Europe Organic Food and Beverages Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Sector, and Country, 2025-2033

Europe Organic Food and Beverages Market Size and Share:

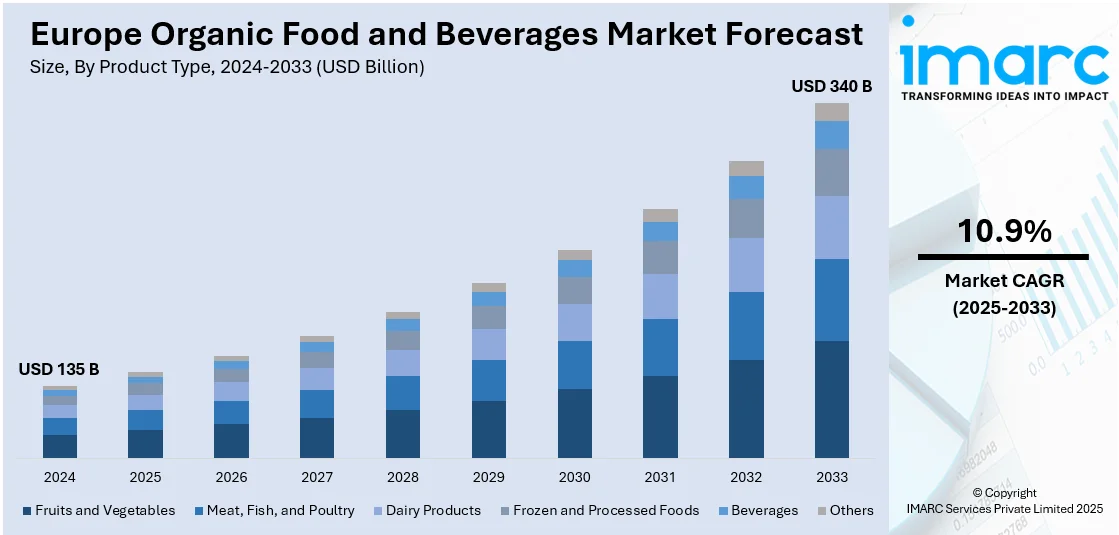

The Europe organic food and beverages market size was valued at USD 135 Billion in 2024. Looking forward, the market is estimated to reach USD 340 Billion by 2033, exhibiting a CAGR of 10.9% from 2025-2033. Within the segment, fruits and vegetables emerged as the highest revenue-generating product category in 2024. Supermarkets and hypermarkets were the biggest distribution channels across the region. The retail sector recorded the highest revenue in organic food and beverages. Germany is projected to achieve the highest CAGR between 2025 and 2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 135 Billion |

|

Market Forecast in 2033

|

USD 340 Billion |

| Market Growth Rate (2025-2033) | 10.9% |

Growing awareness among European consumers about the connection between nutrition and overall health is significantly boosting the demand for organic food and beverages. People are increasingly avoiding products with artificial additives, pesticides, and genetically modified organisms (GMOs), opting for cleaner, more natural options. Chronic diseases such as diabetes, obesity, and heart conditions are prevalent concerns across the region as they account for 80% of the EU’s disease burden. This growing awareness is driving interest in organic products, often viewed as safer and more nutrient-rich alternatives. Organic products often have fewer harmful residues and are considered less processed, aligning with the preferences of health-focused shoppers.

Environmental awareness is another powerful factor driving demand for organic food and beverages in Europe. Organic farming practices focus on enhancing biodiversity, maintaining soil health, and conserving water, making them particularly appealing to environmentally conscious consumers. People are more informed than ever about how conventional agriculture contributes to problems like soil degradation, water pollution, and climate change. Moreover, Governments and organizations also play a key role in this trend. The European Union's Green Deal, for instance, includes ambitious goals to increase the share of organic farming to 25% of agricultural land by 2030. This institutional support encourages both farmers and consumers to transition to organic products, further fueling the Europe organic food and beverages market share.

Europe Organic Food and Beverages Market Trends:

Stricter Regulatory Standards

Europe enforces some of the world's strictest regulations for organic certification, ensuring high standards of quality and authenticity. This ensures high-quality organic products, increasing consumer confidence and trust. Labels like the EU Organic Logo guarantee that items meet specific standards for production and processing. These strict rules set organic food and beverages apart from their non-organic counterparts, reinforcing their appeal to quality-conscious buyers. The consistent enforcement of these regulations reduces the likelihood of misleading claims on packaging, which is critical for maintaining consumer trust. Stricter standards also create a competitive advantage for European organic products in international markets. This regulatory environment not only drives domestic consumption but also positions Europe as a leader in the global organic industry.

Growing Popularity of Plant-Based Diets

Plant-based eating habits are becoming mainstream in the region, boosting the Europe organic food and beverages market demand. Many consumers see plant-based diets as healthier and more sustainable. Organic plant-based milk, meat alternatives, and snacks are experiencing rapid growth as they meet the dual demand for organic and plant-based products. In 2023, 36.5% of households in Germany purchased plant-based milk at least once, while 37.4% bought plant-based meat alternatives during the same period. Organic certification adds another layer of appeal, as it assures buyers that these plant-based products are produced sustainably.

Increased Availability in Retail Channels

The availability of organic food and beverages has expanded significantly in Europe, due to the growth of specialized organic stores, supermarket chains, and e-commerce platforms. Retailers recognize the growing demand for organic products and are stocking more options to cater to a diverse customer base. Supermarkets like Tesco, Carrefour, and Aldi have introduced private-label organic brands, making these products more accessible and affordable. Online platforms are also playing a key role by offering a wide range of organic items with the convenience of home delivery. Subscription-based organic food boxes are gaining traction, further enhancing accessibility. This increased availability ensures that consumers from urban to rural areas can easily purchase organic products. Easy accessibility reduces barriers to entry, supporting consistent market growth.

Europe Organic Food and Beverages Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe organic food and beverages market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, distribution channel, and sector.

Analysis by Product Type:

- Fruits and Vegetables

- Meat, Fish, and Poultry

- Dairy Products

- Frozen and Processed Foods

- Beverages

- Others

The fruits and vegetables segment dominated the organic food market in 2024, driven by increasing consumer demand for fresh, pesticide-free produce. This segment's growth is supported by the increasing adoption of organic farming practices and a surge in demand for seasonal and locally grown products. Consumers perceive organic fruits and vegetables as healthier and more sustainable, aligning with the broader shift toward eco-friendly consumption. Retailers are extending their organic scope in this particular category by earmarking specific space in supermarkets as well as across online platforms. Germany, France, and Italy are the leader countries in organically produced fruit and vegetables across Europe, out of which 25% above is accounted for alone by Germany. Increased availability with high quality assurance and increasing concerns for the environmental factor have greatly enhanced the popularity of this range in the market segment.

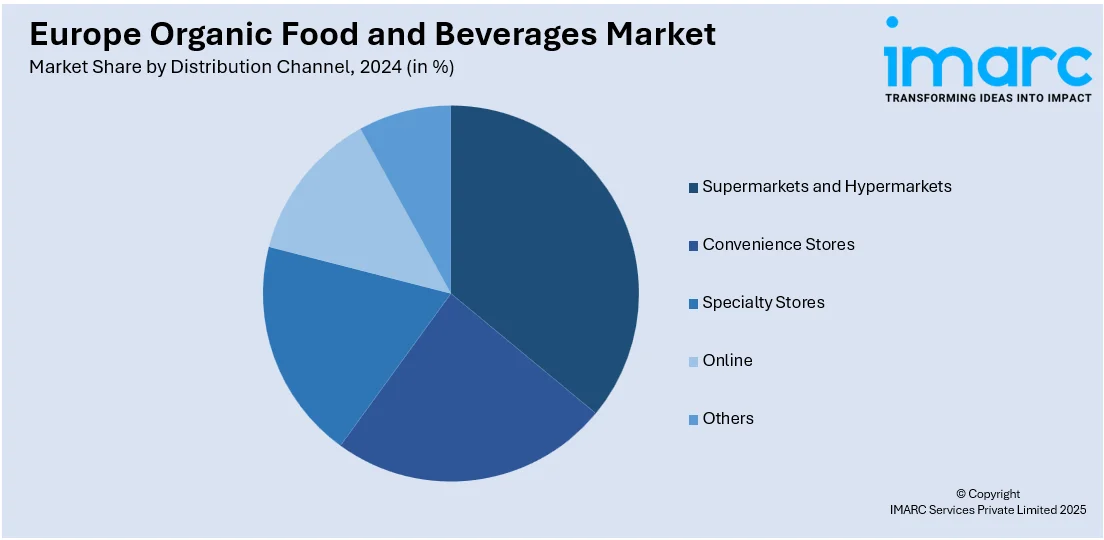

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Supermarkets and hypermarkets have emerged as the leading distribution channels for organic food and beverages, according to the Europe organic food and beverages market trends. The growth of access to a broad spectrum of organic items enhances the emerging need for organic products. They provide several products under one roof at good pricing as well as premium options. Leading chains such as Carrefour, Tesco, and Aldi have significantly developed their organic range, with many of them offering entire aisles devoted to organic goods. Private-label organic brands available in these outlets further increase both price affordability and consumer trust. Their highly capable supply chain infrastructure ensures a steady flow of fresh organic produce, dairy and packaged goods, thereby ensuring that the majority of shoppers prefer these channels to others.

Analysis by Sector:

- Retail

- Institutional

The retail sector dominates the European organic food and beverages market, driven by the increasing presence of organic products in mainstream and specialty stores. With a significant share in the market, retail outlets provide consumers with easy access to organic options, ranging from fresh produce to packaged goods. Supermarkets, hypermarkets, and dedicated organic stores like Bio Company and Alnatura play a crucial role in catering to the growing demand. The sector benefits from strong consumer trust, as many buyers prefer in-person shopping to verify product quality and certifications. Additionally, enhanced product visibility, frequent discounts, and in-store promotions make retail the most convenient and preferred channel for purchasing organic products.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

Germany is the largest market for organic food and beverages in 2024 owing to the heightened consumer awareness and a commendable demand for sustainable and pesticide-free products. In 2023, Germany represented almost 25% of the entire organic market in Europe with sales beyond €15 billion. This dominant position is a result of the nation's robust regulatory environment, encouraging government policies, and widespread use of organic agricultural methods. German customers give high priority to environmental sustainability and health, which is aligned with the ideals of the organic industry and drives steady demand growth. Supermarket chains like REWE and Edeka have also expanded their organic offerings, while specialty stores such as Denn's Biomarkt cater exclusively to organic shoppers. A further boost to Germany's organic market comes from the high level of trust placed in certifications such as the EU Organic Logo, which further ensures trust in product integrity. Quality and wide availability put Germany on top of the country ranking in the European market for organic food and beverages.

Europe Organic Food and Beverages Companies:

The major market players are strongly diversifying their product lines, enhancing their distribution systems, and leveraging customer demands for sustainability and health. The companies are also launching advanced organic products in several categories, such as dairy, snacks, and drinks, to corner the market. Retail giants are also focusing on private-label organic goods that deliver quality at affordable prices to attract budget-conscious customers. Due to its ease and wider selection of products, online shopping is becoming a growing trend, so more businesses are investing in e-commerce platforms. In order to ensure a steady flow of fresh, high-quality products, partnerships with local organic farms are further growing. In addition, to attract the environmentally conscious consumer, businesses have started adopting transparent labeling practices and sustainable packaging solutions. Marketing efforts highlight the health and ethical benefits of organic products, which are now in line with changing consumer values. All these strategies together contribute to growth and competition in the rapidly expanding European organic market.

The report provides a comprehensive analysis of the competitive landscape in the Europe organic food and beverages market with detailed profiles of all major companies, including:

- General Mills Inc.

- The Hain Celestial Group Inc.

- Amys Kitchen Inc.

- Clipper Teas

- Nestle SA

- Danone SA

- Starbucks Corporation

- Sasma BV

- Ahold Delhaize

- Uncle Matt's Organic

Latest News and Developments:

- In November 2024, Amy's Kitchen introduced five new organic soups inspired by international cuisines. The company highlights that these soups are made from scratch using organic ingredients, fresh vegetables, and wholesome grains.

- In August 2024, Clipper Teas introduced four new flavors in its infusions range, designed to enhance consumers' connection to nature and promote wellness with the use of organic ingredients. Peppermint & Spearmint, Blackcurrant & Blueberry, Chamomile & Peach, and Orange & Turmeric are the new added organic varieties.

- In September 2023, Uncle Matt's Organic expanded its product line with the launch of Superfruit Punch, a functional juice-based beverage. This blend features real superfruits such as dark sweet cherries, blueberries, and black elderberry. With just 45 calories per 8 oz serving, it is free from cane sugar, preservatives, and added flavors.

Europe Organic Food and Beverages Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fruits and Vegetables, Meat, Fish, and Poultry, Dairy Products, Frozen and Processed Foods, Beverages, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Sectors Covered | Retail, Institutional |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Russia, Others |

| Companies Covered | General Mills Inc., The Hain Celestial Group Inc., Amys Kitchen Inc., Clipper Teas, Nestle SA, Danone SA, Starbucks Corporation, Sasma BV, Ahold Delhaize and Uncle Matt's Organic |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe organic food and beverages market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe organic food and beverages market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe organic food and beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe organic food and beverages market was valued at USD 135 Billion in 2024.

The growth of the Europe organic food and beverages market is driven by the rising health awareness, increasing environmental concerns, stringent organic certification standards, supportive government policies, expanding retail and e-commerce availability, growing demand for plant-based diets, and a shift toward sustainable, premium, and ethical consumption.

IMARC estimates the Europe organic food and beverages market to exhibit a CAGR of 10.9% during 2025-2033.

Fruits and vegetables segment dominated the product type market share in 2024.

Some of the major players in the Europe organic food and beverage market are General Mills Inc., The Hain Celestial Group Inc., Amys Kitchen Inc., Clipper Teas, Nestle SA, Danone SA, Starbucks Corporation, Sasma BV, Ahold Delhaize, Uncle Matt's Organic, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)