Farm Equipment Rental Market Size, Share, Trends and Forecast by Equipment Type, Drive, Power Output, and Region, 2026-2034

Farm Equipment Rental Market Size and Share:

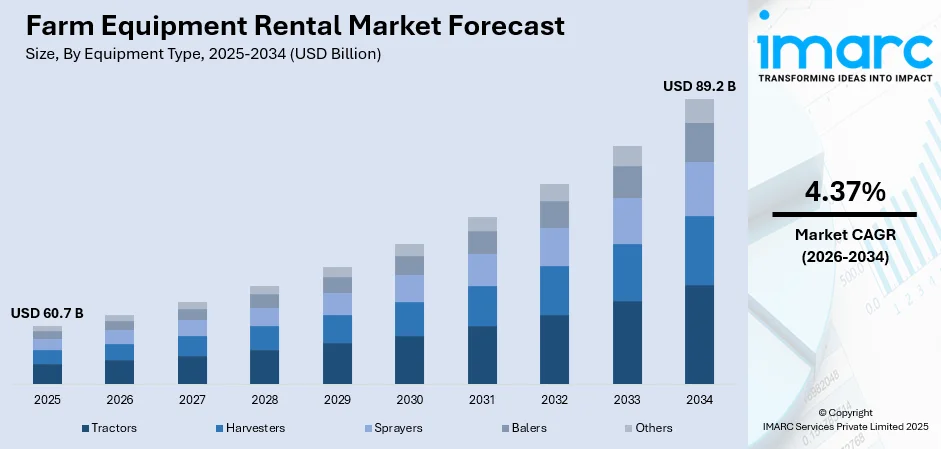

The global farm equipment rental market size was valued at USD 60.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 89.2 Billion by 2034, exhibiting a CAGR of 4.37% from 2026-2034. Asia Pacific currently dominates the market, holding a farm equipment rental market share of over 34.6% in 2025. The rising trend of agricultural mechanization, improved access to advanced technology without heavy investment, an increased demand for flexible farming solutions, rapid urbanization, rising sustainability concerns, the growing trend of precision agriculture, and increasing government support for mechanized farming are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 60.7 Billion |

|

Market Forecast in 2034

|

USD 89.2 Billion |

| Market Growth Rate 2026-2034 | 4.37% |

The high cost of purchasing agricultural machinery is a major driver of the farm equipment rental market. Advanced farming equipment, such as tractors, harvesters, and seeders, requires substantial capital investment, making ownership challenging for small and mid-sized farmers. For example, the operational costs of a 310-horsepower tractor rose by 4%, from $181.10 per hour in 2019 to $189.20 per hour in 2021, increasing financial strain. Renting offers an affordable alternative, providing access to modern technology without heavy financial burdens. Additionally, rental services reduce maintenance and storage expenses, making them a cost-effective solution. Government initiatives promoting farm mechanization through subsidies and cooperative equipment-sharing programs further drive market expansion.

To get more information on this market Request Sample

The U.S. farm equipment rental market is driven by rising mechanization, high machinery costs, and fluctuating agricultural incomes with a significant farm equipment rental market share of 78.80%. Farmers prefer renting over purchasing to reduce financial strain, especially amid unpredictable commodity prices. Advanced technologies, such as precision farming and autonomous equipment, are increasingly available through rental services, enhancing efficiency. Seasonal demand for specialized machinery, such as harvesters, further supports the rental model. Additionally, government programs promoting sustainable farming and cooperative equipment-sharing encourage market growth. The presence of major rental providers and digital platforms facilitating equipment access also strengthens the market, making rentals a viable alternative to ownership.

Farm Equipment Rental Market Trends:

Cost Savings and Flexibility

Farmers, especially small and medium-sized ones, often face financial constraints when purchasing expensive machinery. From industry reports, approximately 570 Million farms exist worldwide with the majority of the world's farmers working as smallholders, with the farms being under two hectares. The smallness and low labour productivity on such farms can discourage smallholders from raising their income. Besides this, high possession costs also include maintenance regime and repair costs, which are typically too expensive for farmers to make. Along with this, according to a 2023 study in the United States, in addition to inflation, farmers lose an average of USD 3,348 per year to repair downtime and limitations imposed by equipment manufacturers that restrict their capacity to repair machinery. Based on the farm equipment rental market report, renting will remain a strong trend since it enables farmers of limited height to use required equipment without the heavy initial ownership expenditure, which is also fueling the market growth worldwide.

Significant Technological Advancements

The speedy growth of agricultural technology, such as precision farming, GPS technology, and autonomous equipment, is serving as a major market driver. For example, in February 2024, John Deere (Deere & Company) introduced new state-of-the-art equipment solutions for Model Year 2025, at the Commodity Classic tradeshow in Houston, Texas. The release features autonomy-ready high-horsepower 9RX series tractors; C-Series air carts, offering new possibilities for enhanced seeding-time productivity, quality, and accuracy; factory installation of the AI-powered See & Spray™ Premium weed sensing technology on Hagie STS sprayers; and S7 Series combines, with new fuel-efficient engines, leading-edge automation features, and redesigned residue-handling, grain-handling, and loss-sensing systems. Farmers are now choosing to lease the most recent technology to maximize efficiency and productivity without the requirement of heavy investments in buying and upgrading machinery. This enables them to employ new, high-performance machinery when required, without the long-term obligations, thereby generating a positive farm equipment rental market forecast.

Fluctuating Demand and Seasonal Operations

Agriculture is highly seasonal, with certain types of equipment only required during specific times of the year, like planting or harvesting seasons. According to industry reports, the number of extreme weather events in Europe has increased by almost half over the last two years. The continent, including the UK, saw more than 16,000 events between 2023 and 2024, as compared to 11,000 between 2021 and 2022. In addition to this, market fluctuations in crop prices and unpredictable weather patterns can make purchasing equipment risky, further encouraging rental solutions for farmers to mitigate financial risks. Moreover, renting provides farmers the flexibility to meet these seasonal demands without having to own equipment year-round.

Farm Equipment Rental Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Farm Equipment Rental market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on equipment type, drive, and power output.

Analysis by Equipment Type:

- Tractors

- Harvesters

- Sprayers

- Balers

- Others

Tractors dominate the farm equipment rental market, holding a 32.6% share, due to their essential role in various agricultural activities, including plowing, tilling, planting, and hauling. Their versatility makes them a crucial asset for farmers, driving high rental demand. The rising costs of new tractors encourage farmers, especially small and mid-sized operators, to opt for rentals instead of outright purchases. Technological advancements, such as GPS integration and automated steering, further boost demand as farmers seek cost-effective access to modern machinery. Seasonal farming cycles also contribute to tractor rentals, as many farmers require them for specific periods. Additionally, increasing mechanization trends and government initiatives promoting efficient farming practices support sustained growth in this segment.

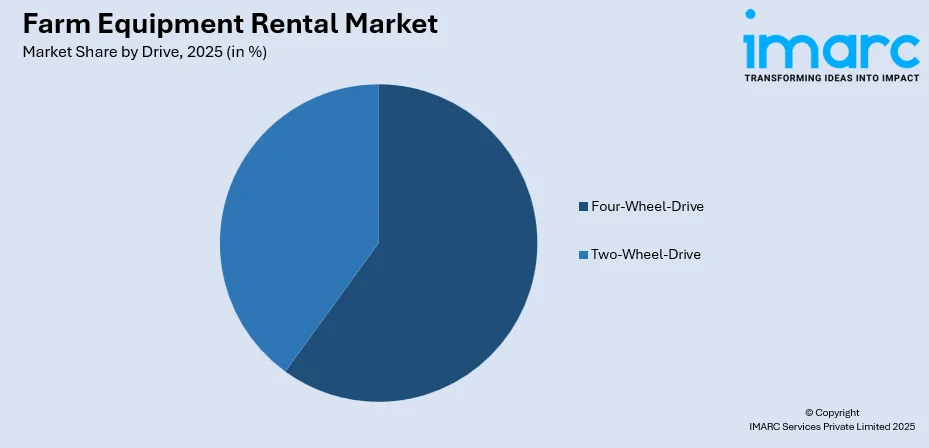

Analysis by Drive:

Access the comprehensive market breakdown Request Sample

- Four-Wheel-Drive

- Two-Wheel-Drive

The dominance of four-wheel-drive (4WD) farm equipment, accounting for 54.6% market share, is driven by its superior power, traction, and efficiency in handling diverse agricultural tasks. These machines perform well in challenging terrains, including wet, uneven, and heavy soil conditions, making them essential for large-scale farming operations. Farmers prefer 4WD tractors and machinery for their higher load-carrying capacity, enhanced fuel efficiency, and ability to operate with various attachments. The growing adoption of precision farming techniques further boosts demand, as 4WD equipment supports advanced technologies like GPS and automation. Additionally, increasing farm sizes, mechanization trends, and the need for high-performance machinery contribute to the segment’s strong growth in both developed and developing agricultural markets.

Analysis by Power Output:

- <30 HP

- 31-70 HP

- 71-130 HP

- 131-250 HP

- >250 HP

The 71-130 HP segment dominates the farm equipment rental market due to its versatility and suitability for a wide range of agricultural tasks. These mid-range horsepower tractors and machinery are ideal for plowing, tilling, planting, and hauling, making them highly preferred by small to mid-sized farms. Their affordability compared to higher HP models makes them accessible for farmers seeking cost-effective rental solutions. Additionally, these machines offer the right balance between power and fuel efficiency, catering to diverse farming needs across different terrains. The demand for mechanized farming in developing regions further drives this segment, as it provides the necessary power without excessive operational costs. Seasonal rental demand for crop-specific activities also contributes to its widespread adoption.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the farm equipment rental market forecast, the Asia Pacific holds a leading position in the farm equipment rental market, accounting for 34.6% share, due to rapid agricultural mechanization and increasing demand for cost-effective solutions among small and medium-scale farmers. The high cost of purchasing advanced machinery makes rentals a preferred option, especially in countries with fragmented land holdings. Government initiatives promoting farm mechanization, subsidies, and cooperative farming models further drive rental adoption. Seasonal farming patterns in the region create fluctuating equipment demand, making short-term rentals an attractive choice. Additionally, technological advancements, including digital rental platforms and telematics-enabled machinery, enhance accessibility. Strong agricultural output and a growing population requiring higher food production further support market expansion across Asia Pacific.

Key Regional Takeaways:

North America Farm Equipment Rental Market Analysis

The North America farm equipment rental market is driven by increasing mechanization, high equipment costs, and fluctuating farm incomes. Farmers in the region, particularly small and mid-sized operations, prefer renting over purchasing to reduce financial burdens associated with machinery ownership, maintenance, and storage. The demand for precision agriculture technologies, such as GPS-enabled tractors and automated harvesting equipment, is rising, making rentals a cost-effective alternative for accessing advanced machinery. Seasonal farming cycles further boost rental demand, as farmers require specialized equipment for short durations. Additionally, government incentives promoting sustainable agriculture and cooperative farming models supporting the farm equipment rental market growth. The presence of established rental providers and digital platforms enhances accessibility, allowing farmers to conveniently lease equipment based on specific needs. Moreover, growing interest in sustainable practices encourages the adoption of modern machinery with lower emissions and higher efficiency. With continuous technological advancements and evolving agricultural practices, the North American farm equipment rental market is expected to expand steadily in the coming years.

United States Farm Equipment Rental Market Analysis

The increase in average farm size in the United States, as reported by the USDA National Agricultural Statistics Service, is a key growth driver for the United States Farm Equipment Rental Market. Between 2017 and 2022, the average farm size grew by 5.0%, from 441 Acres to 463 Acres. Also, the farm equipment rental market in the United States is growing as mechanization becomes essential for improving agricultural efficiency. High ownership costs for large machinery make renting an attractive option, especially for small and medium-sized farmers managing capital investment and seasonal demand fluctuations. Rental service providers offer tractors, harvesters, and implements with flexible terms, ensuring accessibility. For instance, on June 28, 2023, Solectrac introduced an electric tractor rental program through its 70+ U.S. dealer network, featuring the 4WD e25G compact electric tractor (25 HP) for monthly rentals. The battery-powered tractor operates at 65 dB, eliminating emissions and noise pollution. Advanced technologies, including GPS-enabled tractors and precision farming tools, are increasing rental appeal, while government incentives support sustainable equipment adoption. Major rental firms, equipment dealerships, and third-party platforms are intensifying competition. However, challenges such as maintenance costs, logistical complexities, and rural infrastructure limitations may restrict market expansion. The increasing adoption of electric and autonomous farm equipment is expected to shape future rental demand.

Europe Farm Equipment Rental Market Analysis

Farm equipment rental services in Europe are expanding as farmers seek cost-effective solutions amid rising machinery costs. High land fragmentation in countries like Italy and Poland makes ownership impractical for small-scale farmers, increasing demand for rentals. Germany, France, and the UK remain key markets due to strong agricultural sectors and the presence of leading farm equipment manufacturers. According to Gov.UK, the UK agriculture industry had 209,000 farm holdings in 2023, covering 17 Million hectares (70% of UK land). It contributed EUR 13.7 Billion to the economy and employed 462,100 people, representing 1.4% of the workforce, with 65% involved in business ownership or management. The rental market benefits from EU policies supporting sustainable and digital farming, encouraging the use of precision farming equipment. Seasonal crop cycles and cooperative farming also drive demand for short-term rentals. However, equipment shortages during peak seasons and the need for operator training present challenges. The emergence of digital rental platforms and advancements in automated machinery are expected to improve market accessibility and efficiency, offering farmers more flexible and technologically advanced rental solutions.

Asia Pacific Farm Equipment Rental Market Analysis

The market in Asia Pacific is expanding due to increasing mechanization and government initiatives supporting smallholder farmers. According to industry reports, Thailand is transitioning to an agribusiness model, with 46.6% of land (23.9 Million ha) used for farming across 5.9 Million farms. Nearly 50% of farmland is for rice, 21.5% for field crops, and 21.2% for horticulture, with rice farming being the most mechanized. Tractor density in the country exceeds 50 per 1,000 ha. Furthermore, India and China are key rental markets, addressing affordability challenges for rural farmers. Government-backed schemes like India’s Custom Hiring Centers (CHCs) are improving rental accessibility. Japan and South Korea are driving demand for high-tech rentals, including autonomous tractors and drones. Seasonal labor shortages and the need for efficiency support the farm equipment rental market demand, though infrastructure gaps and limited rental fleets in remote areas pose challenges. Digital platforms and financing partnerships are enhancing access to modern equipment rentals.

Latin America Farm Equipment Rental Market Analysis

The farm equipment rental market in Latin America is bolstering due to economic constraints and increasing mechanization. Brazil, Argentina, and Mexico lead the market, supported by government subsidies. For example, on December 3, 2024, Brazil announced BRL 546.6 Billion for sustainable agro-industrial chains, targeting 28% family farm mechanization by 2026 (35% by 2033) and encouraging tractor adoption. Brazil’s agro-industry expects BRL 296.3 Billion in private investments by 2029. Rental services help small and medium-sized farmers manage high machinery costs and credit limitations. Seasonal demand fluctuations drive interest in tractors, sprayers, and harvesters, though rural connectivity and fragmented supply chains remain challenges. Digital platforms, financing support, and technological advancements will drive future growth in rental accessibility.

Middle East and Africa Farm Equipment Rental Market Analysis

The market in the Middle East and Africa (MEA) is growing as mechanization becomes essential for improving agricultural productivity. The World Bank, on December 19, 2024, approved USD 250 Million for Morocco’s Transforming Agri-food Systems Program, promoting no-till agriculture, mechanized climate-smart farming, and insurance reforms, benefiting 1.36 Million people, including 120,000 farmers. Countries like South Africa, Nigeria, and Egypt are witnessing rising demand for rentals due to high equipment costs. Government programs and international funding initiatives are increasing rental access for smallholder farmers. Water-efficient technologies and precision irrigation rentals are expanding in the Middle East. Challenges include limited infrastructure, low awareness, and servicing constraints. Agritech startups, digital platforms, and smart farming investments in drones and automation are expected to augment rental adoption across MEA.

Competitive Landscape:

The competitive landscape of the farm equipment rental market is characterized by the presence of established players and emerging service providers offering a diverse range of machinery. Companies compete based on equipment availability, pricing models, service quality, and technological integration. Digital rental platforms are gaining prominence, enhancing accessibility and ease of booking. The market is witnessing increased partnerships between rental providers and agricultural cooperatives to expand reach. Technological advancements, such as GPS-enabled tractors and autonomous machinery, are becoming key differentiators. Additionally, flexible rental plans, including short-term and long-term leases, are being introduced to cater to varying farmer needs. The growing focus on sustainability and cost efficiency is also driving innovation and competition in the sector.

The report provides a comprehensive analysis of the competitive landscape in the Farm Equipment Rental market with detailed profiles of all major companies, including:

- AGCO Corporation

- Deere & Company

- Escorts Limited

- Flaman Group of Companies

- Friesen Sales & Rentals

- Messick Farm Equipment Inc.

- Pacific Ag Rentals

- Pacific Tractor & Implement

- Premier Equipment Ltd.

- The Papé Group Inc.

- Titan Machinery Inc.

- Tractors and Farm Equipment Limited

Latest News and Developments:

- In June 2023, Philadelphia's Burro, an independent mobility firm offering Agriculture industry solutions company, announced a new alliance with Salinas, Calif.-based Pacific Ag Rentals (PAR), a top supplier of agricultural tractor and equipment rentals in the United States. The alliance aims to bring autonomous Burro robots into PAR's equipment inventory, with shipping accessible anywhere in the U.S.

- In April 2024, H&E Equipment Services signed a definitive agreement to acquire Lewistown Rental and its three affiliates in Montana. The acquisition expands H&E’s rental fleet, valued at USD 28.5 Million, and strengthens its 145-location network across 30 states, serving non-residential, industrial, and agricultural markets.

- In September 2024, BiofuelCircle launched its first large-scale deployment of farm equipment in Uttar Pradesh, India. On the BiofuelCircle platform, farmers can rent their tractors, operate equipment, and create extra revenue streams.

- In December 2024, Agtonomy expanded its automation rental program to Washington State, targeting fruit, nut, and wine grape growers. The program offers electric and diesel automation for tasks like mowing, spraying, and weeding with flexible rental options. Agtonomy secured USD 32.8 Million in Series A funding to scale operations across the U.S. and internationally.

Farm Equipment Rental Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Tractors, Harvesters, Sprayers, Balers, Others |

| Drives Covered | Four-Wheel-Drive, Two-Wheel-Drive |

| Power Outputs Covered | <30 HP, 31-70 HP, 71-130 HP, 131-250 HP, >250 HP |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGCO Corporation, Deere & Company, Escorts Limited, Flaman Group of Companies, Friesen Sales & Rentals, Messick Farm Equipment Inc., Pacific Ag Rentals, Pacific Tractor & Implement, Premier Equipment Ltd., The Papé Group Inc., Titan Machinery Inc., Tractors and Farm Equipment Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the farm equipment rental market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global farm equipment rental market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Farm Equipment Rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Farm Equipment Rental market was valued at USD 60.7 Billion in 2025.

The farm equipment rental market was valued at USD 89.2 Billion in 2034 exhibiting a CAGR of 4.37% during 2026-2034.

The farm equipment rental market is driven by high equipment costs, seasonal farming needs, and increasing demand for advanced machinery. Limited capital among small farmers, rising mechanization, and sustainability concerns further boost rentals. Additionally, technological advancements and government support for shared agricultural resources contribute to market growth.

Asia Pacific leads the farm equipment rental market due to increasing mechanization, high demand from small and mid-sized farmers, and government initiatives promoting agricultural efficiency. Rising costs of machinery drive farmers toward rentals, while the presence of major agricultural economies like India and China further strengthens market dominance.

Some of the major players in the Farm Equipment Rental market include AGCO Corporation, Deere & Company, Escorts Limited, Flaman Group of Companies, Friesen Sales & Rentals, Messick Farm Equipment Inc., Pacific Ag Rentals, Pacific Tractor & Implement, Premier Equipment Ltd., The Papé Group Inc., Titan Machinery Inc., Tractors and Farm Equipment Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)