Evaporative Cooling Market Size, Share, Trends and Forecast by Cooling, Distribution Channel, Application, and Region, 2025-2033

Evaporative Cooling Market Size and Share:

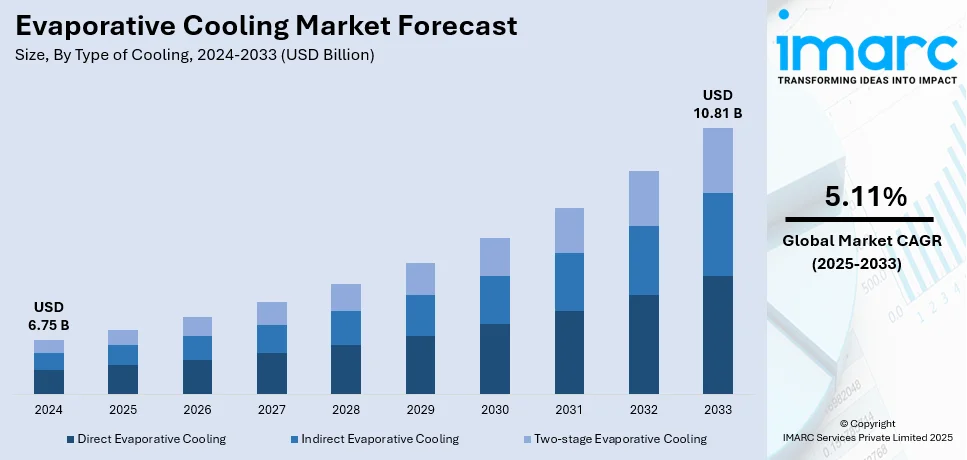

The global evaporative cooling market size was valued at USD 6.75 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.81 Billion by 2033, exhibiting a CAGR of 5.11% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 39.4% in 2024. The expanding use of evaporative cooling in the industrial sector, the increasing demand for cost-effective, energy-efficient, and sustainable solutions, along with various initiatives from governing bodies, are key factors driving the growth of the evaporative cooling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.75 Billion |

|

Market Forecast in 2033

|

USD 10.81 Billion |

| Market Growth Rate (2025-2033) | 5.11% |

Several key factors, including the increasing demand for energy-efficient cooling solutions, drive the evaporative cooling market toward growth. As energy costs rise, consumers and businesses turn to evaporative coolers, which use water and air to cool spaces, offering a more sustainable and cost-effective alternative to traditional air conditioning systems. The growing concerns about environmental impact and carbon emissions further fuel this shift, as evaporative cooling is considered eco-friendly. Additionally, rising global temperatures and urbanization have created a higher need for effective cooling systems, particularly in regions with hot, dry climates. Technological advancements, such as improved energy efficiency and ease of installation, also contribute to the evaporative cooling market growth.

To get more information on this market, Request Sample

The evaporative cooling market in the United States is driven by several factors, including increasing energy costs and a growing emphasis on sustainability. With rising electricity prices, consumers and businesses seek more energy-efficient alternatives to traditional air conditioning, making evaporative coolers an attractive solution. Environmental concerns also play a significant role, as evaporative cooling systems use less energy and water than conventional HVAC systems. Additionally, extreme weather patterns, including hotter summers and prolonged heat waves, are increasing the demand for effective cooling solutions. Technological advancements in evaporative cooling systems, such as better efficiency and ease of maintenance, further represent key evaporative cooling market trends. For instance, in February 2024, Aggreko, a key player in the field of energy solutions, declared that the USPTO had awarded it Patent 11,844,541 B2. The cooling tower for evaporative cooling of water enclosed in an ISO-compliant shipping container frame is covered by the patent. It helps clients save space, shorten project installation times, and enhance worker and job site safety in general. Additionally, state-level incentives for energy-efficient systems contribute to the widespread adoption.

Evaporative Cooling Market Trends

Rising Demand for Energy Efficiency

Evaporative cooling systems are highly energy-efficient compared to traditional air conditioning units. They consume significantly less power as they use water evaporation to cool the air, which requires minimal electricity. As global energy costs rise and environmental concerns increase, consumers and businesses are seeking cooling solutions that are effective and energy efficient. With its lower energy consumption, evaporative cooling presents a cost-effective alternative, making it increasingly attractive for residential, commercial, and industrial applications. This growing focus on reducing energy use is a key driver of the evaporative cooling market. For instance, in August 2024, DUG Technology (Australia) Pty Ltd ("DUG") and Baltimore Aircoil Company, Inc., a world pioneer in data center cooling systems, signed an exclusive worldwide licensing agreement. Through this strategic alliance, DUG's patented and proven immersion-cooling technology for high-density data centers is exclusively licensed to BAC.

Growing Environmental Sustainability

Evaporative cooling systems are considered eco-friendly as they use water evaporation to cool the air, eliminating the need for refrigerants that can be harmful to the environment. Unlike traditional air conditioners that use refrigerants linked to ozone depletion and global warming, evaporative coolers have a much smaller carbon footprint. As awareness about climate change and environmental degradation increases, businesses and consumers are increasingly opting for greener cooling solutions. The ability to reduce energy consumption and the absence of harmful chemicals make evaporative cooling a sustainable choice, contributing significantly to market growth. For instance, in July 2024, Munters, a world leader in temperature control and energy-efficient air treatment systems, announced that it had agreed to buy Geoclima, a state-of-the-art producer of water- and air-cooled chillers. Munters' existing comprehensive data center cooling solutions portfolio, which includes air conditioners, high-efficiency computer room air handlers, cutting-edge evaporative cooling, and flexible air-and-liquid cooling systems, is completed by Geoclima's chilling technology product offerings.

Associated Cost-Effectiveness

Evaporative coolers are a more affordable option than traditional air conditioning systems. Their low operational and maintenance costs make them highly attractive, particularly for budget-conscious consumers and businesses. They require minimal upfront investment, and their energy-efficient design results in lower electricity bills over time. The reduced need for costly refrigerants, which are typically used in air conditioning systems, further enhances their cost-effectiveness. This affordability, combined with long-term savings, positions evaporative cooling as a compelling option for residential and commercial applications, contributing to its growing global market adoption. For instance, in January 2024, The OlympusVTM (pronounced o-lym-pus-vee) Adiabatic Systems line of adiabatic cooling products was introduced by SPX Cooling Tech, LLC, a full-line, full-service industry leader in the design and manufacture of evaporative cooling towers, fluid coolers, and other products. These products are intended to give operators and engineers of commercial refrigeration, industrial refrigeration, HVAC, or industrial process systems a versatile cooling option.

Evaporative Cooling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global evaporative cooling market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on cooling, distribution channel, and application.

Analysis by Type of Cooling:

- Direct Evaporative Cooling

- Indirect Evaporative Cooling

- Two-stage Evaporative Cooling

Direct evaporative cooling stand as the largest type of cooling in 2024, holding around 55.7% of the market. Direct evaporative cooling has the greatest market share of evaporative cooling owing to its energy conservation probability, low cost, and environmentally sustainable operation aspect. This system cools the air by passing air over water first and then passing the water vapor through a cooling stage to reduce temperatures without a compressor or refrigerator. It is extensively used for industrial, commercial, and residential purposes especially within hot arid climates. The energy efficiency, low maintenance, and quick and easy installation also benefit businesses and consumers looking for ecological cooling solutions. In addition, as the environmental conscience rises with the increase in regulatory measures on the use of carbon, the demand for direct evaporative cooling is boosting as a more natural substitute to traditional systems.

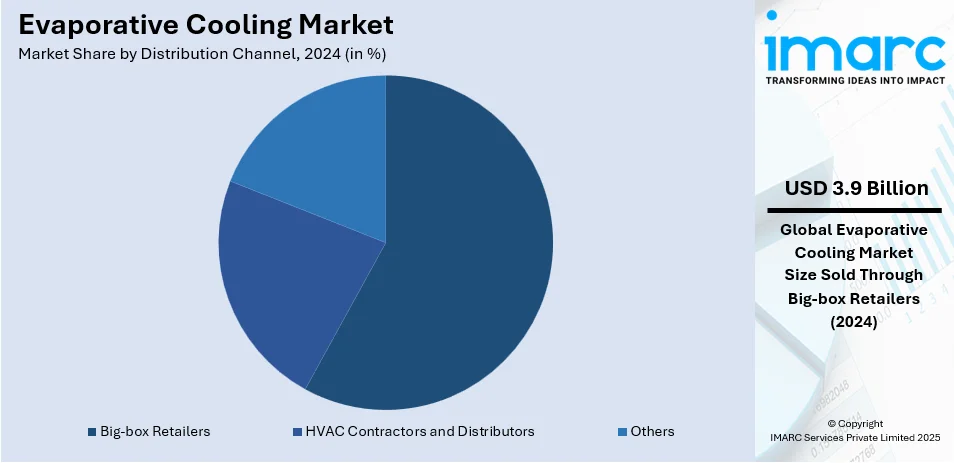

Analysis by Distribution Channel:

- Big-box Retailers

- HVAC Contractors and Distributors

- Others

Big-box retailers leads the market with around 58.4% of market share in 2024. Big-box retailers hold the largest share of the evaporative cooling market due to their extensive infrastructure and large operational spaces, which require cost-effective and energy-efficient cooling solutions. Evaporative cooling systems are well suited for these conditions since the energy they use for cooling is far less than in the case with conventional HVAC systems. Big-box retail stores focus on providing comfort for shoppers and controlling of merchandising environment with low cost of operation and energy efficiency which evaporative cooling benefits. Additionally, their strong financial capabilities enable bulk purchases and large-scale installations, further driving market dominance. The increasing focus on sustainability and green building practices strengthens the adoption of evaporative cooling within this sector.

Analysis by Application:

- Residential

- Commercial

- Industrial

- Confinement Farming

- Others

Industrial leads the market with around 42.2% of market share in 2024. The industrial application is dominating the evaporative cooling market since it has large cooling requirements across industries including manufacturing, processing, and warehouse industries. The evaporative cooling systems are suitable for such environments and much cheaper and more efficient than refrigeration and heating, ventilation, and air conditioning systems. These systems provide control for areas with high heat generation to enhance the comfort of the workers and the performance of machinery. Since evaporative cooling does not require refrigerants for cooling large areas, the latter option is more sustainable given a continually increasing emphasis on environmental conservation. In addition, more industries continue to embrace evaporative cooling solutions because they help to reduce operating expenses and energy utilization.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 39.4%. The rise of confinement farming practices is fuelling the demand for evaporative cooling systems. According to Ministry of Fisheries, Animal Husbandry & Dairying, the expansion of livestock sector, achieving a CAGR of 13.36% from 2014-15 to 2021-22, highlights its role in enhancing evaporative cooling efficiency for sustainable agricultural practices. Livestock and poultry farming operations require precise temperature management to ensure animal health and productivity, particularly in high-density settings. Evaporative cooling provides an effective solution to regulate ambient temperatures in such environments, enabling better ventilation and reducing heat stress for livestock. The trend towards modernizing agricultural practices has further encouraged the adoption of evaporative cooling in farming infrastructure. These systems are particularly valued for their ability to maintain humidity and temperature balance in enclosed spaces, crucial for optimizing growth and reducing disease risks. Additionally, they contribute to energy savings and lower operational costs, making them a preferred choice for technologically advanced farming setups seeking sustainable solutions.

Key Regional Takeaways:

North America Evaporative Cooling Market Analysis

The evaporative cooling market in North America is driven by several key factors. Increased concern for energy utilization and environmental consciousness is one aspect as evaporative cooling systems use less power and common water instead of noxious chemicals. Increasing temperatures and hotter summers, particularly in the southwestern United States, boost demand for effective cooling solutions. The growing regulations focus on green building practices and lowering the carbon footprints is further facilitating the market expansion. Moreover, the industrial, commercial and residential sectors are embracing evaporative cooling for cheaper, sustainable methods of cooling than air conditioning. In system design, technological advancements, and better performance highlight the evaporative cool as the most desirable in both new and existing buildings.

United States Evaporative Cooling Market Analysis

In 2024, the United States accounted for the largest market share of over 89.60% in North America. The increasing adoption of evaporative cooling systems is strongly linked to the surge in the construction of warehouses, factories, and power generation facilities in the region. According to Forbes, the expansion of DCs and refrigerated facilities, accounting for 17% of 170,000 warehouses, highlights increased opportunities for leveraging evaporative cooling benefits. These sectors demand efficient cooling solutions to maintain optimal temperature levels for equipment and worker safety. The expansion of storage facilities with stringent environmental requirements has driven the use of evaporative cooling, which offers a cost-effective and energy-efficient alternative to traditional air conditioning. Factories, especially those handling heat-intensive processes, require reliable cooling mechanisms to improve productivity and reduce downtime. Similarly, the power generation sector benefits from evaporative cooling systems to enhance the efficiency of cooling towers, reducing water consumption while maintaining performance. These applications showcase the practical advantages of such systems in handling large-scale industrial cooling needs, making them an essential choice for operational and sustainability goals.

Europe Evaporative Cooling Market Analysis

The industrial sector's expansion is driving the demand for evaporative cooling systems, offering an efficient way to maintain suitable temperatures in production facilities. According to reports, in 2021, the EU's industrial production rose by 8.5% over 2020, followed by a further 0.4% increase in 2022, indicating continued sector growth. Industries requiring specific climate conditions for manufacturing processes, such as food processing and pharmaceuticals, are particularly reliant on such cooling technologies. Evaporative cooling is preferred for its ability to provide uniform cooling, enhancing the quality of production while reducing energy consumption. Manufacturing plants benefit from these systems by improving air quality and ensuring compliance with stringent environmental and occupational safety standards. Moreover, the integration of evaporative cooling into industrial setups aligns with the growing emphasis on sustainability, as these systems help minimize carbon footprints. The versatility and scalability of evaporative cooling solutions further cement their role as a vital component of modern industrial operations.

Latin America Evaporative Cooling Market Analysis

In Latin America, urbanization is driving the adoption of evaporative cooling in residential spaces. According to UN-Habitat, Latin America and the Caribbean is the most urbanized region in the developing world, with 81% of its population 539 Million people living in cities. As cities expand and more people move to urban areas, the demand for affordable, sustainable, and efficient cooling solutions is increasing. Evaporative cooling systems offer a cost-effective alternative to traditional air conditioning units, especially in areas with hot, dry climates. These systems are particularly attractive for homeowners seeking to reduce energy bills and environmental impact. As more residential buildings emerge in urban areas, the need for energy-efficient solutions to handle the heat generated by high-density living is becoming more critical. Evaporative cooling not only provides a practical cooling solution but also supports sustainable living by reducing energy consumption. As urbanization continues to accelerate in the region, evaporative cooling is increasingly seen as an ideal solution for residential cooling needs.

Middle East and Africa Evaporative Cooling Market Analysis

In the Middle East and Africa, the growth of the real estate market is driving the adoption of evaporative cooling in commercial properties. For instance, with over 5,200 construction projects underway in Saudi Arabia, valued at USD 819 Billion, the sector continues its rapid expansion. As the real estate sector expands in this region, particularly in large-scale commercial developments such as office buildings, shopping malls, and hotels, there is an increasing need for energy-efficient climate control systems. Evaporative cooling systems provide an affordable and sustainable alternative to conventional cooling methods, offering a significant reduction in energy consumption and operating costs. This is particularly important in regions with hot climates where traditional air conditioning can be expensive and inefficient. As commercial real estate projects grow in number and scale, the adoption of evaporative cooling technologies is becoming more prevalent, as they are well-suited to handle the high cooling demands of large commercial spaces while promoting energy savings.

Competitive Landscape:

The evaporative cooling market is highly competitive, with key players like Munters, SPX Cooling Tech, Condair, and Baltimore Aircoil leading the way. These companies focus on expanding their product portfolios with energy-efficient and sustainable cooling solutions for industries such as HVAC, industrial refrigeration, and data centers. Technological innovation, such as adiabatic cooling systems and enhanced evaporative media, differentiates market leaders. Additionally, companies are increasing their global presence through strategic acquisitions, partnerships, and facility expansions. Competitive pressures are also driven by the growing demand for cost-effective, eco-friendly alternatives to traditional air conditioning systems, leading to continuous product development and market growth.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Baltimore Aircoil Company, Inc.

- Bonaire

- Celsius Design

- CFW Evapcool

- Colt International Ltd

- Condair Group

- Delta Cooling Towers, Inc.

- EcoCooling

- Munters Global

- Phoenix Manufacturing

- SPX Cooling Tech, LLC

Latest News and Developments:

- December 2024: Metso has launched its upgraded Evaporative Cooling Tower, a dry gas cleaning solution designed to efficiently cool furnace off-gases through evaporation. The tower reduces gas temperatures from 600-700°C to 200-350°C, ensuring rapid evaporation with minimal retention time. Featuring advanced model-based automatic control, it allows precise cooling management, protecting both the tower and downstream equipment. The enhanced design promises even and efficient cooling, even under varying process conditions.

- October 2024: MITA Cooling Technologies introduces the PME XL, an open-loop evaporative cooling tower offering up to 5 MW of capacity in a single cell. Optimized for high cooling efficiency, it expands the PME-E range, providing a compact and powerful solution for industrial plants. The tower features a fibreglass sandwich panel and inclined tank for corrosion resistance and lightweight design. Ideal for precise temperature control, the PME XL combines low noise and performance with advanced technical innovations.

- September 2024: Kaltra is set to unveil a redesigned hybrid cooler in Q4 2024, featuring a novel heat exchanger wetting solution that overcomes the challenges of traditional adiabatic cooling systems. This innovation reduces water consumption, eliminates additional air pressure drops, and cuts costs by removing extra components like pads and nozzles. The gravity-fed water flow ensures uniform wetting, offering improved thermal performance with minimal maintenance.

- September 2024: Kaltra is set to unveil a redesigned hybrid cooler in Q4 2024, featuring a novel heat exchanger wetting solution for improved evaporative cooling. The new system addresses common drawbacks of adiabatic coolers, such as high water consumption and initial costs. Utilizing gravity-fed water flow and a unique fin surface geometry, it ensures uniform wetting and superior thermal performance. This innovation offers a more efficient alternative to traditional adiabatic solutions.

- July 2024: Condair acquired US-based evaporative cooling specialist Kuul to strengthen its global operations. The acquisition includes Kuul's cellulose media and glass fibre products for cooling applications, which are vital for data centers and industrial technologies. Condair plans to invest in expanding US production capacity to meet growing demand. This move positions Condair as a key player in the evaporative cooling and adiabatic pre-cooling markets for chillers and turbines.

Evaporative Cooling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types of cooling Covered | Direct Evaporative Cooling, Indirect Evaporative Cooling, Two-stage Evaporative Cooling |

| Distribution channels Covered | Big-box Retailers, HVAC Contractors and Distributors, and Others |

| Applications Covered | Residential, Commercial, Industrial, Confinement Farming, and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Baltimore Aircoil Company, Inc., Bonaire, Celsius Design, CFW Evapcool, Colt International Ltd, Condair Group, Delta Cooling Towers, Inc., EcoCooling, Munters Global, Phoenix Manufacturing, SPX Cooling Tech, LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the evaporative cooling market from 2019-2033.

- The evaporative cooling market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the evaporative cooling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The evaporative cooling market was valued at USD 6.75 Billion in 2024.

The evaporative cooling market is projected to exhibit a CAGR of 5.11% during 2025-2033, reaching a value of USD 10.81 Billion by 2033.

Key factors driving the global evaporative cooling market include rising energy costs, increasing demand for energy-efficient and sustainable cooling solutions, growing industrial and residential cooling needs, and the need to reduce environmental impact. Additionally, technological advancements, such as adiabatic cooling systems, further boost adoption and growth.

Asia Pacific currently dominates the evaporative cooling market, accounting for a share of 39.4%. The rising demand for cost-effective and energy-efficient cooling solutions represent one of the key factors driving the evaporative cooling market growth. Other factors, such as significant technological advancements and extensive research and development (R&D), are creating a positive evaporative cooling market outlook across the region.

Some of the major players in the evaporative cooling market include Baltimore Aircoil Company, Inc., Bonaire, Celsius Design, CFW Evapcool, Colt International Ltd, Condair Group, Delta Cooling Towers, Inc., EcoCooling, Munters Global, Phoenix Manufacturing, SPX Cooling Tech, LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)