Europe Security Market Size, Share, Trends and Forecast by System, Service, End- User, and Country, 2026-2034

Europe Security Market Size and Share:

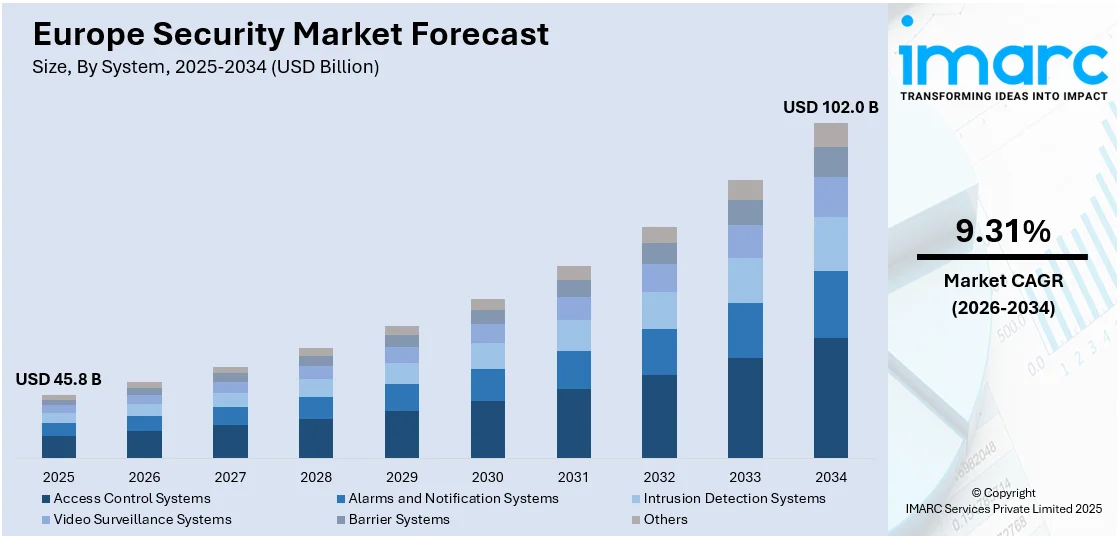

The Europe security market size was valued at USD 45.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 102.0 Billion by 2034, exhibiting a CAGR of 9.31% from 2026-2034. The market in Europe is majorly driven by the rising concerns over cyber-attacks, terrorism, geopolitical tensions, digital transformation, advancement in smart technologies, infrastructure expansion, increased revenue generation from surveillance systems, cybersecurity frameworks, and regulatory compliance measures.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 45.8 Billion |

| Market Forecast in 2034 | USD 102.0 Billion |

| Market Growth Rate (2026-2034) | 9.31% |

The market in Europe is fueled by the rising fear of cyber-attacks, terrorism, and increasing geopolitical tensions among nations, as governments and institutions are compelled to invest in new-age security architecture. For instance, On January 7, 2025, Bruno Retailleau, France's Interior Minister, stated that the French intelligence has been able to stop nine planned attacks over the past year, including three aimed at the Olympic Games, the largest number of thwarted attacks since 2017. Moreover, rapid digital transformation across sectors fosters robust cybersecurity that can safeguard the sensitive data as well as strategic infrastructure. The market is reshaped with smart technologies, surveillance systems, and AI-powered security tools in place. Furthermore, faster threat detection and response can now be accomplished due to the application of such solutions. Moreover, regulatory frameworks, such as GDPR, also force companies to adopt data protection and compliance measures.

To get more information on this market Request Sample

The market is further driven by the expansion of crucial infrastructure projects, including smart cities, energy grids, and transportation networks, throughout Europe. This can be attributed to the augmenting demand for advanced physical and digital security solutions for asset-protection and continuity of operations. The growing awareness of security threats in healthcare, finance, and manufacturing sectors is another factor propelling market growth. For instance, on August 24, 2024, the European Union announced plans to bolster its defense strategy for cyberattacks on healthcare, following the spate of cyberattacks targeting hospitals and other medical institutions. The new measure will make health systems more robust by imposing stiffer security standards and encouraging more cooperation among the member states. The EU places great importance on safeguarding patient data and guaranteeing the smooth delivery of healthcare services across the continent. Moreover, the ongoing conflict along the borders of Europe has also propelled the demand for defense spending, which has improved border security, surveillance, and military capabilities, thereby providing a boost to the market growth. Apart from this, the integration of IoT with physical security technologies, delivering end-to-end protection solutions in an integrated format, is supporting the market further.

Europe Security Market Trends:

Increase in Cybersecurity Investments

The market in Europe is witnessing significant growth due to the increasing cyber threats and data breaches. Organizations are allocating more budgets towards advanced cybersecurity frameworks for safeguarding critical information and ensuring business continuity. For instance, on November 22, 2024, the European Union Agency for Cybersecurity (ENISA) published its fifth NIS Investments report. The report is based on data from 1,350 organizations in all EU Member States, including sectors of high criticality and manufacturing. The key findings are that information security now accounts for 9% of EU IT investments, a 1.9% point increase from 2022, with median IT spending rising to EUR 15 Million in 2023. This trend is shaping the Europe security market outlook as enterprises prioritize AI-driven threat detection, endpoint security, and cloud-based solutions. The increasing adoption of digital platforms across industries further accelerates demand for comprehensive cyber defense strategies, significantly influencing the market by improving the competitive landscape of technology providers.

Expansion of Physical Security Infrastructure

A significant trend in the European market is the rapid development of physical security infrastructure, driven by investments in smart cities, transportation hubs, and border security improvements. Governments and private organizations are installing surveillance systems, access control technologies, and biometric solutions to improve security and maintain operational continuity. For instance, on December 26, 2024, The UK government committed £15 Million to deploy advanced surveillance technology, including spy satellites, radar, cameras, and sensors, to monitor migrant crossings in the English Channel. This initiative will track and detect small boats used by migrants, enabling the Home Office to respond more effectively. The surveillance system will be operating 24/7, thus enhancing the UK's ability to manage border security and prevent illegal crossings. The Europe security market growth is further fostered by this aspect, as demand for integrated physical and digital security solutions continues to rise. Public safety and infrastructure protection remain a key concern, strengthening the prospects of the market and encouraging adoption across industries.

AI and IoT Integration in Security Solutions

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is transforming the Europe security market through predictive analytics, automation, and real-time monitoring. This technological shift improves security operations across industries, promoting seamless threat management and rapid incident response. Integration of AI-powered surveillance and IoT-enabled sensors is significantly impacting the Europe security market share by introducing novel products and providing competitive differentiation. For instance, a recent survey conducted by IE University reveals that 75% of Europeans favor the adoption of AI technologies, including facial recognition and biometric data, by law enforcement and the military for surveillance activities. This study, carried out on over 3,000 people from 10 European countries, found the greatest support in Romania (84.7%), Poland (84%), and Italy (78.8%). The most opposed were Spain at 31.7%, France at 32.1%, and the UK at 31.4%. Additionally, 67% of Europeans worry that AI may manipulate democratic processes, which shows a complex public sentiment towards AI applications in security and governance. And as these are being increasingly integrated into industries, Europe Security Market Growth is backed by intelligent security systems and automation-driven solutions.

Europe Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe security market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on system, service, and end user.

Analysis by System:

- Access Control Systems

- Alarms and Notification Systems

- Intrusion Detection Systems

- Video Surveillance Systems

- Barrier Systems

- Others

Access control systems prevent only authorized individuals from accessing restricted areas, safeguarding sensitive information and critical infrastructure. These systems are essential for healthcare, finance, and government sectors, where data protection and operational security become paramount. Adoption of these systems enhances organizational security frameworks and significantly contributes to overall market growth while further reinforcing defense against physical breaches.

Alarms and notification systems provide instant alertness in emergencies or security breaches. The systems improve response time, reducing damage and ensuring safety of the public in residential, commercial, and industrial areas. With increased development in infrastructure, the demand for sophisticated alarm systems integrated with real-time monitoring and communication technologies grows, emphasizing the role they play in the design of holistic security solutions.

In the Europe security market, intrusion detection systems are essential, providing real-time surveillance and threat identification to prevent unauthorized access or criminal activities. These systems are widely deployed across crucial infrastructure and high-risk facilities, providing continuous monitoring and rapid response capabilities. Their integration with AI and IoT technologies enhances accuracy and efficiency, driving market expansion and solidifying their role in fortifying security across diverse sectors.

Analysis by Service:

- System Integration and Consulting

- Risk Assessment and Analysis

- Managed Services

- Maintenance and Support

System integration and consulting play an important role in the market as the advanced security solution is easily implemented across various industries. Organizations take up complex technologies, and at that point, the need to integrate various systems such as surveillance, cybersecurity, and access control becomes critical. Consulting services tailor strategies for overcoming unique security issues, making efficiency better and assuring compliance with evolving regulatory frameworks.

Risk assessment and analysis are part of the major driving factors of the Europe security market as these can help organizations quickly identify vulnerabilities in their defenses and mitigate potential threats. More thorough evaluations would give businesses priority on assets that are truly vital and implement proactive security measures on them, which will improve decision-making and reduce operational risks to the ability of longevity. Growing cyber threats and physical risks propel the demand for risk management solutions widely across sectors.

Managed services are increasingly dominating the market, as it offers continuous monitoring, incident response, and system maintenance. It enables organizations to outsource security operations so that the organizations can focus on their core business functions while maintaining protection 24/7. The providers of managed services utilize advanced tools and expertise to provide scalable solutions to both physical and digital security needs. This model improves operational efficiency and reduces costs, which makes it the most sought-after choice for businesses of all sizes.

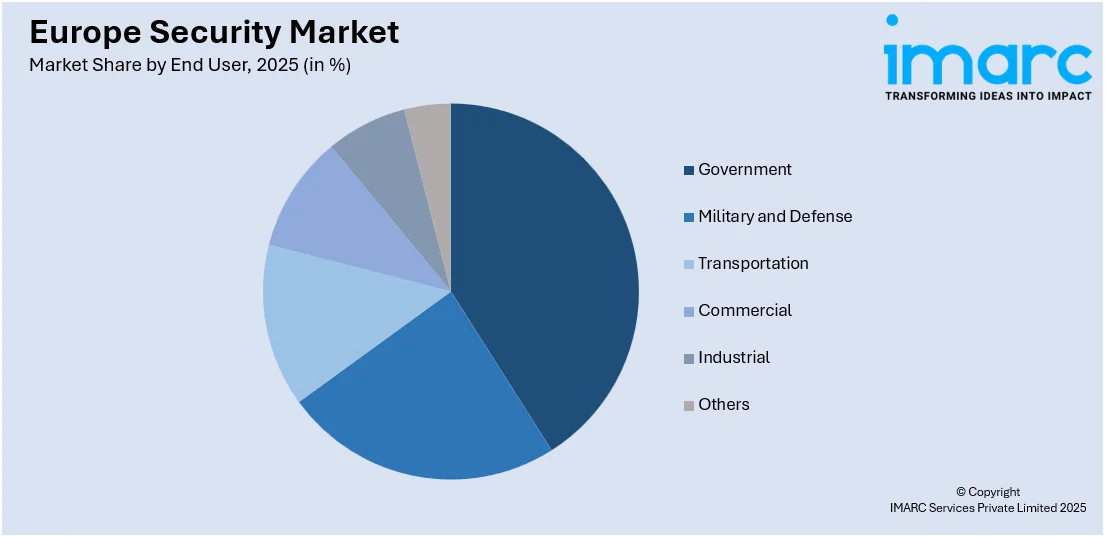

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Government

- Military and Defense

- Transportation

- Commercial

- Industrial

- Others

The implementation of rigorous policies and public safety investments by governments significantly influences the Europe security market. Demand for surveillance systems, border control technologies, and cybersecurity frameworks in support of crucial infrastructure protection results from national policies. Further growth in the market is improved by public sector initiatives on smart city projects and data protection, which underlines the role of government-driven security development across the continent.

The military and defense sector significantly contributes to the Europe security market by emphasizing advanced defense technologies and intelligence systems. Investments in surveillance, threat detection, and secure communication networks are driven by growing geopolitical tensions and cross-border threats. Programs regarding defense modernization are aimed at strengthening national security and enhancing military capabilities, which, in turn, fuels continuous innovation and market expansion, positioning the sector as a key driver of long-term security growth.

The role of transportation infrastructure in the Europe security market is crucial, as there is more emphasis on the security of airports, railways, and maritime operations. Security solutions such as biometric screening, video surveillance, and access control are crucial for ensuring passenger safety and operational efficiency. Since transportation hubs remain vulnerable to cyberattacks and physical threats, continued investment in integrated security measures enhances resilience, reflecting the sector's importance in driving market advancement and stability.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany plays a pivotal role in the Europe security market, driven by its robust industrial base and technological leadership. As the largest economy in the region, Germany prioritizes advanced cybersecurity frameworks and physical security solutions to protect crucial infrastructure and manufacturing sectors. The country’s emphasis on innovation and compliance with stringent data protection regulations strengthens its influence, contributing significantly to market growth and shaping security standards across Europe.

France is a key region in the market, with significant investments in defense, border security, and cybersecurity initiatives. The country’s strategic focus on strengthening national security and safeguarding crucial sectors such as transportation and energy improves its market representation. France’s leadership in the development of surveillance technologies and smart city projects further amplifies its role, promoting growth and innovation within the broader European security landscape.

The United Kingdom holds a prominent position in the market, driven by its advanced cybersecurity infrastructure and defense capabilities. As a financial and technological hub, the UK prioritizes comprehensive security strategies to protect sensitive data and crucial services. The nation’s focus on public safety, counterterrorism, and smart technologies bolsters market demand, reinforcing the UK’s role in shaping the future of security solutions across Europe.

Italy's growing focus on improving physical security and cyber resilience underscores its importance in the market. Investments in surveillance systems, crucial infrastructure protection, and maritime security reflect the country’s commitment to addressing emerging threats. Italy’s active participation in European defense collaborations and smart infrastructure projects contributes to market expansion, reinforcing its role in driving regional security advancements and promoting technological development.

Spain’s representation in the market is marked by increasing investments in public safety, transportation security, and cybersecurity frameworks. The country’s emphasis on securing critical infrastructure, particularly in sectors like energy and telecommunications, enhances its market position. Spain’s proactive approach to digital transformation and adoption of smart security solutions further drives market growth, supporting innovation and strengthening overall security resilience in the European region.

Competitive Landscape:

The security market in Europe is characterized by an intense innovation in the competitive landscape, supported by an increase in the demand for entire security solutions. The growing need for comprehensive security products has led companies to expand their products through integrated physical and cybersecurity for emerging threats in different sectors. The market majors are investing heavily in AI, IoT, and cloud-based security services to enhance their offerings as well as gain a competitive edge. Strategic partnerships, mergers, and acquisitions are prevalent, and companies can extend their capabilities and reach in the market. The fluid environment continues to drive product development, influencing market growth and sustaining resilience in the face of new security threats.

The report provides a comprehensive analysis of the competitive landscape in the Europe security market with detailed profiles of all major companies, including:

- ZABAG Security Engineering

- Perimeter Protection Group

- Anixter International

- Axis Communications

- Morgan Stanley

- Assa Abloy AB

- ATG Access Ltd.

- CIAS Elettronica Srl

- Frontier Pitts Ltd.

- Honeywell International Inc.

- Teledyne FLIR LLC

- Senstar Corporation

- Johnson Controls International PLC

Latest News and Developments:

- On January 7, 2025, GlobalLogic Inc. and Hitachi Systems Trusted Cyber Management inaugurated a new state-of-the-art Security Operations Center in Kraków, Poland, designed to meet the ever-growing need for cybersecurity in Europe. This 24/7 monitored and bespoke facility is to help organizations build resilience against advanced threats, reduce risk, and meet regulatory compliance in GDPR and NIS2. The SOC is powered by the most advanced technologies, such as AI capabilities, for accurate monitoring of threats and is tailored to fit the unique needs of finance, energy, rail, manufacturing, and healthcare.

- On February 29, 2024, Eurosmart introduced the updated PP-0117 V2 Secure Sub-System in System-on-Chip (3S in SoC) Protection Profile. This iteration includes enhancements such as the "Secure Update" package for advanced system maintenance and the "Composite Software Identity Binding" package to strengthen provisioning capabilities. Developed in collaboration with GSMA, this Protection Profile ensures hardware-based solutions meet GSMA's stringent security standards.

- On December 2, 2024, the Council of the European Union enacted legislation to enhance the EU's cybersecurity framework, including the Cyber Solidarity Act and updates to the Cybersecurity Act. These initiatives establish a cybersecurity alert network comprising national and cross-border centers for threat detection, information sharing, and coordinated responses. The measures aim to reinforce cooperation and improve the EU's resilience against cyber threats.

- On November 5, 2024, the European Union Agency for Cybersecurity (ENISA) announced that Team Europe secured victory in the International Cybersecurity Challenge for the third consecutive year. The competition, held from October 28 to November 1, 2024, in Santiago, Chile, brought together seven teams representing Africa, Asia, Canada, Europe, Latin America, Oceania, and the United States, encompassing over 80 countries. Team Europe achieved the highest scores in both the Capture the Flag (CTF) and Attack/Defense challenges, underscoring their exceptional cybersecurity skills.

- On March 13, 2024, Eurosmart, the leading association representing the digital security industry in Europe, welcomed the European Parliament's adoption of the Cyber Resilience Act (CRA) and the Artificial Intelligence Act (AI Act). These legislative advancements aim to enhance cybersecurity measures for products with digital elements in the EU market and promote ethical AI development across the European Union.

Europe Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Systems Covered | Access Control Systems, Alarms and Notification Systems, Intrusion Detection Systems, Video Surveillance Systems, Barrier Systems, Others |

| Services Covered | System Integration and Consulting, Risk Assessment and Analysis, Managed Services, Maintenance and Support |

| End Users Covered | Government, Military and Defense, Transportation, Commercial, Industrial, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | ZABAG Security Engineering, Perimeter Protection Group, Anixter International, Axis Communications, Morgan Stanley, Assa Abloy AB, ATG Access Ltd., CIAS Elettronica Srl, Frontier Pitts Ltd., Honeywell International Inc., Teledyne FLIR LLC, Senstar Corporation, Johnson Controls International PLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe security market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe security market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Europe security refers to the measures, technologies, and strategies implemented to protect critical infrastructure, sensitive data, and citizens from physical and cyber threats. Applications include surveillance systems, access control, cybersecurity frameworks, and defense technologies, safeguarding sectors such as healthcare, transportation, and government operations.

The Europe security market was valued at USD 45.8 Billion in 2025.

IMARC estimates the Europe security market to exhibit a CAGR of 9.31% during 2026-2034.

The security market in Europe is mainly driven by the rising concerns over cyber-attacks, terrorism, geopolitical tensions, digital transformation across industries, advancements in smart technologies, the expansion of infrastructure projects, the increasing demand for advanced physical and digital security solutions to protect assets and ensure operational continuity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)