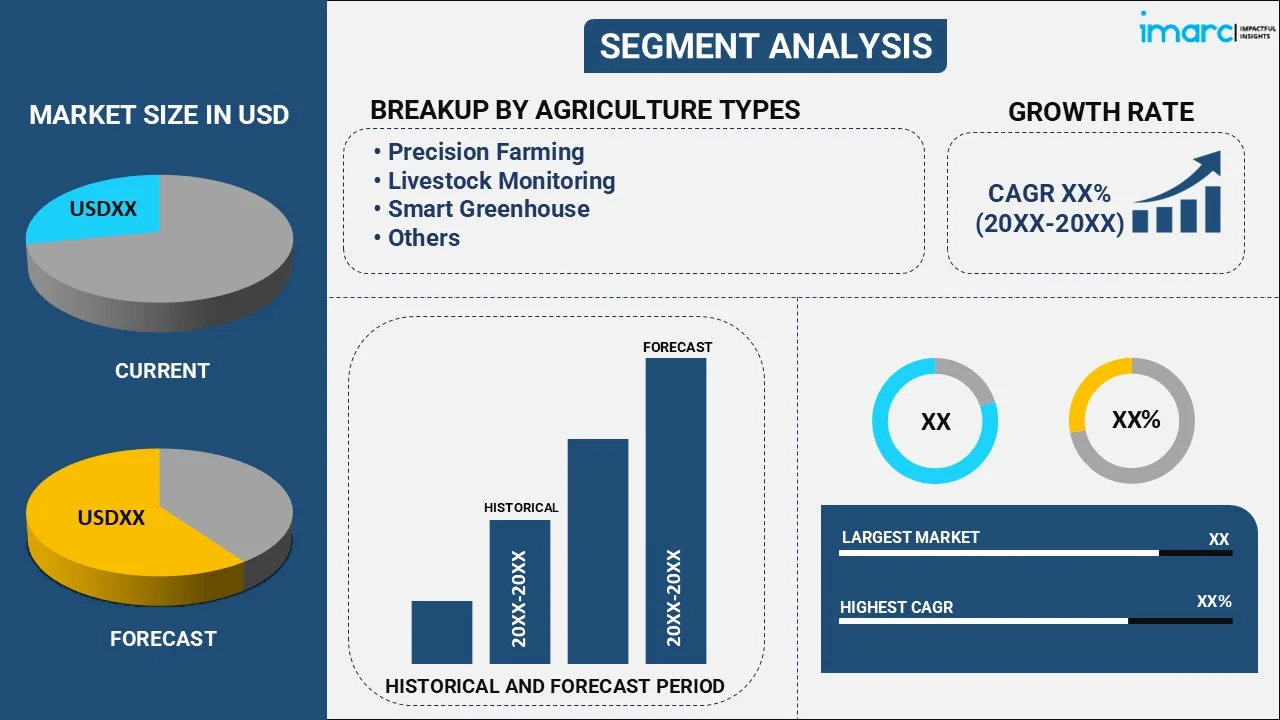

The global farm management software market size reached USD 3.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.0 Billion by 2033, exhibiting a growth rate (CAGR) of 8.96% during 2025-2033. The market is experiencing significant growth due to the rising adoption of precision farming techniques, continual advancements in IoT and big data technologies, increasing government support, the escalating demand for sustainable agriculture, rapid utilization of cloud-based solutions and automated tools, and increasing demand for enhanced livestock management.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.1 Billion |

|

Market Forecast in 2033

|

USD 7.0 Billion |

| Market Growth Rate 2025-2033 | 8.96% |

Farm Management Software Market Analysis:

- Major Market Drivers: The market is majorly driven by the growing trend towards precision farming, emergence of IoT and big data technologies, and the support offered by the government encouraging the adoption of digital farming techniques. These technologies improve productivity, use of inputs, and control of emissions to make farming current and sustainable.

- Key Market Trends: The use of cloud computing as a viable option is a key trend as farmers increasingly rely on remote access to real-time data for better decision-making. This deployment model offers scope, flexibility, and cost efficiency additionally the advantage of collaboration, while precision farming remains in the front line due to the efficient utilization of resources.

- Geographical Trends: North America is the leading region in the global market. The region benefits from government initiatives supporting sustainable agriculture and has a well-established agricultural infrastructure, making it a hub for farm management software adoption.

- Competitive Landscape: Some of the key vendors in the market are Ag Leader Technology, AGCO Corporation, AgJunction Inc., AGRIVI, Corteva Inc., Deere & Company, DeLaval, Microsoft Corporation, Raven Industries Inc. (CNH Industrial N.V.), RELX Group plc, Syngenta (China National Chemical Corporation), The Climate Corporation (Bayer AG), Topcon Corporation and Trimble Inc. These companies are purchasing artificial intelligence, machine learning and IoT technologies to develop new products and services, as well as to sustain market shares within the advancing market.

- Challenges and Opportunities: Some of the challenges in the market include the high initial investment costs and the complexity of integrating advanced technologies into traditional farming practices. However, the potential brought by the increasing demand for sustainability, automation, and resource optimization based on IoT and AI are creating lucrative opportunities in the market.

Farm Management Software Market Trends:

Increased adoption of precision farming techniques

Farmers utilize precision farming to reduce resource consumption, enhance production, and minimizes losses. Various modulating techniques and haphazard implementation of IoT devices, such as geographic information system (GIS), and sensors are presenting real time data of soil parameters, climate, and crop health. These optimizations enable farmers to make the right choices as to when to irrigate, what fertilizer to use and when to apply pesticide, which in turn is driving the global demand. Moreover, with growing concerns over water scarcity and sustainable agricultural practices, precision farming plays the role of an intelligent tool to gather all data for better usage of available resources. Consequently, the demand for farm management software is on the rise as it plays a critical role in the implementation of precision farming techniques.

Government initiatives and subsidies

The authorities of different geographical locations are encouraging the use of advanced tools in farming such as the use of farm management software. Most nations are providing subsidies, grants and even tax incentives to farmers to embrace digital farming technologies. These initiatives aim to increase production of agricultural outputs, food security and sustainable use of agricultural resources. In addition to this, governments of European and North American countries have started policies that encourage the use of digital farming innovations to reduce carbon footprint and enhance land use. This favorable regulatory environment is supporting the growth of the farm management software market, as it reduces the financial burden on farmers and encourages the adoption of digital solutions.

Continual advancements in internet of things (IoT) and big data technologies

The integration of IoT and big data technologies is rapidly changing the landscape in the agricultural sector by offering farmers timely information, thus supporting the farm management software market outlook. Farm management software includes IoT devices such as drones, sensors in the soil, GPS system that collect large volume of information on health of crops, moisture content, soil conditions and weather. This data is processed through analytics and machine learning that enables farmers to provide detailed recommendations on when to water and when to apply fertilizers and pesticides. The wide utilization of IoT-enabled predictive analytics provides the early detection of agricultural issues such as crop diseases or water shortages enabling timely interventions. This technology use in farming is enhancing operational productivity as well as improving crop production and food sustainability.

Farm Management Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on agriculture type, deployment mode and service.

Breakup by Agriculture Type:

- Precision Farming

- Livestock Monitoring

- Smart Greenhouse

- Fish Farming

- Others

Precision farming accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the agriculture type. This includes precision farming, livestock monitoring, smart greenhouse, fish farming, and others. According to the report, precision farming represented the largest segment.

The precision farming holds the largest share in the market. Growing use of precision farming as a means of managing field variability in order to identify area-specific variations in water, fertilizers, and pesticides is contributing to the farm management software market growth. IoT devices, sensors and GPS technologies give real time data on soil condition, climatic conditions, and crop health particularly allowing farmers to target various farming practices. This practice produces high yields while incurring the least amount of costs. Moreover, with the increasing awareness of sustainable farming practices, the precision farming segment remains the most significant driver of the market, primarily due to the enhanced, technological approaches to farming.

Breakup by Deployment Mode:

- On-premises

- Cloud-based

Cloud-based holds the largest share of the industry

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based. According to the report, cloud based accounted for the largest market share.

Cloud-based deployment is dominating the global market as it allows farmers to access data using any device connected to the internet. This model offers various advantages, including scalability, affordability, and secure and real time exchange of data in different places. Additionally, farmers can control operations, receive information about crop status, and locate equipment from any place, enhancing productivity of their decisions. Cloud solutions also help share information with the various stakeholders, such as the agronomist and the supplier through platforms as well. Moreover, the lower upfront costs associated with cloud solutions make them more accessible to small and medium-sized farms, contributing to their widespread adoption.

Breakup by Service:

- System Integration and Consulting

- Maintenance and Support

- Managed Services

- Assisted Professional Services

The report has provided a detailed breakup and analysis of the market based on the service. This includes system integration and consulting, maintenance and support, managed services, and assisted professional services.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest farm management software market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for farm management software.

North America holds the largest share in the global market as the region has well-developed agriculture coupled with the higher prevalence of technology. The United States of America and Canada are among the leading countries in adopting and implementing new technologies such as IoT, precision farming, and automation in farming. Various government policies are encouraging sustainable farming and the provision of financial incentives for the use of digital tools. The need for resource optimization and increasing attention to the food security problem makes the farmers from North America embrace the use of better software which in turn strengthens the region’s leadership on the market.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the farm management software industry include Ag Leader Technology, AGCO Corporation, AgJunction Inc., AGRIVI, Corteva Inc., Deere & Company, DeLaval, Microsoft Corporation, Raven Industries Inc. (CNH Industrial N.V.), RELX Group plc, Syngenta (China National Chemical Corporation), The Climate Corporation (Bayer AG), and Topcon Corporation and Trimble Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the market are investing heavily in the product development and expanding strategic collaborations to increase their market share. Several manufacturers are using digital innovations, such as AI, machine learning, and cloud computing to integrate real-time data and analytics for precision farming. These firms are also partnering with Agritech startups to enhance more automation and adopt data-driven solutions which is a promising aspect through the IoT applications. Further, they are also venturing into new areas of offering functionalities for controlling livestock, managing the supply chain, and sustainability, in order to meet the needs of the farmers.

Farm Management Software Market News:

- On 18th March 2024, Bayer launched GenAI system for farm management that offers quick, accurate answers to complex questions related to agronomy, farm management, and Bayer’s agricultural products. The tool stands out by responding in natural language, offering expert information within seconds, significantly outperforming standard large language models (LLMs) in the agricultural market.

- On 10th October 2023, Zuari FarmHub announced its partnership with CropX Technologies, in digital agronomic solutions. The collaboration aims to revolutionize farming practices by introducing real-time monitoring technology that empowers farmers with data-driven insights for enhanced productivity and sustainability.

Farm Management Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Agriculture Types Covered | Precision Farming, Livestock Monitoring, Smart Greenhouse, Fish Farming, Others |

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Services Covered | System Integration and Consulting, Maintenance and Support, Managed Services, Assisted Professional Services |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ag Leader Technology, AGCO Corporation, AgJunction Inc., AGRIVI, Corteva Inc., Deere & Company, DeLaval, Microsoft Corporation, Raven Industries Inc. (CNH Industrial N.V.), RELX Group plc, Syngenta (China National Chemical Corporation), The Climate Corporation (Bayer AG), Topcon Corporation, Trimble Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the farm management software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global farm management software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the farm management software industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global farm management software market was valued at USD 3.1 Billion in 2024.

We expect the global farm management software market to exhibit a CAGR of 8.96% during 2025-2033.

The rising adoption of farm management software, as it provides predictive analytics and insightful outputs to assist efficient crop growth and animal health is primarily driving the global farm management software market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt of various agricultural practices, thereby negatively impacting the global market for farm management software.

Based on the agriculture type, the global farm management software market has been segregated into precision farming, livestock monitoring, smart greenhouse, fish farming, and others. Among these, precision farming currently holds the largest market share.

Based on the deployment mode, the global farm management software market can be bifurcated into on-premises and cloud-based. Currently, cloud-based exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global farm management software market include Ag Leader Technology, AGCO Corporation, AgJunction Inc., AGRIVI, Corteva Inc., Deere & Company, DeLaval, Microsoft Corporation, Raven Industries Inc. (CNH Industrial N.V.), RELX Group plc, Syngenta (China National Chemical Corporation), The Climate Corporation (Bayer AG), Topcon Corporation, and Trimble Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)