Europe Textile Recycling Market Size, Share, Trends and Forecast by Product Type, Textile Waste, Distribution Channel, End Use, and Country, 2025-2033

Europe Textile Recycling Market Size and Share:

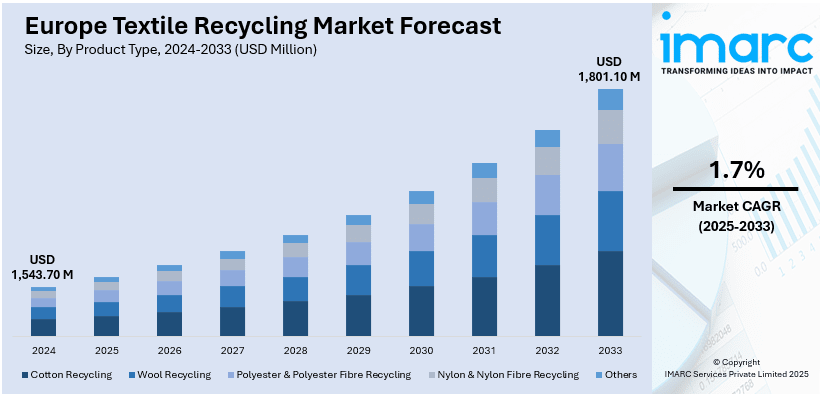

The Europe textile recycling market size was valued at USD 1,543.70 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,801.10 Million by 2033, exhibiting a CAGR of 1.7% from 2025-2033. The market is driven by increasing environmental awareness, growing waste legislation, increased need for green products, and the need to reduce landfill waste. Government policy supporting circular economy behaviors, technological advancements, and consumer desire for green options also propel the market

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,543.70 Million |

|

Market Forecast in 2033

|

USD 1,801.10 Million |

| Market Growth Rate 2025-2033 | 1.7% |

The European textile recycling market is driven by rising environmental awareness and regulatory pressures. As sustainability becomes a priority, the EU has set ambitious targets, including a goal to recycle 50% of textile waste by 2030 under the Circular Economy Action Plan. In another example, EURATEX's ReHubs Europe initiative aims to recycle 2.5 million tons of textile waste by 2030 through 250 industrial projects. Launched by EURATEX and industry partners, it responds to upcoming EU legislation mandating textile waste collection and sorting by 2025. The initiative focuses on enhancing recycling capacity by uniting textile manufacturers, fashion brands, and recyclers to drive a circular economy. Increasing consumer demand for sustainable products further fuels the market, with many Europeans considering eco-friendliness in their purchasing decisions. This growing focus on circularity is encouraging companies to invest in sustainable recycling solutions and adopt more environmentally conscious practices.

Technological advancements in recycling are driving the Europe textile recycling market growth. Technologies such as chemical and enzymatic recycling are simplifying the recycling and processing of textiles on an efficient scale, enhancing material quality and quantity. The sector has witnessed substantial investments in recycling technology, which are proving to boost recycling facility capacity as well as efficiency. Furthermore, extended producer responsibility (EPR) schemes are compelling producers to assume responsibility for the product lifecycle, promoting improved recycling habits. With more investment and innovation, Europe is making significant progress toward increased recycling levels in the textiles industry.

Europe Textile Recycling Market Trends:

Adoption of Advanced Recycling Technologies

One of the key trends in the European textile recycling industry is the increasing use of advanced recycling technologies. Conventional mechanical recycling processes are being supplemented by new technologies such as chemical and enzymatic recycling, which make it possible to produce higher-quality recycled materials and more efficient processes. These technologies make it possible to recycle a wider variety of textile fibers, including those that were previously hard to process. Consequently, the recycling industry for textiles is experiencing better quality and higher quantities of recycled textiles, which, in turn, is leading to greater investment in recycling facilities and shifting the market towards greater circularity and sustainability. For instance, the PESCO-UP project, launched in January 2024, aims to improve textile recycling by transforming mixed polyester/cotton waste into high-quality materials, supporting the EU’s mandatory textile waste collection starting in 2025. Led by VTT Technical Research Centre of Finland, the 48-month project focuses on enhancing the textile recycling value chain with innovative methods, including digitalized material identification, advanced sorting, and chemical and mechanical separation techniques for up to 90% processing efficiency.

Implementation of Extended Producer Responsibility (EPR)

Another important trend accelerating the Europe textile recycling market demand is the widespread implementation of Extended Producer Responsibility (EPR) schemes across the region. For instance, in February 2025, the European Parliament and Council reached an agreement on new rules requiring fashion brands to pay for the recycling of their products, aiming to reduce textile waste. The measures include Extended Producer Responsibility (EPR) schemes, where companies cover the costs of collecting, sorting, and recycling their products based on sustainability factors. These programs hold manufacturers accountable for the entire lifecycle of their products, including post-consumer waste. As a result, brands are increasingly designing products with recyclability in mind, promoting sustainable production practices. EPR policies have driven the development of more efficient textile collection, recycling, and reuse systems. This trend is critical to meeting the EU’s ambitious recycling targets and advancing the circular economy in the textile sector, making manufacturers key players in the reduction of textile waste.

Growing Consumer Demand for Sustainable Fashion

A third trend shaping the European textile recycling market is the rising consumer demand for sustainable fashion. As environmental concerns become more prominent, consumers are prioritizing eco-friendly and sustainable products in their purchasing decisions. This shift is pushing fashion brands to adopt more sustainable production processes, including the use of recycled materials and the creation of closed-loop systems where old garments are recycled into new ones. As consumer demand for eco-conscious fashion grows, it is driving further innovation in recycling technologies and sustainable design, contributing to a greener, more sustainable textile industry in Europe. For instance, in November 2024, Project Re:Claim, a collaboration between the Salvation Army Trading Company and Project Plan B, introduced Europe's first polyester textile recycling system, utilizing the ISEC evo system from PURE LOOP. This system aims to recycle post-industrial and post-consumer polyester textiles, including items like workwear, bed linens, and promotional banners. The project, located at a processing center in Kettering, UK, uses energy-efficient technology to produce high-quality rPET, reducing the energy consumption to a tenth of that used for virgin polyester. With plans to recycle 2,500 tonnes of polyester in its first year, Project Re:Claim is a pioneering step in the circular economy and sustainable textile recycling.

Europe Textile Recycling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe Textile Recycling market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, textile waste, distribution channel, and end use.

Analysis by Product Type:

- Cotton Recycling

- Wool Recycling

- Polyester & Polyester Fibre Recycling

- Nylon & Nylon Fibre Recycling

- Others

Polyester & polyester fibre recycling leads the segment in 2024, holding a market share of around 35.44%. This dominance is prevalent due to their widespread use and recyclability. Polyester is the most common fiber in textiles, making up a large portion of global fabric production. Its durability and versatility make it ideal for recycling, especially through chemical and mechanical methods. Innovations in recycling technologies have made it easier to regenerate high-quality fibers, reducing the need for virgin polyester and conserving natural resources. This aligns with the European Union's circular economy goals, encouraging sustainability and waste reduction. As a result, polyester recycling plays a vital role in creating a positive Europe textile recycling market outlook.

Analysis by Textile Waste:

- Pre-consumer Textile

- Post-consumer Textile

Pre-consumer textile dominates the segment. This can be attributed to its higher quality and more controlled nature compared to post-consumer waste. This waste typically consists of factory leftovers, defective products, or surplus materials, which are easier to recycle as they are often made from uniform, high-quality fabrics. Additionally, pre-consumer waste is often sorted and processed before reaching the consumer market, reducing contamination levels. Manufacturers are more inclined to recycle pre-consumer waste due to cost-efficiency and sustainability goals, making it a significant contributor to the textile recycling market in Europe, where resource efficiency is a key focus.

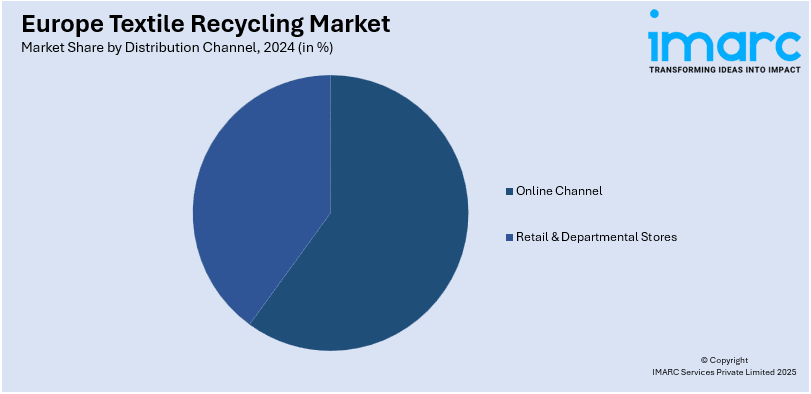

Analysis by Distribution Channel:

- Online Channel

- Retail & Departmental Stores

Retail & departmental stores leads the market with around 59.8% of market share in 2024. This can be attributed to their large-scale operations and direct consumer interactions. These stores generate significant amounts of textile waste through returns, unsold stock, and damaged goods. Additionally, many retailers are adopting sustainability initiatives, such as take-back programs and recycling partnerships, to promote circular economy practices. These initiatives encourage consumers to return used textiles for recycling, ensuring a steady supply of recyclable materials. Retailers also have the infrastructure to efficiently collect, sort, and process waste, making them key players in driving textile recycling efforts across Europe while meeting environmental and regulatory goals.

Analysis by End Use:

- Apparel

- Industrial

- Home Furnishings

- Non-woven

- Others

Apparel leads the market in 2024, holding a significant market share of over 44.6%. The Europe textile recycling market forecast suggests that apparels are experiencing high volumes of production and consumption. The fashion industry is a major contributor to textile waste, with millions of garments being discarded each year. As a result, recycling apparel is crucial for reducing landfill waste and conserving resources. The growing demand for sustainable fashion has also pushed brands to adopt recycling practices, such as using recycled fabrics or offering garment take-back programs. Furthermore, the relatively simple structure of many garments, often made from single-fiber fabrics, makes them easier to recycle, positioning the apparel sector as a key driver of textile recycling in Europe.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany accounted for the largest Europe textile recycling market share of around 26.4% in 2024. The country exhibits strong commitment to sustainability, advanced recycling technologies, and efficient waste management infrastructure. As one of Europe’s largest economies, Germany has implemented stringent regulations to reduce textile waste and promote a circular economy. The country’s government has supported textile recycling through initiatives like the Extended Producer Responsibility (EPR) program, encouraging manufacturers to take responsibility for their products' lifecycle. Additionally, Germany has a well-established textile recycling infrastructure, with innovative technologies enabling the processing of various textile materials. High consumer awareness and demand for eco-friendly products further drive the market. Germany’s leadership is also fueled by its strong industrial base, where textile manufacturers actively engage in recycling and sustainable practices, setting a model for the rest of Europe. For instance, in January 2024, BASF and Inditex developed loopamid, a groundbreaking textile-to-textile recycling solution, which is the first circular nylon 6 made entirely from textile waste. This polyamide 6 (nylon 6) can be recycled multiple times while maintaining virgin-quality characteristics. Zara further launched a jacket made from 100% loopamid, incorporating textile waste into all components of the garment. This breakthrough supports BASF's and Inditex's sustainability goals, aiming for more circularity in the fashion industry by 2030.

Competitive Landscape:

The competitive landscape of the European textile recycling market features a mix of large multinational firms, regional companies, and innovative startups. Key players include recycling technology providers offering advanced solutions like chemical and enzymatic recycling, which enhance material recovery and processing efficiency. Apparel brands are also actively incorporating recycled fibers into their products to meet growing sustainability demands. For instance, in May 2024, a new project, Solstice, was launched to support waste prevention in the textile and plastics supply chains across Europe. Led by the French chemistry platform Axel’One, the project involves key stakeholders such as the European Technology Platform for the Future of Textiles (Textile ETP), Recyc’Elit, and Circle Economy Foundation. The initiative aims to address waste issues and promote sustainability in these industries by focusing on waste prevention strategies. Government regulations, such as the EU's Circular Economy Action Plan, play a significant role by encouraging eco-friendly practices and influencing competition. While larger companies dominate, startups focusing on new, more efficient recycling technologies are increasing competition by offering scalable, cost-effective solutions. Collaboration between industry stakeholders is essential for achieving long-term sustainability goals.

The report provides a comprehensive analysis of the competitive landscape in the Europe textile recycling market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Reju and Novelles Fibres Textiles (NFT), two textile recycling companies in France, partnered to enhance the circular textile ecosystem in the country. The collaboration focuses on sourcing and recycling textile scrap, with NFT supplying secondary raw materials derived from used textiles to Reju for the production of regenerated Reju Polyester. This partnership aims to expand collection and processing infrastructure for textile waste from both postconsumer and postindustrial sources in France, ensuring 100% traceability of recycled materials.

- In April 2025, Circulose, a Swedish leader in recycled pulp production, formed a strategic partnership with Tangshan Sanyou Chemical Fiber, a major player in the cellulose fiber industry. This collaboration aims to scale the use of Circulose's pulp in the production of ReVisco fibers, driving the development of high-quality, circular, and renewable materials in the textile sector. The companies aim to accelerate the shift toward sustainable textile practices and create a global shift toward circularity in the industry.

Europe Textile Recycling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cotton Recycling, Wool Recycling, Polyester & Polyester Fibre Recycling, Nylon & Nylon Fibre Recycling, Others |

| Textile Wastes Covered | Pre-consumer Textile, Post-consumer Textile |

| Distribution Channels Covered | Online Channel, Retail & Departmental Stores |

| End Uses Covered | Apparel, Industrial, Home Furnishings, Non-woven, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe textile recycling market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe textile recycling market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe textile recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe textile recycling market was valued at USD 1,543.70 Million in 2024.

The growth of the European textile recycling market is driven by increasing consumer demand for sustainable fashion, stricter environmental regulations, rising textile waste, and advancements in recycling technologies. Additionally, the EU's commitment to a circular economy, including mandatory textile waste collection, further accelerates the market's expansion.

IMARC estimates the Europe textile recycling market to exhibit a CAGR of 1.7% during 2025-2033, reaching USD 1,801.10 Million by 2033.

Germany accounted for the largest market share in 2024, with around 26.4% of the market share. This is due to its advanced recycling infrastructure, strong environmental regulations, and high consumer awareness of sustainability. The country's robust recycling technologies, along with government support for circular economy initiatives, have positioned Germany as a leader in textile waste management and recycling.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)