EV Charging Cables Market by Cable Length (Below 5 Meter, 6 Meter to 10 Meter, Above 10 Meter), Shape (Straight, Coiled), Charging Level (Level 1, Level 2, Level 3), Power Type (AC Charging, DC Charging), Application (Private Charging, Public Charging), and Region 2026-2034

EV Charging Cables Market Size:

The global EV charging cables market size reached USD 1,461.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 6,574.8 Million by 2034, exhibiting a growth rate (CAGR) of 18.18% during 2026-2034. The imposition of government regulations and incentives, increasing adoption of EVs, rapid technological advancements, escalating investment by public and private sectors is developing charging networks, and increasing integration of EV charging stations with renewable energy are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,461.7 Million |

|

Market Forecast in 2034

|

USD 6,574.8 Million |

| Market Growth Rate 2026-2034 | 18.18% |

EV Charging Cables Market Analysis:

- Major Market Drivers: Key market drivers include the increasing demand for electric vehicles (EVs) as governments push for cleaner energy solutions. Supportive policies and incentives for EV adoption are encouraging investments in charging infrastructure thereby boosting the product demand. Technological advancements are enhancing charging efficiency and reducing charging times, making EVs more attractive to consumers. In line with this, rising awareness about reducing carbon emissions and the shift toward sustainable transportation are fueling the need for efficient charging solutions further driving the market for charging cables. The growth of fast and ultra-fast chargers also contributes positively to the market growth.

- Key Market Trends: Key market trends include the development of ultra-fast charging cables in order to support high-powered charging stations. There is also a rising shift toward using lightweight and durable materials like aluminum and copper alloys to improve cable efficiency and reduce overall weight. The market is witnessing an increase in the demand for longer cables that offer more flexibility in vehicle positioning during charging. In addition to this, manufacturers are focusing on improving cable durability to withstand various weather conditions, thereby enhancing safety and performance.

- Geographical Trends: The geographical trends in the market show significant growth in Asia-Pacific mainly driven by China's rising adoption of electric vehicles and substantial investments in charging infrastructure. Countries like Japan and South Korea are also contributing to regional growth with supportive government policies and increasing EV sales. Europe follows closely, with nations like Germany, Norway, and the Netherlands pushing for emission reductions and offering incentives that boost demand for advanced charging solutions. In North America, the United States shows steady growth due to rising EV adoption and expanding charging networks. Emerging markets in Latin America and the Middle East are gradually investing in EV infrastructure, indicating potential future growth.

- Competitive Landscape: Some of the major market players in the EV charging cables industry include AG Electrical Technology Co., Besen International Group Co. Ltd., Brugg Group, Coroplast Fritz Müller GmbH & Co. KG, Dyden Corporation, Eland Cable Limited, EV Cables UK (Wottz Group), EV Teison, Leoni AG, Phoenix Contact GmbH & Co. KG, Sinbon Electronics Co. Ltd., Systems Wire Cable, TE Connectivity Ltd., among many others.

- Challenges and Opportunities: The market faces various challenges including high production costs, the need for durable and weather-resistant materials, and the complexities of ensuring compatibility across various charging standards globally. However, these challenges create opportunities for innovation mainly in developing lightweight and high-efficiency materials that can lower costs and improve performance. The expansion of fast-charging infrastructure presents further growth potential, as does the increasing demand for flexible, longer cables to accommodate different charging setups. In line with this, the rise of wireless charging technology opens up new avenues for cable manufacturers to explore in the evolving electric vehicle ecosystem.

To get more information on this market Request Sample

EV Charging Cables Market Trends:

The imposition of government regulations and incentives

Government incentives and regulations promoting electric vehicles are shaping EV charging cables market dynamics by creating increased demand for charging infrastructure. Governments across the world are playing a pivotal role in driving the EV charging cables market by implementing strict environmental regulations aimed at reducing greenhouse gas emissions. Furthermore, they are imposing restrictions on fossil fuel-powered vehicles and also incentivizing the adoption of electric and hybrid vehicles through subsidies on purchase, tax benefits, free or discounted tolls, and preferential parking spaces. Additionally, some jurisdictions are setting deadlines for phasing out internal combustion engine vehicles, thereby accelerating the need for robust charging infrastructure, including cables. Moreover, the increasing collaborative efforts between government bodies and private sectors to enhance the availability and accessibility of charging stations are positively influencing the market growth. This multifaceted approach by governments globally is driving the EV charging cables demand across the world. For instance, in September 2024, the Government of India (GoI) launched the ₹10,900 crore PM Electric Drive scheme to promote the adoption of electric vehicles. The scheme offers subsidies worth ₹3,679 crore for electric two-wheelers, three-wheelers, e-ambulances, e-trucks, and other emerging EVs. It also includes an outlay of ₹2,000 crore for EV charging stations. The scheme aims to support 24.79 lakh e-2Ws, 3.16 lakh e-3Ws, and 14,028 e-buses, and modernize test agencies to promote green mobility. The increasing involvement of governments is significantly shaping the EV charging cables market by fostering growth through regulations and incentives. These initiatives are creating a positive the EV charging cables market outlook, as they not only encourage the adoption of electric vehicles but also support the development of a reliable charging infrastructure.

Increasing adoption of electric vehicles

The escalating awareness regarding environmental sustainability resulting in a significant increase in the adoption of electric and hybrid vehicles is propelling the market growth. Along with this, the shift away from traditional fuel-powered vehicles to reduce dependence on fossil fuels and diminishes harmful emissions is acting as another growth-inducing factor. Moreover, consumers are increasingly recognizing the long-term economic and environmental benefits of EVs, including lower maintenance costs and decreased air pollution. Additionally, automotive manufacturers are responding to changing consumer preferences by offering diverse EV models across various price ranges, thus making EVs an attractive option for a broader consumer base. In line with this, the rapid expansion of charging infrastructure and cables to meet the growing needs of EVs on the road is strengthening the EV charging cables market growth. According to industry reports, in 2023, global electric car sales neared 14 million, with 95% sold in China, Europe, and the United States. Electric car sales increased by 35% from 2022, reaching over 250,000 new registrations per week. Around 18% of all cars sold in 2023 were electric, up from 14% in 2022. China saw 8.1 million new electric car registrations, while the United States had 1.4 million and Europe nearly 25%.

The rapid technological advancements

Rapid advancements in charging technology are a central driver in the EV charging cables market. Researchers and manufacturers are continually working to enhance charging speed, efficiency, and convenience, making EVs more appealing to consumers. In line with this, the development of fast charging solutions, which enables quicker replenishment of EV batteries, thus reducing charging times, is positively influencing the market growth. Furthermore, the rapid innovations in cable materials, design, and safety features are also contributing to a more user-friendly and reliable experience. Apart from this, the integration of smart charging systems, allowing remote monitoring and control, is positively impacting the market growth. Moreover, these technological enhancements are not only improving the performance of charging cables but also fostering consumer confidence in the overall electric vehicle ecosystem. According to EV charging cables market insights, these technological advancements are expected to significantly boost the demand for high-quality charging cables, further accelerating market expansion in the coming years. For instance, in March 2024, itselectric, a Brooklyn-based electric vehicle (EV) charging network, achieved a significant milestone as their first-generation charger, the "Brooklyn-718", becomes the first EV charger with a detachable cable to be certified under UL Standards. This certification supports itselectric's plans for broad deployment in major cities across the US in 2024. The detachable cable model addresses the immediate needs for curbside charging and ensures charger uptime, offering a solution to limited access to public EV charging.

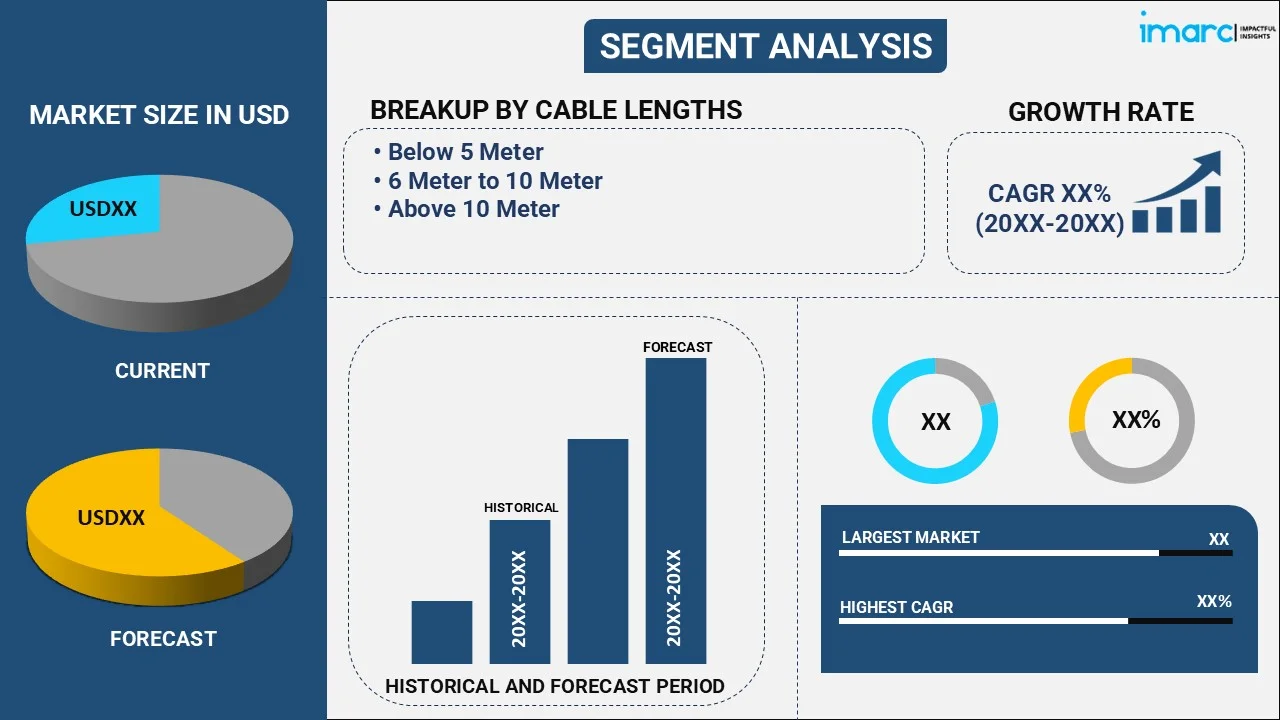

EV Charging Cables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on cable length, shape, charging level, power type, and application.

Breakup by Cable length:

To get detailed segment analysis of this market Request Sample

- Below 5 Meter

- 6 Meter to 10 Meter

- Above 10 Meter

Below 5 meter accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the cable length. This includes below 5 meter, 6 meter to 10 meter, and above 10 meter. According to the report, below 5 meter represented the largest segment.

According to EV charging cables market research report, below 5-meter cables are dominating the market as they are generally more manageable and easier to handle. In addition, they can be easily coiled and stored, making them particularly suitable for residential and public charging stations where space might be limited. Furthermore, they require fewer materials in their production, leading to a reduction in manufacturing costs. This saving is further passed on to the consumers, making below 5-meter cables an attractive option for both individual users and commercial operators. Apart from this, they enhance user safety, minimize the risks of accidents, and prevent tripping or entanglement. Moreover, below 5-meter cables reduce energy loss during transmission, leading to more efficient charging. Along with this, they present a neater appearance and are more practical to use in various scenarios, whether it's a private garage or a public charging station.

Breakup by Shape:

- Straight

- Coiled

Straight holds the largest share of the industry

A detailed breakup and analysis of the market based on the shape have also been provided in the report. This includes straight and coiled. According to the report, straight represented the largest segment.

According to EV charging cables market report, straight-shaped cables are dominating the market as they are simpler and more cost-effective to manufacture. The straightforward design reduces production complexity, resulting in cost savings that are passed on to consumers. Furthermore, they offer greater versatility and are suitable for a diverse range of applications, including residential and commercial charging stations. Additionally, the straight shape minimizes the chances of kinks and bends, which could potentially harm the cable's integrity over time. Apart from this, they are easier to handle and manage, particularly when connecting and disconnecting from the charging point. The absence of coiling makes them less prone to tangling, further enhancing the user experience. Moreover, straight cables offer more efficient energy transmission by minimizing resistance and potential loss that might occur in coiled or bent designs.

Breakup by Charging Level:

- Level 1

- Level 2

- Level 3

Level 1 represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the charging level. This includes level 1, level 2, and level 3. According to the report, level 1 represented the largest market segment.

Level 1 charging is dominating the market as it requires no special equipment beyond a standard outlet, which is available in most homes and businesses. Along with this, it doesn't require significant electrical upgrades or specialized charging equipment. The lower installation cost makes it an attractive option for those who are new to EVs or have budget constraints. Additionally, level 1 charging provides adequate replenishment for daily commuting needs, thus making it a practical and convenient solution for home charging, where speed is not the primary concern. Furthermore, it is highly energy efficient, as it charges at a lower power level, thus reducing potential losses in energy transfer. These advantages are creating a positive EV charging cables industry outlook, as they make Level 1 charging a viable and cost-effective solution for many EV users, thereby driving demand for compatible charging cables in both residential and commercial settings.

Breakup by Power Type:

- AC Charging

- DC Charging

AC Charging exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the power type have also been provided in the report. This includes AC charging and DC charging. According to the report, AC charging represented the largest market segment.

AC charging is dominating the market as it is the standard form of electricity available in most homes and businesses, making it an accessible option for a broad range of users. Furthermore, compared to DC charging, AC charging stations are less expensive to install and maintain, as they don't require specialized equipment or significant modifications to existing electrical systems. Apart from this, AC charging is well-suited for home charging solutions, as most daily commutes fall within the range that can be replenished overnight with AC charging. Besides this, it can be seamlessly integrated with existing electrical grids without requiring complex or costly adaptations. Moreover, AC charging allows for optimal battery management and control, thus ensuring efficient energy usage.

Breakup by Application:

- Private Charging

- Public Charging

Private charging dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes private charging and public charging. According to the report, private charging represented the largest market segment.

Private charging allows EV owners to charge their vehicles at home or at private workplaces, thus offering unmatched convenience. It also enables users to charge overnight or during work hours without needing to make special trips to public charging stations. Furthermore, the utilization of residential electricity in private charging, combined with favorable government incentives for home charger installation, which makes private charging an economically attractive option, is boosting the market growth. Apart from this, private charging aligns perfectly with the predictable daily routine of EV owners, thus allowing users to replenish their vehicle's battery during downtime. Moreover, it provides users with greater security and control over the charging process, as they can choose when and how to charge, using preferred charging levels and methods, without competing for access with other users.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest EV charging cables market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for EV charging cables.

Asia Pacific is dominating the EV charging cables market due to the imposition of robust policies and incentives by regional governments to promote electric vehicle adoption. Furthermore, the region's rapid urbanization and growth of megacities, which is creating a need for cleaner transportation solutions, such as electric vehicles (EVs), is boosting the market growth. Additionally, Asia Pacific hosts several leading EV and EV component manufacturers, thus contributing to the local production and availability of EV charging cables. Moreover, significant investments by public and private players in developing and expanding EV charging infrastructure across the region are strengthening the market growth. In addition, the rising awareness about environmental issues, coupled with the easy availability of various EV options, is acting as another growth-inducing factor. According to EV charging cables market forecast, Asia Pacific is expected to maintain its dominance in the coming years, with continued investments in charging infrastructure and government policies further accelerating the adoption of electric vehicles, driving sustained demand for EV charging cables across the region. For instance, in April 2024, Huawei partnered with Singapore's EVe to introduce ultra-fast EV chargers, significantly reducing charging time. The collaboration aims to enhance Singapore's EV charging infrastructure and meet the growing demand for electric vehicles. Rated at 480kW, the chargers are 10 times faster than conventional ones, offering a charging rate of one kilometer per second. The partnership reflects a commitment to sustainability and supports Singapore's Green Plan 2030.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the EV charging cables industry include AG Electrical Technology Co., Besen International Group Co. Ltd., Brugg Group, Coroplast Fritz Müller GmbH & Co. KG, Dyden Corporation, Eland Cable Limited, EV Cables UK (Wottz Group), EV Teison, Leoni AG, Phoenix Contact GmbH & Co. KG, Sinbon Electronics Co. Ltd., Systems Wire Cable, TE Connectivity Ltd., etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The leading EV charging cable companies are developing advanced charging solutions that are more efficient, faster, and compatible with various EV models. Furthermore, they are diversifying and expanding their product offerings by providing various types of charging cables, connectors, and accessories that suit different charging levels and vehicle requirements. Additionally, several key players are entering new geographic markets through strategic partnerships, acquisitions, and collaborations with local entities. They are also forming alliances with automakers, utilities, and governments to ensure seamless integration of their products into the wider EV ecosystem. Apart from this, leading companies are adopting environmentally friendly practices and materials to align with global sustainability goals. They are also integrating smart technologies, such as the Internet of Things (IoT) sensors, to allow remote control, monitoring, and optimization of the charging process. These factors are expected to increase EV charging cables market revenue in the coming future.

EV Charging Cables Market News:

- In September 2024, Believ acquired SMS Public EV Charging in a strategic partnership, enhancing its EV charging capabilities. With financial backing from Liberty Global and Zouk Capital, Believ aims to expand its network of charge points across the UK. The partnership will also bring 10 new employees to Believ and open new offices in Wales and Scotland. This move is expected to accelerate the deployment of EV charging infrastructure and improve services for customers.

- In July 2024, Starbucks partnered with Mercedes-Benz to introduce electric vehicle (EV) charging stations at over 100 Starbucks stores across the U.S., starting along Interstate 5. The initiative aims to enhance the charging experience for EV drivers and attract high-income consumers. This partnership reflects the growing trend of retailers catering to EV owners, with malls also investing in ultra-fast charging stations to appeal to this lucrative market segment.

EV Charging Cables Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cable Lengths Covered | Below 5 Meter, 6 Meter to 10 Meter, Above 10 Meter |

| Shapes Covered | Straight, Coiled |

| Charging Levels Covered | Level 1, Level 2, Level 3 |

| Power Types Covered | AC Charging, DC Charging |

| Applications Covered | Private Charging, Public Charging |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AG Electrical Technology Co., Besen International Group Co. Ltd., Brugg Group, Coroplast Fritz Müller GmbH & Co. KG, Dyden Corporation, Eland Cable Limited, EV Cables UK (Wottz Group), EV Teison, Leoni AG, Phoenix Contact GmbH & Co. KG, Sinbon Electronics Co. Ltd., Systems Wire Cable, TE Connectivity Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the EV charging cables market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global EV charging cables market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the EV charging cables industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global EV charging cables market was valued at USD 1,461.7 Million in 2025.

We expect the global EV charging cables market to exhibit a CAGR of 18.18% during 2026-2034.

The introduction of innovative products that provide charging status through Light-Emitting Diode (LED) indicators and offer protection against overheating of domestic plugs is primarily driving the global EV charging cables market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for EV charging cables.

Based on the cable length, the global EV charging cables market can be segmented into below 5 meter, 6 meter to 10 meter, and above 10 meter. Among these, below 5 meter holds the majority of the total market share.

Based on the shape, the global EV charging cables market has been divided into straight and coiled, where straight currently exhibits a clear dominance in the market.

Based on the charging level, the global EV charging cables market can be categorized into level 1, level 2, and level 3. Currently, level 1 accounts for the majority of the global market share.

Based on the power type, the global EV charging cables market has been segregated into AC charging and DC charging, where AC charging currently holds the largest market share.

Based on the application, the global EV charging cables market can be bifurcated into private charging and public charging. Currently, private charging exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global EV charging cables market include AG Electrical Technology Co., Besen International Group Co. Ltd., Brugg Group, Coroplast Fritz Müller GmbH & Co. KG, Dyden Corporation, Eland Cable Limited, EV Cables UK (Wottz Group), EV Teison, Leoni AG, Phoenix Contact GmbH & Co. KG, Sinbon Electronics Co. Ltd., Systems Wire Cable, TE Connectivity Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)