Extra Neutral Alcohol (ENA) Market in India Size, Share, Trends and Forecast by Application, and State, 2025-2033

Market Overview 2025-2033:

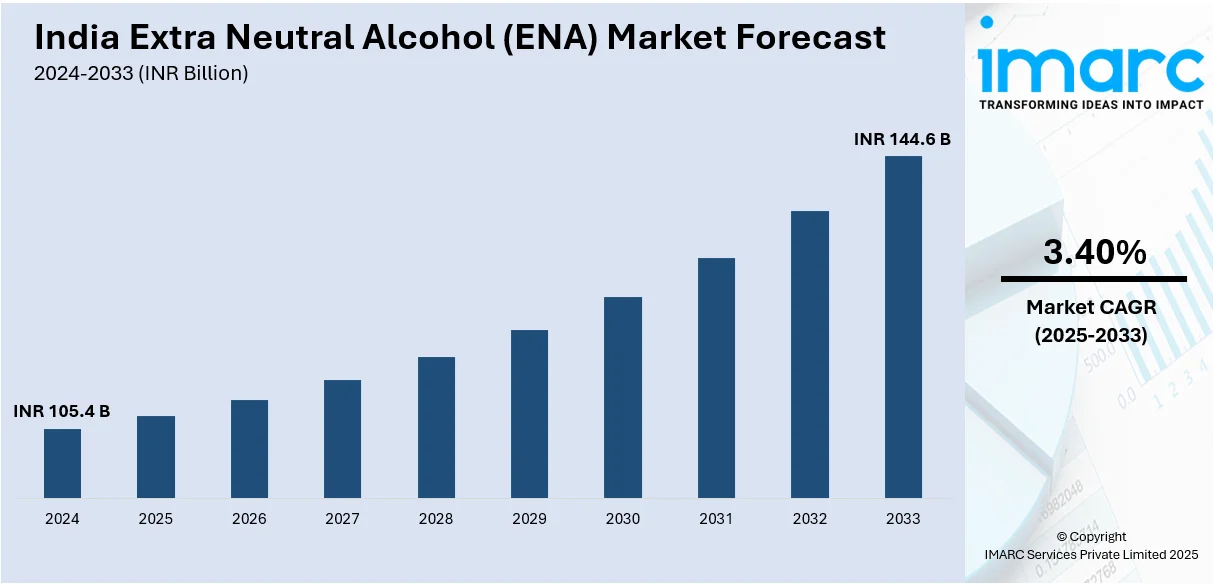

The extra neutral alcohol (ENA) market in India size reached INR 105.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach INR 144.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.40% during 2025-2033. The increasing number distilleries and microbreweries, rising collaboration of various alcoholic beverage brands, and the growing need for prescription drugs are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 105.4 Billion |

|

Market Forecast in 2033

|

INR 144.6 Billion |

| Market Growth Rate 2025-2033 | 3.40% |

Extra neutral alcohol (ENA), also known as rectified spirit or neutral spirit, is a high-grade, neutral-tasting alcohol primarily produced from fermented molasses or grains. It has a high alcohol content, usually above 95% by volume. It is made using different raw materials, such as sugarcane molasses and grains like rye, wheat, corn, rice, and barley. Its production involves several stages, including fermentation, distillation, and rectification. ENA is extensively used in the manufacturing of alcoholic beverages, such as vodka, gin, and liqueurs, where it serves as a base spirit.

To get more information on this market, Request Sample

The increasing number of commercial spaces, such as distilleries, microbreweries, cafes, restaurants, bars, and hotels, which offer a variety of experimental cocktails, is catalyzing the demand for ENA in India. Moreover, the rising collaboration of alcoholic beverage brands with these establishments to launch numerous endorsement programs is favoring the growth of the market in the country. In addition, the thriving food tourism industry and expanding culinary services in the country are resulting in the growing adoption of ENA in luxury hotels and restaurants for gourmet cooking. Apart from this, ENA is used as a solvent in the pharmaceutical industry for the extraction of active pharmaceutical ingredients (APIs) and the production of various medicines, syrups, and tinctures. This, coupled with the increasing need for prescription drugs due to the surging prevalence of medical conditions, is strengthening the growth of the market in the country.

Extra Neutral Alcohol (ENA) Market in India Trends/Drivers:

Emerging trend of partying among millennials

On account of inflating income levels of individuals and changing consumer preferences, there is a rise in the demand for alcoholic beverages, including spirits like whiskey, vodka, and rum, across India. This represents one of the key factors impelling the growth of the market. As more Indians are embracing Western drinking culture and socializing in bars, restaurants, and clubs, the overall sales of high-quality spirits is increasing. ENA serves as a key ingredient in the production of these beverages, which makes it essential for meeting the growing consumer demand.

Rising government policies and regulations

The Government of India (GoI) is implementing various policies and regulations to control the quality of spirits in the market. These policies often mandate the use of ENA of a specific standard in the production of alcoholic beverages. As a result, leading manufacturers are procuring ENA that meets the required specifications, which, in turn, is supporting the growth of the market. Additionally, continuous efforts of the governing agency to minimize the production and sales of illicit are also catalyzing the demand.

Extra Neutral Alcohol (ENA) Market in India Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the extra neutral alcohol (ENA) market in India report, along with forecasts at the country and state level from 2025-2033. Our report has categorized the market based on application.

Breakup by Application:

- Alcoholic Beverages

- Flavours and Fragrances

- Pharmaceuticals

- Cosmetics

- Others

ENA finds extensive application in alcoholic beverages

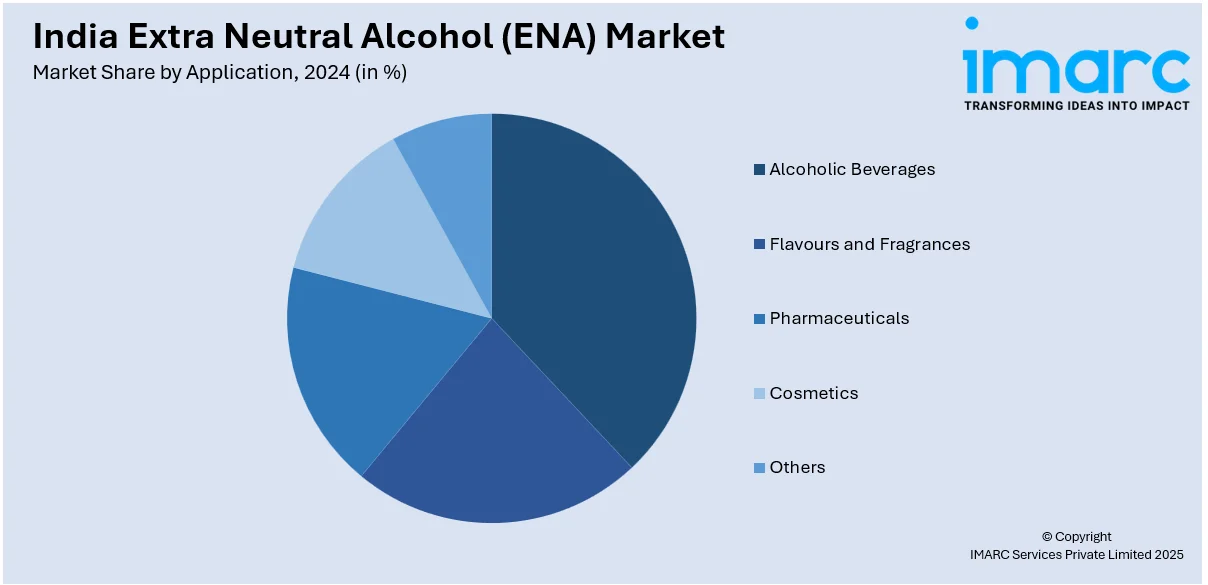

The report has provided a detailed breakup and analysis of the market based on the product type. This includes alcoholic beverages, flavors and fragrances, pharmaceuticals, cosmetics, and others. According to the report, alcoholic beverages represented the largest segment.

ENA serves as a key ingredient in the production of various alcoholic beverages. Its neutral taste and high alcohol content makes it an ideal base spirit for creating a wide range of drinks. It is commonly used in the production of vodka, gin, rum, and other distilled spirits. It provides a neutral foundation that allows the flavors of botanicals, fruits, or other ingredients to shine through. It is also utilized in the production of fortified wines, aperitifs, liqueurs, and cocktail bitters.

ENA serves as a solvent and carrier for natural and synthetic flavor compounds, essential oils, and fragrance ingredients. Its neutral character ensures that it doesn't interfere with the aromatic profiles of the flavors and fragrances being developed. ENA is commonly used in the extraction and dilution of plant essences and essential oils, and as a base for creating concentrated flavors and fragrances used in food products, beverages, perfumes, colognes, and personal care items.

ENA finds application in the pharmaceutical industry for various purposes. Its high purity and neutral properties make it suitable for pharmaceutical formulations. It is used as a solvent in the production of liquid medications, tinctures, and syrups. It helps in dissolving active pharmaceutical ingredients (APIs) and other components, which facilitates the formulation and delivery of medicines. It is also utilized in the extraction of medicinal compounds from plants and herbs for use in herbal medicines and traditional remedies.

ENA is widely employed in the cosmetic industry due to its purity and lack of flavor. It is used as a solvent and diluent in the production of cosmetics and personal care products. It is utilized in the formulation of perfumes, colognes, deodorants, and body sprays, wherein it helps in dissolving and blending fragrance oils and other cosmetic ingredients. It is also utilized in the manufacturing of skincare products such as toners, cleansers, and lotions, where it acts as a base for active ingredients and aids in ensuring product stability.

Breakup by State:

- Punjab

- Maharashtra

- Madhya Pradesh

- Uttar Pradesh

- Karnataka

- Andhra Pradesh and Telangana

- Tamil Nadu

- Haryana

- Rajasthan

- Chhattisgarh

- West Bengal

- Uttarakhand

- Kerala

- Bihar

- Odisha

- Goa

- Assam

- Delhi

- Himachal Pradesh

- Jammu and Kashmir

- Arunachal Pradesh

- Meghalaya

- Jharkhand

- Tripura

- Sikkim

Punjab and Andhra Pradesh and Telangana exhibit a clear dominance in the market for production and consumption respectively

The report has also provided a comprehensive analysis of all the major regional markets, which include Punjab, Maharashtra, Madhya Pradesh, Uttar Pradesh, Karnataka, Andhra Pradesh and Telangana, Tamil Nadu, Haryana, Rajasthan, Chhattisgarh, West Bengal, Uttarakhand, Kerala, Bihar, Odisha, Goa, Assam, Delhi, Himachal Pradesh, Jammu and Kashmir, Arunachal Pradesh, Meghalaya, Jharkhand, Tripura, and Sikkim.

The increasing use of ethanol as a biofuel represents one of the major factors driving the production of ENA in Punjab. Moreover, the rising ENA usage as a solvent for flavoring and coloring agents is favoring the production in the state. Besides this, the growing sales of spirits like whisky, rum, and vodka are influencing the production in the market.

The consumption of ENA is growing in Andhra Pradesh and Telangana, owing to the increasing number of pubs and distilleries, emerging trend of socializing, favorable initiatives by state governing authorities, etc.

Competitive Landscape:

The key players in the market are focusing on using membrane filtration techniques, such as reverse osmosis and nanofiltration, to separate and concentrate the alcohol during the distillation process. These techniques help remove impurities, water, and other undesirable components, which results in higher alcohol concentrations and improved quality of ENA. Moreover, key players are adopting various energy-efficient technologies to reduce energy consumption and environment impact. They use energy efficient distillation columns, heat recovery systems, and process optimization techniques. Besides this, leading players are integrating advanced technologies for quality control and automation throughout the ENA production process.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Extra Neutral Alcohol (ENA) Market in India Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion, Million Litres |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Alcoholic Beverages, Flavors and Fragrances, Pharmaceuticals, Cosmetics, Others |

| States Covered | Punjab, Maharashtra, Madhya Pradesh, Uttar Pradesh, Karnataka, Andhra Pradesh and Telangana, Tamil Nadu, Haryana, Rajasthan, Chhattisgarh, West Bengal, Uttarakhand, Kerala, Bihar, Odisha, Goa, Assam, Delhi, Himachal Pradesh, Jammu and Kashmir, Arunachal Pradesh, Meghalaya, Jharkhand, Tripura, Sikkim |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the extra neutral alcohol (ENA) market in India from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the extra neutral alcohol (ENA) market in India.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the extra neutral alcohol (ENA) market in India industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The extra neutral alcohol (ENA) market in India was valued at INR 105.4 Billion in 2024.

We expect the extra neutral alcohol (ENA) market in India to exhibit a CAGR of 3.40% during 2025-2033.

The widespread use of extra neutral alcohol in the production of alcoholic beverages, such as whisky, vodka, gin, etc., along with the shifting consumer preferences towards Indian Made Foreign Liquor (IMFL), are primarily driving the extra neutral alcohol (ENA) market in India.

The sudden outbreak of the COVID-19 pandemic has led to the rising demand for Extra Neutral Alcohol (ENA) in India, particularly across the healthcare and pharmaceutical sectors for producing hand sanitizers and vaccines , to combat the risk of coronavirus infection.

Based on the application, the extra neutral alcohol (ENA) market in India can be segmented into alcoholic beverages, flavors and fragrances, pharmaceuticals, cosmetics, and others. Currently, alcoholic beverages hold the majority of the total market share.

On a regional level, based on the production the extra neutral alcohol (ENA) market has been classified into Punjab, Maharashtra, Madhya Pradesh, Uttar Pradesh, Karnataka, Andhra Pradesh and Telangana, Tamil Nadu, Haryana, Rajasthan, Chhattisgarh, West Bengal, Uttarakhand, Kerala, Bihar, Odisha, Goa, Assam, Delhi, Himachal Pradesh, Jammu and Kashmir, Arunachal Pradesh, Meghalaya, Jharkhand, Tripura, and Sikkim, where Punjab currently dominates the market.

On a regional level, based on the consumption the extra neutral alcohol (ENA) market has been classified into Punjab, Maharashtra, Madhya Pradesh, Uttar Pradesh, Karnataka, Andhra Pradesh and Telangana, Tamil Nadu, Haryana, Rajasthan, Chhattisgarh, West Bengal, Uttarakhand, Kerala, Bihar, Odisha, Goa, Assam, Delhi, Himachal Pradesh, Jammu and Kashmir, Arunachal Pradesh, Meghalaya, Jharkhand, Tripura, and Sikkim, where Andhra Pradesh and Telangana currently dominate the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)