Europe Textile Market Size, Share, Trends and Forecast by Raw Material, Product, Application, and Country, 2026-2034

Europe Textile Market Size and Share:

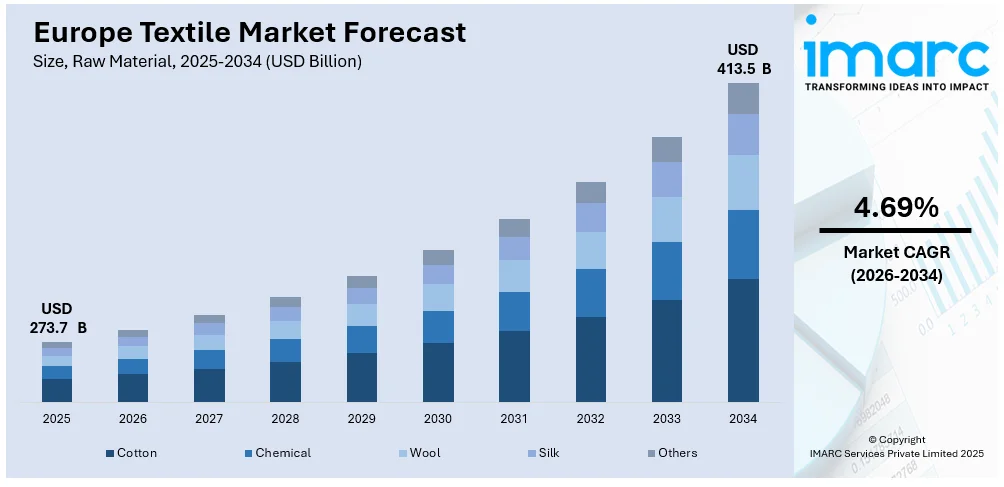

The Europe textile market size is estimated at USD 273.7 Billion in 2025 and is expected to reach USD 413.5 Billion by 2034, at a CAGR of 4.69% during the forecast period 2026-2034. Germany currently dominates the market, holding a market share of over 20.7% in 2025. The market is growing rapidly, fueled by rising demand for sustainable textiles, technological advancements in manufacturing, and the robust presence of fashion and home furnishings industries, supported by innovation and evolving consumer preferences across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 273.7 Billion |

| Market Forecast in 2034 | USD 413.5 Billion |

| Market Growth Rate (2026-2034) | 4.69% |

The Europe textile market is expanding rapidly due to various factors influencing its growth trajectory. The rising consumer preference for sustainable and eco-friendly textiles is encouraging manufacturers to innovate and adopt organic and recycled materials. For instance, in March 2024, Syre, launched by Vargas and H&M Group, is set to revolutionize the textile industry by decarbonizing and reducing waste through eco-friendly textile-to-textile recycling, starting with polyester, aiming to cut CO2e emissions by 85%. Moreover, the European Union's regulations and policies for sustainable practices with reduced environmental impacts drive the demand for ecofriendly manufacturing practices in textiles. Advances in digital textile printing and automated production processes are further improving efficiency and quality of fabric production, attracting global investments in the sector. The fashion industry is growing in the region as well, especially with global fashion capitals such as Paris and Milan enjoying significant influence. Boosting interest in luxury home furnishing and smart textiles are also contributing to the market.

To get more information on this market Request Sample

Furthermore, demand is rising for technical textiles applied in various sectors, such as the automotive and health and construction industries. Technical textiles also provide functionalities, such as durability, fire resistance, and antibacterial properties, matching the evolving demands of advanced industries. The inclusion of smart textiles in clothing and medical applications that integrate sensors and responsive materials within them also increases the rate of demand. For example, in November 2024, Myant Corp. acquired Swiss companies Nanoleq and Osmotex, specializing in smart textiles and biosensing technologies, expanding its European presence and advancing its mission in connected health solutions. In line with this, the expansion of e-commerce platforms is making it easy for consumers to get hold of a variety of textile products which is enhancing sales in multiple segments. Robust exports from European nations and their commitment to innovation in the design and production of fabrics continue to cement Europe's position as the leading textile hub globally.

Europe Textile Market Trends:

Growing Demand for Sustainable Textiles

The European textile industry is increasing rapidly with the new shift towards sustainability as consumers are becoming concerned about making ecological purchases. Heightening awareness in the environmental sector causes demand for items made of organic cotton or hemp and recycled materials in textiles. This encourages companies to look for more environmentally friendly procedures for production, such as biodegradable dyes and water-saving technologies. Besides this, the government policies like European Green Deal are urging companies to be reduced carbon emitters and apply the circular economy principles. The sustainability certifications such as GOTS and OEKO-TEX are being used by the brands to be certified compliant and attract environmentally aware customers. The second-hand and upcycled clothing markets also indicate this direction of change, where the retailers and customers want to minimize waste. The demand for sustainable textiles is central to the growth of the Europe textile market as both demand and regulatory support continue to increase.

Technological Innovations in Textile Production

Technological advancements are reshaping the Europe textile market share, significantly enhancing production capabilities and efficiency. For instance, in April 2024, Getzner Textil launched advanced technical textiles showcasing innovations in PPE fabrics, acoustic textiles under the acunic brand, sustainable materials, 3D technology, and high-performance fabrics for various applications. Moreover, innovations, such as digital textile printing are making it possible to produce complex patterns much faster and at a lower cost, thus responding to individual and small batch orders. Automated weaving and knitting machines reduce labor costs and improve the quality of fabrics. Additionally, AI and IoT integration in manufacturing facilities enable real-time monitoring and predictive maintenance, thus reducing downtime and maximizing output. This area includes smart textiles, incorporating integrated sensors, in the textile industries such as fashion and health, and providing features like temperature regulation and biometric monitoring. Improvements in the application of treatments on fabric include antimicrobial coatings, water-repellent finishes, thereby escalating product durability and versatility. This is also one reason Europe textile market growth drives global investments and competencies for the region.

Rising Popularity of Luxury and Technical Textiles

The Europe textile market is experiencing growing demand for luxury and technical textiles in various applications. Luxury textiles, are known for their improved quality and aesthetics, find their applications in the fashion and interior design sectors, wherein consumers are ready to pay for premium products. In addition to this, technical textiles are gaining acceptance in automotive, healthcare, and construction segments due to their advanced functionalities. Such technical textiles benefit with increased strength, thermal insulation, and antibacterial properties, which help to satisfy specialized industrial demands. Sportswear, medical devices, and protective clothing also incorporate technical textiles further increasing the diversification of applications. Focus on innovation and customization also is promoting manufacturers to make more tailored solutions which is augmenting the textile industry in Europe. Luxury and technical textiles together play an important role in developing the Europe textile market size with improving the competitiveness.

Europe Textile Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe textile market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on raw material, product, and application.

Analysis by Raw Material:

- Cotton

- Chemical

- Wool

- Silk

- Others

Cotton is a widely used natural fiber in the textile sector, prized for its breathability, versatility, and softness. It is essential for manufacturing apparel, home furnishings, and industrial products. Its sustainable and biodegradable nature further enhances its appeal in meeting the growing demand for eco-friendly textiles.

Chemical fibers, including synthetic and regenerated fibers, are extensively utilized for their durability, affordability, and adaptability. Materials like polyester, nylon, and viscose dominate various textile applications. These fibers are essential in producing high-performance fabrics for apparel, home textiles, and technical uses, offering strength and resistance to wear and tear.

Wool is a natural fiber lauded due to its warmth, resilience, and elasticity. Commonly used in clothing, upholstery, and carpets, it is particularly favored for winter apparel and luxury items. Wool’s moisture-wicking and insulating properties make it a preferred choice for sustainable and high-quality textile applications.

Silk is a luxurious natural fiber with shine, smooth texture, and strength. It is predominantly used in premium apparel, accessories, and home décor. Its lightweight and breathable qualities, coupled with a growing demand for sustainable luxury products, sustain its relevance in the textile market.

Other raw materials include flax, hemp, jute, and innovative bio-based fibers. These materials are gaining attention for their eco-friendly attributes and versatility. Their applications span from fashion and home textiles to industrial uses, aligning with the increasing emphasis on sustainability and biodegradable alternatives in the textile industry.

Analysis by Product:

- Natural Fibers

- Polyesters

- Nylon

- Others

Natural fibers, such as wool, silk, and cotton, are widely used for their eco-friendly, breathable, and biodegradable properties. They are essential in producing sustainable textiles, including apparel, home furnishings, and industrial applications, catering to the rising demand for environmentally conscious products in the textile industry.

Polyesters are synthetic fibers valued for their durability, wrinkle resistance, and affordability. Commonly used in fashion, upholstery, and industrial applications, polyester offers versatility and cost-effectiveness. Its ability to blend with other materials and support high-performance textiles makes it a popular choice across multiple segments.

Nylon is a strong and flexible synthetic fiber widely applied in textiles requiring durability and elasticity. From sportswear and hosiery to technical applications such as industrial fabrics, nylon offers high resistance to wear and tear. Its lightweight nature enhances its adaptability for various textile needs.

Other fibers include regenerated fibers like viscose and innovative materials such as bio-based fibers and recycled textiles. These materials are gaining traction for their sustainability and unique properties, finding applications in fashion, home textiles, and technical uses. They align with the industry's focus on innovation and eco-friendly solutions.

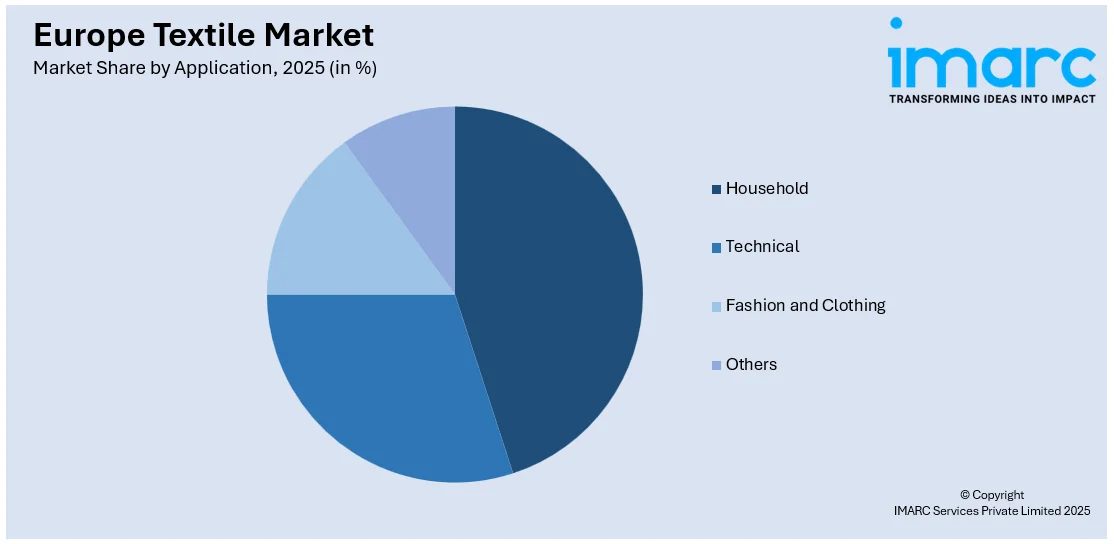

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Household

- Technical

- Fashion and Clothing

- Others

Household textiles, including bed linens, curtains, and upholstery, are essential in the textile industry. Demand for these products is driven by consumer preferences for comfort, design, and sustainability. Innovations in fabric technology, such as stain-resistant or eco-friendly materials, are amplifying their appeal in modern households.

Technical textiles are specialized products made for industrial, medical, and safety applications. These materials offer enhanced properties like durability, resistance to heat, and filtration capabilities. They are used in fields like automotive, healthcare, and construction, where performance and functionality are prioritized. Their growth is driven by advances in materials and increasing industrial needs.

Fashion and clothing textiles are key drivers of the textile market, driven by trends in apparel, sportswear, and accessories. The demand for fabrics like cotton, wool, and synthetics is influenced by changing consumer preferences, fashion trends, and seasonal collections. Innovations in sustainable fashion and smart textiles are further shaping this sector's growth.

Other applications of textiles include materials used in automotive interiors, medical devices, and agriculture. These products include non-woven fabrics, geotextiles, and medical-grade textiles, which cater to niche industries. The heightening focus on sustainability and functional design in various sectors is driving growth in these specialized textile applications.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2025, Germany accounted for the largest market share of over 20.7%, driven by its strong manufacturing base, technological advancements, and high demand for both traditional and technical textiles. The country’s focus on innovation, sustainability, and efficient production processes helps it maintain a competitive edge in the global market.

France has a rich history in textile production, particularly in fashion and luxury apparel. The country continues to lead in design and innovation, with growing demand for high-quality textiles in home décor and clothing. France's emphasis on sustainability in textile production is further boosting market growth.

The United Kingdom is a major consumer of textile products, with a focus on fashion, technical textiles, and home textiles. The market in the UK benefits from a thriving retail industry, high consumer demand for sustainable products, and growing investments in textile technology and innovation, positioning it as a significant market hub.

Italy is known for its premium textiles, particularly in fashion and luxury segments. The country’s strong focus on craftsmanship, design, and high-quality materials drives demand for Italian-made fabrics. Additionally, Italy's advancements in textile machinery and sustainable practices contribute to its ongoing growth in the textile sector.

Spain has a growing textile industry, driven by a combination of low-cost manufacturing and bolstering demand for both fashion and home textiles. Spain is also capitalizing on its proximity to key European markets, enhancing its position as a competitive player in the textile export sector.

Other European regions are also witnessing growth in the textile market, with countries like Portugal, Belgium, and the Netherlands increasingly participating in both production and innovation. These countries focus on producing eco-friendly textiles, advancing textile technology, and expanding their presence in international markets.

Competitive Landscape:

Strong competitiveness in the Europe textile market is marked by innovation, sustainability, and advanced manufacturing practices. Competitors focus on the use of cutting-edge technology: from the advent of digital printing, automatic systems for production, and the emergence of smart textiles-all focused-on efficiency and catering to demands from diverse consumer groups. Sustainable elements remain a prime competitive tool, with producers focusing more on eco-friendly materials and processes to achieve regulatory and market imperatives. In addition, the integration of technical textiles into healthcare, automotive, and construction is opening up opportunities for specialization and market expansion. Companies are also strengthening their distribution networks, including partnerships with e-commerce platforms, to enhance accessibility and reach. This dynamic competition fosters continuous growth and diversification within the Europe textile market.

The report provides a comprehensive analysis of the competitive landscape in the Europe textile market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024: Reju opened Regeneration Hub Zero in Frankfurt, Germany, its first textile-to-textile recycling facility. Using IBM-invented technology and backed by Technip Energies, the hub focuses on recycling polyester with a 50% lower carbon footprint. Reju aims to create a circular textile system to tackle global textile waste, producing sustainable, infinitely regenerable polyester.

- In September 2024: The Filament Factory (TFF) launched high-performance PA12 high-strength multifilament yarn, developed in collaboration with Evonik. The lightweight textile innovation features low moisture absorption, high chemical resistance, dimensional stability, and durability. Applications span automotive, aviation, and sports sectors, supporting hoses, ropes, belts, and other advanced textile uses, marking a significant advancement in polymer-based materials.

- In July 2024, Lenzing Group, in collaboration with 13 partners, is driving the reformation of the textile industry through the EU-funded CELLFIL project. With €6.9 million in support, the project aims to scale sustainable, bio-based lyocell filaments, replacing synthetic fibers and promoting a circular economy for a greener, more sustainable textile value chain.

- In January 2024, BASF and Inditex announced the launch of loopamid®, a pioneering circular nylon 6 made entirely from textile waste. Zara introduced a jacket utilizing this innovative material, incorporating it into every garment component. The technology enables the recycling of polyamide 6 fibers across multiple cycles, driving sustainability and circularity in the fashion industry.

Europe Textile Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Cotton, Chemical, Wool, Silk, Others |

| Products Covered | Natural Fibers, Polyesters, Nylon, Others |

| Applications Covered | Household, Technical, Fashion and Clothing, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe textile market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe textile market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe textile industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Textile refers to any material made from natural or synthetic fibers, created through weaving, knitting, crocheting, or felting processes. It is used in multiple applications, including home furnishings, clothing, and industrial sectors. Textiles serve purposes ranging from fashion and upholstery to technical uses in automotive, healthcare, and construction, providing functionality, durability, and aesthetic appeal.

The Europe textile market was valued at USD 273.7 Billion in 2025.

IMARC estimates the Europe textile market to exhibit a CAGR of 4.69% during 2026-2034.

Key factors driving the Europe textile market include rising demand for sustainable and eco-friendly textiles, advancements in digital printing and automation technologies, and growing applications of technical textiles in industries like healthcare and automotive. Additionally, the region's strong fashion and home furnishings sectors, coupled with increasing consumer preferences for premium and innovative products, are fueling market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)