Europe Peanut Butter Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Country, 2025-2033

Europe Peanut Butter Market Size and Share:

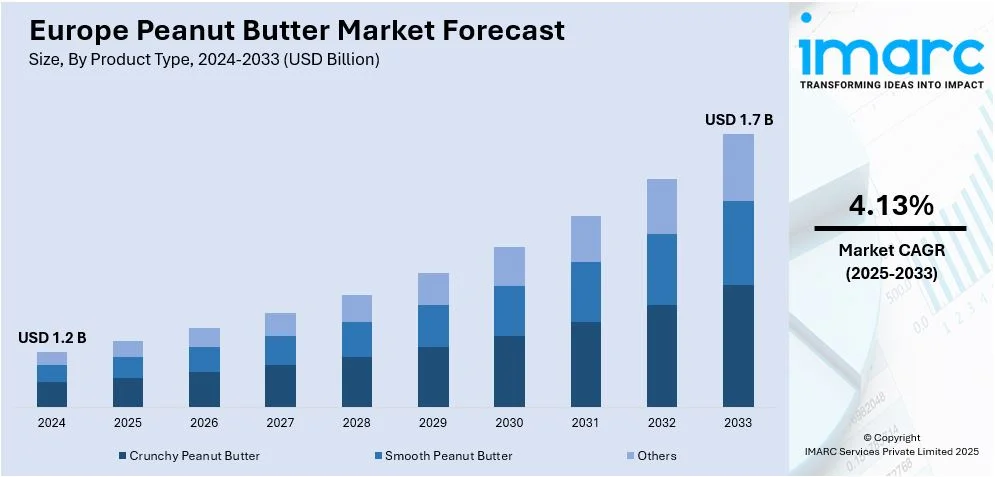

The Europe peanut butter market size was worth USD 1.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.7 Billion by 2033, exhibiting a CAGR of 4.13% from 2025-2033. The Europe peanut butter market is driving the market due to the increasing health consciousness among consumers, growing demand for plant-based protein sources, and the rising popularity of convenient and nutritious snack options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.2 Billion |

|

Market Forecast in 2033

|

USD 1.7 Billion |

| Market Growth Rate (2025-2033) | 4.13% |

The European peanut butter market is propelled by various crucial elements that together impact its expansion and broad acceptance. A major factor is the growing consciousness of nutritious eating practices among European consumers. Peanut butter, recognized for its high protein content, beneficial fats, and vital nutrients, is becoming more popular as a nutritious substitute for conventional spreads loaded with sugar or synthetic ingredients. This change corresponds with the increasing trend of protein-rich diets, particularly among fitness fans and health-minded individuals. Another important element is the increasing impact of Western dietary practices in Europe. Peanut butter, a long-standing favorite in North America, has gained a solid consumer following in Europe because of its adaptability as a breakfast or snack choice.

Economic elements, including consistent peanut supply chains and competitive pricing, have facilitated the availability of peanut butter to a wider audience. Promotional campaigns highlighting its health advantages and eco-friendliness have increased consumer interest even more. Additionally, the existence of leading companies in the European food sector has encouraged innovations and partnerships, resulting in the launch of high-end and specialty peanut butter offerings. The increasing preference for sustainable and recyclable packaging also appeals to environmentally aware consumers, further influencing market trends.

Europe Peanut Butter Market Trends:

Increased adoption in culinary applications

The rising trend of private label peanut butter brands has become a key element influencing the market. Supermarkets and retail chains throughout Europe are launching their own peanut butter offerings, frequently priced lower than well-known brands. These private brands serve price-sensitive shoppers while upholding competitive quality measures. Moreover, retailers are putting resources into developing high-quality private-label selections that feature organic, natural, or flavored varieties to cater to the tastes of specialized consumer segments. The strategic positioning and marketing efforts surrounding these private-label items enhance their sales even more. As European consumers grow more confident in store brands, private-label peanut butter is gaining substantial market presence. This trend additionally promotes price competition, which advantages end-users while fostering innovation and diversity in the market.

Growing awareness about allergies and specialized diets

The increasing knowledge of dietary limitations and food allergies is another element driving the need for peanut butter in Europe. Although peanut allergies continue to be a worry for certain individuals, the emergence of allergen-free peanut butter substitutes and tailored products aimed at those with unique dietary requirements has created new opportunities for expansion. For instance, low-sodium, sugarless, or enriched peanut butter options serve individuals with health issues such as diabetes or high blood pressure. Producers are also providing peanut butter combinations that include seeds, nuts, or probiotics to meet specific health needs. As shoppers look for functional foods that match their health objectives, peanut butter is becoming more recognized as a versatile and personalized option. Improved labeling and clear ingredient sourcing provide additional reassurance to consumers, facilitating the integration of peanut butter into meals for those with dietary restrictions.

Increased adoption in culinary applications

The growing emphasis on sustainability and ethical sourcing in Europe has significantly influenced the peanut butter market. Consumers are increasingly concerned about the environmental and social impact of their food choices, prompting a demand for products made from sustainably sourced ingredients. Peanut butter manufacturers are responding by adopting ethical sourcing practices, such as sourcing peanuts from certified farms that prioritize fair labor practices, water conservation, and reduced pesticide use. These efforts enhance brand credibility and resonate with environmentally conscious consumers.

Europe Peanut Butter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe peanut butter market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Crunchy Peanut Butter

- Smooth Peanut Butter

- Others

Crunchy peanut butter spreads, with chunks of peanuts and is preferred by consumers who seek a satisfying crunch in their spread. This particular product is apt for health-conscious consumers who appreciate a more naturally occurring product since it contains lesser added oils and sugars. It can be used when baking and used as a cereal, yogurt, or salad topper. The segment will benefit from an increasing interest in premium and artisanal variants that often include additional ingredients such as honey or seeds that enhance flavor and nutritional appeal.

Smooth peanut butter is recognized for its smooth and uniform consistency, thereby holding a significant portion of Europe peanut butter market share. It is a popular option for sandwiches, spreads, and cooking uses, particularly among households with young kids. This sector is driven by the need for enhanced and flavored choices, such as low-fat and sugarless alternatives, addressing dietary requirements. The extended shelf life of smooth peanut butter and its capacity to blend effortlessly with various ingredients enhance its appeal in both retail and food service industries.

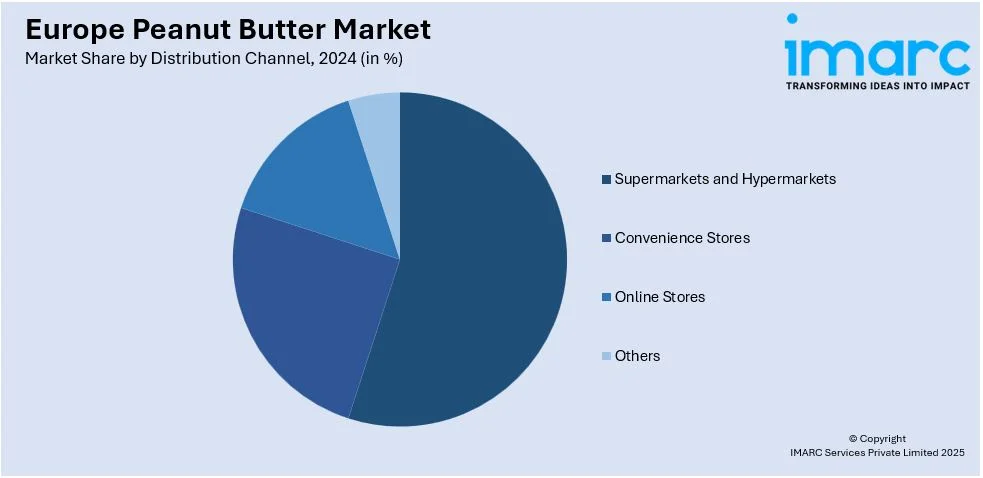

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

In Europe, supermarkets and hypermarkets serve as the primary distribution channels for peanut butter, providing a diverse selection of brands and packaging options. These retailers attract consumers in with favorable prices, special deals, and the convenience of buying in large quantities. Their ample shelf area enables them to display a variety of local and global peanut butter brands, meeting a wide range of consumer tastes. The presence of additional products, such as bread and jams, further boosts sales in this category. Moreover, the ease of one-stop shopping contributes to the popularity of these stores among families and health-aware consumers.

Convenience stores serve consumers in a hurry seeking quick purchases of peanut butter. These smaller retail stores are intentionally situated in city and neighborhood locations, offering convenient access to a restricted yet well-chosen array of products. Although they usually offer a limited selection of brands and smaller package sizes, they attract impulse shoppers and individuals who require quick restocking. Convenience stores frequently depend on customer brand loyalty, guaranteeing regular access to favored choices. Their attention to local demand trends renders them essential for penetrating rural and semi-urban markets.

Online retailers are seeing swift expansion as a distribution method for peanut butter in Europe because of the growth of e-commerce platforms. These platforms provide customers with the ease of home delivery, a vast selection of products, and attractive pricing. E-commerce sites further offer comprehensive product descriptions, user reviews, and personalized suggestions, assisting in buying choices. Models based on subscriptions and discounts for large orders promote ongoing purchases. This segment gains from rising internet access, hectic lifestyles, and a preference for shopping without physical contact. Brands of specialty and organic peanut butter frequently use online platforms to target specific markets.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The market for peanut butter in Germany is driven by the rising preference for health-focused and plant-based foods in the nation. German consumers are progressively looking for options that are high in protein and low in sugar, making peanut butter a versatile alternative for spreads and culinary uses. Organic and all-natural peanut butter options are especially favored, fueled by the country's focus on sustainable and environmentally friendly goods. The popularity of global cuisines and fitness movements has increased demand, with peanut butter acknowledged as a healthy component in both classic and contemporary dishes.

In France, peanut butter is becoming popular as a fashionable and health-oriented substitute for classic spreads such as butter and jam. French shoppers prioritize quality and taste, leading to increased interest in high-end and artisanal peanut butter choices. The impact of American culinary traditions, along with the growing popularity of high-protein diets, is promoting the use of peanut butter in French homes. Moreover, younger age groups are driving the trend toward convenient and globally influenced snack choices, further enhancing market expansion in this area.

The United Kingdom ranks among the top markets for peanut butter in Europe, fueled by its enduring popularity as a breakfast and snack favorite. British shoppers emphasize items with lower sugar, elevated protein levels, and natural components, driving the expansion of health-focused peanut butter brands. The growth of veganism and plant-based diets has additionally broadened the market, since peanut butter is regarded as an essential protein source. Creative flavors and practical packaging options have also played a role in its broad attraction among various age demographics in the UK.

Competitive Landscape:

Major key players in the Europe peanut butter market are diligently pursuing strategies to leverage new opportunities and stimulate growth. They are concentrating on product development to meet changing consumer tastes, launching healthier choices such as organic, sugar-free, and enhanced peanut butter varieties. Firms such as Unilever and Hormel Foods are broadening their product ranges with distinctive flavors and mixtures to appeal to varied consumer demographics. Moreover, leading brands are utilizing strategic alliances with retailers to improve product visibility and accessibility in supermarkets, specialty shops, and online marketplaces. Marketing campaigns highlighting the nutritional advantages and versatility of peanut butter are also prevalent. To tackle sustainability issues, companies are implementing ethical sourcing methods and environmentally friendly packaging options.

Latest News and Developments:

- 6 November 2024: KP Snacks has acquired Whole Earth Foods Limited from the Ecotone group, in order to expand their healthier product range and complementing their portfolio of iconic snack brands. Whole Earth brand, including Nut Butters and Soft Drinks ranges, has achieved fivefold sales returns and become the No.1 peanut butter brand in the UK, with impressive growth across organic peanut butter in key European markets.

- 2023: The American Peanut Council was in favor of the expansion of Skippy peanut butter in Europe by financing the creation of 800 temporary display units in Germany to enhance sales and promote the product. The display units featuring the APC logo and slogan were very successful in drawing consumer interest in the store, enhancing visibility, and prompting impulse buys.

- 1 November 2024: ManiLife is putting £1m into a new production plant, indicating its swift expansion as the UK's quickest-growing peanut butter brand. The newly constructed factory in Shirebrook, Derbyshire will be able to store six billion peanuts, facilitating effective distribution and aiding small-batch production.

Europe Peanut Butter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Crunchy Peanut Butter, Smooth Peanut Butter, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe peanut butter market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe peanut butter market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe peanut butter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Peanut butter is a smooth or chunky spread created by milling roasted peanuts into a paste, frequently enhanced with salt, sugar, or various ingredients for taste.

The Europe peanut butter market was valued at USD 1.2 Billion in 2024.

IMARC estimates the Europe peanut butter market to exhibit a CAGR of 4.13% during 2025-2033.

The Europe peanut butter market is propelled by heightened health consciousness, expanding use in various culinary uses, growing interest in private label and specialized items, along with a significant emphasis on sustainability and ethical sourcing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)