Europe Solar Microinverter Market Size, Share, Trends and Forecast by Connectivity, Component, Communication Channel, Type Application, and Country, 2025-2033

Europe Solar Microinverter Market Size and Share:

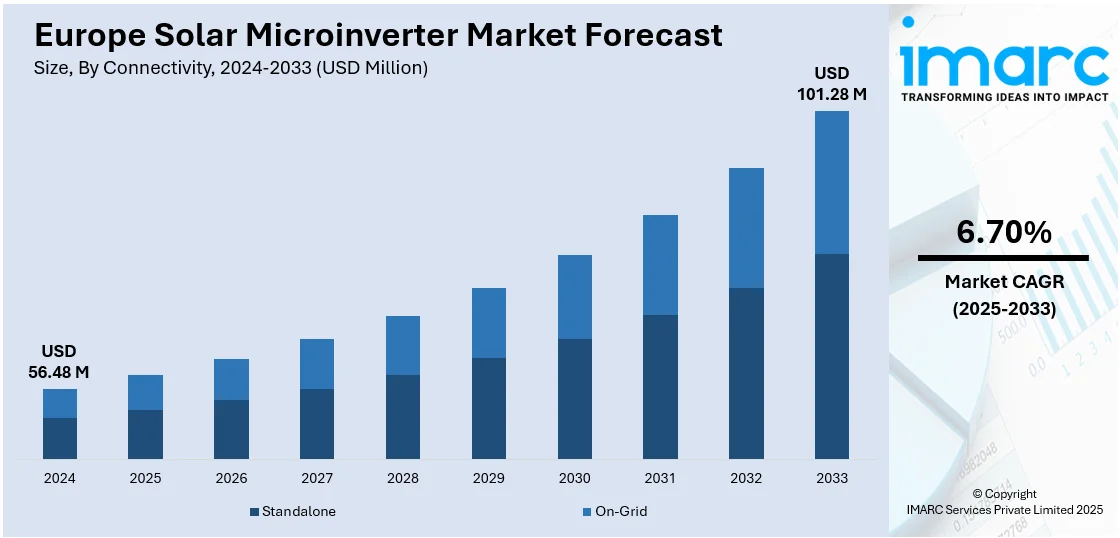

The Europe solar microinverter market size was valued at USD 56.48 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 101.28 Million by 2033, exhibiting a CAGR of 6.70% from 2025-2033. The market is driven by an increasing demand for renewable energy, government incentives for clean energy adoption, and technological advancements in microinverters. These systems offer higher efficiency, improved energy harvest, and easy system expansion, making them popular among residential and commercial solar installations across Europe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 56.48 Million |

|

Market Forecast in 2033

|

USD 101.28 Million |

| Market Growth Rate (2025-2033) | 6.70 % |

The region's increased interest in carbon reduction and renewable energy drives the solar microinverter market. Most European governments are giving various forms of incentives, subsidies, and benefits to encourage people to employ solar energy. The European Union's Green Deal and carbon neutrality by 2050 are other factors that add fuel to the need for effective energy solutions. For instance, European legislators, in March 2024, voted to adopt the EU Solar Standard in the European Parliament as part of the European Performance of Buildings Directive. According to the standard, solar installations on buildings will be mandatory throughout the European Union. Solar installations should be placed in such a way to be part of building structures, and public institutions shall be required to install PV systems on those structures. These policies were merely agreed upon in December 2023 but will be properly implemented gradually starting from the year 2026. Microinverters are ideally suited for both residential as well as commercial solar installs because they maximize energy derived from each solar panel with the conversion of DC from individual panels into AC.

Improvements in solar microinverter technology are another major force that drives the market toward growth. For example, in June 2024, Sungrow, the global leading PV inverter and energy storage system provider, announced the release and showed its first line of microinverters. Three variants with power ratings of 450W, 800W, and 1600W, respectively, are part of the product lineup: S450S, S800S, and S1600S. These microinverters are made for rooftops and balconies, among other home uses. Sungrow offers users a more effective and convenient experience with plug-and-play capabilities, a one-click network configuration, and a 2% boost in power generation when compared to similar goods. Unlike other traditional string inverters, the modern microinverters offer more durability, improved efficiency, and easier monitoring systems for photovoltaic systems. Presently, microinverters are quite frequently used, especially in houses, due to the greater demand for more flexible, scalable, and efficient photovoltaic systems. For areas with changing sunlight exposure, they are ideal, as they optimize energy, reduce shading losses, and provide real-time performance figures. The product popularity can also be associated to the proliferating smart homes across the region. As advances in connectivity and interaction into energy management systems are gaining traction, microinverters are the trending products for European markets.

Europe Solar Microinverter Market Trends:

Government Incentives and Policies

European governments are offering subsidies, tax credits, and incentives to encourage renewable energy adoption, especially solar power. Policies such as the European Green Deal and carbon neutrality goals by 2050 promote solar energy systems, thereby driving the demand for efficient solutions like microinverters, which optimize energy output. For instance, in June 2024, the Net-Zero Industry Act, a significant piece of legislation intended to support the EU's Clean Industrial Deal, was successfully published. By 2030, it aims to achieve a minimum of 30 GW of operational solar PV manufacturing capacity along the whole PV value chain. This act aims to restore solar production to Europe and guarantee that the EU stays at the forefront of clean technology deployment and manufacture, ultimately supporting the bloc's ambitious climate ambitions. This further encourages the adoption of solar technologies, including microinverters, which are essential for optimizing solar energy production.

Significant Technological Advancements

The market is expanding due to advancements in microinverter technology, which include increased durability, efficiency, and monitoring capabilities. Modern microinverters are becoming more and more common for residential and commercial installations as they enhance energy conversion, reduce power loss from shade, and make it simpler to integrate them into solar systems. For instance, in October 2024, Enphase Energy, Inc., a global energy technology company and the world’s leading supplier of microinverter-based solar and battery systems, announced that they started shipping IQ8™ Microinverters to support novel, high-powered solar panels in selected countries and territories, such as the Netherlands, Austria, Malta, and New Caledonia. With this launch, Enphase made its first foray into the solar markets for New Caledonia and Malta. Enphase launched three microinverters with peak output powers of 330 W, 366 W, and 384 W in Malta: the IQ8MCTM, IQ8ACTM, and IQ8HCTM. Enphase launched the IQ8AC and IQ8HC Microinverters in New Caledonia. These microinverters impeccably pair with a range of solar modules up to 560 W DC. IQ8 Microinverters activated in Malta and New Caledonia come with a 25-year warranty from Enphase .

Rising Electricity Prices

As energy prices increase across Europe, consumers and businesses seek ways to reduce electricity bills. According to industry reports, household electricity prices increased in 10 and decreased in 15 EU countries in the first half of 2024, as compared with the first half of 2023. In the first half of 2024, as compared with the initial half of 2023, household electricity prices in the EU exhibited the steep rise in Ireland (37%). Non-household electricity prices in the EU were highest in Ireland (€0.256 per KWh) and lowest in Finland (€0.0939 per KWh) in 2024 . Microinverters help maximize the energy harvested from solar panels, making solar energy more efficient and cost-effective. This price sensitivity encourages the adoption of microinverter technology, especially for residential solar installations.

Europe Solar Microinverter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe solar microinverter market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on connectivity, component, communication channel, type, application.

Analysis by Connectivity:

- Standalone

- On-Grid

Standalone microinverters hold the largest share of the market due to their flexibility, reliability, and ability to improve the performance of particular solar panels. In contrast to centralized systems, freestanding microinverters function autonomously, guaranteeing optimal energy harvesting even if panels encounter obstacles such as shade, dirt, or orientation. They are a popular option for small-scale commercial and residential applications because of their modular architecture, which makes installation and maintenance easier. The need for independent systems is further supported by Europe's expanding renewable energy adoption and government incentives, as these systems improve long-term system performance and energy efficiency while meeting a variety of installation requirements.

Analysis by Component:

- Hardware

- Software

Hardware holds the largest market share in Europe owing to its crucial role in energy conversion and system dependability. To transform solar panel DC output into usable AC power for households and businesses, microinverter gear is necessary. It is a major investment in solar installations due to its efficiency and durability are essential for guaranteeing steady energy generation. Additionally, their use has grown because of developments in hardware technology, such as higher durability, compact designs, and improved efficiency. The hardware segment's rise in the European market is also fueled by the growing demand for high-performance and reasonably priced solar systems across the residential, commercial, and industrial sectors.

Analysis by Communication Channel:

- Wired

- Wireless

Wired microinverters dominate the market due to their reliability, cost-effectiveness, and established compatibility with most solar installations. Stable data and power transfer is guaranteed by wired connections, which lowers the possibility of communication outages that are frequently connected to wireless systems. They are appropriate for a variety of applications, including the commercial and residential sectors, due to their strong performance in a range of environmental situations. Furthermore, wired solutions are favored because of their shown dependability in long-term operations and are simpler to incorporate into current infrastructure. As energy efficiency and system stability remain key priorities, wired microinverters continue to dominate the European market.

Analysis by Type:

- Single Phase

- Three Phase

Single-phase microinverters hold the largest share of the market due to their widespread use in residential solar installations, which dominate the region. These systems are ideal for small to medium-sized energy needs, offering cost-effective solutions with simpler installation and maintenance compared to three-phase systems. Single-phase inverters efficiently handle the lower power outputs typical of residential setups while maintaining compatibility with existing electrical grids. Additionally, government incentives promoting rooftop solar installations and the growing trend of sustainable housing have bolstered their adoption. Their reliability, affordability, and suitability for individual households make single-phase microinverters a preferred choice in Europe.

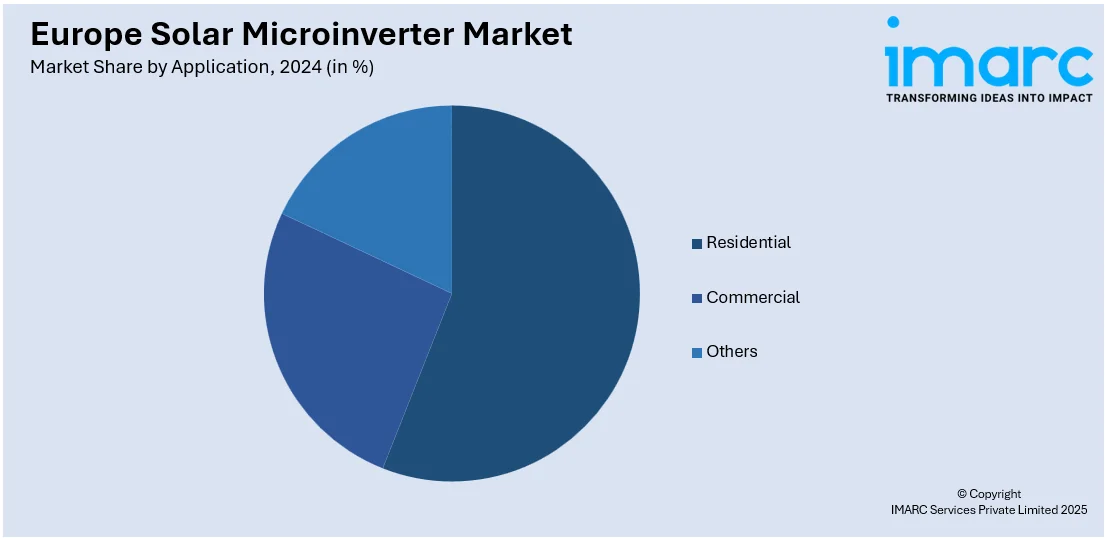

Analysis by Application:

- Residential

- Commercial

- Others

The residential sector holds the largest share of the market due to the growing adoption of rooftop solar systems driven by rising energy costs, government incentives, and a push for sustainable living. Microinverters are particularly suitable for residential installations as they optimize energy output for individual panels, enhancing efficiency and reliability, especially in small-scale setups. Additionally, increasing consumer awareness of renewable energy benefits and the desire for energy independence contribute to their popularity. With advancements in solar technology and attractive financial incentives across European countries, homeowners are increasingly adopting solar microinverters, solidifying the residential sector's dominance.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In Germany, factors driving the solar microinverter market include strong government support for renewable energy, such as the Renewable Energy Sources Act (EEG) and subsidies for solar power installations. Germany’s commitment to reducing carbon emissions and achieving energy independence fuels demand for solar systems. Additionally, rising electricity prices and growing environmental awareness encourage homeowners and businesses to adopt solar energy solutions. The country's robust solar industry, technological advancements, and a preference for efficient, decentralized energy systems further promote the use of microinverters. Moreover, the increasing trend of residential solar installations and energy storage solutions boosts microinverter demand in Germany.

Competitive Landscape:

The Europe solar microinverter market is highly competitive, with key players like Enphase Energy, SolarEdge Technologies, and SMA Solar Technology leading the industry. These companies focus on offering advanced microinverter solutions that enhance solar system efficiency, energy production, and monitoring capabilities. Enphase Energy, a market leader, is known for its high-performance microinverters and robust global presence. SolarEdge, with its innovative technology, continues to grow its share by offering integrated solutions. Local players are also emerging, capitalizing on the EU's renewable energy incentives and growing demand for energy-efficient solar power solutions, further intensifying market competition. For instance, in June 2024, Enphase Energy, Inc., a global energy technology company and the world's leading supplier of microinverter-based solar and battery systems, announced the showcase of a variety of its new products for the European market at The Smarter E Europe (Intersolar Europe) in Munich, Germany on June 19-21, 2024. Enphase launched a range of innovative products tailored for the European market at the event.

Latest News and Developments:

- In March 2024, Hoymiles, a world-leading power electronics company well-versed in PV and energy storage and specializing in microinverters, and VDH Solar, a top PV inverter distributor in the Netherlands, announced a significant partnership agreement that was signed during Solar Solutions International at Greater Amsterdam on March 19th. This strategic collaboration between two industry leaders promises to reshape the distributed photovoltaic market in the country and Europe by delivering advanced solar energy solutions.

- In May 2024, Enphase Energy, Inc., a global energy technology company and the world’s leading supplier of microinverter-based solar and battery systems, announced that it had entered the solar market in Finland with the introduction of IQ8™ Microinverters, with peak output AC power of up to 384 W.

Europe Solar Microinverter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Connectivity’s Covered | Standalone, On-Grid |

| Components Covered | Hardware, Software |

| Communication Channels Covered | Wired, Wireless |

| Types Covered | Single Phase, Three Phase |

| Applications Covered | Residential, Commercial, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe solar microinverter market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe solar microinverter market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe solar microinverter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A solar microinverter is a device that converts DC (direct current) electricity generated by solar panels into AC (alternating current). Unlike traditional string inverters, microinverters are attached to individual panels, improving system efficiency by optimizing power output, reducing shading effects, and enhancing monitoring capabilities for each panel.

The Europe solar microinverter market was valued at USD 56.48 Million in 2024.

IMARC estimates the Europe solar microinverter market to exhibit a CAGR of 6.70% during 2025-2033.

The key factors driving the Europe solar microinverter market are increasing renewable energy adoption, government incentives for clean energy, rising electricity costs, and advancements in solar technology. Additionally, growing environmental awareness, energy efficiency demands, and the shift toward decentralized power generation are propelling the demand for microinverters in residential and commercial sectors.

In 2024, standalone represented the largest segment by connectivity, due to their flexibility, ease of installation, individual panel optimization, and suitability for diverse solar installations.

Hardware leads the market by component due to high demand for durable, efficient microinverter units, crucial for reliable solar energy conversion and system performance.

The wired is the leading segment by communication channel, due to their reliability, stable connections, cost-effectiveness, and widespread compatibility with existing solar installations.

The single phase is the leading segment by type, due to their suitability for residential applications, cost-efficiency, and compatibility with Europe's small to medium-sized installations.

The residential is the leading segment by application, due to increasing rooftop solar installations, government incentives, energy savings, and growing demand for sustainable housing solutions.

On a regional level, the market has been classified into Germany, France, United Kingdom, Italy, Spain, and others, wherein Germany currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)