Europe Mobile Payment Market Size, Share, Trends and Forecast by Mode of Transaction, Application, and Country, 2025-2033

Europe Mobile Payment Market Size and Share:

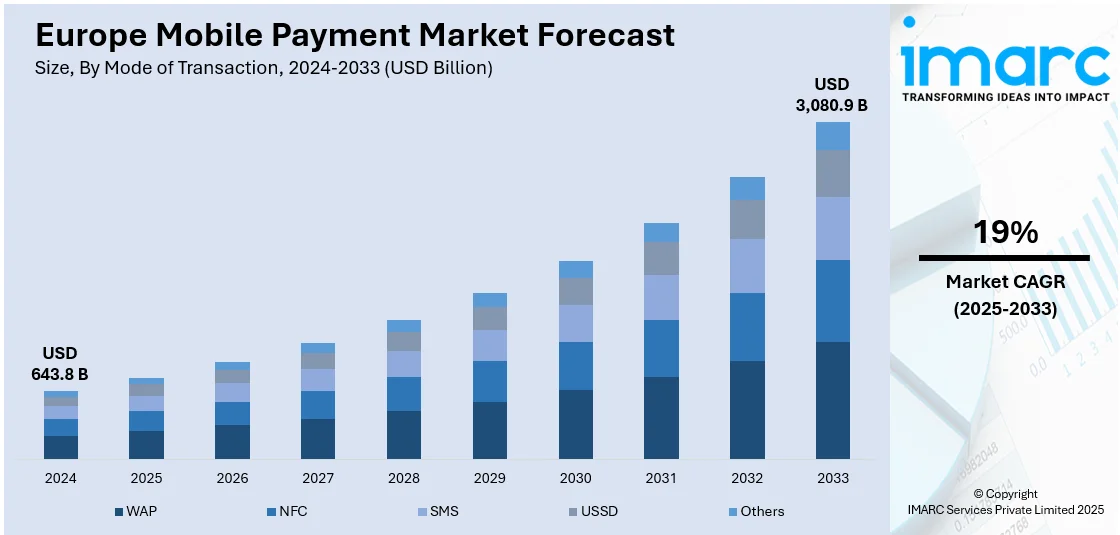

The Europe mobile payment market size was valued at USD 643.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,080.9 Billion by 2033, exhibiting a CAGR of 19% from 2025-2033. The market is witnessing significant growth principally bolstered by the growing adoption of smartphones and the preference for cashless transactions and the shift toward government-supported cashless economies. Additionally, the expansion of digital wallets, integration with loyalty programs and rewards, and adoption of blockchain technology is significantly influencing the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 643.8 Billion |

|

Market Forecast in 2033

|

USD 3,080.9 Billion |

| Market Growth Rate (2025-2033) | 19% |

Cashless trends are supported by an advanced infrastructure that enhances the digital process. Increased consumer preferences for cashless transactions result from the widespread use of smartphones, which has fundamentally altered consumption patterns and made it possible to access mobile pay application transactions without any problems from anywhere in the world. These trends have stemmed from the improved payment access channels, the increasing use of safe digital wallets, and advanced near-field communication technology, which significantly improves both access and security in this region. For instance, in July 2024, Apple announced to grant third-party developers access to NFC technology for various transactions, including loyalty rewards. This development will enable iPhone users in the European Economic Area to leverage their preferred mobile wallet for store payments with features like double-click, tap-and-go, and Face ID. . These changes will be applied to 30 countries in the European Economic Area. As a result, consumers and businesses are increasingly leveraging these technologies for both online and in-store purchases.

The shift toward cashless economies across Europe, driven by regulatory frameworks and incentives promoting digital payment systems, has further accelerated the adoption of mobile payment solutions. Governments and financial institutions are actively encouraging digital transactions to enhance transparency, reduce the risks associated with cash handling, and improve economic efficiency. This aligns with government initiatives promoting digital transactions and transparency, as such solutions enhance trust in online financial systems. By improving fraud detection, these institutions not only safeguard customer trust but also align with the government's vision of a secure and transparent digital economy, continuing to fuel the growth of the mobile payment market across Europe, and transforming the region's payment landscape. For instance, as per a survey concluded in 2024 by the European Central Bank, 37% of the businesses across the European Union accept mobile or online payments.

Europe Mobile Payment Market Trends:

Expansion of Digital Wallets

The rapid expansion of digital wallets is a significant trend shaping the European mobile payment market. Digital wallets like Apple Pay, Google Pay, and PayPal are gaining traction among consumers for their convenience, security, and ability to consolidate multiple payment methods in one platform. For instance, in September 2024, Wero, a new digital wallet under the European Payments Initiative, launched in Germany, Belgium, and France, supported by 16 major European banks, aims to unify cross-border payments across Western Europe. The adoption of these wallets is further driven by their compatibility with various devices, including smartphones, tablets, and wearables, and their integration with e-commerce platforms for seamless online transactions. As consumers continue to embrace cashless solutions, the proliferation of digital wallets is redefining payment behaviors across Europe.

Integration with Loyalty Programs and Rewards

The integration of mobile payment platforms with loyalty programs and rewards systems is another key trend reshaping the market. For instance, in 2024, 90% of European consumers are willing to share personal data for loyalty rewards or discounts, while over 80% would do so for prizes or exclusive offers, highlighting incentive-driven preferences. Businesses are using these integrations to enhance customer engagement and strengthen brand loyalty. By delivering personalized offers, discounts, and real-time rewards through mobile applications, companies are creating seamless and enjoyable payment experiences. his innovation will solve real customer problems and will change payments and commerce dynamics. These features not only encourage repeat transactions but also serve as a competitive advantage in attracting and retaining customers.

Adoption of Blockchain Technology

Blockchain technology is emerging as a transformative force in the mobile payment ecosystem, addressing critical concerns regarding security, transparency, and fraud. Its decentralized and cryptographically secure framework offers an ideal solution for cross-border transactions, which are inevitable in the diverse economic landscape of Europe. Many European fintech companies are adopting blockchain to enhance transaction efficiency while complying with regulations and protecting consumer data. For instance, in 2024, UBS introduced Digital Cash, a blockchain-based payment solution. This further improves efficiency, transparency, and programmability, thus allowing for smooth cross-border transactions, improved intraday liquidity management, and real-time visibility of corporate cash positions. These innovations are appealing as they build trust among users by ensuring data privacy and reducing risks associated with financial fraud.

Europe Mobile Payment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe mobile payment market, along with forecasts at the regional and country levels from 2025-2033. The market has been classified based on the mode of transaction, and application.

Analysis by Mode of Transaction:

- WAP

- NFC

- SMS

- USSD

- Others

WAP is leading with a substantial share in the mode of transaction segment. WAP stands for wireless application protocol. In the mobile payment segment, it is the protocol that allows mobile devices to access internet-based services. In Europe, WAP improves mobile payment capabilities through secure and seamless transaction options across platforms, thereby supporting the growth of mobile commerce and boosting consumer adoption of digital payment methods. For instance, in 2024, Seven French banks announced the adoption of Wero, replacing Paylib for instant account-to-account payments within 10 seconds, expanding to e-commerce and in-store transactions. This development aligns closely with the capabilities of WAP, which enhances mobile payment systems by enabling secure, real-time communication between mobile devices and payment platforms.

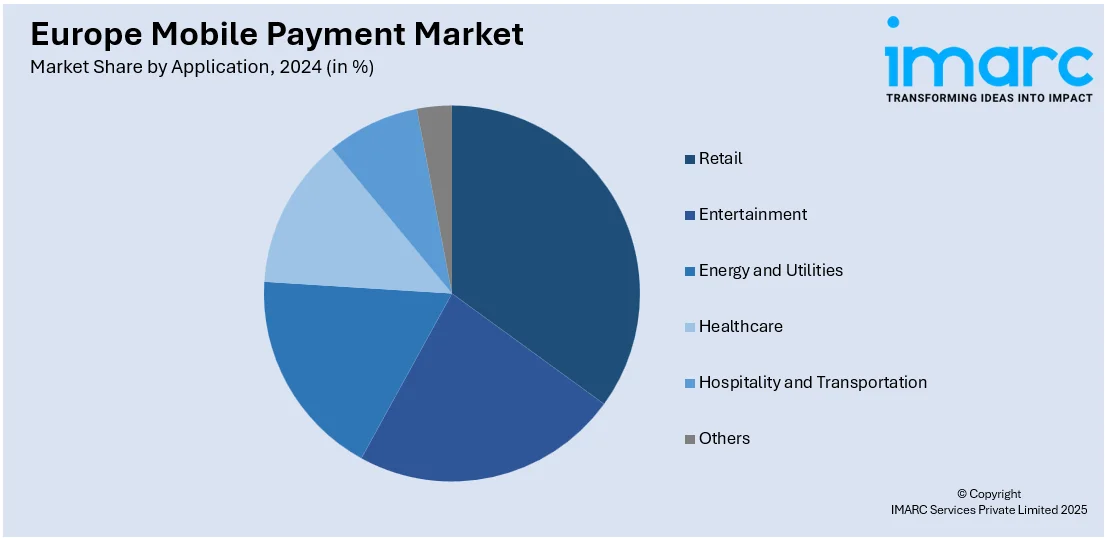

Analysis by Application:

- Entertainment

- Energy and Utilities

- Healthcare

- Retail

- Hospitality and Transportation

- Others

The retail application leads the market. The application segment plays an important role in the Europe mobile payment market as retail enables seamless transactions through mobile apps and contactless payments. It elevates customer experience, streamlines purchases, and increases efficiency in transactions, thereby accelerating growth in mobile payment adoption within the retail sector. For instance, in 2024, ABN Amro, a European bank, introduced a 'Pay on Invoice' tool for B2B e-commerce, enabling businesses to access a 'Pay Later' service with deferred payments of up to 30 days. This innovative solution holds significant implications for the retail sector, enabling wholesalers and suppliers to streamline transactions and improve cash flow management. By offering flexible payment terms, the tool supports retailers in managing inventory procurement more effectively, reducing financial pressure, and enhancing operational efficiency.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The United Kingdom represents the leading country in this market and is one of the most important market players, fostering technological innovation and benefiting from strong regulatory support.. Its advanced digital infrastructure, widespread smartphone adoption, and favorable payment ecosystems have made it a hub for mobile wallet services and driven growth and trends throughout Europe. For example, in 2024, more than 50% of adults in the UK used digital wallets such as Apple Pay, Google Pay, and PayPal, forcing regulators to measure their influence on competition, market integrity, and consumer experience. This increased adoption has led regulatory bodies to examine their impact on market competition, consumer protection, and financial integrity so that the industry evolves responsibly while still allowing innovation and growth.

Competitive Landscape:

The competitive landscape of the Europe mobile payment market is characterized by a diverse mix of established players and emerging fintech companies. Major global players dominate the market, leveraging their widespread brand recognition and user-friendly platforms. Additionally, regional players and local bank-driven solutions also hold significant market share by offering tailored services and integration with European banking systems. The market is highly competitive, with continuous innovation, strategic partnerships, and regulatory compliance being key factors for success and market differentiation. For instance, in 2024, PayPal expanded its cashback rewards program to encourage offline use, offering up to 5% cashback for purchases made with Mastercard debit cards. The initiative aims to broaden PayPal's reach beyond online transactions, with services starting in Europe and later in the US.

The report provides a comprehensive analysis of the competitive landscape in the Europe mobile payment market with detailed profiles of all major companies.

Latest News and Developments:

- In February 2024, MEPs supported plans for an EU-wide digital wallet, providing cross-border access to key public services. The wallet will be voluntary, with provisions for citizens' rights, inclusive digital systems, and free electronic signatures, thereby enhancing transparency and security.

Europe Mobile Payment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mode of Transactions Covered | WAP, NFC, SMS, USSD, Others |

| Applications Covered | Entertainment, Energy and Utilities, Healthcare, Retail, Hospitality and Transportation, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

Mobile payment refers to making financial transactions using a smartphone or tablet, typically through apps or digital wallets. Users can link bank accounts, credit cards, or digital currencies to make purchases, transfer money, or pay bills securely and conveniently without using physical cash or cards.

The Europe mobile payment market was valued at USD 643.8 Billion in 2024.

IMARC estimates the Europe mobile payment market to exhibit a CAGR of 19% during 2025-2033.

The key factors driving the market include increasing smartphone penetration, the rise of e-commerce, growing consumer demand for convenient and secure transactions, advancements in digital payment technologies, and government initiatives promoting cashless transactions. Additionally, the adoption of contactless payments and fintech innovations further boost market growth.

In 2024, WAP represented the largest segment by mode of transaction owing to its secure connectivity with various devices, and ability to enable seamless real-time mobile payments across e-commerce and retail platforms, among other factors.

Retail leads the market by application owing to the widespread adoption of contactless payment technologies, increasing e-commerce penetration, and the demand for fast, secure, and convenient transactions both in-store and online.

On a regional level, the market has been classified into Germany, France, United Kingdom, Italy, Spain, and others, wherein the United Kingdom currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)