Europe Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Country, 2026-2034

Europe Whiskey Market Size and Share:

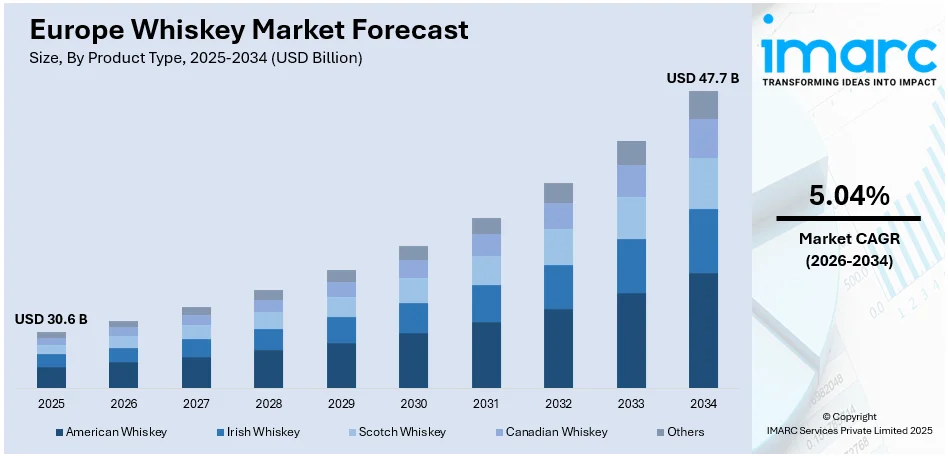

The Europe whiskey market size was valued at USD 30.6 Billion in 2025. Looking forward, IMARC Group estimates the market to grow to USD 47.7 Billion by 2034, exhibiting a CAGR of 5.04% from 2026-2034. The rising demand for premium and craft varieties, expanding global exports, increasing whiskey tourism, evolving consumer preferences for innovative flavors, and the growing influence of e-commerce, are boosting the Europe whiskey market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 30.6 Billion |

| Market Forecast in 2034 | USD 47.7 Billion |

| Market Growth Rate (2026-2034) | 5.04% |

The demand for premium and craft whiskey in the European market is on the rise. Consumers are showing increased interest in high-quality options, valuing unique flavor profiles, superior ingredients, and the authenticity of traditional production methods. Craft distilleries have responded by offering small-batch and artisanal options that cater to these preferences. For instance, retailers like Selfridges have reported a doubling in interest for limited-edition whiskies from small and independent distilleries. To meet this demand, they've expanded their range to over 1,000 different bottles, with plans for further additions. This shift aligns with a broader trend toward premiumization in the alcohol industry, where people are willing to pay more for products that deliver a distinct experience. The rise of storytelling and branding, emphasizing heritage and authenticity, plays a huge role in this trend.

To get more information on this market Request Sample

Whiskey tourism has also become a significant contributor to the European market. Distilleries across Scotland, Ireland, and emerging markets like France and Germany are capitalizing on this trend. Whiskey trails, tours, and festivals draw enthusiasts eager to experience the production process, taste rare varieties, and engage with the heritage of iconic brands. According to the Irish Whiskey Association, distilleries across Ireland welcomed over 800,000 visitors between June 2023 and June 2024, with most of these tourists traveling from abroad. Along with this, Scotland's Speyside and Islay regions are global hotspots for whiskey tourism, attracting thousands annually. This has spurred economic benefits for local economies and increased global recognition of European whiskey. The integration of tourism with whiskey production strengthens brand loyalty, fosters word-of-mouth marketing, and increases consumer engagement, making it a potent driver for the industry.

Europe Whiskey Market Trends:

Expanding Global Demand and Exports

European whiskey producers are witnessing growing interest from global markets, with notable traction in Asia and the Americas. Rising disposable incomes and an expanding preference for Western spirits have positioned countries like China and India as key consumers in the category. Scotch whiskey exports reached a value exceeding £5.6 billion in the year 2023 that is equivalent to an astounding 1.35 billion 70cl bottles. Among these, Singapore saw a total of £378m worth imports during the same period. The European Union's trade agreements have played a pivotal role in facilitating smoother exports. For instance, agreements reducing tariffs on whiskey in markets like Japan and South Korea have bolstered trade. Export success is also tied to the Europe whiskey market growth as a high-quality, premium product, backed by stringent production standards.

Changing Consumer Preferences Toward Low-ABV and Innovative Flavors

Modern consumers are exploring a broader spectrum of whiskey options, including lower-alcohol-by-volume (ABV) products and innovative flavor profiles. Infused whiskeys, flavored variants, and experimental aging techniques are attracting younger demographics. Brands are also launching new products to cater to this shift, such as honey-flavored whiskey or variants aged in unconventional casks. These innovations make whiskey more accessible and versatile, appealing to cocktail enthusiasts and those new to the category. The trend also aligns with the larger movement toward personalization and exploration in consumer preferences, keeping the Europe whiskey market demand vibrant and diverse.

Growth of E-Commerce and Digital Platforms

The growth of e-commerce has transformed the marketing and distribution of whiskey, offering consumers greater access to a wide range of brands and products. As per a survey, 70% of the individuals in Europe bought or ordered products or services online in a year. These online platforms have made premium and rare whiskey varieties more accessible to consumers across the region. As such, virtual stores allow buyers to explore extensive collections, compare prices, and discover niche brands. Additionally, digital marketing campaigns and social media engagement have enabled whiskey brands to connect directly with consumers, showcasing product stories, pairing ideas, and cocktail recipes.

Europe Whiskey Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe whiskey market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, quality, and distribution channel.

Analysis by Product Type:

- American Whiskey

- Irish Whiskey

- Scotch Whiskey

- Canadian Whiskey

- Others

As per the whiskey market outlook in Europe, American whiskey, including bourbon, Tennessee whiskey, and rye, holds a growing share due to its distinct flavor profiles and rising global recognition. Bourbon, known for its sweeter and fuller-bodied taste, has gained traction among younger consumers and cocktail enthusiasts. With increasing exports from the U.S. and collaborative branding efforts, American whiskey is becoming a staple in Europe’s premium spirits category.

Irish whiskey is renowned for its smooth, triple-distilled profile, which gives it a mellow and accessible flavor. This characteristic makes it a popular choice, particularly among those new to whiskey, as it offers an inviting introduction to the spirit. Its resurgence has been remarkable, with brands like Jameson driving significant export growth to Europe. The market is further bolstered by innovative offerings, such as cask-finished variants, and the revival of smaller distilleries that emphasize traditional Irish craftsmanship, fueling demand in both premium and mid-tier segments.

Scotch whiskey form a major part of the European market share, benefiting from its global reputation as a high-quality and versatile spirit. Its varied styles, such as single malt, blended, and single grain, cater to diverse consumer preferences. Countries like France, Germany, and Spain are key importers with exports to Europe increasing tremendously. Heritage and innovation, such as cask experimentation, continue to drive its appeal.

Canadian whiskey, often characterized by its lighter, smoother taste, occupies a niche but steadily growing market in Europe. Its versatility in cocktails and unique flavor blends appeal to consumers seeking alternatives to traditional whiskey types. While less prominent than Scotch or Irish whiskey, Canadian whiskey is gaining recognition, supported by new-age marketing efforts and an increased presence in specialty whiskey stores across Europe.

Analysis by Quality:

- Premium

- High-End Premium

- Super Premium

As per the Europe whiskey market forecast, premium whiskey represents a significant segment, catering to a wide audience seeking quality at an accessible price. This category includes both well-known brands and newer distilleries offering consistent taste and craftsmanship. The appeal lies in its balance of affordability and quality, making it a popular choice for casual drinkers and cocktail enthusiasts. With innovations in flavor profiles and broader retail availability, this segment continues to thrive.

High-end premium whiskey caters to discriminating customers who value exceptional workmanship and distinctive flavor profiles. This category's products frequently highlight limited-edition releases, unique aging techniques, and conventional production methods. With more customers looking to invest in collectibles or make status-driven purchases, this market has experienced strong development. In a market that is becoming increasingly competitive, brand storytelling and legacy are playing a crucial role for setting high-end premium items apart.

Super premium whiskey appeals to the most affluent consumers, offering exclusivity, rarity, and unparalleled quality. This segment includes rare single malts, ultra-aged blends, and limited-edition releases often priced in the hundreds or thousands of dollars. Growth in this category is fueled by whiskey connoisseurs, collectors, and investors. Distilleries capitalize on this trend by releasing ultra-premium products with intricate packaging and compelling narratives to enhance their luxury appeal.

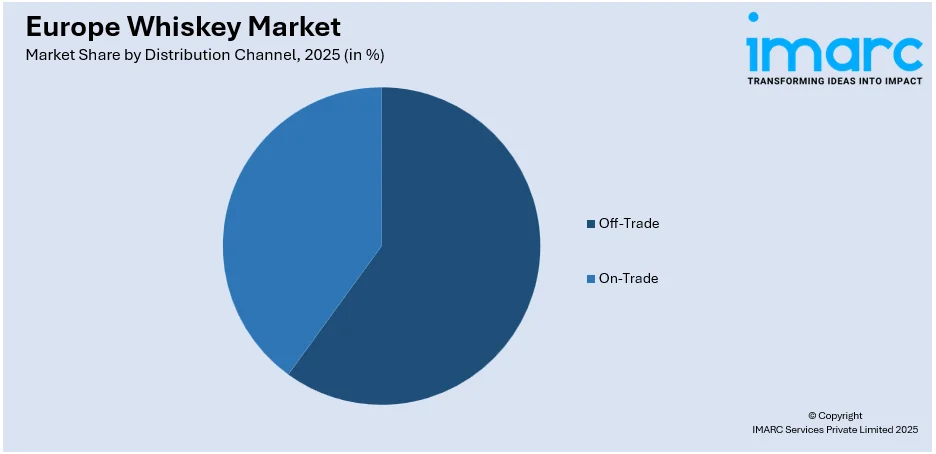

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Off-Trade

- Supermarkets and Hypermarkets

- Discount Stores

- Online Stores

- Others

- On-Trade

- Restaurants and Bars

- Liquor Stores

- Others

A significant amount of whiskey sales come from the off-trade sector in Europe, which includes liquor stores, supermarkets, retail establishments, and internet sites. It serves customers looking for convenience and a large selection of products for consumption at home. Due to its accessibility, competitive price, and availability of premium and niche whiskey brands, e-commerce has greatly increased sales in this market. Retail chains' discounts and promotions also boost demand in this channel.

By adding an immersive element to drinking, the on-trade sector—which includes bars, eateries, and lodging facilities—plays a vital part in whiskey sales. Sales in this channel are driven by whisky-based cocktails, tasting events, and unique alliances with hospitality destinations. The on-trade industry has rebounded well in the past few years and the increased demand for premium and super-premium whiskey at upscale places reflects the consumers' desire for carefully chosen and superior drinking experiences.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Based on the Europe whiskey market trends, Germany stands as one of the largest whiskey markets in Europe, driven by a growing preference for premium and craft whiskey. German consumers have a strong interest in Scotch and Irish varieties, alongside an emerging appreciation for American and Japanese whiskeys. Local craft distilleries are also gaining traction, offering unique regional flavors. The country’s robust retail network and increasing whiskey festivals further fuel market growth.

In 2023, France imported more than 174 million bottles of Scotch whiskey, making it the largest whiskey consumer in Europe. Blended Scotch and single malts are highly preferred by French customers, who place an elevated emphasis on legacy and quality. Interest in whiskey as a flexible component has also increased as a result of the expanding cocktail culture. Furthermore, whiskey tourism and tasting events are becoming increasingly popular, which opens doors for premium and super-premium brands to grow their market share.

The United Kingdom (UK) continues to be a sizable market, with Scotch accounting for the majority of both exports and local consumption. The market is now more diverse due to the emergence of artisan distilleries and creative whiskey mixes. Whiskey's cultural significance in the UK contributes to its appeal, while younger audiences' increasing interest in whiskey-based drinks adds momentum to this mature market.

Italy is emerging as a significant market for whiskey, with increasing interest in premium and high-end offerings. The country's sophisticated consumer base, known for appreciating quality and craftsmanship, is driving demand for distinctive and luxury whiskey products. Italian consumers increasingly seek Scotch and Irish whiskeys, with an emphasis on unique and aged variants. The country’s thriving bar culture and demand for whiskey in cocktails have spurred growth in the on-trade channel. Partnerships with luxury establishments and the presence of niche whiskey clubs further enhance its market appeal.

As per the Europe whiskey market outlook, Spain is a key market for whiskey, ranking among the top European importers of Scotch. Spanish consumers exhibit a strong preference for blended varieties, though single malts are gaining popularity among enthusiasts. The country’s vibrant nightlife and cocktail culture significantly drive on-trade whiskey sales. Additionally, the use of whiskey in traditional Spanish spirits like Licor de Whisky adds a unique dimension to the market.

Competitive Landscape:

To stay competitive and meet rising customer demand, major industry participants are utilizing innovation, branding, and sustainability. Industry players are also investing extensively in product innovation, creating new flavors, barrel finishes, and premium blends to meet changing tastes. By focusing on local products and artisanal techniques, smaller craft distilleries are establishing niches. Businesses are embracing eco-friendly methods including carbon-neutral distilleries, recyclable packaging, and sustainable raw material procurement as sustainability has taken center stage. In order to reach younger consumers, many firms are also enhancing their online presence through e-commerce and interesting social media initiatives. Limited-edition releases, celebrity endorsements, and partnerships with premium goods are important strategies being employed to cater to the affluent market. Additionally, key players are investing in whiskey tourism by enhancing visitor experiences at distilleries, offering tastings, and showcasing production processes, further boosting brand loyalty and market presence.

The report provides a comprehensive analysis of the competitive landscape in the Europe whiskey market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, The Danish whiskey brand Stauning launched a special limited-edition release, Rye Whisky Madeira Single Cask, exclusively for Selfridges. This unique offering was made available at Selfridges stores in London, Birmingham, and Manchester, as well as online. With only 248 bottles produced, this single cask whiskey represents a rare and collectible addition for enthusiasts.

- In October 2024, whisky producer Compass Box secured a £35 million lending facility from Santander UK, aimed at expanding its operations. This funding will support the development of new warehousing, enhance inventory, and facilitate the launch of a new core collection. With plans to penetrate broader European and Asian markets, Compass Box seeks to leverage Santander's international network for growth. The partnership is viewed as strategic, focusing on quality cask procurement and innovation within the whisky sector, following significant investment from Caelum Capital in 2022.

- In October 2024, Sotheby announced a long-term partnership with Chivas Brothers to bring aged and one-off whiskey creations to auction, exclusively for Sotheby’s collectors.

- In October 2024, Label 5, a brand by La Martiniquaise, unveiled its first flavored spirit drink, Original Citrus. This innovative product combines Label 5 Classic Black Scotch whisky with a blend of natural citrus flavors, including lime, lemon, orange, and bergamot, offering a refreshing twist on traditional Scotch whisky.

- In January 2024, Bacardi announced a transaction for Teeling Whiskey Co., taking on its distribution responsibilities for the Irish whiskey in six European markets, including Austria, Germany, the Netherlands, United Kingdom (UK), Sweden, and Belgium.

Europe Whiskey Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | American Whiskey, Irish Whiskey, Scotch Whiskey, Canadian Whiskey, Others |

| Qualities Covered | Premium, High-End Premium, Super Premium |

| Distribution Channels Covered | • Off-Trade: Supermarkets and Hypermarkets, Discount Stores, Online Stores, Others • On-Trade: Restaurants and Bars, Liquor Stores, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe whiskey market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe whiskey market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe whiskey industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe whiskey market was valued at USD 30.6 Billion in 2025.

The Europe whiskey market is growing due to the rising demand for premium and craft varieties, expanding whiskey tourism, increasing exports driven by global demand, evolving consumer preferences for flavored and low-ABV options, the influence of e-commerce, the resurgence of cocktail culture, and sustainability-focused production practices.

IMARC Group estimates the Europe whiskey market to reach USD 47.7 Billion by 2034, exhibiting a CAGR of 5.04% from 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)