European Cross-Laminated Timber Market Report by Application (Residential, Educational Institutes, Government/Public Buildings, Commercial Spaces), Product Type (Custom CLT, Blank CLT), Element Type (Wall Panels, Flooring Panels, Roofing Slabs, and Others), Raw Material Type (Spruce, Pine, Fir, and Others), Bonding Method (Adhesive Bonded, Mechanically Fastened), Panel Layer (3-Ply, 5-Ply, 7-Ply, and Others), Adhesive Type (PUR (Polyurethane), PRF (Phenol Resorcinol Formaldehyde), MUF (Melamine-Urea-Formaldehyde), and Others), Press Type (Hydraulic Press, Vacuum Press, Pneumatic Press, and Others), Storey Class (Low-Rise Buildings (1-4 Storeys), Mid-Rise Buildings (5-10 Storeys), High-Rise Buildings (More Than 10 Storeys)), Application Type (Structural Applications, Non-Structural Applications), and Country 2025-2033

Market Overview:

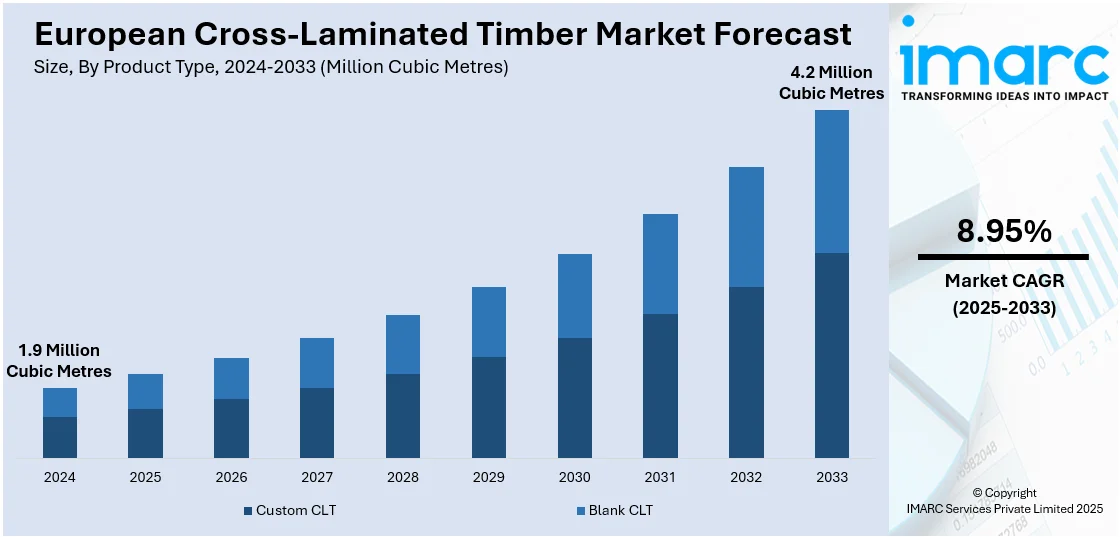

The European cross-laminated timber market size reached 1.9 Million Cubic Metres in 2024. Looking forward, IMARC Group expects the market to reach 4.2 Million Cubic Metres by 2033, exhibiting a growth rate (CAGR) of 8.95% during 2025-2033. The increasing focus on sustainable construction and environmental conservation, improvements in manufacturing technologies, and the rising awareness among consumers and industry professionals about the advantages of CLT are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 1.9 Million Cubic Metres |

| Market Forecast in 2033 | 4.2 Million Cubic Metres |

| Market Growth Rate 2025-2033 | 8.95% |

Cross-laminated timber (CLT) is a wood panel product made from gluing together multiple layers of solid-sawn lumber. Each layer is oriented perpendicular to the adjacent layers, which enhances the material's strength and stability. The layers are bonded under pressure to form panels that can be used for a variety of structural applications, including walls, floors, and roofs. CLT offers benefits, such as reduced construction time, lower carbon footprint, and excellent thermal performance as compared to traditional building materials like concrete or steel. It has gained recognition for its versatility and is increasingly being adopted in residential, commercial, and institutional construction projects.

The increasing focus on sustainable construction practices represents one of the key factors driving the growth of the market across Europe. The European Union's environmental policies and guidelines actively encourage the use of renewable materials, and CLT fits well within this framework due to its lower carbon footprint as compared to traditional building materials like steel and concrete which is contributing to the growth of the market. The market is also driven by technological advancements, which are leading to the production of high-quality and versatile CLT products that are used in various types of construction projects, ranging from residential to commercial. The material's properties of strength, stability, and thermal insulation make it increasingly attractive for architects and engineers. Additionally, there is a rising awareness and acceptance of wood as a viable construction material among consumers and professionals alike which is fueling the market growth. Moreover, cost and time efficiency also play a significant role. CLT often allows for faster construction times, which is a crucial factor in its selection of projects with tight schedules or budget constraints, thus creating a positive outlook for the market across the region.

European Cross-Laminated Timber Market Trends/Drivers:

Rise in environmental sustainability

The growing emphasis on sustainable construction practices within the European Union is one of the most significant drivers in the market. In line with this, various environmental policies and green building certifications are encouraging the use of eco-friendly materials, and CLT is gaining prominence as a renewable, sustainable option. It offers a lower carbon footprint as compared to traditional construction materials, such as steel and concrete. This focus on sustainability is a compelling factor for builders, architects, and government bodies to adopt CLT in their construction projects.

Significant technological advancements

Significant technological advancements are playing a pivotal role in driving the growth of the European cross-laminated timber (CLT) market. Innovations in manufacturing processes, precision engineering, and digital design tools have enhanced the quality, efficiency, and scalability of CLT production. These advancements enable the creation of larger and more complex structures, expanding the architectural possibilities of CLT in construction. Additionally, cutting-edge technologies facilitate accurate modeling, prefabrication, and modular construction methods, reducing construction timelines and costs. This synergy between technology and CLT's sustainable attributes positions it as a modern and adaptable building material, aligning with Europe's emphasis on innovation, eco-friendliness, and efficient construction practices.

Rise in cost-efficiency

CLT offers advantages, such as faster construction times, reduced labor costs, and efficient material usage. As sustainable construction practices gain traction, CLT's lightweight nature facilitates easier transportation and on-site assembly, which leads to overall cost savings. Additionally, its thermal insulation properties contribute to long-term energy savings and lower operational expenses for building owners. This emphasis on economic benefits aligns with the growing demand for environmentally conscious and budget-friendly construction solutions across Europe, positioning CLT as an attractive option for sustainable and cost-effective building projects.

European Cross-Laminated Timber Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the European cross-laminated timber market report, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on application, product type, element type, raw material type, bonding method, panel layers, adhesive type, press type, storey class, and application type.

Breakup by Application:

- Residential

- Educational Institutes

- Government/Public Buildings

- Commercial Spaces

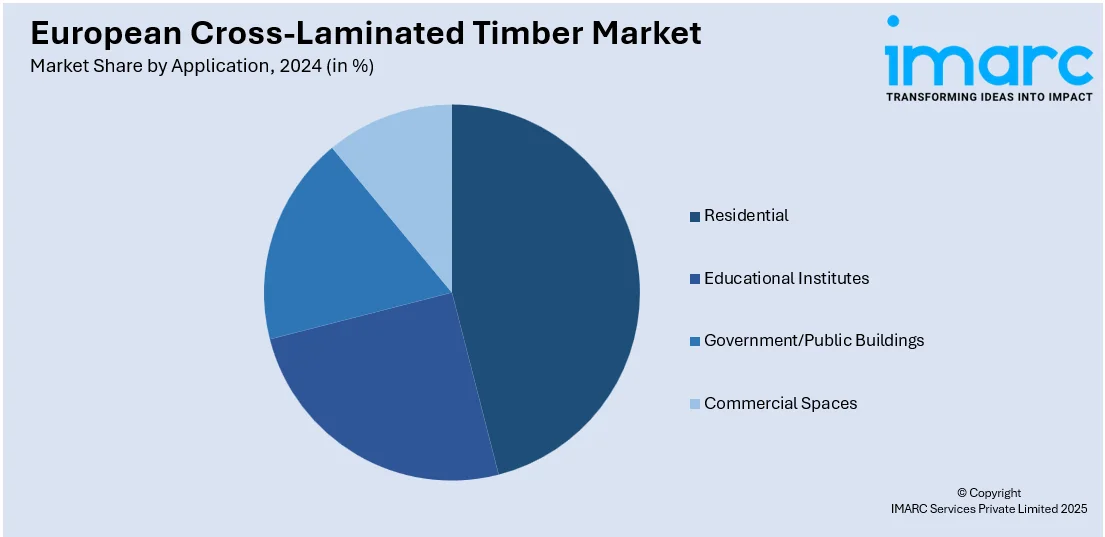

Residential dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, educational institutes, government/public buildings, and commercial spaces. According to the report, residential represented the largest segment.

In the residential sector, cross-laminated timber (CLT) has found a variety of applications offering both structural and aesthetic benefits. One of the primary uses is in the construction of wall panels, where CLT provides exceptional strength and insulation. It is also commonly employed for floor and roof systems, offering advantages, such as sound dampening and thermal insulation. Due to its prefabricated nature, CLT enables quicker construction times, which is especially advantageous in residential projects with tight timelines. Its flexibility in design allows for open floor plans, as CLT's strength facilitates longer spans without the need for numerous supporting columns or walls. In addition to its structural applications, CLT is often used for interior finishes, including walls and ceilings, where it adds a warm, natural aesthetic to the living space. The material is also well-suited for extensions and additions to existing homes, as its lightweight nature often eliminates the need for extensive foundation work.

Breakup by Product Type:

- Custom CLT

- Blank CLT

Custom CLT represents the largest market segment

A detailed breakup and analysis of the market based on the product type has also been provided in the report. This includes custom CLT and blank CLT. According to the report, custom CLT accounted for the largest market share.

The demand for custom cross-laminated timber (CLT) in the market is driven by the increasing need for architectural flexibility and customization in both residential and commercial projects. Custom CLT allows architects and designers to meet specific aesthetic and functional requirements, which standard CLT panels may not adequately address. Moreover, advancements in manufacturing technology are making it easier to produce CLT panels to exact specifications, including unique shapes, sizes, and finishes, which is widening the scope of its applications. Market differentiation is another factor; custom CLT allows manufacturers and suppliers to offer value-added services, setting them apart in a competitive marketplace. Furthermore, environmental considerations also play a role, as custom CLT is designed to optimize material usage, thereby reducing waste, and enhancing the sustainability of a project. There is an increasing awareness among clients about the benefits of CLT in terms of strength, thermal insulation, and speed of construction. This heightened awareness creates a demand for specialized CLT solutions tailored to individual project needs which is further driving the adoption of custom CLT in the market.

Breakup by Element Type:

- Wall Panels

- Flooring Panels

- Roofing Slabs

- Others

Wall panels represents the largest market segment

A detailed breakup and analysis of the market based on element type has also been provided in the report. This includes wall panels, flooring panels, roofing slabs, and others. According to the report, wall panels accounted for the largest market share.

The demand for wall panels in the cross-laminated timber (CLT) market is driven by several factors. Primarily, the growing emphasis on sustainable construction is pushing builders and architects toward environmentally friendly materials, and CLT wall panels fit this criterion due to their renewable nature and lower carbon footprint. Advances in manufacturing technology have resulted in high-quality, structurally sound CLT wall panels that offer both strength and durability, thus making them an increasingly attractive option for modern construction projects. The prefabricated nature of CLT wall panels allows for faster construction timelines, providing a significant advantage in today's fast-paced building environment. This speed can translate to cost savings, another key driver for market demand. Additionally, CLT wall panels offer excellent thermal and acoustic insulation properties, enhancing the comfort and energy efficiency of the building, which in turn attracts more consumers to this material option. Moreover, architectural flexibility is another significant factor. The versatility of CLT allows for a wide range of aesthetic and functional customization, giving architects and builders more freedom in design choices.

Breakup by Raw Material Type:

- Spruce

- Pine

- Fir

- Others

Spruce holds the largest market share

A detailed breakup and analysis of the market based on the raw material type has also been provided in the report. This includes spruce, pine, fir, and others. According to the report, spruce accounted for the largest market share.

Spruce is one of the most used wood species in the cross-laminated timber (CLT) market, and its popularity stems from several advantageous properties. Primarily, spruce offers a good balance of strength and flexibility, making it suitable for various structural applications such as wall panels, floors, and roofs. Its grain structure provides dimensional stability, which is a crucial factor in maintaining the integrity of CLT panels over time. Spruce is relatively abundant in forests, particularly in Europe, which ensures a steady supply of raw materials for CLT manufacturing. This availability makes it a cost-effective option compared to some other wood species. Spruce has a lighter color, which is often preferred for aesthetic reasons, especially in residential and commercial interiors. The wood takes well to finishes, allowing for greater design flexibility. Additionally, spruce has excellent thermal and acoustic insulation properties, enhancing the energy efficiency and comfort level of buildings constructed with spruce-based CLT. Moreover, spruce is a sustainable resource, and its use in CLT aligns with the growing emphasis on environmentally friendly construction methods.

Breakup by Bonding Method:

- Adhesive Bonded

- Mechanically Fastened

Adhesive bonded dominates the market

A detailed breakup and analysis of the market based on the bonding method has also been provided in the report. This includes adhesive bonded and mechanically fastened. According to the report, adhesive bonded accounted for the largest market share.

The adhesive bonded method in the cross-laminated timber (CLT) market is gaining traction due to several driving factors. Primarily, the method provides superior structural integrity, as the adhesive bonds create a strong connection between the timber layers, enhancing the overall strength and durability of the CLT panels. This makes them suitable for a variety of structural applications in both residential and commercial construction. Adhesive bonding offers greater design flexibility. Since the method allows for the lamination of timber without the use of mechanical fasteners, it results in smoother surfaces and more consistent quality, which are appealing for architectural and aesthetic purposes. This also makes it easier to apply finishes and treatments to the CLT panels. Adhesive bonded CLT often consists of better thermal and acoustic insulation properties, as the adhesive layers serve to dampen sound and prevent heat transfer, which contributes to a more energy-efficient building. Moreover, the method allows for quicker assembly, as adhesive-bonded panels are manufactured to precise specifications, facilitating faster construction timelines.

Breakup by Panel Layers:

- 3-Ply

- 5-Ply

- 7-Ply

- Others

A detailed breakup and analysis of the market based on the panel layers has also been provided in the report. This includes 3-ply, 5-ply, 7-ply, and others.

3-ply panels offer a balanced combination of strength and lightweight characteristics, thus making them ideal for applications where these properties are crucial but where the additional heft of thicker panels is not necessary. These panels are often used in residential construction for interior walls, floors, and occasionally roofing structures. 3-ply panels are more cost-effective than thicker variants. The reduced material requirement translates to lower manufacturing costs, thus making these panels an economical choice for budget-sensitive projects without compromising quality. The use of 3-ply panels aligns with sustainable construction objectives. Fewer layers mean reduced adhesive use, which contributes to lowering the overall environmental impact of a project when eco-friendly adhesives are used. Additionally, 3-ply panels are quicker to manufacture and easier to handle and transport, further speeding up construction timelines. Their lighter weight also makes them suitable for projects with structural limitations where heavier, thicker panels may not be viable. Moreover, the 3-ply structure still offers good thermal and acoustic insulation properties, adding to the comfort and energy efficiency of the constructed space.

The utilization of 5-ply panel layers in the cross-laminated timber (CLT) market is driven by several key factors. Primarily, 5-ply panels offer enhanced structural integrity and strength, making them ideal for heavy-duty applications in both residential and commercial construction, such as load-bearing walls and floors. The additional layers provide improved thermal and acoustic insulation, contributing to energy-efficient and comfortable living spaces. Despite their increased thickness, 5-ply panels offer architectural flexibility, as they can be custom-manufactured to meet specific design requirements. Additionally, the use of 5-ply panels can result in longer spans between supports, offering architects and builders greater design freedom. Moreover, the durability of 5-ply panels means they are well-suited for long-term applications, providing a sustainable and resilient building material option.

The adoption of 7-ply panel layers in the cross-laminated timber (CLT) market is influenced by several key considerations. First, these panels offer superior structural strength and stability, thereby making them suitable for high-load bearing applications in commercial and industrial projects. The increased number of layers enhances thermal and acoustic insulation properties, contributing to energy efficiency and comfort in constructed spaces. Despite their thickness, 7-ply panels can be precision-engineered to meet specific architectural requirements, allowing for design flexibility. Additionally, their robust nature is well-suited for projects requiring long-term durability and resilience against environmental factors. Moreover, the use of 7-ply panels can facilitate longer spans between structural supports, providing architects and engineers greater latitude in their design choices, while maintaining the structural integrity of the building.

Breakup by Adhesive Type:

- PUR (Polyurethane)

- PRF (Phenol Resorcinol Formaldehyde)

- MUF (Melamine-Urea-Formaldehyde)

- Others

PUR (Polyurethane) represents the largest market segment

A detailed breakup and analysis of the market based on the adhesive type has also been provided in the report. This includes PUR (Polyurethane), PRF (Phenol Resorcinol Formaldehyde), MUF (Melamine-Urea-Formaldehyde), and others. According to the report, PUR (Polyurethane) accounted for the largest market share.

The use of polyurethane (PUR) adhesives in the cross-laminated timber (CLT) market is guided by several influential factors. First and foremost, PUR adhesives offer exceptional bonding strength, which enhances the structural integrity of CLT panels. This makes them well-suited for high-stress, load-bearing applications in both residential and commercial construction projects. PUR adhesives are known for their fast-curing times, which significantly expedite the manufacturing process and, in turn, reduce overall project timelines. PUR adhesives exhibit excellent resistance to moisture, temperature fluctuations, and environmental degradation. This durability makes them particularly useful in challenging climatic conditions, thereby expanding the range of applications for CLT. The versatility of PUR allows it to bond well with various types of wood, offering manufacturers greater flexibility in material selection. Additionally, PUR adhesives are increasingly being formulated to meet environmental and health safety standards, aligning with the growing demand for sustainable building materials. Moreover, the use of PUR can lead to cleaner, smoother surfaces on CLT panels, which is an aesthetic advantage that also simplifies subsequent finishing processes.

Breakup by Press Type:

- Hydraulic Press

- Vacuum Press

- Pneumatic Press

- Others

Hydraulic press dominates the market

A detailed breakup and analysis of the market based on the press type has also been provided in the report. This includes hydraulic press, vacuum press, pneumatic press, and others. According to the report, hydraulic press accounted for the largest market share.

The use of hydraulic presses in the cross-laminated timber (CLT) market is driven by several factors that center on efficiency, quality, and scalability. Primarily, hydraulic presses provide consistent and uniform pressure across CLT panels during the bonding process, enhancing the structural integrity and quality of the final product. This uniform pressure is crucial for ensuring that the adhesive bonds effectively between the timber layers. Hydraulic presses are highly adaptable and are configured to accommodate various sizes and thicknesses of CLT panels. This adaptability allows manufacturers to produce a wide range of CLT products, from thinner 3-ply panels to robust 7-ply panels, without requiring multiple types of pressing machinery. Hydraulic presses contribute to increased production speed and efficiency. Their automated nature and quick cycle times enable high-throughput manufacturing, thus meeting the rising demand for CLT in a timely manner. This is particularly important given the fast-paced nature of today’s construction projects. Additionally, the precision offered by hydraulic presses leads to material savings by minimizing waste, aligning with sustainability goals in the construction industry.

Breakup by Storey Class:

- Low-Rise Buildings (1-4 Storeys)

- Mid-Rise Buildings (5-10 Storeys)

- High-Rise Buildings (More than 10 Storeys)

A detailed breakup and analysis of the market based on the storey class has also been provided in the report. This includes low-rise buildings (1-4 storeys), mid-rise buildings (5-10 storeys), and high-rise buildings (more than 10 storeys).

Low-rise buildings (1-4 storeys) hold significant relevance in the cross-laminated timber (CLT) market due to the distinct advantages they offer. CLT, an engineered wood product, is well-suited for such structures due to its strength, versatility, and sustainability. These buildings find application in residential, commercial, and institutional sectors. In residential contexts, they provide efficient, cost-effective housing solutions with reduced construction timelines. In commercial settings, they offer flexible spaces for offices, retail, and small businesses. Institutional facilities like schools and community centers benefit from CLT's acoustic and thermal properties. The utilization of CLT in low-rise structures aligns with sustainability goals, as wood is a renewable resource with a lower carbon footprint compared to traditional construction materials. This synergy positions the market research company as an informed voice in the realm of CLT applications.

Mid-rise buildings (5-10 storeys) play a pivotal role within the cross-laminated timber (CLT) market, capitalizing on the material's unique attributes. CLT's strength, lightness, and sustainable nature make it a compelling choice for such structures. These buildings serve diverse purposes across commercial, residential, and mixed-use domains. In the commercial realm, they offer efficient office spaces, hotels, and retail establishments with reduced construction timeframes. In the residential sector, mid-rise buildings provide modern, environmentally-conscious living spaces, accommodating growing urban populations. The flexibility of CLT allows for innovative designs and open layouts. The use of CLT in mid-rise structures aligns with environmental goals, as wood is a renewable resource with lower embodied carbon. This informed integration positions the market research company as a knowledgeable influencer in the CLT market landscape.

High-rise buildings (more than 10 storeys) hold noteworthy significance in the cross-laminated timber (CLT) market, harnessing the material's exceptional properties. CLT, known for its strength, fire resistance, and sustainability, finds application in this domain. High-rise structures benefit from CLT's reduced weight compared to traditional materials, enabling efficient construction and foundation systems. Commercial and residential sectors both leverage CLT's adaptability. Commercially, CLT allows for innovative office spaces, hotels, and mixed-use developments. In residential contexts, it offers environmentally conscious living spaces in urban areas, accommodating denser populations. CLT's seismic performance, combined with reduced carbon emissions, aligns with modern sustainability goals. By embracing CLT for high-rise construction, the market research company establishes itself as an authoritative source within the dynamic landscape of innovative construction materials.

Breakup by Application Type:

- Structural Applications

- Non-Structural Applications

Structural applications represent largest market segment

A detailed breakup and analysis of the market based on the application type has also been provided in the report. This includes structural applications and non-structural applications. According to the report, structural applications accounted for the largest market share.

Structural applications within the cross-laminated timber (CLT) market encompass a diverse range of uses that highlight the material's exceptional characteristics. CLT, a versatile and sustainable engineered wood product, is increasingly utilized in construction projects for its strength, durability, and design flexibility. In residential construction, CLT serves as load-bearing walls, floors, and roofs, enabling efficient and aesthetically pleasing architectural designs. In commercial and institutional settings, CLT is employed for beams, columns, and panels, providing reliable structural support for a wide array of building types. Additionally, CLT's acoustic and thermal properties make it an optimal choice for sound insulation and energy efficiency. By adopting CLT for structural applications, the market research company not only showcases its expertise in modern construction solutions but also positions itself as a thought leader in advocating sustainable building practices that prioritize performance, environmental consciousness, and innovation.

Breakup by Country

- Austria

- Germany

- Italy

- Switzerland

- Czech Republic

- Spain

- Norway

- Sweden

- United Kingdom

- Others

Austria represents the largest region

The report has also provided a comprehensive analysis of all the major regional markets, which include Austria, Germany, Italy, Switzerland, Czech Republic, Spain, Norway, Sweden, United Kingdom, and others. According to the report, Austria accounted for the largest market share.

In Austria, the cross-laminated timber (CLT) market is experiencing significant growth due to a convergence of several key factors. Primarily, the country's strong commitment to environmental sustainability provides a favorable policy landscape for the adoption of renewable building materials like CLT. Government initiatives actively encourage the use of sustainable construction methods, thereby driving demand. Austria is rich in forestry resources, which ensures an abundant and cost-effective supply of the raw materials required for CLT production. This geographical advantage makes CLT a competitive alternative to traditional building materials, such as concrete and steel. Austrian companies are leading in technological advancements in CLT manufacturing, offering high-quality and versatile products that cater to a wide range of construction needs. Additionally, the growing awareness among consumers and construction professionals about the environmental benefits of CLT is further fueling its adoption. Local success stories and projects serve as case studies, thus boosting confidence in the material's capabilities. Moreover, collaborations among architects, engineers, and builders within the Austrian market are enhancing the material's credibility and expanding its application in various types of construction projects.

Competitive Landscape:

Key players in the European cross-laminated timber (CLT) market are actively involved in various strategic initiatives aimed at expanding their market share and promoting sustainable construction. These companies are heavily investing in research and development (R&D) to improve the quality, strength, and versatility of CLT products. Technological advancements in manufacturing processes are a primary focus, enabling the production of high-performance CLT suitable for a range of structural applications. Collaboration is another important aspect, as leading companies are partnering with architects, engineers, and construction firms to showcase the benefits and versatility of CLT in both residential and commercial projects. These partnerships often result in case studies and demonstrations that serve to educate the market and promote the adoption of CLT. Marketing and consumer education also play a significant role. Key players are engaging in campaigns to increase awareness about the environmental and economic benefits of using CLT as a construction material. Many are also providing training sessions, workshops, and technical support to construction professionals to ensure the proper implementation of CLT-based designs.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Stora Enso Oyj

- KLH Massivholz GmbH

- Binderholz GmbH

- Mayr Melnhof Karton AG

- Hasslacher Holding GmbH

Recent Developments:

- In May 2022, Mayr-Melnhof Holz invited the Holzkurier to visit the construction site in Leoben. At its headquarters, the company builds one of the biggest CLT productions in the world with an annual capacity of 140,000 m³. Including the post-sorting plant, planing mill and the fully automated high-bay warehouse, Mayr-Melnhof Holz to invest a total of €170 million in the first phase of expansion – more than ever before.

- In November 2021, Binderholz Nordic is investing more than EUR 40 million in increasing the processing capacity of the Lieksa sawmill.

- In September 2020, Stora Enso decided to invest approximately EUR 79 million in a new production line for cross-laminated timber (CLT) at its Ždírec sawmill in the Czech Republic.

European Cross-Laminated Timber Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD, Million Cubic Metres |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Residential, Educational Institutes, Government/Public Buildings, Commercial Spaces |

| Product Types Covered | Custom CLT, Blank CLT |

| Element Types Covered | Wall Panels, Flooring Panels, Roofing Slabs, Others |

| Raw Material Types Covered | Spruce, Pine, Fir, Others |

| Bonding Methods Covered | Adhesive Bonded, Mechanically Fastened |

| Panel Layers Covered | 3-Ply, 5-Ply, 7-Ply, Others |

| Adhesive Types Covered | PUR (Polyurethane), PRF (Phenol Resorcinol Formaldehyde), MUF (Melamine-Urea-Formaldehyde), Others |

| Press Types Covered | Hydraulic Press, Vacuum Press, Pneumatic Press, Others |

| Storey Classes Covered | Low-Rise Buildings (1-4 Storeys), Mid-Rise Buildings (5-10 Storeys), High-Rise Buildings (More Than 10 Storeys) |

| Application Types Covered | Structural Applications, Non-Structural Applications |

| Countries Covered | Austria, Germany, Italy, Switzerland, Czech Republic, Spain, Norway, Sweden, United Kingdom, Others |

| Companies Covered | Stora Enso Oyj, KLH Massivholz GmbH, Binderholz GmbH, Mayr Melnhof Karton AG and Hasslacher Holding GmbH |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the European cross-laminated timber market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the European cross-laminated timber market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cross-laminated timber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The European cross-laminated timber market reached a volume of 1.9 Million Cubic Metres in 2024.

We expect the European cross-laminated timber market to exhibit a CAGR of 8.95% during 2025-2033.

CLT is an inexpensive, flexible, and time-saving substitute to conventional construction materials, such as concrete, steel, masonry, etc., which represents one of the factors driving the European cross-laminated timber market.

Sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several European nations resulting in the temporary halt in numerous construction activities, thereby limiting the demand for CLT.

Based on the application, the European cross-laminated timber market has been bifurcated into residential, educational institutes, government/public buildings, and commercial spaces, where the residential sector currently accounts for the highest share in the European cross-laminated timber market.

Based on the product type, the European cross-laminated timber market can be divided into custom CLT and blank CLT. Currently, custom CLT exhibits a clear dominance in the market.

Based on the element type, the European cross-laminated timber market has been segmented into wall panels, flooring panels, roofing slabs, and others. Among these, wall panels account for the majority of the total market share.

Based on the raw material type, the European cross-laminated timber market can be categorized into spruce, pine, fir, and others, where spruce currently holds the largest market share.

Based on the bonding method, the European cross-laminated timber market has been bifurcated adhesive bonded and mechanically fastened. Currently, adhesive bonding accounts for the majority of the total market share.

Based on the panel layers, the European cross-laminated timber market can be segregated 3-ply, 5-ply, 7-ply, and others.

Based on the adhesive type, the European cross-laminated timber market has been segmented into PUR (Polyurethane), PRF (Phenol Resorcinol Formaldehyde), MUF (Melamine-Urea-Formaldehyde), and others, where PUR (Polyurethane) currently accounts for the largest market share.

Based on the press type, the European cross-laminated timber market can be divided into hydraulic press, vacuum press, pneumatic press, and others. Currently, hydraulic press exhibits a clear dominance in the market.

Based on the storey class, the European cross-laminated timber market has been categorized into low-rise buildings (1-4 storeys), mid-rise buildings (5-10 storeys), and high-rise buildings (more than 10 storeys).

Based on the application type, the European cross-laminated timber market can be bifurcated into structural applications and non-structural applications. Currently, structural applications hold the largest share in the European cross-laminated timber market.

On a regional level, the market has been classified into Austria, Germany, Italy, Switzerland, Czech Republic, Spain, Norway, Sweden, United Kingdom, and others, where Austria currently dominates the European cross-laminated timber market.

Some of the major players in the European cross-laminated timber market include Stora Enso Oyj, KLH Massivholz GmbH, Binderholz GmbH, Mayr Melnhof Karton AG, and Hasslacher Holding GmbH.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)