Europe Wi-Fi Chipset Market Size, Share, Trends and Forecast by Product, Band, MIMO Configuration, and Country, 2025-2033

Europe Wi-Fi Chipset Market Size and Share:

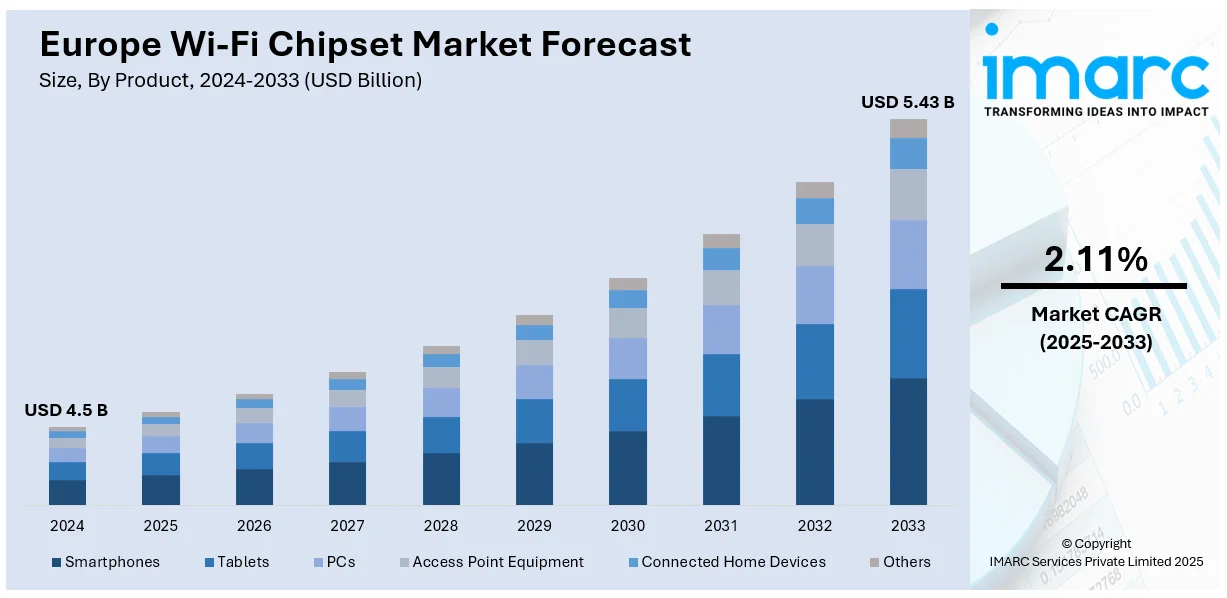

The Europe wi-fi chipset market size was valued at USD 4.5 Billion in 2024. Looking forward, reports estimate the market to reach USD 5.43 Billion by 2033, exhibiting a CAGR of 2.11% from 2025-2033. Germany leads the market, driven by strong advancements in industrial automation, widespread adoption of Internet of Things (IoT) devices, and robust investments in 5G infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.5 Billion |

|

Market Forecast in 2033

|

USD 5.43 Billion |

| Market Growth Rate (2025-2033) | 2.11% |

The Europe wi-fi chipset market demand is propelled by the rapid expansion of smart home devices and the increasing adoption of IoT technologies. As industries shift towards automation and Industry 4.0 practices, the need for seamless and high-speed wireless connectivity grows, driving market expansion. Moreover, the proliferation of 5G networks amplifies the need for advanced wi-fi chipsets to enable faster data transfer and low latency, contributing to the market expansion. For example, the 6G strategy of the region focuses on leveraging expertise and investing up to £100 million to lead telecoms and 6G research, shaping global standards to maintain competitiveness in the global economy. Besides this, the region emphasizes sustainability and energy efficiency, encouraging the development of energy-efficient chipsets, and aligning with eco-friendly initiatives. Furthermore, rising investments in digital infrastructure by governments and private entities are catalyzing the market growth.

Concurrently, the Europe wi-fi chipset market growth is fueled by its strong industrial base and advancements in automotive connectivity, including connected and autonomous vehicles. In addition, the country's robust research and development (R&D) capabilities and thriving telecommunications sector drive innovation in wi-fi technologies, boosting the market demand. Besides this, the increasing adoption of smart city solutions and extensive use of wireless connectivity in the public and private sectors is strengthening the Europe wi-fi chipset market share. Furthermore, supportive government policies, such as investments in 5G rollouts and digitalization initiatives, create a conducive environment for market expansion. Apart from this, the growing consumer preferences for smart devices and high-speed internet services drive the adoption of cutting-edge wi-fi chipsets across Europe, thereby propelling the market forward.

Europe Wi-Fi Chipset Market Trends:

The Increasing Adoption of Wi-Fi 6 and Wi-Fi 7 Technologies

The Europe wi-fi chipset market is witnessing rapid adoption of advanced technologies such as Wi-Fi 6 and the emerging Wi-Fi 7. These standards provide higher data throughput rates, lower delays, and better network utilization for the growing need for effective coverage in smart homes, offices, and public areas. For example, in 2024, a French broadband, and ISP were the first operators in Europe to introduce Wi-Fi 7 services. Their ‘Freebox Ultra’ gateway offers up to 8 Gbps of symmetric connectivity to households; they use Qualcomm’s Networking Pro 820 platform. This service is offered to about 35 million homes in France. Moreover, these technologies satisfy the increasing number of connected devices, solving the problem of congestion in a network, and improving the experience of users. Besides this, sectors such as gaming, video streaming, and applications based on augmented or virtual reality require high-performance wi-fi, making these advanced chipsets critical for future network demands, thus contributing to the market expansion.

The Rising Emphasis on IoT and Smart Devices

The rising integration of IoT devices is significantly influencing the Europe wi-fi chipset market outlook. In line with this, smart homes, health care, manufacturing industries, and agriculture require wi-fi for real-time communication and data transfer. This is because IoT environments are growing across the region and the need for more compact and power-efficient chipsets is increasing. Reports indicate that by 2029, more than 100 million Wi-Fi HaLow devices, tailored for mid-range IoT applications within the 850-950 MHz spectrum, will be in circulation. Also, the high interest in digitalization and the development of smart cities is allowing Europe wi-fi chipset manufacturers to adopt IoT solutions in wi-fi. Apart from this, longer device life through low-power wi-fi chipsets is important for sustainability, aligning with the region’s green technology and energy-efficient approach, thereby fostering the market growth.

The Rising Integration of wi-fi in Automotive and Industrial Sectors

The incorporation of wi-fi chipsets in automotive and industrial applications is emerging as a key trend in Europe. Real-time data transfer and communication are mandatory for connected vehicles in-car infotainment and autonomous driving, and all these are reliable on wi-fi connectivity. Moreover, in the industrial sector, applications include wi-fi-based solutions to provide automation, remote control, and predictive maintenance. For instance, ACCESS Europe and MediaTek have extended their partnership to cover complete solutions that bring together MediaTek chipsets with ACCESS’s car-oriented app store and in-car entertainment system. This partnership is supposed to improve in-vehicle infotainment services and focus on the automotive industry’s further development of connectivity. Germany is at the forefront of the automotive and industrial revolution and is leading in the advancement of this technology. Apart from this, the integration of wi-fi with 5G networks, increases its functionality, and ensures stable and extremely high connection speed for critical applications, thus impelling the market demand.

Europe Wi-Fi Chipset Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe wi-fi chipset market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, band, and MIMO configuration.

Analysis by Product:

- Smartphones

- Tablets

- PCs

- Access Point Equipment

- Connected Home Devices

- Others

The smartphone segment commands the largest market share in the European Wi-Fi chipset market, fueled by the growing demand for high-speed internet and uninterrupted connectivity. The rise in the use of smartphones in the region along with the integration of the latest wi-fi standards such as Wi-Fi 6 and the upcoming Wi-Fi 7 calls for the use of hi-end wi-fi chipsets. Customers are focusing on providing the best wireless experience for gaming, video streaming, and video conferences. Also, the developments of portable applications in various sectors including health, games, and commerce help to increase the need for enhanced connection. As smartphone manufacturers are adding new features like 5G support and multi-band wi-fi, the requirement for highly functional chipsets for higher speed and stable connectivity is rising. As a result, the growing concern with the internet, remote work, and services also contribute to the growth of the smartphone segment, thereby influencing the Europe wi-fi chipset market trends.

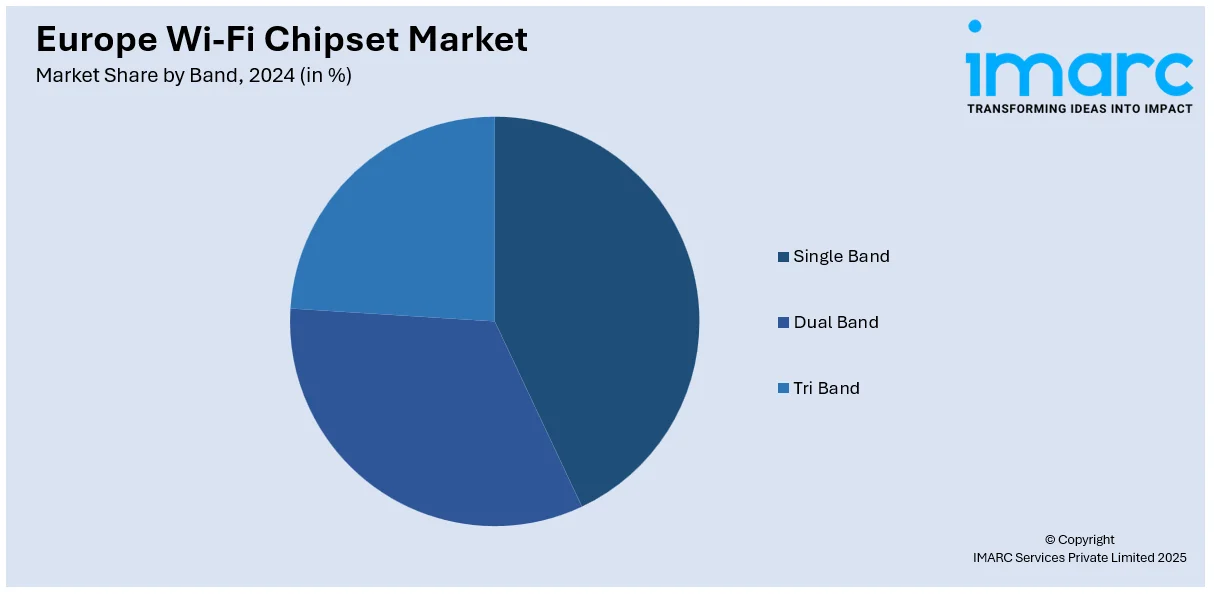

Analysis by Band:

- Single Band

- Dual Band

- Tri Band

The Europe wi-fi chipset market is led by the dual-band segment that supports both the 2.4 GHz and 5 GHz frequency bands. This versatility helps the dual-band chipsets to provide better network performance, by minimizing interference and increasing speeds which are essential in applications that need high data throughput such as video streaming and gaming. The requirement for fast services within a home environment and the business environment is the driving force behind offering dual-band chipsets. As a result, more users and companies are employing gadgets that depend on fast wireless connections, the dual-band technology is expanding due to the capacity to solve the problem of traffic density. In addition, with the appearance of smart homes and IoT devices, the usage of dual-band wi-fi is effectively ensured in a wide variety of situations. The consistent developments of Wi-Fi 6 and Wi-Fi 7 technologies continue to improve the dual-band chipsets, driving the market forward.

Analysis by MIMO Configuration:

- SU-MIMO

- MU-MIMO

The SU-MIMO (single-user multiple input, multiple output) segment holds a significant share of the Europe wi-fi chipset market, driven by its ability to improve network efficiency and maximize data transfer speeds for individual users. SU-MIMO technology enables multiple data streams to be transmitted to a single device at the same time, increasing the data throughput and performance. This makes it suitable for applications that require high bandwidth such as streaming of high-definition (HD) videos and online gaming. With consumers and businesses using the internet for work from home, social interactions, and entertainment the need for devices with SU-MIMO capability is rapidly growing. Apart from this, continuous advancements in the use of Wi-Fi 6 and Wi-Fi 7 technologies which both have support for SU-MIMO are fueling the market demand. The technologies used in such systems enable faster and more stable connections in comparison with the environments where many devices connect. It also helps the largest segment’s market remain healthy and growing because of smart homes, IoT devices, and connected systems, as well as SU-MIMO chipsets.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is the leading market for wi-fi chipsets in Europe because of its effective industrial development, vast technology spending, and high demand for smart devices. Being one of the key automotive, manufacturing, and telecommunication industry players, Germany is already in line with the newest wireless technologies like Wi-Fi 6 and Wi-Fi 7. In confluence with this, the trends to digitalization, smart city, and IoT solutions create a demand for better Wi-Fi chips in the country. For instance, EE unveiled its intentions to launch the Smart Hub Pro, a Wi-Fi 7 router that Qualcomm helped it to create. This router is designed to deliver the higher speed and stable connection needed for the current and emerging high bandwidth applications like cloud gaming, AR/VR, and 4K/8K streaming. Furthermore, the contribution of the country in the deployment of the 5G network and the advanced technology industry of the country is a great factor that is significantly contributing to the market expansion.

Competitive Landscape:

The European Wi-Fi chipset market is highly competitive. Major companies focus on continuous innovation, developing advanced chipsets that support Wi-Fi 6, Wi-Fi 7, and other emerging technologies. Strategic partnerships, acquisitions, and collaborations with device manufacturers are key tactics used to strengthen their market positions. As the demand for faster, more efficient wireless connectivity rises, these players are increasingly investing in R&D to meet evolving consumer and industrial needs. Competitive pricing, technological innovations, and product differentiation will remain key factors in shaping the landscape of this dynamic market.

The report provides a comprehensive analysis of the competitive landscape in the Europe wi-fi chipset market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2024, Intel in collaboration with Broadcom, demonstrated the world’s first Wi-Fi 7 solution that operates in harmony, delivering throughput over the air higher than 5 Gbps, showcasing the capability of Wi-Fi 7 to achieve five times the bandwidth of Wi-Fi 6E, and 75% less latency, which boosts the AI applications.

- In February 2024, Qualcomm introduced the FastConnect 7900, a Wi-Fi 7 solution featuring an integrated artificial intelligence processor. This chip has a data rate capability of up to 5.8 Gbps and supports ultra-wideband (UWB) and Bluetooth Sounding for enhanced proximity-based services. The integration enhances the link interface and power supply, critical aspects for AI devices.

Europe Wi-Fi Chipset Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Smartphones, Tablets, PCs, Access Point Equipment, Connected Home Devices, Others |

| Bands Covered | Single Band, Dual Band, Tri Band |

| MIMI Configurations Covered | SU-MIMO, MU-MIMO |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe wi-fi chipset market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe wi-fi chipset market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe wi-fi chipset industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe wi-fi chipset market was valued at USD 4.5 Billion in 2024.

Factors driving the Europe wi-fi chipset market include the increasing adoption of IoT devices, the rise of smart homes, automation in industries, and the demand for seamless connectivity in sectors like automotive and healthcare.

IMARC estimates the Europe wi-fi chipset market to exhibit a CAGR of 2.11% during 2025-2033.

Based on products, smartphones accounted for the largest segment owing to their high demand for fast, reliable wireless connectivity and constant technological advancements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)