Europe Veterinary Healthcare Market Size, Share, Trends and Forecast by Product, Animal Type, and Country, 2026-2034

Europe Veterinary Healthcare Market Overview:

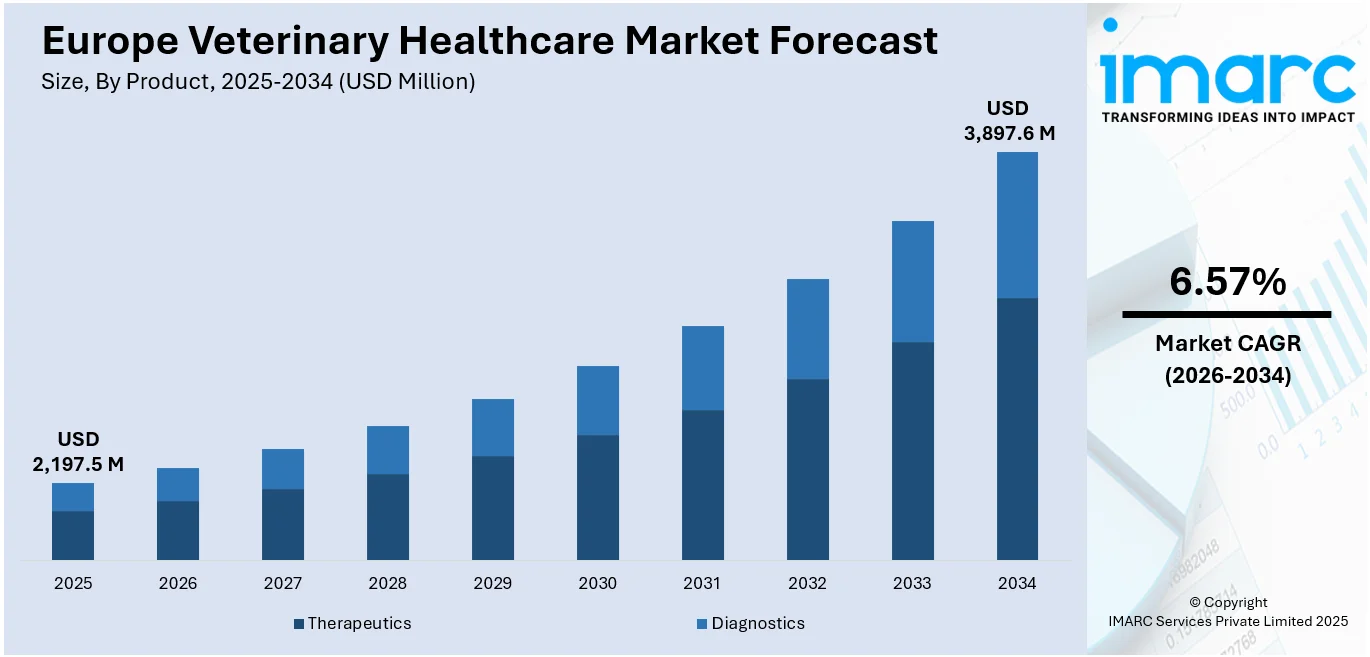

The Europe veterinary healthcare market size reached USD 2,197.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,897.6 Million by 2034, exhibiting a growth rate (CAGR) of 6.57% during 2026-2034. The Europe veterinary healthcare sector is driven by widespread pet ownership, a significant growth in livestock population, advancements in veterinary technology, stringent EU animal welfare regulations, and rising demand for specialized veterinary services ensuring optimal animal health and food safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,197.5 Million |

| Market Forecast in 2034 | USD 3,897.6 Million |

| Market Growth Rate 2026-2034 | 6.57% |

Europe Veterinary Healthcare Market Trends:

Rising Pet Ownership and Increased Spending on Animal Health

Europe has witnessed a consistent increase in pet ownership, with more than 90 million families now keeping pets, as per the European Pet Food Federation (FEDIAF). The resultant growing pet population has led to greater demand for veterinary services, pharmaceuticals, and specialized treatments. Humanization of pets, whereby owners identify with animals as members of the family, has fostered greater expenditure on higher-quality pet health services, including vaccination, prevention, and cutting-edge treatments such as orthopedic procedures and dental treatment. Germany, France, and the UK are at the forefront of the region in terms of expenditure on veterinary healthcare, fueled by increasing disposable incomes and insurance coverage for animals. Moreover, the European pet insurance sector is growing in leaps and bounds, enabling pet owners to financially support costly treatment. In Sweden, for instance, close to 90% of dogs are covered by pet insurance, acting as a beacon for other countries in Europe that are increasingly opting for pet insurance. This, in turn, is fueling the animal healthcare sector with insured pet owners being more prone to avail complex medical treatment for their pets.

To get more information on this market Request Sample

Innovations in Veterinary Medicines

The European market for veterinary healthcare is gaining from speedy technological innovations. Advancements in diagnostic equipment, telemedicine, artificial intelligence imaging, and minimally invasive surgical procedures have enhanced efficiency and access to veterinary care. For instance, diagnostic platforms powered by AI are increasingly popular in Europe, enabling veterinarians to diagnose diseases in livestock and pets with greater precision. Other technologies like pet wearable health monitors and mobile vet clinics are also revolutionizing the market. Within the livestock sector, the uptake of precision livestock farming (PLF) technologies is improving animal health, minimizing the use of antibiotics, and streamlining disease control. The EU's antibiotic restriction policy in farm animals, enacted in 2022, has hastened the need for substitute healthcare solutions like probiotics, vaccines, and early disease diagnosis technologies. Moreover, growth in corporate veterinary chains like AniCura (Sweden) and CVS Group (UK) has led to increased investment in more advanced medical facilities. These firms are outfitting their clinics with MRI scanners, robotic-assisted surgery, and 3D printing of prosthetics, enhancing treatment choices and outcomes.

Europe Veterinary Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product and animal type.

Product Insights:

- Therapeutics

- Vaccines

- Parasiticides

- Anti-infectives

- Medical Feed Additives

- Others

- Diagnostics

- Immunodiagnostic Tests

- Molecular Diagnostics

- Diagnostic Imaging

- Clinical Chemistry

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes therapeutics (vaccines, parasiticides, anti-infectives, medical feed additives, and others) and diagnostics (immunodiagnostic tests, molecular diagnostics, diagnostic imaging, clinical chemistry, and others).

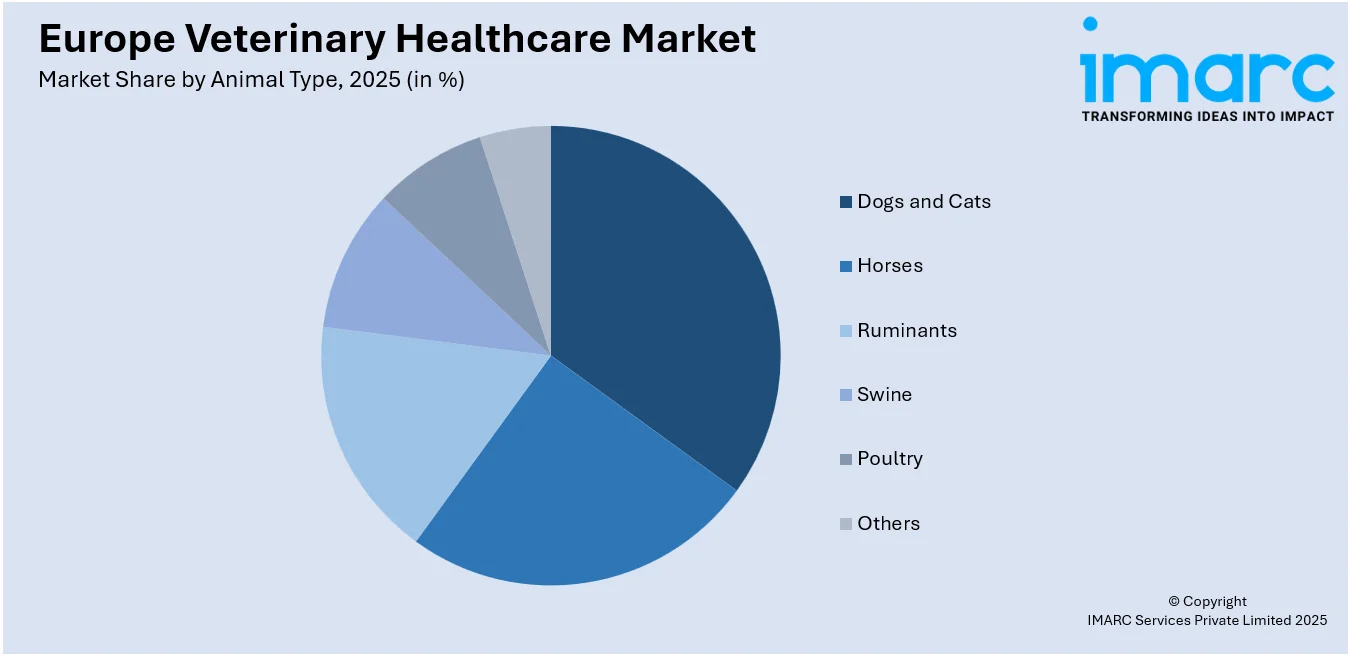

Animal Type Insights:

Access the Comprehensive Market Breakdown Request Sample

- Dogs and Cats

- Horses

- Ruminants

- Swine

- Poultry

- Others

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes dogs and cats, horses, ruminants, swine, poultry, and others.

Country-Wise Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The report has also provided a comprehensive analysis of all the major country-based markets, which include Germany, France, United Kingdom, Italy, Spain, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Europe Veterinary Healthcare Market News:

- November 2024: Scandinavian ChemoTech's Animal Care just sold its vetIQure™ TSE device with treatment kits to the German veterinary practice Christoph Sonntag, which specializes in the treatment of domestic animals. This sale reflects a new collaboration that reinforces ChemoTech's dedication to bringing quality solutions to animal healthcare suppliers in Europe.

- July 2024: Inflexion, a European mid-market private equity company, bought German veterinary practice group Tierarzt Plus Partner (TPP) for more than €300 million. The transaction represents Inflexion's fourth investment in the animal health sector and reveals a keen interest in this sector. The purchase was made in collaboration with TPP's founders through Inflexion's Buyout Fund VI.

Europe Veterinary Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Animal Types Covered | Dogs and Cats, Horses, Ruminants, Swine, Poultry, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Europe veterinary healthcare market performed so far and how will it perform in the coming years?

- What is the breakup of the Europe veterinary healthcare market on the basis of product?

- What is the breakup of the Europe veterinary healthcare market on the basis of animal type?

- What are the various stages in the value chain of the Europe veterinary healthcare market?

- What are the key driving factors and challenges in the Europe veterinary healthcare market?

- What is the structure of the Europe veterinary healthcare market and who are the key players?

- What is the degree of competition in the Europe veterinary healthcare market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe veterinary healthcare market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe veterinary healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe veterinary healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)