Europe Organic and Natural Pet Food Market Size, Share, Trends and Forecast by Pet Type, Product Type, Packaging Type, Distribution Channel, and Country, 2025-2033

Europe Organic and Natural Pet Food Market Size and Share:

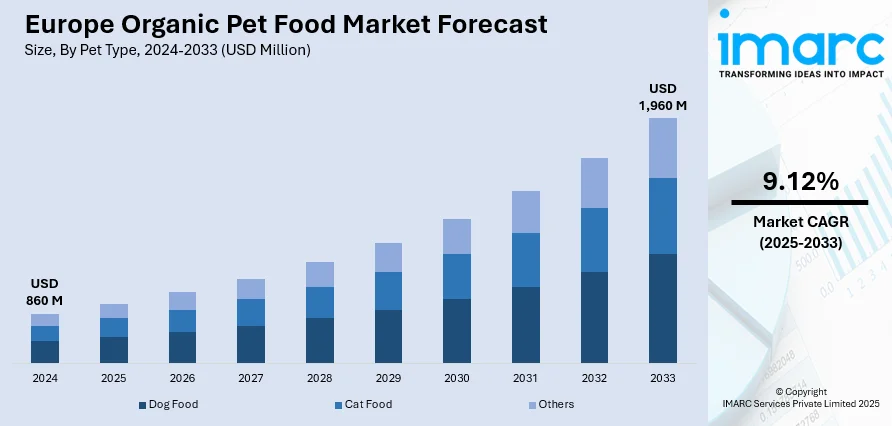

The Europe natural pet food market size reached USD 10.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 23.6 Billion by 2033, exhibiting a growth rate (CAGR) of 8.46% during 2025-2033. Moreover, the Europe organic pet food market size reached USD 860 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,960 Million by 2033, exhibiting a growth rate (CAGR) of 9.12% during 2025-2033. Germany currently dominates the market, fueled by high pet ownership, heightening consumer health awareness, amplifying demand for premium, sustainable products, and a move towards eco-friendly, high-quality pet food alternatives, contributing to Europe organic and natural pet food market share.

Europe Natural Pet Food Market:

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.9 Billion |

| Market Forecast in 2033 | USD 23.6 Billion |

| Market Growth Rate 2025-2033 | 8.46% |

Europe Organic Pet Food Market:

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 860 Million |

| Market Forecast in 2033 | USD 1,960 Million |

| Market Growth Rate 2025-2033 | 9.12% |

One of the leading motivations behind the European organic and natural pet food market is the growing concern for the health and welfare of pets. Pet owners are now becoming more aware of the dietary requirements of their pets and are therefore looking for foods that are not only healthy but also free from artificial additives, chemicals, and preservatives. Since pet owners consider their pets as members of the family, they are more interested in giving them food that matches their healthy lifestyles. For instance, in April 2025, VEGDOG, the German vegan pet food company, will experience substantial growth of up to 80% after expanding into Austria and Switzerland, mirroring the increasing Europe Organic and Natural Pet Food Market demand. Moreover, natural and organic pet food products, which have fewer processed ingredients and often consist of better-quality, locally produced materials, are regarded as a healthier option. This need for products that support improved pet health and lifespan is driving brands to evolve and develop formulas with a focus on natural ingredients, and this has helped drive growth in this market segment in Europe.

To get more information on this market, Request Sample

Sustainability is increasingly an important factor in European consumers' lives, not just in personal decisions but also in the choice of product for their pet. Natural and organic pet food brands, which tend to be billed as green, resonate with this environmentally aware state of mind through products that focus on sustainable production methods, sourcing, and packaging. For example, in June 2024, THE PACK, a plant-based pet food brand based in the UK, grew its foothold in the European organic and natural pet food sector by obtaining a listing with Planet Organic and launching an equity crowdfunding campaign to drive growth. Furthermore, most pet owners are influenced by environmental considerations for mass-produced pet foods, such as carbon emissions and waste from non-recyclable packaging and artificial ingredients. Brands that make use of recyclable, biodegradable, or minimalist packaging, and source their ingredients from sustainable agriculture, are on the rise. With more pet owners bringing their purchase decisions to match their environmental ethos, demand for organic and natural pet food products meeting these sustainability requirements will continue to increase. This trend sits in line with wider societal shifts towards sustainability, impacting both pet food production and consumption within Europe. This shift is reflected in the Europe Organic and Natural Pet Food Market report, highlighting the increasing importance of sustainable practices in the pet food industry.

Europe Organic and Natural Pet Food Market Trends:

Growing Pet Population Driving Market Expansion in Europe

The growing population of pets in Europe is the major driving factor for the development of the pet food market because more and more households are turning to pets. Europe's pet population expanded from 340 million to 352 million in 2022, as stated by the European Pet Food Industry Federation (FEDIAF). This growth in pet ownership is directly leading to the increased demand for pet food products, especially those addressing the health and wellbeing of pets. Pet owners are increasingly concerned about their pet's diet and are looking for high-quality products to meet the nutritional requirements of their pets. As pets become part of family life, pet care, which includes pet foods, is treated as a necessity. The spurring of spending on pet foods is seen through an increased assortment of products across specialized, premium, and organic food products. This trend is not just increasing the demand in the market but is also defining the future of pet food in Europe.

Trend Towards Natural and Organic Pet Food Products

There is a tremendous trend towards natural and organic pet food products that is reforming the European pet food sector. With pet owners increasingly becoming health-conscious and attentive to the nutritional content of ingredients, they are now turning more towards food prepared from organic, natural, and healthier ingredients. This is being fueled by anxiety regarding the long-term health impact of artificial additives and preservatives in pet foods. Organic pet food is viewed as offering superior nutritional value, providing pets with healthier alternatives that ensure their health. Additionally, consumer demand for foods that have no artificial chemicals, hormones, or genetically modified components has intensified, as consumers are looking for cleaner, sustainable pet food options. This follows suit with an increasing interest in grain-free and plant-based pet foods. For these reasons, pet food manufacturers are adapting and releasing more natural and organic lines to satisfy demand, driving the market toward greener, healthier options.

Health Issues and Regulatory Reform Propelling Market Trends

Health issues involving pets, such as the increased prevalence of obesity and metabolic disease, are significant drivers of reform in the European pet food market. The People's Dispensary for Sick Animals (PDSA) noted that 45% of pets evaluated had a body condition score of six or more, which means that a large percentage of pets are overweight or obese. These emerging health issues have resulted in pet owners looking for pet food products emphasizing weight control and overall health. Pet food companies, therefore, are coming up with products aimed at correcting such issues, e.g., low-calorie, high-protein, and fiber-containing foods. Also, groups like the European Pet Food Industry Federation (FEDIAF) have put into place new dietetic food laws aimed at checking the increased rate of pet obesity. These regulatory reforms are having a positive impact on the market by promoting the creation of functional pet foods that enhance health and avert chronic diseases, further driving Europe organic and natural pet food market growth.

Europe Organic and Natural Pet Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe organic and natural pet food market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on pet type, product type, packaging type, and distribution channel.

Analysis by Pet Type:

- Dog Food

- Cat Food

- Others

The dog food segment dominated the Europe organic and natural pet food market outlook, occupying 42.4% of the market share in 2024. It is driven by the increasing number of dog owners in Europe and the need for high-quality, organic pet food. Pet owners are becoming more and more particular about the health content and nutritional value of food that they feed their pets, leading to a shift towards natural and organic ingredients. Also, because dogs are members of the family, there is growing demand for quality products that ensure their health. With the dog food market expanding, organizations are coming in for innovation to offer various products catering to different dietary needs, including grain-free, hypoallergenic, and breed-specific recipes. As pet owners place more concern on dogs' health, the dog food segment will likely sustain leading the market.

Analysis by Product Type:

- Dry Pet Food

- Wet and Canned Pet Food

- Snacks and Treats

According to the Europe Organic and Natural Pet Food Market analysis Dry pet food is estimated to hold 45.3% of the total market share in 2024. The ease of convenience, affordability, and shelf life explain the high popularity of dry pet food. It is a favorite among most pet owners because it is convenient to store, is a full meal, and promotes dental health by lessening plaque buildup. In addition, dry pet food comes in a broad selection of organic and natural formulations that address the increased consumer demand for healthier, environmentally friendly products. With customers increasingly looking for healthy food options for their pets, companies are turning their attention to using superior organic ingredients and sustainable production processes. As demand moves towards healthier, environmentally friendly products, dry pet food remains a leading product in the organic pet food category.

Analysis by Packaging Type:

- Bags

- Cans

- Pouches

- Boxes

- Others

In 2024, pouches and bags are set to claim 50.7% of the packaging type share within the Europe organic and natural pet food market forecast. Pouches and bags are preferred by consumers due to their convenience, portability, and ease of use. Bags and pouches are lightweight, resealable, and more environmentally friendly than other packaging forms, hence suitable for organic and natural pet food products where sustainability is key. Apart from this, the capacity to remain fresh and avoid contamination also increases their popularity. With more consumers emphasizing sustainability, brands are choosing recyclable or biodegradable packs, which resonate with the boosting eco-sensibility of pet parents. Packaging innovation is important in the organic pet food industry, and with a focus on minimizing environmental footprint, bags and pouches are likely to continue their market leadership.

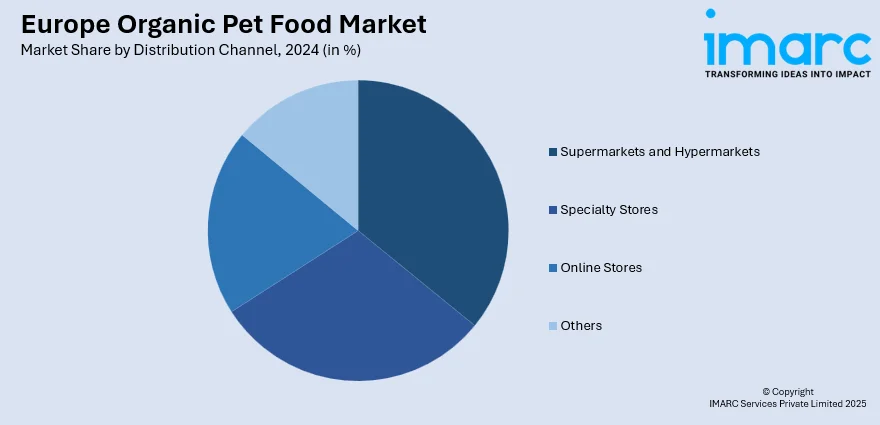

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets will have a projected market share of 35.8% in 2024 for the European natural and organic pet food market. These distribution channels remain leading in terms of widespread coverage, trust among consumers, and ease of access. Buyers like buying pet food from supermarkets and hypermarkets because they have easy access to a wide range of choices, including natural and organic pet food, at a single place. In addition, the stores tend to provide competitive pricing, discounts, and promotional sales, which prove to be very appealing to value-conscious pet owners. As pet owners highly opt for organic food for their pets, supermarkets and hypermarkets have broadened the range of their products to provide for this changing consumer trend. As the stores continue to establish their organic and natural food range, they will continue to serve as a core distribution channel for pet food items in Europe.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is a prime market for natural and organic pet food in Europe due to high pet ownership and growing consumer education on pet health and well-being. Germany is one of the biggest pet markets in Europe and its consumers have a strong demand for high-quality, sustainable products with pet owners being discerning about the food fed to their pets. The increasing popularity of "pet humanization" whereby pets are viewed as members of the family has also stimulated the demand for high-quality, organic pet food. Furthermore, German consumers are also focusing more on environmentally friendly approaches, favoring brands that use sustainably produced ingredients and green packaging. This has stimulated organic pet food from local producers and international brands entering the market. Germany's strict regulatory environment and devotion to quality also help guarantee that the market for organic pet food remains robust, satisfying health-aware pet owners throughout the nation.

Competitive Landscape:

The European organic and natural pet food market is moderately fragmented, driven by innovation, sustainability, and health-focused branding. Companies differentiate through clean-label, grain-free, and high-protein offerings, with growing emphasis on functional ingredients and eco-friendly practices. Premiumization trends, fueled by pet humanization, push demand for gourmet, organic-certified foods, while e-commerce and subscription services intensify competition. Private label brands from major retailers are also expanding, challenging established players to offer added value. Northern and Western Europe lead in adoption due to higher consumer awareness, while Eastern Europe shows gradual growth constrained by price sensitivity. Success increasingly hinges on transparency, ethical sourcing, and personalized nutrition solutions, as brands compete to align with evolving pet owner preferences for quality, wellness, and sustainability.

The report provides a comprehensive analysis of the competitive landscape in the Europe organic and natural pet food market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: BioCraft and Prefera launched Europe’s first cat food made with 99% cultured mouse meat. Named "mouse mousse", the product mimics a cat's natural diet and showed strong palatability in trials. It will debut at Zoomark International and roll out across European markets by late 2025.

- March 2025: Sweden-based The Nutriment Company (TNC) acquired Germany’s BAF Petfood from Fressnapf. The move strengthens TNC’s presence in Germany and Europe, expanding its raw pet food operations and providing broader retail access through Fressnapf’s extensive franchise network.

- February 2025: Meatly and THE PACK launched Chick Bites, Europe’s first commercially available dog treat made with cultivated chicken. The company said the product marks a milestone in sustainable pet nutrition, offering an ethical, low-impact alternative to traditional meat-based pet foods.

- February 2025: Marsapet launched MicroBell, a complete dog food featuring FeedKind Pet protein. This vegan, grain-free kibble combines sweet potatoes, peas, and cultured protein made without animal or arable land inputs.

- May 2024: Dr. Clauder’s and Calysta launched a new range of dog treats using FeedKind Pet protein. Made through natural fermentation, this vegan, non-GMO protein offers a complete amino acid profile and gut health benefits.

Europe Organic and Natural Pet Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million USD |

| Scope of the Report |

|

| Pet Types Covered | Dog Food, Cat Food, Others |

| Product Types Covered | Dry Pet Food, Wet and Canned Pet Food, Snacks and Treats |

| Packaging Types Covered | Bags, Cans, Pouches, Boxes, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe organic and natural pet food market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe organic and natural pet food market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe organic and natural pet food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe natural pet food market size reached USD 10.9 Billion in 2024. Moreover, the Europe organic pet food market size reached USD 860 Million in 2024.

The Europe organic food market is projected to reach USD 23.6 Billion by 2033, exhibiting a growth rate (CAGR) of 8.46% during 2025-2033. The Europe organic pet food market is projected to reach USD 1,960 Million by 2033, exhibiting a growth rate (CAGR) of 9.12% during 2025-2033.

The market is fueled by increasing consumer knowledge of pet health and wellness, a desire for natural and organic ingredients, and expanding demand for sustainable, environmentally friendly products. Furthermore, rising fears regarding artificial additives and preservatives, as well as a focus on high-end pet care, also drive market expansion.

Germany currently dominates the Europe organic and natural pet food market, driven by growing pet ownership, heightened health awareness among pet owners, a move towards premium foods, and expanding demand for green and sustainable products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)