Europe Oral Hygiene Market Report by Product (Toothpaste, Toothbrushes & Accessories, Mouthwash/Rinses, Dental Accessories/Ancillaries, Denture Products, Dental Prosthesis Cleaning Solutions, and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Pharmacies, Online Stores, and Others), Application (Adults, Kids, Infants), and Country 2025-2033

Market Overview:

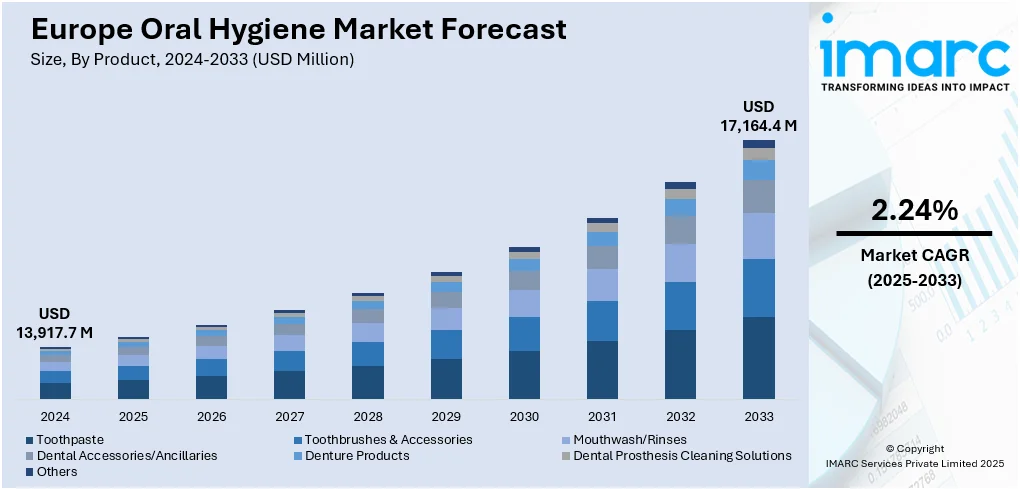

The Europe oral hygiene market size reached USD 13,917.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 17,164.4 Million by 2033, exhibiting a growth rate (CAGR) of 2.24% during 2025-2033.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13,917.7 Million |

| Market Forecast in 2033 | USD 17,164.4 Million |

| Market Growth Rate 2025-2033 | 2.24% |

Oral hygiene is the process of keeping the mouth, gums, and teeth healthy and clean. Some of the common oral care products include toothbrush, toothpaste, breathe fresheners, mouthwash, and dental floss. Practicing healthy oral hygiene reduces bad breath and tooth sensitivity, lowers healthcare costs, and prevents the development of serious dental ailments. Along with self-care, the services provided by dentists and orthodontists are also crucial in maintaining dental hygiene. They treat several diseases pertaining to the mouth, such as toothache, periodontal disease, gingivitis, tooth decay, oral cancer, plaque, and halitosis.

To get more information on this market, Request Sample

The rising prevalence of oral diseases, due to the changes in lifestyles, rising intake of sugar-rich diets, and the increasing consumption of alcohol and tobacco are majorly driving the oral hygiene market in Europe. The increasing awareness regarding the importance of preventive oral care is acting as a growth-inducing factor. The introduction of dental care products formulated with natural ingredients and whitening properties is supporting the market growth. Moreover, consumers are increasingly shifting toward premium oral care products for effective dental hygiene. This has led key players to launch innovative products, such as electric toothbrush with pressure sensor technology and head replacement reminding capability, which is positively influencing the market growth in the region.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Europe oral hygiene market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on product, distribution channel and application.

Breakup by Product:

- Toothpaste

- Toothbrushes & Accessories

- Mouthwash/Rinses

- Dental Accessories/Ancillaries

- Denture Products

- Dental Prosthesis Cleaning Solutions

- Others

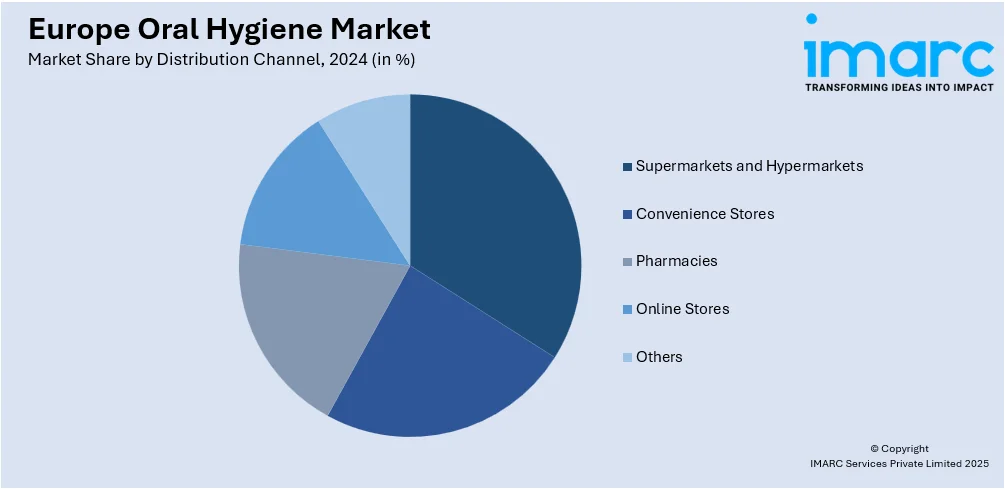

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies

- Online Stores

- Others

Breakup by Application:

- Adults

- Kids

- Infants

Breakup by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Product, Distribution Channel, Application, Country |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Europe oral hygiene market was valued at USD 13,917.7 Million in 2024.

We expect the Europe oral hygiene market to exhibit a CAGR of 2.24% during 2025-2033.

The rising consumer awareness regarding the importance of preventive oral care, along with the introduction of dental care products formulated with natural ingredients and whitening properties for effective dental hygiene, is primarily driving the Europe oral hygiene market.

In Europe, the sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of oral hygiene-based products.

Based on the product, the Europe oral hygiene market can be segmented into toothpaste, toothbrushes & accessories, mouthwash/rinses, dental accessories/ancillaries, denture products, dental prosthesis cleaning solutions, and others. Currently, toothpaste holds the majority of the total market share.

Based on the distribution channel, the Europe oral hygiene market has been divided into supermarkets and hypermarkets, convenience stores, pharmacies, online stores, and others. Among these, supermarkets and hypermarkets currently exhibit a clear dominance in the market.

Based on the application, the Europe oral hygiene market can be categorized into adults, kids, and infants. Currently, adults account for the largest market share.

On a regional level, the market has been classified into Germany, France, United Kingdom, Italy, Spain, and others, where Germany currently dominates the Europe oral hygiene market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)