Europe Running Gear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Country, 2025-2033

Europe Running Gear Market Size and Share:

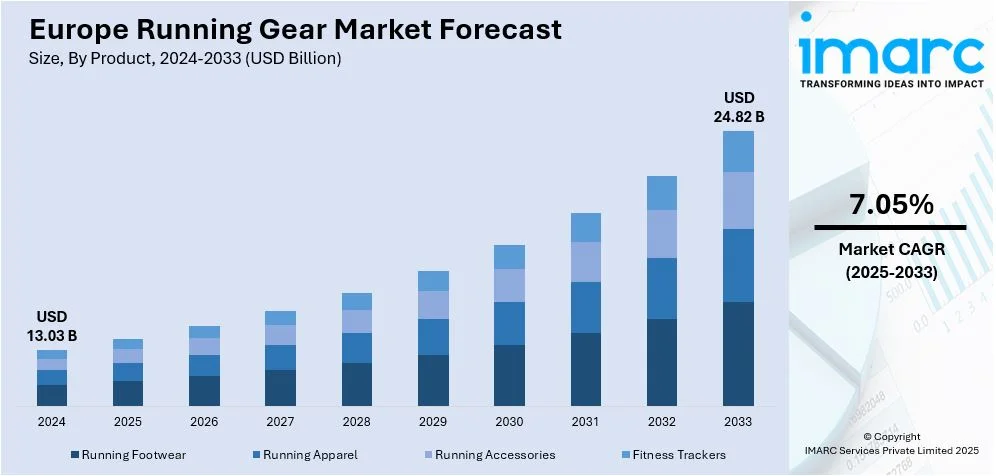

The Europe running gear market size was valued at USD 13.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 24.82 Billion by 2033, exhibiting a CAGR of 7.05% during 2025-2033. The market is fueled by expanding health awareness, growing marathon and fitness event attendance, and heightened focus on active living. Demand is also complemented by popularity for wearable exercise technology, advances in lightweight and high-performance materials, and social media fitness trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.03 Billion |

|

Market Forecast in 2033

|

USD 24.82 Billion |

| Market Growth Rate 2025-2033 | 7.05% |

One of the primary drivers of the Europe running gear market is the growing focus on preventive healthcare and wellness among the general population. Public and private sectors encouraging physical activity, combined with increased awareness about the long-term benefits of regular exercise, have significantly boosted participation in running as a recreational and fitness activity. For instance, in July 2024, Hyundai launched its ‘Run to Progress’ campaign to promote active living across Europe, aligning with its values of sustainability, innovation, and inclusivity. The initiative unified running events in France, Spain, Portugal, and Austria, including the Adidas 10k in Paris, which featured a V2L-powered music arch and a robot-run refreshment bar. Hyundai also collaborated with nonprofit organizations to enhance accessibility and inclusion, reinforcing its role as a community-focused brand beyond the automotive sector. Urban infrastructure improvements, such as dedicated jogging tracks, parks, and community fitness programs, have further encouraged daily running habits. In addition, the rise in women's participation in fitness activities has led to a growing demand for gender-specific running gear designed for comfort and performance. This evolving consumer profile has prompted brands to invest in research and design tailored to diverse body types and usage preferences.

Another significant growth factor is the increased integration of smart technologies and sustainability practices in product development. Consumers are showing strong interest in running gear equipped with sensors, GPS trackers, and real-time performance feedback, supporting data-driven training. For instance, in August 2024, UK-based Sealskinz unveiled a new Run collection for men and women, featuring ultra-lightweight, high-performance running gear designed for all-weather conditions. The line includes jackets, tees, shorts, and accessories, with standout products such as Anti-Blister Running Socks using double-layer technology and the Wymondham Running Hat, claimed to be the lightest waterproof foldable cap in the world. Incorporating Aquasealz technology, UV protection, and reflective elements, the range emphasizes comfort, visibility, and durability. Simultaneously, rising environmental awareness has pushed manufacturers to introduce eco-friendly apparel and footwear made from recycled or biodegradable materials. European brands are responding by adopting circular production models and transparent sourcing. These innovations align with the region’s broader sustainability goals and appeal to the environmentally conscious segment of runners, fostering brand loyalty and long-term market growth.

Europe Running Gear Market Trends:

Rise of Athleisure and Hybrid Usage

A growing trend in the Europe running gear market is the increasing demand for versatile apparel that bridges athletic performance and everyday fashion. Consumers are increasingly favoring running gear that delivers both technical functionality and aesthetic appeal, allowing them to transition seamlessly from workout sessions to casual settings. This shift has led to the expansion of the athleisure category within the running segment, with brands introducing collections that combine breathable fabrics, ergonomic designs, and modern style elements. The appeal of minimalistic, street-ready running attire is particularly strong among urban consumers who prioritize convenience and style. As workplace dress codes become more relaxed and health-conscious behavior spreads, the demand for dual-purpose running gear continues to strengthen across multiple age groups. For instance, in January 2025, Nike introduced the Swift and Stride running apparel collections for women and men, respectively. These lines cater to all runner levels, featuring technologies like Dri-FIT, Therma-FIT, UV protection, and Storm-FIT. Designed with input from diverse body types, the collections include functional updates such as improved fits, anti-chafing fabrics, reflective details, and practical storage. With a focus on modern aesthetics and versatility, the collections reflect growing consumer demand for performance gear that seamlessly fits into everyday urban lifestyles.

Personalization and Custom-Fit Running Gear

The trend toward personalized and custom-fit running gear is gaining traction in the European market, driven by advances in digital design and 3D scanning technologies. Runners are seeking products that accommodate their unique biomechanics, preferences, and training goals. As a result, manufacturers are offering customizable footwear and apparel solutions, allowing consumers to tailor sizing, cushioning, arch support, and fit. This level of precision enhances performance and reduces the risk of injury, making it particularly appealing to serious amateur athletes and marathon participants. Retailers are also leveraging in-store motion analysis and digital interfaces to guide customers in selecting the most suitable gear. This emphasis on individualized comfort and optimization reflects a broader shift toward user-centric product development in the European sportswear industry. For instance, the International Running Expo (IRX 2025), set for 4–5 November in Amsterdam, will gather over 300 exhibitors and 6,000 stakeholders from Europe’s running industry. Organized by Raccoon Media Group, it will highlight the latest in gear, technology, and customization, including tailored footwear and 3D-fit solutions. As Europe’s first major running-focused trade event, IRX will offer hands-on product testing, networking, and innovation exchange, aligning with the market’s shift toward personalized, user-centric development in running gear and performance apparel.

Expansion of Direct-to-Consumer (DTC) and Digital Retail Channels

The Europe running gear market is witnessing a notable shift toward direct-to-consumer (DTC) and digital-first retail strategies. Brands are increasingly investing in their own e-commerce platforms and mobile applications to offer a more personalized and seamless shopping experience. For instance, as per industry reports, the Europe online fashion market is projected to reach USD 198.77 Billion by 2028, growing at a CAGR of 10% between 2024 and 2028. This approach allows them to gather first-party consumer data, deliver targeted product recommendations, and maintain greater control over brand presentation. Additionally, interactive features such as virtual try-ons, AI-driven size guidance, and live fitness events are enhancing customer engagement. The convenience of online ordering, combined with flexible return policies and exclusive online collections, has further accelerated this trend. As digital literacy and mobile commerce grow across Europe, especially in regions with high smartphone penetration, DTC models are expected to become central to running gear distribution.

Europe Running Gear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe running gear market, along with forecast at the regional/country levels from 2025-2033. The market has been categorized based on product, gender, and distribution channel.

Analysis by Product:

- Running Footwear

- Running Apparel

- Running Accessories

- Fitness Trackers

Running footwear stands as the largest product in 2024, holding around 35.9% of the market. The running footwear segment dominates the Europe running gear market due to its essential role in both performance enhancement and injury prevention. European consumers place high value on technologically advanced shoes that offer cushioning, stability, and support tailored to various running styles and surfaces. Continuous innovation in materials, such as lightweight foams and breathable meshes, has further elevated consumer interest. The widespread popularity of organized running events, including marathons and trail races, also contributes to strong, recurring demand. Additionally, the influence of fitness influencers and athlete endorsements reinforces brand credibility, making running shoes a primary and often repeat purchase in the athletic gear category.

Analysis by Gender:

- Male

- Female

- Unisex

Male leads the market with around 49.8% of market share in 2024. This dominance can be attributed to historically higher participation rates of men in structured running activities such as marathons, competitive races, and endurance training. This has led brands to focus product innovation and marketing efforts on male consumers, resulting in a broader range of performance-oriented gear tailored to men's preferences. Additionally, men typically exhibit higher spending patterns on technical sportswear, especially for high-performance footwear and wearable fitness devices. Cultural associations of running with strength and athleticism have further reinforced male engagement. As a result, the male segment continues to generate a significant share of overall market revenue.

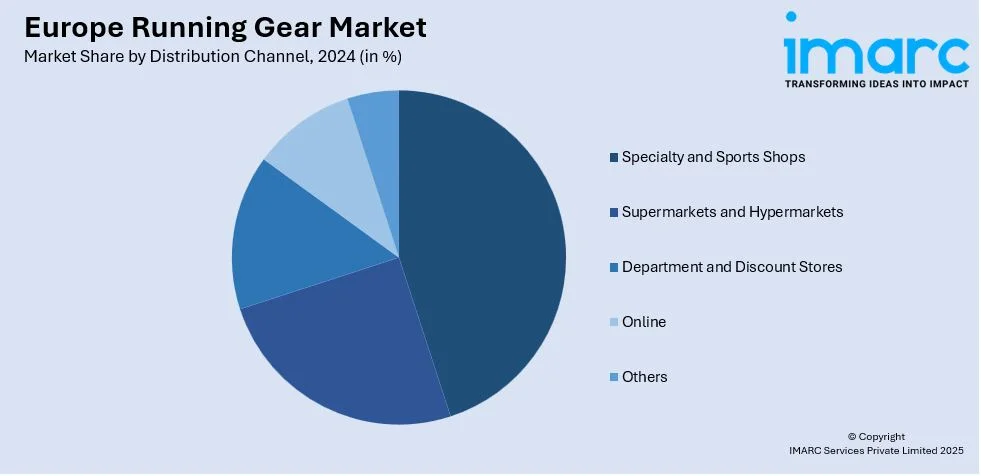

Analysis by Distribution Channel:

- Specialty and Sports Shops

- Supermarkets and Hypermarkets

- Department and Discount Stores

- Online

- Others

Specialty and sports shops lead the market with around 35.4% of market share in 2024. The specialty and sports shops segment dominates the market due to its ability to offer expert guidance, personalized service, and curated product selections tailored to runners' specific needs. These stores often provide gait analysis, product trials, and staff with technical knowledge, which helps consumers make informed decisions about performance gear. Additionally, shoppers value the opportunity to physically evaluate fit, comfort, and material quality, especially for footwear and apparel used in intensive training. Many specialty retailers also build community engagement through local running clubs and events, strengthening customer loyalty and positioning themselves as trusted sources within the broader fitness ecosystem.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share of over 25.4%. The country leads due to its strong sports culture, well-established fitness infrastructure, and high consumer spending on athletic apparel and equipment. The country has a large base of recreational runners, supported by extensive urban parks, running trails, and annual marathons in major cities like Berlin and Frankfurt. Additionally, Germany is home to several leading sportswear manufacturers and innovation hubs, fostering continuous product development and domestic brand loyalty. A health-conscious population, widespread participation in organized fitness activities, and the country’s central role in European logistics also contribute to Germany’s leading position in both production and consumption of running gear.

Competitive Landscape:

The competitive landscape of the Europe running gear market is characterized by a mix of established players, regional brands, and emerging niche labels. Competition centers around product innovation, performance enhancement, and sustainability. Companies are investing heavily in research and development to introduce lightweight materials, advanced cushioning systems, and smart technologies in footwear and apparel. Branding and athlete endorsements play a vital role in maintaining market visibility and loyalty. There is also an increasing emphasis on personalized customer experiences, both online and in-store, to differentiate offerings. Sustainability has become a strategic priority, with brands integrating recycled fabrics and circular production models. Additionally, the rise of direct-to-consumer sales channels is intensifying competition by enabling closer engagement with consumers and faster product feedback loops. For instance, in February 2025, Nike launched the Vaporfly 4 and Streakfly 2, marking the brand’s latest innovations in performance racing footwear. Both shoes incorporate ZoomX foam and a carbon fiber Flyplate to enhance speed and efficiency. The Vaporfly 4, now the franchise’s lightest model, is tailored for distances ranging from 5K to marathons, offering an ideal balance of support and propulsion. The Streakfly 2, weighing just 126 grams, is engineered for shorter races and fast intervals, with a track-inspired design and full-length Flyplate. These releases reinforce Nike’s focus on cutting-edge athletic design and align with its Racing line and Aeroswift apparel, delivering advanced solutions for runners at all levels.

The report provides a comprehensive analysis of the competitive landscape in the Europe running gear market with detailed profiles of all major companies, including:

- Nike, Inc.

- Adidas AG

- Skechers USA, Inc.

- Puma (Kering)

- Under Armour®, Inc.

- Garmin Ltd.

- Amer Sports, Inc.

- Columbia Sportswear Company

Latest News and Developments:

- November 2024: Adidas introduced the Supernova Rise 2, the most recent instalment in its Supernova series, made for daily running use. The Supernova Rise 2 features a new upper made of a sandwich mesh material for an improved breathable and secure fit.

- October 2024: Swiss running brand On and South Korean brand Post Archive Faction (PAF) released the Current Form 2.0 collection, which is the second product range under On’s partnership with PAF. The Current Form 2.0 running gear focuses on meeting the needs of trail runners, combining functional features with innovative aesthetics. Moreover, the unisex collection also introduced the new Cloudventure trail running shoes for harsh terrains.

- August 2024: German sportswear brand PUMA launched the MagMax NITRO everyday running shoes. They are cushioned shoes for runners seeking underfoot comfort. The shoes incorporate PUMA's NITROFOAM technology, featuring a 46mm heel height for optimal padding, support, and bounce.

- January 2024: Salomon, a sports equipment manufacturing company based in France, launched INDEX.03 recyclable running shoes. The INDEX.03 has several advancements compared to the INDEX.02, including a more lightweight midsole material, a tongue composed entirely of recycled polyester, and a more effective cutting method for the upper portions.

Europe Running Gear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Running Footwear, Running Apparel, Running Accessories, Fitness Trackers |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Specialty and Sports Shops, Supermarkets and Hypermarkets, Department and Discount Stores, Online, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | Nike, Inc., Adidas AG, Skechers USA, Inc., Puma (Kering), Under Armour®, Inc., Garmin Ltd., Amer Sports, Inc., Columbia Sportswear Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe running gear market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe running gear market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe running gear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe running gear market was valued at USD 13.03 Billion in 2024.

The Europe running gear market is growing due to rising health awareness, increased participation in recreational and competitive running, and advancements in performance-oriented apparel and footwear. Urban fitness trends, demand for sustainable products, and expanding e-commerce platforms are also contributing to market expansion across diverse consumer demographics and activity levels.

IMARC estimates the Europe running gear market to exhibit a CAGR of 7.05% during 2025-2033, reaching USD 24.82 Billion by 2033.

Germany accounted for the largest market share in 2024, with around 25.4% of the market share. This can be attributed to its strong sports culture, frequent running events, and high consumer demand for premium athletic wear. Well-established retail infrastructure, rising fitness awareness, and local manufacturing capabilities further contribute to Germany’s dominant position in the regional running gear industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)