Europe Watch Market Size, Share, Trends and Forecast by Type, Price Range, Distribution Channel, End User, and Country, 2026-2034

Europe Watch Market Size and Share:

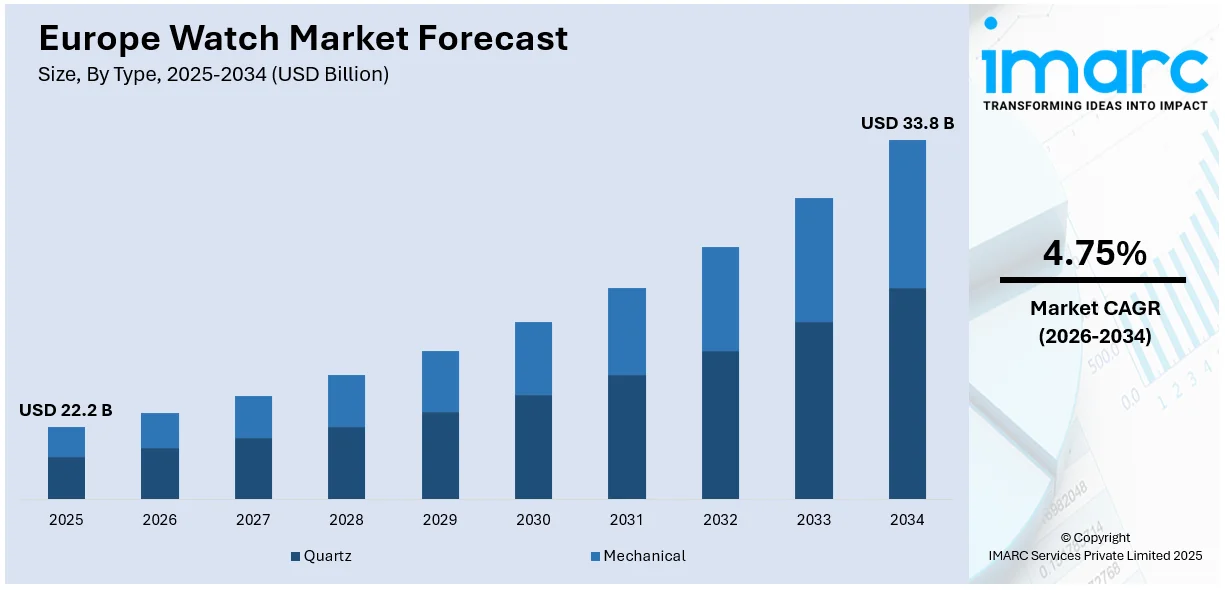

The Europe watch market size was valued at USD 22.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 33.8 Billion by 2034, exhibiting a CAGR of 4.75% from 2026-2034. The market is experiencing steady growth driven by the rising demand for luxury, smart, and sustainable timepieces. Increasing consumer preference for personalized and connected watches is shaping innovation. E-commerce expansion and brand collaborations are influencing market dynamics across premium and mid-range segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 22.2 Billion |

|

Market Forecast in 2034

|

USD 33.8 Billion |

| Market Growth Rate (2026-2034) | 4.75% |

Europe's watch market is driven by growing consumer demand for luxury and premium timepieces. This is furthered by the heritage of brands, craftmanship and status symbolism. The Swiss and European brands dominate with strong brand loyalty and innovation in materials, design and complications. The smartwatches segment is also increasing with advancements in health tracking, connectivity and customization appealing to tech-savvy consumers. For instance, in November 2024, Honor launched the Watch 5 in select European markets featuring a 1.85-inch AMOLED display, 15-day battery life, and 85 sports modes. Key health tracking tools include heart rate and SpO2 monitoring. E-commerce growth is strengthening the positively watch market outlook in Europe. Ecommerce expansion and omnichannel retail strategies further expand access by enabling brands to reach a larger population even as the shopping experience is individualized via new digital platforms as well as in-store experiences.

To get more information on this market Request Sample

Sustainability and heritage are driving purchase decisions where consumers are attracted to watches from ethically sourced materials and sustainable manufacturing processes. The resurgence of vintage and mechanical watches reflects the shift toward timelessness and investment-worthy pieces. Limited edition collections and collaborations between watchmakers and fashion brands attract collectors and enthusiasts pushing exclusivity-driven demand, representing one of the key Europe watch market trends. For instance, in November 2024, Seiko announced the launch of the Prospex Solar Speedtimer European Exclusive in a limited-edition Factory Red featuring a 39mm stainless steel case and a matte burgundy dial. With only 2,400 pieces available in Europe the watch includes a solar-powered movement and comes with a stainless steel and brown leather strap. Economic stability, increasing disposable income, and the growing interest in horology drive market expansion especially in Western Europe's prime luxury hubs.

Europe Watch Market Trends:

Luxury and Heritage Appeal

Luxury and heritage are the key drivers of the European watch market where consumers appreciate craftsmanship, precision and exclusivity. Swiss and European brands maintain strong demand due to their legacy, meticulous hand-finishing and innovative complications. Heritage-driven storytelling enhances brand prestige with limited-edition collections and historical reissues appealing to collectors. For instance, in March 2024, Bulgari announced its partnership with Watches of Switzerland by launching two limited-edition timepieces: the Serpenti Seduttori and the Octo Roma Automatic. Each is limited to 30 pieces, featuring exclusive designs and engravings. Luxury watches are status symbols and investment pieces for consumers thereby increasing demand. High-net-worth individuals and enthusiasts are interested in bespoke and customized designs thereby reinforcing the exclusivity of the market. The resale market for heritage timepieces is also expanding which will strengthen long-term value retention.

Growth of Smartwatches

Europe has a growing smartwatch segment as consumers are looking for multifunctional timepieces with both technology and convenience. Features like heart rate monitoring, ECG, sleep analysis and other activity tracking promote adoption among the fitness-conscious audience. The high connectivity features including smartphone integration, GPS and voice assistants contribute to making it attractive to the customer. For instance, in February 2023, Huawei launched its Watch Buds 2-in-1 smartwatch in Europe that includes a free Huawei Scale 3. The device features a smartwatch with an integrated pair of TWS earbuds and offers AI Noise Cancelation Calling compatible with both Android and iOS devices. Customization via interchangeable straps, watch faces and app integration can customize the experience for users. The leading brands are Apple, Samsung and Garmin but traditional watchmakers are entering the segment with hybrid models. Demand for wellness-oriented technology and stylish designs is further accelerating smartwatch penetration across Europe. Advancements in smartwatch technology continue to accelerate Europe watch market growth.

Rising Focus on Sustainability

Sustainability is increasingly becoming a core focus in the European watch market as consumers demand ecofriendly materials and responsible production practices. Brands are now using recycled stainless steel, ocean plastics and ethically sourced gold to reduce environmental impact. For instance, in May 2024, Norwegian brand Radium Instruments launched its new collection of watches made from Hydro CIRCAL featuring over 75% recycled aluminium. Combining rugged design with Swiss precision the watches emphasize sustainability and local craftsmanship. Leather alternatives such as vegan and plant-based straps are also gaining popularity. Transparency in supply chains, fair labor practices and carbon-neutral manufacturing processes further influence purchasing decisions. Circular economy initiatives such as watch recycling programs and extended product lifecycles are also attracting attention.

Europe Watch Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe watch market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, price range, distribution channel, and end user.

Breakup by Type:

- Quartz

- Mechanical

Quartz watches dominate the European market due to their affordability, precision and low maintenance. These timepieces use battery-powered movements offering higher accuracy than mechanical counterparts while requiring minimal servicing. Mass production techniques enable brands to offer stylish and functional designs at accessible price points attracting a broad consumer base. Fashion and mid-range brands such as Casio, Seiko, and Swatch drive sales by blending aesthetics with reliability. The popularity of quartz is both in analog and digital models with chronographs, alarms and solar charging adding value. An increasing demand for convenience and cost-effective options sustains quartz market leadership.

Analysis by Price Range:

- Low-Range

- Mid-Range

- Luxury

The low-range segment dominates the European watch market as it is affordable, accessible and diversified. Consumers who are looking for functional yet stylish timepieces at budget-friendly prices drive demand. Brands such as Casio, Swatch and Timex dominate this category with quartz-powered watches made of durable materials and everyday practicality. Fast fashion brands and private labels expand the segment even further appealing to trend-conscious buyers. Ecommerce growth and discount-driven sales contribute to higher volume purchases. Many consumers prefer low-range watches as secondary timepieces or fashion accessories reinforcing their market leadership. Advancements in design, materials and features continue to attract price-sensitive buyers.

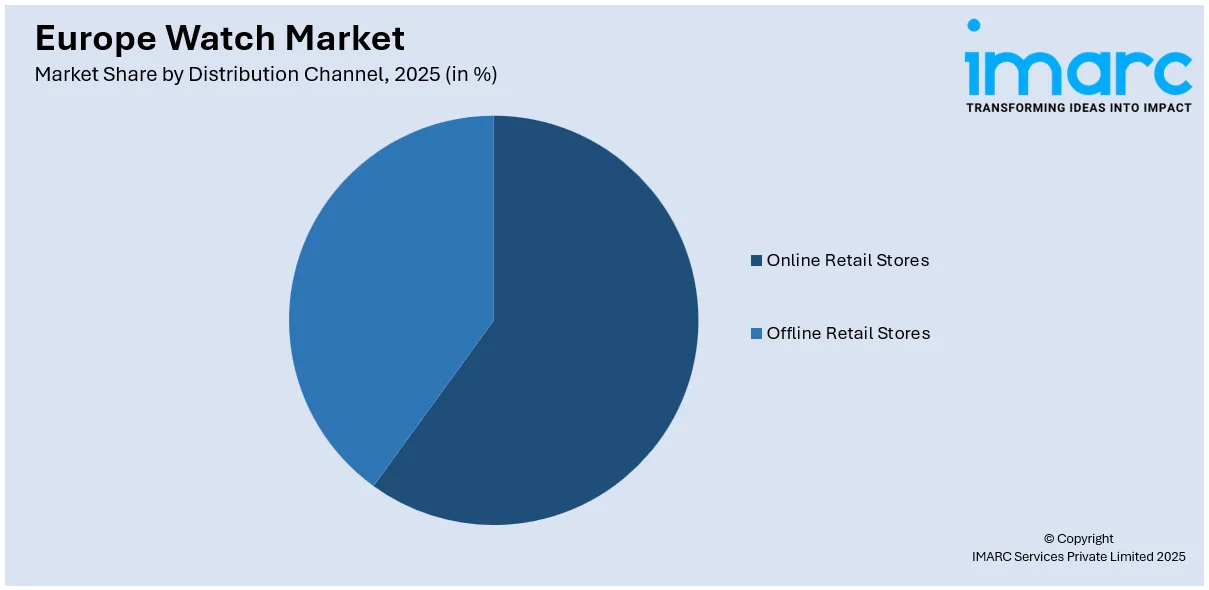

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online Retail Stores

- Offline Retail Stores

Offline retail stores lead the European watch market as consumers prefer in-person experiences when purchasing timepieces. Physical stores offer hands-on product inspections, expert guidance and brand-authorized warranties enhancing trust and purchase confidence. Luxury brands rely on flagship stores, boutiques and authorized dealers to maintain exclusivity and personalized service. Department stores and multi-brand retailers further drive sales catering to mid-range and fashion-oriented consumers. The old watch buyer focuses on the craft and authenticity hence preferring the offline channel of sales. Moreover, the offline stores provide after-sales services like repairing and customization which further strengthen customer loyalty and continue to lead in the market for watches.

Analysis by End User:

- Men

- Women

- Unisex

Men dominate the European watch market with high demand for luxury, mechanical and sports watches. Wristwatches are considered fashion accessories that give status, excellent craftsmanship and personal style. Swiss and European brands like Rolex, Omega and TAG Heuer cater to males through classic, rugged and high-performance designs. Mechanical and automatic watches have appeal to collectors and enthusiasts which is why they also reinforce market dominance. The popular demand for smartwatches for fitness tracking and connectivity further boosts sales.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is a significant market in the European watch industry given the strength of its economy and demand for luxury and precision-engineered timepieces. Consumers prefer high-quality, durable designs and brands such as Nomos Glashütte and A. Lange & Söhne have a loyal consumer base. Smartwatches are also gaining popularity appealing to tech-savvy buyers seeking fitness and connectivity features.

France's watch market thrives on luxury and fashion with high demand for heritage brands and designer timepieces. Consumers value aesthetics, brand prestige and exclusivity making premium Swiss and French brands highly desirable. Paris is a strategic retail hub for luxury watches while smartwatches expand for younger consumers emphasizing technology and customization capabilities.

The UK market is dominated by high demand for luxury and heritage watches with London being a global hub for luxury timepieces. Consumers are more interested in investment-worthy models from brands like Rolex and Patek Philippe. Smartwatches are increasing rapidly driven by health-conscious buyers and digital advancements while online retail expansion enhances accessibility.

Italian watch demand is influenced by a culture of style and craftsmanship. Consumers are drawn to sophisticated and premium designs. Swiss brands lead but domestic luxury brands such as Panerai and Bulgari also play an important role. Smartwatches are on the rise as younger consumers opt for fashionable and practical wearables. Retail boutiques and flagship stores are key channels.

Spain’s market is influenced by tourism and a preference for fashionable yet affordable watches. Luxury brands perform well in metropolitan areas like Madrid and Barcelona while mid-range and smartwatches dominate mass-market sales. Consumers appreciate stylish designs with high functionality boosting demand for hybrid and connected watches. Seasonal trends and promotions significantly impact sales.

Competitive Landscape:

The European watch market is highly competitive with a mix of luxury, mid-range and smartwatches catering to diverse consumer preferences. Premium brands dominate the high-end segment, leveraging heritage, craftsmanship and exclusivity to maintain their appeal. Mid-range brands focus on affordability, durability and stylish designs attracting fashion-conscious and practical buyers. The smartwatch sector is expanding rapidly driven by advancements in health tracking, connectivity and customization. Ecommerce and direct-to-consumer channels are intensifying competition with brands enhancing online presence and offering personalized experiences. Sustainability, limited editions and innovation in materials further differentiate players. Market competition remains strong with continuous product development and strategic partnerships shaping the evolving landscape.

The report provides a comprehensive analysis of the competitive landscape in the Europe watch market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Casio announced the launch of the limited-edition G-Shock MRG-B2000JS-1A watch in Europe featuring a titanium casing, Bluetooth connectivity and solar charging. Designed in collaboration with swordsmith Kamiyama Teruhira the watch has only 800 units available worldwide.

- In December 2024, Huawei announced the launch festive editions of the Watch GT 5 and GT 5 Pro in Europe featuring holiday colors and strap options. Both models retain original features and include a special Christmas watch face.

- In June 2024, Watch X smartwatch was launched by Oppo in Europe featuring Wear OS 4 and offering up to 12 days of battery life in Power Saver Mode. With a 1.43-inch AMOLED display and advanced fitness tracking metrics it’s now available in countries like the UK following its earlier introduction in Malaysia.

- In December 2023, Amazfit launched four Special Edition colors of the Amazfit Balance smartwatch, with proceeds supporting reforestation projects in Europe through a partnership with One Tree Planted. Each purchase contributes $2, promoting environmental sustainability. The ecofriendly packaging highlights the brand's commitment to health and nature.

Europe Watch Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-Range, Mid-Range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Men, Women, Unisex |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe watch market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe watch market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe watch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The watch market was valued at USD 22.2 Billion in 2025.

The Europe watch market is experiencing growth due to rising demand for luxury and smartwatches, increasing consumer preference for personalized and connected timepieces, expansion of e-commerce, and sustainability-driven purchasing trends. Additionally, strong brand heritage, craftsmanship, and technological advancements in smartwatch features are boosting market expansion.

IMARC estimates the market to reach USD 33.8 Billion by 2034, exhibiting a CAGR of 4.75% from 2026-2034.

Quartz watches account for the largest segment of the European watch market, dominating due to their affordability, precision, and low maintenance. Their widespread availability, technological advancements, and diverse styles appeal to consumers, solidifying Quartz as the leading choice in Europe.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)