Eye Testing Equipment Market Size, Share, Trends and Forecast by Device, Application, End User, and Region, 2025-2033

Eye Testing Equipment Market Size and Share:

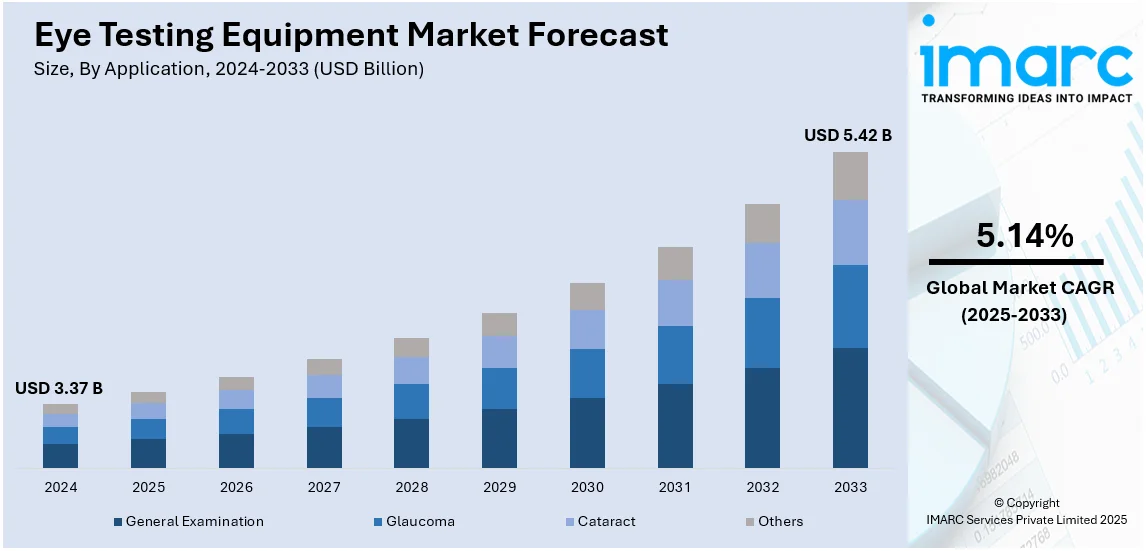

The global eye testing equipment market size was valued at USD 3.37 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.42 Billion by 2033, exhibiting a CAGR of 5.14% during 2025-2033. North America currently dominates the market, holding a significant market share of over 41.7% in 2024. The increasing prevalence of various eye disorders such as cataract and glaucoma, several collaborations and partnerships among key players, and rising awareness among individuals about eye health are some of the factors positively impacting the eye testing equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.37 Billion |

| Market Forecast in 2033 | USD 5.42 Billion |

| Market Growth Rate (2025-2033) | 5.14% |

The market is significantly influenced by the increasing integration of artificial intelligence (AI) and machine learning (ML) in diagnostic tools, which is enhancing the efficiency and accuracy of eye testing equipment. Additionally, the growing trend of home-based and portable eye diagnostic devices is expanding accessibility, particularly in remote regions. Furthermore, rising investments in ophthalmic research and technological innovation are fostering the development of advanced diagnostic solutions and strengthening market expansion. For example, on September 10, 2024, ZEISS Vision Care announced an investment in CREAL, a Swiss business that specializes in light field display technology. This strategic investment aims to enhance ZEISS's vision care offerings and create innovative digital solutions for eye care professionals and consumers. By leveraging CREAL's technology, ZEISS plans to transform the eyewear customer experience, incorporating digital eye examinations and precise diagnoses into the process.

The United States stands out as a key regional market, driven by the increasing insurance coverage for vision care services, which is enabling patients access to comprehensive eye testing. For instance, on November 25, 2024, UnitedHealthcare outlined the vision coverage provided under its Medicare Advantage plans. These plans include routine eye exams, prescription glasses, and contact lenses, with costs varying depending on the plan type and location. Additional benefits for those with diabetes include diabetic retinal exams, and the costs for vision coverage are detailed, such as copayments and allowances for eyewear. Moreover, the country’s aging population, coupled with a rising the increasing frequency of age-related eye conditions such as diabetic retinopathy and macular degeneration, is further driving growth. Apart from this, the adoption of digital health records and integration of eye testing equipment with electronic medical systems is improving diagnostic efficiency and encouraging greater usage. In line with this, the expanding network of retail optometry chains offering quick and affordable eye exams is also contributing to market expansion.

Eye Testing Equipment Market Trends:

Rising Prevalence of Eye Disorders

The increasing prevalence of eye diseases such as glaucoma and cataracts across the world is opening lucrative opportunities for the market. Many eye conditions, including diabetic retinopathy and age-related macular degeneration (AMD), are prominent among elderly individuals. According to reports, the causes of cataract-related conditions include age-related macular degeneration for 8 Million, glaucoma for 7.7 Million, diabetic retinopathy for 3.9 Million, refractive error for 88.4 Million, and distant vision impairment or blindness for around 94 Million. Moreover, key players are focusing on developing products that assist in early disease detection, which supports eye testing equipment market growth. Apart from this, more use of digital devices is a major cause of eye strain, commonly known as computer vision syndrome. Long-term screen time can cause pain and vision problems that promote more frequent ocular examinations, thus catalyzing the demand for eye testing equipment to assess and manage these conditions.

Strategic Collaborations and Partnerships Among Key Players

Several large as well as small scale companies are engaging in partnerships, collaborations, and mergers and acquisitions (M&As), which are offering a favorable eye testing equipment market outlook. Partnerships enable companies to combine their strengths and technologies to develop advanced eye testing equipment. They help companies enter new geographical markets and expand their user base. They also enable companies to innovate and develop new technologies more efficiently. By sharing resources and expertise, companies can accelerate the development of cutting-edge eye testing devices. For example, on December 13, 2024, Narayana Nethralaya Eye Hospital and SHG Technologies introduced Aura Vision, the country's first in-house-developed low-vision assistive technology that uses augmented reality. This wearable device makes it easier for those with impaired vision to read, navigate, and see items at different distances.

Increased Awareness Regarding Eye Care

One of the significant eye testing equipment market trends is the growth in awareness of eye health by people. Higher cases of eye problems such as myopia, glaucoma, and diabetic retinopathy are forcing people to focus more on early identification and preventive treatments. Governments and healthcare institutions, coupled with business-related organizations, are propagating the issue of regular ocular checkups. On July 11, 2024, the International Agency for the Prevention of Blindness (IAPB) launched the World Sight Day 2024 campaign, emphasizing child eye health. It aims to remind parents and other caregivers of the critical role of eye care in children's development, learning, and social interactions. IAPB introduced "Artie," a mascot symbolizing the campaign, accompanied by educational materials to engage children in eye health awareness. Additionally, digitalization and social media have made information about eye health more accessible, encouraging individuals to seek timely screenings. This growing awareness is fueling market expansion and encouraging the adoption of advanced eye testing technologies.

Eye Testing Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global eye testing equipment market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on device, application, and end user.

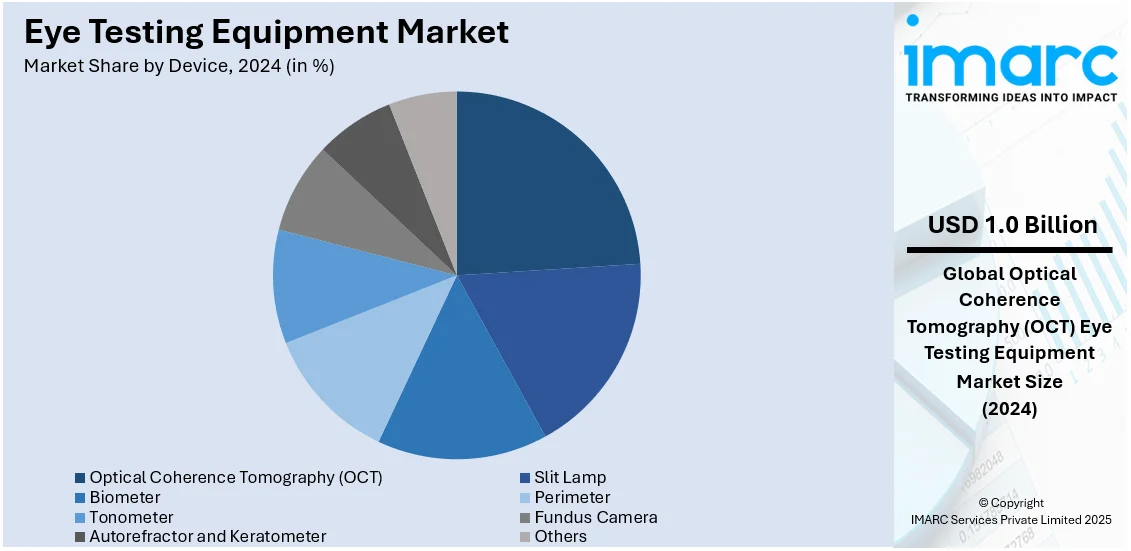

Analysis by Device:

- Slit Lamp

- Biometer

- Perimeter

- Tonometer

- Optical Coherence Tomography (OCT)

- Fundus Camera

- Autorefractor and Keratometer

- Others

Optical coherence tomography (OCT) leads the market with around 18.7% of market share in 2024. It is utilized for the high-resolution imaging of the retina and optic nerve. It mainly detects glaucoma, AMD (age-related macular degeneration), diabetic retinopathy, and many eye disorders. The demand for OCT devices has increased significantly because of the increasing prevalence of these disorders. With swept-source and spectral-domain systems, the technology in OCT has increased with higher speed, depth, and accuracy for imaging. As a result, this is one of the essential tools that has to be applied in ophthalmology and optometry practice. With artificial intelligence and machine learning, diagnostic efficiency will also increase the chance of early detection and the plan of individual treatment. The growth of telemedicine and remote diagnostics in the field will fuel the market of OCT further. Hence, the OCT still occupies an important place in the market for eye-testing equipment.

Analysis by Application:

- General Examination

- Glaucoma

- Cataract

- Others

General examination leads the market in 2024. It is a fundamental procedure performed to assess overall eye health, diagnose vision problems, and detect early signs of eye diseases. It is a routine part of primary eye care and are performed across various healthcare settings. Routine screening eye tests by employing a mixture of diagnostic instrumentations such as autorefractors, slit lamps, and tonometer's accompanied by visual analyzers are used for evaluating the general situation of the ocular system. Preventive eye care awareness, along with an aging population and increased screen time, increases the demand for comprehensive eye exams. Efficiency, accuracy, and accessibility have been enhanced through improvements in digital and AI-powered diagnostic equipment, which make eye testing easier and more convenient for patients and practitioners.

Analysis by End User:

- Hospitals

- Eye Clinics

- Optometry Academic Institutes

Eye clinic leads the market in 2024. These clinics offer a wide range of services, ranging from routine eye exams to specialized treatments for various eye conditions. It act as the primary vision care and diagnostic service provider. They serve patients of different levels, including regular checkup needs and the treatment of various specific conditions, such as glaucoma, cataracts, and diabetic retinopathy. This comprehensive care approach makes eye clinics a primary place for patients seeking eye health services. These clinics are equipped with specialized diagnostic tools and staffed by experts in ophthalmology and optometry. The presence of advanced equipment such as OCT scanners, fundus cameras, and slit lamps allows these clinics to provide high-quality and specialized care, attracting a large patient base. Besides this, various eye testing equipment companies are engaging in partnerships with eye clinics to provide the latest products to these facilities so that they can be beneficial for handling the diverse needs of patients.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 41.7%. Major market players in the region are continuously innovating and provide cutting-edge technologies to increase their eye testing equipment market revenue. Besides this, the healthcare system in North America, especially in the US and Canada, is highly advanced and outfitted with the newest medical technology. Favorable policies on reimbursement, along with effective regulation, encourage hospitals, eye clinics, and optical retail centers to incorporate innovative solutions related to eye testing. Increasing R&D spending combined with key market players increases the level of competition. With the growing adoption of digital healthcare solutions and home-based vision testing, North America remains a significant force behind innovation and growth for the overall eye testing equipment market globally.

Key Regional Takeaways:

United States Eye Testing Equipment Market Analysis

Growth in the US market for eye testing equipment is on account of the increased prevalence of vision disorders, primarily among older patients. There has been an increasing prevalence of presbyopia, cataracts, diabetic retinopathy, and AMD; therefore, a greater demand is being experienced for more sophisticated diagnostic tools. According to reports, more than half of the people aged 80 years and older in the United States either suffer from cataracts or have already had the surgery. The increase in the usage of digital devices also causes myopia and digital eye strain and calls for periodic eye screening. Technological advancements in ophthalmic diagnostic apparatus, such as OCT, fundus cameras, and autorefractors, are further fueling growth in the market. Manufacturers are bringing in artificial intelligence and machine learning for automated diagnostic equipment to optimize precision in clinical practice with better efficiency. Government policies, especially in funding for vision care and reimbursement packages for ophthalmic procedures, open an avenue for optometrists and ophthalmologists to adopt high-tech instrumentation. Increased awareness about preventive eye care also increases routine eye checkups and, therefore, demand. In addition, retail chains and optical stores are expanding their diagnostic capabilities, and eye exams are becoming more accessible to the general population. In addition, partnerships between technology companies and healthcare providers accelerate the implementation of teleophthalmology and facilitate greater availability of remote eye examinations.

Asia Pacific Eye Testing Equipment Market Analysis

The Asia Pacific eye testing equipment market is rapidly expanding due to rapid urbanization, changing lifestyles, and increasing screen time. The prevalence of myopia among the major economies, especially China, Japan, and South Korea, further propels market growth. The high burden of vision impairment and blindness with growing awareness of early diagnosis is encouraging demand for advanced ophthalmic diagnostic tools. In addition, regional governing bodies are taking measures to offer access to ophthalmic care in rural and underdeveloped regions. Free eye checkup camps and low-cost treatments for age-related vision disorders are being offered by public health programs, thereby creating a demand for diagnostic devices. In the case of India and China, the number of investments in clinics for ophthalmology is significantly increasing, which elevates the need for testing equipment. Also, the presence of a huge elderly population contributes to the high requirement since older adults are more susceptible to cataracts, glaucoma, and diabetic retinopathy. According to NITI Aayog, by 2050, India will have 319 Million older adults, which would make up 20% of the total population. Besides this, inflating disposable incomes and high healthcare expenditures are allowing patients to avail themselves of premium eye care services. The affordability of advanced diagnostic procedures is improving, particularly with the expansion of private eye care centers.

Europe Eye Testing Equipment Market Analysis

Demographic trends, technological innovation, and healthcare investments are the factors driving the Europe eye testing equipment market. The aging population in countries such as Germany, France, and Italy lead to an increase in age-related vision disorders such as cataracts, macular degeneration, and glaucoma. According to reports, primary open-angle glaucoma affected 7.8 Million individuals in Europe, with a prevalence of 2.51%. This demographic change is demanding the need for sophisticated diagnostic equipment to help detect it early and then treat it. The region leads in adopting cutting-edge ophthalmic technologies like AI-based imaging, high-resolution OCT, and automated refraction systems. Healthcare providers are increasingly embracing digital diagnostic solutions to achieve more precision and efficiency. Strong medical technology firms and research institutions' presence hasten new ophthalmic device development and commercialization in Europe. More so, there is great emphasis on the sustainability and ecological approach in medical equipment manufacturing, with European firms seeking energy-efficient and recyclable equipment that is more durable. Therefore, telemedicine and remote diagnostics of the eyes are integrated increasingly, especially for those in rural areas lacking easy access to specialists.

Latin America Eye Testing Equipment Market Analysis

Latin America's eye testing equipment market is gaining momentum because of rising vision disorders, an aging population, and growing healthcare awareness. The IBGE Population Projections indicated that Brazilians aged 60 years old or above grew nearly double during the period 2000 to 2023 from 8.7% to 15.6%. Improvements in healthcare infrastructure, government initiatives regarding vision screening programs, and more private eye care facilities are thereby increasing the growth of the market. Many Latin American countries have adopted policies regarding ophthalmic services, focusing more on such underserved populations. Technological advancements, such as AI-integrated diagnostic solutions and mobile eye testing units, are making it more accessible. In-store vision tests offered by optical retail chains are also a key driver of demand. As investment in ophthalmic healthcare increases, the Latin American market is expected to experience steady growth in the coming years.

Middle East and Africa Eye Testing Equipment Market Analysis

The Middle East & Africa (MEA) eye testing equipment market is expanding on account of increasing cases of vision impairment, growing healthcare investments, and rising awareness about eye health. According to the analysis, the region's current healthcare expenditure (CHE) is expected to increase by 5.4 percent annually from USD 104.1 Billion in 2022 to USD 135.5 Billion by 2027. It is projected that CHE in the GCC nations will rise at growth rates between 4.4% and 7.4%. High rates of diabetes-related eye diseases, including diabetic retinopathy and glaucoma, are driving demand for advanced ophthalmic diagnostic tools. Countries such as the UAE, Saudi Arabia, and South Africa are witnessing increased spending on specialized eye care services. In addition, the growing presence of international medical device companies and increasing collaborations with local healthcare providers are supporting the market expansion. With ongoing infrastructure developments and a rising focus on early disease detection, the MEA eye testing equipment market is expected to experience steady growth.

Competitive Landscape:

The market is highly competitive due to technological advancement, the increasing prevalence of vision disorders, and the demand for early diagnosis. Companies compete on innovation, product quality, pricing, and ease of use. Digitalization and artificial intelligence (AI) integration further heightens competition as more people now opt for automated and portable devices. New market entrants focus on low cost and access, especially for regional markets in developing countries, whereas established players focus on high-image resolution, accuracy, and multipurpose functionality. Compliance with regulatory measures and industry standards will deter new contenders. Also, the contractual involvement of healthcare providers and optical retail chains boosts the attainment of penetration. The uptake of tele-optometry and home-based vision testing solutions is also transforming the landscape.

The report provides a comprehensive analysis of the competitive landscape in the eye testing equipment market with detailed profiles of all major companies, including:

- Alcon Inc. (Novartis AG)

- bon Optic

- Canon Medical Systems USA (Canon Inc.)

- Carl Zeiss AG (Carl-Zeiss-Stiftung)

- Essilor International (EssilorLuxottica)

- HEINE Optotechnik GmbH & Co. KG

- Luneau Technology Group

- Metall Zug AG

- NIDEK CO. LTD.

- Topcon Corporation

Latest News and Developments:

- January 2025: Residents of Ghumarwin and the surrounding communities of Barthin, Jhandutta, Baldwara, and Ladraour are praising the recently opened robotic eye testing system at the Government Hospital in Ghumarwin. Technical Education Minister Rajesh Dharmani officially opened the facility and the facility serves a sizable population in the Bilaspur district.

- January 2025: The government Wenlock Hospital, Mangalore, will soon upgrade its eye care facility with two cutting-edge ophthalmology machines, Topcon 3D Optical Coherence Tomography (OCT) and Topcon Slit Lamp, which Mangalore Refinery and Petrochemicals Limited, MRPL, will be providing as part of its CSR program Arogya Samrakshan.

- June 2024: C3 Med-Tech creates and produces eye screening equipment. To launch innovative telemedicine and AI-enabled portable equipment for seamless and speedy eye exams and real-time illness detection, the company has obtained an undisclosed amount from Industrial Metal Powders.

- February 2024: During the esteemed in-optics events in New Delhi, the German medical technology company ZEISS launched the ZEISS VISUCORE 500. It offers medical professionals, retail store owners, and end users a cutting-edge, technologically advanced solution to objective and subjective refraction. This refractometer represents a significant change in the Indian vision care sector. With the help of the newest device, eye care professionals and store owners can easily incorporate the newest ZEISS technology without having to make major adjustments to the physical space.

Eye Testing Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Devices Covered | Slit Lamp, Biometer, Perimeter, Tonometer, Optical Coherence Tomography (OCT), Fundus Camera, Autorefractor and Keratometer, Others |

| Applications Covered | General Examination, Glaucoma, Cataract, Others |

| End Users Covered | Hospitals, Eye Clinics, Optometry Academic Institutes |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alcon Inc. (Novartis AG), bon Optic, Canon Medical Systems USA (Canon Inc.), Carl Zeiss AG (Carl-Zeiss-Stiftung), Essilor International (EssilorLuxottica), HEINE Optotechnik GmbH & Co. KG, Luneau Technology Group, Metall Zug AG, NIDEK CO. LTD., Topcon Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the eye testing equipment market from 2019-2033.

- The eye testing equipment market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the eye testing equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The eye testing equipment market was valued at USD 3.37 Billion in 2024.

The eye testing equipment market is projected to exhibit a CAGR of 5.14% during 2025-2033, reaching a value of USD 5.42 Billion by 2033.

The market is driven by the rising prevalence of vision disorders, increasing elderly population, technological advancements in ophthalmic diagnostics, growing adoption of AI-powered devices, and increasing awareness of early eye disease detection. The implementation of government initiatives and investments in healthcare infrastructure further supports market growth.

North America currently dominates the eye testing equipment market, accounting for a share of 41.7% in 2024. The dominance is fueled by high healthcare expenditure, advanced ophthalmic diagnostic technologies, growing demand for early disease detection, and strong insurance coverage.

Some of the major players in the eye testing equipment market include Alcon Inc. (Novartis AG), bon Optic, Canon Medical Systems USA (Canon Inc.), Carl Zeiss AG (Carl-Zeiss-Stiftung), Essilor International (EssilorLuxottica), HEINE Optotechnik GmbH & Co. KG, Luneau Technology Group, Metall Zug AG, NIDEK CO. LTD., Topcon Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)