Failure Analysis Market Size, Share, Trends and Forecast by Equipment, End Use, Industry, and Region, 2025-2033

Failure Analysis Market Size and Share:

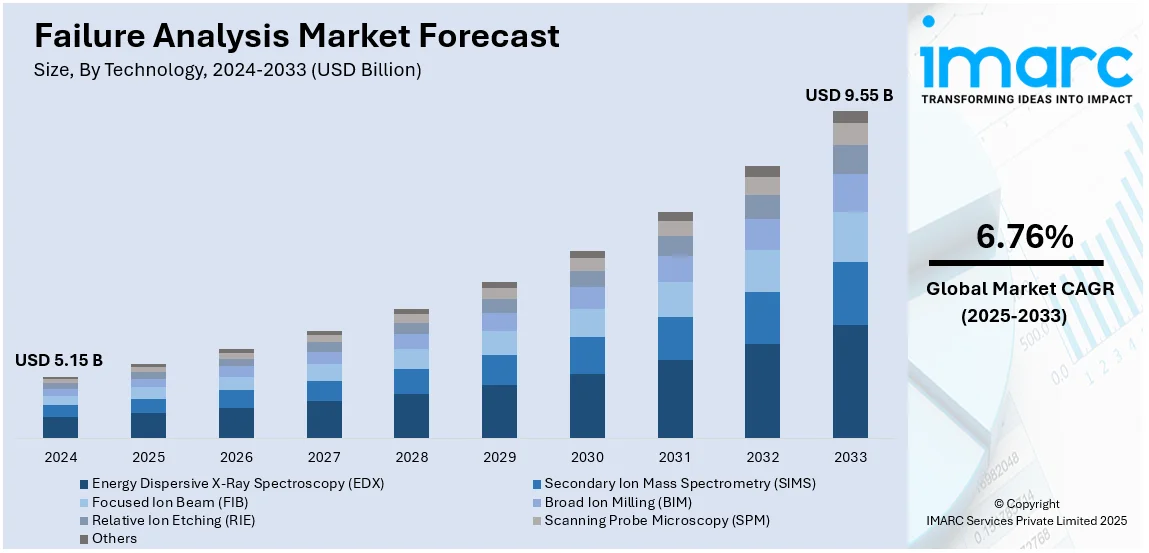

The global failure analysis market size was valued at USD 5.15 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.55 Billion by 2033, exhibiting a CAGR of 6.76% from 2025-2033. North America currently dominates the failure analysis market share by holding over 40.2% in 2024. The market in the region is driven by its advanced manufacturing sectors, significant research and development (R&D) investments, and a strong emphasis on product quality and regulatory compliance across industries like electronics, aerospace, and automotive.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.15 Billion |

|

Market Forecast in 2033

|

USD 9.55 Billion |

| Market Growth Rate (2025-2033) | 6.76% |

The global failure analysis market growth is spurred by the expanding demand for product reliability and safety across industries like aerospace, automotive, and electronics. This is increasing the need for advanced failure analysis solutions, which are aiding the market growth. Moreover, ongoing technological advancements in microscopy and spectroscopy enhance accuracy and efficiency, fueling the market demand. Besides this, stricter regulatory standards push industries to adopt failure analysis for compliance. Also, the rising R&D investments drive innovation in analysis techniques, thus impelling the market growth. Furthermore, the rapid growth of the semiconductor industry fuels the demand for defect analysis, which is driving the market demand. For example, Bosch invested USD 1.9 billion to upgrade its Roseville, California facility for the production of SiC power semiconductors, with the initiative backed by proposed government loans. In line with this, the increasing adoption of artificial intelligence (AI) and automation in failure analysis improves precision and reduces operational costs, catalyzing the market growth.

The United States is emerging as a key region with 84.80% share. The failure analysis market demand in this country is driven by the strong defense and aerospace sectors of the country, as they require rigorous failure analysis to ensure mission-critical system reliability. In addition, the increasing semiconductor manufacturing reshoring initiatives boost the demand for advanced defect detection, which is strengthening the market share. For example, the United States Commerce Department approved a USD 1.5 billion subsidy for GlobalFoundries to expand semiconductor production in New York and Vermont, strengthening domestic chip manufacturing capabilities. Concurrently, the rise of electric vehicles (EVs) necessitates failure analysis for battery safety and performance, fostering the market growth. Additionally, the growing adoption of 5G and the Internet of Things (IoT) technologies fuel the demand for failure analysis in electronics, which is contributing to the market expansion. Furthermore, stringent Food and Drug Administration (FDA) regulations drive the market demand for failure analysis in medical devices. Apart from this, the expansion of AI-driven predictive maintenance in industrial sectors enhances the need for advanced failure diagnostics, thereby propelling the market forward.

Failure Analysis Market Trends:

Increasing Complexity of Products and Systems

The rising complexity of products and systems within the aerospace and automotive industries along with electronics and manufacturing drives businesses to conduct failure analysis. The enhancement of product sophistication requires identifying failure origins to guarantee operational reliability and safety alongside performance quality. The market expansion of failure analysis services continues because companies need to prevent expensive failures and extend product durability while improving system operational effectiveness. Moreover, the complexity challenges caused by growing product intricacy became evident when NVIDIA released its hardware products series networked components in February 2024. Besides this, systems with increased complexity lead to higher chances of component failure occurrences. The NVIDIA Failure Analysis Lab aims to resolve problems at both silicon and board levels so advanced failure analysis techniques become essential for managing complex engineering systems effectively. Apart from this, the market shows rising demand for accurate failure detection which is influencing the failure analysis market trends.

Stringent Safety and Regulatory Standards

The rising demands from governmental agencies and regulatory bodies compel industries to meet strict safety requirements which makes failure analysis essential for compliance. The automotive aerospace and energy sectors together with other industries need to perform routine failure analysis examinations to satisfy their safety quality and performance requirements. Failure analysis service demand increases due to regulatory pressure because the analysis helps organizations identify potential risks to reduce liability risks while improving customer trust. The Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) have set stringent failure analysis and testing standards to ensure aircraft safety in the aerospace sector. Furthermore, automotive industry reports show that the Takata airbags recall serves as an essential demonstration of failure analysis significance in the sector because hundreds of millions of U.S. vehicles received the defective airbag design that led to dangerous explosions triggering fatal injuries. Besides this, regulatory standards and public safety measures require extensive failure analysis, which enhances the failure analysis market outlook.

Rising Demand for Predictive Maintenance

The rising adoption of predictive maintenance approaches by industries focuses on minimizing downtime and extending asset lifecycles, thus strengthening the failure analysis market share. Failure analysis acts as an essential component of predictive maintenance because it detects early indicators of equipment or system failure which enables organizations to intervene before breakdowns occur. The market continues to expand because high demand exists for real-time monitoring systems combined with predictive capabilities that help prevent unplanned shutdowns. Besides this, predictive maintenance supports operational efficiency through AI-based preventive maintenance which leads to a breakdown reduction of 30% to 50% among manufacturers. This development decreases operational interruptions while extending asset service life to support long-term company success and significant cost reduction. Apart from this, failure analysis within predictive maintenance becomes crucial because businesses need to achieve higher levels of efficiency and reliability, thereby impelling the market forward.

Failure Analysis Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global failure analysis market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on equipment, technology, and end use industry.

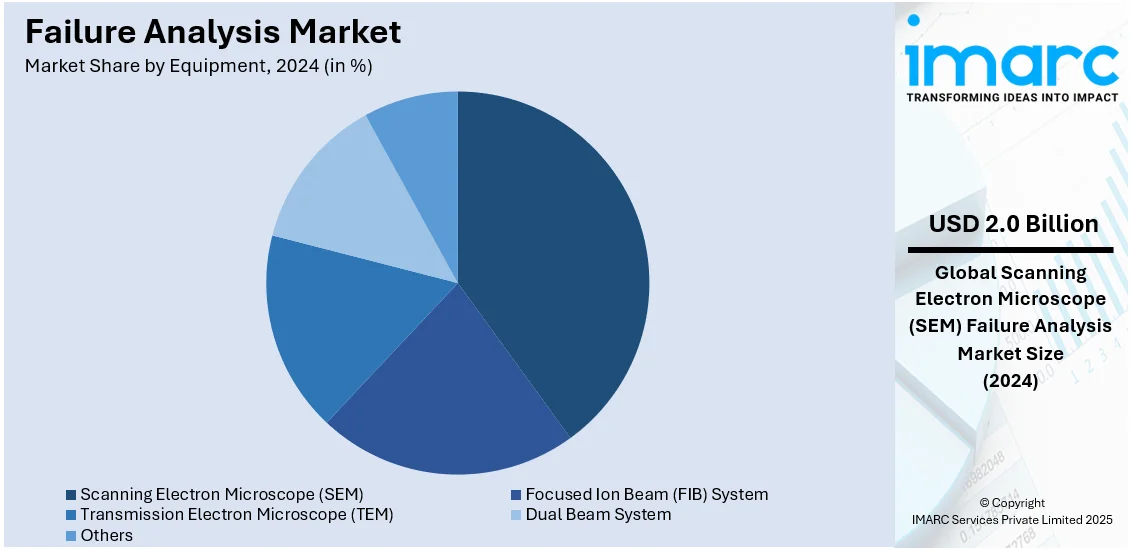

Analysis by Equipment:

- Scanning Electron Microscope (SEM)

- Focused Ion Beam (FIB) System

- Transmission Electron Microscope (TEM)

- Dual Beam System

- Others

The scanning electron microscope (SEM) represents the largest market segment with 38.9% share. SEM provides high-resolution imaging at the microscopic level, which is critical for discovering and investigating material defects. Its capacity to record specific surface details and detect abnormalities like cracks, fractures, and other flaws makes it useful in a variety of sectors, including electronics, aerospace, and automotive. The SEM's versatility in studying both conductive and non-conductive materials, as well as its ability to do elemental analysis using energy-dispersive X-ray spectroscopy (EDS), contribute to its supremacy in failure analysis applications. As companies focus quality control and defect avoidance, demand for SEM in failure analysis is projected to stay strong, fueling market expansion.

Analysis by Technology:

- Energy Dispersive X-Ray Spectroscopy (EDX)

- Secondary Ion Mass Spectrometry (SIMS)

- Focused Ion Beam (FIB)

- Broad Ion Milling (BIM)

- Relative Ion Etching (RIE)

- Scanning Probe Microscopy (SPM)

- Others

The secondary ion mass spectrometry (SIMS)segment holds the largest market share due to its unmatched sensitivity in detecting trace elements and contaminants. SIMS is widely used in the semiconductor industry for depth profiling and surface analysis, ensuring precise defect detection in microelectronics and nanotechnology. Its ability to analyze thin films and detect low-concentration impurities makes it crucial for quality control in industries like aerospace, automotive, and medical devices. Additionally, SIMS supports advancements in material science by providing detailed chemical composition analysis. As industries demand higher precision and reliability, the adoption of SIMS continues to grow, reinforcing its dominance in the failure analysis market.

Analysis by End Use Industry:

- Automotive

- Oil and Gas

- Defense

- Construction

- Manufacturing

- Others

The report indicates that the automotive segment leads the market, driven by the industry's growing emphasis on vehicle safety, reliability, and the integration of advanced technologies. Failure analysis enables manufacturers to test critical components like battery sensors and electronic control units because of the emergence of electric vehicles together with autonomous driving systems. The requirement to detect defects thoroughly together with material testing emerges from stringent safety regulations and regulatory standards. Furthermore, modern vehicles need increased failure analysis because they utilize advanced materials alongside lightweight composites combined with high-performance electronics. As a result, prevailing market dominance will continue for precise failure diagnostics as the automotive industry advances toward innovations.

Regional Analysis

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the market, holding a significant market share of 40.2% due to its strong presence in industries like semiconductors, aerospace, automotive, and electronics. The region benefits from high R&D investments, advanced manufacturing facilities, and a strong regulatory framework ensuring product quality and safety. Moreover, the rapid adoption of cutting-edge technologies, such as AI-driven failure analysis and automation, further drives market growth. Additionally, government initiatives supporting domestic semiconductor production and electric vehicle development increase the demand for failure analysis services. For example, the U.S. government secured a preliminary agreement with Bosch for up to USD 225 million in subsidies to manufacture silicon carbide power semiconductors in California, which are crucial for electric vehicles (EVs). With a strong focus on innovation and stringent quality standards, North America continues to lead the global failure analysis market.

Key Regional Takeaways:

United States Failure Analysis Market Analysis

The failure analysis market in the United States is growing, largely due to the ever-increasing size of the semiconductor and electric vehicle sector. The Semiconductor Industry Association documented that U.S. economic sector performance reached USD 257.5 billion in 2021 through its most recent industry sales data release. Although these products contain complicated content their failure potential grows in parallel with product usage. Besides this, the electric car registration market experienced exponential growth during 2023 because new registrations reached 1.4 million and exceeded 2022 levels by 40% as per International Energy Agency statistics. Furthermore, the rapid expansion of electric car markets requires intensified failure analysis adoption by the automotive manufacturing sector because safety together with quality and performance stand as its primary focal points. The aggressive growth patterns of semiconductor and EV industries will drive market expansion within failure analysis in the United States.

Europe Failure Analysis Market Analysis

The Europe failure analysis market is growing significantly due to the increasing demand for electric vehicles and the growth of the semiconductor industry. The International Energy Agency reports that new electric car registrations in Europe reached 3.2 million in 2023, reflecting a 20% increase compared to 2022. The rise of EVs demonstrates the rising technological complexity of vehicles making failure analysis essential for preserving both safety features and performance together with reliability. The semiconductor market across Europe will continue to grow because the EU Chips Act actively works to build stronger semiconductor infrastructure within the European marketplace. The Chips for Europe Initiative will activate EUR 43 Billion (USD 44.8 Billion) worth of public and private financing from public funds which includes EUR 3.3 Billion (USD 3.4 Billion) from European budget support. Also, the semiconductor investment drives the growing demand for failure analysis services among different industries, supporting European failure analysis market expansion.

Asia Pacific Failure Analysis Market Analysis

The Asia Pacific semiconductor industry expansion creates a strong demand for failure analysis products. The Semiconductor Industry Association (SIA) reports that semiconductor sales in China totaled USD 14.76 billion in January 2024, up from USD 11.66 billion in January 2023. Semiconductor production increases while device complexity grows which results in rising demand for failure analysis techniques to produce dependable and effective semiconductor devices. The Indian government approved three new semiconductor manufacturing facilities through its national incentive program in March 2024 to strengthen regional semiconductor operations. Furthermore, the semiconductor industry's ongoing development increases the product quality improvement requirements and defect identification needs thus driving the Asia Pacific failure analysis market growth. The advancements in the semiconductor industry indicate that Asia Pacific has an increasing demand for sophisticated failure analysis solutions across its region.

Latin America Failure Analysis Market Analysis

The failure analysis market in Latin America is booming because of the rapidly increasing demand for EVs and increased investment in the automotive and semiconductor industries. The region purchased around 90,000 electric vehicles during the year 2023. Brazil together with Colombia Costa Rica and Mexico form the primary leaders. The International Energy Agency (IEA) reports that Brazil achieved a record-breaking growth of electric car registrations during the year reaching over 50,000 vehicle registrations alone. Moreover, the fast-growing EV market demands sophisticated failure analysis methods that focus on securing the reliability and safety of EV battery systems alongside electronic components. Additionally, the expanding semiconductor market of Latin America will drive up the need for failure analysis services that identify probable component breakdowns. Furthermore, the market requires failure analysis services as a result of advancing technological product complexity while sustainably growing practices which establishes the market as a primary driver for expansion.

Middle East and Africa Failure Analysis Market Analysis

The failure analysis market in the Middle East and Africa (MEA) is growing, driven by the United Arab Emirates government's efforts to enhance its industrial manufacturing sector through initiatives like Vision 2021, the Dubai Industrial Strategy 2030, and the Abu Dhabi Economic Vision 2030. The target establishes an objective to grow industrial manufacturing GDP contribution beyond 25 percent from its current level. The regional emphasis on industrial growth drives up failure analysis service requirements within the automotive, aerospace, and energy industries. Besides this, the region requires more thorough failure analysis to preserve product reliability and operational efficiency and maintain safety standards because industries steadily adopt advanced technologies during their modernization process. The demand for failure analysis services is also increasing because manufacturing innovation along with local semiconductor and electronics industries requires it to prevent expensive breakdowns and enhance operating performance. As a result, the MEA region stands to become the primary market driver for global failure analysis development based on current market trends.

Competitive Landscape:

The competitive landscape of the failure analysis market is marked by the presence of several key players focusing on technological advancements and strategic collaborations. Major companies are investing in R&D to enhance their analysis tools, such as SEM and FIB systems. Strategic partnerships, mergers, and acquisitions are prevalent as companies seek to broaden their service offerings and extend their geographical presence. Additionally, players are increasingly adopting automation and AI technologies to improve accuracy, speed, and cost-efficiency. There is also a trend toward offering integrated solutions that combine failure analysis with predictive maintenance to meet the growing demand for proactive quality management in various industries, including electronics, automotive, and aerospace.

The report provides a comprehensive analysis of the competitive landscape in the failure analysis market with detailed profiles of all major companies, including:

- A&D Company Ltd.

- Bruker Corporation

- Carl Zeiss AG (Carl-Zeiss-Stiftung)

- Hitachi High-Technologies Corporation (Hitachi Ltd.)

- Horiba Ltd.

- Intertek Group PLC

- JEOL Ltd.

- Motion X Corporation

- Tescan Orsay Holding A.S.

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- May 2024: Hitachi High-Tech Corporation released its latest models, High-Resolution Schottky Scanning Electron Microscopes SU3900SE and SU3800SE. These state-of-the-art instruments are reportedly being designed for the detailed observation of large and heavy specimens to the nanometer level. One of its excellent features is the camera navigation system, which combines images to present the operator with a comprehensive view of the entire specimen, thereby providing better opportunities to identify areas of interest and improve the overall user experience.

- April 2024: The 14ACMOS project, sponsored by the European Union, is driving forward semiconductor manufacturing technologies. The program is focused on the creation of chip structures that are as small as 14 angstroms. Physik Instrumental (PI) is making significant contributions in this area with ultra-precise positioning systems that can provide sub-nanometer accuracy.

- January 2024: India's electric vehicle market witnessed attention after an accident caught a Volvo C40 Recharge electric SUV, priced at INR 63 lakh (USD 0.073 Million), on fire. Though it is still uncertain what led to the fire, this incident puts emphasis on the need for product failure analysis. According to a study, almost 80% of new products fail in the first year of use.

Failure Analysis Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipments Covered | Scanning Electron Microscope (SEM), Focused Ion Beam (FIB) System, Transmission Electron Microscope (TEM), Dual Beam System, Others |

| Technologies Covered | Energy Dispersive X-ray spectroscopy (EDX), Secondary Ion Mass Spectrometry (SIMS), Focused Ion Beam (FIB), Broad Ion Milling (BIM), Relative Ion Etching (RIE), Scanning Probe Microscopy (SPM), Others |

| End Use Industries Covered | Automotive, Oil and Gas, Defense, Construction, Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A&D Company Ltd., Bruker Corporation, Carl Zeiss AG (Carl-Zeiss-Stiftung), Hitachi High-Technologies Corporation (Hitachi Ltd.), Horiba Ltd., Intertek Group PLC, JEOL Ltd., Motion X Corporation, Tescan Orsay Holding A.S., Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the failure analysis market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global failure analysis market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the failure analysis industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The failure analysis market was valued at USD 5.15 Billion in 2024.

IMARC estimates the failure analysis market to exhibit a CAGR of 6.76% during 2025-2033, expecting to reach USD 9.55 Billion by 2033.

Key factors driving the failure analysis market include increasing demand for product reliability, advancements in technology, and the need to address complex issues in industries like electronics, aerospace, and automotive. Additionally, rising quality control standards, regulatory requirements, and growing emphasis on research and development fuel the market growth.

North America currently dominates the market, driven by the increasing demand for failure analysis services across a range of industries, including aerospace, automotive, electronics, and medical devices, growing emphasis on safety and reliability, and the development of advanced technologies and techniques for failure analysis.

Some of the major players in the failure analysis market include A&D Company Ltd., Bruker Corporation, Carl Zeiss AG (Carl-Zeiss-Stiftung), Hitachi High-Technologies Corporation (Hitachi Ltd.), Horiba Ltd., Intertek Group PLC, JEOL Ltd., Motion X Corporation, Tescan Orsay Holding A.S., Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)