Indian Agricultural Equipment Market Size, Share, Trends and Forecast by Equipment, Application, and Region, 2025-2033

Market Outlook 2025-2033:

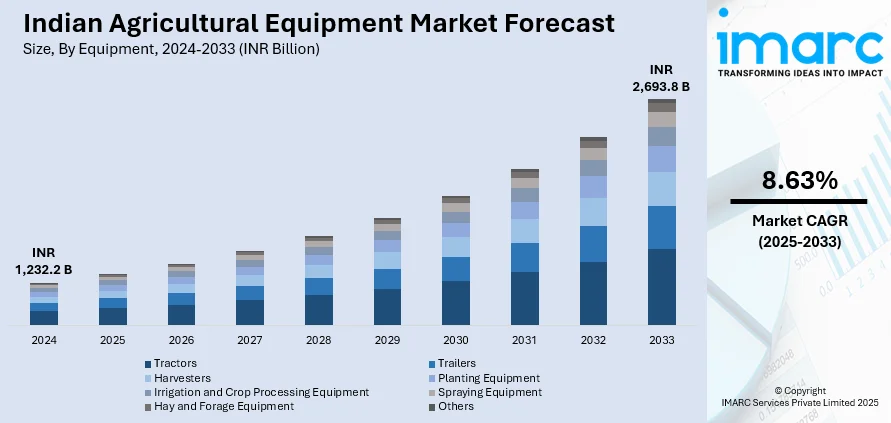

The Indian agricultural equipment market size reached INR 1,232.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach INR 2,693.8 Billion by 2033, exhibiting a growth rate (CAGR) of 8.63% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 1,232.2 Billion |

|

Market Forecast in 2033

|

INR 2,693.8 Billion |

| Market Growth Rate 2025-2033 | 8.63% |

Over the last few years, there has been a considerable progress in agriculture mechanization. A significant proportion of farmers in the country have already started moving from using animate sources to mechanical equipments to power their farming activities. Mechanical equipments for various farm operations like tillage, sowing, irrigation, plant protection and threshing, etc., are generally being used by the farming community. As a result of increasing farm mechanization trends, the agricultural equipment market has witnessed strong growth in the past few years. This market is currently being driven by a number of factors such as easy availability of credit, government incentives, increasing agricultural productivity, emergence of contract farming, increasing rural incomes, etc.

To get more information of this market, Request Sample

Indian Agricultural Equipment Market Drivers:

- Labour Shortage: Labour shortage has been a major reason that has driven farmers towards farm mechanization. Large scale migration from rural to urban areas and a number of rural employment schemes have created a labour shortage in rural areas. For instance, the National Rural Employment Guarantee Agency (NREGA) has had in many places a ripple effect - labour shortage leading to farm mechanization. The implementation of this scheme has significantly reduced the inflow of seasonal migrant labourers from Bihar and UP to states like Haryana and Punjab during the crucial sowing and transplantation season. As a result, the demand for farm machines in these states has witnessed a significant increase.

- Ease of Financing: In recent years, a number of banks and microfinance institutions have been set all across rural India. This has provided farmers an easy availability of credit to purchase farm machinery.

- Government Incentives: Incentives in the form of subsidies, low import duties on agricultural machinery and easy financing schemes by the Indian government has also been a major driver of the farm equipments market in India.

- Rising incomes: As a result of strong economic growth and agricultural productivity, the income levels of rural households have been continuously increasing over the last few years. Rising incomes have enabled farmers to significantly increase their spending on agriculture mechanization.

- Large Untapped Market: Despite strong growth in recent years, the penetration of tractors and a number of related equipments still remains relatively low. This is expected to leave a lot of room for future growth.

- Emergence of Contract Farming: The emergence of contract farming is also expected to give a strong boost to the agricultural equipments market in India. We expect contract farming to enable farmers to get the benefit of technology, training and financing with the contractor’s support. This is expected to facilitate the adoption of mechanized farming practices.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Indian agricultural equipment market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on equipment and application.

Breakup by Equipment:

- Tractors

- Trailers

- Harvesters

- Planting Equipment

- Irrigation and Crop Processing Equipment

- Spraying Equipment

- Hay and Forage Equipment

- Others

Based on the equipment, the market has been segmented as tractors, trailers, harvesters, planting equipment, irrigation and crop processing equipment, spraying equipment, hay and forage equipment and others.

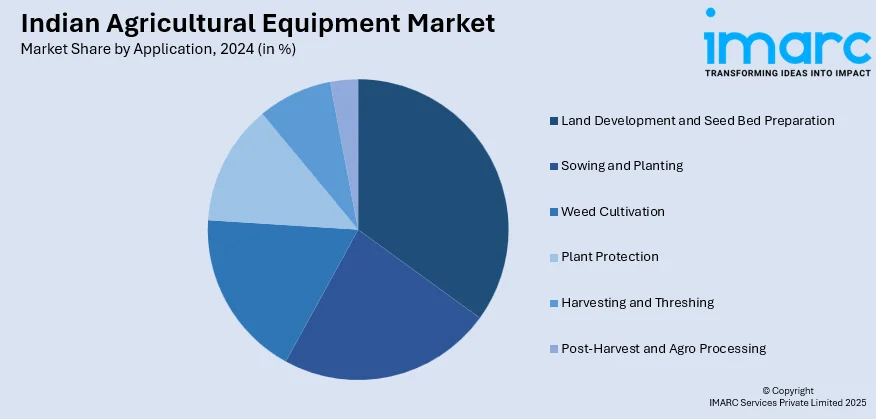

Breakup by Application:

- Land Development and Seed Bed Preparation

- Sowing and Planting

- Weed Cultivation

- Plant Protection

- Harvesting and Threshing

- Post-Harvest and Agro Processing

On the basis of application, the market has been segmented as land development and seed bed preparation, sowing and planting, weed cultivation, plant protection, harvesting and threshing, and post-harvest and agro processing.

Breakup by Region:

- North India

- South India

- West India

- East India

On the basis of region, the market has been segmented as North India, South India, East India and West India.

Competitive Landscape:

The competitive landscape of the market has also been examined in the report and the profiles of key players have also been provided.

This report provides a deep insight into the Indian agricultural equipments market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Indian agricultural equipments market in any manner.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion |

| Segment Coverage | Equipment, Application, Region |

| Region Covered | North India, West India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian agricultural equipment market was valued at INR 1,232.2 Billion in 2024.

We expect the Indian agricultural equipment market to exhibit a CAGR of 8.63% during 2025-2033.

The emerging farm mechanization trends, coupled with the growing adoption of contract farming that aid in facilitating agricultural equipment from the buyers, are primarily driving the Indian agricultural equipment market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing demand for agricultural equipment across the nation to promote the machine-centric farming activities, with minimal manual interventions for maintaining social distancing.

Based on the equipment, the Indian agricultural equipment market has been segmented into tractors, trailers, harvesters, planting equipment, irrigation and crop processing equipment, spraying equipment, hay and forage equipment, and others. Among these, tractors represent the largest market share.

Based on the application, the Indian agricultural equipment market can be bifurcated into land development and seed bed preparation, sowing and planting, weed cultivation, plant protection, harvesting and threshing, and post-harvest and Agro processing. Currently, land development and seed bed preparation accounts for the majority of the total market share.

On a regional level, the market has been classified into North India, South India, West India, and East India, where North India currently dominates the Indian agricultural equipment market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)