Europe Organic Food Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Application, and Country, 2026-2034

Europe Organic Food Market Size and Share:

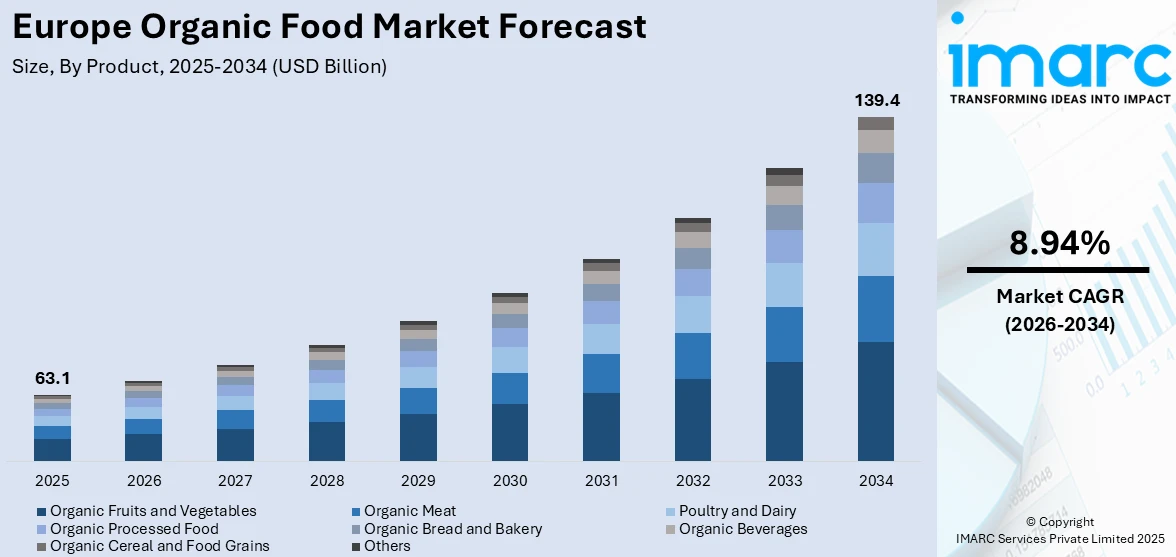

The Europe organic food market size was valued at USD 63.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 139.4 Billion by 2034, exhibiting a CAGR of 8.94% from 2026-2034. Germany currently dominates the market, holding a market share of over8.94% in 2024. The market is experiencing significant growth in the region driven by rising consumer demand for sustainable products, heightened health consciousness, and stringent regulatory frameworks supporting organic certification, eco-friendly farming methods, and transparency in labeling, fostering trust and preference among consumers seeking healthier and environmentally sustainable food options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 63.1 Billion |

|

Market Forecast in 2034

|

USD 139.4 Billion |

| Market Growth Rate (2026-2034) | 8.94% |

The growth of the Europe organic food market share is being driven by several key factors, including the increasing consumer demand for healthy, sustainable, and environmentally friendly food options. As consumers become aware of the health problems related to conventional food production, including synthetic additives and pesticide residues, many are shifting towards organic alternatives. This shift is largely influenced by a growing concern over long-term health and wellness, with many individuals seeking food products that align with their values of sustainability and natural ingredients. In addition, the growing trend towards plant-based diets, particularly in Europe, has contributed to the rise of organic food demand, as plant-based foods are often associated with organic farming practices that promote biodiversity and reduce environmental harm.

To get more information on this market Request Sample

Moreover, government policies and regulations play a significant role in fueling the growth of the EU organic food market. For example, in December 2024, the European Union introduced stricter organic regulations that will go into effect in 2025. These regulations, transitioning from an "equivalence" to a "compliance" system, aim to enhance consumer confidence and organic integrity, impacting smallholder producer groups. Moreover, subsidies and financial support for organic farmers further enhance the growth prospects of organic products by making them more accessible to producers and consumers alike. As the EU market continues to focus on meeting environmental and sustainability targets, organic food has become a vital part of the broader food policy agenda, driving growth in both supply and demand for organic products across Europe.

Europe Organic Food Market Trends:

Increasing Consumer Preference for Plant-Based Organic Foods

The growing adoption of plant-based diets has significantly driven the demand for organic plant-based foods across Europe. As consumers become aware of the ethical and ecological implications of their dietary preferences, organic plant-based products have emerged as a preferred option. These include organic fruits, vegetables, grains, and dairy alternatives like almond and oat milk. For instance, In December 2024, the European innovation project Delicious, backed by Horizon Europe with €5 million, launched in Barcelona to revolutionize plant-based dairy using microbial fermentation and machine learning for sustainable, nutritious alternatives. Moreover, organic certification assures consumers of sustainable farming practices and the absence of synthetic inputs, further boosting trust in these products. The trend is strongest among younger demographics, which view organic plant-based foods as healthier and better for the environment. Retailers and manufacturers are responding by expanding their product offerings, creating opportunities for innovation in organic, plant-based ready meals, snacks, and beverages, thereby driving sustained Europe organic food market growth.

Rising E-Commerce Penetration in the Organic Food Market

E-commerce platforms have revolutionized the organic food market. The wide range of products is available for customers, with an unparalleled level of convenience. Major players have tapped into digital platforms as online shopping gains momentum in Europe to boost organic food sales. Retailers like Whole Foods Market, Carrefour, and specialized organic brands have invested in powerful online channels with user-friendly interfaces and targeted marketing campaigns. Doorstep delivery, subscription models, and discounts have been the magnets that attracted more consumers. Significantly, the online platform has made the small organic producers visible in the market. Therefore, the market landscape has become highly competitive and diversified.

Product Innovation and Diversification

The Europe organic food market is witnessing a surge in product innovation and diversification to cater to the evolving preferences and tastes of people. Manufacturers are launching unique organic food offerings, such as gluten-free, keto-friendly, and allergen-free products, addressing the demand for personalized nutrition. The rise of functional organic foods, enriched with added vitamins and probiotics, has also gained traction among health-conscious buyers. Moreover, organic beverages, including cold-pressed juices, kombucha, and plant-based milk, have experienced significant growth. Packaging innovation, such as biodegradable and reusable materials, is further enhancing the appeal of these products. For example, in September 2024, Marigold Health Foods and Sonoco introduced a fully recyclable can with a paper base, made of 95% paper and 60% recycled fibre, improving sustainability and meeting recycling regulations. Moreover, this continuous innovation ensures a steady influx of new consumers while retaining existing ones, driving market growth and reinforcing the competitive edge of brands investing in research and development (R&D).

Europe Organic Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe organic food market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, distribution channel, and application.

Analysis by Product Type:

- Organic Fruits and Vegetables

- Organic Meat, Poultry and Dairy

- Organic Processed Food

- Organic Bread and Bakery

- Organic Beverages

- Organic Cereal and Food Grains

- Others

In 2024, organic fruits and vegetables dominate the market with share of 28.8% because of health benefits and appeal as a non-GMO, pesticide-free product. Increased plant-based diets and more ecologically conscious consumers boost the demand for these products in retail. Seasonal, locally sourced produce is frequently sought after, especially within Europe, which follows trends toward healthier eating habits. This shift is led by heightening awareness of environmental and health impacts of the food choices made, making consumers opt for sustainability and nutritional value of diets. As a result, organic produce is accelerating in accessibility and prevalence by consumer preference and market trend.

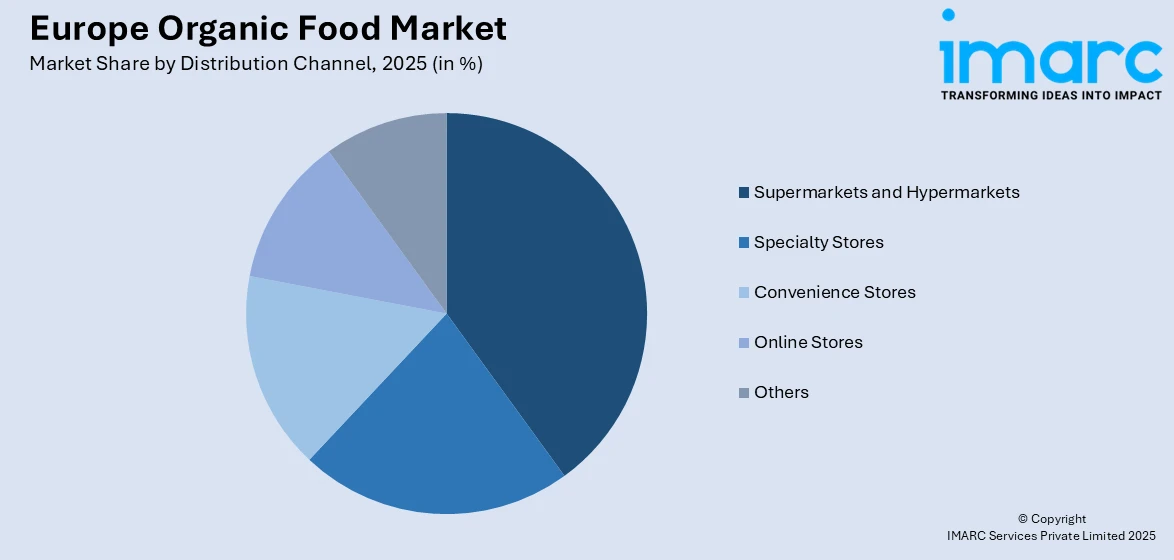

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets are the market leaders with the share of 44.0%, selling all organic products at one stop. Organized sections and special offers related to organic food attract health-conscious consumers. This kind of strategic positioning of organic food items is much more visible to both the urban and suburban consumer segments, who in turn, are going to spend much more time with organic products. In addition, growth in supermarket and hypermarkets facilities increases the availability of organic products, which enables more to meet the growing needs and reach a wider demographic of health-conscious shoppers.

Analysis by Application:

- Bakery and Confectionery

- Ready-to-eat Food Products

- Breakfast Cereals

- Others

Organic bakery and confectionery products are observing an immense growth due to the consumers' preference for healthy choices. These products provide indulgence in traditional sweets and baked products, free from synthetic additives and preservatives. It caters to the health-conscious consumer who demands a natural ingredient without sacrificing the taste and texture.

RTE organic food products are fast gaining popularity, especially as ready-to-use meal solutions for busy consumers. Such products have been formulated to offer a taste of nutrition and organic certification without reducing the quality of the end product. Heightening health awareness among consumers makes the trend of RTE organic meals boost which is a healthier option in comparison with conventional processed products.

Breakfast cereals made from organic ingredients are gaining consumer attention because of the health benefits they bring. With no artificial additives or preservatives, they have become a clean-label option for families and individuals. It attracts those who are searching for nutritious and sustainable choices at breakfast, focusing on the quality of ingredients and production.

Other products, ranging from organic snack foods, baby foods to drinks, contribute to growing the market. These helps respond to this accelerating demand for organic, clean-label food which supports healthful lifestyles. Focusing on sustainability and transparency in these products is what affords consumers numerous choices between wholesome, natural options fitting their healthful values.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Consumer demand for sustainability and health is making Germany one of the prime markets for organic food with the market share of 22.4%. Strong organic certification is maintained that ensures high-quality products with authenticity, increasing consumer trust. The organic products are available in nearly all retail stores which further aids market growth by making these products accessible to a much wider consumer group. Environmental awareness is one of the significant factors making more consumers choose organic food to promote environmental-friendly farming and minimize carbon footprint. This shift in consumer behavior has been the primary reason for the steady growth in the demand for organic food, making Germany a major market in the global organic food market.

Competitive Landscape:

The competitive landscape of the European organic food market is dynamic, where established brands mix with new entrants. Large retailers dominate this market, offering a vast number of organic products using extensive distribution networks and economies of scale. Niche players concentrate on quality, sustainability, and local sourcing, catering to health-conscious consumers looking for premium and ethically produced items. The rise of e-commerce platforms offers significant competition, providing ease of access and a wider variety of products at often highly competitive prices. Furthermore, various companies focus on clean-label products and transparent ingredient sourcing to create a distinction for themselves. Innovation, ethical practices, and strategic partnerships will remain the way forward for companies in maintaining their competitive advantage as the demand for organic food grows.

The report provides a comprehensive analysis of the competitive landscape in the Europe organic food market with detailed profiles of all major companies.

Latest News and Developments:

- In February 2024, Alnatura launched a complete range of organic pasture milk products, including crème fraîche, yogurt, and milk, starting in March. By June, the range will expand to over 30 products, setting a new standard for animal welfare and sustainability in organic dairy, while ensuring fair compensation for farmers and promoting biodiversity.

- In September 2024, Biona launched its Organic Super Seed Bread, a protein-rich, minimally processed loaf featuring sunflower, flax, and pumpkin seeds. Free from artificial additives, yeast, wheat, and sugar, this vegan bread aligns with rising demand for healthier options, retailing at £3.79 to meet clean-eating trends.

- In October 2024, Biona launched the following high-fiber organic three bakery products: high-fiber Rustic Seeded Sourdough Baguettes, Oat Topped Wholemeal Rolls, and Power Protein Bread. Position for the health-conscious consumer that is vegan, minimally processed and in line with the clean label trend which also offers variety and high protein content as well as fiber, against the growing demand for a sustainable product.

- In December 2024, IFOAM Organics Europe and Diversified Communications renewed their partnership to support the growth of the organic market. The collaboration includes trade events across Europe, highlighting industry trends, market opportunities, and EU policies, with key events like the Natural & Organic Products Expo and Organic Food Iberia.

Europe Organic Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Organic Fruits and Vegetables, Organic Meat, Poultry and Dairy, Organic Processed Food, Organic Bread and Bakery, Organic Beverages, Organic Cereal and Food Grains, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others |

| Applications Covered | Bakery and Confectionery, Ready-to-eat Food Products, Breakfast Cereals, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe organic food market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe organic food market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe organic food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Organic food is defined as agricultural goods cultivated and processed without fertilizers, synthetic pesticides, artificial additives, and genetically modified organisms (GMOs). Common organic foods include fruits, vegetables, grains, dairy, and meats. They are often chosen for their perceived health benefits, environmental friendliness, and adherence to strict certification standards.

The Europe organic food market was valued at USD 63.1 Billion in 2025.

IMARC estimates the Europe organic food market to exhibit a CAGR of 8.94% during 2026-2034.

The Europe organic food market growing owing to heightened consumer awareness of health and environmental sustainability, coupled with growing need for chemical-free and non-GMO products. Supportive government policies and certifications further boost market growth. The expansion of e-commerce platforms and availability of a wider organic product variety have enhanced accessibility, while growing interest in plant-based and sustainable diets has accelerated the adoption of organic food across Europe.

On a country level, the market has been classified into Germany, France, United Kingdom, Italy, Spain, Others, wherein Germany currently dominates the market.

Germany has one of the largest organic food markets, driven by strong consumer demand for sustainability, a reliable certification system, widespread availability, and growing environmental awareness promoting healthier, eco-friendly food choices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)