Europe Telehealth Market Size, Share, Trends and Forecast by Component, Communication Technology, Hosting Type, Application, End User, and Country, 2026-2034

Europe Telehealth Market Summary:

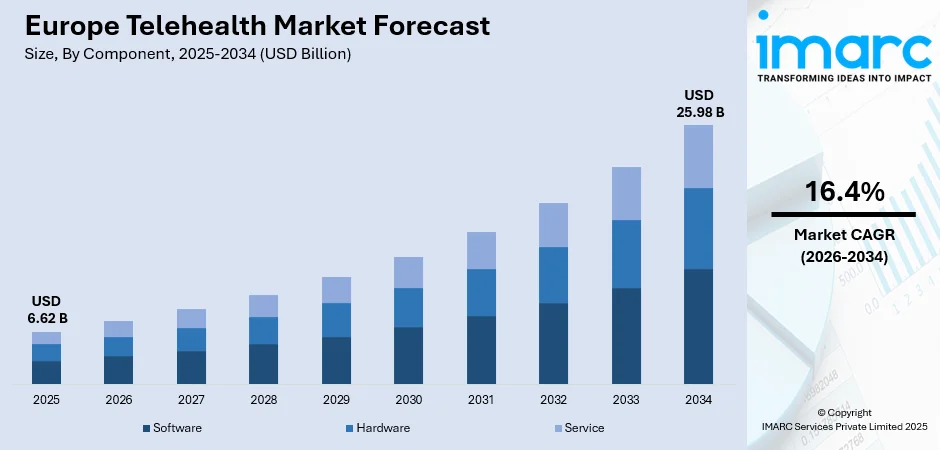

The Europe telehealth market size was valued at USD 6.62 Billion in 2025 and is projected to reach USD 25.98 Billion by 2034, growing at a compound annual growth rate of 16.4% from 2026-2034.

The Europe telehealth market is experiencing robust momentum as healthcare systems across the region prioritize digital transformation and remote care delivery. Growing demand for accessible healthcare services, coupled with favorable regulatory frameworks and reimbursement policies, is accelerating adoption among providers and patients alike. Technological advancements in mobile health applications, wearable devices, and artificial intelligence are enhancing service quality and operational efficiency. Rising prevalence of chronic conditions and an expanding elderly population are further strengthening the need for scalable remote monitoring and consultation solutions, positioning the region as a key contributor to Europe telehealth market share.

Key Takeaways and Insights:

-

By Component: Software dominates the market with a share of 56% in 2025, driven by the accelerating adoption of cloud-native telehealth platforms, interoperable electronic health record integrations, and regulatory-compliant digital workflows. Rising investments in modular digital platforms are enhancing service delivery capabilities.

-

By Communication Technology: Video conferencing leads the market with a share of 43% in 2025, owing to its widespread use in real-time consultations, specialist referrals, and multi-disciplinary care coordination. Enhanced bandwidth availability and secure communication protocols support growing adoption.

-

By Hosting Type: Cloud-based and web-based exhibit a clear dominance in the market with 68% share in 2025, indicating a strong preference for scalable, adaptable, and reasonably priced infrastructure that permits remote access across healthcare locations and easy integration with electronic health data.

-

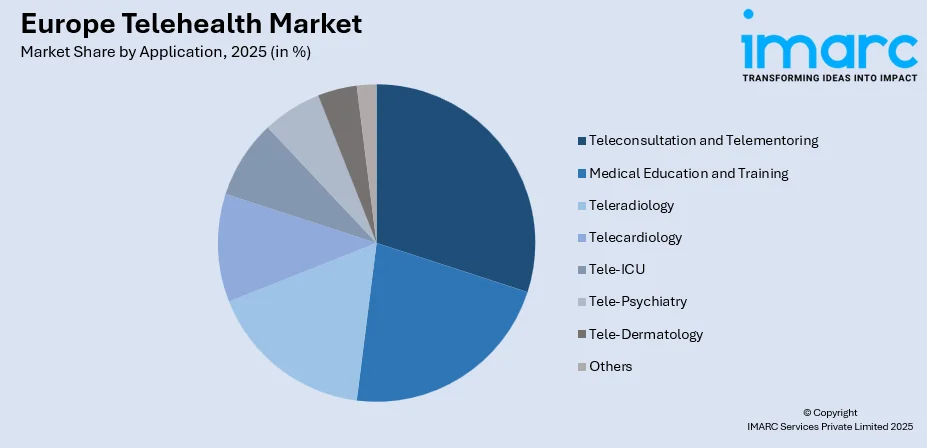

By Application: Teleconsultation and telementoring represent the largest segment with a market share of 23% in 2025, driven by increasing patient preference for convenient virtual consultations and the growing need for specialist guidance in primary care settings across European healthcare systems.

-

By End User: Providers prevail the market with a share of 43% in 2025, owing to the strategic integration of telehealth solutions into hospital networks, clinics, and primary care practices seeking to optimize operational efficiency and expand patient reach.

-

By Country: United Kingdom is the largest region with 32% share in 2025, driven by the NHS's strategic embrace of digital transformation, significant investments in telehealth infrastructure, and expanding ecosystem of digital health startups supporting virtual care delivery.

-

Key Players: Key players drive the Europe telehealth market by expanding digital care portfolios, enhancing platform interoperability, and investing in AI-powered diagnostic capabilities. Their strategic partnerships with national health systems and focus on regulatory compliance accelerate adoption across diverse healthcare settings.

To get more information on this market Request Sample

The Europe telehealth market is advancing rapidly as healthcare systems prioritize digital solutions to address evolving patient needs and operational challenges. Supportive government initiatives, including the European Health Data Space regulation that came into force in March 2025, are enabling seamless electronic health data sharing for care and research across EU member states. Healthcare providers are increasingly adopting telehealth platforms to manage chronic conditions, deliver mental health services, and reduce hospital admissions through remote monitoring. Technological innovations in artificial intelligence and wearable integration are enhancing diagnostic accuracy and enabling predictive care models. The growing acceptance of virtual consultations among patients, particularly following widespread exposure during the pandemic era, continues to drive sustained demand. Additionally, workforce shortages and the need for cost-effective care delivery are compelling healthcare organizations to embrace scalable digital health solutions that improve access without compromising quality.

Europe Telehealth Market Trends:

Integration of Artificial Intelligence in Remote Care Delivery

Healthcare providers across Europe are increasingly integrating artificial intelligence capabilities into telehealth platforms to enhance diagnostic accuracy and streamline clinical workflows. AI-powered tools are enabling real-time analysis of patient data from wearable devices, supporting early detection of health deteriorations and facilitating proactive interventions. In November 2024, Hamburg-based TCC raised €20 Million in Series A funding to enhance intensive care unit support through AI-enabled telehealth solutions, currently managing over three thousand hospital beds globally. These advancements are transforming traditional reactive care models into predictive health management systems that improve patient outcomes while reducing clinician workloads.

Expansion of Cloud-Based Telehealth Infrastructure

The migration toward cloud-based telehealth platforms is accelerating across European healthcare systems, driven by the need for scalable, interoperable, and cost-efficient digital infrastructure. Cloud solutions enable seamless integration with electronic health records and facilitate secure data sharing across disparate healthcare settings. Philips announced in February 2025 that its cloud-based HealthSuite Imaging technology would be extended to Europe, providing radiology departments with safe remote access to AI-enabled processes and imaging tests via Amazon Web Services. This trend supports Europe telehealth market growth by enabling healthcare organizations to deploy advanced virtual care capabilities without substantial capital investments in on-premises infrastructure.

Rising Demand for Mental Health Teleconsultation Services

Telepsychiatry and mental health teleconsultation services are witnessing significant adoption growth across European markets as awareness of mental wellness increases and stigma surrounding virtual therapy diminishes. Digital platforms are providing accessible pathways for individuals to receive counseling, therapy, and psychiatric care regardless of geographic location. Telepsychiatry has emerged as one of the most utilized telehealth services across the region, with numerous countries integrating mental health teleconsultation within broader digital health frameworks and national telehealth strategies. The convenience and privacy offered by virtual mental health services continue to attract patients seeking flexible treatment options.

Market Outlook 2026-2034:

The Europe telehealth market is positioned for sustained expansion as healthcare systems continue their digital transformation journeys and patients increasingly embrace virtual care modalities. Regulatory harmonization efforts, technology standardization initiatives, and expanded reimbursement frameworks are creating favorable conditions for market participants. The market generated a revenue of USD 6.62 Billion in 2025 and is projected to reach a revenue of USD 25.98 Billion by 2034, growing at a compound annual growth rate of 16.4% from 2026-2034. Continued investments in 5G infrastructure, artificial intelligence applications, and interoperable health data systems will further accelerate adoption across provider networks, payer organizations, and patient populations throughout the forecast period.

Europe Telehealth Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Software | 56% |

| Communication Technology | Video Conferencing | 43% |

| Hosting Type | Cloud-Based and Web-Based | 68% |

| Application | Teleconsultation and Telementoring | 23% |

| End User | Providers | 43% |

| Country | United Kingdom | 32% |

Component Insights:

- Software

- Hardware

- Service

Software dominates with a market share of 56% of the total Europe telehealth market in 2025.

The software segment maintains market leadership driven by accelerating healthcare digitization and growing demand for integrated telehealth platforms capable of supporting diverse clinical workflows. Investments in software systems that integrate electronic health records and facilitate clinical decision support, remote patient monitoring, and smooth virtual consultations are becoming a top priority for healthcare companies. Regulatory frameworks across European countries have expanded the scope of reimbursable digital health applications, enabling more complex treatment schemes including telemonitoring through certified software platforms.

Software platforms are evolving to incorporate artificial intelligence capabilities that enhance diagnostic accuracy, automate administrative tasks, and personalize patient engagement. National frameworks across multiple European markets are encouraging widespread adoption of standardized telehealth software systems among healthcare providers, promoting interoperability and data sharing across care settings. Cloud-native architectures enable healthcare organizations to scale services according to demand while ensuring compliance with evolving data protection requirements. These regulatory and policy enablers, combined with growing technical sophistication, modular deployment flexibility, and seamless integration with existing healthcare infrastructure, continue to strengthen the software segment's position as the primary revenue contributor within the European telehealth ecosystem.

Communication Technology Insights:

- Video Conferencing

- Health Solutions

- Others

Video conferencing leads with a share of 43% of the total Europe telehealth market in 2025.

Video conferencing technology has emerged as the cornerstone of telehealth service delivery across Europe, enabling real-time clinical consultations that closely replicate in-person interactions. Healthcare providers leverage video platforms for primary care consultations, specialist referrals, follow-up appointments, and multidisciplinary team meetings. The modality supports comprehensive clinical assessments, allowing physicians to observe patient presentations, evaluate symptoms visually, and deliver accurate diagnoses while maintaining meaningful patient-provider relationships across geographical distances.

The proliferation of high-speed internet connectivity and improvements in secure video transmission protocols have enhanced the quality and reliability of virtual consultations across urban and rural settings. Healthcare organizations are investing in enterprise-grade video conferencing solutions that integrate with electronic health records, enabling clinicians to access patient information during consultations while maintaining compliance with data protection requirements. Video platforms increasingly incorporate features supporting screen sharing, digital prescription generation, and appointment scheduling to streamline clinical workflows. The convenience and efficiency of video-based care continue to drive patient acceptance and provider adoption across European healthcare systems, positioning video conferencing as an essential component of modern telehealth infrastructure.

Hosting Type Insights:

- Cloud-Based and Web-Based

- On-Premises

Cloud-based and web-based exhibits a clear dominance with a 68% share of the total Europe telehealth market in 2025.

Cloud-based hosting has become the preferred deployment model for telehealth solutions across Europe, offering healthcare organizations scalable infrastructure that adapts to fluctuating demand without substantial capital investments. The model enables efficient data storage, secure information sharing, and seamless platform updates while supporting interoperability across disparate healthcare systems. Regulatory frameworks across European markets have further accelerated cloud adoption by establishing guidelines for secure electronic health data access and sharing across member states, fostering confidence in cloud-based healthcare delivery.

Healthcare providers benefit from cloud platforms that integrate artificial intelligence capabilities, advanced analytics, and remote monitoring functionalities without requiring extensive technical expertise or IT infrastructure investments. The software-as-a-service model ensures regular security updates, compliance monitoring, and access to latest innovations from any location while reducing operational burdens on healthcare IT departments. Cloud infrastructure supports real-time data synchronization across multiple care settings, enabling coordinated patient management and seamless information exchange between providers. This trend toward cloud-native telehealth solutions continues to strengthen as organizations prioritize operational flexibility, cost efficiency, and interoperability in their digital health transformation strategies.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Teleconsultation and Telementoring

- Medical Education and Training

- Teleradiology

- Telecardiology

- Tele-ICU

- Tele-Psychiatry

- Tele-Dermatology

- Others

Teleconsultation and telementoring represent the leading segment with a 23% share of the total Europe telehealth market in 2025.

Teleconsultation services have become fundamental to healthcare delivery across European markets, enabling patients to access medical advice and specialist opinions without geographic constraints. Healthcare systems are leveraging virtual consultation platforms to reduce waiting times, optimize specialist utilization, and improve care coordination between primary and secondary care settings. Government-backed telemedicine initiatives across multiple countries have achieved substantial patient adoption, with growing proportions of citizens actively utilizing digital consultation platforms to receive timely medical care and guidance.

Telementoring applications are expanding the reach of specialist expertise to healthcare providers in underserved areas, enhancing clinical decision-making and supporting professional development. These platforms facilitate real-time guidance during complex procedures, enable case consultations across institutional boundaries, and strengthen healthcare workforce capabilities through continuous learning opportunities. Virtual mentoring reduces professional isolation among practitioners in remote settings while ensuring consistent care quality regardless of location. The combination of patient-facing teleconsultation and provider-focused telementoring services addresses both care access and quality improvement objectives across European healthcare systems.

End User Insights:

- Providers

- Patients

- Payers

- Others

Providers dominate the market with a share of 43% of the total Europe telehealth market in 2025.

Healthcare providers including hospitals, clinics, and specialty practices represent the primary adopters of telehealth solutions across European markets. Organizations are integrating virtual care capabilities into existing care pathways to enhance operational efficiency, extend geographic reach, and address workforce constraints. National healthcare systems have emerged as key drivers of provider-led telehealth adoption, with significant investments in digital health infrastructure supporting virtual care delivery across primary and secondary care settings throughout the region.

Provider organizations are leveraging telehealth platforms for diverse applications including outpatient consultations, chronic disease management, post-acute care coordination, and emergency triage services. Strategic collaborations between healthcare institutions and technology partners are enabling implementation of versatile telehealth platforms designed for adaptability to current and emerging healthcare technologies. These investments in digital infrastructure enable providers to deliver care more efficiently while meeting evolving patient expectations for convenient healthcare access. As businesses realize telehealth's potential to maximize resource utilization, save operating costs, and enhance patient happiness across a range of clinical specializations, provider adoption is growing.

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

United Kingdom holds the largest share with 32% of the total Europe telehealth market in 2025.

The United Kingdom maintains market leadership driven by the National Health Service's comprehensive digital transformation strategy and substantial investments in telehealth infrastructure development. The NHS Long Term Plan has positioned digital health integration as a strategic priority, fostering an ecosystem of innovative startups, technology providers, and healthcare organizations advancing virtual care delivery. In March 2024, the UK government announced £3.4 Billion investment in NHS digitization as part of broader public sector productivity initiatives, doubling investment in digital transformation to harness artificial intelligence capabilities and reduce administrative workloads.

The UK telehealth market benefits from high digital literacy, widespread internet connectivity, and strong consumer acceptance of virtual healthcare services. Healthcare providers across the country are deploying telehealth solutions for diverse applications including mental health services, chronic disease management, and remote patient monitoring. In April 2025, the UK government announced up to £600 Million investment for a centralized Health Data Research Service designed to streamline NHS data access for researchers and reduce clinical trial setup times. These investments continue to strengthen the United Kingdom's position as the leading telehealth market in Europe.

Market Dynamics:

Growth Drivers:

Why is the Europe Telehealth Market Growing?

Supportive Government Policies and Regulatory Frameworks

European governments are implementing comprehensive digital health strategies and regulatory frameworks that create favorable conditions for telehealth adoption across healthcare systems. National initiatives are establishing reimbursement mechanisms, technical standards, and legal frameworks that enable healthcare providers to deliver and bill for virtual care services. Several countries have pioneered the prescription and reimbursement of certified digital health applications through statutory health insurance systems, creating blueprints for digital therapeutics integration across the region. Pan-European collaborative initiatives are uniting member states with leading digital health partners to address challenges in health system transformation and promote best practice sharing. Regulatory frameworks governing cross-border health data sharing represent significant policy enablers, establishing mechanisms that support seamless telehealth service delivery across national boundaries while ensuring patient data protection and privacy compliance.

Aging Population and Rising Chronic Disease Prevalence

Europe's demographic profile is characterized by rapidly aging populations that require increased healthcare services, particularly for chronic condition management and elderly care. Telehealth solutions offer practical pathways for delivering continuous care to older adults who may face mobility challenges or live in areas with limited healthcare facility access. Remote monitoring platforms enable healthcare providers to track vital signs, medication adherence, and disease progression without requiring frequent in-person visits. The continent's elderly population continues expanding substantially, increasing demand for scalable remote care solutions that can address growing healthcare needs efficiently. The rising prevalence of chronic conditions including cardiovascular diseases, diabetes, and respiratory disorders further amplifies the need for sustained remote monitoring and virtual consultation services that telehealth platforms effectively provide.

Technological Advancements in Digital Health Infrastructure

Rapid technological progress in artificial intelligence, wearable devices, and cloud computing is enhancing the capabilities and accessibility of telehealth solutions across European healthcare systems. Advanced algorithms enable real-time analysis of patient data, predictive health modeling, and automated clinical decision support that improve care quality and efficiency. Wearable technology integration allows continuous health monitoring outside clinical settings, generating valuable data streams for personalized care management. Regional investment initiatives are strengthening artificial intelligence adoption across the continent, including support for healthcare AI applications and regulatory compliance preparation. The convergence of improved connectivity infrastructure, sophisticated software platforms, and innovative hardware devices creates an ecosystem where telehealth services can deliver clinical value comparable to traditional care modalities while offering enhanced convenience and accessibility for patients and providers alike.

Market Restraints:

Regulatory Complexity and Cross-Border Challenges

The fragmented regulatory landscape across European countries presents challenges for telehealth providers seeking to operate across multiple jurisdictions. Variations in licensing requirements, reimbursement policies, and data protection standards complicate market entry and service delivery for organizations aiming to scale operations beyond national borders. While harmonization efforts are progressing, bureaucratic delays and inconsistent approval processes continue to hinder the seamless expansion of telehealth services across the European market.

Digital Infrastructure Disparities

Uneven distribution of digital infrastructure across European regions creates barriers to equitable telehealth access, particularly in rural and underserved areas. Limited broadband connectivity, insufficient device availability, and varying levels of digital literacy among patient populations constrain the reach of virtual care services. Healthcare organizations in less connected regions face challenges in implementing telehealth solutions that require stable high-speed internet connections for video consultations and real-time data transmission.

Data Security and Privacy Concerns

Healthcare data security remains a significant concern for patients and providers adopting telehealth solutions across European markets. The sensitive nature of health information requires robust cybersecurity measures and compliance with stringent data protection regulations including the General Data Protection Regulation. Organizations must invest substantially in security infrastructure, staff training, and compliance frameworks to maintain patient trust and meet regulatory requirements while delivering virtual care services.

Competitive Landscape:

The Europe telehealth market is characterized by dynamic competition among established healthcare technology companies, specialized telehealth providers, and emerging digital health startups. Market participants are pursuing diverse strategies including platform enhancement, geographic expansion, strategic partnerships, and technology acquisitions to strengthen competitive positions. Companies are investing significantly in artificial intelligence integration, user experience improvements, and interoperability capabilities to differentiate their offerings. Collaborations with national health systems and insurance providers are creating pathways for market access and sustainable revenue models. Regulations that affect product specifications and market entry obstacles in various European jurisdictions further define the competitive environment.

Europe Telehealth Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Hardware, Service |

| Communication Technologies Covered | Video Conferencing, Mhealth Solutions, Others |

| Hosting Types Covered | Cloud-Based and Web-Based, On-Premises |

| Applications Covered | Teleconsultation and Telementoring, Medial Education and Training, Teleradiology, Telecardiology, Tele-ICU, Tele-Psychiatry, Tele-Dermatology, Others |

| End Users Covered | Providers, Patients, Payers, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Europe telehealth market size was valued at USD 6.62 Billion in 2025.

The Europe telehealth market is expected to grow at a compound annual growth rate of 16.4% from 2026-2034 to reach USD 25.98 Billion by 2034.

Software dominates the market with a share of 56%, driven by accelerating adoption of cloud-native telehealth platforms, interoperable electronic health record integrations, and regulatory-compliant digital workflows across European healthcare systems.

Key factors driving the Europe telehealth market include supportive government policies and regulatory frameworks, aging populations requiring chronic disease management, technological advancements in digital health infrastructure, expanding reimbursement mechanisms, and growing patient acceptance of virtual care services.

Major challenges include regulatory complexity and cross-border inconsistencies, digital infrastructure disparities between urban and rural areas, data security and privacy concerns, interoperability limitations across healthcare systems, and varying levels of digital literacy among patient populations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)